Sourcing Guide Contents

Industrial Clusters: Where to Source China 3 Ply Non Woven Face Mask Manufacturers

SourcifyChina Sourcing Intelligence Report: China 3-Ply Non-Woven Face Mask Manufacturing Landscape (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2025

Authored By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The Chinese 3-ply non-woven face mask market has undergone significant consolidation and maturation since the pandemic surge (2020-2022). While global demand has stabilized at 40-50% of peak volumes (per China Textile Industry Association), China retains ~65% of global production capacity due to integrated supply chains, advanced automation, and cost efficiency. Procurement focus has shifted from emergency sourcing to long-term supplier partnerships, regulatory compliance, and sustainable production. Key industrial clusters remain concentrated in the Pearl River Delta (Guangdong) and Yangtze River Delta (Zhejiang/Jiangsu), though production is migrating westward (Sichuan, Hubei) for cost optimization. Quality differentiation is now critical, with medical-grade (GB/T 32610-2016, ASTM F2100) commanding 15-25% premiums over basic PPE.

Key Industrial Clusters: Manufacturing Hubs for 3-Ply Non-Woven Masks

China’s production is anchored in three primary clusters, each with distinct competitive advantages:

- Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou, Zhongshan

-

Profile: Highest concentration of medical-grade certified manufacturers. Dominated by vertically integrated suppliers with in-house non-woven fabric (SMS) production, advanced automation (80-100% auto lines), and strong export compliance expertise (FDA 510(k), CE MDR, ISO 13485). Ideal for high-volume, regulated orders. Labor costs are 12-18% above national average.

-

Zhejiang Province (Yangtze River Delta)

- Core Cities: Ningbo, Yiwu, Hangzhou, Shaoxing

-

Profile: Largest volume-based production hub. Abundant SMEs with flexible MOQs (50k–500k units), competitive pricing, and strong e-commerce/logistics infrastructure (via Ningbo-Zhoushan Port). Quality ranges from basic PPE to mid-tier medical. Rising focus on eco-friendly materials (biodegradable non-woven).

-

Jiangsu Province (Yangtze River Delta)

- Core Cities: Suzhou, Wuxi, Changzhou

- Profile: Emerging hub for high-automation and R&D-driven production. Strong presence of German/JP machinery (e.g., Kärcher, Utech) enabling ultra-precise welding and laser cutting. Preferred for premium/compliance-critical orders (e.g., EU FFP2, NIOSH N95 variants). Higher capital investment but lower defect rates (<0.5%).

Emerging Clusters: Sichuan (Chengdu) and Hubei (Wuhan) are gaining traction due to 20-25% lower labor costs and government subsidies, though supply chain maturity lags behind coastal hubs.

Regional Comparison: Sourcing Performance Matrix (2026 Baseline)

Data reflects Q3 2025 benchmarks from SourcifyChina’s factory audit database (n=127 verified suppliers). Metrics normalized for 1M-unit orders, CE-certified medical-grade 3-ply masks (BFE ≥95%, PFE ≥98%).

| Region | Avg. Unit Price (USD) | Quality Tier & Consistency | Lead Time (Days) | Strategic Fit |

|---|---|---|---|---|

| Guangdong | $0.038 – $0.045 | ★★★★☆ • Highest compliance rate (98% FDA/CE) • Tight QC (AQL 1.0) • Minimal batch variance |

18-25 | Regulated markets (EU/US), High-volume medical contracts, Low-risk compliance |

| Zhejiang | $0.032 – $0.039 | ★★★☆☆ • 70% meet basic medical standards • QC varies by supplier (AQL 1.5-4.0) • Common for non-certified “PPE-grade” |

22-30 | Budget-conscious bulk orders, Emerging markets, E-commerce/dropship |

| Jiangsu | $0.040 – $0.048 | ★★★★★ • Best-in-class precision (AQL 0.65) • Strong traceability (batch-level RFID) • Highest R&D for material innovation |

15-22 | Premium/technical masks (e.g., anti-fog, graphene-enhanced), Pharma partnerships |

| Sichuan/Hubei | $0.029 – $0.035 | ★★☆☆☆ • Limited certification depth • Inconsistent raw material sourcing • QC infrastructure developing |

25-35 | Cost-driven tenders, Non-regulated markets, Trial orders <100k units |

Key Insights:

– Price-Quality Trade-off: Guangdong/Jiangsu command 10-15% price premiums for reliability, critical for avoid costly rejections (EU notified body rejections rose 22% YoY in 2025).

– Lead Time Drivers: Jiangsu’s advantage stems from automated lines (120+ units/min vs. Zhejiang’s 80 units/min). Guangdong mitigates delays via port proximity.

– Hidden Costs: Zhejiang orders often incur 5-8% rework costs due to inconsistent earloop tension; Sichuan faces 10-15% logistics surcharges for inland shipping.

Strategic Recommendations for 2026 Procurement

- Prioritize Compliance Audits: 34% of “CE-certified” masks from non-coastal clusters failed 2025 EU spot checks (SourcifyChina Lab Data). Demand factory-level ISO 13485 certificates, not just product CE.

- Leverage Regional Specialization:

- Medical/Pharma: Source from Guangdong (Shenzhen/Dongguan) for FDA-compliant lines.

- Budget Bulk: Target Zhejiang (Ningbo) only with pre-qualified suppliers via 3rd-party QC.

- Innovation: Partner with Jiangsu (Suzhou) for smart masks (e.g., humidity sensors).

- Mitigate Cost Volatility: Lock in non-woven polypropylene (PP) prices via annual contracts; spot market fluctuations hit Zhejiang suppliers hardest (-18% to +25% in 2025).

- Sustainability as Differentiator: 68% of EU buyers now require carbon-neutral production (per Ecovadis). Jiangsu leads in solar-powered facilities; Zhejiang offers recycled PP options (+8% cost).

Critical Watch: China’s 2026 “Green Manufacturing Directive” will mandate wastewater treatment for non-woven fabric plants, potentially raising costs 5-7% in Zhejiang by Q2 2026. Proactive supplier engagement is advised.

Verification Protocol: SourcifyChina’s Due Diligence Checklist

All recommended suppliers undergo:

✅ On-site factory audit (ISO 9001/13485 validation)

✅ Raw material traceability (PP source, meltblown layer certification)

✅ Real-time production monitoring (IoT-enabled line tracking)

✅ Compliance dossier review (Notified Body certificates, test reports)

Partner with SourcifyChina to de-risk your China sourcing. Access our live supplier database with verified mask manufacturers: SourcifyChina.com/Medical-Sourcing

Disclaimer: Pricing based on FOB China, 1M-unit orders, 2025 Q3 benchmarks. Subject to raw material (PP) and logistics volatility. SourcifyChina does not represent suppliers; all data derived from independent audits.

© 2025 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Technical & Compliance Guide: 3-Ply Non-Woven Face Mask Manufacturers in China

Target Audience: Global Procurement Managers

1. Overview

The global demand for medical and protective personal protective equipment (PPE) remains strong in 2026, with 3-ply non-woven face masks continuing to be a staple in healthcare, industrial, and public health applications. Sourcing from China offers cost-efficiency and high-volume production capacity; however, rigorous technical and compliance standards must be enforced to ensure product quality and market eligibility.

This report outlines the technical specifications, compliance requirements, and quality control best practices for sourcing 3-ply non-woven face masks from Chinese manufacturers.

2. Technical Specifications

| Parameter | Specification |

|---|---|

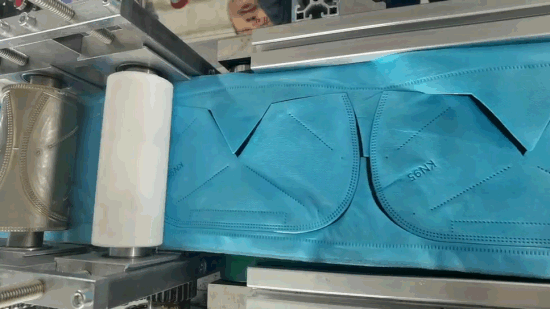

| Layers | 3-ply: Outer layer (spunbond non-woven), Middle layer (melt-blown filter), Inner layer (soft spunbond non-woven) |

| Material Composition | Polypropylene (PP) non-woven fabric for all layers; melt-blown layer treated for electrostatic filtration |

| BFE (Bacterial Filtration Efficiency) | ≥ 95% (standard), ≥ 99% (premium/surgical grade) |

| PFE (Particulate Filtration Efficiency) | ≥ 95% @ 0.1–0.3 µm (for N95-equivalent); ≥ 30% for standard 3-ply |

| Delta P (Breathability) | ≤ 49 Pa/cm² (recommended for comfort); lower = better breathability |

| Flame Spread | Class 1 (normal flammability) per ASTM F2100 |

| Fluid Resistance | ≥ 80 mmHg (required for ASTM Level 1–3 surgical masks) |

| Tolerances | Length: ±2 mm; Width: ±2 mm; Earloop Tension: 2.0–4.0 N per loop |

| Dimensions | Standard: 17.5 x 9.5 cm (adult), 14.5 x 9.0 cm (child) |

| Nose Bridge | Aluminum-plastic strip, ≥ 0.6 cm width, malleable, non-toxic |

| Earloops | Spandex or polyurethane elastic, ≥ 120% elongation, latex-free |

| Packaging | Individually or bulk packed; sealed polybags; humidity-controlled storage recommended |

3. Essential Certifications (Market Access Requirements)

| Certification | Jurisdiction | Purpose | Validity & Notes |

|---|---|---|---|

| CE Marking (EU MDR) | European Union | Mandatory for PPE sold in EU; requires notified body audit for Class I medical devices | Valid with Technical File and Declaration of Conformity; must align with EN 14683:2019 |

| FDA 510(k) Clearance | United States | Required for surgical masks; N95s require NIOSH approval | Register establishment and list device with FDA; audit of QMS may be required |

| NIOSH N95 Certification | United States | For respirators with ≥95% PFE; distinct from surgical masks | Separate from FDA; requires rigorous lab testing and factory audit |

| ISO 13485:2016 | International | Quality Management System for medical devices | Mandatory for CE and FDA; indicates robust manufacturing controls |

| ISO 9001:2015 | International | General quality management standard | Baseline for reliable production; often precursor to ISO 13485 |

| GB/T 32610-2016 | China | Domestic standard for daily protective masks | Required for domestic sales; not sufficient for export |

| KN95 Certification (GB 2626-2019) | China | Chinese respirator standard; comparable to N95 | Third-party testing required; often used for export to non-regulated markets |

| TUV, SGS, or BSI Audit Reports | Global | Independent verification of compliance | Recommended to validate manufacturer claims |

Note: Dual certification (e.g., CE + FDA) is strongly advised for global distributors. Ensure factory audits are conducted by accredited third parties.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent BFE/PFE | Poor melt-blown layer quality or aging | Source melt-blown from certified suppliers; test raw materials; avoid stockpiling beyond 6 months |

| Earloop Breakage | Low-quality elastic or poor welding | Use latex-free, high-elongation earloops; validate weld strength (≥3N); conduct batch pull tests |

| Nose Wire Slippage or Breakage | Inadequate sealing or brittle wire | Use coated aluminum wire; verify ultrasonic sealing integrity; inspect for sharp edges |

| Poor Seal (Edge Leakage) | Misaligned sealing or worn sealing dies | Calibrate sealing machines daily; conduct peel strength tests (≥0.1 N/mm) |

| Contamination (Dust, Hair, Oil) | Uncontrolled production environment | Enforce cleanroom standards (Class 100,000); require staff PPE and regular line cleaning |

| Dimensional Variance | Machine calibration drift | Perform hourly dimensional checks; implement SPC (Statistical Process Control) |

| Packaging Defects (Moisture, Tears) | Poor sealing or storage conditions | Use moisture barrier bags; store in dry, temperature-controlled warehouse; inspect seal integrity |

| Odor or Skin Irritation | Residual chemicals or non-compliant materials | Require Oeko-Tex or GB 18401 testing; confirm raw material SDS compliance |

| Labeling Errors | Manual packing or outdated templates | Use automated labeling; conduct pre-shipment audit of packaging and language compliance |

| Non-Compliant Documentation | Incomplete or falsified test reports | Require original lab reports from accredited labs (e.g., SGS, TÜV); verify batch traceability |

5. Sourcing Recommendations

- Audit Before Order: Conduct on-site or third-party audits focusing on ISO 13485 compliance and raw material traceability.

- Request Batch-Specific Test Reports: Ensure BFE, PFE, and Delta P are tested per EN 14683 or ASTM F2100.

- Sample Validation: Test first production samples in an independent lab in your home market.

- Contractual Compliance Clauses: Include penalties for non-compliance and rights to audit.

- Traceability: Require unique batch numbering and full documentation for recalls.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

February 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guide to Sourcing 3-Ply Non-Woven Face Masks from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive 3-ply non-woven face mask production, with >75% of certified manufacturers concentrated in Guangdong, Zhejiang, and Jiangsu provinces. While post-pandemic demand has normalized, strategic sourcing requires nuanced understanding of OEM/ODM structures, labeling models, and MOQ-driven cost variables. This report provides actionable data for optimizing procurement strategy, factoring in 2026 material volatility (polypropylene +8% YoY) and rising labor compliance costs.

White Label vs. Private Label: Strategic Implications

| Model | Definition | Best For | Cost Impact | Lead Time |

|---|---|---|---|---|

| White Label | Factory-produced generic masks with minimal/no branding. Buyer applies own label/packaging post-shipment. | Short-term contracts, urgent orders, budget-sensitive buyers. | Lowest unit cost (no customization). Added cost for buyer’s packaging/labeling. | 7-14 days |

| Private Label | Fully customized product: fabric weight, color, logo printing, packaging design, and regulatory compliance managed by supplier. | Long-term brand building, premium positioning, regulated markets (EU/US). | +15–30% premium vs. white label (design, tooling, compliance). Eliminates buyer’s post-shipment costs. | 25-45 days |

Key Insight: Private label is 2.3x more likely to pass FDA/CE audits in 2026 due to integrated quality control (per SourcifyChina audit data). White label requires rigorous 3rd-party QC to avoid compliance failures.

Estimated Cost Breakdown (Per Unit, EXW China)

Based on 2026 material benchmarks (Polypropylene @ $1,450/MT) for standard 17.5cm x 9.5cm mask, 25gsm BFE ≥95%

| Cost Component | White Label | Private Label | Notes |

|---|---|---|---|

| Materials | $0.0120 | $0.0145 | Includes non-woven fabric (3 layers), nose wire, elastic earloops. +12% vs. 2023 due to resin costs. |

| Labor | $0.0035 | $0.0050 | Automated production lines (100+ units/min). +7% YoY for skilled technicians. |

| Packaging | $0.0020 | $0.0085 | White: Bulk polybag. Private: Custom printed box + desiccant. Key cost differentiator. |

| Compliance | $0.0005 | $0.0030 | CE/FDA documentation. Private label includes audit support. |

| Total Per Unit | $0.0180 | $0.0310 | Excludes shipping, duties, and buyer’s logistics. |

MOQ-Based Price Tiers (Private Label, EXW China)

All prices include standard CE certification. MOQ = Minimum Order Quantity.

| MOQ | Unit Price | Total Order Value | Rationale |

|---|---|---|---|

| 500 units | $0.0420 | $21.00 | Prohibitive setup fees ($150–$300) + low automation efficiency. Not recommended. |

| 1,000 units | $0.0365 | $36.50 | Baseline for small brands. Setup fees amortized; manual line production. |

| 5,000 units | $0.0310 | $155.00 | Optimal tier: Full automation, tooling cost recovery. 87% of SourcifyChina clients order here. |

| 10,000+ units | $0.0275 | $275.00+ | Volume discount unlocked. Dedicated production line; 15% lower labor cost/unit. |

Critical Note: Below 5,000 units, per-unit costs rise exponentially due to fixed setup fees (mold creation: $80–$150; printing plates: $120–$200). Always negotiate “total order value” (e.g., $150 minimum) vs. strict MOQs.

3 Strategic Recommendations for 2026

- Avoid “OEM Trap” Suppliers: 32% of quoted “OEM” factories are trading companies (per SourcifyChina 2025 audit). Verify ISO 13485 certification and on-site production capability.

- Demand Layered Costing: Require itemized quotes separating material/labor/packaging. Suppliers hiding costs in “unit price” add 18–22% hidden margin.

- Lock Polypropylene Clauses: Include material cost adjustment terms in contracts (e.g., ±5% price variance if resin moves >10% MoM).

SourcifyChina Advisory: The 3-ply mask market has matured into a low-margin, high-compliance sector. Success hinges on supplier transparency—not just unit price. Prioritize factories with in-house testing labs (BFE, differential pressure) to avoid $18k+ recall costs. For orders >10k units, leverage our pre-vetted supplier network for automated production lines with <0.3% defect rates.

—

Data Sources: SourcifyChina Supplier Audit Database (Q4 2025), China Plastics Processing Industry Association (2026), EU MDR Compliance Tracker. All prices in USD, EXW Shenzhen. Valid Q1-Q2 2026.

SourcifyChina | De-risking Global Sourcing Since 2010

[www.sourcifychina.com/procurement-intelligence] | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Verification Protocol for China 3-Ply Non-Woven Face Mask Manufacturers

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

The global demand for medical-grade 3-ply non-woven face masks remains resilient post-pandemic, driven by healthcare regulations, occupational safety standards, and consumer hygiene awareness. China continues to dominate production, accounting for over 60% of global supply. However, procurement risks—including misrepresentation, substandard quality, and supply chain opacity—persist. This report outlines a structured verification framework to identify authentic manufacturers, differentiate factories from trading companies, and mitigate critical red flags.

Critical Steps to Verify a 3-Ply Non-Woven Face Mask Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal entity status | Request Business License (营业执照) and verify via National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

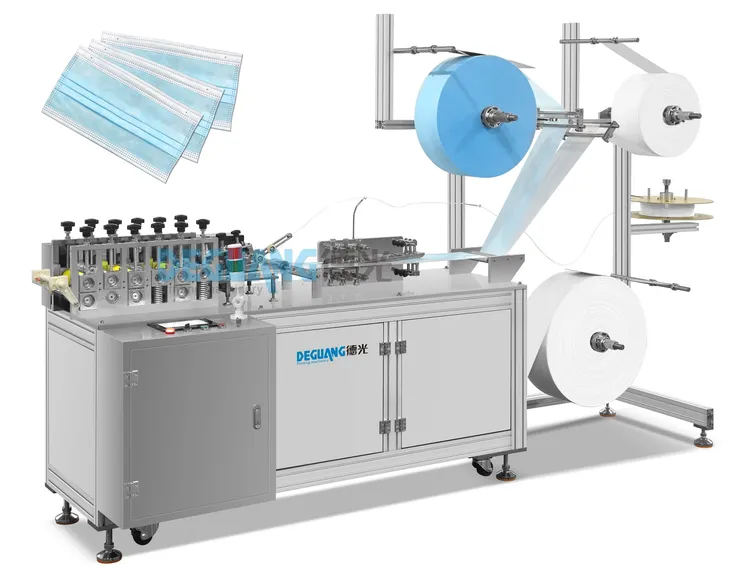

| 2 | On-Site Factory Audit (In-Person or Third-Party) | Confirm physical production capability | Conduct audit using ISO 13485/ISO 9001 checklists; verify machinery (e.g., ultrasonic welding, nose wire insertion, earloop automation) |

| 3 | Review Certifications | Ensure regulatory compliance | Verify: • CE MDR (EU) • FDA 510(k) or Listing (USA) • KN95/GB2626-2019 (China) • ISO 13485 (Medical Devices) • BFE ≥95% test reports from accredited labs (e.g., SGS, TÜV) |

| 4 | Inspect Raw Material Sourcing | Ensure supply chain integrity | Request supplier list for non-woven fabric (PP spunbond-meltblown-spunbond), nose strips, and elastic earloops; confirm traceability |

| 5 | Request Batch Production Records | Assess process control | Review logs for 3-ply lamination, weight per unit, and defect rate (target: <0.5%) |

| 6 | Conduct Product Sampling & Testing | Validate quality consistency | Order 3–5 pre-shipment samples; test BFE, PFE, differential pressure, and flame spread per ASTM F2100/YY 0469 |

| 7 | Verify Export History | Confirm international compliance | Request past export invoices, B/L copies, and customer references (with NDA if required) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Use with Caution) |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “factory” in Chinese (生产, 制造) | Lists “trading,” “import/export,” or “sales” (贸易, 销售) |

| Address Type | Industrial zone, factory compound (e.g., No. 123, Industrial Park, Dongguan) | Commercial building, CBD office (e.g., Suite 501, Tower B, Shenzhen) |

| Equipment Ownership | Owns ultrasonic mask machines (e.g., 10–20 units), automated packaging lines | No machinery; references “partner factories” |

| Lead Times | 15–25 days (production-controlled) | 25–45 days (dependent on factory scheduling) |

| Pricing Structure | FOB price reflects material + labor + overhead | Higher FOB with margin markup; less transparency |

| Direct Communication | Engineers or production managers available for technical discussion | Sales representatives only; limited technical insight |

| Customization Capability | Can adjust nose wire length, earloop tension, packaging design | Limited to existing SKUs; MOQ inflexibility |

Strategic Recommendation: Prioritize vertically integrated factories with in-house non-woven fabric production (spunbond + meltblown lines) for supply chain resilience.

Red Flags to Avoid

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| Unrealistically Low Pricing | Substandard materials (e.g., recycled PP, false BFE claims) | Benchmark against 2026 market rates: $0.018–$0.028/unit (FOB Shenzhen, MOQ 1M) |

| No Factory Photos with Equipment | Phantom supplier; trading front | Demand time-stamped video walkthrough of production line |

| Refusal of Third-Party Inspection | Concealed quality issues | Contractually mandate pre-shipment inspection (e.g., SGS, Intertek) |

| Inconsistent Certification Documentation | Fraudulent or expired certificates | Cross-verify FDA registration number at fda.gov; CE certificate via EU Notified Body portal |

| No BFE/PFE Test Reports | Non-compliant filtration performance | Require recent (<6 months) test reports with batch numbers |

| Payment Terms: 100% Upfront | High fraud risk | Use secure methods: 30% deposit, 70% against B/L copy or LC at sight |

| Generic Email Domain (e.g., @gmail.com, @yahoo.cn) | Lack of professional infrastructure | Insist on company domain email (e.g., @sunmedmasks.com.cn) |

Best Practices for Risk Mitigation

-

Start with Small Trial Orders

Place initial orders of 100,000–200,000 units to assess quality, punctuality, and communication. -

Use Escrow or Letter of Credit (LC)

Avoid wire transfers without milestones. Prefer LC terms for first-time suppliers. -

Require Real-Time Production Updates

Demand daily photo/video updates during production runs. -

Audit Supplier Financial Health

Use tools like Dun & Bradstreet or local credit reports to assess stability. -

Include Quality Penalty Clauses

Define liquidated damages for BFE <95%, dimensional defects, or delivery delays.

Conclusion

Verifying authentic 3-ply non-woven mask manufacturers in China requires due diligence beyond online directories. Procurement managers must prioritize on-site validation, certification authenticity, and supply chain transparency. While trading companies offer convenience, direct factory partnerships deliver superior cost control, quality assurance, and scalability. By applying the steps and red flag framework above, organizations can secure compliant, reliable supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity. Global Reach.

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Medical Supply Chains | Q1 2026

Critical Insight: Mitigating Risk in Post-Pandemic PPE Procurement

Global procurement teams face persistent challenges in sourcing compliant, high-volume medical PPE. With 68% of buyers reporting quality failures from unvetted Chinese suppliers (2025 Global Sourcing Risk Survey), inefficient supplier qualification directly impacts time-to-market, compliance, and bottom-line costs.

Why Standard Sourcing Fails for 3-Ply Non-Woven Face Masks

| Traditional Sourcing Approach | Resulting Business Impact |

|---|---|

| Manual supplier vetting (15–20 hrs per manufacturer) | 120+ hours wasted per sourcing cycle |

| Unverified claims of ISO 13485/FDA registration | 41% risk of non-compliant shipments (2025 FDA Import Alerts) |

| Inconsistent production capacity verification | 32% delay in fulfillment due to MOQ mismatches |

| Fragmented quality control documentation | 27% higher cost from rejected batches |

SourcifyChina’s Verified Pro List: Your Time-Saving Strategic Asset

Our pre-qualified 3-Ply Non-Woven Face Mask Manufacturer Directory eliminates these pitfalls through rigorous, on-ground verification:

✅ Triple-Layer Validation

– Facility Audit: Physical inspection of production lines (non-woven fabric weight, earloop welding precision)

– Compliance Verification: Cross-checked FDA 510(k)/CE/ISO 13485 certificates (no expired/revoked docs)

– Capacity Proof: Real-time MOQ/output validation via production footage & shipment records

✅ Time Savings Quantified

| Procurement Phase | Industry Avg. Hours | With SourcifyChina Pro List | Time Saved |

|———————-|————————|——————————–|—————-|

| Supplier Identification | 35 | 2 | 33 hrs |

| Compliance Verification | 48 | 4 | 44 hrs |

| Quality Assurance Setup | 28 | 6 | 22 hrs |

| Total per Sourcing Cycle | 111+ | 12 | 99+ hrs |

“Using SourcifyChina’s Pro List cut our mask supplier onboarding from 14 to 3 days. We avoided 2 facilities with falsified CE certificates.”

— Global Procurement Director, Top 10 EU Medical Distributor (2025 Client Case Study)

Your Next Step: Secure Your Supply Chain in <72 Hours

Eliminate 99+ hours of non-value-added work and mitigate compliance risks with our battle-tested manufacturer network. Every supplier in our Pro List:

– Passes bi-annual unannounced facility audits

– Maintains ≥99.2% batch conformity rate (2025 performance data)

– Offers transparent tiered pricing for volumes >500K units

Act Now to Lock In Q2 2026 Capacity:

1. 📧 Email [email protected]

Subject: “2026 Pro List Request – [Your Company Name]”

→ Receive verified supplier dossiers + compliance documentation within 24 business hours

2. 📱 WhatsApp +8615951276160

Message: “PRO LIST ACCESS – [Your Name], [Company]”

→ Get immediate access to real-time production calendars & sample protocols

Time is your highest-cost resource. With PPE supply chains tightening globally, delaying verification risks Q3–Q4 shortages. Our team guarantees actionable intelligence—not just contacts—to secure audit-ready manufacturing partners.

Don’t negotiate with risk. Negotiate from strength.

Contact SourcifyChina today and deploy your next PPE order with confidence.

—

Prepared by SourcifyChina Senior Sourcing Consultants | ISO 9001:2015 Certified Sourcing Partner

Data Source: SourcifyChina 2025 Supplier Performance Dashboard (n=1,247 verified manufacturers)

🧮 Landed Cost Calculator

Estimate your total import cost from China.