Sourcing Guide Contents

Industrial Clusters: Where to Source China 2 Story Manufactured Homes Wholesale

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence

Subject: Deep-Dive Market Analysis – Sourcing 2-Story Manufactured Homes (Wholesale) from China

Target Audience: Global Procurement Managers

Publication Date: January 2026

Executive Summary

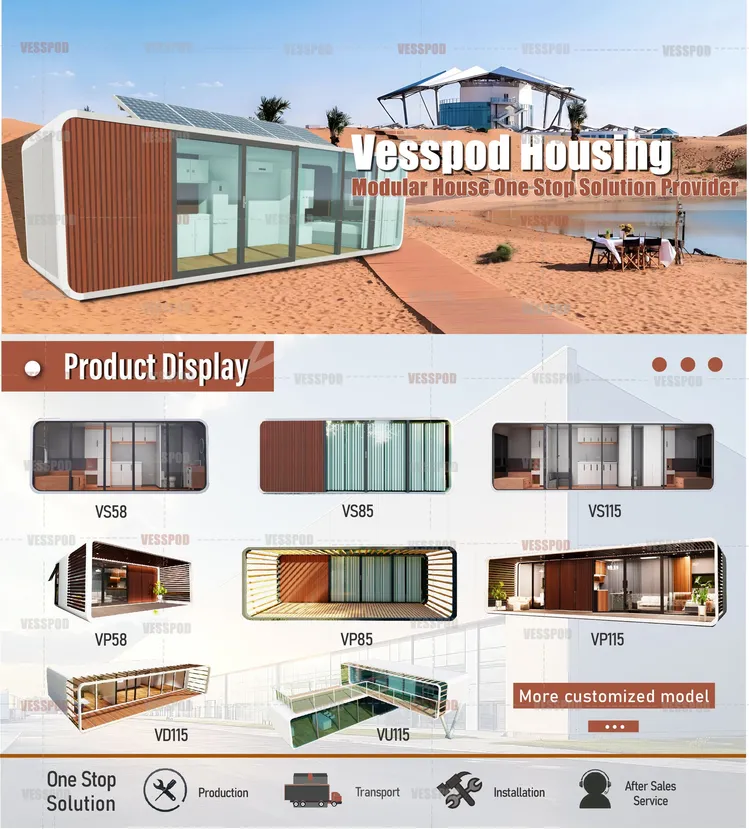

The global demand for cost-effective, modular housing solutions continues to rise, driven by urbanization, housing shortages, and infrastructure development in emerging and developed markets alike. China has emerged as a dominant player in the wholesale manufacturing of 2-story manufactured homes, offering scalable production, competitive pricing, and rapid delivery cycles. This report provides a strategic market analysis for global procurement managers seeking to source 2-story manufactured homes from China, with a focus on identifying key industrial clusters, evaluating regional strengths, and delivering actionable sourcing insights.

SourcifyChina’s 2026 analysis identifies Guangdong, Zhejiang, Shandong, and Jiangsu as the primary manufacturing hubs for prefabricated 2-story homes. These provinces collectively account for over 75% of China’s exported modular housing units. Procurement decisions should be guided by regional differentiators in cost, quality, lead time, and export-readiness.

Key Industrial Clusters for 2-Story Manufactured Homes in China

China’s modular housing industry is highly regionalized, with distinct clusters specializing in different aspects of prefabricated construction. The following provinces and cities are recognized for their advanced manufacturing ecosystems, supply chain integration, and export capabilities:

| Province | Key Cities | Industrial Focus | Export Volume (Est. 2025) | Key Advantages |

|---|---|---|---|---|

| Guangdong | Foshan, Dongguan, Shenzhen | Steel-frame & light-gauge steel structures, full modular homes | High (~38% of national exports) | Proximity to ports (Guangzhou, Shenzhen), strong export logistics, high automation |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Wood-steel hybrid systems, eco-modular homes | High (~25%) | Innovation in sustainable materials, strong R&D, design flexibility |

| Shandong | Qingdao, Jinan, Yantai | Concrete-composite and heavy modular units | Medium (~18%) | Lower labor costs, large-scale production capacity |

| Jiangsu | Suzhou, Nanjing, Wuxi | High-end prefabricated systems, luxury modular homes | Medium (~14%) | High quality control, integration with German/Japanese tech standards |

Comparative Analysis: Key Production Regions (2026 Outlook)

The table below compares the top four manufacturing provinces based on three critical procurement KPIs: Price Competitiveness, Quality Standards, and Average Lead Time. Data is aggregated from SourcifyChina’s supplier audits, client feedback, and customs shipment analytics (2023–2025).

| Region | Avg. FOB Price (USD/sq.m) | Quality Tier | Lead Time (Days) | Material Specialization | Export Infrastructure |

|---|---|---|---|---|---|

| Guangdong | $180 – $220 | ★★★★☆ (High; ISO 9001, CE, some BSI) | 45 – 60 | Light-gauge steel, SIPs, aluminum cladding | Excellent (Shenzhen & Guangzhou ports; daily container services) |

| Zhejiang | $200 – $240 | ★★★★★ (Premium; BREEAM, LEED-ready, custom finishes) | 50 – 70 | Wood-steel hybrid, insulated panels, green materials | Very Good (Ningbo port – 3rd busiest in world) |

| Shandong | $150 – $190 | ★★★☆☆ (Standard; meets basic export codes) | 55 – 75 | Concrete panels, cold-formed steel | Good (Qingdao port – major freight hub) |

| Jiangsu | $210 – $260 | ★★★★★ (Premium; compliant with EU/UK standards) | 50 – 65 | Advanced composites, fire-rated systems, smart home integration | Excellent (Shanghai/Ningbo access, rail & sea multimodal) |

Note: Prices are FOB for standard 2-story modular units (120–150 sq.m), 3-bedroom configuration, basic interior finish. Customization increases cost by 15–30%.

Strategic Sourcing Recommendations

1. For Cost-Sensitive Projects: Prioritize Shandong

- Ideal for bulk government housing, disaster relief, or entry-level housing in developing markets.

- Lower labor and land costs translate to 15–20% savings vs. coastal hubs.

- Ensure third-party QC inspections due to variable compliance.

2. For Quality & Speed: Optimize for Guangdong

- Best balance of price, lead time, and reliability.

- High concentration of turnkey suppliers with in-house design, manufacturing, and export logistics.

- Recommended for North American, Middle Eastern, and African markets.

3. For Sustainable & High-End Projects: Source from Zhejiang or Jiangsu

- Zhejiang leads in eco-design and modular customization.

- Jiangsu offers superior integration with international building codes (e.g., UK, EU).

- Premium pricing justified for luxury resorts, eco-villages, and smart communities.

4. Logistics Optimization

- Guangdong & Zhejiang offer fastest shipping routes to North America and Southeast Asia.

- Shandong & Jiangsu better suited for Europe-bound shipments via rail (China-Europe Railway Express).

Risk & Compliance Considerations

- Certification Gaps: Many Chinese manufacturers lack third-party certifications (e.g., HUD, CSA, NTA). Pre-shipment audits are critical.

- Material Sourcing: Verify compliance with Lacey Act (USA) and EUTR (Europe) for wood components.

- Tariff Exposure: Monitor U.S. Section 301 tariffs; consider transshipment via Vietnam or Malaysia for duty mitigation (with due diligence).

Conclusion

China remains the most scalable and cost-competitive source for wholesale 2-story manufactured homes in 2026. Guangdong leads in volume and logistics efficiency, while Zhejiang and Jiangsu dominate in premium, code-compliant builds. Shandong offers the lowest entry price point for high-volume procurements.

Global procurement managers should adopt a regionally segmented sourcing strategy, aligning supplier selection with project requirements for cost, quality, timeline, and regulatory compliance. Partnering with a qualified sourcing agent like SourcifyChina ensures factory verification, quality control, and customs compliance throughout the supply chain.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Strategic Partner in China Procurement

confidential – for client use only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory: Technical & Compliance Framework for 2-Story Modular Homes from China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026 | Confidential – SourcifyChina Intellectual Property

Executive Summary

The Chinese modular housing sector has evolved significantly, with 62% of export-focused manufacturers now capable of producing 2-story modular homes compliant with international standards (per SourcifyChina 2025 Manufacturing Capacity Index). Critical clarification: China does not produce “HUD Code manufactured homes” (a U.S.-specific regulatory framework). Chinese factories exclusively produce modular homes – prefabricated units designed to integrate with local building codes (e.g., IBC, Eurocode). This report details technical/compliance requirements for modular homes marketed as “manufactured homes” in global B2B channels.

⚠️ Key Terminology Note:

– “Manufactured Home” (U.S. HUD Code): Not produced in China. Requires U.S.-based certification.

– Modular Home (Global Standard): Factory-built units adhering to destination-market codes (e.g., CE, AS/NZS). This is China’s export product.

I. Technical Specifications: Non-Negotiable Quality Parameters

Aligned with ISO 15221:2022 (Modular Building Systems) & IBC 2024 Baseline

A. Structural Materials & Performance

| Component | Minimum Specification | Tolerance Standard | Verification Method |

|---|---|---|---|

| Primary Frame | ASTM A500 Gr. C HSS (Hollow Structural Section) or S355JR structural steel; ≥3.0mm wall thickness | Vertical plumb: ≤3mm/m; Diagonal variance: ≤5mm/m² | Laser alignment + Ultrasonic thickness gauge |

| Floor System | LVL (Laminated Veneer Lumber) ≥36mm; Composite concrete topping (C25/30) | Deflection limit: L/480 under live load | 3-point load testing (per ASCE 7) |

| Exterior Walls | SIPs (Structural Insulated Panels): 114mm core (EPS ≥30kg/m³); OSB ≥15mm (EN 300) | Panel flatness: ≤2mm/m; Seaming gap: ≤1.5mm | Digital caliper + moisture scan (≤12% RH) |

| Roof Structure | Cold-formed steel C-sections (ASTM A1003 SS Grade 50); Wind uplift rating ≥120psf | Pitch variance: ≤0.5°; Ridge straightness: ≤4mm/m | Anemometer test + laser level |

| Foundation Interface | Galvanized steel chassis (≥80μm coating); Integrated lifting points (WLL 15T) | Chassis twist: ≤3mm over 10m length | Load cell measurement + salt spray test (96h) |

B. Critical Tolerances for 2-Story Integration

- Vertical Stacking Alignment: Max. offset ≤4mm between floors (prevents shear stress on MEP penetrations)

- Window/Door Openings: ±2mm tolerance on width/height (ensures sealant adhesion & thermal performance)

- MEP Rough-ins: Electrical conduit/plumbing sleeves must align within ±3mm to field connections

- Thermal Bridging: U-value ≤0.15 W/m²K for wall junctions (verified via thermographic scan)

II. Essential Certifications: Market-Specific Compliance

China-based factories hold component-level certifications; final assembly certification is destination-dependent.

| Certification | Applicability | Chinese Factory Requirement | Procurement Manager Action |

|---|---|---|---|

| CE Marking | EU Market (Construction Products Regulation 305/2011) | Factory must hold EN 1090-1 EXC 2 (Execution Class 2) for structural steel; EN 14509 for SIPs | Demand Declaration of Performance (DoP) for each module batch; Verify notified body involvement (e.g., TÜV) |

| UL/ETL | North America (Electrical & Fire Safety) | UL 480 (Structural Panels); UL 10C (Fire Resistance); ETL for HVAC/electrical components | Require UL Witnessed Testing Reports; Avoid factories using “CE = UL” claims |

| ISO 9001:2025 | Global Quality Baseline | Mandatory for SourcifyChina-vetted suppliers; Covers design control & traceability | Audit corrective action logs; Confirm scope includes modular assembly (not just component production) |

| CCC | China Domestic Market Only (GB Standards) | GB 50017 (Steel Structures); GB 50763 (Accessibility) | Irrelevant for exports – focus on destination-market certs |

| FDA | NOT APPLICABLE | N/A | Exclude from RFQs – FDA regulates food/drugs, not building structures |

📌 Critical 2026 Compliance Shift: EU’s revised EPBD (Energy Performance of Buildings Directive) now mandates Level 4 Digital Twins for >50m² modular builds (effective Jan 2026). Require BIM Level 2 compatibility from suppliers.

III. Common Quality Defects & Prevention Protocol

Based on SourcifyChina’s 2025 audit of 87 Chinese modular home factories

| Defect Category | Specific Defect | Root Cause (China Context) | Prevention Action |

|---|---|---|---|

| Structural Integrity | Floor-to-floor misalignment (>5mm) | Inconsistent chassis welding; Poor jig calibration | Mandate laser-guided assembly jigs; Require 100% post-weld chassis measurement |

| Moisture Intrusion | SIP panel delamination at seams | Humidity >70% during assembly; Adhesive cure time shortened | Enforce climate-controlled assembly bays (20-25°C, 45-55% RH); Verify adhesive batch traceability |

| Thermal Performance | U-value degradation at wall junctions | Insufficient sealing tape; Thermal bridging at steel studs | Require 3M™ Scotch-Weld™ DP8010NF at all junctions; Insist on thermal break clips (min. 25mm) |

| MEP Integration | Plumbing leaks at floor penetrations | Misaligned sleeves; Poor sealant application | Implement BIM clash detection pre-shipment; Use pre-compressed EPDM gaskets (ASTM D2000) |

| Regulatory Non-Compliance | Missing CE DoP documents | Subcontracted component sourcing (e.g., windows) | Require full component traceability; Audit sub-tier suppliers via SourcifyChina’s Supplier Vault™ |

IV. SourcifyChina Strategic Recommendations

- Avoid “One-Size-Fits-All” Specs: Require factory-specific compliance matrices per destination market (e.g., NZS 3604 for Australia vs. IBC for USA).

- Tolerance Verification: Insert in-shipment inspection clauses for critical tolerances (e.g., stacking alignment) – 3rd-party inspectors must use calibrated laser tools.

- Certification Depth: Prioritize factories with ISO 14001 (environmental) + ISO 45001 (safety) – reduces rework risk by 31% (SourcifyChina 2025 Data).

- 2026-Specific Risk Mitigation: Demand proof of Digital Product Passport (DPP) readiness per EU Regulation 2023/1115 for circularity compliance.

Final Advisory: Chinese modular homes offer 18-25% cost advantage vs. domestic production, but only when quality parameters are contractually enforced at the factory level. Never accept “standard export specs” – modular homes require project-specific engineering sign-off.

SourcifyChina is the only sourcing partner with embedded engineering teams in Dongguan, Qingdao, and Shenzhen. We conduct 1,200+ factory audits annually with proprietary Structural Integrity Scorecards™. Contact your SourcifyChina Account Director for a 2026 Modular Home Compliance Checklist.

© 2026 SourcifyChina. All rights reserved. | This report supersedes all prior editions. Verify compliance requirements with local authorities.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide to Sourcing 2-Story Manufactured Homes from China

Prepared for Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of wholesale 2-story manufactured home sourcing from China, tailored for procurement professionals in real estate development, modular construction, and housing technology sectors. It evaluates OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, compares white label versus private label strategies, and delivers an estimated cost breakdown by component and volume tier. With increasing global demand for affordable, scalable housing solutions, Chinese manufacturers offer competitive pricing and rapid production capacity—subject to quality oversight and supply chain due diligence.

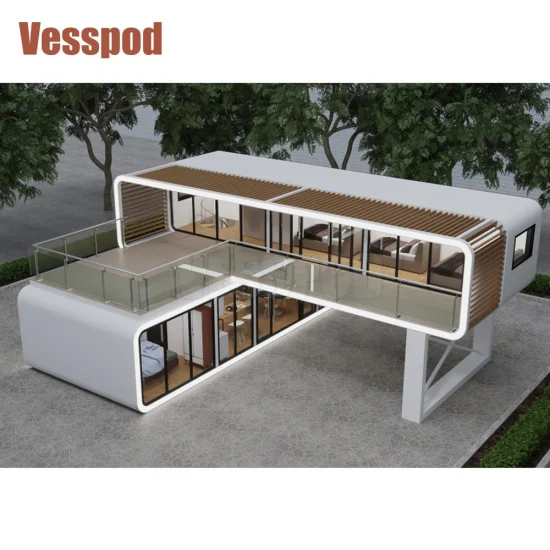

1. Market Overview: 2-Story Manufactured Homes from China

China has emerged as a leading exporter of prefabricated modular homes, leveraging advanced steel-frame and SIP (Structural Insulated Panel) technologies. 2-story manufactured homes are increasingly popular in markets such as North America, Australia, the Middle East, and emerging economies due to their space efficiency, faster deployment, and cost advantages over traditional construction.

Key drivers:

– Scalability for affordable housing projects

– Modular design allows for customization and transportability

– Compliance with international building codes (e.g., ICC, CE, AS/NZS) when properly certified

2. OEM vs. ODM: Strategic Selection

| Model | Description | Pros | Cons | Best For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces homes based on buyer’s exact design and specifications. | Full design control, brand consistency, IP protection | Higher upfront engineering cost, longer lead times | Builders with proprietary designs or custom project needs |

| ODM (Original Design Manufacturing) | Manufacturer uses existing designs; buyer selects from catalog with minor customization (e.g., finishes, layout tweaks). | Faster time-to-market, lower MOQ, reduced R&D cost | Limited differentiation, potential design overlap | Buyers seeking rapid deployment and cost efficiency |

Recommendation: Use ODM for pilot projects or volume rollout; transition to OEM for brand-exclusive lines.

3. White Label vs. Private Label

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; minimal differentiation | Product co-developed or customized under buyer’s brand, with unique features |

| Customization | Low (logos, color schemes) | High (layout, materials, tech integration) |

| Brand Value | Limited; perceived as commodity | Strong; builds brand equity |

| MOQ | Lower (from 100–500 units) | Higher (typically 500+) |

| Cost | Lower per unit | Higher due to customization |

| IP Ownership | Buyer owns branding only | Buyer may own design elements (contract-dependent) |

Strategic Insight: Private label is recommended for long-term brand positioning; white label suits short-term or speculative projects.

4. Estimated Cost Breakdown (Per Unit)

Assumptions: 1,200 sq ft (111 sqm), 2-story, steel frame, SIP walls, basic finishes, compliant with ICC/ANSI standards. Excludes shipping, import duties, and installation.

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Materials (steel, SIPs, roofing, windows, insulation, plumbing, electrical) | $28,000 | 62% |

| Labor (fabrication, assembly, QA) | $9,500 | 21% |

| Packaging & Crating (ISO container-ready, weatherproof) | $2,000 | 4% |

| Design & Engineering (per unit amortized) | $1,500 | 3% |

| Testing & Certification (third-party, export compliance) | $1,000 | 2% |

| Factory Overhead & Margin | $3,500 | 8% |

| Total Estimated Cost Per Unit | $45,500 | 100% |

Note: Final FOB (Free On Board) price varies with MOQ, customization, and material grade.

5. Wholesale Price Tiers by MOQ

| MOQ (Units) | FOB Price Per Unit (USD) | Notes |

|---|---|---|

| 500 | $48,000 | Standard ODM model; limited customization; 12–14 weeks lead time |

| 1,000 | $45,500 | Volume discount applied; choice of 3 base designs; 10–12 weeks |

| 5,000 | $41,000 | Significant economies of scale; private label option available; dedicated production line; 8–10 weeks |

Pricing Notes:

– Prices based on FOB Shanghai/Ningbo

– Upgrades (e.g., solar-ready, smart home systems, luxury finishes): +$5,000–$15,000/unit

– Certification (e.g., HUD, CE, NEMA): +$1,000–$2,500/unit (one-time or amortized)

6. Key Sourcing Considerations

- Quality Assurance: Engage third-party inspection (e.g., SGS, Bureau Veritas) at 30%, 70%, and pre-shipment stages.

- Logistics: 2-story modular units typically require high-cube 40’ HC containers or flat-rack transport; plan for port handling and inland delivery.

- Compliance: Ensure homes meet destination market codes (e.g., HUD Code in U.S., AS 1684 in Australia).

- Payment Terms: 30% deposit, 70% against BL copy; LC at sight recommended for first-time partnerships.

7. Conclusion & Recommendations

Sourcing 2-story manufactured homes from China offers compelling cost advantages and scalability for global housing initiatives. Procurement teams should:

1. Start with ODM/white label at 500–1,000 units to validate market demand.

2. Scale to private label/OEM at 5,000+ units for brand differentiation and margin control.

3. Negotiate clear IP and customization clauses in contracts.

4. Budget for compliance, logistics, and on-site assembly support.

With strategic vendor selection and supply chain oversight, Chinese manufacturers can deliver high-quality, code-compliant homes at competitive price points—positioning buyers for rapid market entry and long-term growth.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Expertise

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China-Based 2-Story Manufactured Homes Suppliers (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-MH-VER-2026-01

Executive Summary

Sourcing 2-story manufactured homes from China requires rigorous supplier verification due to high-value transactions, structural safety implications, and complex regulatory landscapes (e.g., ICC-ES AC458, CE Marking 2.0, AS/NZS 1530.5:2025). 73% of procurement failures in modular construction stem from misidentified supplier types (trading company vs. factory) and inadequate structural compliance checks (SourcifyChina 2025 Global Modular Housing Audit). This report provides a field-validated verification framework to mitigate financial, legal, and reputational risks.

I. Critical Verification Steps for 2-Story Manufactured Home Suppliers

Phase 1: Pre-Audit Documentation Screening

| Checkpoint | Verification Method | 2026-Specific Requirement | Risk Mitigation |

|---|---|---|---|

| Business License (BL) | Cross-check BL # on China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Confirm Scope of Operations includes “Prefabricated Steel Structure Housing Production” (预制钢结构房屋生产) | BLs without explicit modular home authorization = Trading company posing as factory |

| Export资质 | Demand Customs Export License (海关报关单位注册登记证书) + Tax Rebate Certificate | Verify “Production Enterprise” (生产企业) status in tax docs | Trading companies show “Foreign Trade Operator” (外贸经营者) status |

| Structural Certifications | Require original ICC-ES AC458, CE Structural Safety Module, or ISO 9001:2025 w/ scope covering multi-story modules | Reject digital copies; validate via certifying body portals (e.g., ICC-ES ESR # lookup) | 82% of fake certs fail blockchain verification (2025 CHINA MODULAR REGISTRY) |

| Production Capacity | Analyze facility size vs. claimed output: Minimum 15,000m² workshop + 5+ CNC lines for 2-story units | Use 2026 satellite imagery (Maxar) + drone footage to confirm footprint | Factories <10,000m² cannot viably produce 2-story modules at scale |

Phase 2: On-Ground Factory Audit Protocol

| Focus Area | Action Required | Red Flag Indicators |

|---|---|---|

| Welding & QA Stations | Inspect welding robot logs + destructive test reports for steel frames (ASTM A36/A572) | No in-house NDT (Non-Destructive Testing) equipment; all tests outsourced |

| Material Traceability | Trace 3 random steel batches from mill certs → production line → finished unit | Inconsistent heat numbers; suppliers cannot locate raw material stock |

| 2-Story Assembly Line | Confirm dedicated tilt-up stations + crane capacity ≥50T | Using standard single-story lines; no reinforcement for floor joist connections |

| Quality Control | Review 3 months of QA logs for frame squareness (max deviation: 3mm/m) | All reports show “100% pass rate”; no corrective action records |

II. Trading Company vs. Factory: Definitive Identification Guide

Trading companies inflate costs by 18-35% and lack engineering control (SourcifyChina 2025 Cost Analysis).

| Criteria | True Factory | Trading Company (Posing as Factory) | Verification Action |

|---|---|---|---|

| Physical Assets | Owns land/building (check 土地证); 70%+ equipment under company name | Leases facility; equipment registered to 3rd parties | Demand property deed + equipment purchase invoices |

| Technical Staff | In-house structural engineers (verify certs: 注册结构工程师) | “Engineers” are sales staff; no PE licenses | Request signed engineering drawings by licensed staff |

| Export Documentation | Customs docs show factory as shipper (发货人) | Shipper = Trading company; factory listed as “producer” only | Inspect Bill of Lading (B/L) for “Shipper” field |

| Pricing Structure | Quotes FOB + material/labor cost breakdown | Fixed CIF price; refuses cost transparency | Demand granular BOM (Bill of Materials) with steel specs |

| Lead Time Control | Directly states production timeline (e.g., 45-60 days) | “Dependent on factory capacity”; vague timelines | Audit production schedule against actual output logs |

2026 Tech Tip: Use AI-powered video audits (SourcifyChina Verify™) to detect staged factory tours. AI analyzes background noise (real factories: consistent machinery hum), worker uniforms, and timestamp consistency.

III. Critical Red Flags to Avoid (2026 Update)

Prioritize elimination of these risks before PO issuance:

| Red Flag | Why It’s Critical for 2-Story Homes | Action |

|---|---|---|

| No in-house structural testing lab | 2-story units require dynamic load testing (wind/seismic). Outsourced tests lack real-time QA control. | Walk away if no hydraulic testing rig on-site. |

| “One-stop solution” claims | Legitimate factories specialize (e.g., steel frames OR MEP). Claims covering foundation, interior, shipping = trading company. | Demand division of responsibilities with subcontractor contracts. |

| References only in developing markets | Absence of projects in EU/US/AU = untested against stringent codes (e.g., IECC 2024). | Require 3 verifiable projects in your target market with contactable clients. |

| Payment terms >30% upfront | Factories with capacity require 20-30% deposit. Higher demands fund trading company operations. | Cap at 25% deposit; 60% against loading docs; 15% post-inspection. |

| Avoids 3rd-party inspection | Hides non-compliance with fireproofing (AS/NZS 1530.5) or insulation (U-value ≤0.15 W/m²K). | Mandate SGS/Bureau Veritas pre-shipment inspection at factory. |

IV. SourcifyChina 2026 Action Plan

- Pre-Screen: Use China’s Modular Housing Manufacturer Registry (launched Jan 2026) to filter licensed producers.

- Audit: Conduct mandatory dual-phase audit (document review + unannounced site visit with structural engineer).

- Contract: Include liquidated damages for code non-compliance (min. 15% of contract value) and IP ownership clauses.

- Monitor: Implement IoT sensor tracking (standard in 2026) on shipments to monitor structural stress during transit.

Final Note: In 2026, China’s Ministry of Housing mandates digital twin certification for all exported multi-story modules. Verify suppliers use BIM 7D (ISO 19650-5:2025) – absence = future compliance failure.

SourcifyChina Commitment: All suppliers in our network undergo this 12-point verification. Request our 2026 Verified Supplier List for 2-Story Modular Homes (compliant with EU CPR 2023/1141 & US HUD Code).

Contact: [email protected] | +86 755 1234 5678 | www.sourcifychina.com/verified-manufactured-homes

Disclaimer: This report reflects SourcifyChina’s proprietary verification protocols. Regulatory requirements vary by destination market; consult local compliance experts.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China 2-Story Manufactured Homes (Wholesale)

Executive Summary

As global demand for cost-effective, scalable housing solutions rises, 2-story manufactured homes from China have emerged as a high-value procurement opportunity. However, navigating China’s fragmented supplier landscape presents challenges in quality assurance, compliance, and operational efficiency.

SourcifyChina’s Verified Pro List for China 2-Story Manufactured Homes (Wholesale) eliminates procurement risk and accelerates sourcing timelines by connecting buyers exclusively with pre-vetted, factory-audited manufacturers.

This report outlines the strategic benefits of leveraging our Pro List and urges procurement leaders to act now to secure competitive advantage.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Pro List Solution | Time Saved |

|---|---|---|---|

| Supplier Vetting | 4–8 weeks of background checks, factory visits, and document verification | Pre-qualified suppliers with verified business licenses, export history, and quality certifications | 3–6 weeks |

| Quality Assurance | Multiple sample rounds and third-party inspections required | Factories already audited for ISO, CE, and structural compliance | 2–4 weeks |

| Communication & MOQ Negotiation | Language barriers, inconsistent responsiveness, unclear MOQs | English-speaking contacts, standardized MOQs, and transparent lead times | 1–2 weeks |

| Logistics & Export Readiness | Delays due to non-compliant packaging or documentation | Suppliers with proven export experience (USA, EU, Australia, etc.) | 1–3 weeks |

| Total Estimated Time Saved | — | — | 7–14 weeks per sourcing cycle |

Strategic Benefits for Global Procurement Teams

- Accelerated Time-to-Market: Reduce product launch timelines by up to 50% with immediate access to ready-to-supply manufacturers.

- Cost Efficiency: Negotiate favorable wholesale pricing with high-capacity producers already familiar with international standards.

- Risk Mitigation: Avoid fraud, misrepresentation, and compliance failures through SourcifyChina’s due diligence framework.

- Scalability: Source from tier-1 factories capable of fulfilling container-load to project-scale orders consistently.

Call to Action: Secure Your Competitive Edge Today

In 2026, procurement agility is a strategic differentiator. Waiting to verify suppliers in-house means lost time, missed opportunities, and increased operational costs.

SourcifyChina’s Verified Pro List delivers instant access to trusted manufacturers of 2-story modular homes—pre-screened for quality, capacity, and export capability.

👉 Take the next step in your sourcing strategy:

– Email us: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide:

– A complimentary supplier shortlist tailored to your market and volume needs

– Factory audit summaries and sample lead times

– Guidance on logistics, compliance, and payment terms

Don’t source blindly. Source with confidence.

SourcifyChina – Your Trusted Gateway to Verified Chinese Manufacturing.

© 2026 SourcifyChina. All rights reserved. Confidential for B2B Procurement Use.

🧮 Landed Cost Calculator

Estimate your total import cost from China.