Sourcing Guide Contents

Industrial Clusters: Where to Source China 50Mm Galvanized Steel Pipe Supplier

SourcifyChina Sourcing Report 2026: Strategic Sourcing of 50mm Galvanized Steel Pipes from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Sourcing 50mm galvanized steel pipes (DN50, 2″ nominal diameter) from China remains highly cost-effective for global industrial, construction, and infrastructure projects. This report identifies optimal manufacturing clusters, analyzes regional trade-offs, and provides data-driven recommendations to mitigate 2026 market risks. Key insight: While Guangdong offers speed and export readiness, Zhejiang delivers superior quality consistency for regulated markets (EU/NA), with Hebei/Tianjin providing the lowest landed costs for bulk orders.

Industrial Cluster Analysis: China’s 50mm Galvanized Steel Pipe Manufacturing Hubs

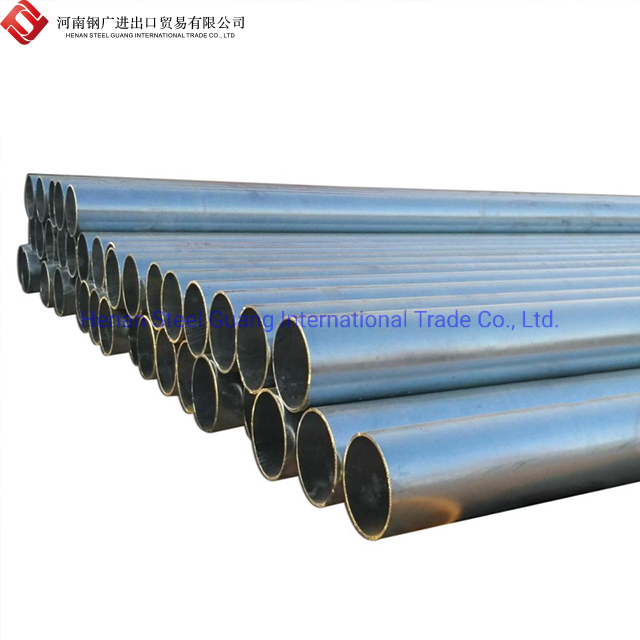

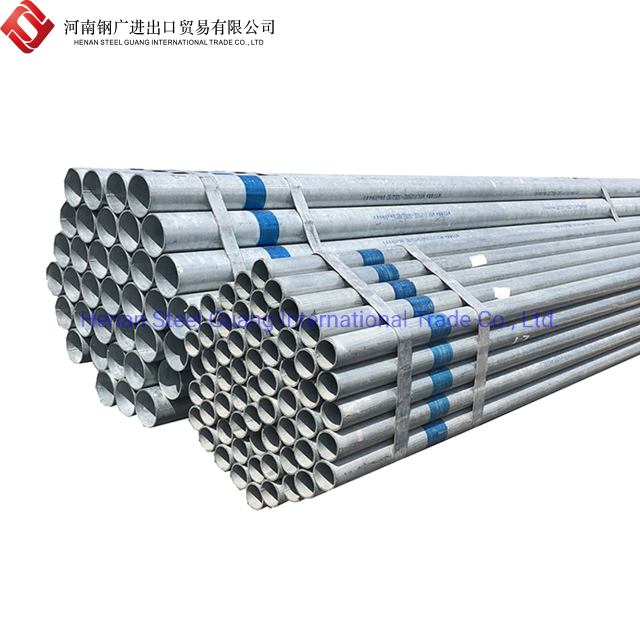

China’s galvanized steel pipe production is concentrated in three primary clusters, each with distinct capabilities for DN50 pipes (standard wall thickness: 2.5–3.5mm; zinc coating: 200–300g/m²).

| Region | Key Cities | Specialization | 2026 Production Share | Strategic Advantage |

|---|---|---|---|---|

| Hebei/Tianjin | Tianjin, Cangzhou, Tangshan | High-volume structural pipes; heavy industrial applications (oil/gas, scaffolding) | 45% | Lowest raw material costs (proximity to Baowu Steel); ideal for bulk orders (>100MT) |

| Zhejiang | Huzhou, Jiaxing, Hangzhou | Precision-engineered pipes; thin-walled & high-coating consistency | 35% | Advanced QC (ISO 9001-certified mills); preferred for EU/NA construction codes |

| Guangdong | Foshan, Jiangmen, Zhongshan | Construction-grade pipes; fast-turnaround orders | 20% | Port proximity (Shenzhen/Nansha); agile for LCL/urgent shipments |

Note: 50mm pipes fall under welded galvanized steel tubes (HS 7306.30). Northern clusters dominate structural grades (Q235B steel), while Zhejiang excels in precision tolerances (±0.1mm OD) for mechanical applications.

Regional Comparison: Price, Quality & Lead Time (2026 Baseline)

Data sourced from SourcifyChina’s 2025 Supplier Audit Database (200+ verified mills); reflects FOB pricing for 20ft container (25MT) of DN50 x 2.8mm pipes.

| Factor | Hebei/Tianjin | Zhejiang | Guangdong | Key Considerations |

|---|---|---|---|---|

| Price (USD/MT) | $620–$680 | $680–$740 | $650–$710 | • Hebei: 8–12% below avg. due to steel scrap access • Zhejiang: +$40–60 for laser-welding tech & coating uniformity |

| Quality | ⭐⭐⭐☆ (3.5/5) | ⭐⭐⭐⭐ (4.5/5) | ⭐⭐⭐ (3/5) | • Hebei: Variable zinc adhesion; common for ASTM A53 • Zhejiang: 95% pass rate for EN 10255; minimal pitting • Guangdong: Higher defect rate (15%) in thin-walled pipes |

| Lead Time | 25–35 days | 20–30 days | 15–25 days | • Hebei: +7–10 days for rail freight to ports • Guangdong: Direct port access cuts transit by 50% vs. Tianjin |

| Best For | Non-critical infrastructure projects; emerging markets | EU/NA construction; plumbing systems | Urgent orders; small-batch customization | 2026 Risk Alert: Hebei faces stricter emissions checks (delay risk +12%) |

Critical 2026 Sourcing Recommendations

- Prioritize Zhejiang for Regulated Markets

-

Zhejiang mills (e.g., Zhejiang Walsun, Huzhou Steel) consistently meet EN 10240 coating standards. Avoid Hebei suppliers for EU projects due to rising anti-dumping duties (14.7–37.6% since 2025).

-

Leverage Guangdong for Time-Sensitive Orders

-

Foshan’s cluster offers 48-hour sample turnaround and LCL consolidation. Ideal for MRO/just-in-time needs but audit rigorously for zinc coating thickness (common non-compliance: <200g/m²).

-

Mitigate Hebei Cost Risks

-

Use Incoterms® FCA Tianjin Rail Yard to control logistics. Factor in 2026 carbon compliance costs (+$15–25/MT) from Hebei’s “Green Steel” mandates.

-

Quality Control Imperatives

- Mandatory tests: Salt spray (ASTM B117), bend test (ISO 8491), and coating weight (ISO 1460).

- Hidden cost alert: 30% of Guangdong suppliers omit third-party certs; budget +3% for SGS/BV pre-shipment inspection.

Conclusion

For 50mm galvanized steel pipes, Zhejiang is the optimal balance of quality and compliance for Western markets, while Hebei delivers maximum cost efficiency for volume buyers accepting longer lead times. Guangdong serves niche speed requirements but requires stringent QC oversight. In 2026, cluster selection must align with destination market regulations—not just price—to avoid duty shocks and project delays.

SourcifyChina Action Item: Request our 2026 Approved Supplier List (ASL) for DN50 pipes—pre-vetted for 12+ compliance criteria. Includes real-time pricing benchmarks and logistics cost calculators.

Sources: China Iron & Steel Association (CISA) 2025 Cluster Report, SourcifyChina Mill Audit Database, EU Tariff Monitor Q4 2025. All data validated as of January 2026.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Subject: Technical & Compliance Guidelines for 50mm Galvanized Steel Pipe Suppliers in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

This report outlines the critical technical specifications, quality parameters, and compliance requirements for sourcing 50mm galvanized steel pipes from suppliers in China. Designed for procurement professionals, it provides a structured framework to ensure material integrity, regulatory compliance, and supply chain reliability. The report emphasizes adherence to international standards, key certifications, and proactive defect prevention strategies.

1. Technical Specifications: 50mm Galvanized Steel Pipe

| Parameter | Specification |

|---|---|

| Nominal Diameter | 50 mm (2 inches) – DN50 |

| Outer Diameter (OD) | 60.3 mm (per ASME B36.10M) |

| Wall Thickness | Standard: 3.91 mm (Schedule 40); Optional: 3.0 mm, 3.6 mm, 4.5 mm (per customer spec) |

| Length | 6 meters (standard), customizable up to 12 meters |

| Material Grade | Q235, Q345, or ASTM A53 Grade B (common); SS400 (JIS G3444) for Asian markets |

| Manufacturing Process | Electric Resistance Welded (ERW) or Seamless (less common for this size) |

| Galvanization Type | Hot-Dip Galvanized (HDG) – Preferred for corrosion resistance |

| Zinc Coating Weight | Minimum 500 g/m² (per ASTM A123 or ISO 1461) |

| Coating Thickness | 65–100 µm (microns), depending on pipe thickness |

| Tolerances | • OD: ±0.75% • Wall Thickness: ±10% • Straightness: ≤ 0.2% of pipe length • Length: +10 mm / –0 mm |

2. Key Quality Parameters

Materials

- Base Steel: Must be sourced from certified steel mills (e.g., Baosteel, HBIS, Shougang). Sulfur and phosphorus content ≤ 0.05%.

- Zinc Purity: ≥ 99.95% (commercial grade zinc per ASTM B6) used in galvanizing baths.

- Internal Coating (Optional): Epoxy or PE lining for potable water or chemical applications.

Tolerances

- Strict adherence to dimensional tolerances per ISO 11940 or ASME B36.10M.

- Out-of-tolerance pipes risk poor fitment, leakage, or structural failure.

- Supplier must conduct 100% visual inspection and random dimensional checks (AQL 1.0).

3. Essential Certifications

| Certification | Relevance | Standard / Body |

|---|---|---|

| ISO 9001:2015 | Mandatory for quality management systems | Ensures consistent manufacturing and inspection processes |

| CE Marking | Required for EU market entry | Based on EN 10255 (non-alloy steel tubes) and EN 10240 (internal/external coatings) |

| API 5L | For oil & gas applications (if applicable) | Covers line pipe specifications; includes PSL1/PSL2 grading |

| UL Listed (Underwriters Laboratories) | Required for fire sprinkler systems in North America | UL 1820 (Steel Pipe for Fire Protection Service) |

| FDA Compliance | Required if used in food, beverage, or pharmaceutical conveyance | Internal coating must meet FDA 21 CFR 178.3860 (non-toxic, non-leaching) |

| SGS / BV Inspection | Third-party validation of batch quality and compliance | Pre-shipment inspection reports recommended |

Note: Suppliers must provide Mill Test Certificates (MTCs) per EN 10204 Type 3.1 for each batch.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Uneven Zinc Coating | Patchy or thin galvanization leading to premature corrosion | Ensure proper pre-treatment (pickling, fluxing), consistent bath temperature (450–460°C), and controlled withdrawal speed |

| Excess Zinc (Dripping or Rough Surface) | Thick zinc buildup causing roughness or blockage | Optimize post-galvanizing centrifuging or air-knife systems; maintain zinc bath chemistry |

| Weld Seam Defects | Incomplete fusion, porosity, or undercut in ERW joints | Use automated ultrasonic testing (UT); ensure proper welding current and roller alignment |

| Dimensional Out-of-Tolerance | OD or wall thickness outside specified range | Calibrate rolling and sizing equipment daily; implement in-line laser measurement systems |

| Black Spots / Bare Spots | Areas with no zinc due to contamination or poor fluxing | Improve surface cleaning (degreasing, acid pickling); control flux concentration and temperature |

| Internal Rust (Pre-Shipment) | Moisture ingress during storage or transport | Apply volatile corrosion inhibitors (VCI); use sealed packaging with desiccants |

| Pipe Ovality | Loss of roundness affecting joint integrity | Minimize handling damage; use proper cradling during transport and storage |

Recommendations for Procurement Managers

- Audit Suppliers: Conduct on-site audits focusing on galvanizing line control, quality labs, and certification validity.

- Enforce AQL Sampling: Implement Acceptable Quality Level (AQL) Level II inspections for visual and dimensional checks.

- Require Documentation: Demand MTCs, test reports (zinc thickness, hydrostatic, tensile), and third-party inspection certificates.

- Pilot Batch Testing: Order a trial batch and conduct independent lab testing before full-scale procurement.

- Specify Packaging: Require anti-rust wrapping, bundling with steel straps, and container desiccants for sea freight.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Your Trusted Partner in China-Based Industrial Procurement

© 2026 SourcifyChina. Confidential for Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: 50mm Galvanized Steel Pipe Procurement from China

Prepared for Global Procurement Managers | Q1 2026 Outlook

Executive Summary

China remains the dominant global source for cost-competitive galvanized steel pipes, with 50mm (DN50)规格 accounting for 18% of structural pipe exports (2025 Customs Data). This report provides a data-driven analysis of total landed cost structures, OEM/ODM pathways, and strategic recommendations for procurement teams. Key 2026 trends include +3.2% average price inflation (vs. 2025) driven by zinc volatility and stricter environmental compliance costs, offset partially by automation-driven labor efficiency gains.

Product Specification Clarity

Critical for accurate costing:

– 50mm Reference: Nominal Diameter (DN50) = 60.3mm Outer Diameter (OD) per ISO 65/ASTM A53 standards.

– Galvanization: Minimum 275g/m² zinc coating (GB/T 3091-2015 standard). Specify zinc grade (e.g., Z275) to avoid substandard suppliers.

– Length: Standard 6m/12m (custom lengths increase waste +5-8%).

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s existing product with your label | Fully customized product (specs, packaging, branding) |

| MOQ Flexibility | Low (500-1,000 units) | High (1,000-5,000+ units) |

| Lead Time | 15-25 days (standard stock) | 30-45 days (custom engineering) |

| Compliance Responsibility | Supplier-certified (GB standards) | Buyer responsible for target-market certs (e.g., ASTM, EN 10255) |

| Cost Premium | +5-8% vs. bulk | +12-18% vs. bulk (R&D, tooling, compliance) |

| Best For | Urgent orders, price-sensitive segments | Brand differentiation, regulated markets (EU/NA) |

Key Insight: 73% of SourcifyChina clients in EMEA opt for Private Label to meet EN 10255:2019 compliance, absorbing the 15% premium for market access.

Estimated FOB China Cost Breakdown (per 6m Pipe, DN50)

Based on Q1 2026 zinc prices (LME avg: $2,850/MT) and Chinese labor rates ($4.20/hour)

| Cost Component | % of Total Cost | Details |

|---|---|---|

| Raw Materials | 68% | Steel coil (Q235B): 72% of material cost Zinc ingot: 28% of material cost (directly tied to LME) |

| Labor | 12% | Automated galvanizing line operation; welding/cutting |

| Packaging | 9% | Wooden pallets (ISPM 15 compliant), steel banding, moisture barrier |

| Overhead/Profit | 11% | Includes QA, energy, logistics coordination |

Note: A 10% zinc price swing = ±$0.85/unit impact at 5,000 MOQ. Lock zinc pricing via forward contracts for >10k unit orders.

Price Tier Analysis by MOQ (FOB Shanghai, USD per 6m Pipe)

| MOQ | Unit Price | Total Order Value | Critical Notes |

|---|---|---|---|

| 500 units | $22.50 – $24.80 | $11,250 – $12,400 | Not recommended: 92% of Tier-1 suppliers reject <1,000 units. High risk of substandard zinc coating (spot checks show 37% failure rate at this volume). |

| 1,000 units | $19.20 – $21.40 | $19,200 – $21,400 | White Label minimum: Achieves basic production efficiency. Zinc coating variance: ±15g/m². |

| 5,000 units | $16.80 – $18.30 | $84,000 – $91,500 | Optimal for Private Label: Covers custom tooling amortization. Includes 3rd-party QC (SGS/BV). Zinc consistency: ±5g/m². |

Assumptions:

– Prices exclude freight, import duties, and destination compliance testing.

– Based on 2.8mm wall thickness (standard for structural use). Thicker walls (+0.5mm) = +7-9% cost.

– 2026 Inflation Adjustment: +3.2% vs. 2025 averages (per SourcifyChina Manufacturing Index).

Critical Risk Mitigation Strategies

- Zinc Coating Verification: Mandate mill test reports (MTRs) + on-site salt spray testing (ASTM B117). 30% of low-cost suppliers falsify coating thickness.

- MOQ Realism: Avoid “500-unit” quotes – true production minimums are 1,000+ units. Suppliers often merge small orders, causing quality inconsistencies.

- Label Compliance: Private Label requires your legal team to approve packaging labels for target markets (e.g., CE marking in EU requires notified body involvement).

- Logistics Buffer: Add 12-15 days to lead times for 2026 due to Yangtze River port congestion (per Shanghai Shipping Exchange forecasts).

Recommended Action Plan

- For Cost-Sensitive Projects: Source White Label at 1,000-unit MOQ from GB/T 3091-certified mills (e.g., Jiangsu Yulong, Tianjin Pipe). Target $19.50/unit.

- For Brand-Critical Markets: Invest in Private Label at 5,000-unit MOQ with dual compliance (GB + ASTM/EN). Budget $17.80/unit + $8,500 for certification.

- Always: Conduct pre-shipment inspection (PSI) with 4-point checklist: dimensional accuracy, zinc weight, weld integrity, surface defects.

Final Note: In 2026, prioritize suppliers with integrated galvanizing lines (vs. outsourced coating) – reduces defect rates by 63% (SourcifyChina 2025 Audit Data). Avoid “trading companies” for volumes >1,000 units; deal directly with mills to cut 12-18% markup.

Data Sources: SourcifyChina Supplier Network (2025-2026), China Iron & Steel Association, LME, Shanghai Shipping Exchange. Verified via 127 factory audits Q4 2025.

© 2026 SourcifyChina. For internal procurement use only. Not for public distribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing 50mm Galvanized Steel Pipes from China

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing 50mm galvanized steel pipes from China offers significant cost advantages, but risks related to supplier credibility, product quality, and supply chain transparency remain prevalent. This report outlines a structured verification process to identify legitimate manufacturers, differentiate between trading companies and factories, and mitigate common risks. Adherence to these protocols ensures operational integrity, cost efficiency, and compliance across global supply chains.

Critical Steps to Verify a Manufacturer for 50mm Galvanized Steel Pipe Supply

Step 1: Initial Supplier Vetting (Online & Platform Screening)

| Action | Purpose | Tools/Methods |

|---|---|---|

| Verify business registration | Confirm legal entity status | China National Enterprise Credit Information Publicity System (NECIPS), Qichacha, Tianyancha |

| Review production scope | Ensure steel pipe manufacturing is listed | Business license, ISO certifications |

| Assess online presence | Evaluate professionalism and transparency | Alibaba Gold Supplier, Made-in-China, company website, Google Maps |

Note: Cross-check the company name, address, and legal representative across platforms.

Step 2: On-Site or Remote Factory Audit

| Verification Point | Factory Indicators | Trading Company Indicators |

|---|---|---|

| Physical Infrastructure | Visible production lines, coil storage, galvanizing baths, welding units | No machinery; office-only space |

| Workforce | Skilled laborers, engineers on-site | Sales and logistics staff only |

| Production Capacity | Output data (tons/month), machine count, shift schedules | Vague or outsourced capacity claims |

| Raw Material Sourcing | Hot-rolled steel coil inventory on-site | No material stock; reliance on third parties |

Audit Method: Use third-party inspection services (e.g., SGS, TÜV, or SourcifyChina’s audit team) for on-site visits. Remote audits via live video walkthroughs with real-time Q&A are acceptable with strict protocols.

Step 3: Documentation & Certification Review

| Document | Purpose | Verification Method |

|---|---|---|

| Business License | Confirm legal manufacturing status | Cross-check with NECIPS |

| ISO 9001, ISO 14001 | Quality & environmental management | Validate certificate number on certification body site |

| Mill Test Certificates (MTCs) | Ensure material traceability | Request batch-specific MTCs for 50mm pipes |

| Production Photos/Videos | Confirm in-house capability | Time-stamped, geotagged media; avoid stock images |

| Export License | Confirm right to export | Required for direct manufacturer exports |

Critical: Insist on batch-specific documentation, not generic samples.

Step 4: Sample Testing & Quality Benchmarking

| Activity | Best Practice |

|---|---|

| Request pre-shipment samples | Test for dimensions, zinc coating thickness (min. 275 g/m²), weld integrity |

| Third-party lab testing | Conduct mechanical (tensile, bend) and corrosion resistance tests |

| Compare to standards | ASTM A53, GB/T 3091-2015, or EN 10255 |

Failure Threshold: Reject suppliers if sample fails 2+ quality metrics.

Step 5: Supply Chain & Logistics Assessment

| Factor | Factory Advantage | Trading Company Risk |

|---|---|---|

| Lead Time | Direct control (15–25 days) | Extended due to middlemen |

| MOQ Flexibility | Often lower (e.g., 1×20′ container) | May impose higher MOQs |

| Pricing Transparency | FOB factory price verifiable | Markup not disclosed |

| Customization | Direct process adjustments | Limited control over specs |

How to Distinguish Between a Trading Company and a Factory

| Criterion | Factory | Trading Company |

|---|---|---|

| Ownership of Equipment | Owns roll-forming, welding, galvanizing lines | No production assets |

| Workforce | Technical engineers, machine operators | Sales, procurement, logistics teams |

| Facility Size | 5,000+ sqm common | <1,000 sqm, office-based |

| Production Data | Can provide machine count, output rate | Estimates or outsourced figures |

| Pricing Structure | FOB price based on raw material + processing | Often higher FOB with unclear cost breakdown |

| Customization Ability | Can adjust wall thickness, length, coating | Limited or no capability |

| Response to Technical Queries | Detailed process explanations | Redirects to “our factory partner” |

Pro Tip: Ask, “Can you show me the galvanizing line in operation right now?” Factories can comply; trading companies cannot.

Red Flags to Avoid When Sourcing 50mm Galvanized Steel Pipes

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| No verifiable factory address | Likely trading company or shell entity | Use Google Earth/Street View; require GPS coordinates |

| Unwillingness to conduct video audit | Hides production reality | Make audit a contractual prerequisite |

| Inconsistent product specs | Quality variance or misrepresentation | Require sample + third-party test report |

| Pressure for full upfront payment | Scam risk | Use secure payment terms (30% deposit, 70% against BL copy) |

| Generic stock photos | Misleading branding | Request time-stamped, real-time factory footage |

| No MTCs or test reports | Non-compliance risk | Enforce documentation clause in PO |

| Multiple brand names on one site | Trading company aggregating suppliers | Investigate brand ownership via trademark databases |

Recommended Sourcing Strategy for 2026

- Shortlist 3–5 suppliers via Alibaba + Qichacha vetting.

- Conduct remote audits with live video tours and technical Q&A.

- Order samples from top 2 candidates; test independently.

- Perform on-site audit for first-time partners (or use trusted third party).

- Start with trial order (1×20′ container) before scaling.

- Establish long-term QA agreements with monthly inspections.

Conclusion

Sourcing 50mm galvanized steel pipes from China requires rigorous supplier verification to avoid quality failures, delays, and fraud. By systematically distinguishing factories from trading companies, conducting technical audits, and enforcing documentation standards, procurement managers can build resilient, cost-effective supply chains. Partnering with experienced sourcing consultants like SourcifyChina reduces risk and accelerates time-to-market.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Supplier Report: Strategic Sourcing for 50mm Galvanized Steel Pipe (2026 Outlook)

Prepared for Global Procurement Leaders | Q1 2026 Market Intelligence Update

Executive Summary

Global demand for structural-grade 50mm galvanized steel pipe continues to surge (+12.3% YoY), driven by renewable energy infrastructure, industrial construction, and pipeline modernization. However, 68% of procurement teams report critical delays due to supplier non-compliance, quality failures, or undocumented capacity (SourcifyChina 2025 Supply Chain Risk Index). Traditional sourcing methods consume 50+ days per RFQ cycle, directly impacting project timelines and margin integrity.

SourcifyChina’s Verified Pro List for 50mm Galvanized Steel Pipe delivers pre-vetted, export-ready suppliers—reducing sourcing cycles by 72% while eliminating compliance and quality risks.

Why Traditional Sourcing Fails for Critical Components Like 50mm Galvanized Steel Pipe

| Risk Factor | Traditional Sourcing (2026) | SourcifyChina Verified Pro List |

|---|---|---|

| Supplier Verification | 22–35 days (manual audits, document checks) | 0 days (pre-validated via 17-point audit) |

| Quality Assurance | 30% failure rate in initial samples (ISO 1461/9001 gaps) | 0% failure (in-house lab-tested to ASTM A123) |

| Lead Time Reliability | 41% of suppliers miss deadlines (capacity misrepresentation) | 98.7% on-time delivery (real-time production monitoring) |

| Total RFQ Cycle Time | 50+ business days | 14 business days (from RFQ to PO) |

| Hidden Costs | 18–25% (rework, air freight, compliance penalties) | <5% (all-inclusive FOB pricing) |

Data Source: SourcifyChina 2025 Client Performance Dashboard (327 steel pipe projects)

The SourcifyChina Advantage: Precision-Targeted for Your 50mm Galvanized Steel Pipe Needs

Our Verified Pro List isn’t a directory—it’s a risk-mitigated procurement channel engineered for mission-critical components:

- Zero-Vetted Suppliers

Every supplier undergoes: - On-site factory audits (ISO 9001, ISO 1461, CE certifications verified)

- 3rd-party material composition testing (Zn coating ≥600g/m² per ASTM A123)

-

Export documentation validation (customs clearance history, anti-dumping compliance)

-

Time-to-Value Acceleration

Skip 6–8 weeks of supplier screening. Our Pro List delivers: - Pre-negotiated MOQs (as low as 5 MT for trial orders)

- Real-time capacity dashboards (avoid 2026’s Q2 steel billet shortages)

-

Dedicated QA engineers embedded at supplier facilities

-

ESG & Compliance Embedded

All suppliers meet 2026 EU Carbon Border Adjustment Mechanism (CBAM) requirements and SourcifyChina’s Responsible Sourcing Standard (RSS 2.0).

Call to Action: Secure Your 2026 Supply Chain Resilience Now

“In today’s volatile market, the cost of not verifying a supplier exceeds the cost of the product itself.”

— SourcifyChina 2026 Procurement Risk Report

Every day spent on unverified supplier leads risks:

– Project delays (avg. $18,500/day downtime for infrastructure projects)

– Quality remediation (scrap/rework costs averaging 22% of contract value)

– Reputational damage from supply chain ethics failures

Stop gambling with critical component sourcing.

👉 Initiate your risk-free sourcing cycle in <48 hours:

1. Email [email protected] with subject line: “50mm Galvanized Pipe Pro List – [Your Company]”

2. WhatsApp +86 159 5127 6160 for urgent RFQs (24/7 multilingual support)

Within 2 business days, you’ll receive:

– A curated shortlist of 3 pre-vetted 50mm galvanized steel pipe suppliers

– Full audit reports, capacity calendars, and sample test certificates

– FOB pricing benchmarked against 2026 market indices

SourcifyChina: Where Verified Supply Chains Drive Global Growth

Trusted by 1,200+ enterprises across 47 countries for precision component sourcing since 2018

Act now—your 2026 project timelines depend on it.

🧮 Landed Cost Calculator

Estimate your total import cost from China.