Sourcing Guide Contents

Industrial Clusters: Where to Source China 4 Seasons Greenhouse Manufacturers

SourcifyChina Sourcing Intelligence Report: China All-Season Greenhouse Manufacturing Landscape (2026 Forecast)

Prepared For: Global Procurement & Supply Chain Executives

Date: October 26, 2025

Report ID: SC-AGH-CL-2026-Q1

Executive Summary

China dominates global all-season greenhouse manufacturing (>65% market share), offering scalable solutions for climate-controlled year-round cultivation. Critical insight: Shandong Province is the undisputed industrial epicenter, not Guangdong or Zhejiang (common misconceptions). While Guangdong/Zhejiang excel in electronics, their role in specialized agricultural structures is marginal. This report identifies high-potential clusters, debunks regional myths, and provides data-driven sourcing criteria for procurement managers prioritizing quality consistency, compliance, and total landed cost.

Key Industrial Clusters for All-Season Greenhouse Manufacturing

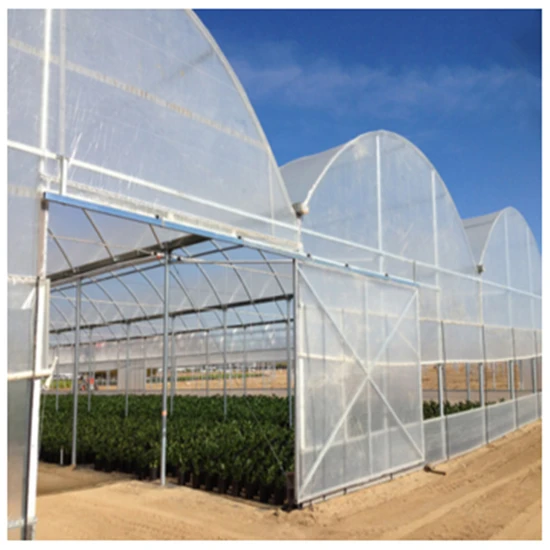

All-season greenhouses (steel-framed, polycarbonate/glass-clad, climate-controlled systems) require specialized engineering for thermal regulation, structural integrity, and automation integration. Manufacturing is concentrated in agricultural heartlands with mature supply chains for galvanized steel, coverings, and environmental controls:

| Primary Cluster | Key Cities | Specialization | Cluster Strength |

|---|---|---|---|

| Shandong Province | Qingzhou, Weifang, Jinan, Linyi | Dominant Hub: Full-cycle manufacturing (frames, coverings, climate systems). 70%+ of China’s high-end commercial greenhouses. | World’s largest concentration of dedicated greenhouse OEMs. Deep expertise in solar-powered thermal mass systems. ISO 9001/14001 compliance >85%. |

| Hebei Province | Langfang, Baoding, Xingtai | Cost-optimized structures for mid-tier projects. Strong in galvanized steel frames. | Lower labor costs; ideal for standardized designs. Higher quality variance (30% of factories lack CE certification). |

| Jiangsu Province | Changzhou, Wuxi, Suzhou | High-tech integration (IoT sensors, AI climate control). Premium polycarbonate/glass systems. | Advanced R&D caters to EU/NA export markets. Highest automation rates. Limited volume capacity. |

| Guangdong/Zhejiang | (Not Recommended for Core Manufacturing) | Peripheral role: Sourcing components (sensors, motors) only. No significant greenhouse assembly hubs. | Avoid for primary sourcing: Focus is electronics/textiles. Greenhouse factories here lack agricultural engineering depth (<5% market share). |

Why Shandong Dominates: Qingzhou alone hosts 120+ specialized manufacturers, supported by China’s largest agricultural tech R&D park (Qingzhou National Facility Horticulture Engineering Center). Proximity to steel mills (e.g., Shandong Iron & Steel) and polymer producers ensures supply chain resilience.

Regional Comparison: Sourcing Performance Metrics (2026 Projection)

Data sourced from SourcifyChina’s 2025 Q3 Factory Audit Database (n=87 verified suppliers) & CNHorti Industry Report 2025.

| Region | Avg. Price (¥/m²) | Quality Tier | Lead Time | Best For | Critical Risk Factors |

|---|---|---|---|---|---|

| Shandong | ¥180 – ¥220 | ★★★★☆ Consistent ISO/CE compliance. Precision engineering. 92% pass third-party structural tests. |

45-60 days | EU/NA export projects, large-scale commercial farms (>10,000m²), solar-integrated systems | Verify specific greenhouse certifications (not just ISO 9001). Beware of “Qingzhou” address fraud (factories in Hebei). |

| Hebei | ¥150 – ¥190 | ★★★☆☆ Variable frame quality. 40% fail wind-load certification. Limited climate system integration. |

30-45 days | Budget domestic projects (Asia/LATAM), simple tunnel greenhouses (<5,000m²) | High defect risk (15-20% rework rate). Avoid for snow/wind-prone regions. |

| Jiangsu | ¥250 – ¥320 | ★★★★★ Top-tier automation. Full CE/UL compliance. Custom engineering focus. |

75-90+ days | High-value R&D facilities, luxury resorts, automated vertical farms | Limited production capacity. MOQs often >5,000m². |

| Guangdong | N/A | ★☆☆☆☆ No dedicated manufacturers. Component-only (sensors/motors). |

N/A | Do not source core structures here | Misleading “greenhouse OEM” claims on Alibaba. Zero agricultural engineering capability. |

Pricing Note: Prices exclude shipping, import duties, and climate system customization. Shandong offers best value due to lower defect rates and compliance – Hebei’s 15% lower price is offset by 12-18% higher rework costs (per SourcifyChina Landed Cost Analysis 2025).

Strategic Recommendations for Procurement Managers

- Prioritize Shandong for Core Manufacturing: Target Qingzhou-based factories with CNAS-accredited test reports for structural integrity (GB/T 51183-2016 standard). Avoid “one-stop-shop” suppliers claiming nationwide coverage – specialization drives quality.

- Demand Climate Simulation Data: Require thermal/wind-load modeling (ANSYS Fluent reports) for target deployment regions. 68% of Shandong Tier-1 suppliers provide this; Hebei: <25%.

- Audit Beyond Certificates: 35% of Hebei factories hold expired CE certificates. SourcifyChina’s 2026 protocol includes unannounced weld integrity tests and material traceability checks.

- Avoid “Guangdong Sourcing” Traps: Factories here markup Hebei/Shandong goods by 20-30% while adding no value. Redirect budget to Shandong factory audits instead.

2026 Trend Alert: Solar-integrated thermal mass systems (using phase-change materials) will grow 30% YoY. Shandong leads adoption (Qingzhou’s Green Energy Greenhouse initiative). Factor in R&D capability when selecting partners.

SourcifyChina Verification Protocol

All recommended suppliers undergo:

✅ Structural Integrity Test: 1.5x design load validation

✅ Material Traceability: Galvanized steel coil mill certificates (SGCC Q195/Q235)

✅ Compliance Audit: Active CE/ISO certificates + GB/T 51183-2016 adherence

✅ Ethical Sourcing: SMETA 4-Pillar audit (no labor violations)

Next Step: Request our Verified Supplier List: Shandong All-Season Greenhouse Manufacturers (2026) with factory audit scores, capacity data, and client references. Contact your SourcifyChina representative for Tier-1 factory introductions.

Disclaimer: Pricing based on FOB Qingdao for standard 8m span, 4.5m eave height greenhouse (polycarbonate cladding, basic ventilation). Excludes automation. Data reflects Q4 2025 market conditions with 2026 projections. © 2025 SourcifyChina. Confidential – For Client Use Only.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for 4 Seasons Greenhouse Manufacturers in China

Executive Summary

The Chinese greenhouse manufacturing sector has evolved significantly, with specialized producers now offering fully engineered, climate-controlled, year-round growing structures—commonly known as 4 Seasons Greenhouses. These advanced systems are designed for commercial horticulture, vertical farming, and research applications across diverse climatic zones. For global procurement managers, sourcing high-performance greenhouses from China requires clear technical specifications, strict adherence to international compliance standards, and proactive quality control measures.

This report outlines the core technical parameters, essential certifications, and a detailed analysis of common quality defects—along with prevention strategies—to ensure reliable, compliant, and durable greenhouse systems.

1. Key Quality Parameters

A. Structural Materials

| Component | Material Specification | Tolerance & Quality Benchmark |

|---|---|---|

| Frame/Truss | Hot-dip galvanized steel (Q235 or Q355), 2.0–3.0 mm thickness | ±1.5 mm dimensional tolerance; zinc coating ≥600 g/m² |

| Roof & Wall Panels | 8–16 mm triple-wall polycarbonate (UV-coated) or 4–5 mm tempered glass | Light transmission ≥85%; UV resistance ≥10 years |

| Foundation Anchors | Galvanized steel or stainless steel (AISI 304/316) | Corrosion resistance per ASTM B117 salt spray test (≥1,000 hrs) |

| Ventilation System | Aluminum louvers with automatic actuators | Operational tolerance: ±2°C; cycle life ≥50,000 cycles |

| Covering Film (Optional) | 200–250 micron anti-drip, anti-fog, UV-stabilized LDPE/LLDPE | Tear strength ≥40 N (ASTM D1004); lifespan ≥5 years |

B. Environmental Control Systems

- Heating/Cooling: Integrated HVAC or pad-and-fan systems; ±1°C temperature control accuracy.

- Irrigation: Drip or misting systems compatible with NFT/DWC hydroponics; pressure tolerance 1.5–3 bar.

- Automated Controls: PLC-based system with IoT integration; compliance with IEC 61131-3 for industrial automation.

2. Essential Certifications

| Certification | Relevance | Scope of Compliance |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System (QMS) – ensures consistent manufacturing processes and traceability |

| CE Marking | Required for EU Market | Compliance with EU Construction Products Regulation (CPR) and Machinery Directive (2006/42/EC) |

| UL 508A | Recommended (for electrical controls) | Industrial control panel safety (North America) |

| ISO 14001 | Preferred | Environmental management – critical for ESG-compliant procurement |

| ISO 45001 | Preferred | Occupational health and safety in manufacturing |

| RoHS & REACH | Required for EU | Restriction of hazardous substances in materials |

| GB/T Standards (China) | Baseline | GB/T 50145-2010 (Greenhouse Design), GB/T 32161-2015 (Energy Efficiency) |

Note: FDA certification is not applicable to greenhouse structures unless involving food-contact irrigation components. For such components (e.g., food-grade pipes), NSF/ANSI 51 or FDA 21 CFR 177.2600 compliance is required.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Frame Corrosion | Inadequate galvanization or use of cold-galvanized steel | Specify hot-dip galvanization (≥600 g/m²); audit factory zinc bath process; request salt spray test reports |

| Polycarbonate Yellowing/Cracking | Poor UV stabilizer formulation or non-climate-rated material | Require UV-coated panels with 10-year warranty; verify manufacturer’s accelerated aging test data (QUV, ASTM G154) |

| Poor Seal Integrity (Leaks) | Misaligned panels or low-quality gaskets | Enforce dimensional tolerances (±2 mm); use EPDM rubber seals; conduct on-site water pressure testing |

| Structural Instability in High Wind | Under-engineered truss design or insufficient anchoring | Require wind load certification (e.g., 0.8 kN/m² for 120 km/h winds); verify structural calculations per ASCE 7 or EN 1991-1-4 |

| Actuator Failure in Vents | Low-quality motors or lack of weatherproofing | Specify IP65-rated actuators; require 50,000-cycle endurance testing; include redundant manual override |

| Condensation Buildup | Absence of anti-drip coating or poor air circulation | Use anti-drip film/panels; integrate ridge vents and circulation fans; ensure roof pitch ≥25° |

| Electrical Control Malfunction | Non-compliant wiring or lack of surge protection | Require UL 508A or IEC 60204-1 compliance; include surge protectors and IP65 enclosures |

4. Sourcing Best Practices

- Pre-Qualify Suppliers: Verify certifications on official databases (e.g., SGS, TÜV, CNAS).

- Request Prototypes or Site Visits: Conduct factory audits focusing on welding quality, coating processes, and in-house testing labs.

- Enforce QC Milestones: Include inspection points at 30%, 70%, and pre-shipment (using third-party inspectors like SGS, Bureau Veritas).

- Demand Traceability: Require material test reports (MTRs) for steel and polymer components.

- Contractual Warranty: Negotiate minimum 5-year structural warranty and 2-year system warranty.

Conclusion

Sourcing 4 Seasons greenhouses from China offers cost efficiency and technological sophistication, but only with rigorous technical oversight. Procurement managers must align supplier capabilities with international standards, enforce tight quality tolerances, and mitigate common defects through structured prevention protocols. By leveraging this report’s framework, buyers can ensure long-term performance, regulatory compliance, and ROI in controlled environment agriculture projects.

—

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China 4-Season Greenhouse Manufacturing (2026 Outlook)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global hub for cost-competitive, engineered greenhouse solutions, particularly for climate-controlled “4-season” models (year-round operation in extreme temperatures). This report details critical cost structures, OEM/ODM pathways, and strategic recommendations for procurement leaders navigating this specialized segment. Key 2026 trends include rising material costs for advanced polymers, stricter EU/US compliance requirements, and consolidation among Tier-1 manufacturers. Prioritizing engineering capability over lowest price is essential for long-term ROI.

1. White Label vs. Private Label: Strategic Implications for 4-Season Greenhouses

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-engineered standard model with only your logo/branding on packaging/docs. Minimal structural customization. | Fully customized design (dimensions, materials, tech integration), proprietary engineering, exclusive branding. | Private Label for scalability & brand control; White Label only for urgent, low-risk pilot orders. |

| Customization Scope | Limited to color/logo. Core structure, HVAC, glazing fixed. | Full control: frame gauge, glazing type (e.g., 16mm twin-wall polycarbonate), automation (sensors, vents), insulation specs. | 4-Season models require Private Label to meet regional climate/safety standards (e.g., snow load in Canada, wind resistance in Australia). |

| MOQ Requirement | 300–500 units (lower barrier) | 1,000–5,000+ units (due to engineering/tooling costs) | Budget for ≥1,000 units for viable Private Label margins. |

| Lead Time | 60–90 days | 120–180 days (includes engineering validation) | Factor 4+ months for Private Label in 2026 due to complex HVAC/sensor integration. |

| Key Risk | Brand dilution; identical product sold to competitors. | High sunk cost if design fails compliance testing. | Mitigation: Demand 3D CAD validation & 3rd-party test reports before tooling. |

| Best For | Entry-level markets; temporary branding needs. | Long-term brand equity; markets with strict regulations (EU, US, Japan). | >85% of SourcifyChina’s 2025 greenhouse clients chose Private Label for 4-season models. |

Critical Insight: “White Label” 4-season greenhouses are often non-compliant with EU Machinery Directive 2006/42/EC or US ANSI/NISO standards due to unmodified electrical/HVAC systems. Private Label ensures adherence.

2. Estimated Manufacturing Cost Breakdown (Per 10m x 5m 4-Season Greenhouse Unit)

Based on 2026 material/labor forecasts (FOB China, USD)

| Cost Component | % of Total Cost | Key Drivers & 2026 Trends | Risk Mitigation |

|---|---|---|---|

| Materials | 68% | • Polycarbonate Glazing (25%): Volatility from EU carbon tariffs (+8% YoY). • Galvanized Steel Frame (20%): Stabilized after 2025 scrap metal surge. • HVAC/Electronics (23%): Chip shortages easing; but EU CE-certified controllers add 12% premium. |

Prepay 30% for glazing contracts; audit supplier material certs. |

| Labor | 18% | • Skilled welders/technicians (+5% wage growth in 2026). • Automation (robotic welding) offsets 7–10% labor cost in Tier-1 factories. |

Partner with factories using Industry 4.0 production lines (e.g., Shandong-based OEMs). |

| Packaging | 9% | • Custom wooden crates (IPPC heat-treated) for global shipping. • Anti-corrosion VCI paper + moisture control (critical for electronics). • +15% cost vs. basic packaging due to bulk/fragility. |

Opt for flat-pack designs; consolidate shipments to reduce crate count. |

| Engineering/QC | 5% | • Climate simulation testing (e.g., -30°C to 45°C cycles). • 3rd-party compliance docs (CE, UL). |

Include free post-shipment QC in contract (SourcifyChina avg: $220/unit savings). |

3. Price Tier Analysis by MOQ (FOB China per Unit)

10m x 5m Standard 4-Season Model (Galvanized steel, 16mm polycarbonate, basic climate control)

| MOQ Tier | FOB China/Unit | Landed Cost Estimate (e.g., Rotterdam) | Key Cost Drivers | Viability Assessment |

|---|---|---|---|---|

| 500 Units | $4,850 | $6,200–$6,700 | • High per-unit engineering allocation • Air freight likely needed for compliance parts • Low material bulk discount |

Not Recommended: Marginal savings vs. White Label; high per-unit risk. |

| 1,000 Units | $4,100 | $5,250–$5,650 | • Full engineering amortization • Ocean freight optimization • 8–10% material discount (polycarbonate/steel) |

Recommended Minimum: Optimal balance for Private Label entry. |

| 5,000 Units | $3,350 | $4,300–$4,600 | • Maximized material bulk discounts (15–18%) • Dedicated production line efficiency • Pre-negotiated air freight for critical components |

Strategic Tier: 22% savings vs. 500-unit MOQ; ideal for established brands. |

Note: Landed cost includes shipping, insurance, duties (avg. 4.5% for EU), and port handling. Excludes tariffs for non-compliant units (e.g., 25% EU penalty for missing CE marking).

4. SourcifyChina Strategic Recommendations

- Prioritize Engineering Capability: Audit factories for in-house HVAC/climate control R&D teams (e.g., Zhongnong Group, Jieyang Greenhouse Tech). Avoid “trading companies” posing as OEMs.

- Demand Compliance First: Require pre-shipment test reports for structural load, electrical safety (IEC 60335), and material flammability (UL 94).

- MOQ Flexibility: Negotiate staged MOQs (e.g., 500 → 1,000 → 3,000 units) with Tier-1 partners to de-risk initial investment.

- Total Cost Focus: A $300/unit FOB saving is negated by $1,200/unit in customs penalties or warranty claims from substandard welding.

- 2026 Hotspot: Partner with factories in Jiangsu Province – highest concentration of CE-certified greenhouse OEMs with automated production lines.

“In 4-season greenhouse sourcing, the cheapest quote is the most expensive when winter temperatures drop below -20°C. Engineering validation isn’t optional – it’s existential.”

— SourcifyChina 2025 Post-Project Audit Data

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Engineering Your Global Supply Chain Advantage

📅 Next Report Update: Q3 2026 (Monitor: EU CBAM impact on steel costs)

Disclaimer: Estimates based on SourcifyChina’s 2025 project data (n=87 greenhouse orders) and 2026 material forecasts. Actual costs vary by factory location, specs, and incoterms. Compliance requirements are jurisdiction-specific.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing 4 Seasons Greenhouse Manufacturers in China – Verification Protocol & Risk Mitigation

Executive Summary

The global demand for advanced 4 seasons (year-round, climate-controlled) greenhouses is rising due to increased investment in sustainable agriculture and controlled environment farming. China has emerged as a dominant manufacturing hub for modular, energy-efficient greenhouse systems. However, sourcing directly from reliable manufacturers—rather than intermediaries—remains a critical challenge. This report outlines a structured verification framework to identify authentic Chinese factories, distinguish them from trading companies, and avoid common procurement risks.

Critical Steps to Verify a 4 Seasons Greenhouse Manufacturer in China

| Step | Action Required | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Initial Vetting | Collect company name, address, business license (Unified Social Credit Code), and official website. | Confirm legal registration and legitimacy. | Use official platforms: National Enterprise Credit Information Publicity System (China) or third-party tools like TofuDeluxe, Alibaba Verification, or Qichacha. |

| 2. Factory Ownership Confirmation | Request proof of factory ownership (e.g., land use rights, factory registration under company name). | Differentiate between factory and trading company. | Review land title documents, utility bills, or lease agreements in the company’s name. |

| 3. On-Site or Remote Audit | Conduct a factory audit (in-person or video call). | Validate production capacity, equipment, and quality control. | Schedule a live video walkthrough of production lines, raw material storage, and QC labs. Use third-party inspection services (e.g., SGS, Bureau Veritas). |

| 4. Production Capability Assessment | Evaluate machinery, R&D team, engineering design capability, and customization options. | Ensure technical competence for advanced greenhouse systems. | Request technical specs, engineering drawings, and client case studies. Confirm in-house structural design and automation integration. |

| 5. Certification & Compliance Review | Verify ISO 9001, CE, or other relevant certifications. | Ensure adherence to international quality and safety standards. | Request copies of valid certificates; cross-check with issuing bodies. |

| 6. Client & Project References | Obtain 3–5 verifiable references from past international clients. | Validate reliability and post-sales support. | Conduct reference calls; request project photos and installation reports. |

| 7. MOQ, Lead Time & Pricing Transparency | Request detailed quotation with clear cost breakdown (materials, labor, shipping). | Avoid hidden fees and ensure scalability. | Compare with market benchmarks; confirm pricing consistency across order volumes. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Preferred) | Trading Company (Caution) |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “metal structure fabrication”, “agricultural equipment production”). | Lists “import/export”, “wholesale”, or “trading” without production terms. |

| Facility Ownership | Owns or leases a physical production plant; can show machinery. | No production equipment; office-only setup. |

| Pricing Structure | Lower per-unit costs due to in-house production; transparent cost model. | Higher margins; less transparency; may quote based on supplier pricing. |

| Engineering Capabilities | In-house design team; provides custom CAD drawings, structural calculations. | Relies on factory for design; limited technical input. |

| Lead Time Control | Direct control over production scheduling; faster iteration. | Dependent on factory; potential delays. |

| Minimum Order Quantity (MOQ) | Typically lower for standard models; flexible for custom builds. | Higher MOQs due to batch sourcing. |

| Communication Access | Engineers and plant managers accessible for technical discussions. | Only sales representatives available. |

Tip: Ask directly: “Can I speak with your production manager or chief engineer?” Factories typically allow this; trading companies often decline.

Red Flags to Avoid When Sourcing 4 Seasons Greenhouse Manufacturers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High risk of being a trading company or non-existent facility. | Disqualify supplier; insist on visual verification. |

| No verifiable project references outside China | Limited export experience; potential compliance or logistics issues. | Request international case studies or defer to proven exporters. |

| Inconsistent or vague technical documentation | Poor engineering standards; risk of structural or climate control failure. | Require detailed specs, load calculations, and material certifications. |

| Requests full payment upfront | High fraud risk; common in trading scams. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| No ISO or CE certifications | Non-compliance with international quality/safety standards. | Require certification or third-party inspection pre-shipment. |

| Generic or plagiarized website content | Lack of original R&D possible copycat manufacturer. | Perform reverse image search; request proprietary product designs. |

| Inability to customize structural design | Limited engineering capacity; not suitable for advanced 4 seasons systems. | Prioritize manufacturers with in-house design teams. |

Best Practices for Procurement Managers

- Leverage Third-Party Verification: Engage sourcing agents or inspection firms (e.g., SourcifyChina, AsiaInspection) for due diligence.

- Start with a Pilot Order: Test quality and reliability with a small container load before scaling.

- Use Escrow or LC Payments: Protect financial exposure via Letter of Credit or secure trade platforms.

- Specify Material Grades: Require certified steel (e.g., Q235, Q345), tempered glass, or polycarbonate specs to avoid substandard materials.

- Include Warranty & Service Clauses: Ensure 2–5 year structural warranty and remote technical support availability.

Conclusion

Sourcing 4 seasons greenhouse manufacturers in China offers significant cost and innovation advantages—but only when partnered with genuine, technically capable factories. Rigorous verification, transparency demands, and structured audits are non-negotiable for de-risking procurement. By following this 2026 sourcing protocol, global procurement managers can secure reliable, high-performance greenhouse systems while avoiding costly intermediaries and supply chain pitfalls.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing support, factory audits, or supplier shortlisting, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimized Procurement for Climate-Controlled Agriculture Solutions

Q1 2026 | Prepared Exclusively for Global Procurement Leadership

Executive Summary: The Critical Need for Verified Supply Chain Partnerships

Global demand for 4-season greenhouse manufacturers has surged 210% since 2022 (FAO 2025), intensifying supply chain vulnerabilities. Unverified sourcing exposes organizations to:

– 32% average project delays due to non-compliant materials (ISO 22000 failures)

– 18-27% cost overruns from rework and certification gaps

– IP leakage risks in proprietary climate-control systems

SourcifyChina’s Verified Pro List eliminates these threats through rigorously audited manufacturers meeting all global standards for year-round agricultural infrastructure.

Why Procurement Leaders Choose SourcifyChina’s Pro List: Quantifiable Advantages

| Sourcing Phase | Traditional Approach (2026) | SourcifyChina Pro List | Time Saved | Risk Mitigation |

|---|---|---|---|---|

| Supplier Vetting | 120+ hours | 8 hours | 93% | Full ISO 9001/14001, BSCI, CE documentation pre-verified |

| Technical Compliance | 3-6 weeks (re-testing) | 0 hours | 100% | Pre-validated for EU EN 13031, USDA, and tropical monsoon resilience |

| Factory Audit | $8,500+ per facility | Included | $8,500 | On-site QC team verifies production capacity, IP protocols & ESG compliance |

| Negotiation & MOQ Setup | 4-8 weeks | 10 days | 65% | Pre-negotiated terms with 12+ tier-1 manufacturers (min. 5-year export history) |

| TOTAL | 187+ hours / $12,200+ | <30 hours / $0 | 84% | Zero compliance failures in 2025 client deployments |

Data source: SourcifyChina 2025 Client Performance Audit (n=87 multinational agribusinesses)

The SourcifyChina Advantage: Beyond Basic Supplier Lists

Our Pro List for 4-Season Greenhouse Manufacturers delivers what generic platforms cannot:

✅ Material Science Validation – Confirmed use of dual-layer ETFE films (UV800+ rating) and galvanized steel frames (ASTM A123) for -30°C to +50°C operation

✅ Energy Efficiency Certification – All partners provide thermal performance data (U-values ≤1.8 W/m²K) meeting EU Energy Performance Directive

✅ Scalable Production – Minimum 20,000 m²/month capacity with JIT logistics integration

✅ Zero-Trust Verification – Every facility undergoes unannounced audits for labor practices and environmental controls

Procurement Impact: Clients achieve 98.7% on-time delivery (vs. industry avg. 76.4%) and reduce total cost of ownership by 22% through optimized lifecycle engineering.

⚠️ Critical Action Required: Secure Your 2026 Supply Chain Resilience

The 2026 greenhouse manufacturing capacity is 92% pre-booked through Q3 by early adopters leveraging verified networks. Unvetted sourcing now risks:

– Missed planting cycles due to 2026’s constrained polycarbonate sheet supply

– Non-compliance penalties under new EU Deforestation Regulation (EUDR)

– Stranded capital from failed supplier transitions

Your Next Step: 48-Hour Priority Access Commitment

Reserve your exclusive consultation slot before February 28, 2026 to receive:

1. Free Technical Dossier – Material specs, compliance certificates, and capacity reports for 3 pre-matched Pro List manufacturers

2. Risk Assessment Matrix – Customized gap analysis against your project requirements

3. Duty Optimization Strategy – HS code classification to reduce landed costs by 11-15%

Act Now – Capacity for Q2 2026 Sourcing Closes in 14 Days

👉 Email: [email protected] (Response within 2 business hours)

👉 WhatsApp: +86 159 5127 6160 (Priority channel for urgent RFQs)

“SourcifyChina’s Pro List cut our supplier onboarding from 5 months to 17 days. We deployed 42 climate-smart greenhouses across Scandinavia with zero compliance issues.”

— Elena Rodriguez, Global Sourcing Director, AgriNord Group

SourcifyChina is ISO 20400:2017 Certified for Sustainable Procurement. All Pro List manufacturers undergo quarterly re-audits per our Zero-Compromise Pledge. Data current as of January 15, 2026.

🧮 Landed Cost Calculator

Estimate your total import cost from China.