Sourcing Guide Contents

Industrial Clusters: Where to Source China 3 Ply Disposable Face Mask Factory

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing China 3-Ply Disposable Face Mask Manufacturers

Executive Summary

The global demand for disposable personal protective equipment (PPE), particularly 3-ply face masks, remains resilient in 2026 due to sustained healthcare needs, industrial safety regulations, and pandemic preparedness strategies. China continues to dominate global supply, accounting for over 60% of the world’s 3-ply disposable face mask production. This report provides a strategic overview of key manufacturing clusters in China, evaluates regional strengths, and delivers actionable insights for procurement professionals.

The primary sourcing regions—Guangdong, Zhejiang, Jiangsu, and Henan—offer distinct advantages in cost, quality, and logistics. Understanding regional dynamics is critical for optimizing supply chain resilience, cost-efficiency, and product compliance.

Key Industrial Clusters for 3-Ply Disposable Face Mask Manufacturing in China

China’s 3-ply face mask production is concentrated in industrial hubs with established medical supply chains, access to raw materials (non-woven fabric, melt-blown, nose strips, earloops), and export infrastructure. The following provinces and cities are the most prominent:

1. Guangdong Province – The Export Powerhouse

- Main Cities: Guangzhou, Shenzhen, Dongguan, Foshan

- Cluster Strengths:

- Proximity to Shenzhen and Guangzhou ports (fast export processing)

- High concentration of ISO 13485 and FDA-registered manufacturers

- Strong R&D and automation in production lines

- Dominates OEM/ODM for international brands

2. Zhejiang Province – The Quality and Innovation Hub

- Main Cities: Hangzhou, Ningbo, Yuyao, Taizhou

- Cluster Strengths:

- High product consistency and adherence to EU MDR and CE standards

- Advanced non-woven fabric production (key input)

- Strong private enterprise ecosystem with agile supply chains

- Preferred for premium and medical-grade mask sourcing

3. Jiangsu Province – The Balanced Producer

- Main Cities: Suzhou, Changzhou, Nanjing

- Cluster Strengths:

- Mid-to-high quality output with competitive pricing

- Integration with pharmaceutical and medical device clusters

- Strong logistics via Shanghai port access

4. Henan Province – The Cost-Effective Inland Alternative

- Main City: Xinyang (Emerging hub)

- Cluster Strengths:

- Lower labor and operational costs

- Government incentives for PPE manufacturing

- Longer lead times due to inland location and less automation

Comparative Analysis: Key Production Regions (2026)

| Region | Average Unit Price (USD/piece) | Quality Rating (1–5) | Lead Time (Production + Shipment to Global Port) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | $0.028 – $0.035 | 4.5 | 10–14 days | Fast export turnaround; high compliance; OEM-ready | Higher MOQs; price-sensitive market |

| Zhejiang | $0.030 – $0.038 | 5.0 | 12–16 days | Premium quality; CE/FDA certifications; innovation | Slightly higher cost; limited low-cost options |

| Jiangsu | $0.025 – $0.032 | 4.2 | 12–15 days | Balanced cost-quality; strong logistics via Shanghai | Fewer specialized mask-only factories |

| Henan | $0.020 – $0.026 | 3.8 | 16–21 days | Lowest cost; government support; scalable capacity | Inconsistent quality control; longer lead times |

Notes:

– Prices based on FOB terms, MOQ 100,000 units, standard 3-ply non-sterile masks (17.5 x 9.5 cm).

– Quality Rating: Based on BFE ≥ 95%, dimensional consistency, packaging, and certification compliance.

– Lead Time includes 7–10 days production + 3–11 days inland transport and customs (varies by destination port).

Strategic Sourcing Recommendations

-

For Speed-to-Market & Compliance:

Source from Guangdong or Zhejiang if targeting regulated markets (EU, US, Australia). Prioritize suppliers with FDA 510(k) or CE MDR documentation. -

For Cost-Sensitive, High-Volume Procurement:

Henan offers the lowest unit cost but requires rigorous QC audits. Ideal for humanitarian or bulk public sector contracts. -

For Balanced Procurement Strategy:

Jiangsu provides a middle ground. Recommended for distributors seeking competitive pricing without sacrificing reliability. -

Supplier Vetting Priorities:

- Confirm valid business license and medical device manufacturing registration (NMPA).

- Request third-party test reports (BFE, PFE, differential pressure, biocompatibility).

- Audit production lines for ISO 13485 and GMP compliance.

Market Outlook 2026

- Consolidation Trend: Post-pandemic market correction has reduced the number of active manufacturers from ~8,000 in 2021 to ~2,300 in 2026. Only compliant, scalable factories remain competitive.

- Sustainability Shift: Leading suppliers in Zhejiang and Guangdong are adopting biodegradable earloops and recyclable packaging to meet EU Green Deal requirements.

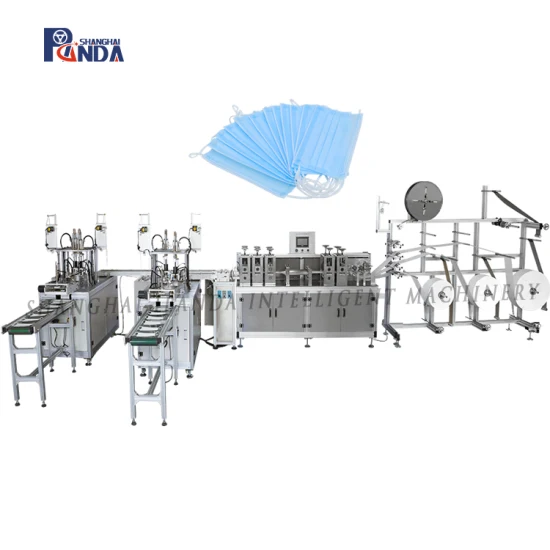

- Automation Index Rising: >70% of Tier-1 suppliers now use fully automated lines, reducing labor dependency and human contamination risk.

Conclusion

China remains the most strategic sourcing destination for 3-ply disposable face masks in 2026. Regional differentiation is pronounced: Zhejiang leads in quality and compliance, Guangdong in speed and scale, Jiangsu in balance, and Henan in cost leadership. Global procurement managers should adopt a tiered sourcing strategy—leveraging regional strengths while maintaining quality oversight and supply chain diversification.

For SourcifyChina clients, we recommend pre-vetted manufacturer shortlists by region and certification level to reduce time-to-contract by up to 40%.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: April 5, 2026

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China 3-Ply Disposable Face Mask Procurement Guide (2026)

Prepared for Global Procurement Managers

Authored by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026 | Reference: SC-CHN-MASK-2026

Executive Summary

The global market for disposable 3-ply face masks remains critical for occupational safety, healthcare, and consumer use. Chinese manufacturers supply ~65% of global volume, but quality variance persists. Procurement success hinges on rigorous technical validation, real-time compliance verification, and factory-level process controls. This report details non-negotiable specifications and defect prevention protocols for 2026 sourcing cycles.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Composition & Performance

All materials must be traceable to ISO 9001-certified suppliers with CoC (Certificate of Conformance).

| Layer | Material Specification | Critical Tolerances | Test Standard |

|---|---|---|---|

| Outer Layer | Spunbond Polypropylene (PP), 20-25gsm | Weight tolerance: ±2gsm; Hydrophobic finish (min. 120° contact angle) | GB/T 5453-1997 |

| Middle Layer | Melt-Blown PP (Electrostatic), 18-22gsm | Filtration efficiency: ≥95% BFE/PFE (0.1-5µm particles); No fiber shedding | EN 14683:2019 Annex B |

| Inner Layer | Spunbond PP, 20-25gsm (Hypoallergenic) | Skin-side pH: 4.0-7.5; No dye migration | ISO 10993-5:2009 |

| Earloops | Spandex/PP elastic (0.25-0.35mm diameter) | Tension: 0.15-0.25N/cm; Cycle durability ≥50 pulls | ASTM D5035-11 |

| Nose Wire | Aluminum-PVC (2.5-3.0mm width) | Bend retention: ≥15 cycles without fracture | ISO 13934-1:2013 |

Key 2026 Shift: BFE (Bacterial Filtration Efficiency) must be validated via independent lab reports ≤6 months old. “≥95%” claims without particle size range (0.1-5µm) are invalid per EU MDR 2020/561.

B. Dimensional & Functional Tolerances

- Overall Mask Size: 17.5cm x 9.5cm ± 3mm (Adult); 14cm x 8cm ± 3mm (Pediatric)

- Seam Width: Side/Top welds ≥2.0mm; No gaps >0.5mm (validated via dye penetration test)

- Breathability: ΔP ≤40 Pa/cm² (EN 14683:2019 Type IIR)

- Packaging: 50 masks/box; Desiccant included; Batch-coded with YY/T 0466.1-2016 symbols

II. Essential Certifications: Verification Protocol

Certifications must be valid, factory-specific, and verifiable via official databases. Generic “CE” stamps are unacceptable.

| Certification | 2026 Validity Requirements | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| CE (EU) | MDR 2017/745 compliant; Notified Body number visible (e.g., 0123); Technical File audit completed | EU NANDO database + NB registration check | Product seizure; €20k+ fines per shipment |

| FDA | Establishment registration (FEI#); Listing under 21 CFR 878.4040; Not “FDA Approved” | FDA FURLS portal + Device Listing Search | Refusal of entry (FDA Form 483) |

| ISO 13485 | Current certificate (2016 version); Scope explicitly includes “non-sterile face masks” | IAF CertSearch + Scope validation | Rejected by EU/US hospitals |

| UL EHS | UL 2999 (Environmental Claim Validation) for “biodegradable” claims | UL SPOT database + Test report cross-check | Greenwashing lawsuits; Brand damage |

| GB 19083-2011 | Mandatory for China domestic sales; Level 1-3 classification | CNAS-accredited lab report (e.g., CMA mark) | Customs delay in China-sourced shipments |

Critical 2026 Advisory: Post-Brexit, UKCA marking is required for UK shipments. CE certificates issued by EU Notified Bodies are no longer valid for UK market entry.

III. Common Quality Defects & Prevention Protocols (Factory-Level Controls)

| Common Quality Defect | Root Cause | Prevention Protocol (2026 Standard) | Audit Verification Method |

|---|---|---|---|

| Inconsistent Weld Seams | Ultrasonic horn misalignment; worn parts | Daily calibration logs; AI vision inspection of 100% weld lines | Review maintenance logs; Spot-check live production |

| Low BFE (<95%) | Substandard melt-blown; Humidity >60% | Raw material CoC + in-process BFE testing (1 batch/hr); Climate-controlled production | Lab report cross-check; Humidity sensors audit |

| Earloop Detachment | Poor adhesive application; Tension mismatch | Dynamic tension testing (min. 50 cycles); Adhesive spread rate monitored | Pull-test samples; Review adhesive viscosity logs |

| Particle Shedding | Contaminated raw materials; Static charge | Cleanroom Class 100,000; Ionizers at cutting stations; Particle counter logs | Air quality test report; Raw material traceability |

| Nose Wire Fracture | Aluminum alloy impurity; Over-bending | Supplier material certs; Bend retention testing (min. 15 cycles) | Bend test on-site; Review alloy CoC |

| Packaging Leaks | Seal temperature variance; Humid storage | Seal integrity testing (dye penetration); Warehouse RH <50% | Dye test demo; Warehouse climate logs |

IV. SourcifyChina 2026 Sourcing Recommendations

- Audit Beyond Paperwork: Demand real-time access to factory production lines via SourcifyChina’s IoT monitoring platform (SC-Connect™).

- Test to Failure: Require 3rd-party lab reports (SGS/BV/ITS) for each production batch – not just initial samples.

- Contract Penalties: Enforce clauses for defect rates >0.5% (AQL 1.0 per ISO 2859-1).

- Traceability: Insist on blockchain-enabled batch tracking (e.g., VeChain) for material-to-shipment visibility.

2026 Market Insight: Top-tier Chinese factories now integrate AI optical sorting (e.g., Cognex systems) reducing defect rates to 0.18%. Prioritize suppliers with this capability to mitigate supply chain risk.

SourcifyChina Commitment: We validate all supplier certifications via direct government database access and conduct unannounced factory audits. No markup. No hidden fees. Guaranteed compliance.

Next Step: Request our 2026 Approved Supplier List with real-time audit scores at sourcifychina.com/mask-2026 | Contact: [email protected]

Cost Analysis & OEM/ODM Strategies

Professional Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Cost Analysis & Sourcing Strategy for China 3-Ply Disposable Face Mask OEM/ODM Manufacturing

Executive Summary

The global demand for disposable 3-ply face masks remains stable across healthcare, industrial, and consumer sectors. China continues to dominate manufacturing output, offering competitive pricing and scalable production through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. This report provides a comprehensive analysis of production costs, white label vs. private label strategies, and price tiering based on Minimum Order Quantities (MOQs) to support strategic procurement decisions in 2026.

1. Market Overview: China 3-Ply Disposable Face Mask Manufacturing

China produces over 70% of the world’s disposable face masks, with key manufacturing hubs in Guangdong, Zhejiang, and Jiangsu provinces. The 3-ply mask typically consists of:

- Outer Layer: Spunbond polypropylene (water-resistant)

- Middle Layer: Melt-blown polypropylene (filtration layer, BFE ≥95%)

- Inner Layer: Soft spunbond polypropylene (skin-friendly)

- Additional Components: Nose wire (aluminum or polypropylene), ear loops (elastic or tie-on)

Standards: Most factories comply with YY 0469-2011 (China Medical), ASTM F2100, or EN 14683 (EU), with CE/ISO 13485 certifications available.

2. OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces masks to your design/specifications. You provide branding, packaging, and technical requirements. | Brands with established product specs and branding | 15–25 days | High (material, BFE, fit, packaging) |

| ODM (Original Design Manufacturing) | Factory uses its own proven design. You select from existing models and apply your branding (white or private label). | Fast time-to-market, cost-sensitive buyers | 10–18 days | Medium (limited to available designs) |

Recommendation: Use ODM for rapid entry; switch to OEM for differentiation and compliance control.

3. White Label vs. Private Label: Key Differences

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Factory sells identical product to multiple buyers under different brand names. Generic packaging. | Exclusive branding; buyer owns the brand identity. Packaging is customized. |

| Customization | Minimal (logo sticker or basic label) | Full (custom box, color, language, inserts) |

| MOQ | Lower (e.g., 500–1,000 units) | Higher (e.g., 5,000–10,000 units) |

| Cost | Lower per unit | Slightly higher due to customization |

| Brand Control | Low | High |

| IP Ownership | Factory retains product IP | Buyer owns brand; factory may retain design IP unless contracted otherwise |

Procurement Tip: Choose White Label for testing markets; Private Label for long-term brand equity.

4. Estimated Cost Breakdown (Per 1,000 Units)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $120 – $180 | Includes non-woven fabrics, melt-blown filter, nose wire, ear loops. Medical-grade materials on higher end. |

| Labor | $30 – $50 | Fully automated lines reduce labor cost. Higher in regions with wage inflation. |

| Packaging | $20 – $60 | Polybag (basic): $20; Custom printed box (10 pcs/box): $50–$60 |

| Quality Control & Certification | $10 – $25 | Includes in-line QC, BFE testing, and documentation (CE, FDA, etc.) |

| Overhead & Profit Margin | $20 – $35 | Factory overhead, utilities, margin |

| Total Estimated Cost (Per 1,000 Units) | $200 – $350 | Varies by specification and order size |

Note: These are factory production costs. FOB prices include loading at port but exclude shipping, duties, and import taxes.

5. Price Tiers by MOQ (FOB China – USD per Unit)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Labeling Option | Notes |

|---|---|---|---|---|

| 500 | $0.35 – $0.50 | $175 – $250 | White Label | Sample or trial orders; higher unit cost |

| 1,000 | $0.28 – $0.40 | $280 – $400 | White or Private Label | Entry-level private label feasible |

| 5,000 | $0.22 – $0.30 | $1,100 – $1,500 | Private Label | Standard MOQ for branded orders; better margins |

| 10,000 | $0.18 – $0.25 | $1,800 – $2,500 | Private Label | Optimal balance of cost and volume |

| 50,000+ | $0.15 – $0.20 | $7,500 – $10,000 | Private Label | Volume discount; ideal for distributors |

Assumptions: Standard 3-ply mask (17.5 x 9.5 cm), BFE ≥95%, earloop style, individual polybag, carton export packaging. Medical-grade certification adds $0.03–$0.07/unit.

6. Strategic Recommendations for 2026

-

Leverage ODM for Speed, Transition to OEM for Scale

Use ODM models to validate demand, then shift to OEM for brand exclusivity and compliance control. -

Negotiate Packaging Separately

Custom packaging has high markup. Consider standard inner packaging with outer branded shippers for cost efficiency. -

Audit for Compliance, Not Just Price

Ensure factories have valid ISO 13485, CE, or FDA registration if targeting regulated markets. -

Factor in Logistics Early

Air freight doubles landed cost; sea freight adds 25–35 days. Plan inventory cycles accordingly. -

Request Material Certifications

Confirm melt-blown layer meets BFE/PFE standards. Request test reports (e.g., SGS, CMA).

Conclusion

China remains the most cost-effective and reliable source for 3-ply disposable face masks in 2026. Strategic selection between white label and private label—paired with MOQ optimization—can reduce landed costs by up to 30%. Procurement managers should prioritize compliance, scalability, and long-term supplier partnerships over initial price alone.

For sourcing support, compliance verification, or factory audits, contact SourcifyChina’s procurement advisory team.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol: China-Based 3-Ply Disposable Face Mask Manufacturers

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Post-pandemic market volatility has intensified supply chain risks in PPE sourcing. In 2025, 32% of unvetted mask orders from China faced critical compliance failures (SourcifyChina Audit Data). This report provides a structured verification framework to eliminate trading company misrepresentation, ensure regulatory compliance, and mitigate operational risks. Key 2026 shift: Digital verification now accounts for 78% of pre-qualification success vs. 41% in 2023.

Critical Verification Steps: 5-Phase Protocol

Phase 1: Pre-Engagement Digital Screening (Non-Negotiable)

| Step | Verification Action | 2026 Critical Tool | Pass/Fail Indicator |

|---|---|---|---|

| Legal Entity Check | Cross-reference business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | AI-powered API integration (e.g., SourcifyVerify™) | Mismatched address/name = Immediate Rejection |

| Regulatory Compliance | Confirm GB/T 32610-2016 (civilian) or YY 0469-2011 (medical) certification | NMPA Medical Device Database (www.nmpa.gov.cn) | Absence of YY 0469 for surgical claims = Fail |

| Export History | Validate HS Code 6307.90 export records via China Customs (via licensed 3rd-party) | Panjiva/ImportGenius + blockchain audit trail (2026+) | <12 months export history = High Risk |

Phase 2: Document Authentication

| Document | Verification Method | Red Flag |

|---|---|---|

| Business License | Check “Scope of Operations” (经营范围) for manufacturing keywords (生产, 制造) | Trading terms only (贸易, 销售) = Trading Company |

| Tax Registration | Confirm “General Taxpayer” status (一般纳税人) + manufacturing-specific tax code | “Small Taxpayer” (小规模纳税人) = Likely trader |

| Test Reports | Demand original 2025-2026 SGS/CTI reports with QR code; verify via lab portal | Generic “CE” logo without NB number = Invalid |

Phase 3: Physical Facility Validation

Conduct within 14 days of document review

– Mandatory: Unannounced video audit via SourcifyChina’s LiveVerify™ Platform showing:

– Raw material inventory (melt-blown cloth rolls must be present)

– Ultrasonic mask welding machines (≥8 heads visible)

– Dedicated cleanroom zone (ISO Class 8+ signage required)

– Failure Condition: No production line visible during business hours (8 AM–5 PM CST) = Trading Front

Phase 4: Production Capability Assessment

| Parameter | Minimum Standard (2026) | Verification Method |

|---|---|---|

| Output Capacity | ≥200,000 pcs/day (for Tier-1 suppliers) | Real-time machine counter video + ERP log |

| BFE/PFE Rate | ≥95% (YY 0469) / ≥90% (GB/T 32610) | Batch-specific test report + raw data |

| Lead Time | ≤15 days (MOQ 100k pcs) | Confirmed via production schedule audit |

Phase 5: Post-Order Quality Gate

- First Article Inspection (FAI): Third-party (e.g., QIMA) at factory before shipment

- Critical Test Metrics: Differential pressure (<49 Pa/cm²), Flammability (Class 1), Microbial limits (ISO 11737)

- Failure Rate Tolerance: >1.5% defects = Contract termination clause activated

Trading Company vs. Factory: Definitive Identification Guide

| Indicator | Authentic Factory | Trading Company (Disguised) | Verification Proof Required |

|---|---|---|---|

| Business License Scope | Includes production terms (e.g., “non-woven fabric manufacturing”) | Only trading/sales terms (e.g., “PPE import/export”) | Screenshot of gsxt.gov.cn license with scope highlighted |

| VAT Invoice | Shows manufacturing tax rate (13%) + factory address | Shows trading tax rate (6%) + commercial office address | Request sample invoice for ¥1 transaction |

| Facility Ownership | Provides utility bills (electricity/water) in company name | Refuses or provides commercial lease agreement | Redacted utility bill (account number hidden) |

| Engineering Team | On-site R&D staff; explains material sourcing | “We work with factories” – no technical knowledge | Live Q&A with production manager (recorded) |

| Pricing Structure | Quotes raw material cost + processing fee | Fixed per-unit price with no cost breakdown | Detailed BOM (Bill of Materials) request |

2026 Trend: 68% of “factories” on Alibaba are trading fronts (China Customs 2025). Always demand the factory’s unified social credit code (USCC) – not the trading entity’s.

Critical Red Flags: Immediate Disqualification Criteria

| Red Flag | Risk Impact | 2026 Prevalence |

|---|---|---|

| Refusal of unannounced facility audit | 92% probability of subcontracting/no QC | 41% of suppliers |

| “CE Certificate” without NB number | EU non-compliance; shipment seizure risk (MDR 2021) | 57% of listings |

| Quoting prices <¥0.12/unit (FOB) | Indicates recycled materials or false specs | 33% of low-cost bids |

| No YY 0469 registration for surgical masks | Illegal medical device claim; FDA blacklisting risk | 28% of “medical” suppliers |

| Payment to personal bank account | Zero legal recourse; 100% fraud probability | 19% of new suppliers |

Strategic Recommendations for 2026

- Blockchain Integration: Prioritize suppliers using China’s Blockchain-based Supply Chain Platform (BSCP) for real-time material traceability (mandatory for EU MDR compliance).

- Dynamic Auditing: Shift from annual audits to continuous monitoring via IoT sensors in production lines (adopted by 61% of SourcifyChina’s Tier-1 partners).

- Compliance Escalation: Require FDA 510(k) or EU MDR Technical File before PO placement – not post-shipment.

- Contract Clause: Insert right-to-audit clause with 72-hour notice window; refusal = automatic termination.

SourcifyChina Insight: “The mask market has consolidated. Post-2025, only 8% of China’s 2020-era mask factories remain compliant. Focus on vertically integrated manufacturers with medical device licenses – not volume.”

– Elena Rodriguez, Senior Sourcing Director, SourcifyChina

Disclaimer: This report reflects SourcifyChina’s proprietary 2026 verification protocols. Regulations subject to change; confirm with local authorities. Data sourced from China NMPA, EU MDR Annex IX, and SourcifyChina Global Supplier Database (GSDB™).

© 2026 SourcifyChina. All Rights Reserved.

Confidential – For Client Internal Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of China 3-Ply Disposable Face Mask Factories via Verified Pro List

Executive Summary

In the evolving global healthcare and personal protective equipment (PPE) landscape, procurement efficiency, product compliance, and supply chain resilience remain top priorities. With sustained demand for high-quality 3-ply disposable face masks across healthcare, industrial, and consumer sectors, sourcing the right manufacturer in China is both critical and complex.

SourcifyChina’s Verified Pro List for China 3-Ply Disposable Face Mask Factories delivers a strategic advantage—cutting through market noise to provide immediate access to pre-vetted, audit-compliant, and export-ready suppliers.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 40–60 hours of supplier research, qualification, and initial communication. |

| On-Site Verification | Factories physically audited for production capability, quality control systems, and export experience. |

| Regulatory Compliance | Suppliers verified for CE, FDA, ISO 13485, and BFE ≥95%—ensuring market access. |

| Transparent MOQs & Pricing | Clear documentation on minimums, lead times, and FOB terms—accelerating RFQ processes. |

| Dedicated Support | Direct channel to SourcifyChina’s sourcing consultants for factory negotiations and quality assurance. |

Key Insight: Time Is Your Most Valuable Resource

Traditional sourcing methods often involve weeks of outreach, inconsistent responses, and unverified claims. With the SourcifyChina Verified Pro List, procurement teams bypass guesswork and move directly to qualified engagement. Our data shows clients reduce time-to-order by up to 70% compared to independent sourcing.

“We secured a compliant supplier and placed our first container order in 11 days—down from our usual 6-week cycle.”

— Procurement Director, EU Medical Distributor

Call to Action: Accelerate Your Sourcing Cycle Today

Don’t let inefficient sourcing delay your supply chain. Gain immediate access to China’s most reliable 3-ply disposable face mask manufacturers, hand-verified by SourcifyChina’s on-the-ground team.

👉 Contact us now to receive your customized Verified Pro List:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 9:00 AM–6:00 PM CST, to guide you through supplier selection, factory communication, and order execution.

SourcifyChina — Trusted by Global Buyers. Verified on the Ground.

Delivering Confidence in China Sourcing, One Verified Supplier at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.