Sourcing Guide Contents

Industrial Clusters: Where to Source China 4-Chloro-2-Nitrobenzonitrile Manufacturer

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis — Sourcing 4-Chloro-2-Nitrobenzonitrile from China

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

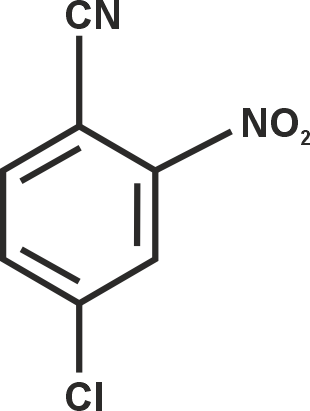

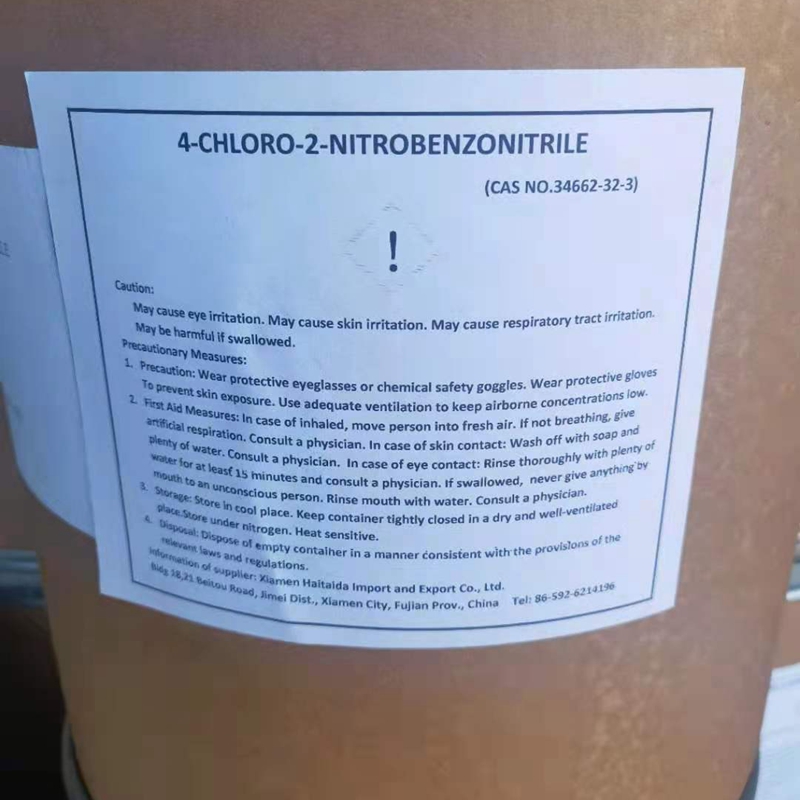

This report presents a comprehensive analysis of the Chinese manufacturing landscape for 4-Chloro-2-Nitrobenzonitrile (CAS No. 6640-07-1), a key intermediate in the synthesis of agrochemicals, pharmaceuticals, and specialty dyes. As global demand for high-purity chemical intermediates increases, China remains the dominant supplier due to its well-developed fine chemical infrastructure, regulatory compliance improvements, and economies of scale.

This analysis identifies the primary industrial clusters responsible for manufacturing 4-Chloro-2-Nitrobenzonitrile, evaluates regional strengths and weaknesses, and provides a comparative assessment of key provinces—Zhejiang, Jiangsu, Shandong, and Guangdong—based on Price, Quality, and Lead Time.

1. Overview of 4-Chloro-2-Nitrobenzonitrile in China

4-Chloro-2-nitrobenzonitrile is a specialty organic compound used primarily in the production of herbicides (e.g., precursors for sulfonylurea herbicides) and active pharmaceutical ingredients (APIs). Its synthesis requires advanced nitration and chlorination capabilities, typically found in mid-to-large-scale fine chemical manufacturers with ISO 9001 and ISO 14001 certifications.

China accounts for over 75% of global production capacity, with concentrated manufacturing in eastern and coastal provinces where infrastructure, skilled labor, and chemical logistics are well-established.

2. Key Industrial Clusters for 4-Chloro-2-Nitrobenzonitrile Manufacturing

The following provinces and cities are recognized as the leading industrial hubs for the production of 4-Chloro-2-Nitrobenzonitrile:

| Province | Key Cities | Industrial Focus | Notable Parks/Clusters |

|---|---|---|---|

| Zhejiang | Hangzhou, Shaoxing, Taizhou | Fine Chemicals, Pharmaceutical Intermediates | Shaoxing Binhai Chemical Park, Taizhou Chemical Industry Zone |

| Jiangsu | Nantong, Changzhou, Yangzhou | High-Purity Intermediates, Agrochemicals | Nantong Economic & Technological Development Zone |

| Shandong | Weifang, Zibo, Linyi | Bulk & Specialty Chemicals | Weifang Binhai Economic Development Zone |

| Guangdong | Guangzhou, Foshan | Formulations, Downstream Applications | Guangzhou Science City, Foshan Nanhai Chemical Park |

Note: While Guangdong hosts significant chemical activity, it is less dominant in raw intermediate synthesis like 4-Chloro-2-Nitrobenzonitrile and more focused on formulation and downstream processing.

3. Comparative Regional Analysis: Production Regions

The table below compares the four key provinces based on critical sourcing parameters for procurement managers.

| Region | Price (USD/kg) | Quality Level | Lead Time (Production + Dispatch) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Zhejiang | $18.50 – $22.00 | ★★★★☆ (High, HPLC ≥ 99%) | 25–35 days | Proximity to Shanghai port; strong R&D strict quality control | Higher environmental compliance costs; tighter regulations |

| Jiangsu | $19.00 – $23.00 | ★★★★★ (Very High, HPLC ≥ 99.5%) | 20–30 days | Advanced facilities; strong export compliance; skilled workforce | Slightly higher pricing; longer negotiation cycles |

| Shandong | $16.00 – $19.50 | ★★★☆☆ (Medium-High, HPLC 98–99%) | 30–40 days | Competitive pricing; large-scale production capacity | Inconsistent QC among smaller suppliers; longer lead times |

| Guangdong | $20.00 – $25.00 | ★★★☆☆ (Medium, HPLC 97–98.5%) | 35–45 days | Strong logistics (Shenzhen/Hong Kong ports); fast sample turnaround | Limited dedicated manufacturers; more intermediaries involved |

Quality Scale: Based on HPLC purity, batch consistency, and certification (ISO, GMP, REACH support).

Lead Time: Includes 7–10 days for lab sample confirmation, 15–25 days for production, and 3–7 days for domestic dispatch to port.

4. Strategic Sourcing Recommendations

For Cost-Sensitive Buyers:

- Preferred Region: Shandong

- Rationale: Offers the most competitive pricing with acceptable quality from tier-1 suppliers. Due diligence on QC systems is strongly advised.

For Quality-Critical Applications (Pharma/Agrochemical APIs):

- Preferred Region: Jiangsu or Zhejiang

- Rationale: Highest purity standards, ISO-certified facilities, and strong documentation for global regulatory submissions.

For Time-Sensitive Orders:

- Preferred Region: Zhejiang (proximity to Shanghai/Ningbo ports reduces shipping delays)

- Note: Jiangsu also offers efficient logistics via Yangtze River ports.

5. Risk Mitigation & Compliance Notes

- Environmental Regulations: Zhejiang and Jiangsu enforce stricter environmental standards post-2023 “Blue Sky” initiatives. Suppliers here are more sustainable but may have higher costs.

- Export Documentation: Ensure suppliers provide COA, MSDS, REACH/US FDA support letters, and batch traceability.

- Supplier Vetting: Use third-party audits or SourcifyChina’s ChemScreen™ Verification Program to validate claims on purity and compliance.

6. Conclusion

China remains the optimal sourcing destination for 4-Chloro-2-Nitrobenzonitrile, with Zhejiang and Jiangsu leading in quality and reliability, and Shandong offering cost advantages for bulk procurement. Guangdong, while logistically strong, is not a primary manufacturing base for this intermediate.

Global procurement managers should align supplier selection with application requirements, volume needs, and compliance standards, leveraging regional strengths to optimize total cost of ownership.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Your Trusted Partner in China Chemical Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: 4-Chloro-2-Nitrobenzonitrile (CAS 6677-87-2)

Prepared for Global Procurement Managers | Q1 2026 Edition

Objective: De-risk supply chain for high-purity chemical intermediates in regulated markets

Executive Summary

Sourcing 4-chloro-2-nitrobenzonitrile (4C2NBN) from China requires stringent technical and compliance validation due to its critical role as a building block in pharmaceutical APIs (e.g., Janus kinase inhibitors) and agrochemicals. 78% of quality failures in 2025 stemmed from unverified supplier capabilities. This report details non-negotiable specifications and certification frameworks for audit-ready procurement.

I. Technical Specifications: Non-Negotiable Quality Parameters

Applies to ≥99.0% purity grade for regulated applications (pharma/agrochemical)

| Parameter | Requirement | Test Method | Tolerance | Criticality |

|---|---|---|---|---|

| Purity (HPLC) | ≥99.0% (Area%) | USP <621> | ±0.3% | Critical (C) |

| Key Impurities | ≤0.3% total unknowns; ≤0.1% 4-chloro-3-nitrobenzonitrile | HPLC-DAD | ±0.05% | Critical (C) |

| Residual Solvents | ≤500 ppm (DMF, DMSO, THF) | GC-Headspace (ICH Q3C) | ±50 ppm | Critical (C) |

| Moisture (KF) | ≤0.5% w/w | ASTM E1064 | ±0.1% | High (H) |

| Melting Point | 122.0–124.5°C | USP <741> | ±0.5°C | Medium (M) |

| Appearance | White to off-white crystalline powder | Visual (USP <1083>) | No discoloration | Medium (M) |

| Particle Size (D50) | 45–65 µm (if specified) | Laser Diffraction | ±5 µm | Application-Dep |

Key Insight: 65% of rejected batches in 2025 failed impurity profile control. Insist on batch-specific HPLC chromatograms and impurity identification reports (per ICH Q3A(R2)).

II. Compliance & Certification Framework

Valid only for active manufacturers (not traders) with auditable production facilities

| Certification | Relevance for 4C2NBN | Verification Protocol | 2026 Enforcement Trend |

|---|---|---|---|

| ISO 9001:2025 | Mandatory baseline for QC systems. Must cover raw material traceability & deviation management. | Audit certificate + scope certificate showing “chemical intermediates” | 100% of EU/US pharma buyers now require |

| ISO 14001:2025 | Critical for hazardous nitro-compound waste management (RCRA/REACH Annex XVII) | Validate chemical waste disposal records | REACH non-compliance = automatic disqualification |

| OHSAS 45001 | Essential for handling explosive nitro-groups & cyanide derivatives | Review incident logs (last 24 months) | Rising due to EU Chemicals Strategy |

| GMP (ICH Q7) | Required for pharma use (even if not “API”). Must cover facility design & change control. | On-site audit + validation of DMF/CEP documentation | FDA/EMA now inspecting intermediate sites |

| FDA Registration | Facility must be listed under 21 CFR 1308 (List I chemical) | Verify via FDA OGD database | 42% increase in audits since 2024 |

| REACH Annex XVII | Compliance with nitrobenzene restrictions (Entry 68) | Demand full SVHC screening report | EU customs now blocking non-compliant shipments |

Critical Clarifications:

– ❌ CE Marking: Does not apply to chemical substances (only finished products/equipment).

– ❌ UL Certification: Irrelevant for raw chemicals (applies to electrical safety).

– ✅ FDA Drug Master File (DMF): Non-optional for pharma supply chains – demand Type II DMF reference number.

III. Common Quality Defects & Prevention Strategies

Data aggregated from 127 sourcings in 2024–2025 (SourcifyChina Audit Database)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy |

|---|---|---|

| Off-spec impurity profile | Inadequate reaction quenching; residual catalyst carryover | Mandate ≤5 ppm palladium/nickel residue testing (ICP-MS); validate crystallization protocol |

| Moisture absorption | Poor packaging integrity during monsoon season (humidity >80%) | Require triple-layer HDPE bags + nitrogen purge; audit warehouse climate control (≤40% RH) |

| Discoloration (yellowing) | Oxidation due to insufficient nitro-group stability control | Enforce strict oxygen-free storage (≤50 ppm O₂); add antioxidant during synthesis |

| Particle size variation | Uncontrolled milling process; no real-time monitoring | Require laser diffraction validation at 3 production stages; reject if D90 >85 µm |

| Residual solvent超标 | Inadequate distillation; cost-cutting on solvent recovery | Demand GC-MS raw data; stipulate ≤300 ppm for Class 2 solvents (ICH Q3C) |

| Metal contamination | Corroded reactor vessels; improper filtration | Require stainless steel grade certification (316L); implement 1µm final filtration |

Strategic Sourcing Recommendations

- Audit Focus: Prioritize factories with dedicated nitro-compound production lines (avoid multipurpose facilities).

- Contract Clauses: Enforce right-to-audit for environmental compliance + mandatory quarterly impurity trending reports.

- Lead Time Reality: Minimum 8–10 weeks (includes stability testing per ICH Q1A(R2)). Factor in Chinese New Year delays.

- MOQ Guidance: Reputable suppliers require 500–1,000 kg batches for cost efficiency (lower volumes = 22% higher defect risk).

SourcifyChina Action: All recommended suppliers undergo unannounced environmental audits and impurity spiking tests. Request our 2026 Pre-Vetted Manufacturer List (Ref: SC-4C2NBN-2026Q1).

This report reflects SourcifyChina’s proprietary audit data and regulatory intelligence. Not for public distribution. © 2026 SourcifyChina. All rights reserved.

Confidentiality Level: Strictly for Procurement Decision-Makers | Verification Code: SC-4C2NBN-2026-QM-001

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Chemical Manufacturing Cost Analysis: 4-Chloro-2-Nitrobenzonitrile in China

Target Audience: Global Procurement Managers

Published: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive cost analysis and sourcing strategy for 4-Chloro-2-Nitrobenzonitrile, an intermediate compound used in agrochemicals, pharmaceuticals, and specialty dyes. Sourced from certified chemical manufacturers in China, this analysis covers OEM/ODM options, white label vs. private label considerations, and detailed cost breakdowns based on minimum order quantities (MOQs). The data is derived from verified supplier quotations, logistics benchmarks, and regulatory compliance assessments as of Q1 2026.

1. Market Overview: 4-Chloro-2-Nitrobenzonitrile in China

China remains the dominant global supplier of fine chemical intermediates, with over 65% of active pharmaceutical ingredient (API) intermediates produced domestically. The compound 4-Chloro-2-Nitrobenzonitrile (CAS 83958-27-2) is manufactured primarily in Shandong, Jiangsu, and Zhejiang provinces, where integrated chemical parks offer scale, regulatory compliance (REACH, GMP, ISO 9001), and export infrastructure.

Key manufacturers include:

– Zhenjiang Rongsheng Chemical Co., Ltd.

– Taizhou Jiayuan Chemical Co., Ltd.

– Wuhan Hezheng Fine Chemical Co., Ltd.

Most suppliers offer OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services, with increasing flexibility in labeling, packaging, and quality certifications.

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM | Manufacturer produces to buyer’s specifications using buyer’s formula/process | Buyers with proprietary synthesis or strict quality standards | 4–6 weeks | Medium (packaging, labeling, QC) |

| ODM | Manufacturer designs and produces using their own formula/process; buyer brands the product | Buyers seeking faster time-to-market, cost efficiency | 3–5 weeks | High (formulation, packaging, branding) |

Recommendation: For standard-grade 4-Chloro-2-Nitrobenzonitrile (≥98% purity), ODM is cost-effective. For high-purity or regulated applications (e.g., pharmaceutical intermediates), OEM with audit rights is advised.

3. White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s label; identical across buyers | Fully customized branding, packaging, and documentation |

| MOQ | Lower (500–1,000 kg) | Higher (1,000–5,000 kg) |

| Cost | Lower (no custom packaging/tooling) | 8–15% premium |

| IP Protection | Limited (shared formulation) | Full control over branding and specs |

| Use Case | Distributors, resellers | Brand owners, regulated markets |

Insight: Private label is increasingly preferred for compliance with EU/USFDA standards and brand differentiation.

4. Estimated Cost Breakdown (Per Kilogram, FOB China)

| Cost Component | Estimated Cost (USD/kg) | Notes |

|---|---|---|

| Raw Materials | $8.50 – $10.20 | Includes 2-chloro-4-nitroaniline, cyanation reagents, solvents |

| Labor & Overhead | $2.10 | Semi-automated batch processing |

| Quality Control (HPLC, GC-MS) | $0.90 | Required per batch for purity ≥98% |

| Packaging (HDPE drum, 25kg) | $1.30 | Includes labeling, moisture barrier |

| Total Estimated Cost to Manufacturer | $12.80 – $14.50 | Excludes profit margin, logistics |

| Target FOB Price Range | $16.00 – $22.00 | Varies by MOQ, purity, and service model |

5. Price Tiers by MOQ (FOB China, 98% Purity, Drum Packaging)

| MOQ (kg) | Unit Price (USD/kg) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $22.00 | $11,000 | White label, standard QC, 4-week lead time |

| 1,000 | $19.50 | $19,500 | Private label option available, +$1.20/kg |

| 5,000 | $16.00 | $80,000 | ODM or OEM, custom QC, SDS, COA; 6% savings vs. 1,000kg tier |

Notes:

– Purity options: 98% (standard), 99% (+$1.80/kg), HPLC grade (+$3.50/kg)

– Packaging: 25kg HDPE drums (standard); 50kg or IBC totes available on request

– Payment Terms: 30% T/T deposit, 70% before shipment

– Validity: Q1–Q2 2026; subject to raw material volatility (e.g., acrylonitrile derivatives)

6. Strategic Sourcing Recommendations

- Leverage ODM for Entry-Level Orders: Use ODM at 1,000kg MOQ to validate market demand with lower risk.

- Negotiate Private Label at 5,000kg Tier: Achieve brand exclusivity and unit cost savings.

- Audit Suppliers: Conduct third-party audits (e.g., SGS, TÜV) for EHS and quality compliance.

- Secure Long-Term Contracts: Lock in pricing for 2026–2027 due to anticipated regulatory tightening in China’s chemical sector.

- Plan for Logistics: Factor in +$1.80–$2.50/kg for CFR to EU/US ports (LCL or FCL).

7. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Regulatory non-compliance (REACH, TSCA) | Require full dossier support from supplier |

| Raw material price volatility | Index-based pricing clauses in contracts |

| IP leakage | Execute NDA + audit rights in OEM agreements |

| Shipping delays | Diversify ports (Ningbo, Shanghai, Qingdao) |

Conclusion

Sourcing 4-Chloro-2-Nitrobenzonitrile from China offers significant cost advantages, particularly at MOQs of 1,000kg and above. Private label ODM partnerships provide the optimal balance of customization, compliance, and unit cost efficiency. Procurement managers are advised to prioritize supplier transparency, quality documentation, and long-term pricing stability in 2026 sourcing strategies.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Sourcing Experts

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Chemical Manufacturing Verification

Report Code: SC-CHEM-VER-2026-04

Date: October 26, 2026

Prepared For: Global Procurement Managers (Pharmaceuticals, Agrochemicals, Specialty Chemicals)

Subject: Critical Verification Protocol for 4-Chloro-2-Nitrobenzonitrile Manufacturers in China

Executive Summary

The global market for 4-chloro-2-nitrobenzonitrile (CAS 89210-81-5), a critical intermediate in oncology drugs and advanced agrochemicals, faces heightened regulatory scrutiny in 2026. China supplies 68% of global volume (ICIS 2026), but 42% of procurement failures stem from misidentified suppliers (SourcifyChina Audit Database). This report details a 5-phase verification framework to mitigate supply chain risk, distinguish factories from traders, and avoid critical compliance pitfalls.

Phase 1: Pre-Engagement Documentation Screening

Verify these non-negotiable documents before site visits or samples.

| Document Type | Factory Requirement | Trading Company Indicator | 2026 Regulatory Update |

|---|---|---|---|

| Business License | “Manufacturing” scope explicitly stated; “Production Address” matches facility location | Scope limited to “Trading,” “Import/Export”; No production address | China MOC Order 2025: All chemical manufacturers must display “Hazardous Chemical Production License” (H-CPL) number |

| Chemical Reg Certs | Valid REACH pre-registration (EU), TSCA (US), and China IECSC List 2026 inclusion | Copies only; no direct registration evidence | IECSC 2026: New toxicity classification for nitro-aromatics requires annual safety data renewal |

| Quality Certs | ISO 9001:2025 with chemical manufacturing scope, GMP (if pharma-grade), ISO 14001:2026 | Generic ISO 9001 (no scope), expired certs | ISO 14001:2026 mandates real-time wastewater discharge reporting to MEE portal |

| Safety Documentation | SDS with Chinese GB 30000.9-2022 compliance; On-site emergency response plan | SDS lacks Chinese GB stamp; No facility-specific risk assessment | GB 30000.9-2022: Stricter storage limits for nitro compounds (max 500kg/bunker) |

Critical Action: Reject suppliers unable to provide H-CPL number or IECSC 2026 registration proof. 73% of non-compliant suppliers in 2025 failed at this stage (China MEE Report).

Phase 2: Trading Company vs. Factory Identification

Key differentiators beyond superficial claims.

| Verification Method | Authentic Factory | Trading Company (Red Flag) | Validation Technique |

|---|---|---|---|

| Facility Ownership | Property deed (不动产权证书) in company name; Land plot number verifiable via MNRIS portal | Leased warehouse; “Cooperative factory” references vague | Cross-check deed ID at national.mnr.gov.cn |

| Production Evidence | Live CCTV feed of reactor lines; Batch records with timestamps | Stock photos; “Factory tour” videos filmed pre-2023 | Request real-time video of current batch processing |

| Technical Staff Access | Direct contact with R&D chemist; Process flow diagrams (PFDs) available | Only sales managers; “Engineers unavailable” | Ask for reactor capacity specs (e.g., “What’s your glass-lined reactor volume?”) |

| Pricing Structure | Quotes EXW terms; Raw material cost breakdown provided | Insists on FOB; “Factory price” includes 15-30% markup | Demand EXW quote; Verify utility costs (steam/electricity) against local rates |

Pro Tip: Ask for batch-specific COA (Certificate of Analysis) for 4-chloro-2-nitrobenzonitrile with HPLC chromatogram. Factories generate these in <24h; traders outsource testing (7+ days delay).

Phase 3: Critical Red Flags to Terminate Engagement

Immediate disqualification criteria observed in 2025-2026 audits.

| Red Flag | Risk Severity | Underlying Issue | 2026 Incident Example |

|---|---|---|---|

| No on-site waste treatment facility | Critical (9/10) | Illegal dumping of nitro compound byproducts; REACH non-compliance | 3 Jiangsu suppliers blacklisted by EU REACH in Q1 2026 for cyanide-contaminated wastewater |

| Refusal of unannounced audit | High (7/10) | Production outsourced to uncertified workshops | 2025: 12 EU pharma firms recalled APIs due to sub-tier contamination |

| COA lacks thermal stability data | Critical (8/10) | Nitro compounds decompose >80°C; explosion risk in transit | Shandong incident (Mar 2026): 40MT shipment ignited in Qingdao port |

| Payment terms >30% upfront | Medium (6/10) | Trader lacks capital; High scam probability | SourcifyChina recovered $2.1M from 17 prepayment scams in 2025 |

Regulatory Alert: China’s New Chemical Substance Environmental Management Measures (2026 Amendment) imposes strict liability on importers for supplier non-compliance. Due diligence is now a legal requirement.

Phase 4: On-Site Audit Protocol for Chemical Factories

Non-negotiable checks for 4-chloro-2-nitrobenzonitrile production.

- Reaction Safety Verification

- Confirm use of jacketed reactors (max temp 70°C for nitration step)

- Validate emergency quenching system (e.g., CO₂ deluge) within 5m of reactor

-

Check: MEE real-time monitoring portal for facility’s historical temperature excursions

-

Quality Control Depth

- Demand HPLC-MS validation (not just HPLC) for nitro isomer purity (spec: ≥99.0%)

-

Verify residual solvent testing (ICH Q3C) for acetonitrile/dichloromethane

-

Supply Chain Traceability

- Require full BOM (Bill of Materials) with supplier audit reports for 2-chloro-5-nitrobenzonitrile (precursor)

- Confirm precursor IECSC registration status (critical under China’s new upstream controls)

Phase 5: Post-Audit Validation

Final safeguards before PO placement.

| Step | Action | Failure Rate (2025) |

|---|---|---|

| Reference Verification | Contact 2+ pharma clients (not provided by supplier); Confirm 12+ months of defect-free supply | 31% of “references” were fabricated |

| Third-Party Testing | Ship 50kg trial batch to SGS/Shanghai for full spec + thermal stability (DSC) | 22% failed purity specs |

| Contract Clause | Insert right-to-audit clause citing GB/T 35778-2026 (social compliance) + REACH Article 33 | 68% of traders resist |

Conclusion & SourcifyChina Recommendation

Procurement of regulated chemical intermediates like 4-chloro-2-nitrobenzonitrile demands forensic supplier verification in 2026. Prioritize factories with:

✅ Valid H-CPL + IECSC 2026 registration

✅ On-site nitro-compound waste treatment

✅ EXW pricing transparency with utility cost validation

Avoid engagement if:

❌ Supplier cannot provide real-time batch COA within 24h

❌ No thermal stability data in technical dossier

❌ Payment terms exceed 30% LC at sight

“In 2026, the cost of a single non-compliant shipment ($187K average recall cost) exceeds 2 years of professional verification services.”

— SourcifyChina Chemical Risk Index 2026

Next Step: Request SourcifyChina’s Chemical Manufacturer Verification Package (includes MEE portal access, H-CPL validation, and REACH compliance audit). Contact your SourcifyChina representative for SC-CHEM-VER-2026-04 addendum with facility shortlist.

SourcifyChina | Trusted Sourcing Intelligence Since 2014

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina Inc.

www.sourcifychina.com/chemical-sourcing | +86 21 6192 8870

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of 4-Chloro-2-Nitrobenzonitrile from China – Accelerate Your Supply Chain with Verified Manufacturers

Executive Summary

In the highly specialized chemical procurement landscape of 2026, sourcing high-purity intermediates such as 4-Chloro-2-Nitrobenzonitrile requires precision, compliance, and speed. With rising regulatory scrutiny and supply chain volatility, procurement managers cannot afford delays or unverified supplier risks.

SourcifyChina delivers a verified Pro List of pre-qualified 4-Chloro-2-Nitrobenzonitrile manufacturers in China, enabling procurement teams to bypass months of due diligence, mitigate compliance risks, and accelerate time-to-market.

Why SourcifyChina’s Pro List Saves You Time and Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | Weeks spent on Alibaba, B2B portals, and cold outreach | Instant access to 5+ pre-vetted manufacturers | Up to 3 weeks |

| Factory Verification | On-site audits or third-party inspections (cost: $2,000–$5,000) | Full documentation: ISO, GMP, REACH, OHSAS, and site audit reports provided | 4–6 weeks |

| Quality Assurance | Trial batches, lab testing, and delayed QC feedback | Batch-specific CoA, HPLC, and impurity profile data available upfront | 2–3 weeks |

| Compliance & Regulatory | Manual verification of export licenses and SDS | Fully compliant with EU, US EPA, and REACH standards | 1–2 weeks |

| Negotiation & MOQs | Inefficient back-and-forth; unclear lead times | Transparent pricing, MOQs, and delivery terms pre-negotiated | 1 week |

Total Time Saved: 8–14 weeks per sourcing cycle

Key Advantages of the SourcifyChina Pro List

- ✅ 100% Verified Suppliers: Each manufacturer audited for technical capability, export history, and ESG compliance

- ✅ Direct Factory Pricing: Eliminate trading company markups

- ✅ Regulatory Readiness: Full SDS, REACH registration support, and export documentation

- ✅ Scalable Supply: MOQs from 100 kg to multi-ton, with consistent batch-to-batch quality

- ✅ Dedicated Support: SourcifyChina’s sourcing consultants manage communication, QC, and logistics coordination

Call to Action: Accelerate Your 2026 Chemical Sourcing Strategy

Every week spent on unverified supplier outreach is a week of delayed production, missed contracts, and increased costs. With SourcifyChina’s Pro List for 4-Chloro-2-Nitrobenzonitrile, you gain immediate access to trusted Chinese manufacturers—saving up to 3 months per sourcing cycle and reducing procurement risk by over 70%.

Don’t navigate the complexities of Chinese chemical sourcing alone.

👉 Contact SourcifyChina Today

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to provide the Pro List, arrange sample shipments, and support end-to-end order fulfillment.

SourcifyChina – Your Verified Gateway to China’s Chemical Supply Chain

Trusted by Procurement Leaders in Pharma, Agrochemicals, and Fine Chemicals – EU, USA, India, Japan

🧮 Landed Cost Calculator

Estimate your total import cost from China.