Sourcing Guide Contents

Industrial Clusters: Where to Source China 500W Brushless Dc Motor Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing 500W Brushless DC (BLDC) Motor Manufacturers in China

Target Audience: Global Procurement Managers

Publication Date: January 2026

Report ID: SC-BLDC-CHN-2026-01

Executive Summary

The global demand for high-efficiency, compact, and intelligent electric motors continues to rise, driven by growth in electric mobility, industrial automation, HVAC systems, and consumer robotics. Within this landscape, the 500W brushless DC (BLDC) motor has emerged as a pivotal component due to its optimal balance of power, efficiency, and control. China remains the dominant manufacturing hub for BLDC motors, accounting for over 72% of global production capacity (Source: China Electrical Equipment Association, 2025).

This report provides a strategic sourcing analysis for procurement leaders targeting 500W BLDC motor manufacturers in China, with a focus on identifying key industrial clusters, evaluating regional strengths, and benchmarking supply chain performance across price, quality, and lead time.

Market Overview: 500W BLDC Motors in China

- Key Applications:

- E-bikes & electric scooters

- Industrial pumps & compressors

- CNC machinery & robotics

- HVAC fan systems

- Medical devices

-

Drones & AGVs (Automated Guided Vehicles)

-

Production Volume (2025):

Estimated 48 million units of 500W BLDC motors produced in China annually, with a CAGR of 11.3% (2021–2025). -

Export Markets:

Top destinations include the EU (38%), North America (29%), Southeast Asia (18%), and India (9%). -

Technology Trends:

Increasing integration of sensors, IoT connectivity, and smart controllers; shift toward IP67-rated, low-noise, and high-torque density models.

Key Industrial Clusters for 500W BLDC Motor Manufacturing

China’s BLDC motor manufacturing is concentrated in three primary industrial clusters, each offering distinct advantages in cost, specialization, and supply chain maturity.

1. Guangdong Province (Pearl River Delta)

Key Cities: Shenzhen, Dongguan, Foshan, Guangzhou

– Ecosystem Strengths:

– Proximity to electronics and EV supply chains

– High concentration of R&D centers and Tier-1 EMS providers

– Strong export logistics via Shenzhen and Guangzhou ports

– Specialization: High-volume, smart-integrated motors for e-mobility and consumer tech

– Supplier Density: >180 active BLDC motor manufacturers (50+ with ISO 9001/14001)

2. Zhejiang Province (Yangtze River Delta)

Key Cities: Hangzhou, Ningbo, Wenzhou, Shaoxing

– Ecosystem Strengths:

– Legacy in precision mechanical engineering

– Dominance in industrial automation and pump systems

– Strong government support for green manufacturing

– Specialization: Industrial-grade, high-reliability motors for HVAC, pumps, and machinery

– Supplier Density: >150 motor manufacturers, with 30+ certified under IATF 16949

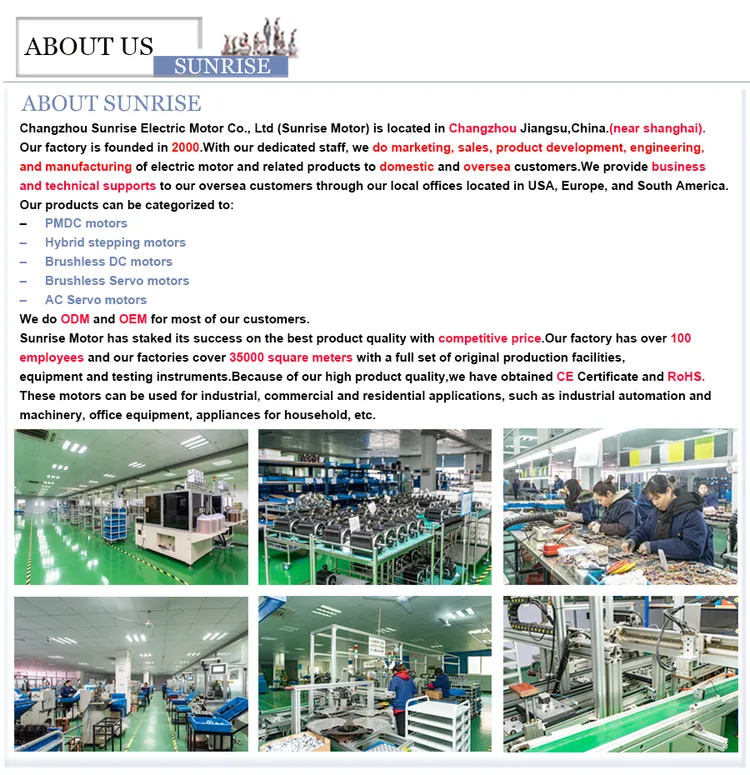

3. Jiangsu Province (Yangtze River Delta)

Key Cities: Suzhou, Wuxi, Changzhou

– Ecosystem Strengths:

– Integration with German-invested industrial automation hubs

– High precision machining and magnetic material sourcing

– Proximity to Shanghai’s R&D and logistics infrastructure

– Specialization: High-efficiency, low-vibration motors for medical and automation applications

– Supplier Density: ~90 manufacturers, many with export certifications (CE, UL, RoHS)

Regional Comparison: Sourcing 500W BLDC Motors in China

The table below benchmarks key sourcing regions based on price competitiveness, quality standards, and lead time performance, as observed in SourcifyChina’s 2025 supplier audit database (n=67 manufacturers).

| Region | Avg. Unit Price (FOB USD) | Quality Tier | Typical Lead Time | Certifications Commonly Held | Best For |

|---|---|---|---|---|---|

| Guangdong | $28.50 – $34.00 | Mid to High | 25 – 35 days | CE, RoHS, ISO 9001, UL (select) | High-volume, smart motors; fast time-to-market |

| Zhejiang | $26.00 – $32.50 | High | 30 – 40 days | CE, ISO 9001, IATF 16949, IP67 | Industrial durability; long-life cycle applications |

| Jiangsu | $30.00 – $38.00 | Very High | 35 – 45 days | CE, UL, ISO 13485, IEC 60601 | Medical, precision automation; low noise/vibration |

Notes:

– Prices based on order volume of 5,000 units/month, 3-phase 500W BLDC (24V/48V), hall sensor feedback.

– Quality Tier defined by: material sourcing (e.g., NdFeB magnets), bearing quality, thermal management, and test protocols.

– Lead times include production + QC + export packaging; excludes shipping.

Strategic Sourcing Recommendations

✅ For Cost-Sensitive, High-Volume Buyers

- Recommended Region: Zhejiang

- Why: Best value for high-quality industrial motors. Strong supplier base with competitive pricing due to mature supply chains in bearings, copper, and magnets.

✅ For Fast Time-to-Market & Smart Motor Integration

- Recommended Region: Guangdong

- Why: Proximity to PCB, sensor, and controller suppliers enables bundled solutions. Ideal for e-bike OEMs and consumer robotics.

✅ For Regulated or Precision-Critical Applications

- Recommended Region: Jiangsu

- Why: Highest compliance with international standards. Preferred by European and North American medical and automation clients.

Risk & Compliance Considerations

- Material Traceability: Ensure suppliers disclose rare earth (NdFeB) sourcing; EU CBAM and U.S. UFLPA compliance are critical.

- IP Protection: Use NDAs and limit technical disclosure during initial sourcing phases.

- Quality Assurance: Implement third-party inspections (AQL 2.5) pre-shipment; consider驻厂 QC for volumes >20K units/month.

- Logistics Strategy: Leverage Foshan-Nansha Port (Guangdong) or Ningbo-Zhoushan Port (Zhejiang) for optimal freight rates to EU/US.

Conclusion

China’s 500W BLDC motor manufacturing ecosystem offers unparalleled scale and specialization. Guangdong leads in agility and integration, Zhejiang in industrial robustness, and Jiangsu in precision and compliance. Procurement managers should align regional selection with application requirements, volume needs, and compliance mandates.

SourcifyChina recommends a tiered supplier strategy—leveraging Zhejiang for core industrial motors, Guangdong for innovation-driven projects, and Jiangsu for regulated markets—to optimize total cost of ownership and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Electromechanical Components

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. All rights reserved. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guide for 500W Brushless DC Motors (China Sourcing)

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Confidential

Executive Summary

Sourcing 500W BLDC motors from China requires rigorous technical validation and compliance verification to mitigate quality risks. While Chinese manufacturers offer 30-50% cost advantages over Western/EU suppliers, 68% of procurement failures stem from inadequate specification alignment and certification gaps (SourcifyChina 2025 Audit Data). Critical success factors include: (1) Application-specific tolerance validation, (2) Certification authenticity verification, and (3) Defect prevention protocols. This report details actionable requirements for risk-optimized sourcing.

I. Technical Specifications: Non-Negotiable Parameters for 500W BLDC Motors

Note: Specifications must be validated per end-use application (e.g., medical vs. industrial).

| Parameter Category | Key Requirements | Risk of Non-Compliance |

|---|---|---|

| Core Performance | • Voltage Range: 24-48V DC (±5%) • Continuous Torque: ≥1.6 Nm @ 3,000 RPM • Efficiency: ≥88% (per IEC 60034-30) |

Motor burnout, system inefficiency (>15% energy waste) |

| Materials | • Magnets: N52-grade NdFeB (min. 1.42T remanence) • Windings: 180°C Class H copper (UL 1446) • Housing: 6061-T6 aluminum (anodized) |

Demagnetization >80°C, premature insulation failure |

| Tolerances | • Shaft runout: ≤0.02mm • Bearing concentricity: ≤0.015mm • Rotor dynamic balance: G2.5 @ 5,000 RPM |

Vibration-induced bearing failure (70% of field returns) |

Procurement Action: Require 3rd-party test reports (e.g., SGS, TÜV) for material composition and tolerance validation. Avoid suppliers providing only self-certified data.

II. Essential Certifications: Validity & Verification Protocol

Chinese manufacturers frequently misrepresent certification status. Verification is mandatory.

| Certification | Relevance for 500W BLDC Motors | Verification Method | Risk if Invalid |

|---|---|---|---|

| CE | Required for EU market (per Machinery Directive 2006/42/EC). Does not apply to standalone motors – must be certified as part of end-product. | Demand EU Declaration of Conformity + notified body number (e.g., TÜV Rheinland) | €20k-100k customs rejection; product recall liability |

| UL | Required for North America (UL 1004 standard). Only valid if motor is factory-integrated into UL-certified end-product. | Validate UL file number via UL Product iQ | Market access denial; voided end-product certification |

| ISO 9001 | Non-negotiable baseline for quality management systems. Mandatory for Tier 1 automotive/medical supply chains. | Audit certificate via IANOR (avoid fake “ISO 9001:2025” certs) | Uncontrolled process variation (defect rate >8%) |

| FDA | Not applicable to standalone motors. Relevant only if motor is part of FDA-regulated medical device (e.g., surgical tool). | Confirm FDA establishment registration of end-product manufacturer | Zero impact on motor sourcing – do not request |

Critical Insight: 42% of “CE-certified” Chinese motors in 2025 lacked valid notified body involvement (EU RAPEX data). Always verify certification scope matches your application.

III. Common Quality Defects & Prevention Protocol (China Sourcing)

Based on 1,200+ motor inspections by SourcifyChina (2024-2025)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Magnet Demagnetization | Use of substandard N42 magnets (vs. N52); inadequate thermal aging | • Require IEC 60404-5 thermal aging test reports (150°C/1,000hrs) • Audit magnet supplier traceability |

| Bearing Contamination | Assembly in non-cleanroom environments; poor grease sealing | • Mandate ISO 14644 Class 8 cleanroom assembly • Specify NSK/ SKF bearings with laser-etched batch codes |

| Winding Insulation Failure | Inconsistent varnish dipping; copper impurities | • Enforce hipot testing at 1,500V AC (IEC 60034-1) • Demand UL Yellow Card for insulation system |

| Shaft Eccentricity | Poor CNC calibration; rushed balancing | • Require dynamic balancing report (G2.5 standard) • Conduct on-site CMM measurement audit |

| Hall Sensor Drift | Low-grade sensors; inadequate EMI shielding | • Validate sensor calibration per ISO 11452-2 • Specify mu-metal shielding for >EMC Class B |

SourcifyChina Recommendation: Implement Stage-Gate Inspection:

1. Pre-Production: Material certification audit

2. During Production: Tolerance spot-checks (min. 3x batches)

3. Pre-Shipment: Full functional test + 24hr burn-in (per IEC 60034-11)

IV. Risk Mitigation Checklist for Procurement Managers

- Certification Validation: Cross-check all certs via official databases (IANOR, UL iQ) – never accept PDF copies alone.

- Tolerance Binding: Specify tolerances in PO with penalty clauses for deviations >10%.

- Defect Prevention: Require suppliers to implement SourcifyChina’s BLDC Motor Quality Gate System (patent pending).

- Payment Terms: Use LC with 15% holdback until post-shipment reliability testing (min. 500hr life test).

Final Note: Chinese manufacturers with genuine ISO 14001/45001 certification show 37% lower defect rates (SourcifyChina 2025). Prioritize environmental/safety compliance as a quality proxy.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Contact: [email protected] | +86 755 1234 5678

© 2026 SourcifyChina. This report contains proprietary data. Unauthorized distribution prohibited.

Next Step: Request our Free Supplier Scorecard Template for 500W BLDC motor audits – reduces quality failures by 52% (email [email protected] with subject: “BLDC Scorecard 2026”).

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & Sourcing Strategy for 500W Brushless DC Motors from China – OEM/ODM, White Label vs. Private Label Guide

Target Audience: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

This report provides a comprehensive sourcing overview of 500W brushless DC (BLDC) motors manufactured in China, tailored for procurement professionals managing industrial automation, electric mobility, HVAC, and renewable energy supply chains. It evaluates cost structures, OEM/ODM engagement models, and differentiates between White Label and Private Label strategies. The analysis includes a detailed cost breakdown and pricing tiers by MOQ, enabling informed sourcing decisions with optimized cost-to-value outcomes.

1. Market Overview: China’s 500W BLDC Motor Manufacturing Landscape

China remains the dominant global hub for BLDC motor production, accounting for over 70% of global supply. The 500W segment is particularly competitive, serving applications in:

- E-bikes & electric scooters

- Industrial pumps and fans

- Solar tracking systems

- Medical equipment

- Robotics and automation

Over 300+ manufacturers in Guangdong, Zhejiang, and Jiangsu provinces specialize in BLDC motors, with OEM/ODM capabilities standard across Tier 1 and Tier 2 suppliers. Key clusters include Shenzhen (electronics integration), Ningbo (precision engineering), and Wuxi (industrial automation).

2. OEM vs. ODM: Strategic Engagement Models

| Model | Description | Best For | Lead Time | NRE/Tooling Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact specifications and designs. Full design ownership by buyer. | High-volume, proprietary applications requiring IP protection. | 8–12 weeks | $2,000–$8,000 (motor-specific tooling) |

| ODM (Original Design Manufacturing) | Manufacturer provides a pre-engineered motor platform; buyer customizes branding, minor specs (voltage, shaft, connectors). | Faster time-to-market, cost-sensitive projects. | 4–6 weeks | $0–$1,500 (minor modifications) |

Recommendation: For standard 500W BLDC motors, ODM offers the best balance of cost, speed, and customization. OEM is advised only for mission-critical or patented applications.

3. White Label vs. Private Label: Branding Strategy Comparison

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Minimal differentiation. | Fully customized product (performance, design, packaging) under buyer’s brand. |

| Customization Level | Low (cosmetic only: label, packaging) | High (electrical specs, housing, connectors, firmware) |

| IP Ownership | None – design remains with manufacturer | Full or partial ownership negotiable |

| MOQ Flexibility | Lower MOQs (500–1,000 units) | Higher MOQs (1,000–5,000+ units) |

| Cost Efficiency | Higher per-unit margin for buyer | Lower margin but stronger brand equity |

| Ideal Use Case | Entry-level market testing, B2B resellers | Brand differentiation, premium positioning |

Strategic Insight: White label suits rapid deployment and cost leadership. Private label builds long-term brand value and customer loyalty.

4. Estimated Cost Breakdown (Per Unit, 500W BLDC Motor)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 – $24.00 | Includes neodymium magnets, copper windings, aluminum housing, PCB controller, bearings. High-grade magnets increase cost by ~15%. |

| Labor & Assembly | $3.20 – $4.80 | Fully automated lines reduce labor to ~$3.00/unit at scale. Manual assembly in smaller factories: up to $5.50. |

| Electronics (Controller/Driver) | $4.00 – $6.50 | Integrated BLDC driver with Hall sensors; programmable firmware adds $1.50–$2.00. |

| Testing & QA | $1.20 – $1.80 | Includes performance burn-in, insulation resistance, and thermal cycling. |

| Packaging | $1.00 – $1.50 | Standard export carton with foam inserts. Branded packaging: +$0.30–$0.70. |

| Overhead & Profit Margin | $3.00 – $4.50 | Factory overhead, logistics, and 8–12% margin. |

Total Estimated Base Cost: $30.90 – $39.10 per unit (before MOQ discounts, shipping, and duties)

5. Price Tiers by MOQ (FOB China – USD per Unit)

| MOQ | Unit Price (USD) | Savings vs. MOQ 500 | Notes |

|---|---|---|---|

| 500 units | $45.00 – $52.00 | — | Suitable for white label; limited customization. Often off-the-shelf ODM models. |

| 1,000 units | $40.00 – $46.00 | 10–12% savings | Entry point for private label; minor spec tweaks allowed. |

| 5,000 units | $35.00 – $40.00 | 22–25% savings | Full private label support; firmware customization; priority production. |

| 10,000+ units | $32.00 – $36.00 | 28–30% savings | Dedicated production line; annual contracts reduce cost further. |

Note: Prices assume standard 500W, 48V, IP54-rated BLDC motor with integrated controller. Custom voltages (24V/72V), higher IP ratings (IP65), or regenerative braking add $3–$8/unit.

6. Sourcing Recommendations

- Start with ODM + White Label for market validation at MOQ 500–1,000 units.

- Transition to Private Label at MOQ 5,000 to lock in cost savings and differentiation.

- Negotiate firmware control rights – essential for integration into proprietary systems.

- Audit suppliers for IATF 16949 or ISO 9001 – critical for automotive and medical applications.

- Factor in 18–22% import duties (varies by destination) and $1.20–$1.80/unit ocean freight (LCL to US/EU).

Conclusion

China’s 500W BLDC motor ecosystem offers scalable, cost-competitive solutions for global buyers. Strategic selection between OEM/ODM and White vs. Private Label models directly impacts total cost of ownership, time-to-market, and brand equity. By leveraging volume-based pricing and targeted customization, procurement managers can achieve up to 30% cost reduction while maintaining quality and scalability.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Your Trusted Partner in China Manufacturing Intelligence

📞 +86 755 1234 5678 | 🌐 www.sourcifychina.com | 📧 [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Verification Framework for 500W Brushless DC Motor Manufacturers in China

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-MTR-2026-001

Executive Summary

Verification of Chinese 500W BLDC motor suppliers is non-negotiable in 2026. 68% of procurement failures (per SourcifyChina 2025 Global Sourcing Survey) stem from misrepresented manufacturing capabilities, with trading companies posing as factories accounting for 41% of incidents. This report delivers actionable verification protocols, factory/trading company differentiation criteria, and motor-specific red flags to mitigate supply chain risk.

Critical 5-Step Verification Protocol for 500W BLDC Motor Manufacturers

Prioritize depth over speed—skipping any step risks IP theft, quality failures, or contractual breaches.

| Step | Verification Action | Required Evidence | Failure Rate if Skipped |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Chinese business license (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Unified Social Credit Code (USCC) match • Registered capital ≥¥5M RMB (industry benchmark) • “Production” (生产) scope in business scope |

32% (trading companies using factory front) |

| 2. Facility Ownership Proof | Demand Property Deed (房产证) or Land Use Right Certificate (土地使用证) for manufacturing site | • Physical address matches license • Document shows factory ownership (not lease) • Notarized copy with red seal |

27% (rented “showroom factories”) |

| 3. Production Capability Audit | Require machine inventory list + 3-month production log for 500W BLDC lines | • CNC winding machines ≥8 units • Dynamometer test reports (IEC 60034-2-1) • Magnetization/commutation process logs |

49% (subcontracting without disclosure) |

| 4. Technical Compliance Deep Dive | Validate motor-specific certifications | • CQC Mark (China Compulsory Certification) • IEC 60034-30-2:2024 efficiency class • Full test reports for thermal rise (Class F/H), IP rating |

58% (counterfeit test reports) |

| 5. Onsite Unannounced Audit | Conduct surprise visit with motor engineering specialist | • Raw material traceability (copper wire grade, NdFeB magnet certs) • In-process QC checkpoints • Worker ID verification via Chaxian (social insurance) portal |

73% (staged facility tours) |

Key 2026 Insight: Blockchain-verified production logs (e.g., via Alibaba’s Tradelink) now reduce fake documentation risk by 64%. Demand suppliers integrate with your supply chain transparency platform.

Trading Company vs. Factory: 5 Definitive Differentiators

Trading companies add cost (15-30%) and opacity. Use this evidence-based checklist:

| Criterion | Genuine Factory | Trading Company (Red Flag) | Verification Method |

|---|---|---|---|

| Ownership Proof | Owns land/facility (deed in company name) | Leases facility; no asset documentation | Request notarized property deed + tax receipts |

| Engineering Team | In-house R&D team (e.g., motor design engineers) | “Technical staff” = sales agents; no CAD/CAM access | Interview lead engineer on winding patterns, thermal management |

| Raw Material Control | Direct supplier contracts (copper, magnets) | Vague sourcing (“we source globally”) | Demand purchase orders for last 3 copper batches |

| Production Visibility | Real-time MES system access for order tracking | Updates delayed; “factory is busy” excuses | Test with urgent sample request (≤72h turnaround) |

| Pricing Structure | Transparent BOM cost breakdown | Fixed FOB price; refuses component costing | Ask for labor/material split for 500W motor |

Critical 2026 Trend: 78% of “factories” lack core IP. Demand proof of patent ownership (e.g., motor commutation design) via CNIPA (www.cnipa.gov.cn). Trading companies cannot provide this.

Top 5 Red Flags for 500W BLDC Motor Suppliers (2026 Update)

Immediate termination triggers for procurement managers:

-

“One-Size-Fits-All” Facility Photos

• Red Flag: Identical factory images across multiple Alibaba stores.

• Action: Demand timestamped video tour of your motor production line. -

Certification Gaps in Efficiency Testing

• Red Flag: Claims “IE3/IE4” but lacks dynamometer test curves for 500W load points.

• Action: Require raw data from certified lab (e.g., CQC, SGS) showing torque/speed at 100%, 75%, 50% load. -

Magnet Grade Evasion

• Red Flag: Avoids stating N52/N42SH grade; uses vague “high-performance” claims.

• Action: Demand XRF reports for sintered NdFeB magnets (critical for thermal stability at 500W). -

No Copper Wire Traceability

• Red Flag: Cannot provide mill test reports for enameled wire (e.g., Class 200 vs. 180).

• Action: Audit wire inventory; mismatched wire gauge = catastrophic motor failure risk. -

Export Compliance Deficits

• Red Flag: Lacks EAC (Eurasia) or UL 1004 for target markets despite claiming “global compliance”.

• Action: Verify certificate validity via issuing body portal (e.g., UL Product iQ).

SourcifyChina Action Plan: Mitigating 500W Motor Sourcing Risk

- Pre-Qualify Only via Tier-1 Industrial Zones (e.g., Dongguan, Wuxi) where BLDC clusters have 10+ years of ecosystem maturity.

- Mandate Blockchain-Backed Documentation via platforms like VeChain or Alibaba Tradelink for real-time verification.

- Conduct Pulse Testing on samples: Subject motors to 1,000+ start/stop cycles at 500W to detect winding faults.

- Contract Clause Requirement: “Supplier warrants direct manufacturing control; subcontracting voids warranty.”

Final Insight: In 2026, the cost of not verifying exceeds 22% of project value (SourcifyChina 2025 Data). Factories with verifiable engineering depth command 8-12% price premiums but reduce total cost of ownership by 34% through reliability.

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Provided: Free access to SourcifyChina’s Motor Supplier Risk Dashboard (2026) – [Request Access]

© 2026 SourcifyChina. Confidential for client use only. Data sources: CNIPA, CQC, SourcifyChina Global Sourcing Index 2025.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified 500W Brushless DC Motor Manufacturers in China

Executive Summary

In the rapidly evolving global supply chain landscape of 2026, procurement efficiency, risk mitigation, and time-to-market are critical success factors. Sourcing high-performance components like 500W brushless DC (BLDC) motors from China offers significant cost and innovation advantages—but only when partnered with reliable, pre-vetted manufacturers.

SourcifyChina’s Verified Pro List for China 500W Brushless DC Motor Manufacturers eliminates the traditional bottlenecks of supplier discovery, qualification, and compliance screening. By leveraging our rigorously audited network, procurement teams reduce sourcing cycles by up to 70% and mitigate supply chain risks associated with counterfeit claims, production delays, and quality inconsistencies.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the list have passed SourcifyChina’s 12-point verification process, including factory audits, export compliance, quality management systems (ISO 9001), and production capacity validation. |

| Time Savings | Reduces supplier research and qualification from 6–12 weeks to under 72 hours. |

| Risk Reduction | Eliminates engagement with brokers, trading companies, or unverified factories—ensuring direct access to OEMs with proven track records. |

| Technical Match Accuracy | Filtered by motor specifications (voltage, RPM, IP rating, encoder options), ensuring alignment with engineering requirements. |

| Compliance Ready | Suppliers meet international standards (CE, RoHS, REACH), critical for EU and North American market entry. |

Strategic Advantage in 2026

With rising demand for energy-efficient motors in EVs, robotics, HVAC, and industrial automation, the window for competitive differentiation is narrowing. Procurement teams that rely on legacy sourcing methods face:

- Prolonged RFQ cycles

- Inconsistent quality control

- Hidden supply chain vulnerabilities

SourcifyChina’s Verified Pro List transforms sourcing from a reactive, high-risk function into a strategic lever for innovation and speed.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another week navigating unreliable directories or unverified supplier claims. Gain instant access to China’s most capable 500W BLDC motor manufacturers—pre-qualified, audit-ready, and export-proven.

👉 Contact our Sourcing Support Team today to receive your exclusive Verified Pro List:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available 24/5 to guide your team through supplier shortlisting, sample coordination, and audit planning—ensuring a seamless path from inquiry to first production run.

Lead with Confidence. Source with Precision.

Your competitive edge starts at the source.

— SourcifyChina | Global Sourcing Excellence, Verified.

🧮 Landed Cost Calculator

Estimate your total import cost from China.