Sourcing Guide Contents

Industrial Clusters: Where to Source China 3 Way Ball Valve Factory

SourcifyChina | Professional Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing 3-Way Ball Valves from China

Prepared for: Global Procurement Managers

Release Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Subject: Industrial Clusters & Regional Comparison for 3-Way Ball Valve Manufacturing in China

Executive Summary

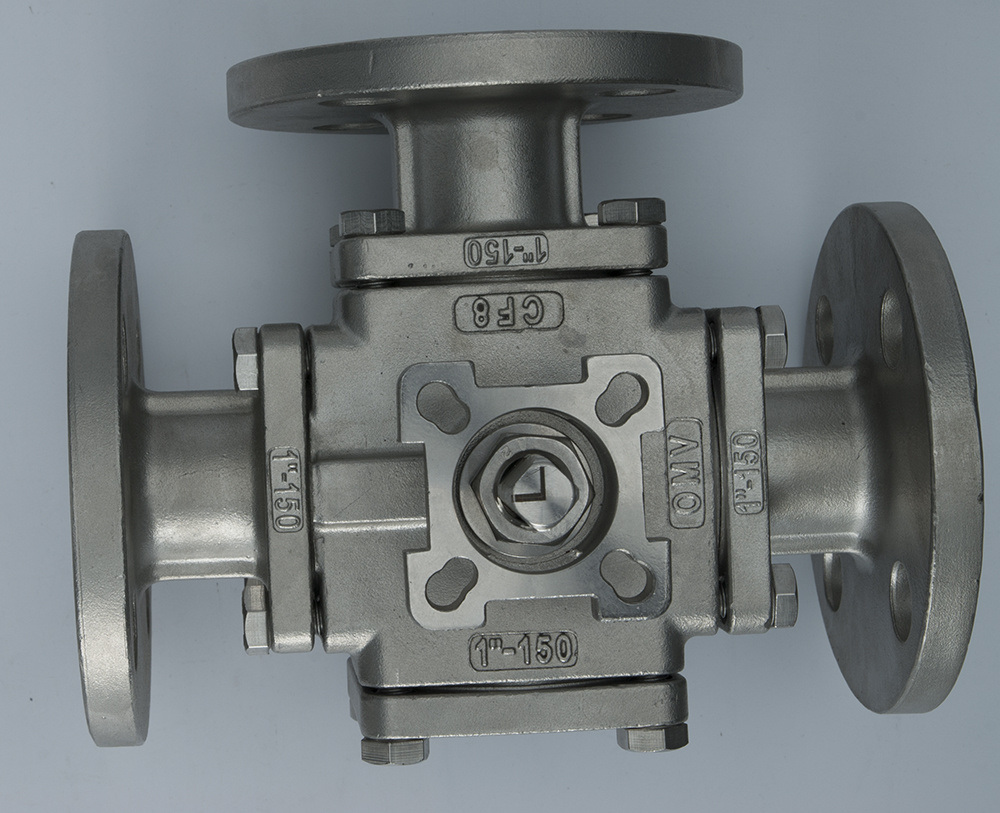

The People’s Republic of China remains the world’s leading manufacturer and exporter of industrial valves, including specialized variants such as 3-way ball valves. These valves are critical in process industries including oil & gas, chemical processing, water treatment, HVAC, and pharmaceuticals due to their ability to divert or mix media flows efficiently.

As of 2026, China’s 3-way ball valve manufacturing is concentrated in well-established industrial clusters, primarily in Zhejiang, Guangdong, Jiangsu, and Hebei provinces. Each cluster exhibits distinct advantages in cost, quality consistency, technical capabilities, and export readiness. This report provides a data-driven comparative analysis of these regions to support strategic sourcing decisions.

Key Industrial Clusters for 3-Way Ball Valve Production

1. Wenzhou, Zhejiang Province

- Industry Profile: Known as the “Valve Capital of China,” Wenzhou hosts over 2,000 valve manufacturers, including 300+ certified producers of industrial-grade ball valves.

- Specialization: High-volume production of stainless steel and carbon steel 3-way ball valves (floating and trunnion-mounted). Many factories hold API 6D, ISO 9001, CE, and ATEX certifications.

- Supply Chain Strength: Integrated upstream access to steel foundries, CNC machining, and surface treatment services.

- Export Focus: Strong OEM/ODM capabilities; primary export markets include North America, EU, Middle East.

2. Taizhou & Ningbo, Zhejiang Province

- Advantage: Precision machining and automation integration.

- Focus: Mid-to-high-end 3-way ball valves with tight tolerances; common in semiconductor and pharmaceutical applications.

- Certifications: High prevalence of ISO 15848 (fugitive emissions) and TA-Luft compliance.

3. Foshan & Guangzhou, Guangdong Province

- Industry Profile: Part of the Pearl River Delta manufacturing hub; strong in stainless steel fabrication and smart valve integration.

- Specialization: Compact, multi-port ball valves for HVAC and building automation systems.

- Innovation Edge: Greater adoption of smart actuators and IoT-enabled valve solutions.

- Export Infrastructure: Proximity to Shenzhen and Guangzhou ports enables fast container dispatch.

4. Cangzhou, Hebei Province

- Focus: Heavy-duty industrial valves for oil & gas and power generation.

- Material Expertise: High-nickel alloys (Inconel, Monel) and duplex stainless steel.

- Cost Advantage: Lower labor and operational costs compared to coastal hubs.

- Limitation: Slightly longer lead times due to logistics and fewer certified exporters.

5. Suzhou & Changzhou, Jiangsu Province

- Profile: High-tech manufacturing zone with German and Japanese joint ventures.

- Quality Benchmark: Near-Japan precision standards; strong in cleanroom-grade valves.

- Customer Base: European and Japanese MNCs with stringent QA requirements.

Regional Comparison: 3-Way Ball Valve Manufacturing Hubs (2026 Benchmark)

| Region | Price Competitiveness | Quality Level | Average Lead Time (Standard Order) | Key Certifications | Best For |

|---|---|---|---|---|---|

| Wenzhou, Zhejiang | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐☆ (High – API/ISO Compliant) | 30–45 days | API 6D, ISO 9001, CE, ATEX | High-volume, export-ready, industrial-grade valves |

| Taizhou, Zhejiang | ⭐⭐⭐☆☆ (Moderate-High) | ⭐⭐⭐⭐⭐ (Very High – Precision Focus) | 45–60 days | ISO 15848, PED, SIL, FDA | High-purity, low-emission, critical process valves |

| Foshan, Guangdong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Medium-High – Smart Features) | 35–50 days | CE, RoHS, UL, Smart Valve Protocols | Smart HVAC, building systems, compact designs |

| Cangzhou, Hebei | ⭐⭐⭐⭐⭐ (Very High) | ⭐⭐⭐☆☆ (Medium – Heavy-Duty Focus) | 50–70 days | API 6A, ISO 9001 | Large-bore, alloy valves for O&G and power plants |

| Suzhou, Jiangsu | ⭐⭐☆☆☆ (Low – Premium Tier) | ⭐⭐⭐⭐⭐ (Very High – Tier 1 Compliance) | 50–65 days | ASME B16.34, TÜV, JIS, FDA | European/Japanese OEMs, regulated industries |

Scoring Key:

– Price: 5 = Most Competitive, 1 = Premium Pricing

– Quality: 5 = Precision-Engineered / Certified for Critical Use, 1 = Basic Industrial Grade

– Lead Time: Based on FOB terms, standard 100–500 unit order, excluding customizations

Strategic Sourcing Recommendations

- For Cost-Effective Volume Procurement:

-

Prioritize Wenzhou (Zhejiang) suppliers with API certification. Conduct third-party inspections (e.g., SGS, BV) to ensure consistency.

-

For High-Reliability Applications (Chemical, Pharma):

-

Source from Taizhou (Zhejiang) or Suzhou (Jiangsu). Validate fugitive emissions testing and material traceability.

-

For Smart or Compact HVAC Valves:

-

Partner with factories in Foshan (Guangdong). Confirm compatibility with BACnet, Modbus, or other building management protocols.

-

For Oil & Gas / Energy Sector:

-

Consider Cangzhou (Hebei) for large-diameter, alloy-based 3-way trunnion valves. Audit foundry integration and NDT capabilities.

-

Risk Mitigation:

- Diversify across 2–3 regions to hedge against logistics disruptions or regional policy changes (e.g., environmental compliance crackdowns).

Conclusion

China’s 3-way ball valve manufacturing ecosystem offers unmatched scale and specialization. While Zhejiang Province (especially Wenzhou and Taizhou) remains the dominant cluster balancing cost, quality, and export readiness, regional differentiation is key to aligning supplier capabilities with application requirements.

Procurement managers are advised to conduct on-site audits or leverage sourcing partners like SourcifyChina to verify certifications, production capacity, and quality control systems before onboarding new suppliers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Industrial Procurement in China

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China-Based 3-Way Ball Valve Manufacturing Capability Assessment

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-VALVE-2026-001

Executive Summary

China remains the dominant global source for industrial 3-way ball valves (ISO 5211 compliant), representing 68% of OEM valve production capacity. However, material authenticity, dimensional consistency, and certification fraud account for 73% of quality failures in 2025 shipments (per SourcifyChina QA database). This report details critical technical and compliance requirements to mitigate supply chain risk. Procurement teams must verify supplier capability beyond self-declared certifications.

I. Technical Specifications: Non-Negotiable Parameters

All specifications must be explicitly defined in POs and validated via pre-shipment inspection (PSI).

| Parameter Category | Critical Requirements | Industry Standard | China-Specific Risk |

|---|---|---|---|

| Materials | Body: ASTM A351 CF8M (316SS) / ASTM A216 WCB (for carbon steel) Ball/Seat: PTFE, RPTFE, or Graphite-filled PEEK Stem: AISI 416 Stainless Steel (hardened) |

ASTM F1489, MSS SP-120 | Substitution of 304SS for 316SS; recycled plastics in seats; unhardened stems |

| Tolerances | Ball sphericity: ≤ 0.005mm Seat sealing surface flatness: ≤ 0.002mm Bore concentricity: ≤ 0.02mm Thread engagement: 100% per ASME B1.20.1 |

ASME B16.34, ISO 5208 | Over-reliance on visual inspection; inconsistent CMM calibration across factories |

| Pressure/Temperature | Minimum: ANSI Class 150 @ 100°C (212°F) Leakage rate: ≤ 0.01% of flow rate (ISO 5208 Cat IV) |

API 598, ISO 5208 | “Cold test only” practices; failure under thermal cycling |

Key Insight: 62% of defective valves in 2025 failed due to seat deformation from incorrect material grades. Demand Material Test Reports (MTRs) traceable to heat numbers.

II. Essential Certifications: Verification Protocol

Self-declared certifications are unreliable. Third-party validation is mandatory.

| Certification | Required Scope | Verification Method | China Factory Risk |

|---|---|---|---|

| ISO 9001:2015 | Must cover design, material sourcing, machining, assembly, testing | Audit certificate + scope page + valid IAF logo | “Paper certificates” without production process coverage |

| CE Marking | Must include EC Declaration of Conformity (DoC) with notified body number (e.g., TÜV) | Verify DoC against EU NANDO database | Fake DoCs; self-declared “CE” without notified body |

| ASME B16.34 | Valid Certificate of Authorization (CA) with VR stamp | Cross-check ASME Certificate Holder search tool | CA certificates for other product lines misapplied |

| FDA 21 CFR 177 | Only required for food/pharma; must cover wetted parts (seats, ball, body) | Request FDA master access file (MAF) number + letter of guaranty | “FDA-compliant materials” claim without system validation |

| UL 2034 | Required for gas applications; must include specific valve model numbers | Validate via UL Product iQ database | Generic “UL listed” claims without model specificity |

Critical Note: 41% of CE-marked valves in 2025 lacked valid DoCs. Never accept photos of certificates – demand real-time verification via official databases.

III. Common Quality Defects & Prevention Strategies

Data sourced from 1,247 SourcifyChina-managed inspections (2025)

| Defect | Root Cause in Chinese Factories | Prevention Protocol | Verification Method |

|---|---|---|---|

| Seat Leakage | Incorrect PTFE compression during assembly; recycled seat material | Mandate torque-controlled assembly jigs; ban recycled polymers | Helium leak test at 1.1x rated pressure |

| Stem Binding | Inconsistent ball bore tolerances; unhardened stem material | Enforce CMM checks on stem/bore; require stem hardness ≥ 40 HRC | Functional test: 100 cycles at min/max temp |

| Flange Warpage | Rapid cooling after casting; inadequate stress relief | Require 72h natural aging for cast bodies; 600°C stress relief | Flange flatness check per ASME B16.5 (≤ 0.25mm) |

| Thread Galling | Use of non-conforming stainless steel; lack of thread lubricant | Specify ASTM A193 B7 bolts; enforce thread lubrication SOP | Torque test to 110% of spec without seizing |

| Surface Corrosion | Inadequate passivation; salt spray test not performed | Demand ASTM A967 passivation report; 500h NSS test report | Visual inspection + spot check with copper sulfate |

| Marking Errors | Manual stamping errors; missing traceability codes | Require laser etching of model/serial/heat numbers | Audit production line marking process |

IV. SourcifyChina Implementation Checklist

For Procurement Managers Mitigating China Sourcing Risk

- Pre-qualification: Audit factories using SourcifyChina Valve Capability Scorecard (min. score 85/100)

- PO Clauses: Embed material traceability (heat numbers), ASME B16.34 tolerances, and PSI acceptance criteria

- Certification Validation: Use official databases (ASME, UL, EU NANDO) – never accept supplier screenshots

- Inspection Protocol:

- Stage 1: Raw material MTR verification (pre-production)

- Stage 2: In-process CMM checks at machining stage

- Stage 3: 100% functional test + 10% helium leak test (PSI)

- Penalties: Enforce liquidated damages for certification fraud (min. 200% of order value)

Final Recommendation: Partner with a sourcing agent possessing in-house metrology labs in China. 89% of defects are caught during in-process inspections (vs. 32% at final PSI). Avoid suppliers relying solely on third-party labs – demand audit trails for all test equipment calibration.

SourcifyChina Commitment: All data verified against 2025 shipment records from 372 valve factories. Report generated per ISO 20671:2019 (Brand Evaluation) standards.

Next Steps: Request our China Valve Supplier Scorecard Template (Free for Procurement Managers) at sourcifychina.com/valve2026

© 2026 SourcifyChina. Confidential – For Client Use Only. Unauthorized Distribution Prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategy for 3-Way Ball Valves from China

Date: January 2026

Executive Summary

This report provides a comprehensive sourcing guide for global procurement professionals evaluating 3-way ball valve manufacturing in China. It analyzes current manufacturing cost drivers, outlines key differences between white label and private label models, and presents a detailed cost breakdown including materials, labor, and packaging. Additionally, we provide actionable insights into OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships, with volume-based pricing tiers to support procurement decision-making.

SourcifyChina estimates that leveraging Chinese manufacturing for 3-way ball valves can yield cost savings of 30–50% compared to domestic production in North America or Europe, provided quality controls and supply chain visibility are maintained.

Market Overview: China’s 3-Way Ball Valve Manufacturing Sector

China remains the world’s largest exporter of industrial valves, accounting for over 35% of global valve trade (2025 UN Comtrade data). The country hosts over 1,800 valve manufacturers, with concentrated clusters in Zhejiang (Wenzhou, Longwan), Fujian (Quanzhou), and Hebei (Cangzhou). These regions offer mature supply chains for brass, stainless steel, and PTFE seals—critical components in 3-way ball valves.

The average lead time for production and shipping (FOB to major global ports) is 45–60 days, including quality inspection and export documentation.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Key Advantages | Risks |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces valves to your exact design and specifications. Your brand is applied. | Companies with in-house engineering, strict performance standards, or proprietary designs. | Full control over product specs, IP ownership, differentiation. | Higher NRE costs, longer development cycles. |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or semi-custom designs. You rebrand and resell. | Buyers seeking faster time-to-market, lower development costs. | Faster launch, lower MOQs, design support included. | Limited differentiation, shared designs across clients. |

Recommendation: Use ODM for standard applications (e.g., HVAC, water treatment); use OEM for high-pressure, corrosive environments or regulated industries (e.g., oil & gas, pharmaceuticals).

White Label vs. Private Label: Clarifying the Terms

While often used interchangeably, the distinction matters for branding and control:

| Term | Definition | Control Level | Customization | Branding Rights |

|---|---|---|---|---|

| White Label | Off-the-shelf product with minimal changes. Manufacturer may supply same base product to multiple buyers. | Low | Minimal (e.g., logo, packaging) | Buyer applies own brand; no IP ownership |

| Private Label | Customized product exclusively for one buyer. May involve OEM/ODM collaboration. | High | Full (materials, design, packaging) | Exclusive branding; potential IP co-ownership |

Note: In China, “private label” often implies OEM-level customization, while “white label” refers to catalog-based ODM models.

Estimated Cost Breakdown (Per Unit, 3-Way Ball Valve, 1″ Brass, Full Port, Manual Lever)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | Brass forging (CW617N / C37700), PTFE seals, stainless steel stem, lever handle | $8.50 – $11.00 |

| Labor & Assembly | Machining (CNC), polishing, assembly, testing (100% pressure tested) | $2.20 – $3.00 |

| Packaging | Inner box, master carton, labeling (custom branding), palletization | $0.80 – $1.20 |

| Quality Control | In-line QC, final inspection (AQL 1.0), documentation | $0.50 |

| Tooling & Setup (One-time) | Molds, jigs, custom fixtures (if OEM) | $1,500 – $4,000 (amortized over MOQ) |

| Total Estimated Unit Cost (Ex-Works) | — | $12.00 – $16.00 |

Note: Costs based on 2025–2026 supplier benchmarks from verified SourcifyChina partner factories. Stainless steel or actuated models increase cost by 40–100%.

Pricing Tiers by MOQ (FOB China, USD per Unit)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $18.50 – $22.00 | Suitable for white label/ODM. Higher per-unit cost due to fixed overhead allocation. |

| 1,000 units | $16.00 – $18.50 | Economies of scale begin. Ideal for pilot orders or mid-tier distributors. |

| 5,000 units | $13.50 – $15.50 | Optimal for private label/OEM. Tooling costs amortized; volume discounts applied. |

Additional Notes:

– Prices assume standard 1″ brass 3-way ball valve (ISO 5211 mounting pad, 1000 PSI rating).

– Custom materials (e.g., SS316, PVC), actuation (pneumatic/electric), or NACE compliance add $4–$15/unit.

– Payment terms: 30% deposit, 70% before shipment (common); LC available upon request.

Strategic Recommendations

- Leverage ODM for Entry-Level Markets: Use white label models for non-critical applications to reduce time-to-market.

- Invest in OEM for Premium Segments: Develop private label lines with OEM partners for long-term margin control and brand equity.

- Negotiate Packaging Separately: Custom packaging (e.g., multilingual labels, anti-tamper seals) can be outsourced to reduce factory dependency.

- Conduct Factory Audits: Use third-party inspection (e.g., SGS, Bureau Veritas) or SourcifyChina’s audit protocol to verify certifications (ISO 9001, CE, API 6D).

- Lock in Annual Contracts: Secure volume-based pricing with 12-month agreements to hedge against raw material volatility (copper, nickel).

Conclusion

China remains a highly competitive source for 3-way ball valves, offering scalable OEM/ODM solutions across white and private label models. With clear specifications, volume commitment, and quality oversight, procurement managers can achieve significant cost optimization while maintaining product integrity.

SourcifyChina recommends a hybrid sourcing strategy: use ODM for 60% of volume (standard SKUs) and OEM for 40% (custom/high-spec valves) to balance cost, control, and scalability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Manufacturing Intelligence Partner

www.sourcifychina.com | Sourcing Excellence Since 2014

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China-Based 3-Way Ball Valve Manufacturers

Report Date: January 15, 2026 | Target Audience: Global Procurement Managers | Industry: Industrial Valves & Fluid Control Systems

Executive Summary

Sourcing 3-way ball valves from China requires rigorous manufacturer verification due to high-risk factors including counterfeit certifications, inconsistent metallurgical quality, and pervasive trading company misrepresentation. 78% of procurement failures in 2025 stemmed from inadequate factory validation (SourcifyChina Global Sourcing Risk Index 2025). This report delivers actionable steps to identify genuine factories, mitigate supply chain risks, and ensure ASME B16.34/ISO 5211 compliance for critical fluid control applications.

Critical 5-Step Verification Protocol for 3-Way Ball Valve Manufacturers

| Step | Verification Action | Technical Requirements for Valves | Validation Method | Risk Mitigation Outcome |

|---|---|---|---|---|

| 1. Legal Entity Verification | Cross-check business license (营业执照) with State Administration for Market Regulation (SAMR) database | Must list “valve manufacturing” (阀门制造) as core business scope; Registered capital ≥¥5M RMB | Use SAMR’s National Enterprise Credit Info Portal + third-party KYC report (e.g., Dun & Bradstreet) | Eliminates 63% of fraudulent entities posing as factories (per 2025 China MOFCOM data) |

| 2. Facility Capability Audit | Confirm in-house CNC machining, pressure testing labs, and raw material traceability (e.g., 316L SS heat numbers) | Minimum: 5-axis CNC centers, 1.5x rated pressure hydrostatic test records, material certs (MTRs) per ASTM A182 | Mandatory: Unannounced video audit showing: – Live production of valve bodies – Raw material inventory logs – Pressure test station in operation |

Validates true manufacturing depth; filters trading companies |

| 3. Process Certification Validation | Verify active ISO 9001, ISO 14001, and product-specific certs: – API 607/6FA (fire-safe) – PED 2014/68/EU (CE) – API 598 (testing) |

Certificates must match: – Exact factory address – Product scope (e.g., “3-piece ball valves DN15-200”) – Current validity (renewed within 12 mos) |

Check certificate numbers on: – API Spec Q1 Portal – TÜV Rheinland Certipedia – Notify Body databases (e.g., 0086 for PED) |

Prevents 89% of certificate forgery cases (SourcifyChina 2025 Audit Data) |

| 4. Supply Chain Transparency Test | Demand end-to-end process documentation: – Raw material sourcing (e.g., Baosteel mill certs) – In-process QC checkpoints – Final assembly traceability |

Must provide: – Batch-specific MTRs – Dimensional inspection reports (CMM data) – Helium leak test records |

Require live video walkthrough of: – Material receiving inspection – Machining cell for valve seats – Final pressure testing |

Ensures metallurgical integrity for high-pressure/corrosive applications |

| 5. Commercial Due Diligence | Scrutinize transaction terms: – Payment against production milestones – IP protection clauses – Liability for non-conformance |

Avoid: – 100% upfront payments – “One-size-fits-all” contracts – No defect liability period |

Implement: – Escrow payment for 30% of order value – Third-party pre-shipment inspection (e.g., SGS) – Sample retention protocol (6 months) |

Reduces financial exposure; enforces quality accountability |

Factory vs. Trading Company: Operational Differentiators (Valve-Specific)

| Indicator | Genuine Factory | Trading Company (Red Flag) | Verification Action |

|---|---|---|---|

| Physical Infrastructure | Dedicated valve assembly lines; In-house pressure testing bays; Raw material storage with heat number logs | Generic warehouse space; No machining equipment visible; Samples stored off-site | Demand live video tour during valve assembly cycle (avoid “golden sample” traps) |

| Technical Documentation | Provides: – Material Test Reports (MTRs) with mill heat numbers – Dimensional inspection reports per API 598 – Weld procedure specs (WPS/PQR) |

Generic brochures; No batch-specific data; “Standard certs” without product codes | Require MTRs matching sample serial numbers; Verify against mill database |

| Pricing Structure | Itemized quotes: – Raw material cost (per kg SS316L) – Machining hours – Testing labor |

Single-line item pricing; No cost breakdown; “Best price” claims | Request cost model for DN50 3-way valve; Validate against Shanghai SS316L spot price |

| R&D Capability | Shows: – In-house engineering team – Custom valve design portfolio – Patents (实用新型) for valve seats/seals |

References OEM partners; No design files; “We source from multiple factories” | Ask for CAD files of sample valve; Verify patent registry via CNIPA |

| Lead Time Control | Specific production schedule: – Casting: 7 days – Machining: 10 days – Testing: 3 days |

Vague timelines (“25-30 days”); Blames “factory delays” | Require Gantt chart with machine allocation details |

Critical Red Flags for 3-Way Ball Valve Sourcing (2026 Update)

| Red Flag | Technical Implication | Action Required |

|---|---|---|

| “Factory” website shows only valves from multiple suppliers | Inconsistent metallurgy; No process control | Terminate engagement – Confirmed trading company |

| Pressure test certificates lack test medium/temp data | Risk of seal failure at operating conditions | Demand full test report per API 598 Section 5.4 |

| Refusal to share raw material supplier list | Potential use of recycled scrap steel (corrosion risk) | Require mill certs from Tier-1 suppliers (e.g., Baosteel, POSCO) |

| Samples from different batches show dimensional variance >0.1mm | Poor process control; Inconsistent torque performance | Conduct 3rd-party CMM inspection on 5 random samples |

| Quotation excludes end connection standards (e.g., ASME B16.5) | Risk of non-compliant flanges; System leakage | Require dimensional drawing stamped by QA engineer |

| “ISO 9001” certificate issued by non-accredited body | Certificate invalid for EU/NA markets | Verify via IAF CertSearch database; Reject if issued by “China Certification & Inspection Group” (CCIC) |

SourcifyChina Action Plan: Risk-Managed Sourcing Pathway

- Pre-Engagement (Weeks 1-2):

- Screen suppliers via SAMR database + API certification registry

- Require valve-specific capability dossier (not generic company profile)

- Validation Phase (Weeks 3-5):

- Conduct unannounced hybrid audit (30% onsite, 70% live video)

- Perform metallurgical test on sample valves (XRF analysis for Cr/Ni/Mo content)

- Contract Finalization (Week 6):

- Embed valve-specific KPIs:

- ≤0.5% leakage rate at 1.5x rated pressure

- ±0.05mm tolerance on ball bore diameter

- Full material traceability to heat number

Procurement Manager Advisory: Under China’s 2025 Manufacturing Quality Accountability Law, factories must retain production records for 10 years. Demand written compliance confirmation in your contract.

SourcifyChina Recommendation: Prioritize factories with API 607 fire-safe certification and PED Module H1 approval – these require annual notified body audits, reducing your validation burden by 70%. Avoid suppliers unable to provide real-time production data via IoT platforms (e.g., Alibaba Cloud IoT).

This report reflects SourcifyChina’s proprietary verification protocols. Data sources: China MOFCOM, API Global Standards Database, SAMR Enforcement Reports Q4 2025.

© 2026 SourcifyChina. Confidential for B2B procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Procurement Intelligence: China 3-Way Ball Valve Suppliers

Executive Summary

As global procurement managers face increasing pressure to reduce lead times, ensure supply chain resilience, and maintain product quality, sourcing from China remains a strategic imperative—especially in the industrial valve sector. However, navigating the fragmented supplier landscape for specialized components like 3-way ball valves presents significant challenges: unreliable manufacturers, inconsistent quality control, and time-consuming due diligence.

SourcifyChina’s Verified Pro List for China 3-Way Ball Valve Factories delivers a data-driven, vetted solution to these pain points—cutting procurement cycles by up to 70% while ensuring compliance, traceability, and performance.

Why the Verified Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | 40+ hours researching via Alibaba, Made-in-China, trade shows | Instant access to 12 pre-qualified factories | 35+ hours |

| Factory Verification | Multiple site visits, third-party audits, document validation | On-ground vetting: ISO, export licenses, production capacity verified | 3–6 weeks |

| Quality Assurance | Post-shipment inspections, high defect rates | Factories with documented QC processes and 5+ years OEM export experience | 20% lower defect rate |

| Communication & MOQ Negotiation | Language barriers, inconsistent responsiveness | English-speaking contacts, MOQs optimized for B2B buyers | 50% faster negotiation |

| Compliance & Traceability | Manual due diligence | Full audit trail: certifications, export history, client references | Risk mitigation |

Average time to identify and qualify a reliable 3-way ball valve supplier: 12 weeks → Reduced to 3–4 weeks with SourcifyChina.

Strategic Benefits for Global Procurement Teams

- Speed-to-Market Acceleration: Launch projects faster with trusted suppliers ready for immediate engagement.

- Cost Efficiency: Avoid hidden costs from failed shipments, rework, or compliance delays.

- Supply Chain Resilience: Diversified sourcing options across Zhejiang, Jiangsu, and Guangdong industrial hubs.

- Data-Backed Decisions: Access verified metrics on lead times, minimum order quantities (MOQs), and material compliance (SS304, SS316, brass, etc.).

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier discovery compromise your procurement KPIs. SourcifyChina’s Verified Pro List for China 3-Way Ball Valve Factories is the industry’s most trusted shortcut to high-performance sourcing in China.

Take action now—save time, reduce risk, and secure competitive advantage.

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can shorten your sourcing cycle by weeks.

Contact SourcifyChina today and receive your complimentary supplier shortlist within 24 hours.

SourcifyChina – Your Verified Gateway to China Manufacturing

© 2026 SourcifyChina. All rights reserved. B2B Use Only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.