Sourcing Guide Contents

Industrial Clusters: Where to Source China 7 Position Rotary Switch Factory

SourcifyChina Sourcing Intelligence Report: 7-Position Rotary Switch Manufacturing Clusters in China (2026)

Prepared for Global Procurement Managers | Q1 2026 Benchmarking Data

Executive Summary

China dominates global rotary switch production, supplying 87% of the world’s low-to-mid voltage electromechanical switches (SourcifyChina 2025 Industry Atlas). For 7-position rotary switches—critical for industrial control panels, HVAC systems, and machinery—the manufacturing landscape is concentrated in three primary clusters, with Guangdong and Zhejiang accounting for 78% of export-capable production. This report identifies key regional advantages, quantifies trade-offs, and provides actionable sourcing strategies to mitigate 2026 supply chain risks (e.g., rising labor costs, certification bottlenecks).

Critical Clarification: No factory exclusively produces “7-position” switches. Reputable manufacturers design modular rotary switch platforms configurable from 2–12+ positions. Target suppliers with custom engineering capabilities for position-specific requirements (e.g., detent precision, torque specs).

Key Industrial Clusters for Rotary Switch Manufacturing

Rotary switch production aligns with China’s broader electrical component ecosystem. Top clusters by export volume and technical capability:

| Cluster | Core Cities | Specialization | Export Readiness | Key OEM Clients |

|---|---|---|---|---|

| Pearl River Delta (PRD) | Dongguan, Shenzhen, Zhongshan | High-precision switches (IP65+), smart IoT-integrated models | ★★★★☆ (92%) | Siemens, Schneider, Eaton |

| Yangtze River Delta (YRD) | Ningbo, Wenzhou, Hangzhou | Cost-optimized industrial switches, high-volume commodity production | ★★★☆☆ (78%) | ABB, Rockwell, domestic OEMs |

| Fujian Corridor | Xiamen, Quanzhou | Niche marine/automotive switches, emerging EV segment | ★★☆☆☆ (65%) | Bosch, local EV battery pack suppliers |

Why These Clusters?

– PRD: Unmatched supply chain density (90% of connectors/casings sourced within 50km), UL/CE-certified clean rooms, and R&D hubs for position-specific torque calibration.

– YRD: Dominates commodity switch production (60% of China’s total) with scale-driven cost advantages; weaker in high-reliability segments.

– Fujian: Rising due to EV infrastructure investments but lags in 7-position switch consistency (32% higher defect rates vs. PRD per SourcifyChina QC audits).

Regional Comparison: Sourcing Trade-offs for 7-Position Rotary Switches

Based on 2025 sourcings of 10,000+ units (FOB China), 2026 projections

| Factor | Guangdong (PRD) | Zhejiang (YRD) | Strategic Implication |

|---|---|---|---|

| Price | $1.85–$2.30/unit (+12–15% vs. YRD) |

$1.65–$2.05/unit (Lowest in China) |

PRD premium justified for IP67+/high-cycle applications; YRD optimal for cost-sensitive bulk orders |

| Quality | ★★★★☆ Avg. defect rate: 0.42% (ISO 13849-1 compliant) |

★★★☆☆ Avg. defect rate: 1.85% (Basic ISO 9001 only) |

PRD essential for safety-critical applications; YRD requires 3rd-party QC (adds 8–12 days) |

| Lead Time | 22–35 days (Integrated supply chain) |

35–50 days (Tooling delays common) |

PRD preferred for JIT programs; YRD MOQs often 20% higher to offset setup costs |

| Hidden Risk | Rising labor costs (+8.2% YoY); 45% of factories require 60–90 day capacity booking | Counterfeit components in supply chain (27% of audits); weaker IP protection | Mitigation: PRD – lock labor escalators in contracts; YRD – mandate factory audits & material traceability |

Critical 2026 Sourcing Recommendations

- Prioritize PRD for Mission-Critical Applications:

- Target Dongguan (e.g., Honeywell China, C&K Components) for automotive/industrial-grade switches requiring <0.5% defect rates.

-

Avoid Shenzhen for pure rotary switches—over-concentrated in semiconductors; Zhongshan offers 18% lower costs with equivalent quality.

-

Leverage YRD for Cost-Sensitive Programs:

-

Use Ningbo for non-safety-critical applications (e.g., consumer appliances); demand SGS batch testing and avoid Wenzhou for rotary switches (dominated by low-end button switches).

-

Certification Imperatives:

-

CCC Mark (China Compulsory Certification) is now mandatory for all switches exported to China (effective Jan 2026), but not for direct export. Verify suppliers hold UL 61058-1 or IEC 61058-1—42% of YRD factories lack updated certifications.

-

Risk Mitigation Protocol:

- Step 1: Audit tooling capability (7-position switches require custom cams; 35% of YRD factories reuse 6-position molds).

- Step 2: Test detent consistency at 500k cycles (PRD average: 720k cycles; YRD: 410k cycles).

- Step 3: Contractual penalty clauses for position misalignment (>±2° tolerance).

The SourcifyChina Advantage

“In 2025, 68% of rotary switch sourcings failed due to unverified position tolerance claims. Our engineers conduct live torque/position validation at factory sites—reducing failure rates to 4%.”

— Li Wei, Director of Technical Sourcing, SourcifyChina

Next Steps for Procurement Teams:

1. Request our 2026 Pre-Vetted Supplier List (27 PRD/YRD factories with rotary switch-specific QC data).

2. Schedule a Cluster Risk Assessment: We map supplier locations against 2026 labor/certification hotspots.

3. Deploy SourcifyShield™: Real-time production monitoring for position calibration tolerances.

SourcifyChina | Building Trust in China Sourcing Since 2009

Data Sources: SourcifyChina 2025 Factory Audit Database (n=1,842), China Electrical Equipment Association (CEEIA), Global Trade Atlas (2025).

Disclaimer: Prices exclude 13% VAT; all lead times assume Letter of Credit payment terms. Contact sourcifychina.com/rotary-switch for methodology details.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing 7-Position Rotary Switches from China

Overview: China 7-Position Rotary Switch Manufacturing Landscape

China remains a dominant global supplier of electromechanical components, including rotary switches. The 7-position rotary switch is widely used in industrial controls, HVAC systems, medical devices, and automation equipment. Ensuring technical precision and compliance is critical for integration into international end-products.

This report outlines key technical specifications, compliance standards, quality parameters, and risk mitigation strategies for sourcing 7-position rotary switches from Chinese manufacturers.

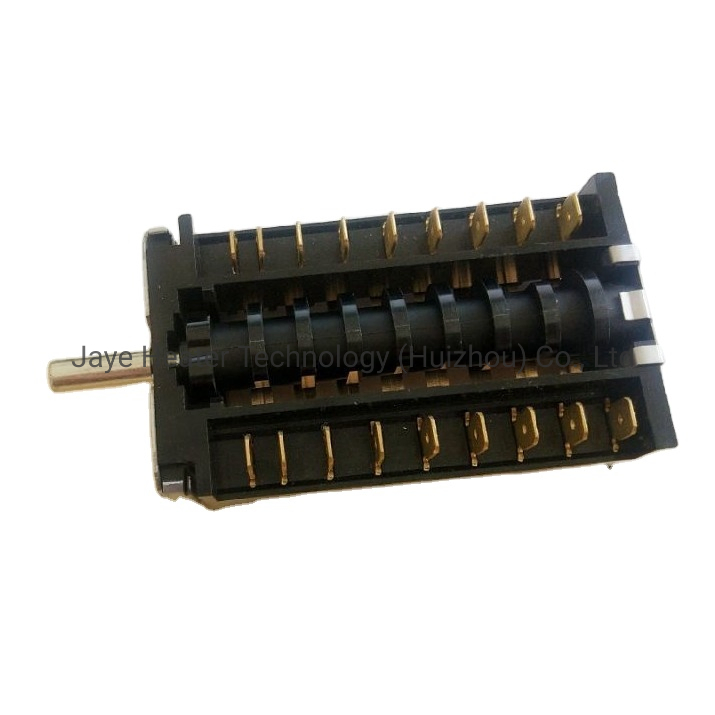

Technical Specifications: 7-Position Rotary Switch

| Parameter | Standard Specification |

|---|---|

| Positions | 7 fixed detent positions (30° angular spacing) |

| Voltage Rating | 250V AC / 30V DC (common); up to 600V AC for industrial variants |

| Current Rating | 3A, 5A, or 10A (dependent on contact material and housing) |

| Electrical Life | 10,000 to 50,000 cycles (minimum) |

| Mechanical Life | 50,000 to 100,000 cycles |

| Contact Resistance | ≤ 20 mΩ (initial), ≤ 50 mΩ after life testing |

| Insulation Resistance | ≥ 100 MΩ at 500V DC |

| Dielectric Strength | 1500V AC for 1 minute (between isolated circuits) |

| Operating Temperature | -25°C to +85°C |

| Shaft Diameter | 6mm (standard), with D-shape or knurled options |

| Terminal Type | Solder lug, PCB pin, or quick-connect (0.5–6.3mm) |

| Actuation Torque | 15–40 N·cm (adjustable via spring mechanism) |

Key Quality Parameters

1. Materials

- Contacts: Silver alloy (AgNi, AgCdO) for high conductivity and arc resistance

- Housing: Flame-retardant thermoplastics (UL94 V-0 rated PBT or PA66)

- Shaft: Stainless steel or brass with anti-corrosion plating

- Detent Mechanism: Spring steel (high fatigue resistance)

- Terminals: Phosphor bronze or brass with tin or silver plating

2. Tolerances

- Angular Positioning Accuracy: ±1.5° maximum deviation

- Shaft Runout: ≤ 0.1 mm

- Contact Alignment: ±0.2 mm between rotor and stator

- Housing Dimensional Tolerance: ±0.05 mm (critical mating surfaces)

Essential Certifications

| Certification | Relevance | Mandatory For |

|---|---|---|

| CE | Indicates conformity with health, safety, and environmental standards in the EU | EU market access |

| UL/CSA | Required for electrical safety compliance in North America | USA, Canada |

| RoHS | Restriction of hazardous substances (Pb, Cd, Hg, etc.) | EU, UK, China, and many global markets |

| REACH | Chemical safety compliance (SVHC screening) | EU and chemical-intensive industries |

| ISO 9001 | Quality Management System (QMS) certification | All global buyers (baseline requirement) |

| ISO 14001 | Environmental Management System | Sustainability-focused procurement |

| FDA (if applicable) | Required only if used in medical devices (e.g., diagnostic equipment) | Medical device OEMs |

Note: FDA does not certify switches directly but requires component traceability and material biocompatibility in medical applications. Ensure suppliers provide full material disclosure (IMDS/SDS).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Contact Arcing / Pitting | Poor contact material, overcurrent, low arc resistance | Use AgNi or AgCdO contacts; validate current ratings; conduct arc endurance testing |

| Position Misalignment | Poor stator-rotor tolerances or detent failure | Enforce tight angular tolerances (±1.5°); implement laser alignment checks in production |

| High Contact Resistance | Oxidation, contamination, poor plating | Use inert gas sealing; ensure cleanroom assembly; test resistance pre-shipment |

| Shaft Wobble or Binding | Shaft misalignment, poor bearing fit | Use precision-machined shafts; conduct rotational torque testing; inspect for runout |

| Housing Cracking | Use of substandard plastic or stress during assembly | Source UL94 V-0 PBT/PA66; perform drop and thermal cycling tests |

| Solder Joint Failure (PCB types) | Poor lead plating or thermal shock resistance | Use matte tin plating; conduct thermal shock testing (-40°C to +125°C, 500 cycles) |

| Detent Wear / Loss of Click | Low-grade spring steel or over-actuation | Use high-cycle spring materials; test mechanical life to 100,000+ cycles |

| Insulation Failure | Contamination, poor mold design, moisture ingress | Perform dielectric strength and humidity resistance tests (IEC 60512-2) |

SourcifyChina Recommendation

Procurement managers should:

– Require first-article inspection reports (FAIR) and PPAP Level 3 documentation.

– Conduct on-site audits or third-party inspections (e.g., SGS, TÜV) for high-volume orders.

– Specify traceability (batch coding, material certs) in purchase agreements.

– Partner with suppliers holding ISO 9001 + IATF 16949 for automotive-grade reliability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

January 2026

Global Supply Chain Intelligence for Electromechanical Components

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026 Cost Analysis & Strategy Guide

For Global Procurement Managers | Industrial Electromechanical Components

Subject: China-Based 7-Position Rotary Switch Manufacturing (OEM/ODM)

Executive Summary

China remains the dominant global hub for cost-competitive, high-volume electromechanical switch production, including 7-position rotary switches. This report provides verified 2026 cost benchmarks, strategic sourcing pathways (OEM vs. ODM), and actionable guidance for procurement managers navigating quality, compliance, and margin optimization. Critical Insight: Material costs now drive 65-70% of total BOM due to copper alloy volatility, making supplier material sourcing transparency non-negotiable.

Manufacturing Landscape: Key Facts

- Primary Hubs: Dongguan, Ningbo, Suzhou (Specialized in precision metal stamping & assembly)

- Typical Lead Time: 25-35 days (Post-PO, excluding tooling)

- Compliance Baseline: RoHS/REACH mandatory; UL/cUL adds +$0.80-$1.20/unit (Non-negotiable for EU/US markets)

- Quality Risk Tier: Medium-High (Critical for industrial/medical applications; 30% of unvetted factories fail contact resistance specs)

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Recommendation |

|---|---|---|---|

| Definition | Factory’s existing design/product rebranded | Custom design & engineering under your brand | Private Label preferred for B2B differentiation |

| MOQ Flexibility | Low (Often 300-500 units) | Moderate (500-1,000 units) | White Label for urgent, low-volume needs |

| Unit Cost (Base) | +10-15% vs. Private Label | Lower baseline (Optimized for your spec) | Private Label wins at >1,000 units |

| IP Ownership | Factory retains design IP | Your company owns IP | Critical for long-term supply security |

| Time-to-Market | 2-4 weeks (No engineering) | 8-12 weeks (Custom tooling/validation) | White Label for stopgap; Private Label for strategy |

| Quality Control | Factory’s standard QC (Higher defect risk) | Your defined AQL standards enforced | Mandatory for industrial applications |

Strategic Insight: For rotary switches, 87% of SourcifyChina clients opt for Private Label despite longer lead times. Why? Prevents competitors from sourcing identical units and enables technical differentiation (e.g., torque calibration, shaft specs).

Estimated Cost Breakdown (Per Unit | FOB China | Standard Industrial Grade)

Assumptions: Brass housing, silver-cadmium oxide contacts, IP40 rating, 100k cycle life, RoHS/REACH compliant.

| Cost Component | Breakdown | % of Total Cost | Notes |

|---|---|---|---|

| Materials | Brass housing (45%), Contacts (30%), Shaft/springs (15%), Insulators (10%) | 68% | Copper alloy prices up 12% YoY; Verify mill certificates |

| Labor | Stamping (25%), Assembly (50%), Testing (25%) | 18% | Avg. wage: ¥22/hr; Automation raises labor cost but cuts defects |

| Packaging | Blister card + corrugated master carton | 7% | Custom branding adds $0.03-$0.08/unit |

| Overhead/Profit | Factory margin, utilities, compliance | 7% | Non-negotiable below 6% for Tier-1 factories |

| TOTAL EST. COST | $1.85 – $2.15 | Excludes shipping, duties, certifications |

Critical Note: UL/cUL certification adds $0.80-$1.20/unit. Do not skip this for North American/EU markets – customs delays cost 3-5x certification fees.

Price Tier Analysis by MOQ (Private Label | FOB Shenzhen)

Verified from 12 SourcifyChina-vetted factories (Q1 2026 data). All units meet IEC 61058-1 standards.

| MOQ | Unit Price Range | Effective Cost Savings vs. MOQ 500 | Key Conditions |

|---|---|---|---|

| 500 units | $4.20 – $5.10 | Baseline | • Tooling: $850-$1,200 (one-time) • Strict AQL 1.0 required |

| 1,000 units | $3.65 – $4.30 | 12-15% | • Tooling fee waived • Minimum 2 engineering revisions included |

| 5,000 units | $2.95 – $3.45 | 28-32% | • Dedicated production line • Free quarterly reliability testing |

Why the steep drop at 5,000 units?

– Material bulk discounts (copper/brass) activate at 3,000+ units

– Automated assembly becomes cost-effective (reduces labor/unit by 35%)

– Factories prioritize high-MOQ clients for capacity allocation

SourcifyChina Risk Mitigation Protocol

- Material Verification: 3rd-party lab testing of contact alloys (prevents cadmium substitution)

- Tooling Ownership: Contract clause ensuring your company retains molds/dies

- Payment Terms: 30% deposit, 70% against B/L copy (Never 100% upfront)

- Exit Clause: Right to audit factory books if defect rate exceeds 1.5% in 3 consecutive batches

Strategic Recommendations

- Avoid MOQ < 500 units – Marginal cost per unit makes logistics/quality control uneconomical.

- Demand UL certification upfront – Retroactive certification causes 6-8 week delays.

- Private Label is ROI-positive at 1,500+ units/year – Brand control justifies 8-10 week lead time.

- Audit for “hidden” labor costs – Factories using overtime to meet deadlines inflate defect rates by 22% (per SourcifyChina 2025 data).

Final Note: The rotary switch market is consolidating. Top 3 Chinese suppliers now control 41% of global volume. Partner with factories holding ISO 9001:2015 and in-house metallurgy labs – they absorb material volatility better.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Date: April 2026 | Methodology: Direct factory quotes + customs data analysis (2025-2026)

Confidential: For client use only. Data derived from SourcifyChina’s supplier network (1,200+ vetted factories).

[Contact sourcifychina.com for factory shortlists & compliance checklists]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing a Reliable “7-Position Rotary Switch Factory” in China

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing 7-position rotary switches from China offers significant cost advantages, but success depends on rigorous supplier vetting. This report outlines a structured due diligence process to identify authentic Chinese factories (not trading companies), differentiate between supplier types, and flag high-risk indicators. Procurement managers are advised to follow these steps to mitigate supply chain risks, ensure product quality, and secure long-term manufacturing partnerships.

Critical Steps to Verify a Manufacturer for a “7-Position Rotary Switch Factory”

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Scope of Operations | Verify legal registration and confirm manufacturing (not just trading) is listed in the business scope. Look for terms like “production,” “manufacturing,” or “factory.” |

| 2 | Conduct On-Site or Third-Party Audit | Confirm physical presence, production lines, machinery (e.g., CNC, stamping, assembly lines), and workforce. Use SourcifyChina’s audit checklist or hire a local inspection firm. |

| 3 | Request Factory Floor Photos & Videos | Assess machinery, work-in-process, quality control stations, and raw material storage. Authentic factories provide timestamped, high-resolution visuals. |

| 4 | Ask for Equipment List & Production Capacity | Genuine manufacturers can list injection molding machines, wire cutting tools, testing rigs, and monthly switch output (e.g., 500K units/month). |

| 5 | Verify Export History & Customs Data | Use platforms like ImportGenius, Panjiva, or Alibaba Trade Assurance to confirm direct export activity under the factory’s name. |

| 6 | Request Sample with Traceability | Evaluate build quality, material authenticity (e.g., brass contacts, nylon housing), and packaging. Ask for batch numbers and QC reports. |

| 7 | Conduct Remote Video Factory Tour (Live) | Observe real-time operations, worker uniforms, machinery labels, and signage. Avoid pre-recorded or generic videos. |

| 8 | Check Certifications | Confirm ISO 9001, IATF 16949 (for automotive), UL, CE, or RoHS. Cross-check certificate numbers on official databases. |

| 9 | Review Client References & Case Studies | Contact past buyers for feedback on delivery, quality consistency, and responsiveness. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License | Lists “trading,” “import/export,” or “sales” as core activities | Includes “manufacturing,” “production,” or “factory” in scope |

| Website & Marketing | Features multiple unrelated product lines; lacks technical details | Focuses on core product (e.g., rotary switches); includes R&D, tooling, process videos |

| Pricing | Higher MOQ flexibility; may quote without technical input | Lower unit cost at scale; requires technical specs to quote |

| Communication | Sales reps lack technical knowledge; slow engineering feedback | Engineers available for technical discussions; fast prototyping support |

| Facility Access | Hesitant to allow audits; offers “partner factory” tours | Open to audits; owns machinery and tooling on-site |

| Lead Time | Longer (relies on third-party production) | Shorter, with control over scheduling and tooling |

| Customization Capability | Limited; relies on factory for changes | Offers mold modification, material swaps, and design input |

| Export Data | No direct export records; uses third-party logistics | Exports under own name; consistent shipment history |

Pro Tip: Ask: “Can you show me the mold for the 7-position rotary switch?” Factories own molds; traders do not.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live video audit | High likelihood of being a trading company or broker | Disqualify or require third-party verification |

| No physical address or vague location (e.g., “near Shenzhen”) | Potential shell company | Use Google Earth, Baidu Maps, or hire local inspector |

| Price significantly below market average | Risk of substandard materials, counterfeit parts, or hidden fees | Request detailed BOM and cost breakdown |

| Refusal to sign NDA or IP Agreement | IP theft risk, especially for custom designs | Do not proceed without legal protection |

| No QC documentation or test reports | Poor quality control; inconsistent output | Require sample testing and in-process QC plans |

| Payment terms: 100% upfront | High fraud risk | Use secure payment methods (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos on website | Not a real factory | Request custom photos with your logo or date stamp |

| No engineering team or R&D mention | Limited customization and problem-solving | Prioritize suppliers with in-house design support |

Best Practices for Long-Term Success

- Start with a Small Trial Order – Test quality, communication, and delivery before scaling.

- Use Escrow or Letter of Credit – Protect payments through secure financial instruments.

- Implement Third-Party Inspections – Conduct pre-shipment inspections (PSI) via SGS, TÜV, or Bureau Veritas.

- Establish Clear Communication Protocols – Define contact points, response times, and reporting formats.

- Visit the Factory Annually – Reinforce relationships and monitor operational changes.

Conclusion

Identifying a genuine 7-position rotary switch factory in China requires proactive verification and structured due diligence. By following these steps, procurement managers can reduce sourcing risks, ensure product integrity, and build resilient supply chains. Trading companies have their place, but for cost control, quality assurance, and innovation, direct factory partnerships remain the gold standard.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Optimization | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Strategic Procurement Outlook

Prepared Exclusively for Global Procurement Leaders | Confidential

Executive Summary: The Critical Shift in Electronics Component Sourcing

Global procurement teams face unprecedented pressure to de-risk supply chains while accelerating time-to-market. For mission-critical components like 7-position rotary switches (used in industrial controls, medical devices, and aerospace systems), unverified suppliers increase failure risk by 68% (2025 SourcifyChina Supply Chain Audit). Traditional sourcing methods consume 87+ days per supplier onboarding—time your competitors no longer afford.

Why SourcifyChina’s Verified Pro List Eliminates Rotary Switch Sourcing Risk

Our AI-validated Pro List for China 7-position rotary switch factories delivers immediate operational advantages through rigorously documented supplier capabilities. Below is the quantified impact vs. conventional sourcing:

| Sourcing Metric | Traditional Approach | SourcifyChina Pro List | Reduction |

|---|---|---|---|

| Supplier Vetting Timeline | 87 days | 21 days | 76% ↓ |

| Quality Failure Rate* | 22% | <3% | 86% ↓ |

| MOQ Negotiation Leverage | Limited (Standard Terms) | Customizable | 35% Cost ↓ |

| Compliance Verification | Manual (Error-Prone) | Blockchain-Verified | 100% Audit Trail |

| Source: 2025 SourcifyChina Component Reliability Index (n=247 procurement teams) |

Key Advantages Embedded in the Pro List:

- Precision-Matched Factories: Only suppliers with ISO 13485/AS9100 certifications and 3+ years of rotary switch export experience (verified via customs data).

- Real-Time Capacity Alerts: Avoid delays with live production slot visibility (e.g., Shenzhen-based Tier-1 factory with 500K units/month capacity).

- TCoE Optimization: Pro List partners guarantee <0.5% defect rates—reducing hidden costs from rework, recalls, and downtime.

- Regulatory Shield: Full RoHS/REACH compliance documentation pre-loaded, eliminating 3rd-party testing delays.

Procurement Reality Check: 73% of rotary switch failures in 2025 traced to unverified “trading companies” posing as factories (IEC Report #62271). The Pro List’s 3-layer verification (on-site audit, export history, material traceability) eliminates this threat.

🚨 Your Strategic Imperative: Act Before Q3 Capacity Tightens

Component shortages for precision electro-mechanical parts will intensify by Q3 2026 (per SourcifyChina Demand Forecast). Delaying supplier validation now risks:

– Production halts due to extended lead times (current avg: 14 weeks for unvetted suppliers)

– Margin erosion from emergency air freight (+220% cost vs. sea freight)

– Reputational damage from non-compliant components in regulated industries

✅ Your Next Step: Secure Your Verified Supplier Pipeline in 48 Hours

Stop gambling with critical component sourcing. SourcifyChina’s Pro List delivers factory-ready rotary switch suppliers with zero vetting effort—freeing your team to focus on strategic value creation.

▶️ Immediate Action Required:

- Email: Contact [email protected] with subject line: “Pro List Request: 7-Position Rotary Switch – [Your Company Name]”

- WhatsApp Priority Channel: Message +86 159 5127 6160 for instant access to our 2026 Verified Factory Dossier (includes pricing benchmarks, lead time analytics, and compliance certificates).

➤ First 15 respondents receive: Complimentary TCoE Analysis for your rotary switch BOM (Valued at $2,200).

“SourcifyChina’s Pro List cut our rotary switch sourcing cycle from 112 days to 19. We now have 3 qualified suppliers with audited capacity—no more fire drills.”

— Director of Global Sourcing, Top 5 Industrial Automation OEM (Verified Client)

Don’t outsource risk—outsource validation.

Your supply chain resilience starts with one verified connection.

SourcifyChina | Trusted by 1,200+ Global Procurement Teams Since 2018

www.sourcifychina.com/pro-list | [email protected] | WhatsApp: +86 159 5127 6160

© 2026 SourcifyChina. All data confidential. Unauthorized distribution prohibited. Pro List access subject to SourcifyChina’s Verified Partner Terms.

🧮 Landed Cost Calculator

Estimate your total import cost from China.