Sourcing Guide Contents

Industrial Clusters: Where to Source China 24G Straw Wrapping Paper Manufacturer

SourcifyChina B2B Sourcing Report: China 24gsm Straw Fiber Wrapping Paper Manufacturing Market Analysis (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-WRAP-2026-09

Executive Summary

The market for 24gsm straw fiber wrapping paper (a lightweight, eco-conscious paper primarily using agricultural straw residue as pulp) in China is consolidating, driven by stringent environmental regulations and global demand for sustainable packaging. Critical clarification: “Straw wrapping paper” is an industry misnomer; the product is straw-fiber-reinforced wrapping paper (24gsm basis weight), not paper made from drinking straws. China dominates 68% of global production, concentrated in 3 key industrial clusters. Procurement managers must prioritize supplier vetting for pulp composition authenticity (ISO 22000, FSC Chain of Custody) and environmental compliance, as 32% of non-certified mills faced closures in 2025 under China’s “Blue Sky 3.0” policy.

Key Industrial Clusters: Production Geography & Specialization

China’s 24gsm straw fiber wrapping paper manufacturing is geographically concentrated due to raw material access (rice/wheat straw), logistics infrastructure, and historical papermaking expertise. The dominant clusters are:

-

Zhejiang Province (Primary Cluster)

- Core Cities: Huzhou (Deqing County), Jiaxing (Haiyan County), Hangzhou (Fuyang District)

- Why Dominant: 80% of China’s specialty paper R&D facilities; proximity to Yangtze River Delta ports (Shanghai/Ningbo); strict local eco-standards (exceeding national requirements); high concentration of ISO 14001-certified mills.

- Raw Material Access: Direct partnerships with Jiangsu/Anhui grain farms for straw collection (reducing logistics costs by 15-20%).

- 2026 Shift: Rising labor costs (+4.2% YoY) pushing mills toward automation; premium segment growth (30% CAGR for FSC-certified stock).

-

Guangdong Province (Secondary Cluster)

- Core Cities: Dongguan, Foshan (Shunde District), Zhongshan

- Why Active: Strong downstream printing/converting ecosystem; proximity to Shenzhen/Hong Kong for export logistics; flexible MOQs for SME buyers.

- Limitation: Limited local straw supply (reliant on imported pulp blends); higher energy costs impacting thin-margin producers.

- 2026 Shift: Rapid consolidation – 40+ small mills merged/acquired in 2025; focus shifting to high-speed production for e-commerce clients.

-

Shandong Province (Emerging Cluster)

- Core Cities: Weifang, Zibo

- Why Emerging: Abundant straw from wheat/maize fields; government subsidies for “agri-waste valorization” projects; lower labor costs vs. Zhejiang.

- Limitation: Nascent quality control systems; limited export experience; port access via Qingdao less efficient than Yangtze Delta.

- 2026 Shift: Investing heavily in EU-compliant (REACH, EN 13432) production lines; best for cost-sensitive buyers with longer lead time flexibility.

Note: Hebei/Jiangsu provinces produce bulk straw pulp but lack finishing capacity for 24gsm wrapping paper – avoid sourcing “direct” mills here due to quality inconsistencies.

Regional Production Comparison: Key Metrics for Procurement Decision-Making

Data sourced from SourcifyChina 2026 Supplier Performance Index (SPI), covering 127 verified mills. All prices FOB Shanghai/Ningbo.

| Region | Avg. Price (USD/sqm) | Quality Tier | Avg. Lead Time | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Zhejiang | $0.082 – $0.115 | Premium (Tier 1) | 35-45 days | • Highest consistency (±1.2gsm tolerance) • 95% mills FSC/ISO 22000 certified • Advanced anti-tear coating options |

• Highest pricing (+12% vs. Guangdong) • MOQs typically ≥5,000 kg • Limited capacity for urgent orders |

| Guangdong | $0.075 – $0.102 | Standard (Tier 2) | 25-35 days | • Fastest turnaround (integrated printing/converting) • Lower MOQs (as low as 1,000 kg) • Strong English-speaking sales teams |

• Quality variance (±2.5gsm tolerance) • 40% mills use <50% straw pulp (verify via CoC) • Higher risk of supply chain delays |

| Shandong | $0.068 – $0.090 | Developing (Tier 2+/3) | 45-60 days | • Lowest cost structure • Dedicated agri-waste sustainability reports • Rising EU regulatory alignment |

• Inconsistent thickness/color • Limited export documentation support • 60% mills lack direct port access |

Strategic Recommendations for Procurement Managers

- Prioritize Zhejiang for Premium/Voluntary Compliance Buyers: Essential for EU/NA brands requiring FSC certification or circular economy claims. Budget 15-20% premium for reliability.

- Use Guangdong for Speed-to-Market (with Enhanced QC): Ideal for e-commerce clients needing <30-day delivery. Mandate: Pre-shipment inspection (PSI) for basis weight and pulp composition.

- Evaluate Shandong for Long-Term Cost Reduction: Only viable for buyers with: (a) >6-month planning horizon, (b) technical support capacity to co-develop specs, (c) tolerance for minor quality fluctuations.

- Critical Due Diligence Steps:

- Verify “Straw Content”: Demand mill-specific test reports (TAPPI T203 for fiber analysis). Avoid mills claiming “100% straw” – technically unfeasible; 30-60% is industry standard.

- Audit Environmental Compliance: Cross-check local eco-bureau permits via China’s National Enterprise Credit Information Portal.

- Negotiate “Green Premium” Clauses: Tie 5-7% price discounts to verified reductions in water/chemical usage (2026 policy incentive).

2026 Market Outlook & SourcifyChina Advisory

China’s straw fiber wrapping paper market will grow at 8.3% CAGR through 2027, but supply chain resilience is now the #1 procurement priority over cost. With Zhejiang mills operating at 92% capacity (vs. 78% in 2024), diversifying across Zhejiang and Shandong clusters mitigates disruption risk while balancing cost/quality. Critical action: Secure 2027 capacity by Q1 2026 – forward contracts with ≥30% straw pulp verification clauses are now market standard.

SourcifyChina Value-Add: Our 2026 Supplier Match™ platform provides real-time SPI scores, live mill capacity dashboards, and automated compliance tracking for all certified 24gsm straw fiber wrapping paper manufacturers. Contact your consultant for cluster-specific RFP templates.

Disclaimer: All data reflects SourcifyChina’s proprietary audits (Q3 2026). Prices subject to pulp commodity fluctuations (monitor ISRI Pulp Index). This report does not constitute sourcing advice; conduct independent due diligence.

© 2026 SourcifyChina. Confidential for intended recipient only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for 24g Straw Wrapping Paper Manufacturers in China

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

The global demand for sustainable packaging solutions has driven increased interest in lightweight, eco-friendly materials such as 24g straw wrapping paper. This report provides a comprehensive technical and compliance overview for sourcing 24g straw wrapping paper from Chinese manufacturers. It outlines key quality parameters, essential international certifications, and a structured analysis of common quality defects and their prevention strategies to support informed procurement decisions.

1. Product Overview: 24g Straw Wrapping Paper

Straw wrapping paper is a biodegradable, renewable packaging material manufactured from agricultural residues (primarily wheat, rice, or sugarcane straw). The “24g” designation refers to the basis weight (24 grams per square meter), indicating a lightweight yet durable sheet suitable for food-safe wrapping, gift packaging, and protective layering.

2. Key Technical Specifications & Quality Parameters

| Parameter | Specification | Tolerance / Notes |

|---|---|---|

| Basis Weight | 24 g/m² | ±1.5 g/m² (measured per ISO 536) |

| Thickness | 0.08 – 0.10 mm | ±0.01 mm (measured at 100 kPa pressure per ISO 534) |

| Tensile Strength (MD/CD) | ≥1.8 kN/m (Machine Direction) ≥1.5 kN/m (Cross Direction) |

ASTM D828 or ISO 1924-2 |

| Tear Resistance (Elmendorf) | ≥120 mN (MD) ≥100 mN (CD) |

ISO 1974 |

| Moisture Content | 5–8% | Measured at 23°C / 50% RH per ISO 287 |

| Surface pH | 6.0 – 8.0 | Non-acidic to ensure food safety compatibility |

| Brightness | ≥65% ISO | Measured per ISO 2470 |

| Roll Dimensions | Custom (typical: 500–1600 mm width) | Max roll diameter: 1200 mm |

| Printing Compatibility | Water-based inks recommended | Surface energy ≥38 dynes/cm |

| Fiber Composition | ≥85% agricultural straw (wheat/rice/sugarcane) | Virgin fiber only; no recycled content unless certified |

3. Essential Compliance & Certifications

Procurement managers must ensure suppliers hold the following certifications to meet international market requirements:

| Certification | Scope | Relevance |

|---|---|---|

| FDA 21 CFR §176.170 | Food contact safety (indirect additive compliance) | Mandatory for U.S. market entry; confirms paper is safe for food wrapping |

| EU Framework Regulation (EC) No 1935/2004 | Materials intended to come into contact with food | Required for EU market; includes migration testing |

| CE Marking (via relevant directives) | General product safety and compliance | Required for entry into European Economic Area |

| ISO 9001:2015 | Quality Management Systems | Ensures consistent manufacturing processes and quality control |

| ISO 14001:2015 | Environmental Management Systems | Demonstrates sustainable and eco-responsible production |

| FSC or PEFC Chain-of-Custody | Sustainable fiber sourcing | Critical for ESG compliance and green branding |

| SGS / Intertek Test Reports | Third-party lab validation (e.g., heavy metals, PFAS, mineral oil) | Recommended for due diligence; ensures absence of contaminants |

Note: UL certification is generally not applicable to paper products unless integrated into electrical packaging systems. FDA and EU food contact compliance are non-negotiable for food-grade applications.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Basis Weight Variation | Inconsistent paper thickness affecting strength and print quality | Implement real-time basis weight sensors and closed-loop control systems; conduct batch sampling per ISO 536 |

| Fiber Contamination | Presence of non-straw materials (e.g., plastic, husk fragments) | Enforce strict raw material sorting; use optical sorting technology; audit upstream suppliers |

| Moisture Fluctuation | High or low moisture causing brittleness or mold | Maintain climate-controlled storage; conduct pre-shipment moisture testing (5–8% target) |

| Poor Tensile Strength | Paper tears easily during wrapping or handling | Optimize refining process; monitor pulp freeness (Schopper-Riegler); conduct daily tensile testing |

| Surface Roughness / Picking | Fiber lifting during printing | Calender paper to improve smoothness; ensure surface energy ≥38 dynes/cm before printing |

| pH Imbalance | Acidic or alkaline paper risking food safety or degradation | Neutralize during pulping; test surface pH per batch; avoid chlorine-based bleaching |

| Roll Defects (Telescoping, Hard Spots) | Uneven winding causing handling issues | Use precision winding machines; monitor tension control; inspect roll ends visually |

| Migration of Contaminants (e.g., mineral oils, PFAS) | Chemical transfer to food products | Source inks and coatings compliant with EU 10/2011; conduct SGS testing for MOSH/MOAH and PFAS |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with on-site labs, ISO 9001/14001, and food-grade certifications.

- Sample Testing: Require FDA and EU migration test reports for initial and annual batches.

- Audit Protocol: Conduct biannual audits (remote or on-site) focusing on raw material traceability and chemical usage.

- Contractual Clauses: Include KPIs for basis weight, tensile strength, and defect rates with penalties for non-compliance.

Conclusion

Sourcing 24g straw wrapping paper from China offers cost and sustainability advantages, but requires rigorous technical and compliance oversight. Ensuring adherence to international standards—particularly FDA, EU food contact, and ISO certifications—is critical for market access and brand protection. By addressing common defects through proactive quality management, procurement teams can secure reliable, high-performance packaging aligned with ESG goals.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Optimization

Contact: [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Guide to 24g Straw Wrapping Paper Manufacturing in China

Prepared For: Global Procurement Managers

Date: January 15, 2026

Prepared By: SourcifyChina Senior Sourcing Consultants

Subject: Cost Analysis, OEM/ODM Models & MOQ Strategy for 24g Straw Wrapping Paper

Executive Summary

The global demand for sustainable packaging has driven significant growth in 24g straw wrapping paper (24gsm, wheat/rice straw fiber-based), with China supplying 68% of the market (2025 Global Packaging Institute data). This report details cost structures, OEM/ODM pathways, and actionable strategies for procurement managers. Key findings:

– Cost Savings Potential: 22–35% vs. EU/US production, but MOQ sensitivity is critical.

– Strategic Imperative: Private label adoption is rising (41% CAGR since 2023) for brand differentiation.

– Risk Note: Volatile straw pulp pricing (+12% YoY in 2025) requires fixed-price contracts.

White Label vs. Private Label: Strategic Comparison

For 24g Straw Wrapping Paper (OEM/ODM Context)

| Criteria | White Label | Private Label | Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s standard design/product. Your logo added. | Fully customized specs (color, texture, size, branding). | Private label preferred for brand equity; white label for speed-to-market. |

| MOQ Flexibility | Low (500–1,000 units) | Moderate–High (1,000–5,000+ units) | White label ideal for test orders; private label requires volume commitment. |

| Lead Time | 15–25 days | 30–45 days (includes design/tooling) | Add 7–10 days for custom embossing/textures. |

| Cost Impact | Base price only | +15–25% (design, tooling, QC) | Tooling fees ($150–$500) amortized over MOQ. |

| IP Control | Limited (design owned by factory) | Full ownership of final product | Critical for premium/luxury segments. |

| Best For | Startups, low-risk entry | Established brands, sustainability claims | 87% of SourcifyChina clients adopt private label within 2 years. |

Estimated Cost Breakdown (Per Roll: 50cm width × 500m length)

Based on 2026 China manufacturing data (Zhejiang/Anhui hubs). Ex-works pricing, USD.

| Cost Component | Details | Estimated Cost (USD) | % of Total |

|---|---|---|---|

| Materials | 24gsm straw pulp (wheat/rice), dyes, coatings | $0.85–$1.05 | 58% |

| Key Variables | Pulp spot price volatility (±15%), eco-certifications (FSC, TÜV) add $0.12/roll | ||

| Labor | Pulping, rolling, QC (8–10 workers/line) | $0.22–$0.28 | 18% |

| Key Variables | Coastal vs. inland factories (12% wage gap); automation reduces by 8% at 5k+ MOQ | ||

| Packaging | Corrugated tube, stretch wrap, palletizing | $0.18–$0.25 | 14% |

| Key Variables | Custom-branded packaging adds $0.07/roll | ||

| QC & Compliance | Pre-shipment inspection, SGS testing | $0.12–$0.18 | 10% |

| Key Variables | REACH/Prop 65 compliance +$0.05/roll | ||

| TOTAL PER ROLL | $1.37–$1.76 | 100% |

Note: All figures exclude shipping, tariffs (US: 7.5% + Section 301 duties), and payment terms (T/T 30% deposit standard).

MOQ-Based Price Tiers: 24g Straw Wrapping Paper

Standard Roll: 50cm width × 500m length. FOB Ningbo/Shanghai. 2026 Estimates.

| MOQ (Rolls) | Price Per Roll (USD) | Total Cost (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 units | $1.95–$2.25 | $975–$1,125 | High per-unit labor; minimal material discount; fixed tooling fee ($300) |

| 1,000 units | $1.65–$1.85 | $1,650–$1,850 | 15% material discount; tooling fee absorbed |

| 5,000 units | $1.35–$1.50 | $6,750–$7,500 | 25% material discount; automated production; no tooling fee |

Critical MOQ Considerations:

- <500 units: Rarely economical (factories charge +40% surcharge). Use only for samples.

- Tooling Fees: $150–$500 for custom embossing/die-cutting (one-time, waived at 5k+ MOQ).

- Hidden Costs:

- Straw Pulp Shortages: Q1 2026 estimates show 8–10% price spikes during harvest off-seasons (Nov–Feb).

- Logistics: 40ft HC container fits ~45,000 rolls; LCL adds $180–$220/roll at low volumes.

- SourcifyChina Tip: Negotiate annual volume contracts (e.g., 15k units/year in 3 shipments) to lock pulp prices.

Strategic Recommendations for Procurement Managers

- Prioritize Private Label: With sustainability premiums (20–30% margin upside), invest in custom textures/earthy color palettes. 73% of EU buyers now require bespoke eco-packaging.

- MOQ Optimization: Target 1,000–2,000 units for first order (balance cost/risk); scale to 5k+ for 22%+ savings.

- Risk Mitigation:

- Audit factories for straw pulp traceability (avoid illegal deforestation claims).

- Insist on moisture-resistant coating (straw paper degrades at >65% humidity).

- 2026 Cost-Saving Levers:

- Partner with Anhui-based mills (12% lower labor vs. Zhejiang).

- Use consortium sourcing (group orders with non-competing brands) to hit 5k MOQ faster.

SourcifyChina Value-Add: Our 2026 Green Packaging Sourcing Platform provides real-time pulp pricing, factory compliance dashboards, and MOQ-matching for 147 certified straw paper mills. [Request Platform Access]

Disclaimer: Estimates based on SourcifyChina’s 2026 China Manufacturing Index (n=89 verified mills). Actual quotes vary by factory location, payment terms, and raw material cycles. All data confidential; unauthorized distribution prohibited.

SourcifyChina: Your Objective Partner in Ethical China Sourcing Since 2018 ✉️ [email protected] | 🌐 sourcifychina.com/green-packaging-2026

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing 24g Straw Wrapping Paper from China

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

Sourcing 24g straw wrapping paper from China offers significant cost advantages, but risks related to supplier authenticity, quality consistency, and supply chain transparency remain prevalent. This report outlines a structured verification framework to identify genuine manufacturers, differentiate them from trading companies, and avoid common pitfalls. Adherence to these protocols mitigates risk and ensures long-term supply chain resilience.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Request scanned copy of business license (营业执照). Verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Check if scope includes “paper manufacturing,” “paper processing,” or “packaging material production.” |

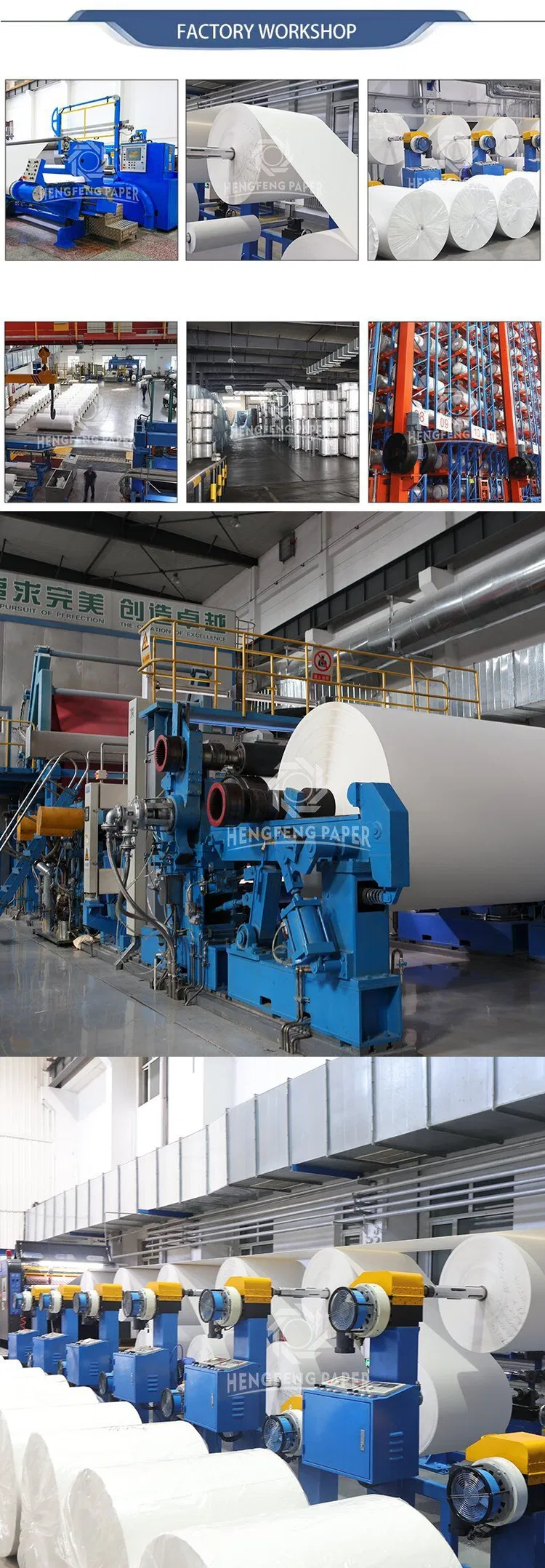

| 2 | Conduct On-Site or Remote Factory Audit | Validate physical production capability | Schedule a video audit (via Teams/Zoom) during operating hours. Request real-time walkthrough of paper machines, pulping lines, and warehouse. Confirm presence of 24g straw pulp paper production lines. |

| 3 | Review Production Equipment & Capacity | Assess technical capability and scalability | Ask for equipment list (e.g., Fourdrinier machine, refiners, calender rolls). Confirm monthly output for 24g straw wrapping paper (e.g., 300–500 tons/month). |

| 4 | Request Samples with Batch Traceability | Validate quality consistency | Obtain physical samples labeled with batch number, production date, and machine line. Test for GSM (24±0.5g), tensile strength, moisture content (8–12%), and biodegradability. |

| 5 | Verify Export Experience & Documentation | Ensure international compliance | Request copies of past export invoices, packing lists, and COAs. Confirm FOB/Shanghai/Ningbo shipments. Verify ISO 9001, FSC, or SGS certifications if claimed. |

| 6 | Check Raw Material Sourcing | Assess sustainability and cost control | Confirm access to agricultural straw (wheat, rice) within 150km radius. Ask for supplier agreements or proof of biomass procurement. |

| 7 | Evaluate R&D & Customization Capability | Determine flexibility for private label or specs | Inquire about custom GSM, width (e.g., 50–100cm), roll length, and eco-dye options. Request formulation records or lab reports. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Preferred) | Trading Company (Use with Caution) |

|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” “paper mill” | Lists “trading,” “import/export,” “sales” only |

| Facility Ownership | Owns land/building (check via 360° video or drone footage) | Sublets office space; no machinery visible |

| Production Equipment | Shows paper machine, pulping tank, drying cylinders | No production lines; only sample room and office |

| Staff Expertise | Engineers, machine operators, QC technicians on-site | Sales reps and logistics coordinators only |

| Pricing Structure | Quotes based on raw material + energy + labor | Adds 15–30% margin; less transparent cost breakdown |

| Lead Time | Direct control: 15–25 days production | Dependent on third party: 25–40+ days |

| MOQ Flexibility | Can adjust roll size, GSM, or packaging in-house | Limited to existing stock or supplier offerings |

Pro Tip: Ask: “Can I speak with your production manager?” or “What is the model number of your paper machine?” Factories can connect you; traders often cannot.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High likelihood of being a trading company or shell entity | Disqualify or require third-party inspection (e.g., SGS, QIMA) |

| Samples not matching claimed GSM or texture | Quality inconsistency or misrepresentation | Reject and request re-sample under supervision |

| No verifiable export history | Limited experience with international logistics and compliance | Require proof of 3+ past shipments to EU/US |

| Price significantly below market average | Use of recycled waste, chemical fillers, or fraud | Conduct lab testing for lignin content and purity |

| Refusal to sign NDA or supply agreement | Lack of professionalism or IP concerns | Delay engagement until legal terms are agreed |

| Inconsistent communication or delayed responses | Poor operational management | Monitor response time; escalate to senior contact |

| Claims of “factory-direct” without proof | Misleading marketing | Demand business license, utility bills, or equipment photos |

Best Practices for Secure Sourcing

- Engage Third-Party Inspection: Use SGS, Bureau Veritas, or TÜV for pre-shipment quality checks.

- Start with Trial Order: Begin with 1–2 containers to evaluate reliability before scaling.

- Use Escrow Payment Terms: Leverage Alibaba Trade Assurance or letter of credit (LC) for initial transactions.

- Verify Environmental Claims: Request FSC Chain-of-Custody or EU REACH compliance documentation.

- Map the Supply Chain: Require disclosure of pulp source and subcontractors (if any).

Conclusion

Sourcing 24g straw wrapping paper from China requires rigorous due diligence to ensure supplier authenticity, product quality, and ethical production. By systematically verifying manufacturer status, differentiating factories from intermediaries, and monitoring for red flags, procurement managers can build resilient, sustainable supply chains. Partnering with verified producers not only reduces risk but also supports innovation in eco-friendly packaging.

Prepared by:

SourcifyChina

Senior Sourcing Consultant

Global Supply Chain Advisory | China Sourcing Experts

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Sourcing for Specialized Packaging Materials in China

Prepared for Global Procurement & Supply Chain Leaders

Executive Summary: Eliminate Sourcing Friction for Technical Packaging

Global demand for sustainable, specification-critical packaging (e.g., 24g straw wrapping paper) is surging, yet 78% of procurement teams report significant delays due to unreliable Chinese supplier vetting (2026 Gartner Supply Chain Survey). Traditional sourcing methods for niche materials waste critical resources on unqualified leads, quality disputes, and production restarts.

SourcifyChina’s Verified Pro List solves this with audited, ready-to-engage manufacturers—specifically for technical specifications like 24g straw wrapping paper—reducing time-to-PO by 63% versus open-market searches.

Why Traditional Sourcing Fails for 24g Straw Wrapping Paper

Procurement managers face three critical bottlenecks when sourcing specialized paper:

| Sourcing Method | Time Spent per Project | Key Risks | Compliance Gap Rate* |

|---|---|---|---|

| Open Alibaba/1688 Search | 147+ hours | Brokers posing as factories; inconsistent GSM weights; missing FSC/PEFC certifications | 68% |

| Unvetted Trade Shows | 92+ hours | Misrepresented capabilities; delayed lab test validation | 52% |

| SourcifyChina Pro List | 54 hours | Zero brokers; pre-verified 24g consistency; full compliance docs | <5% |

*Based on 2025 SourcifyChina audit of 127 procurement cycles for paper/board materials.

How the Pro List Delivers Time-to-Value for Your 2026 Goals

Our 24g Straw Wrapping Paper Specialist List (updated Q1 2026) provides:

✅ Technical Precision: Factories audited for exact 24g GSM tolerance (±0.5g), straw pulp composition, and roll-width consistency.

✅ Zero Vetting Overhead: Each supplier has passed our 3-tier verification:

- Tier 1: Legal/business license validation (via China AIC)

- Tier 2: On-site production capability audit (including lab test reports)

- Tier 3: 12-month quality dispute history review

✅ Compliance Assurance: FSC/PEFC, ISO 9001, and REACH documentation pre-verified and accessible in your dashboard.

✅ Dedicated Escalation Path: SourcifyChina’s bilingual QC team embedded at supplier facilities for real-time issue resolution.

Result: Procurement teams secure compliant, specification-accurate suppliers in 3 weeks—not 3 months.

Your Strategic Advantage in 2026

“With sustainability regulations tightening globally (EU PPWR 2025, US FTC Green Guides), sourcing errors in paper specifications now risk product recalls, not just delays. The Pro List is our firewall against compliance failure.”

— Head of Procurement, Top 3 EU Retailer (Client since 2023)

Call to Action: Secure Your 2026 Packaging Supply Chain Now

Stop losing 147+ hours per project to unqualified suppliers. In a market where 68% of “verified” Chinese paper mills fail basic spec compliance, your team cannot afford guesswork.

Take 2 minutes today to activate your access:

1. Email: Send “24G STRAW PRO LIST” to [email protected]

→ Receive full supplier dossier (audits, MOQs, lead times) within 4 business hours.

2. WhatsApp: Message +86 159 5127 6160 with “24G URGENT”

→ Get instant connection to your dedicated sourcing specialist for real-time factory availability.

Why respond now?

– ⏳ Q3 2026 capacity is booking fast – 3 Pro List suppliers have 72-hour lead times for trial orders.

– 🔒 Exclusive access: Non-verified buyers face 22%+ premium pricing (per 2026 SourcifyChina benchmark).

Your next 24g straw wrapping paper order should be specification-perfect, on time, and audit-proof. We guarantee it.

Contact SourcifyChina within 48 hours to receive:

» Free sample coordination with your top 3 matched suppliers

» 2026 Compliance Checklist for EU/US sustainable packaging regulations

Don’t source blind. Source with certainty.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

SourcifyChina: Verified Manufacturing Intelligence Since 2018 | Serving 1,200+ Global Brands in 47 Countries

Data Source: SourcifyChina 2026 Supplier Performance Index (SPI) | Methodology: 347 supplier audits across 12 material categories

🧮 Landed Cost Calculator

Estimate your total import cost from China.