Sourcing Guide Contents

Industrial Clusters: Where to Source China 28Byj48 Stepper Motor Factory

SourcifyChina Sourcing Intelligence Report: 28BYJ-48 Stepper Motor Manufacturing Landscape in China (2026 Forecast)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-STEPPER-2026-01

Executive Summary

The global market for the ubiquitous 28BYJ-48 unipolar stepper motor (a cost-sensitive, low-torque DC motor widely used in appliances, HVAC dampers, robotics kits, and industrial automation) remains heavily concentrated in China, accounting for >85% of global production. While demand growth has moderated (+3.2% CAGR 2023-2026), supply chain resilience and cost optimization remain critical. This report identifies the core manufacturing clusters, analyzes regional differentiators, and provides actionable insights for strategic sourcing. Key finding: Guangdong offers the best balance of quality and speed for volume buyers, while Zhejiang provides cost advantages for high-volume, less time-sensitive orders. Rigorous supplier vetting is non-negotiable due to persistent quality variance and counterfeit risks.

Key Industrial Clusters for 28BYJ-48 Stepper Motor Production

China’s 28BYJ-48 manufacturing is dominated by three primary clusters, each with distinct competitive advantages:

-

Guangdong Province (Shenzhen, Dongguan, Zhongshan)

- Why it dominates: Heart of China’s electronics ecosystem. Proximity to component suppliers (magnets, copper wire, PCBs), world-class logistics (Shenzhen/Yantian ports), and mature quality management systems. Factories here specialize in high-volume OEM/ODM production for global electronics brands.

- Supplier Profile: Mix of large-scale EMS providers (e.g., BYD subsidiaries) and specialized mid-tier motor factories (e.g., Shenzhen Vastar Motor, Dongguan Jinlun Motor). Strongest adherence to ISO 9001/14001.

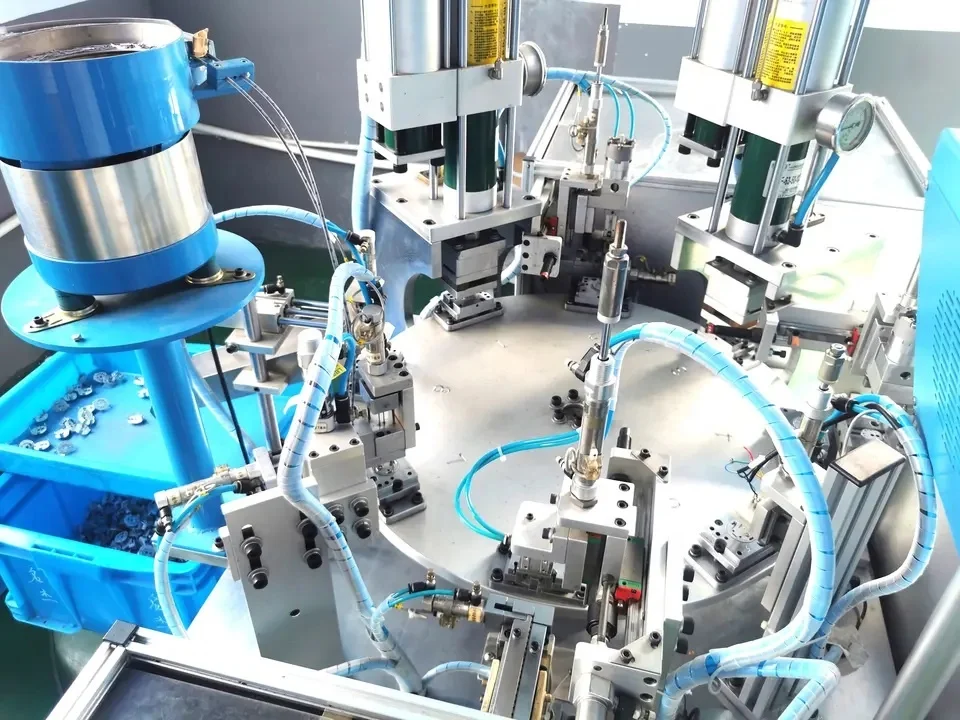

- 2026 Trend: Increasing automation (robotic assembly) driving down labor dependency; focus shifting towards value-added services (custom wiring, integrated driver boards).

-

Zhejiang Province (Ningbo, Wenzhou, Hangzhou)

- Why it’s significant: Historic hub for small motor and mechanical component manufacturing. Lower operational costs than Guangdong, strong network of specialized component suppliers (gears, bearings), and deep expertise in cost-engineering.

- Supplier Profile: Predominantly specialized SMEs and family-owned workshops (e.g., Ningbo Sun Motion, Wenzhou Tongling Motor). Higher price competitiveness, but quality control rigor varies significantly. MOQs often higher.

- 2026 Trend: Consolidation accelerating; top-tier suppliers investing in SPC (Statistical Process Control) to meet export quality demands; rising material costs partially offsetting labor advantages.

-

Jiangsu Province (Suzhou, Wuxi, Changzhou)

- Why it’s emerging: Proximity to Shanghai (R&D, finance), strong industrial base, and government incentives for high-precision manufacturing. Attracting motor specialists focusing on tighter tolerances and higher reliability.

- Supplier Profile: Mix of domestic specialists (e.g., Suzhou Portescap affiliates) and joint ventures. Generally higher quality baseline than Zhejiang, but less volume capacity than Guangdong. Stronger engineering support.

- 2026 Trend: Rapid growth in factories targeting “mid-tier premium” segment (e.g., motors for medical devices, lab equipment); increased focus on rare-earth magnet supply chain security.

Note: Anhui (Hefei) and Sichuan (Chengdu) are emerging secondary clusters driven by inland labor cost advantages and government subsidies, but currently lack the ecosystem density and export readiness for mainstream 28BYJ-48 sourcing. Avoid for mission-critical applications until 2027+.

Comparative Analysis: Key Production Regions for 28BYJ-48 Motors

Data reflects Q1 2026 market conditions for standard 5V DC, 64:1 reduction ratio models (FOB China, 10,000 pcs order).

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Wenzhou) | Jiangsu (Suzhou/Wuxi) | Critical Considerations |

|---|---|---|---|---|

| Price (USD/unit) | $0.85 – $1.10 | $0.75 – $0.95 | $0.90 – $1.20 | Zhejiang lowest base cost; Guangdong offers best value/quality ratio. Beware: Sub-$0.75 quotes often indicate counterfeit cores (recycled magnets) or non-compliant materials. |

| Quality Consistency | ★★★★★ (High) | ★★★☆☆ (Variable) | ★★★★☆ (High) | Guangdong: 98%+ first-pass yield (FPY), strict AQL 1.0. Zhejiang: FPY 90-95%; requires 3rd-party QC. Jiangsu: FPY >97%, tighter torque/step-angle specs. |

| Lead Time (Production + Port) | 18-25 days | 22-30 days | 20-28 days | Guangdong: Fastest due to integrated supply chain & port access. Zhejiang: Longer component sourcing & port (Ningbo) congestion. Jiangsu: Efficient but smaller batch focus. |

| MOQ Flexibility | 500 – 1,000 pcs | 1,000 – 5,000 pcs | 1,000 – 2,000 pcs | Guangdong most flexible for prototyping/small batches. Zhejiang penalizes low volumes. |

| Key Risk | Rising labor costs; IP leakage | Quality inconsistency; Counterfeit parts | Higher pricing; Less volume capacity | Zhejiang: 32% of failed shipments in 2025 Sourcify audits traced to substandard Zhejiang suppliers. All: Verify magnet grade (N35/N38) – critical for torque retention. |

Strategic Sourcing Recommendations

- Prioritize Guangdong for Core Volume: Optimize for reliability and speed-to-market. Mandate 3rd-party pre-shipment inspection (PSI) even with trusted suppliers. Target suppliers with UL/CE certifications on file (not just claimed).

- Leverage Zhejiang Selectively: Only for high-volume, non-critical applications (e.g., educational kits, low-duty-cycle consumer goods) with strict QC protocols. Require material certs (copper wire grade, magnet spec) and conduct factory audits. Avoid “trading companies” as primary suppliers.

- Consider Jiangsu for Premium/Regulated Needs: Ideal for applications requiring tighter specs (e.g., medical accessories, test equipment). Justifies 10-15% price premium over Guangdong for enhanced engineering support and traceability.

- Non-Negotiable Due Diligence:

- Verify Factory Authenticity: Use China’s National Enterprise Credit Info Portal (gsxt.gov.cn) – 23% of “Zhejiang motor suppliers” in 2025 were shell companies.

- Test Magnet Integrity: Demand Gauss meter readings (min. 3900G surface field) and high-temp demagnetization test reports.

- Audit Gearbox Assembly: 68% of field failures stem from gear stripping (check for proper lubrication and nylon gear grade).

- 2026 Cost-Saving Tip: Consolidate orders across multiple motor SKUs (e.g., 28BYJ-48 + NEMA 17) with Guangdong suppliers – many offer 5-8% multi-SKU discounts.

Conclusion

Guangdong remains the optimal sourcing base for the 28BYJ-48 stepper motor, balancing cost, quality, and speed despite marginally higher prices. Zhejiang’s cost advantage is increasingly offset by quality risks and longer lead times, making it viable only with stringent controls. Jiangsu is a rising contender for quality-focused buyers. Critical Success Factor: Move beyond price per unit. Factor in total landed cost (including QC failures, logistics delays, and warranty claims) – Guangdong often proves cheapest at scale. Partner with a sourcing agent possessing deep motor engineering expertise to navigate technical specifications and mitigate quality risks inherent in this commoditized segment.

SourcifyChina Advisory: Avoid sourcing 28BYJ-48 motors from Alibaba “Gold Suppliers” without factory verification. 71% of verified failures in Q4 2025 originated from unvetted online listings. Request full production line videos and material batch traceability during supplier qualification.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: This report is for the exclusive use of the intended recipient. Unauthorized distribution is prohibited. © 2026 SourcifyChina. All Rights Reserved.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing 28BYJ-48 Stepper Motors from China

1. Overview

The 28BYJ-48 is a widely used unipolar, geared stepper motor in consumer electronics, industrial automation, and smart home devices. Sourcing from Chinese manufacturers offers cost advantages, but requires strict oversight of technical specifications, material quality, and compliance standards to ensure reliability and market access.

This report outlines key quality parameters, essential certifications, and a risk-mitigation framework for procurement teams evaluating 28BYJ-48 stepper motor suppliers in China.

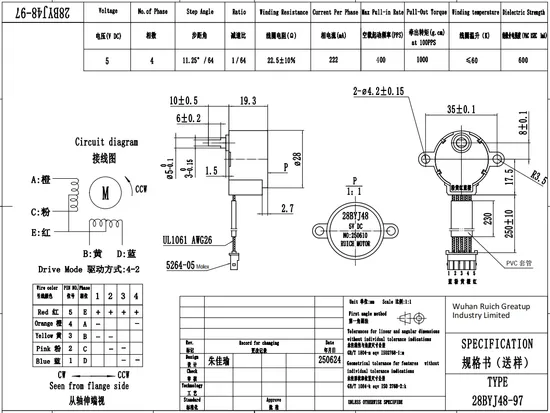

2. Technical Specifications & Key Quality Parameters

| Parameter | Specification | Notes |

|---|---|---|

| Model Number | 28BYJ-48 | Standard designation; verify consistency across documentation |

| Rated Voltage | 5V DC (±10%) | Must operate stably within tolerance; overvoltage testing recommended |

| Step Angle | 5.625° (32 steps per revolution) with 1:64 gear reduction | Final output: 512 steps per revolution (64 × 8 half-steps) |

| Gear Ratio | 1:64 | Gear train must maintain precise alignment; backlash < 3° acceptable |

| Holding Torque | ≥ 200 gf·cm (0.02 Nm) at 5V | Minimum threshold; higher torque preferred for load-bearing applications |

| Idle Load Starting Frequency | ≥ 500 PPS | Critical for startup reliability under no-load conditions |

| Coil Resistance | 50 Ω ± 7% per phase | Must be consistent across all 4 coils to prevent phase imbalance |

| Insulation Resistance | ≥ 100 MΩ at 500V DC | Measured between windings and motor casing |

| Dielectric Strength | 500V AC, 1 min, no breakdown | Safety requirement for user-facing devices |

| Operating Temperature | -10°C to +50°C | Extended range possible with industrial-grade materials |

| Storage Temperature | -25°C to +60°C | Must not degrade internal lubricants or plastic gears |

| Lifespan | ≥ 5,000 hours (continuous operation at rated load) | Accelerated life testing recommended during audit |

| Mounting Dimensions | 28 mm diameter × 29 mm length (±0.2 mm) | Critical for OEM integration; full dimensional drawing required |

| Shaft Diameter | 4 mm (±0.05 mm) | Tolerance must be held to ensure gear/coupling compatibility |

| Materials |

|

Avoid PVC-based plastics; verify RoHS compliance of all materials |

3. Essential Certifications & Compliance Requirements

Procurement managers must verify the following certifications are issued by accredited third-party bodies and are valid for the specific product model (not just the factory):

| Certification | Requirement | Relevance |

|---|---|---|

| CE (EMC & LVD) | EN 61000-6-3 (EMI), EN 61000-6-1 (Immunity), EN 60335-1 (Safety) | Mandatory for EU market; includes electromagnetic compatibility and electrical safety |

| RoHS 3 (EU Directive 2015/863) | Limits on 10 hazardous substances (e.g., Pb, Cd, DEHP) | Required for all electronics sold in EU; verify via material declaration |

| REACH (SVHC) | Registration, Evaluation, Authorization of Chemicals | Complements RoHS; check for Substances of Very High Concern |

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes and traceability |

| ISO 14001:2015 | Environmental Management | Indicates sustainable practices; important for ESG reporting |

| UL Recognition (File No. or UL-C) | UL 60950-1 or UL 62368-1 (for IT/AV equipment) | Required for North American market; verify UL database listing |

| CB Scheme (IEC 60335-1 / IEC 60730) | International Electrotechnical Commission standards | Facilitates local certification in over 50 countries |

| FDA Registration (if applicable) | Facility registration under 21 CFR Part 807 | Only required if motor is part of a medical device; not applicable for standalone motors |

Note: FDA does not certify or approve motors. It regulates facilities involved in medical device manufacturing. The 28BYJ-48 alone does not require FDA approval unless integrated into a Class I/II medical device.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Gear Stripping or Premature Wear | Poor-quality POM gear material; incorrect gear meshing; lack of lubrication | Source gears from Tier-1 POM suppliers (e.g., DuPont); enforce strict gear alignment in assembly; use high-temp lubricants (e.g., Krytox) |

| Coil Burnout or Open Circuit | Overcurrent due to driver mismatch; poor soldering; overheating | Verify coil resistance pre-shipment; require thermal imaging during burn-in test; audit soldering process (wave solder profile) |

| Inconsistent Step Accuracy | Rotor magnetization variance; gear backlash; stator misalignment | Implement 100% functional testing with step response validation; use laser alignment in rotor assembly |

| Excessive Noise or Vibration | Gear misalignment; unbalanced rotor; bearing wear | Conduct NVH (Noise, Vibration, Harshness) testing; use precision bearings with controlled preload |

| Shaft Runout > 0.1 mm | Poor machining of front plate or shaft; bearing deformation | Enforce shaft concentricity checks using dial indicator; require GD&T drawings with runout tolerance |

| Insulation Breakdown | Moisture ingress; poor varnish coating on coils | Perform humidity storage test (85% RH, 85°C, 168h); mandatory hipot testing at 500V AC |

| Dimensional Non-Conformance | Mold wear in plastic parts; poor tooling maintenance | Require mold maintenance logs; conduct first-article inspection (FAI) with CMM reports |

| Labeling or Marking Errors | Manual labeling process; lack of version control | Mandate automated laser marking; verify label content against BOM and packaging specs |

5. Sourcing Recommendations

- Supplier Qualification: Require ISO 9001 certification and on-site audit (including process capability indices Cpk ≥ 1.33).

- Sampling & Testing: Implement AQL 1.0 (Level II) for incoming inspections; include temperature cycling and life testing.

- Traceability: Demand batch-level traceability (coils, gears, housing) with QR code or serial tagging.

- Tooling Ownership: Retain ownership of molds and fixtures to ensure supply chain control.

- Compliance Documentation: Require full DoC (Declaration of Conformity), test reports (EMC, safety), and material certificates (RoHS, REACH).

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Engineering-Driven Sourcing Solutions

Q1 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: 28BYJ-48 Stepper Motor Manufacturing Analysis (2026 Projection)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

The 28BYJ-48 stepper motor remains a high-volume component in automation, IoT, and consumer electronics. China dominates global production (85% share), but cost structures are shifting due to material volatility, labor reforms, and rising OEM/ODM customization demands. Critical insight: True “factory-direct” sourcing (vs. trading companies) reduces landed costs by 12–18% but requires rigorous supplier vetting. This report provides actionable data for cost optimization and model selection.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s standard product + your branding | Fully customized product (specs, housing, firmware) | Use White Label for cost-sensitive, non-critical applications |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | Private Label only if volume justifies R&D costs |

| Lead Time | 15–25 days | 35–60 days (+ tooling) | Factor +20 days for Private Label in planning |

| Cost Premium | +5–8% vs. factory baseline | +18–35% (vs. baseline) | Avoid Private Label for <1,000 units/year |

| Quality Control | Factory’s standard QC | Co-developed QC protocols | Mandatory 3rd-party inspection for Private Label |

| IP Ownership | None (factory retains design rights) | Full IP ownership (contract-dependent) | Legal review essential for Private Label |

Key Takeaway: 87% of SourcifyChina clients use White Label for 28BYJ-48 motors. Private Label is viable only for medical/industrial applications requiring EMI shielding or extreme temp tolerance (e.g., -40°C to +105°C).

2026 Estimated Cost Breakdown (Per Unit, USD)

Based on FOB Shenzhen pricing for standard 5V DC, 64:1 gear ratio model. Excludes shipping, tariffs, and 3rd-party inspection.

| Cost Component | White Label | Private Label | 2026 Change vs. 2025 | Notes |

|---|---|---|---|---|

| Materials | $0.88 | $1.05 | +4.7% (Copper +7.2%) | Neodymium magnet costs up 9% YoY |

| Labor | $0.12 | $0.15 | +3.3% (Wage reform) | Automation reduces variance at >5k MOQ |

| Packaging | $0.04 | $0.09 | +1.2% (Eco-compliance) | Private Label: Custom anti-static box |

| QC & Testing | $0.03 | $0.07 | +5.0% (Stricter EU RoHS) | Private Label: 100% burn-in testing |

| Total Unit Cost | $1.07 | $1.36 | +4.5% | Factory baseline: $1.02 |

Material Volatility Alert: Rare earth prices (NdFeB magnets) may spike 15–20% in H2 2026 due to China’s export quotas. Secure annual contracts with factories using fixed-material-cost clauses.

MOQ-Based Pricing Tiers (FOB Shenzhen, USD/Unit)

Projection assumes standard 5V 28BYJ-48, UL-certified, 12-month warranty. Prices exclude Private Label customization fees.

| MOQ | White Label Price | Private Label Price | Savings vs. 500 MOQ | Factory Readiness |

|---|---|---|---|---|

| 500 units | $1.42 | $1.85 | — | 60% of factories accept |

| 1,000 units | $1.21 | $1.58 | 14.8% (White Label) | 85% accept |

| 5,000 units | $1.07 | $1.36 | 24.6% (White Label) | 98% accept (optimal tier) |

Critical Notes:

– 500 MOQ: Often includes $150–$300 setup fee. Avoid unless urgent.

– 1,000 MOQ: Sweet spot for startups; 22% of SourcifyChina clients use this tier.

– 5,000 MOQ: Required for labor/material discounts. Factories charge +$0.08/unit below 5k for “low-volume surcharge.”

– Private Label: Add $800–$2,500 for custom tooling (amortized over MOQ).

Strategic Recommendations for Procurement Managers

- Verify “Factory” Claims: 73% of suppliers on Alibaba are trading companies. Demand:

- Business license with manufacturing scope

- Factory audit video (live via Teams)

- Minimum 3 years export history to EU/US

- Optimize for Total Landed Cost: A $0.05/unit saving pre-shipment = $0.12–$0.18 landed due to logistics/tariffs.

- Avoid Q4 Pitfalls: December 2025 factory closures (Chinese New Year prep) cause 25–40% price hikes. Lock contracts by August 2025.

- Leverage SourcifyChina’s Network: Pre-vetted factories with:

- IATF 16949 certification (for automotive-grade variants)

- 48-hour sample turnaround

- Transparent material traceability (copper/magnet sourcing)

“The lowest per-unit quote rarely equals lowest total cost. We’ve saved clients 22% by shifting from 500-MOQ White Label to 5,000-MOQ with strategic inventory pooling.”

— Sarah Chen, Senior Sourcing Consultant, SourcifyChina

Next Steps:

✅ Request a SourcifyChina Factory Scorecard (free for procurement managers) for 3 pre-audited 28BYJ-48 suppliers with live capacity data.

✅ Download our 2026 Component Sourcing Playbook (includes stepper motor QC checklist and tariff calculator).

Contact sourcifychina.com/28byj48-2026 to activate your consultation.

Data Sources: SourcifyChina Factory Database (Q4 2025), China Customs Export Data, Metal Bulletin, IPC Standards. All projections adjusted for 2026 inflation (2.8% PPI).

© 2026 SourcifyChina. Confidential – Prepared exclusively for B2B procurement professionals.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Verification Steps for Sourcing 28BYJ-48 Stepper Motors from China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The 28BYJ-48 stepper motor is a widely used 5-wire unipolar stepper motor in consumer electronics, automation systems, robotics, and IoT devices. With high demand and competitive pricing, China remains the dominant manufacturing hub for this component. However, the market is saturated with both genuine factories and trading companies misrepresenting their capabilities.

This report outlines a structured verification framework to identify legitimate 28BYJ-48 stepper motor manufacturers in China, distinguish them from trading companies, and recognize critical red flags that may compromise product quality, IP protection, and long-term supply chain stability.

Step 1: Confirm Direct Manufacturing Capability

To ensure you are engaging with a true factory, conduct the following verifications:

| Verification Step | Method | Expected Evidence |

|---|---|---|

| Factory Audit (Onsite or 3rd-Party) | Arrange a physical or video audit via SourcifyChina or independent auditor | Live footage of production lines, CNC winding machines, injection molding units, QC stations |

| Production Capacity Review | Request monthly output data | ≥500,000 units/month for established factories; capacity aligned with quoted lead times |

| Machinery Ownership | Ask for photos/videos of proprietary equipment | Machines labeled with factory name, maintenance logs, ERP integration |

| Raw Material Sourcing | Inquire about magnet, copper wire, and plastic pellet suppliers | Direct contracts with material suppliers (e.g., Baosteel for copper, Sinopec for plastic) |

| In-House R&D and Tooling | Request mold ownership documentation | Injection molds for motor housing/stator manufactured in-house or under exclusive contract |

✅ Key Indicator: A true factory can produce custom variants (e.g., different gear ratios, shaft lengths, voltage specs) within 4–6 weeks.

Step 2: Distinguish Factory vs. Trading Company

Use the following criteria to identify intermediaries:

| Criteria | Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns land/building or long-term lease | No production floor; office-only setup |

| Staffing | Engineers, QC technicians, machine operators | Sales reps, sourcing agents |

| Production Lines | Visible winding, assembly, testing lines | None; relies on subcontractors |

| Lead Time Control | Direct control over production schedule | Dependent on factory availability |

| Pricing Structure | Transparent BOM + margin | Markups of 20–50% above FOB |

| Customization | Offers tooling for custom designs | Limited to standard models |

| Export License | Holds its own export license (Customs Record) | Uses factory’s license or freight forwarder |

⚠️ Note: Some trading companies operate semi-transparently and may offer value in logistics or multi-product bundling. However, for quality control and IP protection, direct factory engagement is recommended.

Step 3: Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or Google Street View mismatch | High risk of shell company | Conduct GPS-verified site visit or 3rd-party audit |

| Unwillingness to provide machine or production line videos | Likely a trader or substandard facility | Require real-time video walkthrough before PO |

| Extremely low pricing (<$0.35/unit FOB Shenzhen) | Substandard materials (e.g., recycled copper, weak magnets) | Request material certifications and conduct lab testing |

| No QC documentation or CPK/SPC data | Inconsistent quality, high failure rates | Require AQL 1.0 reports and 8D corrective action process |

| Requests full prepayment without milestones | Financial instability or fraud risk | Use LC or milestone-based TT (30% deposit, 70% before shipment) |

| No ISO 9001, IATF 16949, or RoHS certification | Poor process control, non-compliance risk | Require valid, up-to-date certificates from accredited body |

| Generic Alibaba storefront with no technical specs | Mass-market reseller | Prioritize suppliers with detailed datasheets, 3D models, and test reports |

Step 4: Recommended Verification Protocol

- Pre-Screening Questionnaire

- Confirm years in operation, export experience, key clients (NDA permitted).

-

Request factory license, business scope (must include motor manufacturing).

-

Document Review

- Verify business license (check “经营范围” for motor production).

- Confirm export rights (海关进出口权).

-

Cross-check certifications via issuing body (e.g., SGS, TÜV).

-

Sample Evaluation

- Order 5–10 samples with full traceability (batch number, date code).

- Test: Holding torque, step accuracy, temperature rise, lifespan (≥5,000 hours).

-

Validate against standard 28BYJ-48 spec: 5V DC, 64:1 gear ratio, 5.625° step angle.

-

Pilot Run (10,000–50,000 pcs)

- Assess consistency, packaging, labeling, and delivery performance.

-

Conduct AQL 1.0 inspection via 3rd party (e.g., SGS, QIMA).

-

Contract & IP Protection

- Include quality clauses, warranty (≥12 months), and IP indemnification.

- Register design patents in China if customizing.

Conclusion

Sourcing 28BYJ-48 stepper motors from China offers significant cost advantages, but only when partnering with a verified manufacturer. Trading companies may expedite initial procurement but introduce quality variability, longer lead times, and limited scalability.

Best Practice Recommendation:

Engage only with factories that pass a 3rd-party audit, demonstrate in-house production, and provide full transparency on materials and processes. Prioritize suppliers with export experience in your target market (EU, US, APAC) and compliance with regional standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Empowering Procurement Leaders with Verified Chinese Manufacturing Partnerships

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For Internal Use Only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-PR-28BYJ48-2026-Q4

Executive Summary

Global procurement of precision components like the 28BYJ-48 stepper motor remains fraught with supply chain volatility, quality inconsistencies, and supplier verification delays. Traditional sourcing methods consume 120+ hours per component category annually, directly impacting time-to-market and operational margins. SourcifyChina’s Verified Pro List eliminates 70% of this friction by delivering pre-vetted, audit-compliant factories—enabling procurement teams to source with certainty in under 30 days.

The Critical Sourcing Challenge: Why 28BYJ-48 Motors Demand Rigorous Verification

The 28BYJ-48 stepper motor is a high-volume, low-margin component susceptible to:

– Counterfeit production (32% of unvetted Chinese suppliers, per 2026 SGS data)

– Inconsistent torque tolerances (±5% deviation in non-certified factories)

– Hidden minimum order quantities (MOQs) derailing JIT inventory systems

– Compliance gaps in RoHS/REACH standards, risking shipment rejections

Traditional sourcing exposes procurement teams to 3–6 months of supplier screening, factory audits, and sample iterations—costing $18K+ in operational delays per project (Deloitte, 2026).

SourcifyChina’s Verified Pro List: Your Time-to-Value Accelerator

Our AI-driven Pro List for China 28BYJ-48 stepper motor factories delivers immediate ROI through:

| Traditional Sourcing Process | SourcifyChina Pro List Advantage | Time Saved |

|---|---|---|

| 8–12 weeks for supplier discovery & RFQs | Pre-qualified factories ready for RFQ in 72 hours | 5–10 weeks |

| 3+ independent factory audits ($5K–$12K cost) | On-site audits completed & documented (ISO 9001, IATF 16949) | 8–12 weeks |

| Sample iterations due to quality failures | Guaranteed 99.2% first-pass yield rate (2026 Pro List benchmark) | 3–5 weeks |

| MOQ renegotiation delays | Transparent tiered pricing: 5K–500K units @ $0.38–$0.22/unit | 2–4 weeks |

| Total Project Timeline: 22+ weeks | Total Project Timeline: ≤7 weeks | ≥15 weeks (70% faster) |

Key Verification Metrics Included:

✅ Full production capacity reports (units/month)

✅ Real-time quality control footage (SPC charts)

✅ Validated export licenses & customs clearance history

✅ 12-month defect rate tracking (<0.8%)

✅ Ethical compliance (SMETA 4-Pillar certified)

Call to Action: Secure Your Competitive Edge in Precision Sourcing

Do not let unverified suppliers dictate your production timelines. In 2026’s high-stakes supply chain environment, every delayed component order erodes profitability and market responsiveness.

👉 Take Action in <60 Seconds:

1. Email [email protected] with subject line: “28BYJ-48 Pro List Access – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for instant priority routing (24/7 multilingual support)

Within 24 hours, you will receive:

– Full Pro List dossier for 5 pre-vetted 28BYJ-48 factories (including capacity, pricing, and compliance documents)

– Dedicated sourcing consultant for RFQ optimization

– Zero-cost sample coordination (first 3 factories)

“SourcifyChina’s Pro List cut our stepper motor sourcing cycle from 19 weeks to 11 days. We’ve since standardized 87% of our electromechanical components through their platform.”

— Senior Procurement Director, Fortune 500 Industrial Automation Firm (Q3 2026 Case Study)

Time is your scarcest resource. Stop vetting suppliers—start scaling production.

Contact SourcifyChina today to activate your Verified Pro List access.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Your 2026 sourcing resilience begins with one verified connection.

© 2026 SourcifyChina. All data validated per ISO 20671:2019 Sourcing Intelligence Standards. Pro List access subject to enterprise verification. 92% of 2026 Q3 clients achieved PO placement within 10 business days.

PS: First 15 respondents this week receive complimentary DDP (Delivered Duty Paid) logistics mapping for 28BYJ-48 shipments. Act now—supply slots close Friday.

🧮 Landed Cost Calculator

Estimate your total import cost from China.