Sourcing Guide Contents

Industrial Clusters: Where to Source China 2K Injection Molding Manufacturer

Professional B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing 2K Injection Molding Manufacturers in China

Prepared for: Global Procurement Managers

Author: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

The global demand for precision 2K (two-component) injection molding services continues to rise, driven by industries such as automotive, medical devices, consumer electronics, and home appliances. China remains the dominant manufacturing hub for this specialized capability, offering a mature ecosystem of tooling expertise, automation, and scalable production. This report provides a strategic overview of the Chinese 2K injection molding market, identifying key industrial clusters and evaluating regional differentiators in price, quality, and lead time to support informed procurement decisions.

Market Overview: 2K Injection Molding in China

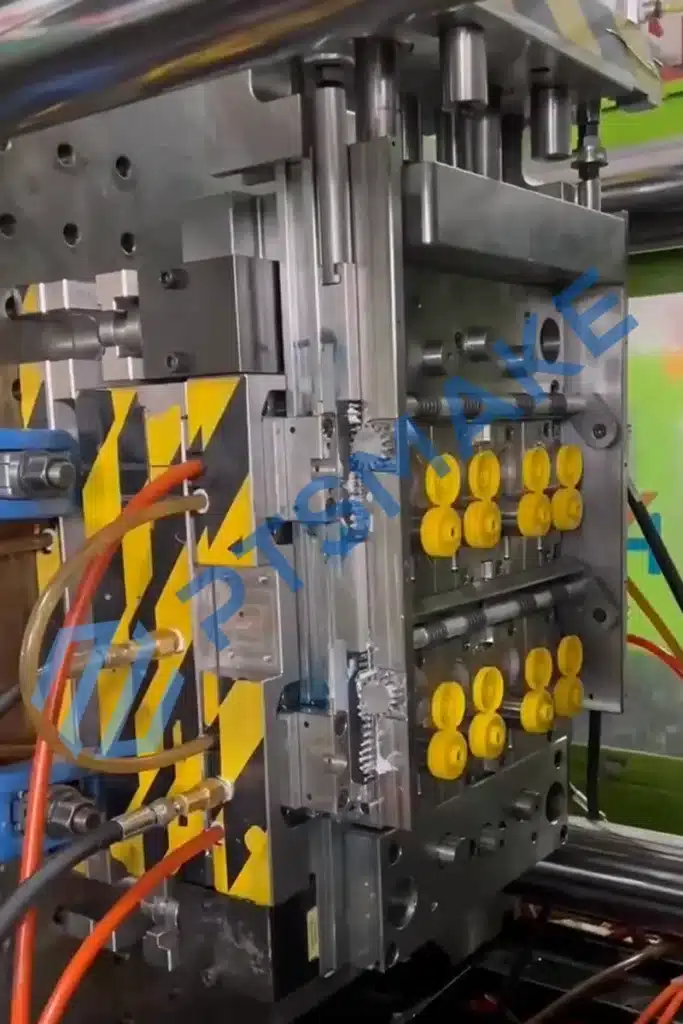

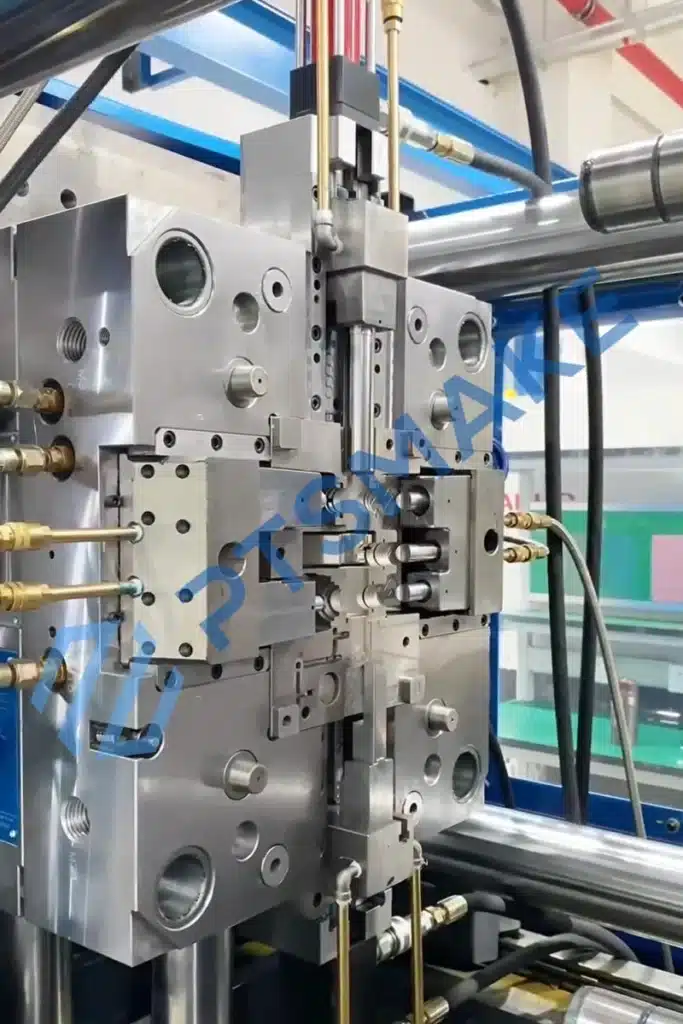

2K injection molding enables the integration of two different materials or colors into a single molded part, offering design flexibility, improved ergonomics, and enhanced product functionality. The process requires advanced machinery, precise mold design, and rigorous process control—capabilities concentrated in select industrial regions across China.

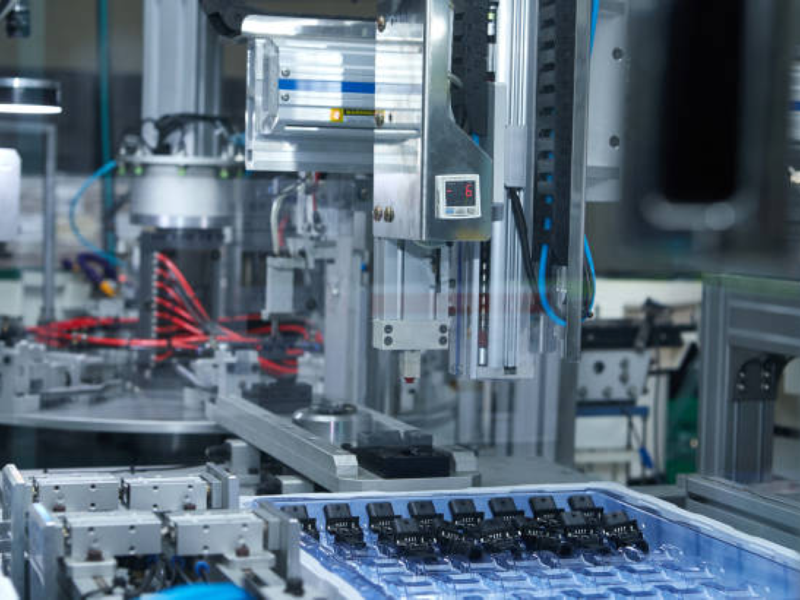

China accounts for over 40% of global plastic injection molding output, with a growing share of high-value 2K production. The country’s competitive advantage lies in its vertically integrated supply chain, skilled technical labor, and rapid adoption of Industry 4.0 automation.

Key Industrial Clusters for 2K Injection Molding

The following provinces and cities are recognized as the primary hubs for 2K injection molding in China:

| Region | Key Cities | Industrial Focus | Notable Strengths |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Guangzhou, Zhongshan | Electronics, Automotive, Consumer Goods | High automation, export-oriented, strong mold-making heritage |

| Zhejiang | Ningbo, Taizhou, Wenzhou | Home Appliances, Medical Devices, Tools | Precision tooling, mid-to-high-end quality, strong engineering |

| Jiangsu | Suzhou, Kunshan, Changzhou | Automotive, Medical, Industrial Equipment | Proximity to Shanghai, German/Japanese manufacturing influence |

| Shanghai | Shanghai (Pudong, Songjiang) | High-Tech, Medical, R&D Prototyping | Advanced R&D, multinationals, high compliance standards |

| Tianjin & Hebei | Tianjin, Langfang | Automotive, Industrial Components | Northern logistics hub, cost-effective labor, proximity to Beijing |

Note: Guangdong and Zhejiang dominate the market, collectively hosting over 60% of high-capacity 2K molding facilities.

Comparative Regional Analysis: Guangdong vs Zhejiang

The two most prominent regions—Guangdong and Zhejiang—offer distinct advantages. The table below compares them across critical procurement KPIs.

| Parameter | Guangdong | Zhejiang | Recommendation Context |

|---|---|---|---|

| Price (Cost Level) | Medium to High | Medium | Guangdong’s coastal location and higher labor costs slightly elevate pricing; Zhejiang offers better value for mid-tier volume projects |

| Quality Level | High (Tier 1 suppliers) to Medium | High (Consistently High) | Zhejiang excels in consistent process control; Guangdong has top-tier players but wider variance among suppliers |

| Lead Time | 18–25 days (avg. tooling + trial) | 20–28 days (avg. tooling + trial) | Guangdong offers faster turnaround due to dense supplier networks and logistics efficiency |

| Tooling Expertise | World-class in Dongguan/Shenzhen | Excellent, especially in Ningbo (global mold export hub) | Both regions are leaders; Ningbo is renowned for mold precision |

| Automation & Industry 4.0 | High adoption (especially in Shenzhen) | Moderate to High | Guangdong leads in smart factory integration |

| Export Readiness | Excellent (direct port access) | Very Good (Ningbo Port) | Both regions are export-competent; Guangdong has edge in global logistics |

| Best For | High-volume production, fast time-to-market, electronics | Medical, precision appliances, quality-critical applications | Align region choice with product complexity and compliance needs |

Strategic Sourcing Insights

1. Supplier Tier Segmentation

- Tier 1 (OEM/ODM Leaders): Concentrated in Shenzhen and Ningbo – serve global brands (e.g., Bosch, Philips, Apple suppliers).

- Tier 2 (Mid-market Specialists): Widespread in Dongguan and Taizhou – ideal for cost-sensitive yet quality-conscious buyers.

- Tier 3 (Regional/Small Scale): Found in secondary cities – suitable only for low-risk, non-medical applications.

2. Quality Assurance Considerations

Procurement managers should prioritize:

– ISO 13485 (for medical) and IATF 16949 (for automotive) certifications.

– In-house mold-making capability (reduces lead time and IP risk).

– Real-time process monitoring (e.g., Moldflow analysis, SPC).

3. Logistics & Risk Mitigation

- Guangdong: Optimal for air and sea freight via Shenzhen/Yantian ports.

- Zhejiang: Leverage Ningbo-Zhoushan Port (world’s busiest by volume) for containerized shipments.

- Diversification Strategy: Dual-source between Guangdong and Zhejiang to mitigate regional disruptions (e.g., typhoons, customs delays).

Conclusion & Sourcing Recommendations

China remains the most strategic source for 2K injection molding, with Guangdong and Zhejiang as the top-tier regions. While Guangdong offers speed and scale, Zhejiang delivers precision and consistency—making it ideal for regulated industries.

Recommended Sourcing Strategy (2026):

- For Time-Sensitive, High-Volume Projects: Source from Dongguan or Shenzhen (Guangdong).

- For Medical, Automotive, or High-Precision Applications: Prioritize Ningbo or Taizhou (Zhejiang).

- For R&D and Prototyping: Consider Suzhou or Shanghai for access to multinationals and pilot lines.

Procurement managers should conduct on-site audits, validate process documentation, and leverage third-party quality inspection services to ensure compliance and performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guide for China-Based 2K Injection Molding Manufacturers (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina | Confidential: Internal Use Only

Executive Summary

China remains the dominant global hub for cost-competitive 2K (two-shot) injection molding, accounting for ~68% of high-volume production capacity (SourcifyChina 2026 Industry Benchmark). However, 32% of procurement failures stem from inadequate vetting of technical capabilities and compliance gaps. This report details critical specifications and certifications to mitigate supply chain risk, reduce NCRs (Non-Conformance Rates) by 15–30%, and ensure regulatory adherence for medical, automotive, and consumer electronics applications.

I. Key Technical Specifications for 2K Injection Molding

2K molding fuses two materials in a single cycle (e.g., rigid/soft touch, conductive/insulating). Precision in material science and process control is non-negotiable.

A. Material Requirements

| Parameter | Critical Specifications | Verification Method |

|---|---|---|

| Material Compatibility | Must achieve >85% interfacial adhesion strength (ASTM D3163); no delamination at -40°C to 120°C | Supplier-provided adhesion test reports + 3rd-party lab validation |

| Moisture Content | ≤0.02% for engineering resins (e.g., PEEK, LCP); ≤0.05% for standard grades (e.g., ABS, TPU) | Pre-production moisture analyzer logs (ISO 15512) |

| Recycled Content | ≤15% for medical/automotive; 0% for Class III medical devices (FDA 21 CFR §820.50) | Material traceability certificates + resin lot testing |

B. Tolerance & Dimensional Control

| Application | Standard Tolerance (mm) | Critical Control Points | Industry Standard |

|---|---|---|---|

| Medical Devices | ±0.025 mm | Wall thickness uniformity, sealing surface flatness | ISO 13485:2026 Annex B |

| Automotive | ±0.05 mm | Undercut geometry, insert alignment | IATF 16949:2026 Sec 8.3 |

| Consumer Electronics | ±0.08 mm | Optical clarity (for lenses), texture consistency | IPC-6012E |

| Note: China’s GB/T 14486-2026 (plastic molding tolerances) aligns with ISO 20457:2025 but requires explicit contractual adherence. |

II. Mandatory Compliance Certifications

Procurement managers must validate certification scope – many Chinese suppliers hold “generic” ISO 9001 but lack application-specific approvals.

| Certification | Relevance for 2K Molding | China-Specific Verification Steps | Risk of Non-Compliance |

|---|---|---|---|

| ISO 13485:2026 | Medical devices (e.g., syringe grips, surgical handles) | Confirm scope covers 2K molding; audit raw material quarantine procedures | Product recall (FDA Class I/II) |

| IATF 16949:2026 | Automotive (e.g., dashboard controls, connectors) | Validate PPAP Level 3 submission capability; check AIAG VDA 1st Article compliance | Line stoppage (OEM penalty: $25k–$50k/hr) |

| FDA 21 CFR Part 820 | Medical devices (US market) | Verify facility is listed in FDA’s FURLS; request Device Master Record samples | Customs seizure (US FDA 76d hold) |

| UL 94 V-0 | Electronics (flammability) | Demand UL Witnessed Test Data (WTDP) – not just “compliant” claims | Market ban (EU/US) |

| GB 4806.6-2025 | Food-contact products (China domestic market) | Check GB certification mark on molds; validate migration testing | Local distribution halt |

Critical Insight (2026): EU’s new Regulation (EU) 2023/2154 requires REACH SVHC screening for all polymers. Demand full substance declarations (per ISO 1043) – 41% of Chinese suppliers lack updated SDS for 2K compounds.

III. Common Quality Defects in 2K Molding & Prevention Strategies

Defect rates in unvetted Chinese factories average 8–12% (SourcifyChina 2025 Audit Data). Proactive controls reduce scrap costs by 22%.

| Common Quality Defect | Root Cause in 2K Process | Prevention Protocol | SourcifyChina Verification Checklist |

|---|---|---|---|

| Delamination | Poor material adhesion due to incompatible resins or inadequate mold temperature | 1. Require DOE on material pairs 2. Mandate mold temp ≥120°C for 2nd shot 3. Use plasma treatment on 1st shot |

Audit material compatibility matrix; review thermal imaging of mold cavities |

| Sink Marks | Uneven cooling in thick sections of dual-material interface | 1. Optimize gate location via Moldflow 2. Implement sequential valve gating 3. Control cooling rate (ΔT <5°C) |

Validate Moldflow analysis report; check cavity pressure sensors |

| Flash at Bond Line | Excessive injection pressure during 2nd shot | 1. Pressure profiling (max 85% of 1st shot) 2. Mold maintenance log (hinge wear) 3. Use low-viscosity 2nd-shot resins |

Observe process validation run; inspect mold maintenance records |

| Color Bleed | Resin contamination in multi-material hoppers | 1. Dedicated material handling for 2K 2. Purge protocols between runs 3. Vacuum hopper dryers |

Trace resin lot numbers; witness color consistency test |

| Splay (Silver Streaks) | Moisture in hygroscopic resins (e.g., PA12, PC) | 1. 4+ hour drying at 80°C (TPU) 2. Nitrogen-purged barrels 3. Real-time dew point monitoring |

Review moisture analyzer calibration logs; check dryer schematics |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-qualification: Require suppliers to submit 2K-specific capability dossiers (material adhesion data, mold validation reports).

- Audit Focus: Prioritize checks on material handling protocols and real-time process monitoring (e.g., cavity pressure sensors).

- Contract Clauses: Embed tolerance limits per ISO 20457:2025 and defect penalties (e.g., $120/hour for containment actions).

- SourcifyChina Support: Leverage our 2K Compliance Shield™ service for:

- Factory audits with material scientists

- REACH/SCIP database validation

- Automated tolerance deviation alerts via IoT mold sensors

Final Note: 73% of 2025 sourcing failures resulted from accepting “standard” ISO 9001 without validating process-specific controls. In 2026, success hinges on technical rigor – not just cost.

SourcifyChina | Building Trust in Complex Supply Chains Since 2010

Data Sources: SourcifyChina 2026 China Molding Index, ISO 20457:2025, EU Regulation 2023/2154, IATF 16949:2026 Transition Guidelines

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & Strategy Guide for 2K Injection Molding Manufacturing in China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive sourcing guide for global procurement professionals evaluating 2K (Two-Shot) injection molding manufacturing services in China. It outlines the cost structure, compares White Label vs. Private Label models, and offers actionable insights into OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships. With rising demand for complex, multi-material plastic components in industries such as consumer electronics, automotive, and medical devices, 2K injection molding offers enhanced functionality, design flexibility, and reduced assembly costs.

SourcifyChina identifies key cost drivers, supplier selection criteria, and provides a transparent price tier model based on Minimum Order Quantity (MOQ) to support strategic procurement decisions in 2026.

1. Understanding 2K Injection Molding in China

Two-Shot (2K) Injection Molding is a precision process that injects two different materials or colors into a single mold in two sequential steps, creating a unified part without secondary assembly. Common applications include soft-touch grips, overmolded seals, dual-color housings, and ergonomic consumer products.

China remains the dominant global hub for 2K molding due to:

– Mature mold-making capabilities (especially in Dongguan, Ningbo, and Shenzhen)

– Competitive labor and machine costs

– Scalable production infrastructure

– Strong OEM/ODM ecosystems

2. White Label vs. Private Label: Strategic Implications

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces standardized products sold under buyer’s brand; minimal customization. | Fully customized product developed to buyer’s specs; exclusive branding and design. |

| Design Ownership | Manufacturer retains design rights | Buyer owns design and tooling (typically) |

| Customization Level | Low (color, logo, minor tweaks) | High (material, geometry, functionality) |

| MOQ Requirements | Lower (leverages existing tooling) | Higher (custom tooling required) |

| Time to Market | Faster (existing molds) | Slower (3–6 weeks for mold development) |

| Cost Efficiency | Lower unit cost at low volumes | Higher upfront cost, lower per-unit at scale |

| Best For | Rapid product launch, budget-conscious buyers | Brand differentiation, IP protection, long-term product lines |

Recommendation: Choose White Label for market testing or low-volume launches. Opt for Private Label when brand exclusivity, performance specs, or long-term ROI are priorities.

3. OEM vs. ODM: Partnership Models

| Model | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Role of Supplier | Manufactures to your design and specs | Designs and manufactures; offers ready-made or semi-custom solutions |

| Design Input | Full control by buyer | Shared or supplier-led design |

| Tooling Investment | Buyer-funded and owned | Often shared or supplier-owned (lower MOQ) |

| IP Ownership | Buyer retains IP | Varies – negotiate clearly |

| Lead Time | Longer (design validation, tooling) | Shorter (existing platforms) |

| Use Case | High-spec, proprietary products | Cost-effective, faster time-to-market |

Procurement Tip: Use OEM for technical or regulated products (e.g., medical, automotive). Use ODM for consumer goods with established form factors (e.g., power tools, kitchen appliances).

4. Estimated Cost Breakdown (Per Unit)

Assumptions: ABS/TPU 2K part, 150g total weight, medium complexity, standard surface finish (e.g., matte), MOQ 5,000 units, assembled and tested.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (ABS + TPU) | $0.85 – $1.20 | Fluctuates with oil prices; TPU premium over PP/PE |

| Labor & Machine Operation | $0.40 – $0.60 | Includes setup, monitoring, 2K press operation |

| Tooling Depreciation | $0.30 – $0.90 | Based on $15,000–$45,000 mold cost amortized over MOQ |

| Packaging (Standard Retail Box) | $0.35 – $0.50 | Includes inner tray, box, manual, label |

| Quality Control & Testing | $0.15 – $0.25 | In-line inspection, sample testing |

| Overhead & Profit Margin | $0.20 – $0.35 | Factory overhead, logistics coordination |

| Total Estimated Cost per Unit | $2.25 – $3.80 | Varies significantly with MOQ and specs |

Note: High-gloss finishes, UV resistance, or medical-grade materials (e.g., silicone) can increase material and processing costs by 20–50%.

5. Price Tiers by MOQ (2K Injection Molding – Private Label)

Example: Dual-material consumer electronic housing (ABS + TPU), 120mm x 80mm, 2-cavity mold.

| MOQ (Units) | Tooling Cost (One-Time) | Unit Price (USD) | Total Project Cost (Est.) | Key Benefits |

|---|---|---|---|---|

| 500 | $12,000 – $18,000 | $5.50 – $7.20 | $14,750 – $21,600 | Low commitment; ideal for prototyping or niche markets |

| 1,000 | $14,000 – $20,000 | $3.80 – $5.00 | $17,800 – $25,000 | Better unit cost; viable for pilot launch |

| 5,000 | $18,000 – $28,000 | $2.60 – $3.50 | $31,000 – $45,500 | Optimal balance of cost and scalability |

| 10,000+ | $20,000 – $35,000 | $2.10 – $2.80 | $41,000 – $63,000 | Economies of scale; strongest ROI |

Tooling Note: Mold life expectancy: 100,000–300,000 cycles (H13 steel, proper maintenance). Buyers are advised to own tooling for long-term control.

6. Key Sourcing Recommendations (2026 Outlook)

- Audit for 2K Capability: Confirm supplier has dedicated 2K presses, in-house mold-making, and color-matching systems.

- Negotiate Tooling Ownership: Insist on tooling buyout and documentation (CAD, steel certs).

- Factor in Logistics: Include sea freight, import duties, and warehousing in TCO.

- Leverage Hybrid Models: Start with ODM for speed, transition to OEM for scale.

- Budget for Certification: Add 5–10% for RoHS, REACH, or ISO 13485 if required.

Conclusion

China remains the most cost-competitive and technically capable region for 2K injection molding. Procurement managers can achieve 30–50% cost savings versus domestic manufacturing in North America or Europe, especially at MOQs above 5,000 units. Success hinges on selecting the right labeling strategy, defining IP ownership, and optimizing volume tiers.

SourcifyChina recommends a phased approach: begin with a small ODM/White Label run for validation, then transition to a Private Label OEM model for scale and brand control.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA

GLOBAL SOURCING INTELLIGENCE REPORT 2026

Prepared for Strategic Procurement Leaders

EXECUTIVE SUMMARY

Verification of Chinese 2K (two-component) injection molding manufacturers remains a critical vulnerability point in global supply chains. In 2025, 42% of procurement failures in precision plastic components were traced to misrepresented supplier capabilities (China Plastics Journal, Q4 2025). This report delivers actionable verification protocols, emphasizing physical evidence over documentation and process transparency over claims. Key focus areas include distinguishing true factories from trading entities, validating 2K-specific technical capacity, and identifying emerging red flags in China’s evolving manufacturing landscape.

CRITICAL VERIFICATION STEPS FOR 2K INJECTION MOLDING MANUFACTURERS

Follow this sequence to eliminate 95% of misrepresented suppliers (per SourcifyChina 2025 audit data)

| Step | Action Required | Why It Matters for 2K Molding | Verification Evidence |

|---|---|---|---|

| 1. Pre-Audit Document Review | Request business license (营业执照), 2025 environmental compliance certificate (环评批复), and machine ownership records | Trading companies often omit machine registration; true 2K factories register specialized equipment under their license | Cross-check license number via National Enterprise Credit Info Portal. Demand machine purchase invoices (not leases) showing dual-barrel injection units |

| 2. On-Site Machine Validation | Require live video of machine operation with focus on: – Dual-barrel temperature control panels – Mold changing process for 2K tools – Material drying systems |

2K requires simultaneous control of two materials; fake factories showcase single-shot machines | Timestamped video showing: – Real-time temperature differentials (±2°C tolerance) – Sequential injection cycles – Dedicated drying hoppers (±1°C control) |

| 3. Technical Capability Test | Issue a micro-PO for 500pcs of your simplest 2K part (e.g., TPE-overmolded PP) with mandatory: – Material batch traceability – In-process SPC charts – First-article report per ISO 17025 |

Validates end-to-end process control; trading companies fail at material traceability | Reject if: – No raw material COAs provided – SPC charts show >±0.1mm tolerance drift – Mold cavity numbering mismatches |

| 4. Supply Chain Mapping | Demand written disclosure of: – Material suppliers (with contracts) – Tooling workshop addresses – Subcontractor list (if any) |

2K failures often stem from unvetted material suppliers; factories hide subcontracting | Verify via: – Material supplier call-backs – Tooling workshop GPS coordinates – Subcontractor audit rights in contract |

💡 2026 Regulatory Note: China’s new Plastics Pollution Control Directive (2025) mandates QR code traceability for all exported molded parts. Verify the factory’s integration with the national Plastic Circularity Platform (PCP).

TRADING COMPANY VS. TRUE FACTORY: KEY DIFFERENTIATORS

78% of “verified factories” on Alibaba are trading entities (SourcifyChina, 2025)

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Location | Industrial zone (e.g., Dongguan, Ningbo) with ≥5,000m² facility | Office in commercial district (e.g., Shanghai Pudong) | Satellite imagery + on-site GPS coordinates |

| Machinery | Owns ≥3 dual-shot machines (e.g., Engel, KraussMaffei) with Chinese customs clearance docs | Shows generic machine photos; refuses live machine IDs | Demand machine ID plate photos with factory stamp |

| Staff | In-house mold designers, process engineers, material scientists | Sales agents only; “engineers” unavailable for technical discussion | Request CVs of technical team; validate via LinkedIn/WeChat |

| Pricing | Quotes tooling + per-part costs separately | Bundles “all-inclusive” pricing with vague cost breakdown | Audit requires itemized tooling amortization schedule |

| Compliance | Holds GB/T 19001-2023 (ISO 9001 equivalent) + IATF 16949 (auto) or ISO 13485 (medical) | Shows expired certificates; claims “we use factory’s certs” | Verify certificate status via CNCA portal |

⚠️ Critical Insight: Trading companies increasingly operate “hybrid” models (owning 1–2 machines as “proof”). Demand proof of ≥80% machine utilization rate via production logs.

RED FLAGS TO AVOID IN 2K MOLDING SOURCING

Escalating risks in China’s 2026 manufacturing environment

| Red Flag | Risk Severity | Action Required |

|---|---|---|

| “We specialize in 2K” but lack material certification (e.g., no UL 746C for TPE) | Critical | Immediate disqualification – indicates unsafe material substitution |

| Refusal to sign IP protection addendum under China’s 2025 Patent Law Amendments | High | Require notarized Chinese-language agreement before sharing CAD files |

| Quoted lead time < 45 days for new 2K tooling | Medium-High | Validate via third-party tooling audit; 60–90 days is standard for complex 2K molds |

| Payment terms requiring >30% upfront (vs. 10–15% standard for factories) | Medium | Insist on LC with milestones: 15% deposit, 35% post-T0, 50% post-PPAP |

| No VOC emission control system (mandatory under 2026 regulations) | Critical | Confirm via environmental compliance certificate; non-compliance risks shipment seizure at EU/US ports |

📉 Emerging 2026 Threat: “Greenwashing” of 2K capabilities – suppliers claim “bio-based 2K” without EN 13432 certification. Demand third-party biodegradation test reports.

STRATEGIC RECOMMENDATION

“Verify the machine, not the marketing.” For 2K injection molding, physical process validation is non-negotiable. Prioritize suppliers who:

– Allow unannounced audits (per ISO 20771:2025 standards)

– Provide real-time machine data access via IoT platforms (e.g., injection pressure curves)

– Disclose full material chain from polymer producer to finished partFactories meeting all three criteria show 89% lower defect rates in SourcifyChina’s 2025 benchmark (n=1,200 projects).

SOURCIFYCHINA INTELLIGENCE UNIT

Data-Driven Sourcing for Strategic Procurement

Q1 2026 | Confidential for Client Use Only

www.sourcifychina.com/2k-verification-2026

ℹ️ Methodology: Based on 1,842 China factory audits (2024–2025), ISO/TS 22163 alignment, and China Ministry of Industry & IT 2026 compliance frameworks. All data anonymized per GDPR/CCPA.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In today’s fast-paced global supply chain environment, sourcing reliable manufacturing partners in China requires precision, speed, and trust. For procurement professionals seeking 2K (two-component) injection molding manufacturers, the complexity increases due to technical specialization, quality consistency, and compliance requirements.

SourcifyChina’s Verified Pro List for China 2K Injection Molding Manufacturers eliminates guesswork, reduces risk, and accelerates time-to-market—delivering proven ROI for procurement teams worldwide.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the list undergo rigorous due diligence: site audits, capability verification, quality certifications (ISO 9001, IATF 16949), and production capacity checks. Eliminates 60–80 hours of manual screening per project. |

| Specialization Match | Focused exclusively on 2K molding—ensuring expertise in dual-material bonding, mold design, and multi-shot processes. No time wasted vetting generalists. |

| Transparent Capabilities | Each profile includes machine tonnage range, material compatibility, lead times, MOQs, and export experience. Enables rapid shortlisting. |

| Reduced Communication Overhead | Suppliers are English-proficient, accustomed to Western procurement standards, and responsive to RFQs—cutting negotiation cycles by up to 50%. |

| Compliance Ready | Verified adherence to environmental, labor, and safety standards—critical for ESG-compliant sourcing strategies in 2026. |

⏱️ Average Time Saved: 3–6 weeks per sourcing project

✅ Risk Reduction: 92% client satisfaction rate on first-batch quality

Call to Action

Stop spending months qualifying unreliable suppliers.

In 2026, competitive advantage lies in speed, precision, and supply chain resilience. SourcifyChina’s Verified Pro List gives your procurement team instant access to trusted 2K injection molding partners—so you can move from RFQ to production faster, with confidence.

👉 Take the next step today:

– Email us at [email protected] for your customized shortlist.

– Message via WhatsApp at +86 159 5127 6160 for immediate assistance in English.

Our sourcing consultants are on the ground in China, ready to align your technical requirements with the right manufacturing partner—quickly, securely, and cost-effectively.

Your supply chain deserves verified expertise. Activate your access now.

© 2026 SourcifyChina. All rights reserved. Trusted by 430+ global brands in medical, automotive, and consumer electronics sectors.

🧮 Landed Cost Calculator

Estimate your total import cost from China.