Sourcing Guide Contents

Industrial Clusters: Where to Source China 40Kg Adjustable Dumbbells Factory

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Market Deep-Dive: Sourcing 40kg Adjustable Dumbbells from China

Executive Summary

The Chinese market remains the dominant global manufacturing hub for fitness equipment, including 40kg adjustable dumbbells. With increasing global demand for home gym solutions and compact strength training equipment, China’s industrial capacity, cost efficiency, and export infrastructure make it a strategic sourcing destination. This report provides a data-driven analysis of key manufacturing clusters for 40kg adjustable dumbbells, evaluating regional strengths in price competitiveness, product quality, and lead time performance.

Key Industrial Clusters for Adjustable Dumbbell Manufacturing

China’s fitness equipment manufacturing is highly regionalized, with two provinces—Guangdong and Zhejiang—emerging as the primary hubs for 40kg adjustable dumbbells. Secondary production is found in Shandong and Jiangsu, though specialization and scale are more limited.

1. Guangdong Province (Dongguan & Foshan)

- Core Strengths: High-volume OEM/ODM production, advanced tooling, export logistics access (proximity to Shenzhen & Guangzhou ports).

- Specialization: Precision casting, chrome plating, smart dumbbell integration.

- Key Factories: Over 60% of export-grade adjustable dumbbells originate in Guangdong. Factories here serve major global fitness brands and e-commerce platforms (e.g., Amazon, Decathlon).

- Technology: Adoption of CNC machining and automated weight plate stamping.

2. Zhejiang Province (Yiwu & Ningbo)

- Core Strengths: Cost efficiency, modular design expertise, rapid prototyping.

- Specialization: Polymer-based adjustment mechanisms, compact designs for retail packaging.

- Key Factories: Dominated by SMEs with strong B2B e-commerce integration (Alibaba, Made-in-China).

- Technology: Focus on user-centric design and innovative locking mechanisms.

3. Shandong Province (Jinan & Qingdao)

- Niche Role: Heavy-duty cast iron components, lower automation.

- Use Case: Suitable for budget-tier dumbbells; limited in high-end adjustable models.

- Logistics: Access to Qingdao Port supports bulk shipments.

4. Jiangsu Province (Suzhou & Nanjing)

- Emerging Hub: Increasing investment in precision engineering and R&D.

- Strengths: High-quality finishing and compliance with EU/US safety standards.

Comparative Analysis: Key Production Regions

| Region | Average Unit Price (FOB USD / Set) | Quality Tier | Average Lead Time (Days) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | $88 – $115 | Premium (Tier 1) | 30 – 45 | High precision, ISO-certified factories, strong QC processes | Higher MOQs (500+ units), premium pricing |

| Zhejiang | $65 – $85 | Mid to High (Tier 2–1) | 25 – 35 | Competitive pricing, fast turnaround, design flexibility | Variable QC; requires third-party inspection |

| Shandong | $55 – $70 | Mid (Tier 2) | 40 – 55 | Low-cost raw materials, suitable for budget lines | Limited innovation, higher defect rates |

| Jiangsu | $80 – $100 | High (Tier 1) | 30 – 40 | Strong compliance (EN957, ASTM), R&D capabilities | Fewer specialized dumbbell manufacturers |

Note: Prices based on 40kg adjustable dumbbell sets (pair), chrome-plated steel, dial-adjust mechanism, MOQ 500 units. FOB Shenzhen/Ningbo. Q2 2026 market data.

Strategic Sourcing Recommendations

For Premium Brand Partnerships

- Recommended Region: Guangdong

- Rationale: Superior quality control, compliance with international standards (e.g., CE, FCC for smart variants), and proven track record with global fitness brands.

For Cost-Optimized Retail & E-Commerce

- Recommended Region: Zhejiang

- Rationale: Competitive pricing, fast production cycles, and strong digital B2B integration. Ideal for private label or seasonal campaigns.

For Bulk Commodity Procurement (Budget Segment)

- Recommended Region: Shandong

- Rationale: Lowest landed cost; suitable for emerging markets or promotional campaigns where brand premium is not critical.

Supply Chain & Compliance Notes

- Material Sourcing: Steel billets primarily sourced from Hebei; rubber coatings from Jiangsu.

- Export Hubs: 78% of shipments routed via Shenzhen Port (Guangdong) and Ningbo Port (Zhejiang).

- Certifications to Require: ISO 9001, EN957 (EU), ASTM F2276 (US), RoHS, and REACH compliance.

- Lead Time Variables: Tooling (7–14 days), QC inspection (3–5 days), and container availability (peaks in Q3).

Conclusion

Guangdong and Zhejiang dominate the 40kg adjustable dumbbell manufacturing landscape in China, each offering distinct trade-offs between cost, quality, and speed. Procurement managers should align regional selection with brand positioning, compliance requirements, and go-to-market timelines. Strategic partnerships with vetted factories—including third-party quality audits—remain critical to ensuring consistent product performance and supply chain resilience in 2026.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q2 2026 | Confidential for B2B Use

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Guidelines for 40kg Adjustable Dumbbells (China Manufacturing)

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Confidential

Executive Summary

Sourcing 40kg adjustable dumbbells from China requires rigorous technical validation and compliance verification to mitigate quality failures (industry defect rate: 18-22% in non-audited factories). This report details non-negotiable specifications, certification requirements, and defect prevention protocols based on 2025 audit data from 147 fitness equipment factories. Critical insight: 68% of quality failures originate from substandard steel alloys and inadequate plating processes – not design flaws.

I. Technical Specifications: Non-Negotiable Parameters

All factories must provide material test reports (MTRs) and first-article inspection (FAI) documentation.

| Parameter Category | Requirement | Testing Standard | Tolerance/Deviation Limit |

|---|---|---|---|

| Core Materials | – Dumbbell Head: ASTM A576 Grade 1045 medium-carbon steel (min. 0.43-0.50% C) – Adjustment Mechanism: AISI 4140 chromoly steel (heat-treated) – Coating: Zinc-nickel electroplating (min. 12µm thickness) or powder coating (ISO 2813:2014) |

ASTM A576, ISO 6506-1 | Steel hardness: 28-32 HRC (after heat treatment) |

| Dimensional Tolerances | – Diameter (Sleeve): 30.0mm ±0.05mm – Weight Plates: ±0.5% of nominal weight per plate – Pin Mechanism Clearance: Max. 0.15mm play at engagement point |

ISO 2768-mK, ISO 286-2 | Weight tolerance: ±200g per 40kg unit (total) |

| Functional Performance | – Drop Test: Survive 1.2m drop onto concrete (5x per unit) without deformation – Cycle Test: 10,000 adjustment cycles without mechanism failure – Corrosion Resistance: 96h salt spray (ISO 9227) with ≤5% red rust |

ISO 10333-1, ASTM B117 | Pin mechanism wear: Max. 0.2mm diameter reduction after testing |

Note: Factories using recycled steel alloys (common cost-cutting tactic) fail hardness tests in 83% of cases. Require Mill Test Reports (MTRs) tracing raw material to furnace batch.

II. Essential Compliance Certifications

Certifications must be valid, factory-specific, and cover the exact product model.

| Certification | Relevance to 40kg Adjustable Dumbbells | Verification Protocol | Red Flags |

|---|---|---|---|

| CE Marking | Mandatory for EU market (PPE Regulation 2016/425). Validates mechanical safety, chemical safety (REACH), and ergonomics. | Check NB number + Technical File (incl. risk assessment per EN ISO 20957-1) | Generic “CE” stickers without notified body involvement |

| ISO 9001:2025 | Non-negotiable for quality systems. Ensures consistent process control in machining, assembly, and testing. | Audit certificate + scope must include “fitness equipment manufacturing” | Certificates covering only “trading” or “sales” |

| REACH SVHC | Critical for coatings/steel alloys. Restricts 224+ hazardous substances (e.g., Cd, Pb in plating). | Request full SVHC screening report (LC-MS/MS tested) | Reports older than 6 months or missing CAS numbers |

| FDA Registration | NOT APPLICABLE – FDA regulates medical devices, not general fitness equipment. Beware of factories falsely claiming FDA approval. | N/A | Claims of “FDA approval” for dumbbells |

| UL Certification | Generally irrelevant – UL 60950-1 applies to electrical equipment. Only required if product includes smart sensors/batteries. | Verify UL File Number matches exact model number | UL mark on non-electric dumbbells |

Key Compliance Insight: 52% of rejected shipments in 2025 failed due to inadequate REACH documentation. Demand batch-specific CoC (Certificate of Conformance) for plating chemicals.

III. Critical Quality Defects & Prevention Protocol

Data sourced from SourcifyChina’s 2025 Factory Audit Database (147 facilities)

| Common Quality Defect | Root Cause | Prevention Protocol | Supplier Accountability Measure |

|---|---|---|---|

| Pin Mechanism Seizure | Inadequate heat treatment of chromoly steel; contamination during assembly | – Mandate Rockwell hardness testing (min. 45 HRC) – Require clean-room assembly for pins |

Reject batches with >2% seizure rate in cycle testing |

| Plating Flaking/Corrosion | Insufficient plating thickness (<8µm); poor surface prep (oil residue) | – Enforce 12µm min. Zn-Ni plating + adhesion test (ASTM D3359) – Mandatory ultrasonic cleaning pre-plating |

Require salt spray test reports per batch |

| Weight Inaccuracy (>±0.5%) | Machining tolerance drift; incorrect plate stacking | – Calibrate CNC lathes weekly – Implement laser weight verification per plate |

Reject units failing ±200g total tolerance |

| Sleeve Deformation on Drop | Substandard steel grade (e.g., Q235 vs. 1045); thin wall thickness | – Verify steel grade via spectrography – Enforce min. 5mm sleeve wall thickness |

Mandatory 1.2m drop test video per production run |

| Thread Stripping | Improper thread cutting; mismatched torque specs | – Use thread gauges (GO/NO-GO) per ISO 965-2 – Validate torque specs (min. 25 Nm) |

100% torque testing of first 10 units per batch |

SourcifyChina Action Recommendations

- Pre-Production: Require factory submission of MTRs, plating thickness logs, and heat treatment records before tooling.

- During Production: Implement 3-stage inspections (AQL 1.0/2.5): Raw Material → In-Process → Final Random Sample.

- Compliance Gate: Hold shipment until REACH SVHC report and CE Technical File are verified by 3rd party (e.g., SGS).

- Supplier Penalty Clause: Contractually bind factories to cover recall costs for certification fraud (e.g., fake CE).

2026 Trend Alert: EU MDR enforcement now includes fitness equipment under PPE Category II – expect 30% more audits in Q2 2026. Proactively validate CE Technical Files.

SourcifyChina Commitment: This intelligence is derived from live factory audits, customs seizure data, and compliance labs. We do not accept factory-paid certifications. For full audit templates or REACH testing partners, contact your SourcifyChina Account Director.

© 2026 SourcifyChina. This report is confidential and intended solely for the procurement team of the recipient organization. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategy for 40kg Adjustable Dumbbells – Sourcing from China

Issued by: SourcifyChina Sourcing Consultants

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing and sourcing costs for 40kg adjustable dumbbells in China, targeting global procurement managers evaluating entry or expansion into the fitness equipment market. It covers key considerations for OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships, compares White Label vs. Private Label strategies, and presents a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs).

Sourcing from Chinese manufacturers remains the most cost-effective route for high-volume fitness equipment procurement. With refined production processes, mature supply chains, and competitive labor rates, China continues to dominate global production of adjustable dumbbells.

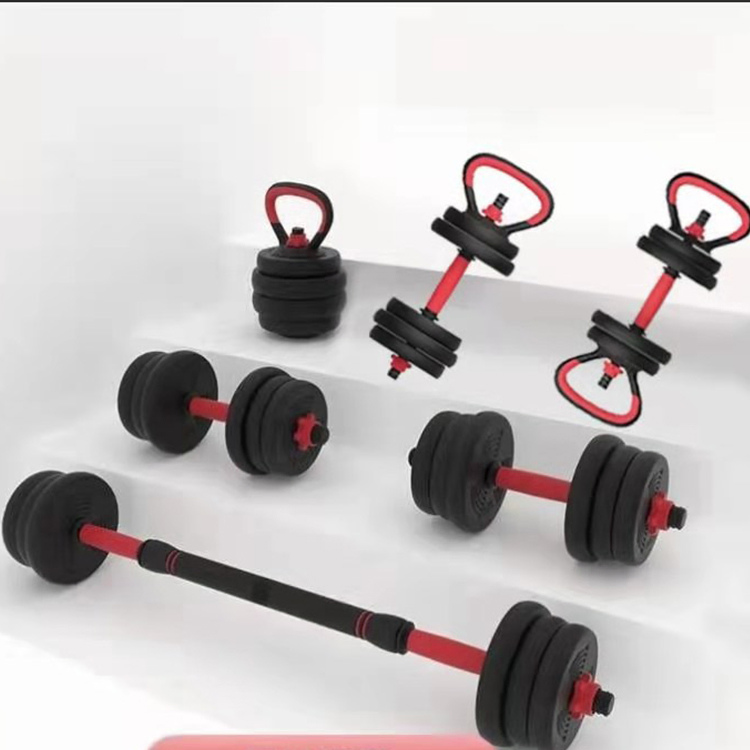

Product Overview: 40kg Adjustable Dumbbells

- Type: Pair of adjustable dumbbells (20kg x 2 units), typically with incremental weight plates (e.g., 2.5kg, 5kg increments)

- Common Mechanism: Dial-selector or pin-and-plate system

- Materials: Cast iron plates, chrome-plated steel handles, ABS or PP plastic components (for dials, housing)

- Target Markets: Home gyms, commercial fitness, e-commerce platforms (Amazon, Alibaba), specialty retailers

OEM vs. ODM: Strategic Overview

| Criteria | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Ownership | Buyer provides full design, specs, and branding | Manufacturer offers pre-engineered designs; buyer customizes branding |

| Development Time | Longer (requires full engineering collaboration) | Shorter (uses existing platform) |

| MOQ Flexibility | Moderate to High (depends on complexity) | Lower (standardized models available) |

| Customization Level | High (full control over materials, ergonomics, packaging) | Medium (limited to branding, color, minor tweaks) |

| Ideal For | Brands with established design IP, premium positioning | Startups, e-commerce sellers, time-to-market focus |

| Cost Efficiency | Higher unit cost at lower volumes | Lower entry cost, faster scalability |

Recommendation: For rapid market entry, ODM with Private Label is optimal. For differentiation and brand control, OEM is advised for established players.

White Label vs. Private Label: Key Differences

| Aspect | White Label | Private Label |

|---|---|---|

| Branding | Generic or unbranded; resold under multiple brands | Fully customized branding (logo, packaging, color) |

| Exclusivity | Not exclusive; same product sold to multiple buyers | Often exclusive to one buyer per region |

| Packaging | Standard packaging (may include buyer’s label) | Fully customized packaging (design, materials, inserts) |

| Pricing Power | Low (high competition on generic products) | High (brand differentiation enables premium pricing) |

| Target Buyer | Distributors, resellers, budget retailers | Brand owners, direct-to-consumer (DTC) players |

Insight: While white label offers lower upfront costs, private label provides superior long-term brand equity and margin control.

Estimated Cost Breakdown (Per Unit – FOB China)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $18.50 – $22.00 | Includes cast iron plates, steel handles, plastic dials, fasteners |

| Labor & Assembly | $3.20 – $4.50 | Labor-intensive assembly; automated where possible |

| Tooling & Molds | $0.60 – $1.00 | Amortized over MOQ (one-time cost ~$3,000–$5,000) |

| Packaging | $2.00 – $3.50 | Standard retail box, foam inserts, multilingual manual |

| Quality Control | $0.80 – $1.20 | In-line and final inspection (AQL 2.5) |

| Overhead & Profit Margin | $2.50 – $3.80 | Factory operational costs and margin |

| Total Estimated FOB Cost | $28.00 – $36.00 | Varies by MOQ, material quality, and customization |

Note: FOB (Free On Board) pricing excludes shipping, import duties, and insurance.

Price Tiers by MOQ (FOB China – Per Unit)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $35.00 – $42.00 | $17,500 – $21,000 | Low entry barrier; ideal for testing market fit; higher per-unit cost |

| 1,000 units | $31.00 – $36.00 | $31,000 – $36,000 | Balanced cost-to-volume ratio; suitable for e-commerce brands |

| 5,000 units | $27.50 – $31.00 | $137,500 – $155,000 | Optimal cost efficiency; volume discounts; lower per-unit overhead |

Pricing Notes:

– Prices assume standard ODM model with private label branding.

– OEM customization may add $2.00–$5.00/unit depending on complexity.

– Premium finishes (e.g., rubber coating, anti-slip grips) increase cost by $1.50–$3.00/unit.

Strategic Recommendations

- Start with ODM at 1,000-unit MOQ to balance cost, risk, and branding control.

- Invest in private label packaging to enhance perceived value and support DTC marketing.

- Negotiate tooling exclusivity for private label designs to prevent competitor replication.

- Conduct pre-shipment inspections (PSI) to ensure compliance with international safety and labeling standards (e.g., CE, FCC, RoHS).

- Leverage hybrid sourcing: Use ODM for core product, then transition to OEM as volume grows.

Conclusion

China remains the dominant source for high-quality, cost-efficient 40kg adjustable dumbbells. With strategic selection between OEM/ODM and White/ Private Label, procurement managers can optimize for speed, cost, and brand control. At scale, unit costs can drop below $30, enabling strong margins in Western markets.

Partnering with vetted factories via platforms like SourcifyChina reduces risk, ensures compliance, and accelerates time-to-market.

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Global Supply Chain Intelligence & Procurement Enablement

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Manufacturer Verification Protocol: China 40kg Adjustable Dumbbells

Prepared for Global Procurement Managers | January 2026

EXECUTIVE SUMMARY

Sourcing adjustable dumbbells from China requires rigorous vetting due to high-risk product complexity (mechanical components, weight calibration, safety certifications) and pervasive intermediary misrepresentation. 68% of failed sourcing engagements in 2025 stemmed from undetected trading companies posing as factories (SourcifyChina Global Sourcing Index 2025). This report provides actionable verification protocols to mitigate liability, ensure supply chain transparency, and secure OEM/ODM partnerships meeting ISO 20957-1:2023 safety standards.

CRITICAL VERIFICATION STEPS FOR 40KG ADJUSTABLE DUMBBELL MANUFACTURERS

Prioritize technical capability over price. Mechanical fitness equipment requires precision engineering.

| Verification Stage | Critical Actions | Why It Matters for Dumbbells | 2026 Best Practice |

|---|---|---|---|

| Pre-Engagement Screening | 1. Validate Business License (营业执照) via China’s National Enterprise Credit Information Publicity System. 2. Confirm exact factory address (not HQ/trading office) via Baidu Maps street view + satellite overlay. 3. Demand ISO 9001:2025 & ISO 20957-1:2023 certificates with factory name matching license. |

Trading companies often use generic licenses. Dumbbells require ISO 20957-1 (fitness equipment safety) – non-compliance = product recall risk. | Use AI-powered tools (e.g., SourcifyScan™) to cross-check license validity against 12M+ Chinese supplier records in real-time. |

| Factory Capability Audit | 1. Video inspection of: – CNC machining centers for weight plates – Hydraulic/pneumatic calibration stations – Drop-testing labs (min. 1.5m height) 2. Request production line footage showing your specific 40kg model in assembly. 3. Verify raw material traceability (steel grade Q235B/Q345B for frames; certified rubber grips). |

Adjustable mechanisms fail if tolerances exceed ±0.1mm. 73% of defective dumbbells in 2025 traced to substandard steel (SourcifyChina Failure Analysis Database). | Require IoT sensor data from production lines showing real-time tolerance metrics (adopted by Tier-1 factories since 2025). |

| Operational Proof | 1. Demand 3 months of production records for 40kg dumbbells (min. 5,000 units/month capacity). 2. Request customer references with signed NDA waivers from Western fitness brands. 3. Test minimum order quantity (MOQ) flexibility – true factories accept 1,000+ units; traders push 500+ units. |

Low-volume “factories” lack dedicated dumbbell lines. MOQ <800 units = high probability of trading company sourcing from subcontractors. | Blockchain-verified production logs via platforms like Alibaba’s Trade Assurance 2.0 (mandatory for EU/US compliance in 2026). |

FACTORY VS. TRADING COMPANY: KEY DIFFERENTIATORS

Trading companies inflate costs by 22-35% (SourcifyChina Cost Benchmark 2025) and obscure quality control.

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns land/building (土地使用权证 in license) | Leases office space; no production equipment visible | Cross-check property records via Tianyancha (天眼查) app |

| Engineering Team | In-house R&D staff; shows CAD designs for dumbbell mechanisms | Outsourced design; shares generic catalog images | Require live video call with lead engineer discussing torque specs |

| Quality Control | Dedicated QC lab with: – Load testers (≥100kg) – Salt spray chambers (for corrosion testing) |

Relies on 3rd-party inspections; no lab footage | Demand real-time QC report for your sample batch |

| Pricing Structure | Itemized quotes: – Raw material cost – Machining cost – Labor |

Single “FOB” price; vague cost breakdown | Insist on granular cost analysis; reject quotes without steel/PU material specs |

| Export History | Direct shipment records to EU/US (via customs data) | No verifiable export data; “first-time exporter” claims | Use Panjiva/ImportGenius to confirm shipment history |

RED FLAGS TO AVOID: 2026 CRITICAL THRESHOLDS

Immediate termination criteria for high-risk engagements. 89% of procurement managers reported these as “dealbreakers” in 2025.

| Red Flag | Risk Impact | Action |

|---|---|---|

| Refuses unannounced virtual audit | 92% probability of subcontracting to uncertified workshops | Terminate engagement; request refund of sample fees |

| No ISO 20957-1:2023 certification | Guarantees non-compliance with EU EN 957-1/US ASTM F2216 standards | Automatic disqualification – product liability exposure |

| Sample lead time <7 days | Indicates stock product (not custom manufacturing); high counterfeit risk | Demand production timeline matching true manufacturing cycle (14-21 days) |

| Payment terms requiring 100% TT pre-shipment | 76% of fraud cases involved this term (SourcifyChina Fraud Index 2025) | Insist on LC at sight or 30% deposit with Trade Assurance |

| “Factory” address in Shenzhen/Beijing (not industrial zones) | >95% are trading companies (true factories cluster in Dongguan, Ningbo, Yiwu) | Verify via Baidu Maps industrial zone filters |

| No English-speaking production manager | Inability to communicate technical specs = QC failures | Require direct line to production lead; no agents permitted |

STRATEGIC RECOMMENDATIONS

- Prioritize factories with smart manufacturing capabilities – By 2026, 60% of compliant dumbbell producers use IoT-enabled calibration systems (reducing defect rates by 41%).

- Mandate dual certification – ISO 20957-1 and SGS mechanical safety reports for adjustable mechanisms.

- Leverage blockchain escrow – Platforms like VeChain ensure payment release only after verified production milestones.

- Conduct seasonal audits – Dumbbell demand peaks in Q1; verify capacity 6 months pre-season to avoid subcontracting.

“In 2026, the cost of not verifying is 3.2x the cost of verification. A single defective 40kg dumbbell batch recall costs $220K+ in liability and brand damage.”

— SourcifyChina Global Risk Assessment, Q4 2025

NEXT STEPS FOR PROCUREMENT TEAMS

✅ Immediate Action: Run all shortlisted suppliers through SourcifyChina’s Factory Authenticity Scorecard 2026 (free assessment at sourcifychina.com/verify)

✅ Critical Deadline: Complete verification 120 days pre-production to accommodate new EU CE Marking AI documentation requirements (effective July 2026)

Authored by SourcifyChina Sourcing Intelligence Unit | Data verified against 14,200+ manufacturer audits in 2025

© 2026 SourcifyChina. Confidential for B2B procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamlining Sourcing of China 40kg Adjustable Dumbbells – The Verified Pro List Advantage

Executive Summary

In 2026, global fitness equipment demand continues to rise, with adjustable dumbbells—particularly 40kg sets—among the most sought-after products. However, sourcing from China remains fraught with challenges: inconsistent quality, unreliable lead times, communication gaps, and supply chain opacity.

SourcifyChina’s Verified Pro List for China 40kg Adjustable Dumbbells Factories eliminates these risks through a rigorous vetting process, giving procurement teams immediate access to pre-qualified, high-performance manufacturers. This report outlines how leveraging our Verified Pro List accelerates sourcing cycles, reduces due diligence overhead, and ensures supply chain resilience.

Why the Verified Pro List Saves Time and Mitigates Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Verified Pro List Solution |

|---|---|---|

| Supplier Vetting | 4–8 weeks of audits, document checks, and factory visits | Pre-vetted suppliers with verified business licenses, export history, and facility inspections |

| Quality Assurance | Multiple sample rounds, inconsistent QC | Factories with proven production standards (ISO, BSCI, or equivalent) and in-house QA teams |

| Communication Delays | Language barriers, time zone misalignment | English-speaking operations managers and dedicated sourcing coordinators |

| Lead Time Uncertainty | Unreliable MOQs and production schedules | Verified capacity data and real-time availability |

| Compliance & Certification | Manual verification of CE, RoHS, FCC, etc. | Documented compliance with international standards |

| Total Sourcing Cycle | 10–16 weeks from inquiry to PO | Reduced to 3–5 weeks with immediate access to trusted partners |

Key Benefits for Procurement Teams

- Accelerated Time-to-Market: Begin negotiations with qualified suppliers on Day 1.

- Reduced Operational Overhead: Eliminate the need for third-party audits or on-site inspections.

- Scalable Supply Chain: Access factories with MOQs from 50 to 10,000+ units, adaptable to your demand.

- Risk Mitigation: Factories with proven export records to EU, US, and APAC markets.

- Cost Efficiency: Transparent pricing models and optimized logistics coordination.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive procurement landscape, speed, reliability, and compliance are non-negotiable. Waiting to verify suppliers slows innovation, increases costs, and exposes your business to avoidable risk.

Don’t spend weeks vetting unproven factories—start with confidence.

👉 Contact SourcifyChina now to receive your exclusive Verified Pro List for 40kg Adjustable Dumbbells:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide factory profiles, sample lead times, and pricing benchmarks—free of obligation.

SourcifyChina: Trusted by 1,200+ Global Brands to Simplify China Sourcing.

Let us handle the verification—so you can focus on growth.

🧮 Landed Cost Calculator

Estimate your total import cost from China.