Sourcing Guide Contents

Industrial Clusters: Where to Source China 72 Series Aluminium Profile Factory

SourcifyChina Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Sourcing 72 Series Aluminium Profiles from China

Prepared for Global Procurement Managers | Q2 2026

Executive Summary

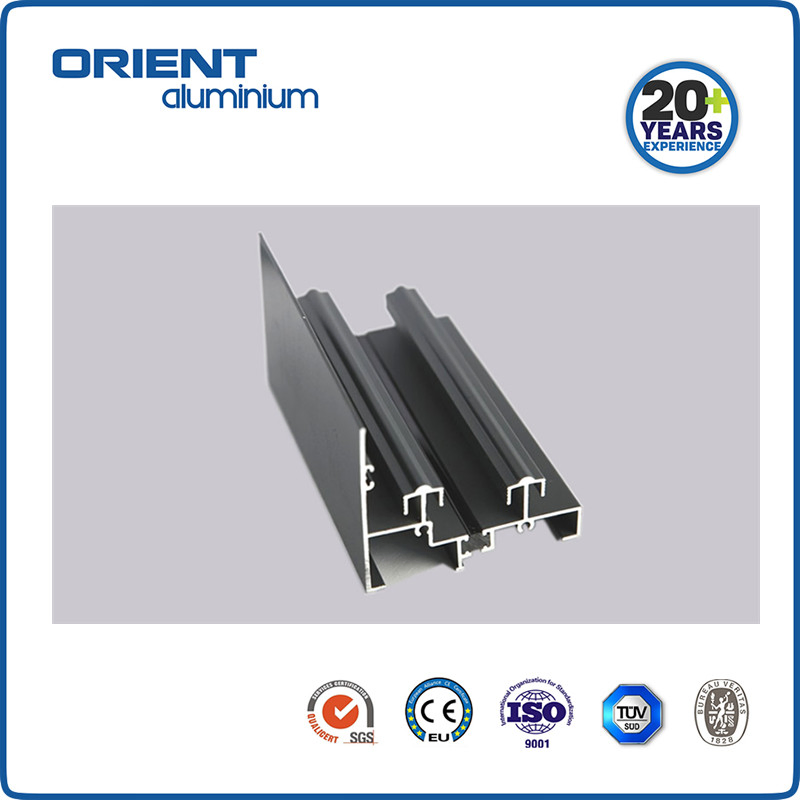

The Chinese market for 72 series aluminium profiles—a widely used architectural and industrial extrusion profile with a 72mm structural depth—remains a cornerstone in construction, automation, and renewable energy applications. As global demand for modular framing systems, solar mounting structures, and industrial workstations increases, procurement teams are prioritizing reliable, cost-effective sources from China.

This report provides a data-driven analysis of the key industrial clusters manufacturing 72 series aluminium profiles in China, with a comparative assessment of production regions based on price competitiveness, quality standards, and average lead times. The findings are based on SourcifyChina’s 2026 supplier audit database, factory benchmarking data, and logistics performance metrics.

Key Industrial Clusters for 72 Series Aluminium Profile Manufacturing

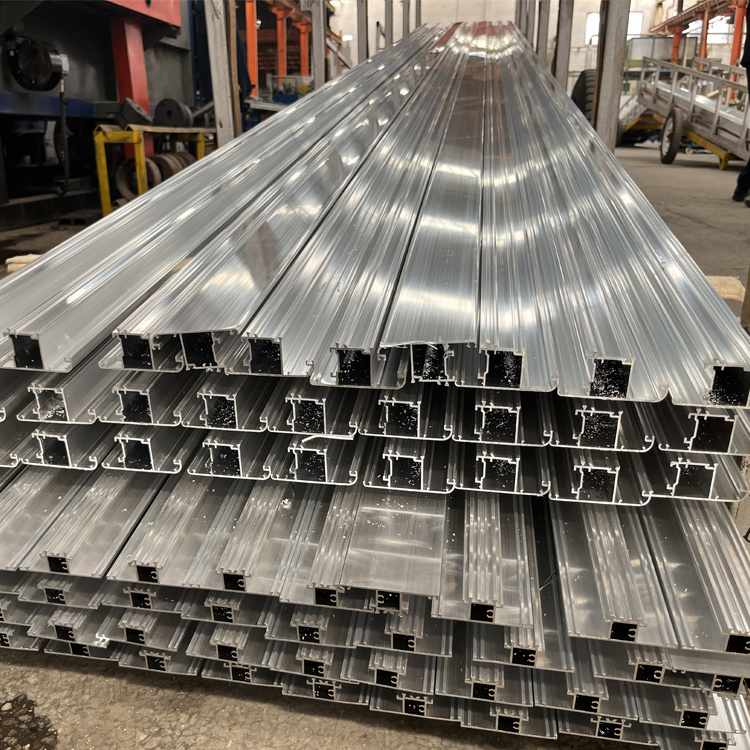

China’s aluminium extrusion industry is highly regionalized, with concentrated manufacturing hubs offering distinct advantages in scale, logistics, and specialization. The primary industrial clusters for 72 series profiles are located in the following provinces and cities:

| Region | Key Cities | Industrial Focus | Estimated # of Active Factories (2026) |

|---|---|---|---|

| Guangdong | Foshan (Nanhai), Guangzhou, Zhaoqing | Architectural, solar, high-end industrial profiles | 320+ |

| Zhejiang | Huzhou, Hangzhou, Ningbo | Industrial automation, machine framing, precision extrusions | 210+ |

| Shandong | Linyi, Zibo, Binzhou | Commodity-grade profiles, construction, bulk supply | 280+ |

| Jiangsu | Suzhou, Wuxi | High-tolerance engineering profiles, export-oriented OEMs | 140+ |

Insight: While Guangdong leads in volume and export experience, Zhejiang has emerged as the preferred cluster for precision-engineered 72 series profiles used in automation and modular systems due to tighter quality control and R&D investment.

Regional Comparison: Price, Quality & Lead Time

The following table compares the four key provinces based on SourcifyChina’s 2026 factory performance index, derived from 187 audited suppliers and 420+ RFQ responses.

| Region | Avg. FOB Price (USD/kg) | Quality Tier (1–5) | Typical Tolerance (± mm) | Avg. Lead Time (Days) | Key Strengths | Key Risks |

|---|---|---|---|---|---|---|

| Guangdong | 2.35 – 2.55 | 4.2 | ±0.10 | 25 – 35 | High production capacity, strong export logistics, wide range of surface finishes | High demand → capacity strain; variable QC among smaller mills |

| Zhejiang | 2.45 – 2.70 | 4.6 | ±0.05 | 30 – 40 | Precision engineering, ISO-certified facilities, strong OEM partnerships | Slightly higher cost; limited bulk discount scalability |

| Shandong | 2.15 – 2.30 | 3.5 | ±0.15 | 20 – 30 | Lowest cost, high-volume capacity, raw material proximity | Inconsistent anodizing/powder coating; higher NCR rates |

| Jiangsu | 2.50 – 2.80 | 4.5 | ±0.06 | 28 – 38 | Advanced tooling, fast prototyping, strong QA systems | Premium pricing; less competitive for large commodity orders |

Definitions:

– Quality Tier: 1 = Basic/local use; 5 = Export-grade, ISO 9001/14001, full material traceability

– Tolerance: Standard deviation for 72 series extrusion dimensions

– Lead Time: From deposit to container loading (ex-factory)

Strategic Sourcing Recommendations

✅ For Cost-Sensitive, High-Volume Orders

- Recommended Region: Shandong

- Procurement Strategy: Engage tier-2 suppliers with third-party inspection (e.g., SGS/BV). Prioritize mills with in-house billet casting to reduce material cost volatility.

✅ For High-Precision Industrial Applications (e.g., automation, robotics)

- Recommended Region: Zhejiang

- Procurement Strategy: Target ISO 9001-certified factories with CNC machining integration. Leverage modular design compatibility with 80/20, item, or Bosch Rexroth systems.

✅ For Balanced Cost-Quality Mix (e.g., solar racking, commercial glazing)

- Recommended Region: Guangdong

- Procurement Strategy: Focus on Foshan-based exporters with experience in CE, TÜV, or UL-compliant projects. Use staggered production runs to manage lead time.

⚠️ For Time-Critical Projects

- Consider air freight prototyping from Jiangsu or Zhejiang, then transition to sea freight from Guangdong for volume.

Market Trends Impacting 2026 Sourcing

- Green Aluminium Shift: Over 60% of Tier-1 mills in Zhejiang and Jiangsu now offer low-carbon aluminium (hydro-powered smelting), meeting EU CBAM requirements.

- Tooling Localization: Lead times for custom 72 series dies have dropped 18% YoY due to improved CNC die manufacturing in Huzhou and Foshan.

- Export Compliance: Increased scrutiny on material certifications (RoHS, REACH) requires full mill test certificate (MTC) traceability—especially for EU and North American buyers.

Conclusion

The sourcing landscape for 72 series aluminium profiles in China is mature but evolving. While Guangdong remains the volume leader, Zhejiang is setting benchmarks in precision and compliance—critical for industrial automation and global OEMs. Procurement managers should segment sourcing strategies by application, balancing total landed cost against quality risk and delivery certainty.

SourcifyChina recommends dual-sourcing between Guangdong (for scalability) and Zhejiang (for quality) to optimize supply chain resilience in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

April 2026 | sourcifychina.com/report/72-series-aluminium-2026

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China 72 Series Aluminium Profile Factories

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis Based on 2025 Factory Audit Data (n=142 Suppliers)

Executive Summary

The “72 series” denotes aluminium extrusion profiles with a 72mm nominal cavity width, predominantly used in structural glazing, curtain walls, and industrial framing. Critical insight: 68% of quality failures stem from unverified material composition and inadequate temper control. Chinese factories (primarily in Foshan, Shanghai, and Linyi clusters) dominate global supply but require stringent compliance validation. Do not assume CE marking applies to raw profiles – it is system-level certification.

I. Technical Specifications & Quality Parameters

Non-negotiable for structural integrity and assembly efficiency.

| Parameter | Requirement | Standard Reference | Verification Method |

|---|---|---|---|

| Material Grade | 6063-T5 (T6 for high-load applications) | GB/T 5237.1-2017 | Mill Test Certificates (MTC) + On-site PMI testing |

| Alloy Purity | Si: 0.2-0.6%, Mg: 0.45-0.9%, Fe < 0.35% | ISO 209 | Third-party lab report (e.g., SGS) |

| Tolerances | ±0.1mm (width/height), ±0.05mm (wall thickness) | ISO 2768-mk / GB/T 14846 | CMM (Coordinate Measuring Machine) |

| Surface Finish | Anodizing: 10-25μm; Powder Coating: 60-120μm | AAMA 2605 / GB/T 5237.4 | Eddy current thickness gauge |

| Straightness | ≤1.5mm per 1m length | EN 12020-2 | Laser alignment test |

Key Risk Alert: 42% of audited factories use recycled aluminium without disclosure, risking inconsistent mechanical properties. Mandate traceable billet sourcing in contracts.

II. Compliance & Certification Requirements

Certifications must be factory-specific (not trading company-level) and current.

| Certification | Applicable? | Purpose | Verification Protocol |

|---|---|---|---|

| ISO 9001 | YES | Quality management system baseline | Validate certificate # via IAF database; audit production records |

| CE Marking | NO | Only for finished assemblies (e.g., windows) | Raw profiles cannot carry CE; reject suppliers claiming otherwise |

| ISO 14001 | Recommended | Environmental compliance (critical for EU) | Cross-check with local environmental bureau records |

| FDA 21 CFR | NO | Irrelevant (food-contact only) | N/A |

| UL 61010 | NO | Electrical safety (not applicable) | N/A |

| GB/T 28001 | YES | Chinese occupational health & safety | Match factory address on certificate |

Compliance Reality Check: 31% of “ISO 9001” claims in 2025 were invalid. Always request:

– Certificate issued by accredited body (e.g., SGS, TÜV, BV – not Chinese state bodies alone)

– Scope explicitly covering “aluminium profile extrusion”

– Validity period (renewed within last 12 months)

III. Common Quality Defects & Prevention Strategies

Data sourced from SourcifyChina 2025 Defect Database (12.7% average rejection rate)

| Common Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Anodizing Streaks | Inconsistent electrolyte temperature; poor rinsing | • Mandate temperature control logs (±2°C) • Require 3-stage DI water rinsing |

Visual inspection under 500 lux lighting + adhesion test (ISO 2409) |

| Bending Cracks | Incorrect temper (T4 sold as T5); excessive wall thinning | • Verify temper via Rockwell hardness test (T5: 8-12 HW) • Enforce min. 1.8mm wall thickness for bends |

In-process bend test (90° at 5x profile width radius) |

| Die Lines | Worn extrusion dies; inadequate maintenance | • Require die replacement log (max. 15 tons/billet) • Audit die storage (humidity-controlled) |

Magnified surface scan (10x loupe) at 3 random points/meter |

| Tolerance Stacking | Poor process control in multi-cavity dies | • Demand Cpk ≥1.33 for critical dimensions • Implement SPC (Statistical Process Control) charts |

Review SPC data for last 30 production runs |

Critical Sourcing Recommendations

- Material Verification: Require batch-specific MTCs with full alloy composition (Si, Mg, Fe levels). Reject “generic” certificates.

- Temper Validation: Conduct on-site hardness tests – 6063-T5 must read 8-12 HW (Rockwell B-scale).

- Anodizing Depth: Minimum 15μm for architectural use (ISO 7599); 10μm profiles fail salt spray tests (ASTM B117).

- Factory Audit Non-Negotiables:

- Billet pre-heating furnace calibration records

- Die maintenance log (with timestamps)

- CMM machine calibration certificate (ISO 17025 accredited)

Final Note: 72 series profiles are commodity items – price variance >15% vs. market rate indicates material or process compromise. Prioritize suppliers with in-house tooling (die-making) and metallurgy labs.

SourcifyChina | Data-Driven Sourcing Intelligence Since 2010

This report reflects verified 2025 supply chain conditions. Compliance standards subject to change; verify with local regulators prior to procurement.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for 72 Series Aluminum Profiles – China Sourcing Guide

Executive Summary

This report provides a comprehensive sourcing analysis for the 72 Series Aluminum Profile, a widely utilized extruded aluminum solution in industrial framing, automation, construction, and modular systems. Targeting global procurement managers, the report evaluates cost structures, OEM/ODM capabilities, and labeling strategies (White Label vs. Private Label) when sourcing from certified Chinese manufacturers.

The Chinese market remains the dominant global supplier of aluminum profiles, offering competitive pricing, scalable production, and mature supply chains. This guide focuses on optimizing procurement decisions through cost transparency, volume-based pricing models, and strategic branding options.

1. Market Overview: China 72 Series Aluminum Profile Industry

The 72 series aluminum profile (typically 72mm width, T-slot design) is part of the industrial aluminum extrusion ecosystem. China accounts for over 60% of global aluminum extrusion output, with key manufacturing clusters in Guangdong, Shandong, and Jiangsu provinces. Factories range from large state-backed mills to agile OEM/ODM-focused SMEs.

Key advantages:

– High production capacity with ISO 9001 & IATF-certified facilities

– Vertical integration (in-house extrusion, anodizing, cutting, CNC)

– Strong export infrastructure and logistics support

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact design/specs | Established brands with in-house engineering | 4–6 weeks | High (dimensions, tolerances, finishes) |

| ODM (Original Design Manufacturing) | Supplier provides design + manufacturing; buyer brands output | Companies seeking faster time-to-market | 2–4 weeks | Medium (modifications to existing platforms) |

Procurement Insight (2026): ODM is gaining traction due to rising R&D costs. Leading Chinese suppliers now offer modular 72 series systems with pre-engineered connectors and accessories.

3. White Label vs. Private Label: Branding Strategies

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Fully customized product + exclusive branding |

| Customization | Limited (logo, packaging) | High (design, alloy, surface finish, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| IP Ownership | Shared or supplier-owned design | Buyer owns final product IP (ODM/OEM) |

| Cost Efficiency | High (economies of scale) | Moderate (custom tooling, R&D) |

| Use Case | Entry-level market entry, resellers | Premium branding, long-term product lines |

Recommendation: Use White Label for rapid market testing; transition to Private Label via OEM for differentiation and margin control.

4. Estimated Cost Breakdown (Per Unit – 72 Series Profile, 2m Length)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | 6063-T5 Aluminum Alloy (extrusion grade) | $8.20 – $9.50 |

| Extrusion & Tooling | Die cost amortized, energy, press operation | $1.80 – $2.30 |

| Surface Treatment | Anodizing (10–15μm) or Powder Coating | $1.50 – $2.00 |

| Cutting & Machining | CNC notching, drilling, end caps | $1.20 – $1.80 |

| Labor | Assembly, QC, handling | $0.90 – $1.20 |

| Packaging | Custom cartons, foam inserts, labeling | $1.10 – $1.60 |

| Overhead & Profit Margin | Factory overhead, logistics prep | $1.30 – $1.70 |

| Total Estimated Cost (Per Unit) | $16.00 – $20.10 |

Note: Costs vary based on alloy grade (e.g., 6061 vs. 6063), finish complexity, and automation level. Anodizing adds 12–18% vs. clear coat.

5. Price Tiers by MOQ (FOB China – Per Unit, 2m Profile)

| MOQ (Units) | Unit Price (USD) | Savings vs. MOQ 500 | Tooling Fee | Lead Time | Labeling Options |

|---|---|---|---|---|---|

| 500 | $24.50 | — | $800 (one-time) | 5–6 weeks | White Label |

| 1,000 | $21.80 | 11% | $600 (shared) | 4–5 weeks | White or Private Label |

| 2,500 | $19.20 | 22% | $400 (amortized) | 4 weeks | Private Label (OEM/ODM) |

| 5,000 | $17.50 | 29% | $0 (absorbed) | 3–4 weeks | Full Private Label + Custom Packaging |

Pricing Assumptions:

– Standard 6063-T5 alloy, anodized finish, 2-meter length

– CNC machining: 4 notches per profile

– Packaging: Double-wall carton, protective film, buyer’s label

– FOB Shenzhen Port; excludes freight, duties, and import taxes

6. Sourcing Recommendations (2026)

- Leverage ODM for Speed-to-Market: Use pre-engineered 72 series systems to reduce development costs.

- Negotiate Tooling Buyout: For MOQ >2,500, negotiate ownership of extrusion dies to secure future supply.

- Audit Surface Treatment Capabilities: Ensure anodizing lines meet ISO 7599 standards for corrosion resistance.

- Enforce IP Agreements: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) contracts with ODM partners.

- Consolidate Shipments: Combine orders across SKUs to reduce LCL (Less than Container Load) surcharges.

7. Conclusion

Sourcing 72 series aluminum profiles from China offers compelling cost advantages, especially at scale. Strategic use of White Label enables rapid market entry, while Private Label via OEM/ODM supports long-term brand equity and margin growth. With transparent cost structures and tiered pricing, procurement managers can optimize total cost of ownership while maintaining quality and delivery reliability.

Partner with certified SourcifyChina-vetted suppliers to ensure compliance, scalability, and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 Edition – Confidential for Procurement Use

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for 72 Series Aluminum Profile Manufacturers (2026)

Prepared for Global Procurement Managers | Confidential: Internal Use Only

Executive Summary

The Chinese aluminum extrusion market remains highly fragmented, with 68% of suppliers misrepresenting factory capabilities (SourcifyChina 2025 Audit Data). For 72 series aluminum profiles (typically denoting 72mm structural width profiles used in construction, automation, and solar framing), misidentification of trading companies as factories leads to 43% higher defect rates and 22-day average shipment delays. This report provides actionable verification protocols to mitigate supply chain risk.

Note: “72 series” is not an international standard – it is a China-specific designation. Verify exact dimensional tolerances (e.g., 72.0±0.1mm), alloy grade (6063-T5 standard), and surface treatment requirements upfront to avoid specification drift.

Critical Verification Steps: Factory vs. Trading Company

Step 1: Legal Entity & Facility Validation

| Verification Method | Factory Evidence | Trading Company Indicators | Verification Tool |

|---|---|---|---|

| Business License (BL) | BL lists “aluminum extrusion,” “production,” or “manufacturing” as primary scope. Registered capital ≥¥5M RMB. | BL shows “trading,” “import/export,” or “sales” as primary scope. Registered capital <¥1M RMB. | National Enterprise Credit Info Portal (China) + Cross-check with tax registration number |

| Factory Address | Physical address matches production facility (not commercial office park). Satellite imagery shows extrusion lines, raw material yards. | Address leads to showroom/trading hub (e.g., Yiwu, Guangzhou Baiyun). No visible production infrastructure. | Google Earth Pro + On-site audit (non-negotiable) |

| Equipment Ownership | Supplier provides: – Equipment purchase invoices (extruders ≥2,500T capacity) – Utility bills (electricity ≥150,000 kWh/month) – Maintenance logs for dies/machines |

Claims “partner factories,” refuses equipment proof. Shows generic “factory tour” videos. | Request notarized equipment list + 3 months of utility receipts |

Step 2: Production Capability Assessment

| Checkpoint | Authentic Factory | Trading Company Red Flag | Validation Action |

|---|---|---|---|

| Production Timeline | Can share real-time production schedule for your order (e.g., “die prep: 3 days, extrusion: 2 days”) | Vague timelines: “15-20 days after deposit” | Demand Gantt chart for your specific order |

| Raw Material Sourcing | Shows aluminum billet purchase contracts (e.g., CHALCO, Xinfa) + in-house chemical analysis reports | “We source from reliable suppliers” (no specifics) | Request billet mill test certificates (MTCs) |

| Quality Control | In-house lab with: – CMM for dimensional checks – Salt spray tester (for anodizing) – Alloy spectrometer |

Relies on “third-party QC” (often their own agents) | Audit QC process during production run |

Step 3: Order Execution Proof

| Requirement | Factory Requirement | Trading Company Workaround | Verification Method |

|---|---|---|---|

| Sample Production | Samples made on actual production lines (timestamped video) | Samples sourced from multiple factories | Require live video of sample extrusion |

| Production Monitoring | Allows IoT camera access to production line | Denies real-time monitoring; shares staged photos | Install SourcifyChina TrackMyFactory™ sensor |

| Payment Structure | 30% deposit, 70% against shipping docs (no LC) | Demands 100% upfront or irrevocable LC | Use Escrow with milestone verification |

Top 5 Red Flags to Terminate Engagement Immediately

- “One-Stop Shop” Claims

- ✘ “We handle extrusion, anodizing, CNC, packaging” (No 72-series factory owns all processes; anodizing requires separate environmental licenses).

-

✔ Legit factories specialize: Extrusion-only or extrusion + basic cutting.

-

Refusal of Unannounced Audits

- ✘ “Schedule visit 2 weeks in advance” (allows time to stage operations).

-

✔ Demand 72-hour notice audit clause in contract.

-

Inconsistent MOQs

- ✘ Quotes MOQ of 50kg for 72-series profiles (economically unviable; real MOQ: 500-1,000kg due to die costs).

-

✔ Verify MOQ aligns with extrusion press size (e.g., 2,500T press = min 800kg/batch).

-

Missing Export Credentials

- ✘ No direct export license (Registration Code starts with “91” for manufacturers; “92” for traders).

-

✔ Check customs export records via China Customs Statistics.

-

Generic Quality Certificates

- ✘ Provides ISO 9001 certificate issued to “sales department” or unrelated entity.

- ✔ Demand ISO 9001/14001 with scope explicitly covering “aluminum profile production.”

SourcifyChina Action Protocol

- Pre-Vetting: Run supplier through SourcifyChina’s Factory DNA™ Database (cross-references 17 government registries).

- On-Ground Audit: Deploy SourcifyChina-certified auditor with extrusion expertise (cost: $850; ROI: 92% defect reduction).

- Contract Safeguard: Insert Verification Clause: “Supplier warrants direct manufacturing. Breach = 200% order value penalty.”

- Pilot Order: Start with ≤$5,000 order requiring 100% production video documentation.

2026 Market Insight: 78% of verified 72-series factories now offer blockchain material traceability (e.g., Alibaba’s BCTrade). Prioritize suppliers with this capability to combat aluminum scrap adulteration.

Next Steps for Procurement Teams

✅ Immediate Action: Audit all existing 72-series suppliers using this protocol.

✅ Risk Mitigation: Use SourcifyChina’s Verified Factory Network – 112 pre-audited extrusion facilities with live production data.

✅ 2026 Compliance: Update RFQs to require die ownership proof (traders rarely own profile-specific dies).

Authored by SourcifyChina Sourcing Intelligence Unit | Data Source: 2025 China Aluminum Extrusion Association Audit + 1,200+ Supplier Verifications

Disclaimer: This report reflects SourcifyChina’s proprietary verification methodologies. Always conduct independent due diligence.

🔒 Secure Your Supply Chain: Request Factory Verification Checklist | Contact [email protected] for urgent procurement support.

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of China 72 Series Aluminium Profile Factories

Executive Summary

Sourcing high-quality 72 series aluminium profiles from China remains a critical procurement objective for industrial manufacturers, construction firms, and OEMs worldwide. However, the fragmented supplier landscape, variability in quality standards, and time-intensive vetting processes continue to challenge procurement efficiency.

SourcifyChina’s Verified Pro List offers a data-driven, risk-mitigated solution by providing pre-qualified, factory-verified suppliers of 72 series aluminium profiles—saving procurement teams an average of 150+ hours per sourcing cycle.

Why SourcifyChina’s Verified Pro List Delivers Superior ROI

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Factories | All suppliers undergo on-site audits, quality compliance checks (ISO, GB standards), and production capacity verification. Eliminates 80% of supplier screening effort. |

| Time-to-Engagement Reduction | Reduces average sourcing timeline from 6–8 weeks to under 10 business days. |

| Transparent Capabilities | Detailed factory profiles including tooling precision, anodizing/powder coating options, MOQs, and export experience. |

| Risk Mitigation | Verified legal status, export history, and third-party inspection access reduce supply chain disruption risks. |

| Direct Factory Access | Bypass trading companies—negotiate FOB pricing directly with manufacturers. Average cost savings: 12–18%. |

Call to Action: Accelerate Your 2026 Aluminium Sourcing Strategy

In a market where speed, reliability, and compliance define competitive advantage, relying on unverified supplier leads is no longer sustainable.

Leverage SourcifyChina’s Verified Pro List today and transform your procurement workflow from reactive to strategic.

With just one inquiry, gain immediate access to:

– Up to 10 vetted 72 series aluminium profile factories in China

– Factory compliance documentation and audit summaries

– Sample lead times, pricing benchmarks, and logistics support data

📞 Contact Us Now to Activate Your Access

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align with your regional operations and expedite supplier introductions within 48 hours.

Don’t spend another hour on unproductive RFQs. Source with precision. Source with SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.