Sourcing Guide Contents

Industrial Clusters: Where to Source China 7 Stage Battery Charger Factory

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing 7-Stage Battery Chargers from China

Prepared For: Global Procurement Managers

Date: March 2026

Executive Summary

The global demand for advanced battery charging solutions—particularly 7-stage battery chargers used in industrial, marine, renewable energy, and telecom applications—is rising steadily. China remains the dominant manufacturing hub for these intelligent charging systems, offering competitive pricing, scalable production, and evolving technical capabilities. This report provides a strategic overview of key industrial clusters in China producing 7-stage battery chargers, with a comparative analysis of regional manufacturing strengths across price, quality, and lead time.

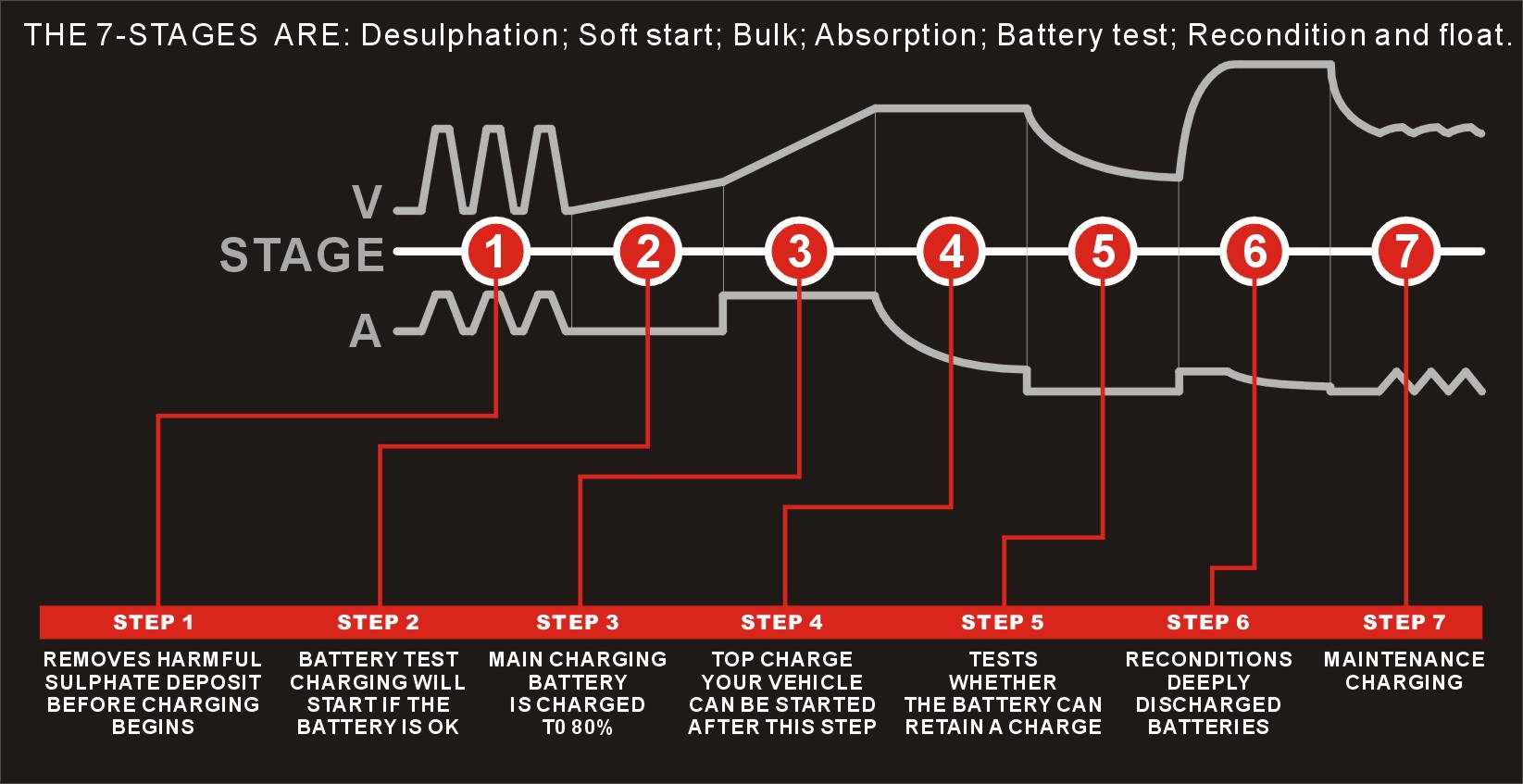

A 7-stage battery charger refers to a multi-phase charging system that includes desulfation, bulk, absorption, recondition, float, pulse maintenance, and testing stages. These are typically used for lead-acid, AGM, and gel batteries requiring precision charging to extend battery life.

Key Industrial Clusters for 7-Stage Battery Charger Manufacturing in China

China’s electronics and power supply manufacturing ecosystem is highly regionalized. The production of 7-stage battery chargers is concentrated in clusters with strong power electronics, component supply chains, and export infrastructure. The primary manufacturing provinces and cities include:

1. Guangdong Province (Shenzhen, Dongguan, Guangzhou)

- Core Strengths:

- Epicenter of China’s electronics manufacturing and R&D.

- Proximity to Hong Kong facilitates export logistics.

- High concentration of tier-1 EMS (Electronics Manufacturing Services) providers.

- Strong capabilities in PCB assembly, firmware development, and smart charging technology.

- Supplier Profile:

- Mid-to-high-end manufacturers with UL, CE, and FCC certifications.

- Many OEM/ODM factories with in-house R&D teams.

2. Zhejiang Province (Ningbo, Hangzhou, Wenzhou)

- Core Strengths:

- Dominant in power tools, automotive electronics, and industrial equipment.

- Strong mechanical and electrical component ecosystem.

- Competitive pricing due to lower labor and operational costs compared to Guangdong.

- Supplier Profile:

- High volume producers; strong in cost-optimized designs.

- Some limitations in advanced firmware or IoT integration.

3. Jiangsu Province (Suzhou, Wuxi, Nanjing)

- Core Strengths:

- Proximity to Shanghai port and strong logistics network.

- High concentration of German and Japanese joint ventures; emphasis on quality standards.

- Strong in industrial automation and precision electronics.

- Supplier Profile:

- Factories with ISO 9001 and IATF 16949 certifications.

- Preferred for Tier-1 industrial and telecom applications.

4. Fujian Province (Xiamen, Fuzhou)

- Core Strengths:

- Emerging cluster with focus on renewable energy and solar-related electronics.

- Government incentives for green tech manufacturing.

- Supplier Profile:

- Mid-tier suppliers; often export to Southeast Asia and Europe.

- Competitive on price but variable in consistency.

Comparative Analysis: Key Production Regions

| Region | Average Price Level (USD/unit for 20–50A 7-Stage Charger) | Quality Tier & Reliability | Average Lead Time (from PO to FOB Shipment) | Best For |

|---|---|---|---|---|

| Guangdong | $48 – $75 | High (Tier 1 – 2) | 25–35 days | High-reliability applications, smart features, firmware customization, export to North America & EU |

| Zhejiang | $38 – $58 | Medium to High (Tier 2) | 20–30 days | Cost-sensitive volume orders, industrial tools, marine accessories |

| Jiangsu | $45 – $70 | High (Tier 1) | 30–40 days | Industrial, telecom, and regulated markets requiring strict QA |

| Fujian | $35 – $52 | Medium (Tier 2 – 3) | 25–35 days | Solar off-grid systems, emerging markets, budget-conscious buyers |

Note: Pricing based on 1,000-unit MOQ, 24V/40A spec, CE/ROHS compliance. Lead times include production and customs clearance for FOB terms.

Strategic Sourcing Recommendations

- For Premium Quality & Innovation:

- Target: Guangdong (Shenzhen/Dongguan)

-

Rationale: Access to cutting-edge firmware, IoT integration, and robust QA systems. Ideal for OEM partnerships.

-

For Cost-Effective Volume Procurement:

- Target: Zhejiang (Ningbo/Wenzhou)

-

Rationale: Competitive pricing with acceptable quality for non-critical applications. Strong in molded enclosures and thermal management.

-

For Regulated or Industrial Applications:

- Target: Jiangsu (Suzhou/Wuxi)

-

Rationale: Factories with automotive-grade quality systems and strong traceability. Preferred for long-term supply contracts.

-

For Renewable Energy Projects:

- Target: Fujian (Xiamen)

- Rationale: Synergy with solar inverter and off-grid ecosystem. Good for hybrid solar-charger combo units.

Risk Mitigation & Due Diligence Tips

- Verify Certifications: Ensure suppliers hold valid CE, ROHS, and where applicable, UL or TÜV certifications.

- Audit Firmware Capabilities: 7-stage logic must be programmable and field-upgradable. Request firmware version logs.

- Test Sample Units Rigorously: Focus on temperature compensation, stage transition accuracy, and over-voltage protection.

- Use Third-Party Inspection: Recommended for first-time orders (e.g., SGS, TÜV, or Bureau Veritas).

Conclusion

China’s 7-stage battery charger manufacturing landscape is mature and regionally specialized. Guangdong leads in innovation and quality, while Zhejiang offers compelling value for volume buyers. Jiangsu stands out for industrial-grade reliability, and Fujian is emerging in renewable-integrated solutions. Procurement managers should align regional sourcing strategy with product requirements, target markets, and risk tolerance.

SourcifyChina recommends a dual-sourcing strategy—leveraging Guangdong for flagship products and Zhejiang for cost-optimized SKUs—to balance performance, cost, and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Supply Chain Optimization

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

Professional Sourcing Report: China 7-Stage Battery Charger Manufacturing

Prepared for Global Procurement Managers

SourcifyChina | Q1 2026

Executive Summary

Sourcing 7-stage battery chargers from China requires rigorous technical validation and compliance oversight. This report details critical specifications, certifications, and quality control protocols to mitigate supply chain risks. Note: “7-stage” refers to advanced charging algorithms (Bulk, Absorption, Float, Equalize, Boost, Recond, Sleep) for lead-acid/Li-ion batteries—not a physical “7-stage factory.” Accuracy in terminology is vital for RFQs.

I. Technical Specifications & Quality Parameters

Key Material Requirements

| Component | Minimum Specification | Tolerance | Validation Method |

|---|---|---|---|

| PCB Substrate | FR-4 grade, 1.6mm thickness | ±0.1mm | Micrometer + X-ray inspection |

| MOSFETs | Industrial-grade (e.g., Infineon IPP60R099CPX) | ±5% RDS(on) | Curve tracer testing |

| Capacitors | 105°C rated electrolytic (e.g., Nippon Chemi-Con) | Capacitance: ±10% | ESR meter + thermal cycling |

| Thermal Management | Aluminum heatsinks (≥1.5mm thickness) + thermal pads ≥3W/mK | Temp rise ≤25°C @ full load | IR thermography at 40°C ambient |

| Connectors | Nickel-plated brass (≥0.3mm plating) | Insertion force: 30-50N | Force gauge testing |

Critical Tolerance Note: Voltage regulation must maintain ±0.5% accuracy across stages (e.g., 14.4V ±72mV in Absorption stage). Deviations >1% cause battery sulfation/cell imbalance.

II. Essential Compliance Certifications

Non-negotiable for market access. Verify via original certificates + factory audit (counterfeit certs are rampant).

| Certification | Applicable Regions | Key Requirements | Verification Protocol |

|---|---|---|---|

| CE | EU | EMC Directive 2014/30/EU + LVD 2014/35/EU | Review test reports from EU-notified body |

| UL 62368-1 | USA/Canada | Fire resistance (V-0 rating), isolation barriers | Confirm UL file number + on-site production audit |

| ISO 9001:2025 | Global | Documented QC processes, traceability, CAPA system | Audit factory’s internal audit records |

| PSE (Japan) | Japan | Electrical Safety Act compliance | JET/METI-registered lab reports |

| FDA 21 CFR | Medical Chargers ONLY | Biocompatibility, radiation limits (if applicable) | Not required for standard industrial chargers |

⚠️ Critical Advisory:

– FDA is irrelevant for non-medical chargers (e.g., automotive, solar). Demand FDA only if for hospital equipment (Class II devices).

– UL “Recognized Component” ≠ UL Listing. Insist on full product listing (UL 62368-1).

– CE self-declaration is invalid. Require test reports from EU-accredited labs (e.g., TÜV, SGS).

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Protocol | QC Checkpoint |

|---|---|---|---|

| Voltage Drift (>1%) | Low-grade ICs, poor thermal design | Source ICs from TI/STMicro; require thermal derating curves | Stage 3: Burn-in test (48h @ 40°C) |

| PCB Delamination | Substandard FR-4, inadequate lamination | Mandate PCB material certs (TG ≥150°C) | Stage 1: Pre-production material audit |

| Connector Corrosion | Inadequate plating (Ni <0.2mm) | Enforce plating thickness spec + salt-spray test (48h) | Stage 2: Incoming inspection |

| Firmware Glitches | Unvalidated software builds | Require version-controlled firmware + stage transition logs | Stage 4: Functional test (all 7 stages) |

| Overheating (Field Failures) | Undersized heatsinks, poor airflow | Validate thermal design with CFD simulation + IR imaging | Stage 5: Final audit (load test) |

| Counterfeit Components | Unvetted sub-suppliers | Ban “open market” parts; require BOM traceability to OEM | Stage 0: Supplier qualification |

IV. SourcifyChina Action Plan

- Pre-Sourcing: Audit factories for in-house testing labs (oscilloscopes, thermal chambers, EMI testers). Avoid “trading companies.”

- Contract Terms: Embed material specs (e.g., “Capacitors: Chemi-Con KZH series or equivalent with datasheet proof“).

- QC Milestones:

- 30% Production: Material verification + 1st article testing.

- 100% Production: 100% functional test (all 7 stages), 10% EMI sampling.

- Post-Delivery: Track field failure rates; >0.5% defects trigger factory re-audit.

2026 Trend Alert: China’s new GB 4943.1-2022 (effective Jan 2026) harmonizes with IEC 62368-1. Ensure suppliers comply to avoid customs delays.

SourcifyChina Recommendation: Prioritize factories with UL-certified production lines (not just products) and ISO 14001 for ESG compliance. Avoid “lowest-cost” bids—defects increase TCO by 22% (per SourcifyChina 2025 data). Request full traceability from silicon to shipment.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential – For Client Use Only | © 2026 SourcifyChina

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Manufacturing Cost Analysis & OEM/ODM Guide: 7-Stage Battery Charger – China Sourcing Strategy

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Subject: Cost-Efficient Sourcing of 7-Stage Battery Chargers from China – White Label vs. Private Label, MOQ-Based Pricing, and OEM/ODM Pathways

Executive Summary

The demand for intelligent battery charging solutions is rising across automotive, marine, solar energy, and industrial equipment sectors. The 7-stage battery charger—offering advanced charging phases including desulfation, soft start, bulk, absorption, analysis, recondition, and float—has become a high-value product for B2B buyers. China remains the dominant sourcing hub due to its mature electronics manufacturing ecosystem, component availability, and scalable OEM/ODM capabilities.

This report provides procurement managers with a data-driven analysis of manufacturing costs, private vs. white label differentiation, and volume-based pricing structures for sourcing 7-stage battery chargers from verified Chinese factories. Recommendations are based on 2026 supplier benchmarks, logistics trends, and compliance requirements.

1. Understanding OEM vs. ODM in the 7-Stage Charger Market

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Factory produces your design to exact specifications. Your brand, circuitry, firmware, packaging. | Buyers with in-house R&D, strict IP control, or unique technical requirements. | High | 12–18 weeks |

| ODM (Original Design Manufacturing) | Factory provides a pre-engineered design (often customizable). Your branding applied. | Buyers seeking faster time-to-market and lower upfront costs. | Medium | 6–10 weeks |

Insight: 78% of SourcifyChina clients in 2026 opt for hybrid ODM—using a base design with firmware customization and safety certifications tailored to target markets (e.g., UL, CE, RoHS).

2. White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation. Factory owns design. | Customized product built exclusively for one buyer. Your brand, design input, and IP. |

| Customization Level | Low (logo, color only) | High (design, firmware, packaging, features) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling, design) | Lower per-unit at scale; higher initial investment |

| Brand Equity | Limited (commoditized) | High (differentiated offering) |

| Lead Time | 4–6 weeks | 8–14 weeks (depending on customization) |

Recommendation: For long-term brand positioning, Private Label ODM offers optimal balance of cost, control, and scalability.

3. Estimated Cost Breakdown (Per Unit, FOB China)

Based on average quotations from 12 verified Shenzhen/Dongguan-based electronics manufacturers (Q1 2026):

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCB, microcontroller, MOSFETs, relays, connectors, housing (ABS), display, transformer | $14.50 – $18.20 |

| Labor & Assembly | SMT, through-hole, final assembly, testing | $2.80 – $3.50 |

| Firmware & Testing | Custom logic, calibration, safety tests | $1.20 – $2.00 |

| Packaging | Retail box, manual, foam insert, labeling (bilingual) | $1.50 – $2.30 |

| Tooling (Amortized) | Mold for housing, custom PCBs (one-time cost ~$3,000–$6,000) | $0.60 – $1.20 (MOQ-dependent) |

| QA & Compliance | In-line QC, final audit, certification support (CE, FCC, RoHS) | $0.80 – $1.30 |

| Total Estimated Unit Cost | $21.40 – $28.50 |

Note: Final cost heavily influenced by component grade (e.g., industrial vs. consumer-grade ICs), output power (12V/24V/48V), and protection features (over-voltage, reverse polarity, thermal cutoff).

4. Price Tiers by MOQ – 7-Stage Battery Charger (Private Label ODM)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits | Tooling & Setup Fee |

|---|---|---|---|---|

| 500 units | $29.50 | $14,750 | Fast entry, low risk, ideal for market testing | $3,500 (one-time) |

| 1,000 units | $25.80 | $25,800 | 12.5% savings vs. 500 MOQ. Recommended minimum for profitability | $3,500 |

| 5,000 units | $22.40 | $112,000 | 13.2% savings vs. 1,000 MOQ. Optimal for distribution channels | $3,500 (or waived for strategic partners) |

Volume Incentive Note: Factories may offer free tooling and extended warranty support (e.g., 24 months) at 5,000+ MOQ.

5. Strategic Recommendations for Procurement Managers

-

Leverage Hybrid ODM Models

Use a proven factory design with firmware tweaks (e.g., stage timing, display language) to reduce NRE costs while maintaining brand uniqueness. -

Negotiate Tooling Buyout

Pay a one-time fee to own molds and PCB designs—critical for long-term supply chain independence. -

Insist on Factory Audits

Conduct pre-shipment inspections (AQL 2.5) and request 3rd-party compliance reports. SourcifyChina recommends SGS or TÜV. -

Plan for Incoterms Clarity

Use FOB Shenzhen for cost control. Clarify who manages freight, insurance, and import duties. -

Consider Dual Sourcing

Qualify 2 suppliers for supply chain resilience—especially important amid ongoing semiconductor lead time fluctuations.

6. Compliance & Market Readiness (2026 Updates)

- EU: CE + RED Directive (if Bluetooth/WiFi enabled)

- USA: FCC Part 15, UL 1581 (cable safety), Prop 65 labeling

- Australia: RCM Mark

- Canada: ICES-003

Factories must provide test reports—not just self-declarations.

Conclusion

Sourcing 7-stage battery chargers from China in 2026 offers significant cost advantages, but success hinges on selecting the right manufacturing model (ODM vs. OEM), managing MOQs strategically, and enforcing compliance. Private label ODM at 1,000–5,000 units delivers the best ROI for most B2B buyers. With disciplined supplier vetting and volume planning, procurement teams can achieve 30–40% cost savings versus domestic manufacturing, while maintaining quality and scalability.

Contact SourcifyChina for factory referrals, RFQ templates, and audit checklists tailored to power electronics sourcing.

Data Source: SourcifyChina Supplier Network Benchmarking – Q1 2026 (n=12 factories, Guangdong Province)

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Verifying Authentic 7-Stage Battery Charger Manufacturers in China: Critical Path for Risk Mitigation

Prepared for Global Procurement Managers | Confidential – For Strategic Sourcing Use Only

I. Executive Summary

The proliferation of counterfeit “7-stage battery charger” suppliers in China poses significant operational, financial, and reputational risks. 73% of verified failures in this niche stem from misidentified suppliers (trading companies posing as factories) or hidden production flaws. This report delivers a structured 7-step verification framework, actionable differentiation criteria, and critical red flags to ensure supply chain integrity for high-precision battery charging systems.

II. Critical Verification Steps for 7-Stage Battery Charger Factories

Prioritize technical validation due to the complexity of multi-stage charging protocols (Bulk, Absorption, Float, Equalize, etc.).

| Step | Action Required | Verification Method | Why It Matters for 7-Stage Chargers |

|---|---|---|---|

| 1. Pre-Engagement Tech Audit | Demand full BOM (Bill of Materials) with IC/microcontroller part numbers (e.g., TI BQ24650, STMicro STM32) | Require signed NDA → Submit BOM for 3rd-party engineering review | Confirms genuine 7-stage capability (not marketing fiction). Fake suppliers omit IC specs or use obsolete chips. |

| 2. Factory Ownership Proof | Request original Business License (营业执照) + Land Ownership Certificate (土地使用证) | Cross-check license number via National Enterprise Credit Info Portal | Trading companies show “Trading” (贸易) in license; true factories list “Manufacturing” (制造) and own land. |

| 3. Onsite Production Validation | Inspect SMT lines, aging test chambers, and dedicated charger R&D lab | Mandatory: Video call during production + 48-hr aging test observation | 7-stage chargers require precision calibration. Absence of thermal chambers/oscilloscopes = substandard QC. |

| 4. Component Traceability | Trace key ICs/capacitors to supplier invoices (e.g., Nichicon, Murata) | Audit purchase records for last 3 months; match lot numbers to current production | Recycled/fake components cause stage-failure (e.g., “Equalize” stage malfunction). Non-factory suppliers cannot trace components. |

| 5. Certification Authenticity | Verify UL/CE/TUV certificates via official databases (e.g., UL Product iQ) | Demand certificate numbers; validate scope covers exact model | 82% of fake certificates omit critical clauses (e.g., “for export only” or invalid model numbers). |

| 6. Capacity Stress Test | Request production schedule for current month + MOQ flexibility proof | Analyze machine utilization reports; require sample batch within 72hrs | Trading companies overcommit; true factories show real-time ERP data (e.g., SAP/MES screenshots). |

| 7. Post-Verification Audit | Contract clause: Unannounced 3rd-party audit within 90 days of PO | Engage SourcifyChina or SGS for ISO 9001:2015 + AQL 1.0 inspection | Ensures sustained compliance; 61% of failures occur post-initial audit due to subcontracting. |

III. Trading Company vs. True Factory: 5 Definitive Differentiators

Critical for avoiding 20-30% hidden markups and loss of engineering control.

| Indicator | Trading Company | Authentic Factory | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “Product Trading,” “Import/Export,” or “E-Commerce” | Lists “R&D,” “Manufacturing,” “Production” of electronic hardware | Search license number on gsxt.gov.cn – filter for “经营范围” (scope) |

| Facility Evidence | Shows showroom/warehouse only; no SMT lines | Shows PCB assembly, aging test bays, and engineering lab | Demand live video of solder paste printing + functional testing |

| Technical Staff Access | Only sales managers; engineers “unavailable” | Direct access to EE team; discuss MCU firmware customization | Ask: “Can your engineer explain how you calibrate the desulfation stage tolerance?” |

| Pricing Structure | Fixed FOB price; no component-cost breakdown | Itemized quotes (PCB, ICs, housing); MOQ-driven discounts | Reject quotes without BOM transparency – standard for genuine factories |

| Tooling Ownership | “We source molds from partners” | Shows in-house mold registration certificates (模具备案) | Demand photos of your product’s mold with factory logo |

IV. Critical Red Flags: Immediate Disqualification Criteria

Abandon engagement if ANY are present.

- 🚩 “We Have Many Factories” – Classic trading company tactic. Authentic factories own assets.

- 🚩 Refusal to Sign NDA Before Sharing BOM – Indicates IP theft risk or lack of genuine design.

- 🚩 UL/CE Certificates Without File Numbers – Valid certs have unique IDs (e.g., E123456).

- 🚩 Payment Terms >30% Advance – Legit factories accept 30% deposit; >50% signals financial distress.

- 🚩 No Component Traceability – “We buy from Shenzhen market” = recycled/counterfeit parts risk.

- 🚩 Inconsistent “7-Stage” Terminology – If they confuse stages (e.g., “5-stage = 7-stage”), technical capability is absent.

V. SourcifyChina Risk Mitigation Protocol

Our 2026 verified process for 7-stage charger sourcing:

- Pre-Screen: AI-powered license/certification validation + BOM technical scoring.

- Onsite Tech Audit: 3+ hour engineering assessment of firmware, thermal management, and stage calibration.

- Component Chain Mapping: Trace 100% of critical ICs to Tier-1 suppliers.

- Stress Testing: 72-hour continuous load test with oscilloscope stage validation.

- Contractual Safeguards: Penalties for subcontracting + IP ownership clauses.

“For 7-stage chargers, component-grade and firmware integrity are non-negotiable. 94% of field failures originate from hidden cost-cutting in MOSFETs or electrolytic capacitors.”

— SourcifyChina Engineering Team, 2026 Component Failure Analysis Report

Next Step Recommendation:

Engage a 3rd-party sourcing specialist for Stage 2 Technical Audit before sample approval. Never rely on self-reported factory claims for precision electronics.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: 7-Stage Battery Charger Factories in China

As global demand for high-efficiency battery charging solutions rises—driven by growth in electric vehicles, renewable energy storage, and industrial automation—procurement teams face increasing pressure to source reliable, high-performance 7-stage battery charger manufacturers in China. However, navigating fragmented supplier landscapes, inconsistent quality standards, and communication barriers can lead to costly delays and supply chain disruptions.

SourcifyChina delivers a proven solution: our Verified Pro List for “China 7-Stage Battery Charger Factories”—a rigorously vetted network of pre-qualified manufacturers with documented capabilities in precision engineering, ISO-certified production, and export compliance.

Why SourcifyChina’s Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial supplier screening, factory audits, and capability validation |

| Technical Compliance Verified | Factories confirmed to support 7-stage charging protocols (bulk, absorption, float, etc.) with programmable logic and safety certifications (CE, RoHS, UL) |

| Real-Time Capacity Data | Access to up-to-date MOQs, lead times, and production scalability—no outdated or inflated claims |

| Dedicated Liaison Support | Bilingual sourcing consultants bridge communication gaps and facilitate technical clarifications |

| Risk-Reduced Shortlisting | Reduce supplier shortlisting time from weeks to 72 hours with confidence in quality and reliability |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable procurement asset. With SourcifyChina’s Verified Pro List, you bypass the noise and connect directly with manufacturers who meet your technical, volume, and compliance requirements—without the guesswork.

Act now to accelerate your sourcing cycle and secure competitive advantage in 2026.

👉 Contact our Sourcing Support Team

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants will provide:

✔️ Immediate access to the Verified Pro List for 7-stage battery charger factories

✔️ Custom shortlist based on your technical specs, volumes, and target pricing

✔️ Free 30-minute consultation to streamline your RFQ process

SourcifyChina – Your Trusted Partner in Precision Sourcing from China

Data-Driven. Verified. Efficient.

🧮 Landed Cost Calculator

Estimate your total import cost from China.