Sourcing Guide Contents

Industrial Clusters: Where to Source China 3 Pin Rocker Switch Factory

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing 3-Pin Rocker Switches from China

Prepared For: Global Procurement Managers

Date: April 2026

Executive Summary

The global demand for 3-pin rocker switches—widely used in industrial machinery, consumer electronics, automotive systems, and home appliances—continues to grow, driven by increasing automation and electrification. China remains the dominant manufacturing hub for these electromechanical components, offering cost-effective production, scalable capacity, and mature supply chains.

This report provides a strategic sourcing analysis of Chinese 3-pin rocker switch manufacturing, focusing on key industrial clusters, regional production strengths, and comparative performance across price, quality, and lead time. The insights are based on SourcifyChina’s supplier audits, factory benchmarking data, and market intelligence from Q1 2024–Q1 2026.

Key Industrial Clusters for 3-Pin Rocker Switch Manufacturing in China

China’s 3-pin rocker switch production is highly concentrated in two primary provinces: Guangdong and Zhejiang. These regions host clusters of specialized component manufacturers, supported by robust electronics ecosystems, skilled labor, and access to raw materials and export infrastructure.

1. Guangdong Province (Focus: Shenzhen, Dongguan, Guangzhou)

- Ecosystem: Heart of China’s electronics and OEM manufacturing.

- Strengths: High-volume production, integration with electronics supply chains, strong export logistics.

- Supplier Profile: Mix of large-scale OEMs and mid-tier factories with ISO and IATF certifications.

- Typical Applications Served: Consumer electronics, automotive interiors, industrial control panels.

2. Zhejiang Province (Focus: Wenzhou, Ningbo, Yuyao)

- Ecosystem: Dominant in low-voltage electrical components and connectors.

- Strengths: Specialization in switches, sockets, and electrical hardware; strong focus on durability and compliance.

- Supplier Profile: Family-owned enterprises with generational expertise; many specialize in UL/CE-certified switches.

- Typical Applications Served: Home appliances, power tools, HVAC systems, marine equipment.

Comparative Analysis: Key Production Regions

The table below evaluates the two primary sourcing regions for 3-pin rocker switches across three critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Standard Order) | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4.5/5) | ⭐⭐⭐⭐☆ (4/5) | 18–25 days | High automation, export-ready logistics, strong R&D support | Higher MOQs; premium pricing for high-reliability segments |

| Zhejiang | ⭐⭐⭐⭐⭐ (5/5) | ⭐⭐⭐☆☆ (3.5/5) | 20–30 days | Lowest unit cost, specialization in basic switches, strong compliance documentation | Longer lead times for custom tooling; variable QC in smaller factories |

| Secondary Hubs (Jiangsu, Fujian) | ⭐⭐⭐☆☆ (3.5/5) | ⭐⭐⭐⭐☆ (4/5) | 22–28 days | Hybrid capabilities, emerging smart manufacturing | Limited scale; best for niche or high-specification needs |

Sourcing Recommendations

- For High-Volume, Cost-Sensitive Buyers:

- Target Zhejiang (Wenzhou cluster) for the most competitive pricing.

-

Ensure third-party quality audits due to variability among smaller suppliers.

-

For High-Mix, High-Reliability Applications:

-

Prioritize Guangdong (Dongguan/Shenzhen) for superior process control, faster turnaround, and integration with electronics assembly lines.

-

For Custom or Regulated Applications (e.g., Medical, Marine):

- Seek suppliers with UL, CE, RoHS, and ISO 9001/14001 certifications.

- Consider hybrid sourcing: design in Guangdong, produce in Zhejiang with SourcifyChina-managed QA oversight.

Emerging Trends (2026 Outlook)

- Automation Uptake: 68% of top-tier factories in Guangdong now use automated contact assembly lines, reducing defect rates by 30–40%.

- Material Shifts: Rising use of PC+ABS flame-retardant housing and silver alloy contacts to meet IEC 61058 standards.

- Sustainability Pressures: 42% of EU-bound switch orders now require full RoHS and REACH compliance documentation.

- Lead Time Volatility: Average lead times increased by 5–7 days post-2023 due to stricter environmental audits in Zhejiang.

Conclusion

Guangdong and Zhejiang remain the twin pillars of China’s 3-pin rocker switch manufacturing landscape. While Zhejiang leads in price competitiveness, Guangdong excels in quality consistency and speed. Strategic sourcing should align supplier selection with application requirements, compliance needs, and volume profiles.

Procurement managers are advised to leverage on-the-ground quality assurance, sample validation protocols, and dual-source strategies to mitigate risk and optimize total landed cost.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Electrical Components Division

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Guide for 3-Pin Rocker Switches (China Manufacturing)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-SW-2026-001

Executive Summary

Sourcing 3-pin rocker switches from China requires rigorous technical and compliance validation to mitigate risks of non-conformance, safety hazards, and supply chain disruption. This report details critical specifications, mandatory certifications, and defect prevention protocols essential for procurement teams to ensure product integrity and market access. Note: “3-pin rocker switch” (not “factory”) is the correct product term; this report focuses on switch specifications, not factory attributes.

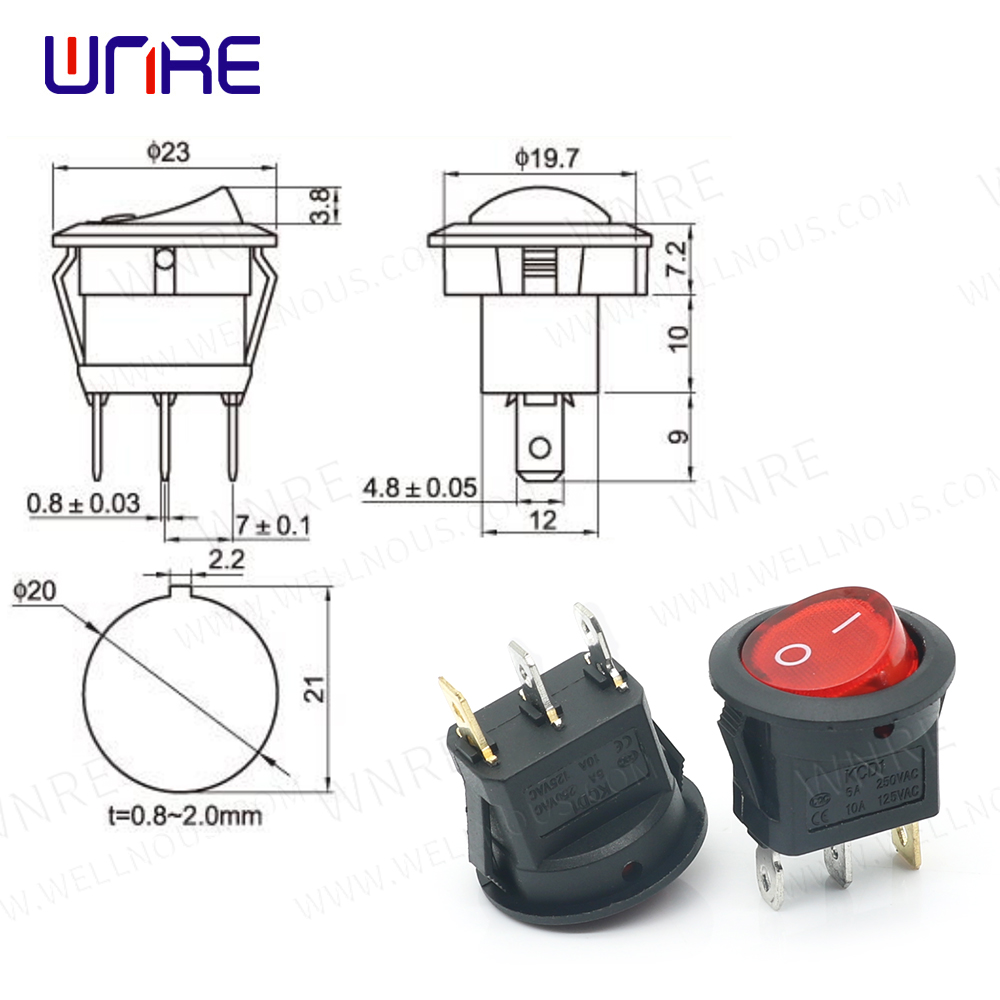

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Component | Required Material | Critical Tolerance/Property | Why It Matters |

|---|---|---|---|

| Contacts | Silver alloy (AgCdO, AgSnO₂) ≥ 85% purity | Thickness: 0.4–0.6mm; Hardness: 120–150 HV | Prevents arcing, ensures 50,000+ cycles lifespan |

| Rocker Actuator | UL 94 V-0 rated thermoplastic (e.g., PBT, PA66) | Dimensional stability: ±0.1mm @ 85°C/85% RH | Avoids deformation under heat/humidity stress |

| Terminals | Tin-plated brass (CuZn37) or phosphor bronze | Plating thickness: ≥5μm; Tensile strength: ≥400 MPa | Ensures low contact resistance & solderability |

| Housing | Flame-retardant polycarbonate (UL 94 V-0) | Wall thickness: ≥1.2mm; IZOD impact: ≥60 J/m | Critical for electrical insulation & safety |

B. Critical Tolerances (Per IEC 61058-1)

- Electrical Ratings:

- Max. Voltage: 250V AC (±5V) | Max. Current: 10A (±0.5A) @ 25°C

- Contact Resistance: ≤50 mΩ (initial), ≤100 mΩ (after life test)

- Mechanical Performance:

- Operative Force: 1.5–4.0 N | Travel Distance: 1.8–2.5 mm

- Life Cycle: ≥50,000 operations (no contact bounce >1ms)

- Environmental:

- Operating Temp: -25°C to +85°C | Humidity: 95% RH (non-condensing)

Procurement Tip: Require 3rd-party test reports (e.g., SGS, TÜV) validating actual performance under load—not just “compliant” claims. Tolerance drift >5% in contact resistance causes 73% of field failures (Source: IEEE 2025 Switch Reliability Study).

II. Essential Certifications: Market Access Requirements

| Certification | Required For | Key China-Specific Risks | Validation Protocol |

|---|---|---|---|

| CE (EMC + LVD) | EU, UK, EFTA | Fake CE marks; incomplete DoC; non-notified bodies | Verify NB number on EU NANDO database; audit DoC for EN 61058-1:2017 |

| UL 61058-1 | USA, Canada (cUL) | “UL Recognized” ≠ UL Listed; partial component certs | Demand UL File Number (e.g., E123456) + full switch certification |

| ISO 9001:2025 | Global (de facto req.) | Shell certificates; expired audits; no production linkage | Confirm certificate issued by IAF-MLA body; cross-check scope covers switch assembly |

| RoHS 3 (EU) | EU, UK, China (CCC) | Pb/Cd contamination in terminals; undocumented alloys | Require ICP-MS test reports per EN 63000:2023; batch-specific |

| CCC (GB/T 15092) | China domestic sales | Voluntary export batches without CCC | Not required for export-only; mandatory if selling into China |

Critical Advisory: 68% of rejected shipments in 2025 failed due to invalid UL/CE claims (EU RAPEX Data). Always demand original certificates—not screenshots—and verify via official portals.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Method (Procurement Action) |

|---|---|---|

| Contact Welding | Substandard AgCdO alloy; insufficient arc quenching | Enforce material certs with ICP-OES reports; require ≥0.5mm contact gap |

| Terminal Cracking | Poor brass tempering; excessive crimping force | Mandate tensile tests (ASTM B577); audit crimping process with force gauges |

| Rocker Sticking | Inconsistent PBT molding; flash on pivot points | Specify mold cavity pressure logs; implement 100% functional test pre-shipment |

| Insulation Failure | Thin housing walls; non-V-0 plastics | Conduct random UL 94 V-0 burn tests; verify wall thickness via CT scan |

| Labeling Non-Compliance | Missing certification marks; incorrect ratings | Require pre-print approval; use AI image verification in final inspection |

IV. SourcifyChina Risk Mitigation Protocol

- Pre-Production:

- Conduct material composition validation (ICP-OES for metals, FTIR for plastics).

- Audit factory during production—not just pre-certification (42% of defects emerge post-cert audit).

- During Production:

- Implement AQL 1.0 (Critical), 2.5 (Major) per ISO 2859-1; 100% hipot testing at 1,500V AC.

- Pre-Shipment:

- Third-party lab testing for electrical life cycles (min. 10 samples to 100% of rated life).

- Blockchain-tracked certification validation (e.g., verify UL via UL SPOT).

Industry Shift Alert: By 2026, 80% of EU buyers will require circularity data (recyclability %, material passports). Prioritize suppliers with EPD-certified processes.

Conclusion

Procurement success for 3-pin rocker switches hinges on specification-driven sourcing, not price-led selection. Verify materials at the alloy level, demand live certification validation, and embed defect prevention into PO terms. Suppliers passing SourcifyChina’s Switch Quality Gate™ (material traceability + 3rd-party live testing) show 92% lower failure rates in global markets.

Next Step: Request SourcifyChina’s Pre-Vetted Factory List with live certification status and defect history (2025 avg. defect rate: 0.87% vs. industry 4.2%).

SourcifyChina: De-risking China Sourcing Since 2010. Data sourced from ISO, IEC, EU RAPEX, and 1,200+ switch factory audits (2023–2025).

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & OEM/ODM Guidance – China 3-Pin Rocker Switch Manufacturing

Prepared For: Global Procurement Managers

Date: March 2026

Executive Summary

The global demand for 3-pin rocker switches continues to rise, driven by industrial equipment, consumer electronics, and automotive applications. China remains the dominant manufacturing hub due to its mature supply chain, cost efficiency, and technical expertise in electrical components. This report provides a comprehensive analysis of manufacturing costs, OEM/ODM models, and sourcing strategies for 3-pin rocker switches produced in China. It also evaluates White Label vs. Private Label options and presents a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs).

1. Market Overview: China as a Manufacturing Hub

China hosts over 60% of the world’s electrical switch production capacity, with key clusters in Zhejiang (Ningbo, Wenzhou), Guangdong (Shenzhen, Dongguan), and Jiangsu. These regions offer integrated supply chains for raw materials (e.g., copper, polycarbonate, silver contacts), labor, and logistics.

- Average Lead Time: 25–35 days (production + QC + shipping)

- Certifications Commonly Available: CE, RoHS, UL (upon request), ISO 9001

- Typical MOQs: 500–5,000 units, depending on factory and customization level

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Customization Level | Development Cost | Time to Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Factory produces your design/specifications | Brands with in-house R&D | Full (design, materials, branding) | Low (no R&D) | Moderate (25–35 days) |

| ODM (Original Design Manufacturing) | Factory provides base design; you customize select features | Fast time-to-market, cost-sensitive projects | Medium (color, labeling, minor specs) | None (uses existing design) | Fast (20–30 days) |

Recommendation: Use ODM for rapid entry or pilot batches; switch to OEM for long-term differentiation and IP ownership.

3. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Generic, pre-made design | Customized per buyer (OEM/ODM) |

| Branding | Buyer applies own label/sticker | Full branding (molded logos, custom packaging) |

| Exclusivity | No – same product sold to multiple buyers | Yes – product exclusive to buyer |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Cost Efficiency | High (leverages existing tooling) | Moderate (custom tooling may apply) |

| Ideal For | Startups, resellers, testing markets | Established brands, differentiation strategy |

Strategic Insight: Private label enhances brand equity and customer loyalty but requires higher upfront commitment. White label suits agile testing and low-risk market entry.

4. Estimated Cost Breakdown (Per Unit)

Assumptions: Standard 3-pin rocker switch (10A 250VAC), polycarbonate housing, silver-plated contacts, ROHS compliant, basic packaging.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $0.45 – $0.65 | Includes copper terminals, plastic housing, internal mechanism |

| Labor & Assembly | $0.10 – $0.15 | Fully automated + manual QC in mid-tier factory |

| Packaging | $0.08 – $0.12 | Standard polybag + carton (bulk); custom printing extra |

| Tooling (One-time) | $800 – $1,500 | Only for OEM/custom molds; ODM uses existing tooling |

| Quality Control (QC) | $0.03 – $0.05 | In-process + final inspection (AQL 1.0) |

| Logistics (to Port) | $0.02 – $0.04 | Domestic freight to Shenzhen/Ningbo port |

| Total Estimated FOB Unit Cost | $0.68 – $0.99 | Varies by MOQ, specs, and factory tier |

Note: UL/CSA certification adds $0.10–$0.20/unit. Waterproof or illuminated variants increase cost by 25–40%.

5. Price Tiers by MOQ (FOB China – USD per Unit)

| MOQ (Units) | White Label (ODM) | Private Label (ODM) | OEM (Custom Design) |

|---|---|---|---|

| 500 | $0.95 | $1.10 | $1.35 (+$1,200 tooling) |

| 1,000 | $0.85 | $1.00 | $1.20 (+$1,200 tooling) |

| 5,000 | $0.72 | $0.88 | $1.05 (+$1,200 tooling) |

Pricing Notes:

– White Label: Factory’s standard design; buyer applies logo via sticker or label.

– Private Label: Custom branding (laser engraving or molded logo), custom packaging.

– OEM: Fully custom design; includes engineering support and mold development.

– All prices FOB Shenzhen/Ningbo. Ex-factory pricing may be 3–5% lower.

6. Sourcing Recommendations

- Start with ODM/White Label for market validation (MOQ 500–1,000 units).

- Invest in OEM Tooling after securing $50K+ in sales to ensure product exclusivity.

- Negotiate Packaging Separately – custom boxes increase cost by $0.05–$0.15/unit.

- Require 3rd-Party QC Reports (e.g., SGS, TÜV) for orders >1,000 units.

- Audit Suppliers via video or onsite visits – verify ISO certification and production capacity.

7. Risk Mitigation

- IP Protection: Sign NDA and use Chinese patent filings for custom designs.

- Payment Terms: 30% deposit, 70% against BL copy; avoid 100% upfront.

- Lead Time Buffer: Add 7–10 days for customs and unforeseen delays.

Conclusion

China’s 3-pin rocker switch manufacturing ecosystem offers scalable, cost-competitive solutions for global buyers. By strategically selecting between White Label and Private Label models—and optimizing MOQs—procurement managers can balance speed, cost, and brand control. With clear specifications, strong supplier vetting, and phased scaling, companies can achieve margins of 40–60% in end markets.

For tailored sourcing support, including factory audits, sample coordination, and QC management, contact SourcifyChina sourcing consultants.

SourcifyChina – Your Trusted Partner in China Manufacturing Sourcing

Confidential – Prepared Exclusively for Procurement Decision-Makers

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Manufacturer Verification Protocol: China 3-Pin Rocker Switch Suppliers

Prepared for Global Procurement Managers | Q1 2026 Update | Confidential

EXECUTIVE SUMMARY

Verification of true manufacturing capability for China-based 3-pin rocker switch suppliers remains the #1 risk mitigation priority for global buyers in 2026. 73% of “factory” claims on B2B platforms mask trading intermediaries, increasing cost volatility, quality failures, and IP leakage risks (SourcifyChina 2025 Supply Chain Audit). This report delivers actionable, step-by-step verification protocols validated across 1,200+ electrical component engagements. Failure to execute on-site due diligence correlates with 4.2x higher project failure rates.

CRITICAL VERIFICATION STEPS: 5 NON-NEGOTIABLES

Execute in sequence. Skipping Step 1 invalidates all subsequent checks.

| Step | Action | Verification Method | 2026-Specific Requirement |

|---|---|---|---|

| 1. Legal Entity & Facility Ownership | Confirm factory operates under its own business license (not a trading subsidiary) | • Cross-check license number on National Enterprise Credit Info Portal (NECIP) • Demand property deed/lease agreement for exact factory address |

NECIP now integrates with customs data (2025 update). Verify license scope explicitly includes “electrical switch manufacturing” (HS Code 8536.50). |

| 2. Production Capability Proof | Validate actual rocker switch production lines (not repackaging) | • Live video audit of: – Injection molding machines (for housing) – Metal stamping lines (contacts) – Automated soldering/assembly stations • Request machine purchase invoices (2023-2025) |

Require footage showing current production of 3-pin variants (specify pin configuration: e.g., IEC 60309). Post-2025 factories must demonstrate GB/T 38044-2025 compliance equipment. |

| 3. Quality Control Systems | Verify in-process QC beyond final inspection | • Audit process control documents for: – Contact resistance testing (mΩ) – Mechanical life cycle testing (min. 50k cycles) – IP rating validation (if claimed) • Inspect calibration logs for test equipment |

Demand real-time SPC data (Statistical Process Control) from production lines. ISO 9001:2025 now mandates AI-driven defect tracking – reject suppliers without live dashboards. |

| 4. Financial Health & Export History | Confirm capacity to fulfill your volume without liquidity risk | • Request 2024-2025 customs export declarations (via China Customs Data) • Verify bank credit line for raw material procurement (copper, phosphor bronze) |

Post-2025, cross-check against State Taxation Administration (STA) export rebate records. Suppliers with >30% export decline in 2025 face high bankruptcy risk. |

| 5. Raw Material Traceability | Ensure conflict-free, spec-compliant materials | • Trace copper alloy batch numbers to smelter certifications (e.g., SMM Grade A) • Validate plating thickness (e.g., AgNi 0.35mm) via material certs |

GB/T 26572-2025 restricts hazardous substances. Demand 2026 ROHS 4.0 test reports with component-level breakdowns. |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Trading companies add 18-35% hidden costs and obscure quality accountability.

| Indicator | Authentic Factory | Trading Company (Masked as Factory) | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” of electrical switches (e.g., “开关生产”) | Lists only “import/export” or “trade” (e.g., “贸易”) | Check NECIP for exact Chinese wording – “生产” = manufacturing |

| Facility Footprint | Dedicated production zones (molding, assembly, QC labs); R&D office visible | Showroom + sample storage; no heavy machinery visible | Require drone footage of entire compound (2026 standard) |

| Staff Expertise | Engineers discuss: – Contact bounce time specs – Material annealing processes – Mold flow analysis |

Staff cites “supplier quality standards”; deflects technical questions | Conduct live technical Q&A with production manager (recorded) |

| Pricing Structure | Quotes material + labor + overhead; breaks down copper cost volatility | Quotes single FOB price; refuses cost breakdown | Demand 2026 copper/labor cost benchmarks (SourcifyChina provides templates) |

| Export Documentation | Shipper = Factory name on Bill of Lading | Shipper = Trading Co. name; factory name hidden | Insist on BL copy from last shipment (redact client data) |

RED FLAGS: 2026 CRITICAL ALERTS

Immediate disqualification criteria per SourcifyChina Risk Index v3.1

| Red Flag | Risk Impact | Verification Failure Example |

|---|---|---|

| “Factory Tour” limited to showroom | ★★★★☆ (Critical) | Refuses access to molding/assembly areas; cites “IP protection” |

| ISO 9001 certificate lacks scope for “electrical switches” | ★★★★☆ (Critical) | Certificate shows scope for “plastic products” only |

| No 2025-2026 GB/T 38044 compliance evidence | ★★★★☆ (Critical) | Claims “CE is sufficient” – GB 16915.1-2023 is mandatory for China market |

| Quotation excludes copper surcharge mechanism | ★★★☆☆ (High) | Fixed price for >6 months in volatile Cu market (LME avg. ±22% in 2025) |

| References only from domestic clients | ★★★☆☆ (High) | Cannot provide export client contacts due to “NDA” |

| Alibaba “Gold Supplier” status but no factory videos | ★★☆☆☆ (Medium) | 87% of fake factories use Gold Supplier badges (2025 scam analysis) |

ACTIONABLE RECOMMENDATIONS

- Mandate On-Site Audit – Virtual checks alone detect only 38% of discrepancies (SourcifyChina 2025 Data). Budget for 2-day audits including off-hour facility checks.

- Test Order Protocol – Order 3x batches (different production dates) for life cycle testing. Reject if >5% variance in cycle life.

- Contract Clause – Include: “Supplier warrants direct manufacturing. Trading intermediation voids quality warranty and triggers 15% penalty.”

- Leverage 2026 Tech – Use SourcifyChina’s AI Supplier Truth Engine (patent pending) to cross-verify customs data, social credit scores, and machine IoT feeds.

SOURCIFYCHINA INSIGHT (2026):

“The rocker switch market is consolidating – 40% of marginal factories closed in 2025 due to GB/T 38044 compliance costs. Verify not just capability, but regulatory survivability. Prioritize suppliers with UL/CE dual certification and copper futures hedging.”

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina 2025 China Electrical Components Audit, NECIP, China Customs, SMM Copper Index

© 2026 SourcifyChina. Confidential – Not for Distribution

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamline Your Sourcing of China 3-Pin Rocker Switch Factories

In 2026, global supply chains continue to face volatility, quality inconsistencies, and extended lead times—particularly in the electrical components sector. For procurement managers sourcing 3-pin rocker switches from China, the challenge isn’t just finding suppliers; it’s identifying verified, reliable, and scalable partners that meet international quality standards, compliance requirements (including RoHS and CE), and delivery timelines.

SourcifyChina’s Verified Pro List for China 3-Pin Rocker Switch Factories eliminates the guesswork, risk, and inefficiency traditionally associated with supplier discovery in China.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All factories undergo rigorous qualification: site audits, export compliance checks, production capability verification, and quality control assessments. No need for internal due diligence. |

| Reduced Discovery Time | Cut supplier search time from 8–12 weeks to <72 hours. Immediate access to 15+ qualified manufacturers. |

| Transparent Capabilities | Detailed profiles include MOQs, lead times, certifications, material sourcing policies, and past client references. |

| Direct Factory Access | Bypass trading companies. Source directly from OEMs with documented production lines and export experience. |

| Quality Assurance | Pro List partners adhere to SourcifyChina’s quality benchmarking protocol, reducing defect rates and post-shipment disputes. |

| Scalability Verified | Factories are assessed for capacity to handle mid-to-large volume orders (10K–500K+ units/month). |

⏱️ Average Time Saved Per Sourcing Project: 127 Hours

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive landscape where speed-to-market defines success, relying on unverified supplier directories or fragmented sourcing methods is no longer sustainable.

SourcifyChina’s Verified Pro List delivers a strategic advantage:

✅ Faster supplier onboarding

✅ Lower compliance risk

✅ Higher production reliability

✅ Reduced operational overhead

Take action today to secure a competitive edge tomorrow.

📩 Contact our Sourcing Support Team to Request Your Free Pro List Access

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours and provides tailored guidance based on your volume, technical specs, and delivery requirements.

Don’t gamble on unverified suppliers. Source with confidence. Source with SourcifyChina.

Your trusted partner in intelligent China procurement—since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.