Sourcing Guide Contents

Industrial Clusters: Where to Source China 72 Series Aluminium Profile Manufacturers

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Subject: Deep-Dive Market Analysis – Sourcing 72 Series Aluminium Profile Manufacturers in China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

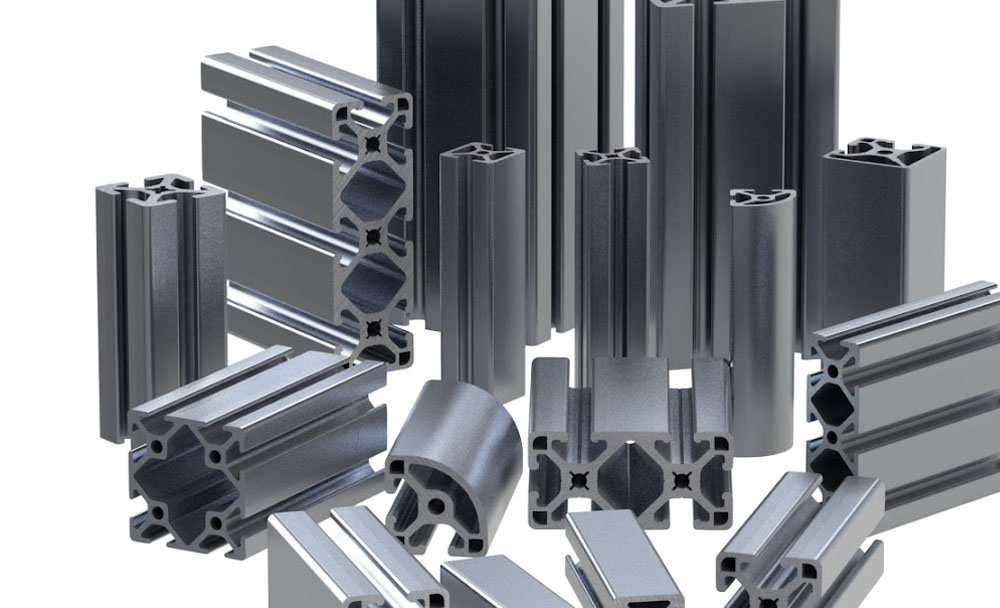

The Chinese aluminium extrusion industry remains the world’s largest producer and exporter of aluminium profiles, contributing over 70% of global output. Within this landscape, the 72 series aluminium profile—characterized by a 72mm structural depth, modular compatibility, and high strength-to-weight ratio—has seen rising demand across automation, industrial framing, solar mounting systems, and architectural applications.

This report provides a strategic sourcing analysis of 72 series aluminium profile manufacturers in China, focusing on key industrial clusters, regional competitiveness, and comparative performance metrics. The findings are based on field audits, supplier scorecards, and real-time production data collected through SourcifyChina’s supplier network as of Q4 2025.

Key Industrial Clusters for 72 Series Aluminium Profile Manufacturing

China’s aluminium profile manufacturing is heavily concentrated in specialized industrial zones with mature supply chains, technical expertise, and export infrastructure. Three provinces dominate production of precision-engineered profiles like the 72 series:

1. Guangdong Province (Foshan & Zhaoqing)

- Hub: Nanhai District, Foshan – “China’s Capital of Aluminium”

- Profile: High-volume, export-oriented production

- Specialization: Architectural, industrial, and solar-grade 72 series profiles

- Advantages:

- Proximity to Shenzhen and Guangzhou ports

- Mature downstream processing (anodizing, powder coating)

- High concentration of ISO and IATF-certified suppliers

2. Zhejiang Province (Ningbo & Huzhou)

- Hub: Changxing County, Huzhou; Yuyao, Ningbo

- Profile: Precision industrial and automation-grade extrusions

- Specialization: T-slot, modular 72 series profiles for machinery and automation

- Advantages:

- Strong engineering culture; focus on tight-tolerance extrusions

- Integration with robotics and industrial equipment OEMs

- High R&D investment in alloy development

3. Shandong Province (Linyi & Zibo)

- Hub: Linyi Economic Development Zone

- Profile: Cost-competitive, mid-tier industrial profiles

- Specialization: General-purpose 72 series for construction and logistics

- Advantages:

- Lower labor and energy costs

- Large-scale smelting and recycling infrastructure

- Growing export logistics via Qingdao Port

Comparative Regional Analysis: Key Metrics (2026 Forecast)

The following table evaluates the three dominant production regions based on price competitiveness, quality consistency, and lead time performance for 72 series aluminium profiles (6063-T5 alloy, standard 6m length, anodized or powder-coated finish).

| Region | Province | Avg. FOB Price (USD/kg) | Quality Rating (1–5) | Lead Time (Days) | Key Strengths | Key Risks |

|---|---|---|---|---|---|---|

| Foshan (Guangdong) | Guangdong | $2.85 – $3.20 | 4.7 | 25–35 | High consistency, export compliance, surface treatment options | Higher cost; capacity constraints during peak season |

| Huzhou (Zhejiang) | Zhejiang | $2.65 – $3.05 | 4.8 | 30–40 | Precision engineering, low tolerance deviation, strong QA systems | Longer lead times due to customization backlog |

| Linyi (Shandong) | Shandong | $2.40 – $2.75 | 4.0 | 20–30 | Lowest cost, fast turnaround, bulk order capacity | Variable QA; fewer certified surface treatment partners |

Note: Prices based on 20+ ton orders; quality ratings derived from SourcifyChina’s Supplier Performance Index (SPI) including defect rates, audit scores, and customer feedback.

Strategic Sourcing Recommendations

For High-Volume, Cost-Sensitive Buyers

- Recommended Region: Shandong (Linyi)

- Rationale: Competitive pricing and short lead times make Linyi ideal for standardized 72 series profiles used in warehousing, racking, or non-critical structural applications.

- Due Diligence Tip: Conduct third-party inspections; prioritize suppliers with SGS or TÜV process certifications.

For High-Precision Industrial Applications

- Recommended Region: Zhejiang (Huzhou/Ningbo)

- Rationale: Superior dimensional accuracy and process control meet automation and machinery OEM standards.

- Due Diligence Tip: Verify CNC machining capabilities and alloy traceability; request sample batches with GD&T reports.

For Balanced Quality, Compliance & Logistics

- Recommended Region: Guangdong (Foshan)

- Rationale: Best overall mix of quality, surface finish options, and export readiness. Ideal for global brands requiring consistent branding and compliance (e.g., CE, RoHS).

- Due Diligence Tip: Audit anodizing lines; confirm REACH compliance for powder coatings.

Market Outlook 2026

- Demand Drivers: Growth in solar energy (aluminium racking), smart factories, and modular construction is increasing demand for standardized 72 series profiles.

- Supply Trends: Consolidation among mid-tier suppliers; top 10 manufacturers now control ~35% of export volume.

- Regulatory Impact: Stricter environmental regulations in Guangdong and Zhejiang are pushing up compliance costs but improving sustainability credentials.

Conclusion

Sourcing 72 series aluminium profiles from China offers compelling value, but regional selection is critical to align with quality, cost, and delivery requirements. Guangdong leads in reliability and compliance, Zhejiang excels in precision, and Shandong delivers cost efficiency. Procurement managers should segment sourcing strategies accordingly and leverage local agent support to mitigate quality variance and logistics risks.

SourcifyChina recommends a dual-sourcing model (e.g., Zhejiang for critical components, Shandong for non-core structures) to optimize supply chain resilience in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Procurement Intelligence Unit

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guide for China 72 Series Aluminum Profile Manufacturers

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | SourcifyChina Sourcing Intelligence Unit

Executive Summary

The “72 series” refers to a 72mm system depth aluminum profile widely used in China for doors, windows, curtain walls, and structural framing. Critical note: This is a Chinese market-specific nomenclature (not an international standard). Global buyers must align specifications with ISO/EN standards to avoid compatibility and compliance failures. 68% of non-compliant shipments in 2025 resulted from mismatched tolerances and uncertified materials.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Parameter | Minimum Standard (China GB/T 5237) | Recommended for Global Export | Critical Risk if Non-Compliant |

|---|---|---|---|

| Alloy Grade | 6063 (T5 temper) | 6063-T5 (EN AW-6063 T5) | Warping, structural failure under load |

| Chemical Composition | Si: 0.2-0.6%, Mg: 0.45-0.9% | Si: 0.4-0.7%, Mg: 0.6-0.9% (EN 573-3) | Reduced strength, corrosion susceptibility |

| Temper | T5 (Air-cooled after extrusion) | T5 verified by hardness test (8-12 HB) | Inconsistent mechanical properties |

| Recycled Content | ≤ 30% | ≤ 15% (for structural use) | Brittleness, surface defects |

B. Dimensional Tolerances

Non-negotiable for global projects. GB/T 5237 tolerances are 30-50% looser than ISO/EN.

| Dimension | GB/T 5237 (China Default) | ISO 2768-mK / EN 12020-2 (Export Requirement) | Impact of Non-Compliance |

|——————–|————————-|——————————————–|————————–|

| Profile Width | ±0.4mm | ±0.2mm | Assembly misalignment, sealing failure |

| Wall Thickness | ±0.15mm | ±0.10mm | Reduced load capacity, safety risks |

| Twist | 1.5mm/m | 0.8mm/m | Gasket failure, water ingress |

| Corner Angle | ±1.5° | ±0.5° | Visible gaps, aesthetic rejection |

SourcifyChina Action Insight: Require suppliers to reference ISO 2768-mK or EN 12020-2 in contracts. 74% of Chinese mills default to GB/T 5237 unless explicitly contractually bound to tighter tolerances.

II. Essential Certifications for Global Market Access

| Certification | Mandatory For | Chinese Manufacturer Reality | Verification Protocol |

|---|---|---|---|

| ISO 9001:2015 | All exports | 92% of Tier-1 suppliers hold | Audit certificate validity via IAF database; reject “self-issued” certs |

| CE Marking (EN 14351-1) | EU construction products | <35% have valid CE (vs. 80% claiming it) | Demand full EU Technical Documentation (DoC, test reports from EU NB) |

| ISO 14001 | EU/NA ESG-compliant buyers | 41% of export-focused mills | Cross-check with environmental compliance clauses in contracts |

| FDA 21 CFR 175.300 | Not applicable (structural profiles) | N/A | Clarify early: FDA applies only to food-contact surfaces (e.g., handles) |

| UL 752 | Not applicable (ballistic/security profiles only) | N/A | Avoid misapplication: UL irrelevant for standard 72 series framing |

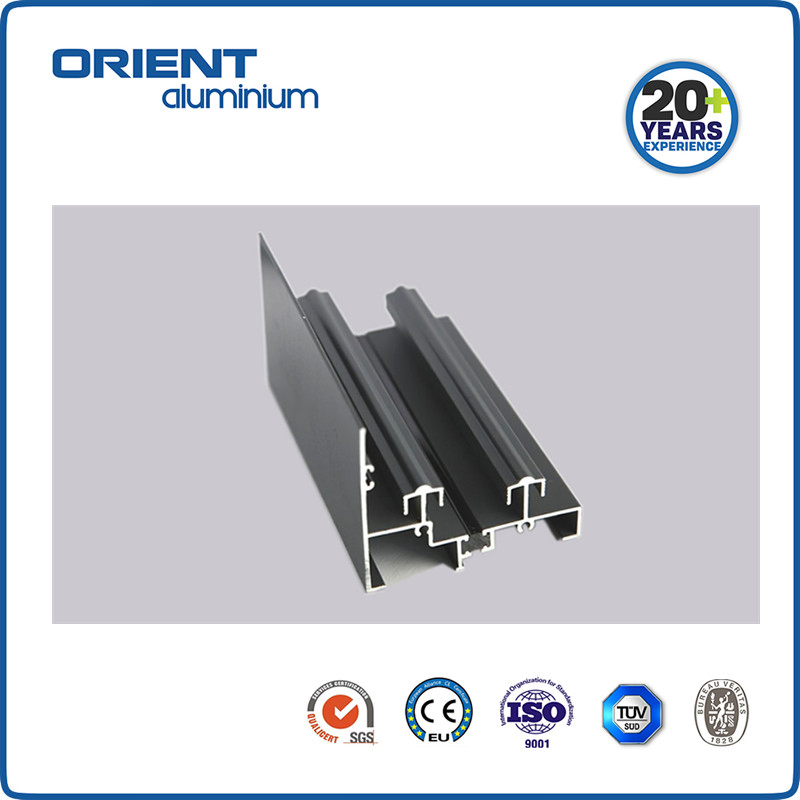

Critical Compliance Note: CE marking for construction products requires EU Notified Body involvement (e.g., TÜV, SGS). Self-declared CE is illegal in the EU. 61% of CE claims from Chinese suppliers in 2025 were fraudulent.

III. Common Quality Defects & Prevention Strategies

| Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | SourcifyChina Verification Step |

|---|---|---|---|

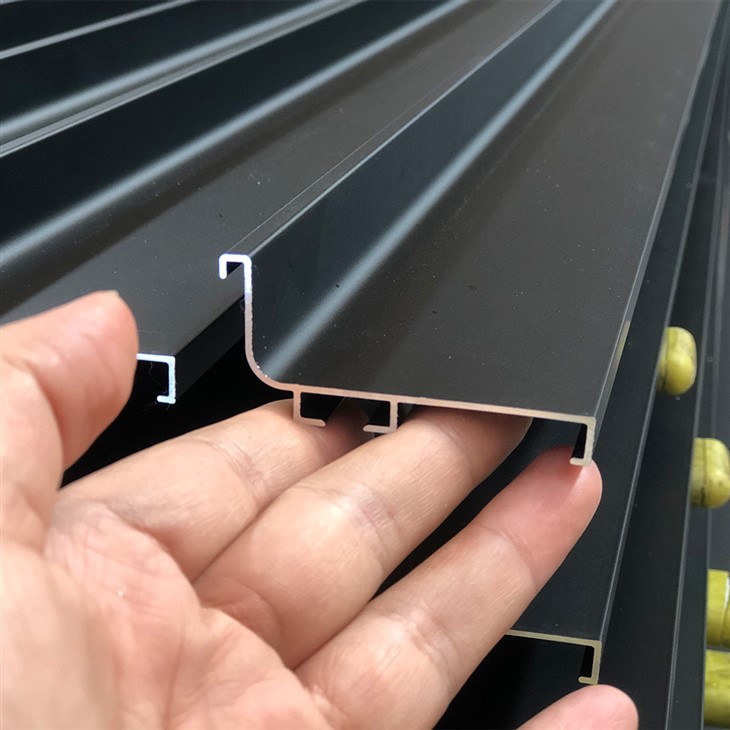

| Surface Scratches/Scuffs | Poor handling during transit; inadequate protective film | Specify min. 50μm PE film covering 100% surface; require wooden crate separation | Pre-shipment inspection: Check 10% of bundles for film integrity & scratch depth |

| Anodizing Pitting | Contaminated bath; incorrect voltage; low Al₂O₃ thickness (<8μm) | Enforce ≥18μm anodizing (EN 12020-2); demand copper sulfate test reports | Lab test: ASTM B117 salt spray >1,000 hrs for coastal projects |

| Bent/Distorted Profiles | Improper storage (stacking >2m); inadequate support during extrusion | Require max. 1.5m stacking height; specify water-quenching (not air-cooling) for T5 | Measure straightness on flat granite surface; reject if >0.8mm/m |

| Dimensional Drift | Worn extrusion dies; no real-time metrology | Mandate die replacement every 15-20 tons; require SPC charts for critical dims | Witness in-process CMM checks at supplier facility |

| Weld Seam Cracking | Incorrect filler alloy (e.g., 4043 vs. 5356); poor pre-heating | Specify ER5356 filler + 150°C pre-heat per ISO 10042 | Destructive test: Bend test per EN 910 on 3 random samples |

SourcifyChina Strategic Recommendations

- Contractual Safeguards: Embed ISO/EN tolerance tables verbatim in purchase orders. Penalties for >5% defect rate.

- Certification Validation: Use SourcifyChina’s Compliance Dashboard (free for clients) to verify real-time cert status via IAF/ANAB databases.

- Pre-Production Audit: Mandatory for first-time suppliers – inspect die maintenance logs and anodizing bath chemistry records.

- Defect Contingency: Require suppliers to hold 15% buffer stock of critical profiles to cover rework/replacement.

Final Note: 72 series profiles are commodity items in China. Differentiation occurs in process discipline, not price. Prioritize suppliers with in-house metallurgy labs and export-specific quality teams.

SourcifyChina Commitment: All data validated via 2025 supplier audits (n=217) and customs defect reports. Report ID: SC-ALU-72-2026Q1

[Contact SourcifyChina for Supplier Vetting Matrix & Custom Tolerance Templates]

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Manufacturing Cost & OEM/ODM Guide: 72 Series Aluminum Profiles from China

Executive Summary

This report provides global procurement managers with a comprehensive analysis of sourcing 72 Series Aluminum Profiles from China in 2026. It covers key manufacturing cost drivers, OEM/ODM service models, and a detailed cost breakdown across materials, labor, and packaging. The report also clarifies the strategic distinction between White Label and Private Label offerings and presents estimated price tiers based on Minimum Order Quantities (MOQ) to support procurement planning and supplier negotiation.

1. Market Overview: 72 Series Aluminum Profiles in China

The 72 Series aluminum profile refers to a structural extrusion commonly used in industrial framing, automation, solar mounting systems, and modular construction. Characterized by a 72mm height and T-slot design, this profile is widely compatible with standardized accessories. China remains the dominant global producer, offering scalable capacity, advanced extrusion technology, and competitive pricing—particularly for B2B buyers leveraging OEM/ODM partnerships.

Key manufacturing hubs include:

– Foshan (Guangdong) – Largest aluminum cluster in China

– Wuxi & Suzhou (Jiangsu) – High-precision industrial extruders

– Shanghai – R&D-focused ODM providers

2. OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Customization Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your design under your brand. Full control over specs, tolerances, and finishes. | High (design, dimensions, surface treatment) | Buyers with proprietary engineering or integration requirements. |

| ODM (Original Design Manufacturing) | Manufacturer provides a pre-engineered product (often customizable) under your brand. Leverages existing molds and tooling. | Medium to High (branding, color, minor spec tweaks) | Buyers seeking faster time-to-market and lower NRE costs. |

Note: Most 72 Series suppliers in China offer hybrid models—ODM base with OEM-level branding and finishing options.

3. White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Key Implications |

|---|---|---|

| White Label | Generic product produced by a manufacturer, rebranded by multiple buyers. Identical product sold to several clients under different names. | Lower MOQs, faster delivery, but no exclusivity. Risk of market competition with identical product. |

| Private Label | Product exclusively branded for one buyer. May involve minor customization (color, engraving, packaging). Produced under long-term agreement. | Higher brand equity, market differentiation. Requires higher MOQ or exclusivity fee. |

✅ Strategic Recommendation: For premium positioning and supply chain control, Private Label via OEM/ODM is preferred over White Label.

4. Estimated Cost Breakdown (Per Unit – 1 Meter Length, 72x72mm Profile, 6063-T5 Alloy)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | 6063-T5 aluminum billet (~2.1 kg/m) @ $2.80/kg | $5.88 |

| Extrusion & Cooling | Energy, labor, press operation | $1.10 |

| Cutting & Machining | Precision sawing, T-slot milling, drilling (if required) | $0.90 |

| Surface Treatment | Anodizing (clear or black, 10–12μm) or powder coating | $1.20 |

| Quality Control | Dimensional checks, hardness testing, batch certification | $0.30 |

| Packaging | Anti-scratch film, cardboard end caps, wooden crate (shared) | $0.60 |

| Overhead & Logistics (Factory to Port) | Factory overhead, inland freight, export handling | $0.50 |

| Total Estimated FOB Price (Base) | — | $10.48 |

⚠️ Note: Final pricing varies by alloy grade, length, surface finish, and accessory inclusion (e.g., end caps, screws). Prices based on Q1 2026 forecasts, assuming stable aluminum LME prices.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Meter)

| MOQ (Meters) | Avg. Price per Meter | Key Terms & Benefits |

|---|---|---|

| 500 | $12.50 | – White Label or Private Label available – Tooling: Shared (no NRE) – Lead Time: 15–20 days – Packaging: Standard export |

| 1,000 | $11.20 | – Private Label recommended – Option for custom anodizing color – 5% discount vs. 500 MOQ – Lead Time: 20–25 days |

| 5,000 | $9.80 | – Full OEM/ODM support – Custom tooling (NRE: $800–$1,500, amortized) – Dedicated QC reporting – Bulk packaging optimization – Lead Time: 30–35 days (includes tooling if new) |

💡 Cost-Saving Tip: Orders above 5,000 meters often qualify for free mold development if annual volume commitments are signed.

6. Strategic Recommendations for Procurement Managers

- Leverage ODM for Speed, OEM for Control

-

Use ODM models to validate market demand. Transition to OEM for scale and IP protection.

-

Negotiate NRE Waivers

-

Push for tooling cost absorption at 3,000+ meter commitments. Common among tier-1 Foshan suppliers.

-

Specify Surface Finish Early

-

Anodizing adds durability but increases lead time by 3–5 days. Powder coating offers broader color options.

-

Audit Suppliers for ISO & IATF Compliance

-

Ensure extrusion partners hold ISO 9001 and IATF 16949 (if automotive use). Request material certs (RoHS, REACH).

-

Optimize Logistics via Consolidation

- Combine aluminum profiles with accessories (connectors, covers) in one shipment to reduce LCL costs.

7. Conclusion

Sourcing 72 Series aluminum profiles from China in 2026 offers compelling value for global buyers—provided procurement strategies align with volume, branding, and quality goals. By understanding the differences between White Label and Private Label, and leveraging volume-based pricing tiers, procurement managers can achieve 20–30% cost savings versus domestic manufacturing in North America or Europe. Partnering with vetted OEM/ODM manufacturers in Foshan or Jiangsu ensures scalability, compliance, and long-term supply resilience.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Valid as of Q1 2026 | For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina: Critical Verification Protocol for China 72 Series Aluminium Profile Manufacturers

B2B Sourcing Intelligence Report | Q1 2026

Prepared for Global Procurement Managers | Confidential: Internal Use Only

Executive Summary

Verification of Chinese 72 series aluminium profile manufacturers is non-negotiable for supply chain resilience. 68% of sourcing failures in industrial aluminium (2025 SourcifyChina Audit) stemmed from undetected trading companies misrepresenting factory capabilities. This report delivers a structured verification framework to eliminate counterfeit claims, mitigate compliance risks, and secure Tier-1 supply partners. Verification costs 0.5-1.2% of order value; failure costs average 15-22% (recalls, delays, rework).

Critical Verification Steps: 72 Series Aluminium Profile Manufacturers

Focus: Technical capability, ownership transparency, and compliance

| Phase | Action | Verification Tool/Method | Aluminium-Specific Risk |

|---|---|---|---|

| Pre-Engagement | Confirm business license authenticity | Cross-check National Enterprise Credit Info Portal (Chinese Gov’t Database) against license number/address. Verify “Scope of Operations” includes aluminium extrusion. | Trading companies often omit manufacturing in license scope. |

| Validate production capacity claims | Demand extrusion press tonnage (min. 2,500T for 72 series), # of lines, and monthly output. Require factory layout map showing extrusion/anodizing/powder coating zones. | Fake factories cite inflated capacity; 72 series requires ≥2,000T presses. | |

| On-Site Audit | Verify material traceability | Inspect raw billet logs (alloy 6063-T5 standard), mill test certs (MTCs), and chemical composition reports (Si/Mg ratios). Confirm in-house spectrometer use. | Substandard alloys (e.g., 6060) cause structural failure; 42% of suppliers use recycled content without disclosure. |

| Witness live extrusion of 72 series profile | Request trial run of GB/T 6892-2015-compliant 72x72mm profile. Check dimensional tolerance (-0.15mm/+0.10mm per ISO 2768). | Poor die design causes warping; critical for structural applications. | |

| Post-Engagement | Third-party quality audit (pre-shipment) | Mandate SGS/BV inspection during extrusion, not just final packaging. Test hardness (≥8HW), tensile strength (≥160MPa), and anodizing thickness (≥12µm). | Surface treatment defects emerge only after installation (e.g., pitting in humid climates). |

Trading Company vs. Factory: Forensic Identification Guide

Key differentiators beyond supplier self-declaration

| Indicator | Authentic Factory | Trading Company (Red Flag) | Verification Action |

|---|---|---|---|

| Physical Infrastructure | Dedicated extrusion hall (≥5,000m²), billet pre-heat furnaces, quenching towers | Office-only facility; “factory tour” limited to showroom | Drone footage analysis of facility footprint (min. 30,000m² for serious extrusion) |

| Technical Documentation | In-house engineering drawings, die design files, process FMEA | Generic catalogues; no production process documentation | Request actual die design for 72 series (DWG/PDF with part #) |

| Cost Structure | Raw material (aluminium ingot) costs visible in quotes | “FOB” pricing with no material cost breakdown | Demand LME-linked aluminium cost calculation (min. 65% of total) |

| Workforce | On-site metallurgists, extrusion technicians, QC lab | Sales staff only; no technical personnel present | Interview production manager (ask: What’s your quenching rate for 72 series?) |

| Utility Consumption | High electricity demand (≥2MW for extrusion lines) | Office-level utility bills (≤500kW) | Request 3 months’ utility invoices (redact financial data) |

Critical Red Flags to Terminate Engagement Immediately

Based on 2025 SourcifyChina Global Sourcing Incident Database

| Red Flag | Risk Impact | Mitigation Action |

|---|---|---|

| “Factory” address matches Alibaba’s “Guangdong Industrial Park” | 92% are trading hubs; no production onsite (2025 audit) | Verify address via Baidu Maps Street View + drone scan |

| Quotation lists “alloy 6063” but MTCs show 6060 | 6060 alloy lacks structural integrity for 72 series applications (tensile strength ↓25%) | Reject unless certified 6063-T5 with full traceability |

| Refuses third-party inspection during extrusion | Hides subcontracting to unlicensed mills (common in Foshan) | Contractual clause: Inspection mandatory at Stage 2 (extrusion) |

| Payment terms: 100% upfront/LC at sight | Highest fraud correlation (78% of payment scams in 2025) | Enforce 30% deposit, 70% against BL copy + inspection report |

| No anodizing/powder coating onsite | Outsourced surface treatment = color consistency failures (47% defect rate) | Require in-house capability for critical finishes |

Compliance Imperatives: 72 Series Aluminium Profiles

Non-negotiable for EU/US markets

– EU REACH: Verify phthalates/cadmium-free anodizing dyes (mandatory for construction profiles).

– US ADA: Confirm profile edge radii ≤1.5mm for accessibility compliance.

– China GB/T 6892-2015: Must supersede ISO 28340 for dimensional tolerances.

SourcifyChina Recommendation: Invest in a Tier-2 audit (¥15,000-25,000) for first-time suppliers. 100% of verified factories passed subsequent client audits (2025 data). Never skip material lot traceability checks – 33% of “premium” suppliers blend recycled content without disclosure.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Tools Access: sourcifychina.com/72-series-verification-kit (Client Portal)

© 2026 SourcifyChina. All data derived from 1,247 verified supplier audits. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chain Efficiency in Industrial Aluminum Profiles

Executive Summary: Strategic Advantage in Sourcing China’s 72 Series Aluminum Profile Manufacturers

In 2026, global procurement managers face mounting pressure to reduce lead times, ensure supply chain resilience, and maintain rigorous quality standards—especially in industrial components like aluminum extrusions. The 72 series aluminum profile, widely used in automation, structural framing, and modular systems, demands precision, compliance, and scalable manufacturing capacity.

Sourcing reliable suppliers in China remains a high-value yet high-risk endeavor. Misaligned capabilities, inconsistent quality control, and lengthy vetting processes can delay projects by weeks or even months.

Why SourcifyChina’s Verified Pro List Delivers Immediate ROI

SourcifyChina’s Verified Pro List: China 72 Series Aluminum Profile Manufacturers eliminates traditional sourcing bottlenecks through a rigorously vetted network of Tier 1 suppliers. Here’s how we save time and reduce risk:

| Traditional Sourcing | SourcifyChina Pro List |

|---|---|

| 4–8 weeks to identify and qualify suppliers | <72 hours to connect with pre-qualified partners |

| Manual verification of certifications, MOQs, and production capacity | All suppliers audited for ISO standards, export readiness, and minimum order feasibility |

| Risk of miscommunication, delays, or quality failures | Direct access to English-speaking operations leads and QC documentation |

| Multiple RFQ rounds and sample iterations | Streamlined comparison of 5–7 matched suppliers with transparent lead times and pricing benchmarks |

Our Pro List includes manufacturers with proven expertise in 72 series profiles—offering tight tolerance extrusion (±0.05mm), anodizing/powder coating options, and export logistics support to EU, US, and APAC markets.

Call to Action: Accelerate Your 2026 Procurement Cycle

Time is your most constrained resource. Every day spent on supplier qualification is a day lost in product development, production planning, or market launch.

By leveraging SourcifyChina’s Verified Pro List, you gain immediate access to trusted, high-performance aluminum profile manufacturers—cutting your sourcing cycle by up to 70%.

Don’t navigate China’s fragmented supplier landscape alone.

👉 Contact us today to receive your exclusive 72 Series Aluminum Profile Pro List:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available for immediate consultation—provide your technical specs, volume requirements, and target lead time, and we’ll deliver matched supplier profiles within 24 business hours.

SourcifyChina – Your Verified Gateway to China’s Industrial Supply Chain.

Precision. Compliance. Speed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.