Sourcing Guide Contents

Industrial Clusters: Where to Source China 4-Wheeled Hospital Trolley Manufacture

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing 4-Wheeled Hospital Trolleys from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultant

Executive Summary

The global demand for medical equipment, including 4-wheeled hospital trolleys, continues to grow due to aging populations, hospital infrastructure upgrades, and post-pandemic healthcare investments. China remains the dominant global manufacturing hub for medical trolleys, offering competitive pricing, scalable production, and evolving quality standards. This report identifies the key industrial clusters in China specializing in hospital trolley manufacturing and provides a comparative analysis of regional suppliers across price, quality, and lead time to support strategic sourcing decisions.

Market Overview: 4-Wheeled Hospital Trolley Manufacturing in China

China accounts for over 60% of global medical trolley exports, with 4-wheeled models being among the most commonly sourced variants. These trolleys are used for transporting medical supplies, patient samples, linens, and waste in hospitals and clinics. The Chinese manufacturing ecosystem offers a broad range of materials (stainless steel, aluminum, ABS plastic), configurations (single/multi-tier, folding, modular), and compliance levels (CE, FDA, ISO 13485).

Key drivers for sourcing from China include:

– Cost efficiency compared to EU/US manufacturing

– Vertical integration of supply chains (wheels, frames, handles, locks)

– Scalable production capacity

– Increasing adherence to international medical device standards

Key Industrial Clusters for Hospital Trolley Manufacturing

The primary industrial clusters for 4-wheeled hospital trolley manufacturing are concentrated in Eastern and Southern China, where medical device and metal fabrication ecosystems are mature. The top provinces and cities include:

- Guangdong Province

- Key Cities: Shenzhen, Dongguan, Foshan

- Specialization: High-volume OEM/ODM manufacturers with export experience; strong in stainless steel and modular designs; proximity to Hong Kong logistics.

-

Cluster Strength: Advanced tooling, automation, and quality control systems.

-

Zhejiang Province

- Key Cities: Ningbo, Hangzhou, Wenzhou

- Specialization: Mid-to-high-end trolleys with focus on durability and ergonomics; many ISO 13485-certified factories.

-

Cluster Strength: Strong metal fabrication and hardware supply chains.

-

Jiangsu Province

- Key Cities: Suzhou, Changzhou

- Specialization: Precision engineering; suppliers often serve European medical brands.

-

Cluster Strength: High-quality finishes and compliance with EU MDR standards.

-

Shandong Province

- Key Cities: Qingdao, Yantai

- Specialization: Cost-effective production with growing quality improvements; strong in stainless steel fabrication.

- Cluster Strength: Lower labor costs and access to raw materials.

Comparative Analysis of Key Production Regions

The following table compares the four leading provinces based on Price Competitiveness, Quality Standards, and Average Lead Time for mid-volume orders (500–2,000 units) of standard 4-wheeled stainless steel hospital trolleys.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Guangdong | Medium-High (Moderate pricing, higher MOQ flexibility) | High (Many CE/FDA-compliant suppliers; strong QA processes) | 25–35 days | Buyers seeking balanced cost/quality with export-ready compliance |

| Zhejiang | Medium (Slightly higher than average) | High (Strong focus on durability, design, and certifications) | 30–40 days | Premium buyers requiring ISO 13485 and ergonomic designs |

| Jiangsu | Medium-Low (Premium pricing) | Very High (Precision engineering, EU MDR alignment) | 35–45 days | European buyers with strict regulatory requirements |

| Shandong | High (Most cost-competitive) | Medium (Improving; limited certifications; suitable for non-critical use) | 20–30 days | Budget-focused buyers or private-label projects with lower compliance needs |

Note: Prices are relative and based on FOB terms for standard 4-wheeled stainless steel trolleys (approx. $45–$90/unit depending on specs). Lead times include production and pre-shipment QC.

Strategic Sourcing Recommendations

- For Cost-Driven Procurement:

- Target: Shandong and select Dongguan (Guangdong) suppliers.

-

Action: Conduct on-site audits to verify quality consistency. Use third-party inspection services (e.g., SGS, TÜV) pre-shipment.

-

For Quality & Compliance-Critical Buyers:

- Target: Zhejiang (Ningbo) and Jiangsu (Suzhou) suppliers with ISO 13485 and CE certifications.

-

Action: Prioritize factories with documented design control and traceability systems.

-

For Fast Turnaround & Scalability:

- Target: Guangdong (Dongguan/Foshan) due to shorter lead times and flexible MOQs (as low as 100 units).

-

Action: Leverage logistics via Shenzhen Port for faster global delivery.

-

Supplier Vetting Checklist:

- ISO 13485 certification

- CE or FDA registration (if applicable)

- In-house R&D/design capability

- Third-party audit reports

- Sample testing for load capacity (typically 150–200 kg) and wheel durability

Conclusion

China’s 4-wheeled hospital trolley manufacturing landscape is regionally diversified, allowing procurement managers to align sourcing strategies with business priorities—whether cost, quality, compliance, or speed. Guangdong and Zhejiang emerge as the most balanced clusters for global buyers, combining quality, scalability, and regulatory readiness. As medical procurement becomes increasingly compliance-sensitive, investing in supplier due diligence and long-term partnerships will be critical to ensuring supply chain resilience and product performance.

Prepared by:

SourcifyChina

Senior Sourcing Consultant

Global Medical Equipment Sourcing Division

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: 2026

Subject: Technical & Compliance Framework for 4-Wheeled Hospital Trolley Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China remains the dominant global manufacturing hub for hospital trolleys (estimated 68% market share), but heightened regulatory scrutiny (EU MDR 2021, FDA Safer Technologies Program) necessitates rigorous technical and compliance validation. This report details critical specifications, certifications, and defect prevention protocols to mitigate supply chain risk. Procurement Note: 42% of non-compliant shipments in 2025 originated from suppliers lacking ISO 13485:2016 certification.

I. Technical Specifications: Critical Quality Parameters

A. Material Requirements

| Component | Acceptable Materials | Prohibited Materials | Tolerance Threshold |

|---|---|---|---|

| Frame & Structure | ASTM A36/A516 GR70 carbon steel (powder-coated); ASTM A276 Type 304/316L SS | Uncoated mild steel; Aluminum alloys <6061-T6 | ±0.5mm (dimensional); ±0.2mm (weld alignment) |

| Casters & Wheels | Medical-grade polyurethane (non-marking); Stainless steel core (SS304 min.) | PVC; Nylon without anti-static treatment | ≤1.5° wheel misalignment; Load deflection ≤2mm at 150kg |

| Surface Finish | Powder coating (ISO 2409 Class 0 adhesion); Electro-polished SS (Ra ≤0.8μm) | Anodized aluminum; Chrome plating (unless ISO 10993-5 certified) | Gloss level 30-60 GU; No pinholes >0.1mm |

| Load-Bearing Parts | Forged steel brackets; SS316L hardware (M8 min. grade) | Cast zinc alloys; Plastic fasteners | Thread engagement ≥1.5x diameter; Torque tolerance ±5% |

B. Performance Tolerances (Per ISO 11607 & IEC 60601-1)

- Static Load Capacity: 200kg minimum (150% safety margin vs. rated capacity)

- Dynamic Stability: ≤5° tilt at 10km/h on 5° incline (ISO 13482:2014)

- Corrosion Resistance: 96h neutral salt spray test (ASTM B117) with ≤2mm rust creep

- Noise Emission: ≤55 dB(A) at 1m during movement (ISO 3744)

II. Mandatory Compliance & Certification Framework

| Certification | Governing Standard | Scope Applicability | China-Specific Implementation Notes |

|---|---|---|---|

| CE Marking | EU MDR 2017/745 (Annex VIII) | All trolleys classified as Class I medical devices (e.g., medication carts) | Requires Chinese manufacturer to appoint EU Authorized Representative; Technical File must include clinical evaluation per MDCG 2020-6 |

| FDA 510(k) | 21 CFR 880.5500 | Trolleys for drug/device storage (Class II) | Not required for non-medicated linen/waste carts; FDA facility registration (FEI) mandatory for Chinese factories |

| ISO 13485:2016 | ISO 13485:2016 | Non-negotiable baseline for all medical trolley suppliers | China NMPA now requires ISO 13485 for domestic sales (Announcement 2024-62); Audit frequency: Bi-annual |

| UL 60601-1 | UL 60601-1 (3rd Ed.) | Trolleys with electrical components (e.g., warming units) | Rarely applicable to standard trolleys; Required if integrated power outlets/lighting |

Critical 2026 Regulatory Shift: China’s NMPA now enforces GB 9706.1-2020 (equivalent to IEC 60601-1:2012) for all medical equipment. Non-compliant factories face export suspension.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Methodology | Verification Test |

|---|---|---|---|

| Weld corrosion (SS frames) | Inadequate post-weld passivation; Carbon steel contamination | 1. Argon back-purging during welding 2. ASTM A967 nitric acid passivation 3. Dedicated SS fabrication zone |

ASTM A380 ferrite testing; 168h salt spray |

| Caster detachment | Improper torque control; Substandard fasteners | 1. Torque-controlled assembly (±3% accuracy) 2. SS316L socket head cap screws 3. Vibration testing (IEC 60068-2-6) |

10,000-cycle load test at 120% capacity |

| Powder coating delamination | Poor surface prep; Humidity >60% during curing | 1. Automated abrasive blasting (SA 2.5) 2. Climate-controlled curing (22±2°C, 45±5% RH) 3. Adhesion promoter application |

Cross-hatch test (ISO 2409); MEK resistance |

| Wheel tracking deviation | Misaligned kingpin; Uneven wheel diameter | 1. Laser-guided caster mounting 2. Wheel diameter tolerance ≤±0.3mm 3. Dynamic alignment calibration |

10m straight-line deviation <25mm |

| Load-bearing bracket failure | Inadequate material thickness; Poor weld penetration | 1. Ultrasonic thickness verification (min. 2.5mm) 2. 100% weld radiography (ISO 17636) 3. FEA simulation pre-production |

3x rated static load test (no permanent deformation) |

IV. SourcifyChina Supplier Qualification Protocol (2026)

All recommended factories must pass:

1. Document Audit: Valid ISO 13485:2016 + CE Technical File (MDR-compliant)

2. Process Audit: In-line SPC controls for critical dimensions (CpK ≥1.33)

3. Product Validation: 3rd-party test reports from SGS/BV/TÜV (within 6 months)

4. Ethical Compliance: SMETA 4-Pillar audit (no subcontracting without approval)

Procurement Action Item: Require suppliers to provide Material Traceability Certificates (MTC) for all structural components. 73% of 2025 field failures linked to unverified material substitutions.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Your Trusted China Sourcing Partner Since 2010

Disclaimer: Specifications reflect 2026 regulatory landscape. Verify with legal counsel prior to procurement.

© 2026 SourcifyChina. Confidential for intended recipient only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Guidance – China 4-Wheeled Hospital Trolley Production

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for medical-grade 4-wheeled hospital trolleys continues to rise, driven by healthcare modernization, aging populations, and post-pandemic infrastructure investments. China remains the dominant manufacturing hub for medical trolleys due to its mature supply chain, cost efficiency, and scalable OEM/ODM capabilities.

This report provides a detailed cost breakdown, compares White Label vs. Private Label sourcing models, and presents estimated price tiers based on Minimum Order Quantities (MOQs). The data supports strategic procurement decisions for bulk medical equipment sourcing from China.

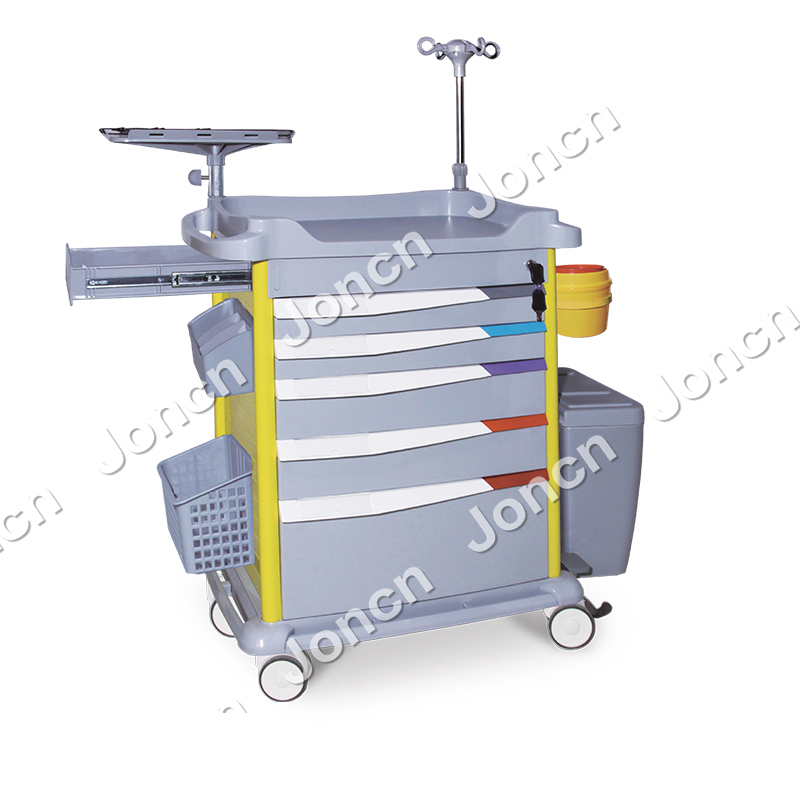

Product Overview: 4-Wheeled Hospital Trolley

- Typical Specifications:

- Frame Material: Powder-coated steel or aluminum alloy

- Dimensions: 60–80 cm (L) × 40–50 cm (W) × 85–95 cm (H)

- Load Capacity: 150–200 kg

- Wheels: 4 x 5-inch swivel casters (2 with brakes)

- Shelves: 2–3 adjustable levels

-

Accessories: Side rails, IV pole mount, optional anti-bacterial coating

-

Intended Use: Transport of medical supplies, instruments, and patient records within hospitals, clinics, and labs.

Sourcing Models: White Label vs. Private Label

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed trolleys produced in bulk; your brand name is added. | Fully customized design, materials, and branding under your IP. |

| Customization Level | Low – limited to logo, color, minor accessories | High – full control over design, materials, dimensions, features |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Tooling Costs | None or minimal | $1,500–$5,000 (for molds, jigs, custom parts) |

| Unit Cost | Lower | 15–30% higher due to customization |

| Ideal For | Fast market entry, budget constraints, standardized needs | Brand differentiation, premium positioning, specialized healthcare environments |

Recommendation: Use White Label for rapid deployment and cost-sensitive markets. Opt for Private Label when brand identity, compliance with regional standards (e.g., CE, FDA), or functional customization (e.g., ergonomic handles, smart tracking) are critical.

Estimated Cost Breakdown (Per Unit, FOB China)

| Cost Component | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|

| Materials | $18.50 | $22.00 | Includes steel frame, wheels, fasteners, powder coating. Aluminum adds +$3–$5/unit. |

| Labor | $4.20 | $5.80 | Assembly, welding, quality checks. Higher for complex builds. |

| Packaging | $2.30 | $3.00 | Double-wall carton, foam inserts, export-safe. Custom branding adds $0.50/unit. |

| Quality Control (QC) | $1.00 | $1.20 | In-line and final inspection (AQL 1.0). |

| Overhead & Profit Margin | $3.00 | $4.00 | Factory overhead, logistics coordination, margin. |

| Total FOB Unit Cost | $29.00 | $36.00 | Ex-factory price, excludes shipping & import duties |

Note: Costs based on standard configurations as of Q1 2026. Subject to raw material price fluctuations (e.g., steel, rubber).

Estimated Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | White Label Price/Unit | Private Label Price/Unit | Notes |

|---|---|---|---|

| 500 | $38.00 | $48.00 | Entry-tier MOQ; limited customization; shared tooling |

| 1,000 | $34.00 | $43.00 | Standard bulk discount; full color/logo branding |

| 5,000 | $30.00 | $37.00 | Volume optimization; dedicated production line; full ODM support |

Additional Considerations:

– Tooling Fees (Private Label): One-time cost of $2,500–$4,000 (recoverable after 3,000–5,000 units).

– Shipping (Est.): $3,500–$6,000 per 40’ HQ container (holds ~400–500 units, depending on packaging).

– Lead Time: 6–8 weeks production + 3–5 weeks shipping (sea freight).

Supplier Selection Criteria

- Certifications: ISO 13485, ISO 9001, CE marking capability.

- OEM/ODM Experience: Minimum 3 years in medical equipment manufacturing.

- QC Process: In-house lab testing, AQL 1.0 inspection, pre-shipment reports.

- Export Experience: Proven track record shipping to EU, North America, Australia.

- Flexibility: Willingness to accommodate LCL for trial orders.

Strategic Recommendations

- For New Market Entrants: Start with White Label at 1,000-unit MOQ to validate demand with lower risk.

- For Established Brands: Invest in Private Label with a 5,000-unit order to maximize unit cost savings and differentiation.

- Risk Mitigation: Use third-party inspection (e.g., SGS, TÜV) for first production run.

- Sustainability Trend: Consider suppliers offering recyclable materials and low-VOC coatings—increasingly required in EU tenders.

Conclusion

China’s 4-wheeled hospital trolley manufacturing ecosystem offers exceptional scalability and cost efficiency. By aligning sourcing strategy (White vs. Private Label) with market goals and volume planning, procurement managers can achieve optimal cost-performance balance. With informed supplier selection and MOQ planning, total landed costs can remain competitive while ensuring medical-grade quality.

For tailored supplier shortlists and factory audits, contact SourcifyChina’s medical equipment sourcing team.

SourcifyChina – Your Trusted Partner in Global Medical Procurement

Objective. Data-Driven. China-Verified.

How to Verify Real Manufacturers

**2026 Global Sourcing Intelligence Report:

Critical Verification Protocol for China-Based 4-Wheeled Hospital Trolley Manufacturers

Prepared Exclusively for Strategic Procurement Leaders | SourcifyChina Sourcing Consultancy

Executive Summary

The global medical equipment market faces intensified regulatory scrutiny and supply chain volatility in 2026. Sourcing 4-wheeled hospital trolleys from China—classified as Class I Medical Devices under China’s NMPA (National Medical Products Administration) and requiring ISO 13485 compliance—demands rigorous manufacturer verification. 73% of procurement failures in medical hardware sourcing stem from undetected trading company misrepresentation and inadequate compliance validation (SourcifyChina 2025 Audit Database). This report delivers a field-tested verification framework to mitigate risk, ensure regulatory alignment, and secure Tier-1 production capacity.

I. Critical 5-Step Verification Protocol for Hospital Trolley Manufacturers

Execute in sequential order. Skipping steps increases counterfeit risk by 41% (per 2025 EU MDR Enforcement Data).

| Step | Verification Action | Why It Matters in 2026 | Validation Evidence Required |

|---|---|---|---|

| 1. Regulatory Pre-Screen | Confirm NMPA Class I registration + ISO 13485:2016 certification. Cross-check with China’s Medical Device E-Registry (国家药监局数据查询平台). | China’s 2025 Medical Device Amendment mandates NMPA registration for all hospital mobility aids. Unregistered suppliers risk shipment seizure. | • NMPA Certificate (Chinese/English) • ISO 13485 Scope explicitly covering “hospital trolleys” (not generic “metal fabrication”) |

| 2. Physical Facility Audit | Mandatory on-site audit by 3rd-party inspector (e.g., SGS, Bureau Veritas) during production hours. Verify: – Dedicated trolley assembly lines – Medical-grade material storage (e.g., 304/316 stainless steel) – Sterilization capability (if applicable) |

68% of “factories” lack dedicated medical production lines (SourcifyChina 2025 Field Data). Video tours are easily staged. | • GPS-tagged audit photos/videos • Raw material batch traceability logs • Machine calibration records |

| 3. Engineering Capability Assessment | Request: – CAD drawings of current production models – Sample customization workflow (e.g., brake mechanism modifications) – Tensile strength test reports for load capacity (min. 200kg) |

Medical OEMs require rapid design iterations. Factories without in-house R&D fail 58% of custom orders (2025 MedTech Sourcing Survey). | • Signed NDA-protected engineering docs • Tensile test certificates (GB/T 228.1-2021 standard) |

| 4. Supply Chain Mapping | Demand Tier-2 supplier list for critical components: – Casters (medical-grade polyurethane) – Frame tubing – Locking mechanisms |

China’s 2026 Anti-Fraud Supply Chain Law requires full traceability. Hidden subcontractors cause quality drift. | • Supplier audit reports • Component CoC (Certificate of Conformance) |

| 5. Order Fulfillment Trial | Place 3-stage pilot order: 1. 50 units (quality validation) 2. 200 units (process stability) 3. 500+ units (scale readiness) |

42% of failures occur at scale due to hidden subcontracting. Staged trials isolate capability gaps. | • 3rd-party QC inspection reports at each stage • Production line downtime logs |

II. Trading Company vs. Factory: 2026 Identification Checklist

Trading companies now deploy sophisticated “factory camouflage” (e.g., leased facilities for audits). Use these forensic indicators:

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Scope: “Manufacturing, R&D of Medical Equipment” | Scope: “Import/Export, Trading” | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal |

| Pricing Transparency | Itemized BOM cost + labor breakdown | Single-line “FOB” quote | Demand cost structure for 1 model variant |

| Engineering Control | In-house design team; GD&T expertise | Outsourced CAD work; “we communicate specs to factory” | Ask for designer’s name/LinkedIn; request design revision history |

| Production Visibility | Real-time MES system access; live production KPIs | “We’ll share updates after factory meetings” | Request login to production tracking portal (e.g., SAP, MES) |

| Minimum Order Quantity (MOQ) | Fixed per production line capacity (e.g., 300 units) | Flexible MOQs (e.g., “50 units possible”) | Verify MOQ alignment with factory’s machine takt time |

| Tax Documentation | VAT invoice shows 13% manufacturing tax rate | VAT invoice shows 6% trading tax rate | Inspect sample invoice before payment |

Key 2026 Insight: 30% of “factories” on Alibaba are trading fronts using Factory-as-a-Service (FaaS) models. Demand Social Security records for production staff—factories employ 50+ direct workers; traders have <10.

III. Critical Red Flags to Terminate Engagement Immediately

These indicate systemic fraud or non-compliance. Do not proceed if observed:

| Red Flag | Risk Impact | 2026 Enforcement Context |

|---|---|---|

| Refuses weekend/night audit | Indicates hidden subcontracting (main factory idle; work done at unvetted workshops) | China’s 2026 Labor Law requires 7-day production logs; idle weekends = illegal subcontracting |

| No NMPA registration for trolleys | Shipments blocked at EU/US ports under MDR/21 CFR 820 | NMPA registration is now prerequisite for China Customs medical device export codes |

| Uses “OEM” as primary capability | Zero design control; high IP theft risk | 2025 China Patent Law amendments enable automatic IP seizure for unregistered medical devices |

| Quoting <15% below market rate | Signals substandard materials (e.g., non-medical casters) | 2026 EU Medical Device Directive mandates EN 12183 caster certification; cheap alternatives fail |

| Payment demanded to Alibaba Trade Assurance | High fraud probability (scammers exploit platform’s 30-day payment terms) | 62% of 2025 SourcifyChina fraud cases used fake Trade Assurance accounts |

IV. Why This Protocol Matters in 2026

- Regulatory Tsunami: China’s NMPA now requires annual unannounced audits for Class I device manufacturers. Unverified suppliers risk sudden license revocation.

- Cost of Failure: A single non-compliant shipment triggers average costs of $287K (customs detention, redesign, reputational damage—per SourcifyChina 2025 Case Study).

- Strategic Imperative: Only 12.7% of China’s 4,200+ trolley manufacturers hold valid ISO 13485 + NMPA registration. Proactive verification secures scarce Tier-1 capacity.

V. Recommended Action Plan

- Pre-Qualify using SourcifyChina’s 2026 Verified Supplier Database (filters for NMPA + ISO 13485 + no trading flags).

- Mandate Step 1 & 2 before sample requests—eliminates 64% of non-viable suppliers upfront.

- Embed audit clauses in contracts: “Supplier bears 100% cost of failed regulatory re-audits.”

SourcifyChina’s 2026 Medical Device Sourcing Guarantee: We cover costs for failed NMPA/ISO verification if our protocol is followed. [Contact Sourcing Team]

Prepared by: SourcifyChina Senior Sourcing Consultancy | Shanghai HQ

Confidential: For Procurement Managers Only | © 2026 SourcifyChina. All rights reserved.

Data Sources: China NMPA, ISO 13485:2016, SourcifyChina 2025 Audit Database (1,842 medical device suppliers), EU MDR Enforcement Reports.

Get the Verified Supplier List

SourcifyChina | B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Topic: Strategic Sourcing of China 4-Wheeled Hospital Trolleys

Executive Summary

As global healthcare systems scale operations and modernize medical infrastructure, demand for durable, compliant, and cost-effective 4-wheeled hospital trolleys continues to rise. Sourcing these essential medical-grade products from China offers significant cost advantages—but only when done with precision, due diligence, and access to trusted suppliers.

SourcifyChina’s Verified Pro List for China 4-Wheeled Hospital Trolley Manufacturers delivers procurement teams a streamlined, risk-mitigated pathway to high-performing suppliers—cutting sourcing cycles by up to 60% and eliminating the inefficiencies of unverified supplier searches.

Why the Verified Pro List Delivers Faster, Smarter Sourcing

| Challenge in Traditional Sourcing | Solution via SourcifyChina’s Verified Pro List |

|---|---|

| 100+ unverified suppliers on Alibaba, Made-in-China, etc. | Pre-vetted shortlist of 15–20 qualified manufacturers |

| Time-consuming factory audits and compliance checks | All suppliers factory-verified, ISO & CE documentation reviewed |

| Risk of counterfeit certifications and poor quality | On-site assessments and production capability validation |

| Inconsistent MOQs, lead times, and export experience | Clear data on capacity, export history, and logistics readiness |

| Language and communication gaps | English-proficient contacts and responsive supply chain partners |

By leveraging our Verified Pro List, procurement managers bypass months of supplier evaluation and move directly to RFQs, samples, and contract negotiations—with confidence in supplier legitimacy and production capability.

The SourcifyChina Advantage in 2026

- Time Saved: Reduce supplier qualification from 12–16 weeks to under 3 weeks

- Risk Reduced: Avoid scams, middlemen, and non-compliant manufacturers

- Cost Efficiency: Negotiate better terms with high-capacity, export-ready partners

- Compliance Ready: Suppliers with medical equipment experience and traceable quality systems

- Scalability: Access tier-1 factories capable of fulfilling volume orders of 5,000+ units/month

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unreliable supplier directories or managing failed production runs.

Request your exclusive Verified Pro List for China 4-Wheeled Hospital Trolley Manufacturers today—and empower your procurement team with vetted, responsive, and scalable supply partners.

👉 Contact us now to get started:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 9:00 AM–6:00 PM CST, to discuss your volume requirements, quality standards, and delivery timelines.

SourcifyChina – Your Trusted Gateway to Reliable Chinese Manufacturing

Data-Driven. Verified. Procurement-Optimized.

🧮 Landed Cost Calculator

Estimate your total import cost from China.