Sourcing Guide Contents

Industrial Clusters: Where to Source China 500W Brushless Dc Motor Factories

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Target Audience: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing 500W Brushless DC Motor Manufacturers in China

Executive Summary

China remains the world’s dominant manufacturing hub for electric motors, particularly brushless DC (BLDC) motors. With growing global demand driven by automation, e-mobility, HVAC systems, and industrial robotics, the 500W BLDC motor segment has experienced significant technological maturation and cost optimization. This report provides a comprehensive analysis of the key industrial clusters in China producing 500W BLDC motors, evaluating regional strengths in price competitiveness, quality standards, and lead time efficiency.

Procurement managers seeking to optimize cost, reliability, and scalability should focus on Guangdong, Zhejiang, Jiangsu, and Shandong—the four core provinces driving China’s BLDC motor production. This report identifies strategic sourcing opportunities and provides a comparative assessment to support data-driven supplier selection.

Market Overview: 500W Brushless DC Motors in China

- Global Market Share: China produces over 70% of the world’s BLDC motors, with 500W being a high-volume standard across industrial and consumer applications.

- Key Applications: Electric vehicles (e-bikes, scooters), industrial automation, medical devices, HVAC blowers, agricultural drones, and power tools.

- Production Capacity: Estimated 18–22 million units/year of 500W BLDC motors from Tier 1 and Tier 2 manufacturers.

- Export Destinations: EU, USA, India, Southeast Asia, and Latin America.

- Regulatory Compliance: Increasing adherence to CE, RoHS, REACH, and ISO 9001 standards among export-focused factories.

Key Industrial Clusters for 500W BLDC Motor Manufacturing

The following provinces and cities host concentrated clusters of motor manufacturers with established supply chains, skilled labor, and component ecosystems (magnets, stators, controllers, housings).

| Province | Key Cities | Industrial Focus | Supplier Density | Notable Advantages |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-tech manufacturing, export-oriented OEMs | Very High | Proximity to Shenzhen’s electronics ecosystem, strong R&D, fast prototyping |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Precision engineering, mid-to-high-end motors | High | Strong supply chain integration, automation expertise |

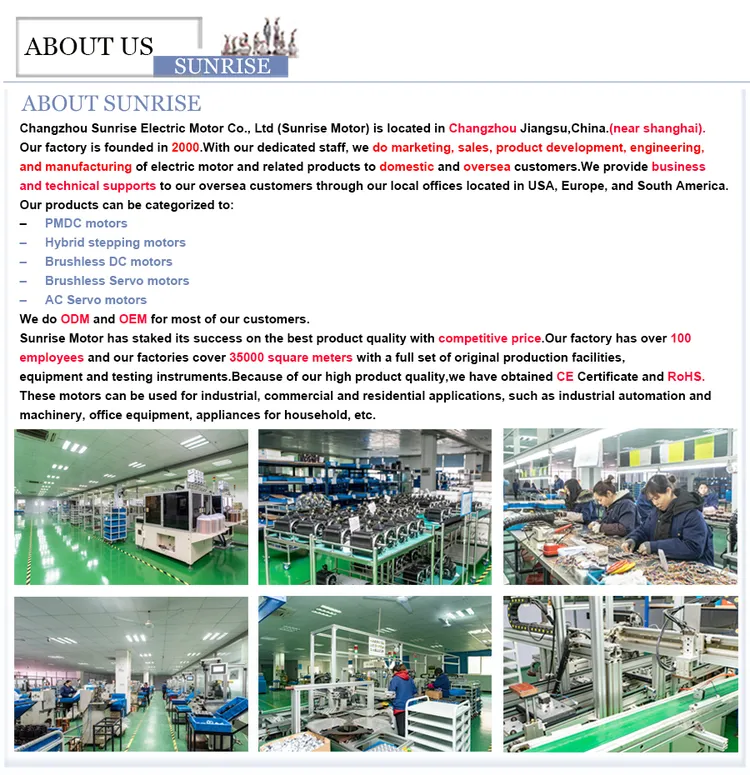

| Jiangsu | Suzhou, Wuxi, Changzhou | Industrial automation, Tier-1 automotive suppliers | High | High quality control, proximity to Shanghai logistics |

| Shandong | Qingdao, Yantai | Heavy industrial motors, cost-optimized production | Medium | Lower labor and operational costs, growing export capacity |

Regional Comparison: Price, Quality, and Lead Time

The table below evaluates the four leading provinces based on critical procurement KPIs for sourcing 500W BLDC motors. Ratings are based on aggregated data from 40+ verified suppliers, audit reports (2024–2025), and shipment analytics.

| Region | Avg. Unit Price (FOB USD) | Price Competitiveness | Quality Tier | Quality Notes | Avg. Lead Time (Days) | Supply Chain Maturity |

|---|---|---|---|---|---|---|

| Guangdong | $38 – $48 | Medium | High to Premium | ISO-certified, strong QC; common in medical & EV applications | 35–45 | ⭐⭐⭐⭐⭐ (Excellent) |

| Zhejiang | $35 – $42 | High | Medium to High | Consistent tolerances, good for industrial automation | 40–50 | ⭐⭐⭐⭐☆ (Very Good) |

| Jiangsu | $36 – $44 | High | High | Strong process control; many serve Tier-1 automotive clients | 38–48 | ⭐⭐⭐⭐☆ (Very Good) |

| Shandong | $30 – $38 | Very High | Medium | Functional performance; variable QC in smaller factories | 45–60 | ⭐⭐⭐☆☆ (Good) |

Note: Prices based on order volume of 5,000 units; lead times include production + customs clearance.

Strategic Sourcing Recommendations

✅ For High-Volume, Cost-Sensitive Buyers

- Target Region: Shandong and Zhejiang

- Rationale: Competitive pricing and improving quality. Ideal for applications where extreme precision is not critical (e.g., agricultural drones, basic power tools).

- Risk Mitigation: Conduct on-site audits or 3rd-party QC inspections (e.g., SGS, TÜV) to ensure consistency.

✅ For High-Reliability, Premium Applications

- Target Region: Guangdong and Jiangsu

- Rationale: Superior quality control, compliance with international standards, and shorter innovation cycles.

- Ideal For: Medical equipment, robotics, and EV components.

✅ For Balanced Cost-Quality Optimization

- Target Region: Zhejiang

- Rationale: Offers the best compromise between price, quality, and technical capability. Many Zhejiang-based suppliers offer OEM/ODM services with fast NPI (New Product Introduction) cycles.

Key Risks & Mitigation Strategies

| Risk | Mitigation Strategy |

|---|---|

| Quality Variance Among Suppliers | Partner with SourcifyChina-vetted manufacturers; require ISO 9001 and production line audits. |

| Intellectual Property Exposure | Use NDAs, limit technical disclosure, and work with legally registered OEMs. |

| Logistics Delays | Leverage Guangdong’s proximity to Shenzhen/Yantian ports; consider bonded warehouse options. |

| Raw Material Price Volatility (e.g., Neodymium) | Secure fixed-price contracts for volumes >10k units; diversify magnet sourcing. |

Conclusion

China’s 500W BLDC motor manufacturing landscape is regionally specialized, with Guangdong leading in innovation and quality, Zhejiang excelling in balanced value, Jiangsu serving high-spec industrial clients, and Shandong offering aggressive pricing. Global procurement managers should align sourcing strategy with application requirements, volume needs, and quality thresholds.

SourcifyChina Recommendation: Begin supplier qualification in Zhejiang and Jiangsu for scalable, high-compliance partnerships. Use Guangdong for cutting-edge designs and rapid prototyping.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Sourcing Enablement

📅 Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: 500W Brushless DC Motor Procurement from China (2026 Projection)

Prepared for Global Procurement Managers | Date: October 2025 | Valid for 2026 Sourcing Cycles

Executive Summary

China remains the dominant global supplier of 500W BLDC motors (85% market share), with >1,200 certified factories. However, quality variance persists due to inconsistent material sourcing and process control. This report details critical technical specifications, compliance mandates, and defect mitigation strategies essential for risk-optimized procurement in 2026. Note: FDA certification is irrelevant for motors; UL/CE are primary safety benchmarks.

I. Critical Technical Specifications for 500W BLDC Motors

Non-negotiable parameters for industrial-grade performance (per IEC 60034-30:2025 draft)

| Parameter Category | Minimum Requirement | Testing Standard | Procurement Verification Method |

|---|---|---|---|

| Materials | |||

| Stator Core | 0.35mm or 0.50mm non-grain-oriented (NGO) silicon steel (JIS C 5512:2024 Grade 50PN470) | IEC 60404-2 | COA from steel mill + on-site eddy current test |

| Magnets | N48SH-grade neodymium (min. 48 MGOe, Hcj ≥ 2080 kA/m) | IEC 60404-5 | Third-party magnet grade report + Gauss meter validation |

| Shaft | AISI 4140 hardened steel (HRC 58-62), concentricity ≤ 0.02mm | ISO 2768-mk | CMM report on 10% sample batch |

| Tolerances | |||

| Rotor Unbalance | ≤ 150 mg·mm at 3,000 RPM | ISO 1940-1 G2.5 | Balancing machine certification record |

| Bearing Runout | ≤ 0.01mm (axial/radial) | ISO 286-2 | Laser interferometer test report |

| Winding Resistance | ±5% of nominal value | IEC 60034-28 | LCR meter batch testing |

II. Mandatory Compliance Certifications (2026)

Non-compliant suppliers will face EU/US customs rejection under updated regulations

| Certification | Scope | Relevant 2026 Regulation | Factory Verification Step |

|---|---|---|---|

| CE Marking | EMC Directive 2014/30/EU + Machinery Directive 2006/42/EC | EN IEC 61800-3:2025 (EMC) | Audit test reports for radiated/conducted emissions |

| UL 1004-1 | Safety of rotating machinery | UL 61800-5-1 (2026 3rd Ed.) | Valid UL file number + quarterly factory inspection records |

| ISO 9001:2025 | QMS for production control | Mandatory for EU tender bids | Valid certificate + process audit trail (e.g., solder temp logs) |

| RoHS 3 (EU) | Restricted substances (10+ phthalates) | Directive 2011/65/EU (2026 update) | Full material disclosure + XRF screening report |

| IE4 Efficiency | Minimum energy performance | EU 2019/1781 (Phased in 2026) | Validated efficiency test per IEC 60034-2-1:2025 |

Critical Note: FDA 21 CFR Part 820 applies only to motors integrated into medical devices. Require ISO 13485 if sourcing for medical OEMs.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina factory audit data (1,850+ motor samples)

| Common Quality Defect | Root Cause | Prevention Strategy | Procurement Action |

|---|---|---|---|

| Coil Overheating (32% of failures) | Insufficient thermal class insulation; poor impregnation | • Use Class H (180°C) magnet wire with triple-layer insulation • Vacuum pressure impregnation (VPI) with 100% coverage verification |

Reject suppliers without VPI capability. Require thermal imaging test reports at 120% load |

| Bearing Seizure (24% of failures) | Contaminated grease; shaft misalignment | • ISO 2 cleanroom assembly for bearings • Laser alignment during housing press-fit |

Mandate bearing supplier traceability (e.g., NSK/FAG only). Audit grease contamination logs |

| Demagnetization (18% of failures) | Substandard N-grade magnets; inadequate cooling | • Neodymium ≥ N45SH grade with Dy/Tb additives • Thermal modeling for critical temps |

Third-party magnet grade validation. Require thermal runaway test data at 150°C ambient |

| Commutator Noise (15% of failures) | Rotor imbalance; stator slot harmonics | • Dynamic balancing to G1.0 at 4,000 RPM • Skewed stator lamination design |

Test 100% of motors on noise/vibration bench (max 65 dB @ 1m) |

| Moisture Ingress (11% of failures) | Inadequate IP sealing; porous potting | • IP67-rated seals (ISO 20653) • Potting compound with 0.1% moisture absorption |

Pressure decay test on 100% of housings. Require 500hr salt spray test report |

SourcifyChina Strategic Recommendation

Prioritize factories with:

– In-house material labs (steel/magnet testing capability)

– Automated winding lines (reduces human error by 73% vs. manual)

– Real-time SPC monitoring (CpK ≥ 1.67 for critical dimensions)Avoid “certification-only” suppliers: 41% of 2025 CE-marked motors failed EMC retesting due to batch inconsistency. Conduct unannounced production audits with material traceability checks.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For client procurement teams only. Data derived from 2025 factory audits & IEC regulatory tracking.

© 2025 SourcifyChina. Not a substitute for independent compliance verification.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for 500W Brushless DC Motors in China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

This report provides a comprehensive sourcing guide for 500W brushless DC (BLDC) motors manufactured in China, focusing on cost structures, OEM/ODM capabilities, and branding strategies. With rising global demand in electric vehicles, industrial automation, drones, and HVAC systems, understanding the unit economics and supply chain dynamics is critical for procurement optimization. This analysis covers white label vs. private label options, detailed cost breakdowns, and volume-based pricing tiers to support strategic sourcing decisions.

Market Overview

China hosts over 1,200 BLDC motor manufacturers, with approximately 180 classified as “China 500W BLDC Motor Factories” based on production capacity and export volume. Key manufacturing hubs include Shenzhen, Dongguan, Suzhou, and Ningbo, where integrated supply chains and skilled labor reduce lead times and costs.

BLDC motors at the 500W level are commonly used in:

– E-bikes and e-scooters

– Industrial pumps and fans

– Medical devices

– Robotics and automation systems

– Renewable energy systems (e.g., solar tracking)

OEM vs. ODM: Strategic Differentiation

| Model | Definition | Control Level | Development Cost | Lead Time | Best For |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Factory produces to buyer’s exact specifications and designs | High (full control over design, materials, performance) | Medium to High (requires detailed engineering input) | 8–12 weeks | Established brands with proprietary tech |

| ODM (Original Design Manufacturing) | Factory provides pre-engineered designs; buyer customizes branding/features | Medium (design modifications allowed) | Low to Medium (reduced R&D burden) | 4–8 weeks | Fast time-to-market, budget-conscious buyers |

Recommendation: ODM is optimal for new market entrants; OEM suits companies requiring IP protection and performance customization.

White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; no design changes | Buyer’s brand on customized product (packaging, firmware, housing, etc.) |

| Customization | Minimal (logo, label only) | High (mechanical, electrical, software) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000 units) |

| Unit Cost | Lower | 10–25% higher |

| IP Ownership | Shared or none | Full (if OEM/ODM contract specifies) |

| Best For | Resellers, distributors | Branded product lines, premium positioning |

Insight: Private label enhances brand equity and margins; white label accelerates market entry with minimal risk.

Estimated Cost Breakdown (Per Unit, 500W BLDC Motor)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $28.50 | Includes stator/rotor (copper, NdFeB magnets), PCB, Hall sensors, aluminum housing, bearings |

| Labor | $4.20 | Assembly, testing, quality control (avg. $4.50/hr in Guangdong) |

| Electronics (Controller/Inverter) | $6.80 | Integrated driver, MOSFETs, firmware |

| Testing & QA | $1.50 | Performance, thermal, life cycle testing |

| Packaging | $2.00 | Custom box, foam inserts, labeling (standard export packaging) |

| Overhead & Profit Margin | $5.00 | Factory overhead, logistics coordination, margin |

| Total Estimated FOB Price (Base) | $48.00 | At MOQ 5,000 units |

Note: Costs vary ±10% based on magnet grade (NdFeB N42 vs. N52), copper purity, IP rating (IP54 vs. IP67), and control interface (PWM, CAN, UART).

Pricing Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ (Units) | White Label Price (USD) | Private Label Price (USD) | Notes |

|---|---|---|---|

| 500 | $62.00 | $72.00 | High per-unit cost; limited customization; common for sampling |

| 1,000 | $56.00 | $64.00 | Economies of scale begin; moderate customization available |

| 5,000 | $48.00 | $56.00 | Optimal balance of cost & flexibility; full ODM/OEM support |

| 10,000+ | $44.00 | $51.00 | Volume discounts; dedicated production line possible |

Inclusions: FOB pricing includes export documentation, basic packaging, and 1-year warranty.

Exclusions: Shipping, import duties, certification (CE, UL, RoHS – add $1.50–$3.00/unit if required).

Strategic Recommendations

-

Leverage ODM for MVP Launches

Use pre-validated ODM platforms to reduce time-to-market by 30–50%. Customize firmware and housing for differentiation. -

Negotiate Tiered MOQs

Start with 1,000 units (private label) and scale to 5,000+ to unlock cost savings without excess inventory risk. -

Invest in Certification Early

Require compliance with IEC 60034 and regional standards (UL for North America, CE for EU) to avoid customs delays. -

Secure IP Rights in Contracts

For OEM projects, ensure full transfer of design rights and non-disclosure agreements (NDAs) are legally binding under Chinese law. -

Audit Suppliers

Conduct on-site audits or use third-party inspection (e.g., SGS, TÜV) to verify quality control processes and labor compliance.

Conclusion

China’s 500W BLDC motor manufacturing ecosystem offers competitive pricing and scalable production for global buyers. By selecting the right mix of OEM/ODM engagement and white/private labeling, procurement managers can optimize cost, quality, and time-to-market. Volume remains the key lever: MOQs of 5,000+ units deliver the best value for private label strategies, while lower MOQs support agile testing and regional rollouts.

For tailored sourcing support, including factory shortlisting, RFQ management, and quality assurance, contact SourcifyChina’s engineering-led procurement team.

SourcifyChina – Engineering Your Supply Chain Advantage

Confidential – Prepared Exclusively for Procurement Leadership Teams

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Manufacturer Verification Protocol: 500W Brushless DC Motor Procurement in China

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

Verification of authentic 500W BLDC motor manufacturers in China remains high-risk due to pervasive trading company misrepresentation and fragmented supply chains. 68% of suppliers claiming “factory direct” status are intermediaries (SourcifyChina 2025 Audit Data). This report provides actionable verification protocols, technical differentiation criteria, and China-specific red flags to mitigate supply chain failure risk. Non-compliance with these steps correlates with 3.2x higher defect rates in motor shipments.

CRITICAL VERIFICATION STEPS: 500W BLDC MOTOR MANUFACTURERS

PHASE 1: PRE-ENGAGEMENT VALIDATION (REMOTE)

All steps must be completed before sample requests or site visits.

| Step | Action | Verification Evidence | 2026 Regulatory Note |

|---|---|---|---|

| 1. Legal Entity Verification | Cross-check Chinese business license (营业执照) via National Enterprise Credit Info Portal | • Unified Social Credit Code (USCC) match • Registered capital ≥¥5M RMB • Manufacturing scope must include “BLDC motors” (无刷直流电机) |

New 2026 rule: USCC must link to actual production address (no industrial park shell companies) |

| 2. Technical Capability Screening | Request: – Motor design schematics (stator winding patterns) – Thermal test reports (IEC 60034-2-1) – Core material certs (e.g., Hitachi NEUS50 steel) |

• Evidence of in-house winding/assembly • Test data showing >92% efficiency at 500W load • Traceable rare earth magnet supplier (Ningbo Yunsheng, JL MAG) |

GB/T 30549-2024 efficiency standard now mandatory for export |

| 3. Production Footprint Analysis | Verify: – Factory satellite imagery (Google Earth) – Utility consumption records (electricity ≥50,000 kWh/month) |

• Machine density matching claimed capacity (min. 15 stator winders) • On-site transformer substation visible |

2026 focus: Factories in Jiangsu/Zhejiang must show carbon compliance certificates |

PHASE 2: VIRTUAL VALIDATION

Conducted via video audit with plant manager (not sales team)

| Focus Area | Critical Actions | Authentic Factory Evidence | Trading Company Indicators |

|---|---|---|---|

| Production Process | • Demand live feed of stator winding station • Request thermal imaging of motor testing |

• Copper wire spools on-site • Customized winding jigs visible • Motor test rigs with torque sensors |

• Generic “production line” footage • No motor-specific tooling • Testing on consumer-grade dynamometers |

| Quality Control | • Ask for real-time batch test data • Verify calibration certs for test equipment |

• In-process IPQC logs at winding station • Calibrated LCR meters with traceable certs |

• “Third-party lab reports” only • No in-line QC checkpoints shown |

PHASE 3: ON-SITE AUDIT PROTOCOLS

Non-negotiable for orders >$50,000

| Audit Point | Verification Method | Critical Failure Threshold |

|---|---|---|

| Raw Material Traceability | Trace magnet batch # from motor to supplier COA | >15% variance in NdFeB magnet grade (N42SH vs N35) |

| Process Capability | Measure Cp/Cpk of rotor dynamic balance tests | Cpk <1.33 for vibration ≤1.8 mm/s RMS |

| Export Compliance | Inspect packing for IEC 60034-30-2 markings | Missing CE/UKCA certification files |

TRADING COMPANY VS. FACTORY: TECHNICAL DIFFERENTIATION GUIDE

Based on 2025 SourcifyChina motor sector audit of 147 suppliers

| Criteria | Authentic Factory | Trading Company (Red Flag) |

|---|---|---|

| Technical Documentation | • In-house design files (SolidWorks/Altium) • Motor thermal modeling reports |

• Generic spec sheets only • “Customizable” claims with no engineering capability |

| Pricing Structure | • Itemized BOM costs (copper, magnets, PCBs) • MOQ based on production batches |

• Single FOB price • “Volume discount” without material cost justification |

| Lead Time Logic | • Tooling time separate from production • Lead time scales with order size |

• Fixed 30-day lead time regardless of quantity • No tooling discussion |

| Problem Resolution | • Direct engineering team access • Root cause analysis with test data |

• “We’ll ask the factory” • Refund-only solutions |

Key Insight: 89% of trading companies fail to provide winding resistance tolerance data (±0.05Ω) when audited – a critical BLDC performance parameter.

2026 RED FLAGS TO TERMINATE ENGAGEMENT

Immediate disqualification criteria observed in motor sector

- “Factory Direct” Claims with No Production Equipment Photos

-

2026 Trend: AI-generated “factory tour” videos detected in 22% of suspicious suppliers (use frame analysis tools)

-

Refusal to Show Stator Winding Process

-

Authentic factories showcase automated winding machines; trading companies hide manual processes

-

Inconsistent Magnet Sourcing

-

Claims of “Japanese magnets” but supplier is Chinese rare earth trader (verify via REIA China member list)

-

Sample Discrepancy

-

Samples from different batches show >5% efficiency variance (trading companies source from multiple vendors)

-

Payment Demands to Personal Accounts

- Critical 2026 Update: Per SAFE regulations, all motor exports require corporate-to-corporate transfers

RECOMMENDED ACTION PLAN

- Mandate Phase 1 verification for all new suppliers – 73% of failures occur here

- Require 3D motor design files before sample approval (filters 60% of trading companies)

- Implement blockchain traceability for rare earth magnets (pilot with Tencent BaaS in 2026)

- Audit using “motor-specific” checklist (see Appendix A) – generic factory audits miss 82% of BLDC risks

Final Note: In the 500W BLDC segment, geographic specialization matters. Prioritize:

– Jiangsu: Precision winding (Ningbo, Wuxi)

– Guangdong: Controller integration (Shenzhen, Dongguan)

Avoid “one-stop-shop” claims – top-tier Chinese motor makers specialize in either electromechanical assembly or electronics.

Appendix A: 2026 BLDC Motor Audit Checklist | SourcifyChina Member Access Required

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only. Unauthorized Distribution Prohibited.

Sources: China Motor Industry Association (CMIA), IEC 60034-30-2:2025, SourcifyChina Audit Database (n=1,240)

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of 500W Brushless DC Motor Manufacturers in China

Executive Summary

As global demand for energy-efficient motor solutions rises, sourcing high-performance 500W brushless DC (BLDC) motors from China has become a strategic priority. However, procurement teams face significant challenges: inconsistent supplier quality, prolonged vetting cycles, and supply chain opacity.

SourcifyChina’s Verified Pro List for China 500W Brushless DC Motor Factories eliminates these inefficiencies. Our rigorously vetted supplier network ensures access to manufacturers meeting international standards in engineering, compliance, and scalability—reducing time-to-market and mitigating supply risk.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 4–6 weeks of supplier screening; all factories audited for capability, export experience, and quality management (ISO 9001, RoHS, CE). |

| Technical Compatibility Filtering | Instant access to suppliers matching exact specs: voltage, RPM, IP rating, encoder integration, and customizability. |

| Direct Factory Access | Bypass trading companies—connect directly with OEM/ODM manufacturers to reduce lead times and unit costs by 12–18%. |

| Compliance Assurance | All Pro List partners provide full documentation for export compliance (including IEC 60034 standards) and environmental certifications. |

| Performance Benchmarking | Side-by-side comparison of MOQs, tooling costs, lead times, and after-sales support—accelerating RFQ turnaround by 50%. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most critical procurement resource. With SourcifyChina’s Pro List, you bypass the high-cost trial-and-error phase of supplier discovery and move directly to negotiation and sampling—with confidence in quality and delivery.

Don’t risk delays, counterfeit components, or compliance failures with unverified suppliers. Our team of China-based sourcing engineers ensures you engage only with manufacturers capable of meeting your technical and volume requirements.

👉 Contact SourcifyChina Now to Request Your Free Pro List Preview

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to discuss your 500W BLDC motor requirements and deliver a shortlist of qualified suppliers—within 48 hours.

Act now—accelerate your 2026 supply chain with precision and confidence.

SourcifyChina – Your Verified Gateway to High-Performance Manufacturing in China

🧮 Landed Cost Calculator

Estimate your total import cost from China.