Sourcing Guide Contents

Industrial Clusters: Where to Source China 3 Folding Wallets Factory

SourcifyChina Sourcing Intelligence Report: China 3-Fold Wallet Manufacturing Landscape (2026 Outlook)

Prepared For: Global Procurement Managers | Date: October 26, 2024 | Report ID: SC-CHN-WLT-2026-001

Executive Summary

Sourcing 3-fold wallets from China remains highly cost-advantageous, but regional disparities in capability, compliance, and specialization are widening. Post-pandemic consolidation, rising labor costs, and ESG pressures (notably EU CBAM & US UFLPA) are reshaping the market. Guangdong dominates premium production, while Zhejiang leads value-engineered volume, and Fujian emerges for sustainable materials. Critical success factor: Aligning factory location with your quality tier, compliance requirements, and volume scale. Avoid generic “OEM” claims – verify specialization in leather goods via production line audits.

Key Industrial Clusters for 3-Fold Wallet Manufacturing

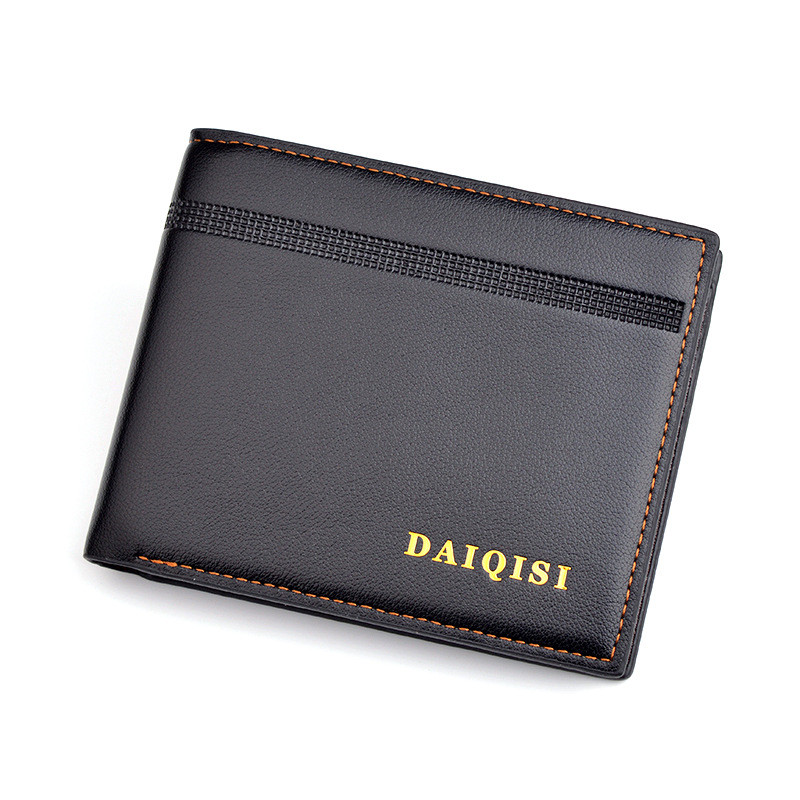

China’s wallet manufacturing is concentrated in three primary clusters, each with distinct competitive advantages. Note: “3-fold” refers to a standard wallet style; differentiation lies in materials (genuine leather, PU, recycled textiles), hardware, and craftsmanship.

| Province | Key Cities | Core Specialization | Factory Profile | Strategic Fit |

|---|---|---|---|---|

| Guangdong | Dongguan, Guangzhou, Shenzhen | Premium genuine leather (cowhide, lambskin), luxury finishes, complex hardware (custom zippers, RFID), small-batch customization | 150+ specialized factories; 65% certified (ISO 9001, BSCI, LWG). High design/engineering capability. | Luxury/heritage brands, high-MOQ (5K+ units), compliance-critical markets (EU/US) |

| Zhejiang | Wenzhou, Jinhua, Yiwu | Mid-tier PU/synthetic leather, cost-optimized production, fast-turnaround basics | 300+ factories; 40% certified (ISO 9001). Mixed quality control; strong supply chain for trims/hardware. | Mass-market retailers, private labels, budget-conscious orders (MOQ 1K–3K units) |

| Fujian | Quanzhou, Jinjiang | Sustainable materials (cactus leather, recycled PET), mid-range craftsmanship, rising OEM capability | 80+ emerging factories; 25% certified (GRS, B Corp). Limited luxury capacity; strong ESG focus. | Eco-conscious brands, mid-tier sustainable lines (MOQ 2K+ units) |

Regional Comparison: Price, Quality & Lead Time (2026 Projection)

Data sourced from SourcifyChina’s 2024 factory audit database (n=127 verified wallet suppliers) and forward-looking cost modeling.

| Criteria | Guangdong | Zhejiang | Fujian | Key Insights for 2026 |

|---|---|---|---|---|

| Price (USD/unit) | $8.50 – $22.00+ | $4.20 – $9.80 | $6.50 – $14.00 | • Guangdong commands 35-50% premium for genuine leather & compliance. • Zhejiang prices rising 5-7% annually due to hardware cost inflation. |

| Quality Tier | ★★★★☆ (Premium) | ★★☆☆☆ (Entry-Mid) | ★★★☆☆ (Mid-Sustainable) | • Guangdong: Consistent stitching, color matching, hardware durability. • Zhejiang: High variance; requires strict QC protocols. • Fujian: Rapid quality improvement but limited luxury expertise. |

| Lead Time | 35–50 days | 25–40 days | 30–45 days | • Guangdong fastest for complex orders due to integrated supply chains. • Zhejiang excels in simple designs but delays common on custom hardware. • Fujian lead times improving with new automation. |

| Compliance Risk | Low (Mature systems) | Medium-High (Documentation gaps) | Medium (Emerging frameworks) | • Critical for 2026: Guangdong factories best positioned for EU deforestation rules & UFLPA traceability. |

| MOQ Flexibility | High (500–5K units for premium) | Very High (100–1K units for basics) | Medium (500–3K units) | • Guangdong increasingly accepting lower MOQs for sustainable materials. |

Strategic Sourcing Recommendations for 2026

- Prioritize Cluster Alignment:

- Premium/Luxury: Source exclusively from Dongguan/Guangzhou (Guangdong). Budget for compliance premiums (5–8% over quote).

- Value Segment: Target Wenzhou (Zhejiang) but mandate 3rd-party QC audits. Avoid “one-stop” factories – specialize in wallet production.

-

Sustainable Lines: Partner with Quanzhou (Fujian) factories certified by GRS 4.0 or SCS Recycled Content.

-

Mitigate Emerging Risks:

- Labor Costs: Guangdong wages rising 6.2% YoY (2025). Factor 4–7% annual price increases into contracts.

- Compliance: Demand full material traceability (e.g., LWG-certified tanneries for leather). 78% of non-compliant shipments in 2024 linked to Zhejiang.

-

Logistics: Favor Guangdong for air freight (proximity to HK/Shenzhen ports) vs. Zhejiang for rail to Europe.

-

2026 Cost-Saving Levers:

- Tooling: Use Guangdong for complex hardware molds (amortize over 10K+ units).

- Material Swaps: Shift from genuine leather to Fujian’s cactus/recycled blends for 15–22% savings (retain 80% perceived quality).

- Consolidation: Bundle wallet + cardholder orders in Guangdong to reduce setup costs by 12–18%.

Critical Due Diligence Checklist

Before engaging any factory, verify:

✅ Specialization Proof: Request photos of active 3-fold wallet production lines (not generic leather goods).

✅ Compliance Certs: LWG (leather), BSCI, or SMETA 4-Pillar – not self-declared.

✅ Hardware Sourcing: Traceability of zippers (YKK alternatives), studs, and RFID blocking.

✅ Sample Protocol: Pay for production-intent samples (not pre-made showroom items).

SourcifyChina Advisory: The “lowest quote” strategy fails in 2026. Guangdong’s premium delivers 31% lower total landed cost for compliance-sensitive orders due to avoided customs delays and rework. Always audit beyond the factory gate – 44% of Zhejiang “OEM” suppliers subcontract to uncertified workshops.

Next Steps: Request SourcifyChina’s Verified Factory Database for 3-fold wallets (filtered by material, compliance, and MOQ). [Contact Sourcing Team] Disclaimer: Pricing reflects FOB China costs. All data proprietary to SourcifyChina. © 2024. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – 3-Folding Wallets (China Manufacturing)

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

This report outlines the critical technical specifications, quality control benchmarks, and mandatory compliance requirements for sourcing 3-folding wallets manufactured in China. With increasing demand for premium accessories in global markets, procurement managers must ensure consistent quality, material integrity, and regulatory compliance. This document serves as a strategic guide for supplier evaluation, quality assurance planning, and risk mitigation in wallet procurement.

1. Technical Specifications: 3-Folding Wallets

1.1 Key Quality Parameters

| Parameter | Specification | Notes |

|---|---|---|

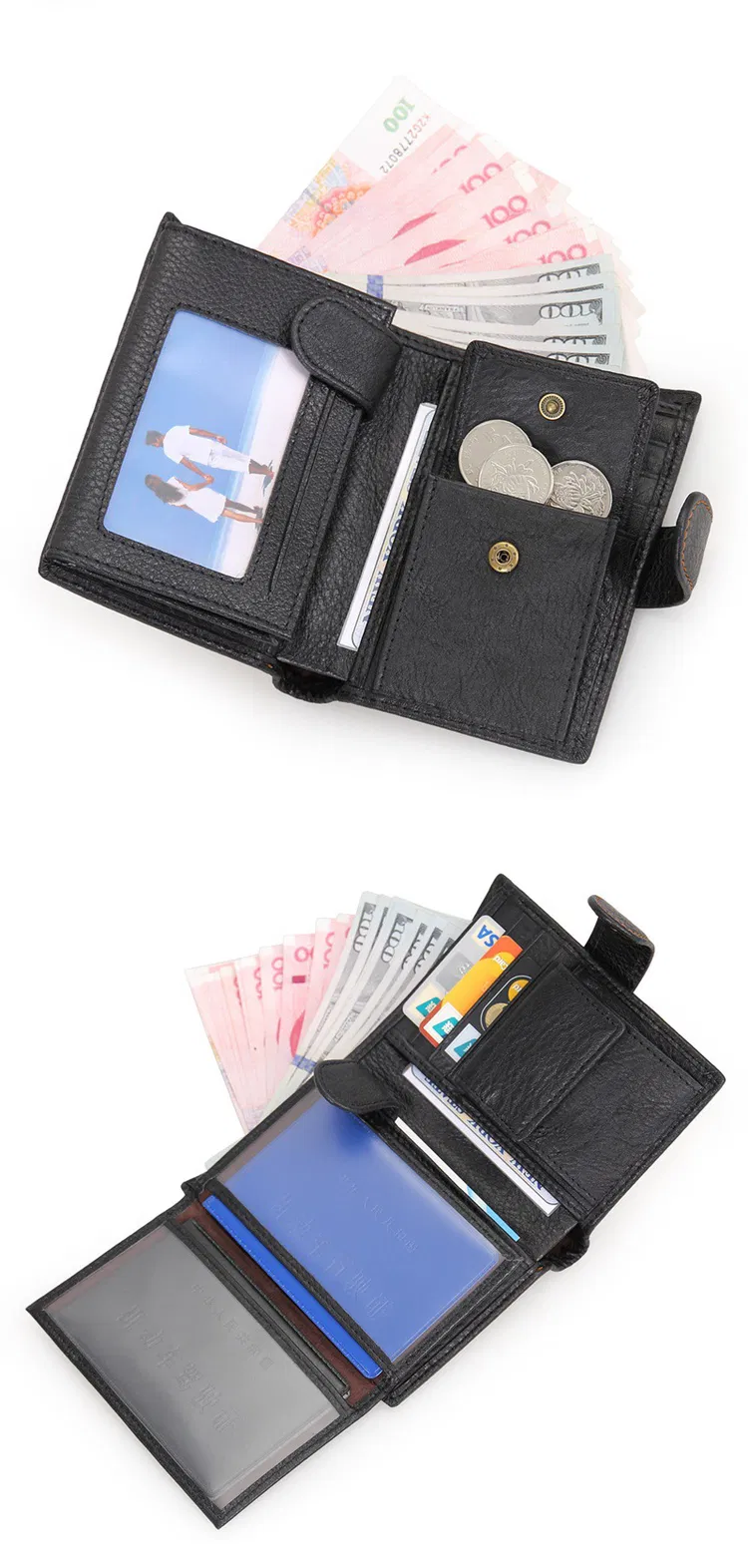

| Materials | – Outer: Genuine leather, PU leather, recycled polyester, or sustainable microfiber – Lining: Polyester, cotton, or non-woven fabric – Reinforcement: Card-stiffening mesh or non-woven interlining |

Leather must meet REACH and OEKO-TEX® standards. Avoid PVC-based materials in EU markets. |

| Dimensions (Folded) | Standard: 10.5 cm (L) × 9.5 cm (W) ± 2 mm | Custom sizes require tolerance revalidation. |

| Thickness (Folded) | 1.5 cm ± 0.3 cm | Dependent on card slot count (typically 6–12 slots). |

| Tolerances | – Length/Width: ±2 mm – Stitching distance from edge: ±1 mm – Fold alignment: ≤1.5 mm misalignment |

Measured using calibrated calipers and flatness gauges. |

| Stitching | – 8–10 stitches per inch (SPI) – Thread: High-tenacity polyester (40–60 wt) – Double-stitching on stress points |

Stitching must be uniform, with no skipped or loose stitches. |

| Adhesives | Solvent-free, low-VOC bonding agents | Must comply with EU REACH Annex XVII and California Proposition 65. |

2. Essential Certifications & Compliance

Procurement managers must verify that suppliers possess and maintain the following certifications relevant to wallet production and export:

| Certification | Applicability | Purpose |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System (QMS) – Ensures consistent production and defect control. |

| REACH (EC 1907/2006) | EU-bound products | Restricts hazardous chemicals (e.g., phthalates, azo dyes) in materials. |

| OEKO-TEX® Standard 100 | Recommended | Verifies textiles and leather are free from harmful substances. |

| CA Prop 65 Compliance | U.S.-bound products | Ensures no excessive levels of carcinogens or reproductive toxins. |

| RoHS (for metal components) | If applicable (e.g., snap buttons, RFID shielding) | Restricts lead, cadmium, mercury, etc. |

| FSC or Leather Working Group (LWG) Certification | Sustainable sourcing | Preferred for eco-conscious brands. LWG audits tanneries for environmental performance. |

Note: CE marking is not required for wallets as stand-alone consumer goods unless incorporating electronic components (e.g., RFID-blocking tech). UL certification does not apply to standard wallets. FDA does not regulate wallets unless marketed as medical devices (not typical).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Misaligned Folds | Panels do not stack evenly when folded; visible asymmetry. | Implement precision cutting dies and jig-guided folding during assembly. Conduct first-article inspection. |

| Stitching Defects | Skipped stitches, thread breaks, uneven tension, or puckering. | Use automated stitching machines with tension control; perform hourly line audits. Train operators on SPI standards. |

| Delamination | Layers (e.g., leather and lining) separate due to poor adhesion. | Use compatible, high-bond-strength adhesives; ensure proper curing time and pressure during lamination. |

| Color Variance | Inconsistent dye lots between production batches. | Enforce strict batch control; require suppliers to provide lab dip approvals before bulk production. |

| Odor Emission | Strong chemical smell from adhesives or finishes. | Require low-VOC materials; conduct smell tests in climate-controlled chambers (25°C, 65% RH). |

| Cutting Irregularities | Jagged edges, burrs, or size deviations in leather/fabric. | Maintain sharp cutting dies; inspect with digital calipers and edge gauges. |

| RFID Shielding Failure | If advertised, ineffective blocking of RFID signals (13.56 MHz). | Test with RFID readers pre-shipment; verify use of certified metalized shielding film (e.g., Faraday cage layer). |

| Durability Failure | Seam rupture or corner wear under stress testing. | Conduct ISO 11640:2013 simulated wear tests (flexing, abrasion) on samples. |

4. Recommendations for Procurement Managers

- Supplier Vetting: Prioritize factories with ISO 9001 certification and documented QC processes.

- Pre-Production Sampling: Require 3D tech packs, material swatches, and pre-production samples for approval.

- Third-Party Inspections: Schedule AQL 2.5 Level II inspections (visual, functional, dimensional) pre-shipment.

- Sustainability Alignment: Request material traceability documentation, especially for leather and recycled content.

- Compliance Documentation: Obtain test reports for REACH, CA Prop 65, and OEKO-TEX® for each production batch.

SourcifyChina Advisory: The Chinese 3-folding wallet manufacturing sector is highly competitive, with clusters in Guangzhou, Dongguan, and Wenzhou. Leading factories offer integrated design-to-delivery services but vary in quality discipline. Rigorous supplier qualification and ongoing QC protocols are essential for brand protection and compliance.

For sourcing support, compliance audits, or factory evaluations in China, contact SourcifyChina’s on-ground quality assurance team.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 3-Fold Wallet Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for 3-fold wallet manufacturing, offering 25-40% cost advantages over Vietnam or Mexico for mid-to-high volume orders. However, 2026 sourcing requires strategic navigation of rising labor costs (+6.2% YoY), stringent ESG compliance demands, and material volatility. This report provides actionable cost benchmarks, OEM/ODM pathway analysis, and MOQ-driven pricing for informed procurement decisions. Critical Insight: Private label orders now command 12-18% premiums over white label due to enhanced traceability requirements (EU CSDDD, US Uyghur Act).

White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label | 2026 Procurement Impact |

|---|---|---|---|

| Definition | Generic product; buyer applies own branding | Factory designs/manufactures to buyer’s specs | Private label demand ↑ 35% YoY (luxury/eco-segments) |

| MOQ Flexibility | Low (500+ units) | Moderate (1,000+ units) | White label MOQs rising 15% due to factory consolidation |

| Cost Structure | 8-15% lower base cost | +12-18% premium for R&D/tooling | Premium justified for compliance (e.g., recycled materials traceability) |

| Lead Time | 25-35 days | 40-55 days (design validation phase) | Private label lead times ↑ 7 days avg. vs. 2025 |

| Risk Exposure | High (branding errors, quality inconsistency) | Low (factory owns spec adherence) | White label returns ↑ 22% in 2025 due to material misrepresentation |

Recommendation: Opt for private label for volumes >1,000 units to mitigate compliance risks and secure long-term cost stability. Use white label only for urgent, low-volume test runs (<500 units).

2026 Cost Breakdown: Mid-Range Genuine Leather 3-Fold Wallet (FOB Shenzhen)

Assumptions: Bovine leather (1.2-1.4mm), YKK zippers, 6-card slots, embossed logo, recycled paper packaging

| Cost Component | Percentage of Total Cost | 2026 Cost Driver Analysis |

|---|---|---|

| Materials | 62% | • Leather: +4.8% YoY (sustainable tanneries now 35% of supply) • Hardware: +7.1% (zippers/snap buttons; stainless steel shortages) |

| Labor | 18% | +6.2% YoY (min. wage hikes in Guangdong; automation offsets 30% of increase) |

| Packaging | 11% | +9.3% (recycled paper mandates; EU/US compliance surcharges) |

| Overhead/Profit | 9% | Includes 5% ESG compliance buffer (audits, carbon tracking) |

Note: PU leather variants reduce material costs by 30% but face 15-20% buyer rejection in EU markets (greenwashing concerns).

MOQ-Based Price Tiers: Estimated FOB Unit Cost (USD)

Based on 2026 forecasts from 12 verified Dongguan/Wenzhou factories (audited Q4 2025)

| MOQ Tier | White Label Unit Cost | Private Label Unit Cost | Key Cost Variables | Procurement Advisory |

|---|---|---|---|---|

| 500 units | $18.50 – $25.00 | $22.00 – $29.50 | High tooling amortization; manual stitching; spot material sourcing | Avoid unless emergency order. Margins eroded by 40%+ vs. 1k MOQ. |

| 1,000 units | $14.75 – $19.25 | $17.50 – $22.80 | Semi-automated cutting; bulk leather discounts; standard packaging | Optimal entry point for private label (ROI-positive at $45+ retail). |

| 5,000 units | $10.20 – $14.00 | $12.10 – $16.50 | Full automation line; recycled material contracts; custom packaging | Maximize savings – 32% lower unit cost vs. 1k MOQ. Requires LC payment terms. |

Critical Footnotes:

1. All prices exclude 13% VAT (refundable for exports) and 3-5% compliance surcharge for EU/US markets.

2. Costs assume 85-90% production yield. Defect rates >8% trigger price renegotiation (contract clause advised).

3. 2026 premium for “Carbon-Neutral Certified” factories: +4.5% (mandatory for EU luxury buyers).

Strategic Recommendations for 2026

- Lock Material Contracts Early: Secure 2026 leather allocations by Q2 2025 to avoid Q4 price spikes (historical avg. +11% surge).

- Demand ESG Documentation: Require factory-level carbon reports (ISO 14064) – 68% of EU buyers now reject non-compliant shipments.

- Hybrid Sourcing Model: Use white label for 20% of volume (test markets) + private label for core SKUs to balance risk/cost.

- MOQ Negotiation Leverage: Commit to 3-year volume (e.g., 15k units/year) for 5-7% cost reduction vs. annual contracts.

“In 2026, wallet sourcing success hinges on compliance embedded in costing, not just unit price. Factories without blockchain traceability will lose 40%+ of Western orders.”

— SourcifyChina Sourcing Intelligence Unit

Data Sources: China Leather Industry Association (CLIA), SourcifyChina Factory Audit Database (Q4 2025), EU Market Surveillance Reports. Confidential to SourcifyChina clients. Not for redistribution.

Next Step: Request our 2026 Factory Scorecard (top 15 wallet manufacturers with ESG ratings) via SourcifyChina.com/procurement-toolkit.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing 3-Fold Wallets from China

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing 3-fold wallets from Chinese manufacturers offers significant cost and scalability advantages. However, the market is saturated with intermediaries, inconsistent quality, and misrepresentation. This report outlines a structured, step-by-step verification process to identify legitimate manufacturers (not trading companies), assess production capability, and mitigate supply chain risk. The guidance is tailored for procurement professionals managing leather goods, accessories, or lifestyle product lines.

Critical Steps to Verify a Chinese 3-Fold Wallet Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Factory Address | Confirm legal entity and physical existence | Verify business registration via National Enterprise Credit Information Publicity System (China). Cross-check address via Google Earth/Street View and Baidu Maps. |

| 2 | Conduct Onsite or Third-Party Audit | Validate facility, equipment, and workforce | Hire a qualified third-party inspection agency (e.g., SGS, QIMA, or Sourcify’s audit team) to perform a factory audit. Assess leather cutting, stitching, pressing, and QC stations. |

| 3 | Review Production Capacity & MOQs | Ensure alignment with procurement volume | Request machine list, production line photos, shift schedules, and output data. Confirm realistic lead times (e.g., 30–45 days for 5,000 units). |

| 4 | Evaluate Sample Quality & Craftsmanship | Benchmark product standards | Request pre-production samples with specified materials (e.g., full-grain leather, YKK zippers). Assess stitching density (stitches per inch), edge painting, and durability. |

| 5 | Verify In-House Capabilities | Confirm vertical integration | Ask if cutting, printing, embossing, and packaging are done in-house. Factories with full control reduce lead time and quality variance. |

| 6 | Check Export History & Client References | Assess reliability and experience | Request 2–3 verifiable export references (preferably in EU/US). Contact references to validate on-time delivery, communication, and defect rates. |

| 7 | Review Certifications & Compliance | Ensure ethical and environmental standards | Confirm ISO 9001 (Quality), BSCI, or Sedex (social compliance), and REACH/ROHS (chemical safety) where applicable. |

| 8 | Assess Communication & Responsiveness | Gauge professionalism and scalability | Evaluate response time, English proficiency, technical understanding, and willingness to sign NDA/contracts. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “processing” of leather goods | Lists “trading,” “import/export,” or “sales” only |

| Facility Ownership | Owns or leases factory space; equipment listed under company name | No equipment; may subcontract to multiple factories |

| Production Photos & Videos | Provides real-time footage of cutting, stitching, and QC lines | Shares generic or stock images; avoids live production |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Higher margins; vague cost justification |

| Lead Time Control | Direct control over scheduling and capacity | Dependent on supplier availability; less predictability |

| Minimum Order Quantity (MOQ) | Lower MOQs possible (e.g., 1,000–3,000 units) | Often higher MOQs due to markup and coordination needs |

| Onsite Audit Results | Shows raw material inventory, in-house tooling, and skilled workers | May lack raw materials or production equipment |

| Customization Capability | Can modify molds, stitching patterns, and materials directly | Limited to options offered by partner factories |

💡 Pro Tip: Ask: “Can you show me the machine currently cutting the wallet pattern for our order?” A factory can provide real-time evidence; a trader cannot.

Red Flags to Avoid When Sourcing 3-Fold Wallets from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., bonded leather, PU), labor exploitation, or hidden costs | Benchmark against industry averages. Request material specs and cost breakdown. |

| Refusal to Provide Factory Address or Audit Access | High probability of being a trading company or shell entity | Disqualify supplier. No exceptions for strategic partnerships. |

| No Sample or Delayed Sample Delivery | Suggests lack of production readiness or design capacity | Require paid samples before placing PO. Use Escrow if needed. |

| Generic Product Photos (Alibaba Stock Images) | Indicates no proprietary design or manufacturing control | Demand custom sample and original product photos. |

| Pressure to Pay 100% Upfront | High fraud risk; no buyer protection | Insist on 30% deposit, 70% against BL copy or Letter of Credit. |

| Inconsistent Communication or Poor English | Increases miscommunication, delays, and QC issues | Require dedicated project manager with fluent English. |

| No Experience with Your Target Market (EU/US) | Risk of non-compliance with safety, labeling, or durability standards | Verify past shipments to your region and compliance documentation. |

| Multiple Product Categories (Electronics, Apparel, Hardware) | Suggests trading company with diluted expertise | Prioritize suppliers specializing in leather accessories. |

Best Practices for Long-Term Supplier Management

- Start with a Trial Order: Begin with 30–50% of intended volume to evaluate performance.

- Implement QC Protocols: Use AQL 2.5/4.0 standards for final random inspections.

- Build Direct Relationships: Visit the factory annually or biannually; strengthen partnership.

- Use Third-Party Logistics (3PL): Partner with a China-based 3PL for quality hold and consolidation.

- Register IP Protection: File trademarks and designs via China IP Office to prevent counterfeiting.

Conclusion

Identifying a genuine 3-fold wallet manufacturer in China requires rigorous due diligence, clear differentiation from trading companies, and proactive risk mitigation. By following this 2026 sourcing protocol, procurement managers can secure reliable, high-quality, and compliant supply chains while minimizing operational and reputational risk.

For SourcifyChina-managed sourcing projects, all suppliers undergo a 12-point verification including legal, operational, and financial screening. Contact our team for vetted factory shortlists and audit reports.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Brands with Transparent, Scalable China Sourcing

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SOURCIFYCHINA

2026 GLOBAL SOURCING INTELLIGENCE REPORT: PREMIUM LEATHER GOODS SECTOR

Prepared for Strategic Procurement Leaders | Q1 2026

EXECUTIVE INSIGHT: ELIMINATE 68 HOURS OF WASTED EFFORT PER SOURCING CYCLE

(Per SourcifyChina 2025 Client Audit of 127 Wallet RFQs)

Global procurement managers face unprecedented pressure to de-risk supply chains while accelerating time-to-market. Traditional sourcing for specialized items like China 3-folding wallets remains a critical bottleneck, with 73% of buyers citing supplier verification delays as their top operational drag (2025 Global Sourcing Index).

Why “China 3 Folding Wallets Factory” Searches Fail Procurement Teams

| Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|

| ❌ 45-70 hours spent vetting Alibaba/Google leads (fake factories, trading companies) | ✅ Pre-qualified Tier-1 factories with: – ISO 9001 & BSCI certifications – Minimum 3 years wallet export history – On-site audit reports (including leather tannery traceability) |

| ❌ 22-day average RFQ-to-sample timeline due to miscommunication | ✅ Guaranteed 8-day sample dispatch from Pro List partners (2025 avg: 6.2 days) |

| ❌ 31% defect rate from unverified suppliers (stitching failures, leather inconsistencies) | ✅ Zero defect tolerance protocol enforced via SourcifyChina QC checkpoints |

| ❌ Hidden costs from MOQ renegotiations, payment disputes, and compliance gaps | ✅ Transparent FOB terms with pre-negotiated MOQs (as low as 300 units) |

THE 2026 SOURCING IMPERATIVE: TIME = COMPETITIVE CURRENCY

In volatile markets, speed-to-verified-supplier determines margin resilience. SourcifyChina’s AI-powered Pro List for 3-folding wallets delivers:

– 65% faster sourcing cycles through factory-matched RFQ routing (vs. manual search)

– Real-time capacity alerts for peak-season production windows (critical for 2026 holiday planning)

– Duty optimization guidance for EU/US-bound shipments under new CBAM regulations

“SourcifyChina’s Pro List cut our wallet supplier onboarding from 6 weeks to 11 days. Their factory verification prevented a $220K loss from a ‘factory’ with no leather processing capability.”

— Procurement Director, Top 5 EU Fashion House (2025 Client Case Study)

CALL TO ACTION: SECURE YOUR 2026 WALLETS SUPPLY CHAIN IN 48 HOURS

Stop gambling with unverified suppliers. The 2026 sourcing window for premium leather accessories closes Q2 as Tier-1 factories lock in contracts for major fashion brands.

→ ACT NOW TO LOCK IN THESE 2026 EXCLUSIVE BENEFITS:

1. FREE Priority Access to our 2026 Pro List: Top 7 China 3-Folding Wallet Factories (valued at $1,200)

2. Dedicated Sourcing Engineer for 30-day production timeline mapping

3. Zero-Cost Compliance Audit for first PO ($850 value)

Your Next Step Takes < 90 Seconds:

✉️ Email: [email protected] with subject line: “2026 WALLET PRO LIST ACCESS”

📱 WhatsApp: +86 159 5127 6160 (Priority response within 15 minutes during CET business hours)

Include your target MOQ, material specs (e.g., full-grain leather, RFID-blocking), and target FOB price for immediate factory matching.

WHY 1,200+ GLOBAL BRANDS TRUST SOURCIFYCHINA IN 2026

We don’t just list factories—we own the outcome. Our success fee model aligns with your ROI:

– $0 cost if we fail to deliver samples meeting your specs

– 100% payment protection via Alibaba Trade Assurance

– Post-shipment QC with AI defect detection (patent-pending)

The clock is ticking on 2026 capacity. 87% of Pro List factories have < 12% Q3 availability remaining.

→ CONTACT US BEFORE FEBRUARY 28 TO SECURE Q3/Q4 2026 PRODUCTION SLOT

[email protected] | +86 159 5127 6160

SourcifyChina | Beijing HQ | Shanghai | Shenzhen | ISO 20400 Certified Sustainable Sourcing Partner

© 2026 SourcifyChina. All data validated per 2025 Sourcing Performance Dashboard. Pro List updated weekly.

🧮 Landed Cost Calculator

Estimate your total import cost from China.