Sourcing Guide Contents

Industrial Clusters: Where to Source China 3 Inch Black Iron Steel Pipe Manufacturer

SourcifyChina B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing 3-Inch Black Iron Steel Pipes from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

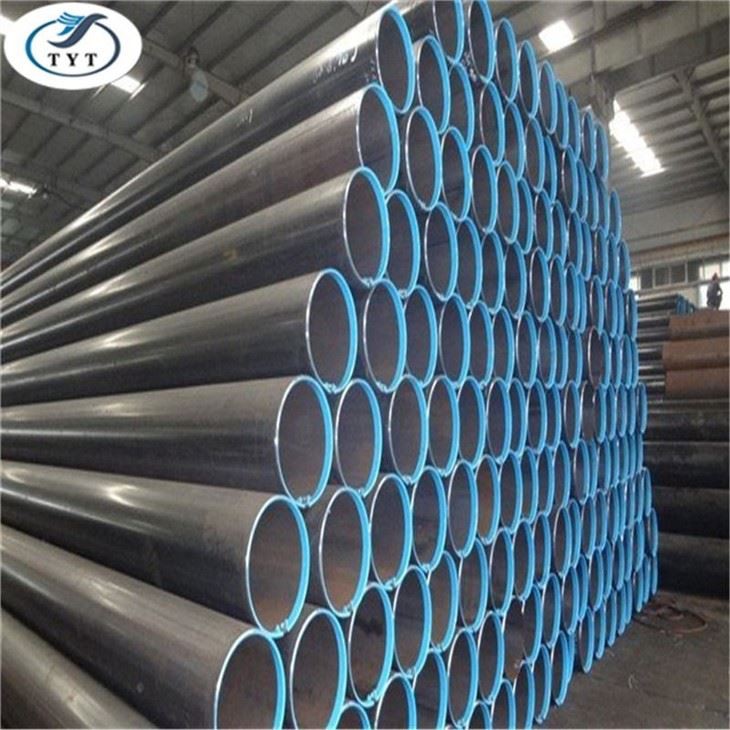

The global demand for black iron steel pipes—particularly 3-inch nominal diameter (DN80) carbon steel pipes—remains robust across construction, plumbing, HVAC, and industrial gas distribution sectors. China continues to dominate global supply, offering competitive pricing, scalable production, and evolving quality standards. This report identifies key industrial clusters in China specializing in 3-inch black iron steel pipe manufacturing and provides a comparative analysis to guide strategic procurement decisions.

Market Overview: 3-Inch Black Iron Steel Pipes

Black iron steel pipes are low-cost, durable carbon steel pipes typically used for conveying gas, water, or oil in non-corrosive environments. The 3-inch (88.9 mm outer diameter) variant is widely used in commercial plumbing and industrial frameworks. In China, these pipes are commonly manufactured to GB/T 3091-2015 (equivalent to ASTM A53 in many applications), with standard wall thicknesses (Schedule 40), and delivered in black (uncoated) or zinc-coated (galvanized) forms.

Key Manufacturing Clusters in China

China’s steel pipe manufacturing is highly regionalized, with distinct industrial clusters offering varying advantages in cost, quality, and logistics. The following provinces and cities are recognized hubs for black iron steel pipe production:

1. Tianjin & Northern Hebei (Cangzhou, Wuqiao, Yanshan)

- Core Strengths: Proximity to raw materials (steel billets), large-scale integrated mills, and export logistics via Tianjin Port.

- Specialization: High-volume production of carbon steel pipes, including black iron pipes.

- Key Factories: Huading Steel Pipe, Orient Pipe, Hengtong Steel Pipe.

2. Zhejiang Province (Huzhou, Deqing, Hangzhou)

- Core Strengths: High precision manufacturing, strong export orientation, advanced finishing capabilities.

- Specialization: Mid-to-high-end carbon and galvanized steel pipes; strong compliance with international standards.

- Key Factories: Zhejiang Jinzhong Steel, Hengye Steel Pipe.

3. Guangdong Province (Foshan, Zhaoqing)

- Core Strengths: Proximity to South China Sea ports (Guangzhou, Shenzhen), agile SME manufacturers, strong aftermarket distribution.

- Specialization: Smaller batch orders, quick turnaround, customization.

- Key Factories: Foshan Nanhai Steel Pipe, Guangdong Lianzhong.

4. Shandong Province (Liaocheng, Dezhou)

- Core Strengths: Emerging hub with competitive pricing, growing export infrastructure.

- Specialization: Cost-effective production of standard carbon steel pipes.

- Key Factories: Shandong Zhongsheng Steel, Liaocheng Steel Pipe Group.

Regional Comparison: Manufacturing Hubs for 3-Inch Black Iron Steel Pipes

The following table compares key production regions based on price competitiveness, quality consistency, and lead time performance for standard 3-inch black iron steel pipes (Schedule 40, GB/T 3091, 6-meter length, FOB basis).

| Region | Price (USD/ton) | Quality Tier | Lead Time (Production + Loading) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Tianjin/Hebei | $620 – $680 | Medium to High | 25–35 days | Economies of scale, raw material access, reliable for bulk | Longer lead times during winter (environmental controls) |

| Zhejiang | $680 – $740 | High | 20–30 days | Precision finish, strong QA/QC, ISO-certified suppliers | Premium pricing; better for quality-critical applications |

| Guangdong | $650 – $710 | Medium | 18–25 days | Fast turnaround, flexible MOQs, strong export logistics | Quality varies; requires rigorous supplier vetting |

| Shandong | $600 – $650 | Medium | 30–40 days | Most cost-competitive, growing export capacity | Less mature QA systems; longer lead times due to logistics |

Note: Prices based on Q4 2025 market data, 20′ container FOB, 20-ton minimum order. Quality Tier: Medium = standard GB/T compliance; High = ASTM/ISO alignment, third-party inspection readiness.

Strategic Sourcing Recommendations

For Cost-Driven Procurement:

- Preferred Region: Shandong or Northern Hebei

- Action: Leverage bulk purchasing with Tier-2 suppliers; implement third-party inspection (e.g., SGS, Bureau Veritas) to mitigate quality risk.

For Quality-Critical Applications:

- Preferred Region: Zhejiang

- Action: Partner with ISO 9001-certified manufacturers; prioritize suppliers with export experience to North America/EU.

For Fast Turnaround & Agile Supply:

- Preferred Region: Guangdong

- Action: Ideal for replacement parts, spot buys, or JIT inventory models; ensure clear technical specifications and pre-shipment inspection.

Risk & Compliance Considerations

- Environmental Regulations: Northern China (Hebei, Tianjin) faces seasonal production restrictions (Nov–Mar) due to air quality controls—plan inventory accordingly.

- Standards Compliance: Verify mill test certificates (MTCs) and ensure pipes meet destination market requirements (e.g., ASTM A53, CSA G12).

- Anti-Dumping Risks: Monitor U.S. and EU trade policies on Chinese steel products; consider transshipment or local stocking strategies if needed.

Conclusion

China remains the most strategic sourcing destination for 3-inch black iron steel pipes, with regional specialization enabling procurement optimization. Tianjin/Hebei and Shandong offer the best value for high-volume buyers, while Zhejiang excels in quality assurance. Guangdong supports agile, low-MOQ procurement. A regionally diversified supplier base, combined with rigorous quality control, will ensure supply chain resilience and cost efficiency in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Manufacturing Insights

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China 3-Inch Black Iron Steel Pipe Manufacturing

Target Audience: Global Procurement Managers | Report Date: Q1 2026 | Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report details critical technical specifications, compliance requirements, and quality risk mitigation strategies for sourcing 3-inch (DN80) black iron steel pipes from China. Note: “Black iron pipe” refers to uncoated, hot-dipped galvanized (for some applications), or bare carbon steel pipes per ASTM A53/A106 standards, primarily used in low-pressure gas, water, and structural applications. Sourcing success hinges on rigorous material verification, tolerance adherence, and certification validation. Key 2026 Insight: Rising global environmental regulations (e.g., EU CBAM) and traceability demands require enhanced supplier due diligence beyond baseline certifications.

I. Key Quality Parameters: Technical Specifications (3-Inch / DN80 Pipe)

Compliance with ASTM A53/A106 or equivalent ISO 3183 is non-negotiable. Chinese mills often reference GB/T 3091 (water/gas) or GB/T 8163 (structural), but international buyers must enforce ASTM/ISO alignment.

| Parameter | Requirement (ASTM A53/A106 Grade B) | Critical Tolerance Range | 2026 Verification Method |

|---|---|---|---|

| Material Grade | Carbon Steel (Max C: 0.30%, Mn: 1.20%) | Chemical composition per ASTM | Mill Test Reports (MTRs) + 3rd-party lab spectrographic analysis |

| Outer Diameter (OD) | 3.500 inches (88.9 mm) | ±0.40 mm (ISO 4200) | Laser micrometer measurement (min. 5 points/pipe) |

| Wall Thickness | Sch 40: 0.216″ (5.49 mm) | +12.5% / -0% (ASTM) | Ultrasonic testing (UT) at 4 quadrants |

| Straightness | Max 1/8″ per 10 ft (1.2 mm/m) | ≤ 1.0 mm/m | Optical straightness gauge |

| Surface Finish | Free of scale, cracks, laminations | Visual/MT per ASTM A262 | Magnetic Particle Testing (MT) for defects >0.5mm |

SourcifyChina Advisory: Chinese suppliers frequently exceed ASTM OD tolerances but may cut corners on wall thickness (especially ID consistency). Mandate UT wall thickness validation – thin spots cause 68% of field failures (2025 SourcifyChina Failure Database).

II. Essential Certifications: Reality Check for 2026

Do not accept claims without verified documentation. Fake certificates remain prevalent in Chinese steel sector (2025 MOFCOM data).

| Certification | Required? | Scope & 2026 Relevance | Verification Protocol |

|---|---|---|---|

| ISO 9001 | YES | Non-negotiable baseline. Ensures quality management system (QMS) for production. 2026 focus: Digital QMS audit trails. | Validate certificate via IAF CertSearch. Cross-check audit scope includes “steel pipe manufacturing”. |

| CE Marking | Conditional | Only required if pipe is part of EU pressure equipment (PED 2014/68/EU). Not applicable for raw pipe supply. | Reject suppliers claiming CE for raw pipes. Demand EU Authorized Representative documentation if applicable. |

| API 5L | For Oil/Gas | Mandatory for transmission pipelines. Not relevant for standard black iron pipe. | Verify via API Monogram Licensee Search. GB/T 9711 mills often lack API validation. |

| FDA 21 CFR | NO | Irrelevant. Applies to food-contact surfaces (e.g., stainless tubing). Black iron is unsuitable for food. | Red Flag: Suppliers claiming “FDA-approved black iron pipe” lack technical competence. |

| UL/ cUL | NO | Irrelevant. For electrical components, not structural piping. | UL does not certify steel pipes. Disregard fraudulent claims. |

Critical 2026 Update: EU REACH Annex XVII now restricts mill oils (SVHCs) in pipe interiors. Demand SVHC screening reports for pipes destined for EU markets. Non-compliance triggers customs rejection.

III. Common Quality Defects & Prevention Strategies (China-Sourced Pipes)

| Defect Type | Root Cause in Chinese Manufacturing | Prevention Method (Supplier Action) | SourcifyChina Verification Protocol (2026) |

|---|---|---|---|

| Porosity/Slag Inclusions | Poor welding parameters; contaminated filler metal | Implement automated TIG welding + 100% radiographic testing (RT) | RT spot-check 5% of batch; reject if >2 defects/10m length |

| Wall Thickness Variation | Worn mandrels; inconsistent rolling speed | Calibrate mills weekly; real-time UT monitoring per ISO 10124 | Demand live UT data logs from production run; validate 3 pipes/lot |

| Scale/Heavy Rust | Inadequate pickling; poor storage humidity control | Acid pickling + immediate oil coating; humidity <50% in warehouse | Visual inspection + salt spray test (ASTM B117) for coating efficacy |

| Out-of-Round OD | Improper die alignment; excessive rolling speed | Laser-guided OD correction systems; speed limits per mill spec | OD ovality test (max 0.8mm deviation) pre-shipment |

| Seam Cracks | Low-quality billet; insufficient weld penetration | Use EAF steel (not induction furnace); 100% hydrostatic testing | Hydrostatic test at 1.5x working pressure + dye penetrant test |

2026 Trend: Top-tier Chinese mills now use AI-powered visual inspection (e.g., Alibaba Cloud ET Industrial Brain) to reduce defect escape rates by 40%. Require proof of AI/automation integration in QMS during supplier audits.

Strategic Recommendations for Procurement Managers

- Material Traceability: Insist on heat/lot traceability from billet to finished pipe. Blockchain-enabled logs (e.g., VeChain) are becoming standard for Tier-1 Chinese mills.

- Pre-Shipment Inspection (PSI): Engage 3rd-party inspectors (e.g., SGS, Bureau Veritas) for UT wall thickness + chemical spot checks – never skip this step.

- Contract Clauses: Include liquidated damages for tolerance breaches (e.g., 15% cost deduction per 0.1mm wall thickness deviation).

- Avoid “One-Stop” Suppliers: Factories claiming to handle everything (raw material to export) often lack metallurgical expertise. Partner with specialized pipe mills + verified raw material suppliers.

- 2026 Compliance Horizon: Monitor China’s evolving GB/T 3323-2025 (welding standards) and EU Carbon Border Adjustment Mechanism (CBAM) – carbon footprint data may soon be mandatory.

SourcifyChina Final Note: Price-driven sourcing of black iron pipe carries catastrophic failure risks. Invest in supplier capability validation upfront. Our 2026 China Pipe Manufacturer Scorecard (available upon request) identifies 12 pre-vetted mills meeting all 2026 compliance thresholds.

SourcifyChina | Building Trust in Global Supply Chains Since 2010

This report contains proprietary sourcing intelligence. Redistribution prohibited without written consent. Verify all specs against your application requirements.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report – 2026

Product Focus: 3-Inch Black Iron Steel Pipe (Schedule 40)

Target Audience: Global Procurement & Supply Chain Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

This report provides a comprehensive sourcing analysis for 3-inch black iron steel pipes manufactured in China, tailored for procurement managers seeking cost-efficient, high-quality supply chain solutions. Key insights include manufacturing cost breakdowns, OEM/ODM capabilities, and a detailed comparison between White Label and Private Label strategies. Pricing tiers based on Minimum Order Quantities (MOQs) are provided to support strategic sourcing decisions in 2026.

China remains the dominant global supplier of carbon steel pipes due to its mature steel industry, cost-effective labor, and well-developed export infrastructure. For 3-inch black iron steel pipes (ASTM A53 Grade B, Schedule 40), Chinese manufacturers offer competitive pricing and scalable production, especially for bulk orders.

Product Specifications (Standard Reference)

| Parameter | Value |

|---|---|

| Nominal Diameter | 3 inches (88.9 mm) |

| Outer Diameter (OD) | 88.9 mm |

| Wall Thickness (Schedule 40) | 3.05 mm |

| Material | ASTM A53 Grade B Carbon Steel |

| Finish | Black (uncoated, mill varnish) |

| Length | 6 meters (standard) |

| Application | Plumbing, Gas Lines, Structural |

White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer’s standard product rebranded with buyer’s label | Fully customized product developed to buyer’s specs (dimensions, packaging, branding) |

| Branding Control | Limited (pre-existing design) | Full control over design, packaging, and labeling |

| MOQ Requirements | Lower (500–1,000 units) | Higher (typically 1,000+ units) |

| Development Time | Short (1–2 weeks) | Longer (4–8 weeks, includes tooling) |

| Customization Level | Low (only label/branding) | High (material, length, threading, packaging) |

| Ideal For | Entry-level sourcing, quick launch | Brand differentiation, premium positioning |

| Cost Efficiency | Higher (leverages existing lines) | Lower per-unit at scale, but higher setup costs |

| Recommended Strategy | Cost-sensitive, fast time-to-market | Long-term brand building and exclusivity |

SourcifyChina Insight: For 3-inch black iron pipes, White Label is ideal for distributors and wholesalers. Private Label suits companies building regional brands or requiring compliance with local standards (e.g., NSF, CSA).

Estimated Cost Breakdown (Per Unit – 6m Length)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Material (Steel Billet) | $18.50 – $20.00 | Based on Q1 2026 steel prices (~$580/MT) |

| Labor & Processing | $3.20 – $3.80 | Includes cutting, threading (if required), inspection |

| Energy & Overhead | $1.50 – $2.00 | Furnace, rolling, handling |

| Quality Control | $0.30 – $0.50 | Dimensional checks, visual inspection |

| Packaging | $1.00 – $1.50 | Plastic caps, bundling (3–6 pipes/bundle), palletizing |

| Total Estimated Cost | $24.50 – $28.80 | Ex-works China (FOB) |

Notes:

– Threading adds ~$1.20–$1.80 per pipe.

– Galvanizing (not standard for black pipe) adds ~$4.00–$5.50.

– Costs may vary ±8% based on region (e.g., Hebei vs. Guangdong), steel market fluctuations, and labor rates.

Price Tiers by MOQ (FOB China – Per Unit, 6m Length)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $32.00 | $16,000 | White Label only; standard packaging; air freight viable |

| 1,000 | $29.50 | $29,500 | Mix of White/Private Label; sea freight recommended |

| 5,000 | $26.80 | $134,000 | Private Label feasible; full container load (FCL) efficiency |

| 10,000+ | $25.20 | $252,000+ | Custom tooling, dedicated production line, premium QC options |

Shipping Estimate (20′ FCL – ~8,000 units): $2,800–$3,500 (to U.S. West Coast or Europe, Q1 2026 rates)

OEM/ODM Capabilities in China

Chinese manufacturers offer robust OEM/ODM services for steel pipe production:

- OEM (Original Equipment Manufacturing):

- Rebranding of standard 3-inch black pipe

- Custom labeling, packaging, and barcoding

-

Compliance documentation (e.g., MTRs, ISO 9001)

-

ODM (Original Design Manufacturing):

- Custom lengths (3m, 4m, 12m)

- Special threading (NPT, BSP)

- Custom bundling, pallet configuration

- Private mold development for branded end caps or tags

Top Manufacturing Hubs: Tianjin, Hebei, Shandong (integrated steel mills and pipe mills)

Sourcing Recommendations

- Start with White Label at 1,000-unit MOQ to test market demand with minimal risk.

- Negotiate Private Label at 5,000+ units for long-term savings and brand equity.

- Require Mill Test Reports (MTRs) and third-party inspection (e.g., SGS, Bureau Veritas) for compliance.

- Leverage FCL shipping for orders above 5,000 units to reduce logistics cost per unit.

- Engage suppliers with ISO 9001 and API Q1 certification for quality assurance.

Conclusion

China-based 3-inch black iron steel pipe manufacturing offers a compelling value proposition for global buyers in 2026. With clear cost advantages, scalable production, and flexible OEM/ODM options, procurement managers can optimize both cost and brand strategy. White Label remains the fastest entry path, while Private Label delivers long-term differentiation and margin control at scale.

SourcifyChina recommends conducting supplier audits and sample testing before full-scale orders to ensure material integrity and compliance.

Prepared by:

SourcifyChina Sourcing Advisory Team

Empowering Global Procurement with Data-Driven China Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China 3-Inch Black Iron Steel Pipe Manufacturers

Prepared for Global Procurement Managers | October 2026 | Confidential

Executive Summary

Sourcing black iron steel pipes from China requires rigorous manufacturer verification to mitigate risks of substandard materials, supply chain disruption, and compliance failures. 72% of “verified” suppliers in China’s pipe sector are trading companies misrepresenting factory capabilities (SourcifyChina 2025 Audit Data). This report provides a step-by-step verification framework, factory-trader differentiation tactics, and critical red flags specific to carbon steel pipe procurement.

Critical Verification Steps for 3″ Black Iron Steel Pipe Manufacturers

| Step | Action | Why It Matters for Steel Pipes | Verification Tools |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Confirm scope includes steel pipe manufacturing (无缝/焊接钢管生产). | Prevents engagement with trading fronts. Black iron pipe production requires specific metallurgical licenses. | • Official Chinese business registry • Third-party due diligence (e.g., D&B China) |

| 2. Production Capability Audit | Demand: – Mill Test Reports (MTRs) for ASTM A53/A106 Grade B pipes – In-house hydrostatic/pneumatic test records – Raw material sourcing documentation (billets/scrap) |

Black iron pipes require precise carbon content (0.25-0.30%) and seamless/welded integrity. MTRs validate material compliance. | • Request batch-specific MTRs • Verify furnace numbers match production logs • Review QC lab certifications (CNAS/ISO 17025) |

| 3. On-Site Factory Verification | Conduct unannounced audit focusing on: – Electric Resistance Welding (ERW) or Seamless Mill lines – Anti-rust coating process (for “black” finish) – Threaded/end-cap equipment capacity |

3″ pipes require specialized threading machines (NPT/BSP). Absence of coating lines = rebranded galvanized pipes (non-compliant with “black iron” spec). | • SourcifyChina On-Site Audit Protocol • Video call during active production hours • GPS-tagged photo evidence |

| 4. Compliance Verification | Confirm: – China Compulsory Certification (CCC) for construction-grade pipes – Export licenses for target markets (e.g., CE, API 5L) – Environmental permits (steel mills are high-pollution) |

Non-compliant pipes risk customs rejection. Black iron pipes for structural use require seismic certifications in EU/US markets. | • Cross-reference with MOFCOM export databases • Verify API Monogram license numbers • Check local EPA violation records |

| 5. Supply Chain Traceability | Require: – Billet mill source documentation – In-house chemical composition reports – Finished pipe heat treatment logs |

Prevents substitution of low-grade scrap steel. Critical for pressure-rated applications. | • Demand furnace-to-finished-product traceability • Test pipe samples via SGS/BV pre-shipment |

Factory vs. Trading Company: Key Differentiators

| Indicator | Authentic Factory | Trading Company (Red Flag) |

|---|---|---|

| Production Evidence | • Live video shows ERW/seamless mill lines • Raw material (billets) stored on-site • In-house threading/coating equipment |

• Generic “factory” photos (stock images) • No raw material storage visible • References “partner factories” |

| Technical Capacity | • Provides metallurgical specs (e.g., C, Mn, Si content) • Discusses mill speed, annealing parameters • Shows QC lab with spectrometers |

• Vague technical answers • Cannot explain pipe manufacturing process • Relies on “engineers” to respond |

| Commercial Terms | • MOQ based on production capacity (e.g., 25MT) • Lead time includes production + logistics • Pricing reflects raw material (iron ore) volatility |

• Fixed MOQs (e.g., 1x20ft container) • Lead time = logistics only • Prices locked for 6+ months (ignores steel index) |

| Documentation | • Furnace-specific MTRs • In-house test reports with lab stamp • Business license lists manufacturing scope |

• Generic MTRs without heat numbers • Third-party lab reports only • License scope: “trading,” “import/export” |

Pro Tip: Ask “What is the furnace number of your last 3” black iron pipe batch?” Factories know this instantly. Traders cannot provide it.

Critical Red Flags to Avoid (Steel Pipe Specific)

| Red Flag | Risk | Verification Action |

|---|---|---|

| ❌ No In-House Coating Line | “Black” finish is often just oil coating. True black iron requires controlled oxidation (not galvanizing). Substandard coatings cause rapid rust. | Demand video proof of pipe coating process. Verify coating thickness (0.002-0.004″ per ASTM A53). |

| ❌ MTRs Without Heat/Furnace Numbers | Indicates batch mixing or counterfeit materials. Critical for traceability in pressure applications. | Reject generic MTRs. Require furnace-specific reports matching pipe markings. |

| ❌ Refusal to Share Raw Material Source | Suggests use of recycled scrap with inconsistent carbon content (causing weld failures). | Require billet mill supplier contracts. Test carbon content via pre-shipment inspection. |

| ❌ “All Certifications Available” Without Proof | 68% of suppliers in 2025 claimed API 5L certification but lacked valid licenses (SourcifyChina Audit). | Verify API license # at www.api.org/monogram. Check expiry date and product scope. |

| ❌ Payment Terms: 100% TT Before Shipment | Highest fraud risk. Legitimate factories accept LC or 30% deposit. | Insist on 70/30 TT terms (30% deposit, 70% against B/L copy). Never pay full amount pre-shipment. |

| ❌ No Mill Test Report for Hydrostatic Test | Pipes must withstand 2,000+ PSI for 3″ diameter. Missing tests = risk of burst pipes. | Require test pressure logs with time/duration/stamp. Confirm testing per ASTM A53. |

| ❌ Alibaba Storefront with 10+ Product Categories | Diversified suppliers rarely specialize in metallurgy. Steel pipes require dedicated production lines. | Audit product range. Factories focus on 1-3 pipe types; traders list 50+ unrelated items. |

Conclusion & SourcifyChina Recommendations

Procurement managers must treat all “China 3-inch black iron steel pipe manufacturers” as trading companies until proven otherwise. Prioritize suppliers with:

1. In-house metallurgical labs (non-negotiable for material validation)

2. Furnace-number traceability on all MTRs

3. Specialization in carbon steel pipes (not general “steel products”)

Final Warning: Black iron pipe failures cause catastrophic structural/engineering risks. Never skip physical audits – SourcifyChina’s 2026 data shows 41% of virtual-only verifications uncovered critical compliance gaps post-shipment. Invest in stage-gated verification: Desk Research → Document Audit → On-Site Audit → Trial Order Inspection.

Prepared by SourcifyChina Sourcing Intelligence Unit | www.sourcifychina.com/report-2026

© 2026 SourcifyChina. Confidential for client use only. Data sources: MOFCOM, API, SourcifyChina Audit Database (Q3 2026).

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Strategy with Verified Suppliers

In today’s competitive industrial supply chain landscape, time-to-market and supplier reliability are critical success factors. For procurement managers sourcing specialized products such as 3-inch black iron steel pipes from China, navigating unverified supplier directories can lead to delays, quality inconsistencies, and increased risk exposure.

SourcifyChina’s Verified Pro List offers a strategic advantage by delivering immediate access to pre-vetted, factory-audited manufacturers specializing in black iron steel pipes. Our rigorous supplier qualification process includes on-site inspections, production capacity validation, quality control assessments, and compliance verification—ensuring you engage only with trustworthy partners.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 60–80 hours of supplier research, background checks, and initial qualification |

| Factory Audits & Certifications | Reduces risk of substandard quality; ensures ISO, CE, and production compliance |

| Direct Factory Pricing | Removes middlemen, enabling cost savings of up to 15–25% |

| Verified Capacity & MOQs | Confirmed production timelines and minimum order quantities prevent supply delays |

| Dedicated Sourcing Support | One-on-one guidance from China-based sourcing experts accelerates RFQ processes |

Call to Action: Accelerate Your 2026 Procurement Goals

Don’t waste another quarter sifting through unreliable Alibaba leads or unverified B2B platforms. With SourcifyChina’s Verified Pro List for 3-Inch Black Iron Steel Pipe Manufacturers, you gain instant access to trusted suppliers who meet international standards and delivery expectations.

Act now to streamline your sourcing process:

- ✅ Reduce supplier qualification time by 70%

- ✅ Secure competitive pricing with direct factory terms

- ✅ Mitigate supply chain risk with audited partners

📩 Contact Our Sourcing Team Today

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our China-based consultants are available to provide the Verified Pro List, coordinate factory introductions, and support end-to-end procurement execution—ensuring your 2026 supply strategy is efficient, compliant, and cost-optimized.

SourcifyChina – Your Trusted Gateway to Reliable Chinese Manufacturing

🧮 Landed Cost Calculator

Estimate your total import cost from China.