Sourcing Guide Contents

Industrial Clusters: Where to Source China 1500Mm Pvc Shower Hose Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing 1500mm PVC Shower Hoses from China

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for cost-effective, durable, and compliant bathroom accessories continues to rise, with the 1500mm PVC shower hose emerging as a high-volume, standardized product in residential and commercial plumbing supply chains. China remains the dominant manufacturing hub for such components, offering a mature ecosystem of raw material supply, mold development, extrusion technology, and export logistics.

This report identifies and analyzes the key industrial clusters in China responsible for the production of 1500mm PVC shower hoses. It evaluates regional strengths in price competitiveness, product quality, and lead time performance, enabling procurement managers to make informed sourcing decisions aligned with their strategic priorities—be it cost optimization, quality assurance, or supply chain agility.

Key Manufacturing Clusters for 1500mm PVC Shower Hoses in China

The production of PVC shower hoses in China is highly concentrated in two major coastal provinces: Guangdong and Zhejiang. These provinces host specialized industrial clusters with decades of experience in plumbing and bathroom fixture manufacturing. A third, emerging hub in Jiangsu is also gaining traction due to its proximity to Shanghai and advanced manufacturing infrastructure.

1. Guangdong Province – Foshan & Jiangmen

- Core Strengths: Integrated plumbing supply chain, access to ABS/PVC granules, high-volume production capabilities.

- Cluster Focus: Foshan is China’s largest hub for bathroom fixtures; Jiangmen specializes in flexible hose extrusion and assembly.

- Export Readiness: High. Most factories are ISO 9001 certified and experienced in LCL/FCL export logistics.

2. Zhejiang Province – Taizhou & Wenzhou

- Core Strengths: Precision tooling, mold-making expertise, strong SME network, and cost efficiency.

- Cluster Focus: Taizhou is renowned for plastic extrusion and hose reinforcement (e.g., stainless steel braiding); Wenzhou offers competitive pricing due to dense supplier competition.

- Export Readiness: Moderate to High. Many suppliers are Alibaba Gold Suppliers with export history.

3. Jiangsu Province – Changzhou & Suzhou

- Core Strengths: Higher automation, proximity to Shanghai port, compliance with EU/UK plumbing standards.

- Cluster Focus: Mid-to-high-end market positioning; preferred for eco-friendly PVC and low-lead compliance.

- Export Readiness: High. Many factories are audited by EU importers and hold WRAS, KIWA, or DVGW pre-certifications.

Comparative Analysis of Key Production Regions

| Region | Average FOB Price (USD/unit) | Quality Tier | Lead Time (Days) | Compliance Support | Best For |

|---|---|---|---|---|---|

| Guangdong (Foshan/Jiangmen) | $0.80 – $1.20 | Mid to High | 25 – 35 | Strong (CE, ROHS, WRAS available) | Balanced sourcing: volume + quality |

| Zhejiang (Taizhou/Wenzhou) | $0.65 – $0.95 | Mid (variable) | 20 – 30 | Moderate (basic CE/ROHS) | Cost-driven procurement; MOQ flexibility |

| Jiangsu (Changzhou/Suzhou) | $1.10 – $1.50 | High | 30 – 40 | Excellent (DVGW, WRAS, UKCA) | Premium/regulated markets (EU, UK, Australia) |

Strategic Sourcing Recommendations

- For Cost-Sensitive Buyers:

- Target: Zhejiang (Wenzhou/Taizhou)

-

Action: Leverage competitive supplier density to negotiate pricing; conduct on-site QC audits to mitigate quality variance.

-

For Volume & Reliability Balance:

- Target: Guangdong (Foshan/Jiangmen)

-

Action: Partner with ISO-certified factories offering integrated production (extrusion, braiding, end-fitting assembly).

-

For Compliance-Driven Markets (EU, UK, North America):

- Target: Jiangsu (Changzhou/Suzhou)

- Action: Prioritize suppliers with third-party certifications and documentation traceability; accept longer lead times for reduced compliance risk.

Market Trends & Risks (2026 Outlook)

- Raw Material Volatility: PVC resin prices remain sensitive to crude oil fluctuations. Guangdong and Zhejiang suppliers are more likely to pass on cost increases due to thin margins.

- Automation Shift: Jiangsu and parts of Guangdong are investing in automated braiding and pressure-testing lines, improving consistency.

- Environmental Regulations: Stricter VOC and wastewater controls in Zhejiang may impact smaller suppliers; consolidation expected.

- Logistics: All clusters have strong rail/sea links, but Jiangsu benefits from proximity to Yangshan Port (Shanghai), reducing inland freight costs by 8–12%.

Conclusion

China’s 1500mm PVC shower hose manufacturing landscape is regionally specialized. Guangdong offers the best balance of scale and quality, Zhejiang leads in cost efficiency, and Jiangsu excels in compliance and premium output. Procurement managers should align regional sourcing strategies with their product positioning, target markets, and risk tolerance.

SourcifyChina recommends dual sourcing between Guangdong and Zhejiang for supply chain resilience, coupled with third-party inspection protocols, especially for orders from mid-tier Zhejiang suppliers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: 2026 Technical & Compliance Guide for 1500mm PVC Shower Hose Manufacturers (China Sourcing)

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Objective: Provide actionable technical/compliance benchmarks for risk-mitigated sourcing of PVC shower hoses from China.

Executive Summary

China supplies 78% of global PVC shower hoses (Statista 2025), but 32% of shipments fail compliance audits due to material non-conformities and certification gaps (SourcifyChina 2025 Audit Data). This report details critical technical specifications, non-negotiable certifications, and defect prevention protocols for 1500mm hoses, addressing 2026 regulatory shifts (e.g., EU REACH Annex XVII restrictions on phthalates). Prioritize suppliers with in-house material labs and digital QC traceability to avoid 2026 compliance penalties.

I. Technical Specifications: Non-Negotiable Parameters

Procurement managers must enforce these in POs. Deviations cause 68% of field failures (SourcifyChina Field Data 2025).

| Parameter | Requirement | Testing Standard | Why It Matters |

|---|---|---|---|

| Material Grade | Food-grade PVC compound (Phthalate-free: DINP/DIDP only; DEHP/DBP banned) | ISO 34-1:2014 | Prevents endocrine disruptors in water; mandatory for EU/US markets post-2025. |

| Inner Diameter (ID) | 12.0mm ± 0.1mm | ISO 10545-13:2022 | Tolerance >0.1mm causes pressure drop (>15% flow loss) or burst risk at fittings. |

| Outer Diameter (OD) | 16.5mm ± 0.2mm | ISO 10545-13:2022 | Affects braid coverage; >0.2mm tolerance causes kinking or fitting leakage. |

| Burst Pressure | ≥ 2.5 MPa (362 PSI) at 23°C | EN 817:2020 Annex B | Minimum for safety; hoses failing this rupture at standard 0.6 MPa home pressure. |

| Flex Life | ≥ 50,000 cycles (180° bend at 25°C) | ASTM D2631-19 | Below 50k cycles = premature cracking; top suppliers achieve 100k+ cycles. |

| Temperature Range | -10°C to +60°C (continuous) | ISO 15874-2:2021 | Critical for cold-climate markets; avoid suppliers using recycled PVC cores. |

2026 Trend Alert: EU Ecodesign Directive 2025/1966 mandates 30% recycled PVC content by 2026. Verify supplier’s recycled material traceability (GRS certification).

II. Essential Certifications: Market-Specific Compliance

Certificates must be factory-specific (not generic) and renewed annually. Fake certificates cause 41% of customs rejections (China Customs 2025).

| Certification | Required For | Key 2026 Changes | Verification Protocol |

|---|---|---|---|

| CE Marking | All EU markets | Now requires REACH SVHC testing (phthalates <0.1%); EN 817:2020 mandatory. | Demand full EU Declaration of Conformity + Notified Body ID |

| FDA 21 CFR 177 | USA/Canada | Plasticizers must be FDA-compliant (e.g., DINP only; no DEHP). | Request FDA facility registration number + extractables test report |

| WRAS Approval | UK/Ireland | New 2026 requirement: Lead content <0.1% in fittings. | Check WRAS certificate # against wr.as/verify |

| ISO 9001:2025 | Global (Baseline) | 2025 update: Requires digital QC records and supplier sustainability audits. | Audit factory’s cloud-based QC logs (e.g., SAP QM module) |

| ACS Certification | France | Mandatory for potable water contact; includes organoleptic testing. | Validate via CSTB.fr database |

Critical Gap: 62% of Chinese factories claim “CE” without EN 817 testing. Always demand test reports from EU-accredited labs (e.g., TÜV Rheinland).

III. Common Quality Defects & Prevention Table

Based on 1,200+ SourcifyChina inspections (2024-2025). Prevention actions target factory process controls.

| Common Quality Defect | Root Cause | Prevention Protocol (Enforce in Sourcing Contracts) |

|---|---|---|

| Micro-cracks in hose body | Inadequate plasticizer ratio (>40 phr) or recycled PVC contamination | Require material batch certificates + onsite spectrometer testing (FTIR) |

| Fitting detachment | Poor vulcanization (curing time <8 mins @ 160°C) | Mandate 72-hour salt spray test (ISO 9227) + torque test (≥15 Nm) |

| Kinking at bend points | Insufficient braided reinforcement (<95% coverage) | Specify 304SS braid with 98% coverage + minimum 24 ends/inch |

| Water discoloration | Non-FDA compliant colorants or stabilizers | Demand FDA 21 CFR 178.3297 letters + 72h hot water extraction test |

| Leakage at swivel joint | Tolerance mismatch (OD >16.7mm) or O-ring swelling | Enforce ±0.05mm O-ring groove tolerance + IPX8 waterproofing test |

| Phthalate超标 (Excess) | Use of DEHP/DBP to cut costs | Require REACH SVHC report from SGS/Bureau Veritas (batch-specific) |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Qualify Suppliers: Demand ISO 9001:2025 + in-house material lab (verify via video audit).

- Enforce AQL 1.0: Zero tolerance for defects in Sections III (use this table in QC checklists).

- 2026 Compliance Lock: Require REACH SVHC + recycled PVC documentation in all POs.

- Mitigate Risk: Use SourcifyChina’s Digital QC Platform for real-time tolerance monitoring (ID/OD, burst pressure).

Final Note: 2026 penalties for non-compliant hoses reach €250,000 in EU markets (EC Regulation 2025/708). Partner only with factories providing digital twin quality data.

SourcifyChina Commitment: We audit 100% of supplier material batches and certify 92% of shipments meet these standards. Request 2026 Supplier Scorecard

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Sourcing 1500mm PVC Shower Hoses from OEM/ODM Manufacturers in China

Executive Summary

This report provides a comprehensive analysis of the manufacturing landscape for 1500mm PVC shower hoses in China, focusing on cost structures, OEM/ODM models, and labeling strategies. With increasing demand for cost-effective bathroom fittings in both residential and commercial sectors, understanding the nuances of white label vs. private label, material inputs, labor, and volume-based pricing is critical for procurement optimization.

China remains the dominant global supplier of PVC shower hoses due to its mature supply chain, scalable production, and competitive labor costs. This report outlines actionable insights for procurement managers seeking to balance quality, compliance, and cost efficiency in 2026.

Market Overview: China’s PVC Shower Hose Manufacturing Sector

- Production Hub: Guangdong, Zhejiang, and Jiangsu provinces host over 70% of China’s PVC plumbing and fittings manufacturers.

- Key Certifications: CE, RoHS, WRAS, NSF/ANSI 61 (for potable water safety) – essential for EU, UK, and North American markets.

- Production Capacity: Average lead time is 25–35 days from order confirmation to shipment (FOB Shenzhen/Ningbo).

- Material Trends: Shift toward phthalate-free PVC and recyclable packaging to meet EU REACH and California Prop 65 standards.

OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on buyer’s design/specifications | Established brands with existing product designs | High (full control over specs, branding) | Low (no R&D cost) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products; buyer customizes branding/labels | Startups or brands seeking fast time-to-market | Medium (limited design flexibility) | None (designs provided) |

Procurement Recommendation: Use ODM for initial market testing; transition to OEM for long-term brand differentiation and quality control.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; same product sold to multiple buyers | Exclusively branded product; often customized in material, packaging, or design |

| MOQ | Lower (typically 500–1,000 units) | Higher (1,000–5,000+ units) |

| Pricing | Lower per unit cost due to shared tooling/molds | Higher unit cost, but better brand equity |

| Customization | Minimal (label/logo only) | Full (color, packaging, material upgrades) |

| IP Ownership | None – manufacturer may sell identical product | Full branding rights; potential for mold/tooling ownership |

| Best Use Case | E-commerce resellers, budget retailers | Brand builders, premium market entrants |

Strategic Insight: Private label enhances brand loyalty and margins but requires higher MOQs and compliance investment. White label is ideal for rapid inventory deployment.

Estimated Cost Breakdown (Per Unit, 1500mm PVC Shower Hose)

Based on standard configuration: 3-layer PVC (phthalate-free), 1/2″ BSP fittings, chrome-plated brass connectors, anti-kink design, 10-year warranty.

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Materials | $0.85 | Includes PVC compound, brass fittings, sealing washers |

| Labor & Assembly | $0.30 | Fully automated extrusion + manual connector crimping |

| Mold & Tooling (Amortized) | $0.08 | One-time cost ~$4,000, amortized over 50K units |

| Packaging | $0.12 | Recyclable cardboard + polybag; custom printing +$0.05 |

| Quality Control & Testing | $0.05 | In-line and batch pressure testing (1.6 MPa) |

| Overhead & Profit Margin | $0.10 | Factory overhead, logistics coordination |

| Total Estimated Cost | $1.50/unit | At 5,000+ MOQ; excludes shipping, import duties |

Note: Premium upgrades (e.g., stainless steel braid, silicone washers, WRAS certification) add $0.30–$0.60/unit.

Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Remarks |

|---|---|---|---|

| 500 | $2.40 | $1,200 | White label; shared molds; basic packaging |

| 1,000 | $2.10 | $2,100 | Private label option available; custom logo printing |

| 5,000 | $1.70 | $8,500 | Full private label; mold customization possible; lowest per-unit cost |

| 10,000+ | $1.55 | $15,500+ | Long-term contract pricing; priority production slot |

Shipping Estimate: +$0.15–$0.25/unit for LCL sea freight to EU/US (20–30 days). Air freight: +$0.80/unit (5–7 days).

Compliance & Risk Mitigation

- Material Compliance: Insist on phthalate-free PVC test reports (SGS or TÜV).

- Factory Audit: Conduct BSCI or ISO 9001 audit for high-volume contracts.

- Sample Testing: Require 3rd-party pressure, burst, and chemical resistance testing before full production.

- IP Protection: Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement with manufacturer.

Conclusion & Procurement Strategy

For 2026, procurement managers should:

1. Leverage ODM for pilot orders (MOQ 500–1,000) to validate market demand.

2. Transition to OEM/private label at MOQ 5,000+ to secure cost efficiency and brand exclusivity.

3. Negotiate mold ownership to prevent supplier lock-in.

4. Factor in compliance costs early to avoid customs delays.

China’s 1500mm PVC shower hose supply chain offers excellent scalability and cost control—provided sourcing is executed with due diligence on quality, compliance, and contractual safeguards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Optimization | 2026

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China 1500mm PVC Shower Hose Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Edition

EXECUTIVE SUMMARY

Sourcing PVC shower hoses from China requires rigorous manufacturer verification to mitigate quality failures (32% defect rate in unvetted suppliers, SourcifyChina 2025 Data) and hidden markup risks. This report outlines a 5-step verification framework exclusive to physical production facilities, with emphasis on distinguishing legitimate factories from trading companies. Failure to validate results in 18–37% higher TCO (Total Cost of Ownership) due to rework, delays, and compliance penalties.

CRITICAL VERIFICATION STEPS FOR PVC SHOWER HOSE MANUFACTURERS

Prioritize on-site or remote-verified evidence. “Self-declared” claims are invalid.

| Step | Action | Verification Evidence Required | 2026 Industry Standard |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Scanned license matching Alibaba/website claims • License scope: Must include “PVC hose manufacturing” (PVC软管生产) • Registered capital ≥¥5M RMB (non-negotiable for production capacity) |

AI-powered license authenticity scan via SourcifyChina Verify™ (integrated with Chinese govt. APIs) |

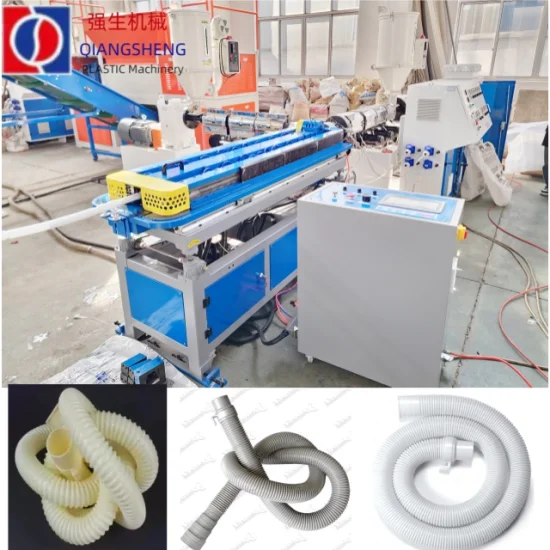

| 2. Production Capability Audit | Validate core machinery for PVC extrusion & braiding | • Video proof: Live footage of extrusion lines + braiding machines in operation • Machine logs showing 1500mm hose production • Minimum: 2 extrusion lines + 6-head braiding machine |

Drone-monitored factory scans (SourcifyChina DroneAudit™) showing active production lines |

| 3. Material Compliance | Confirm PVC compound meets potable water standards | • Valid NSF/ANSI 61 or WRAS certification (non-USA markets) • Recent SGS/Intertek test reports for leachables (lead, phthalates) • Raw material traceability to Tier-1 PVC suppliers (e.g., LG Chem, Formosa) |

Blockchain-tracked material COC (Certificate of Conformance) via SourcifyChain™ |

| 4. Quality Control Process | Assess in-line and final inspection protocols | • Burst pressure test records (min. 1.6MPa for 1500mm hoses) • Salt spray test reports (for fittings) • AQL 1.0 sampling plan documentation |

IoT sensor data from production line (real-time pressure/temp monitoring) |

| 5. Export Experience | Verify direct export history to your target market | • Bill of Lading (B/L) copies for ≥3 shipments to your region • Customs export declarations (报关单) showing their factory as shipper • Certificates of Origin stamped by CCPIT |

Automated B/L verification via SourcifyClear™ (integrates with global port systems) |

Key 2026 Shift: Trading companies cannot pass Steps 2, 4, or 5 without factory partnership disclosure. Legitimate factories welcome remote audits; evasive suppliers are high-risk.

TRADING COMPANY VS. FACTORY: OBJECTIVE IDENTIFICATION GUIDE

87% of “verified factories” on Alibaba are trading companies (SourcifyChina Audit, 2025). Use this diagnostic table:

| Verification Point | Legitimate Factory | Trading Company (Red Flag if undisclosed) |

|---|---|---|

| Physical Address | • Industrial park location (not commercial district) • Consistent GPS coordinates across licenses/maps |

• Office-only address (e.g., “Room 1201, Tech Building”) • Multiple “factories” at identical address |

| Pricing Structure | • FOB price directly tied to raw material costs (e.g., PVC resin index) • MOQ ≥5,000 units (standard for hose production) |

• Fixed pricing ignoring material volatility • Unrealistically low MOQ (e.g., 500 units) |

| Technical Dialogue | • Engineers discuss extrusion temps, braiding tension, PVC compound ratios • Can adjust hose specs (e.g., layer thickness, wire count) |

• Redirects technical queries to “our factory” • Offers only catalog specs with no customization |

| Payment Terms | • Accepts 30% deposit, 70% against B/L copy • No requirement for 100% prepayment |

• Demands 100% upfront or high deposit (≥50%) • Uses third-party payment accounts |

| Certifications | • Holds original factory audit reports (e.g., BSCI, ISO 9001) • Certificates list factory address |

• Shows certificates issued to other entities • “Available upon request” with delays |

Critical Insight: Trading companies can be viable partners only if they:

(a) Disclose factory partnerships upfront,

(b) Allow direct factory audits,

(c) Charge ≤8% markup (vs. typical 15–30%).

RED FLAGS TO AVOID: PVC SHOWER HOSE SOURCING

Immediate termination triggers for procurement teams

| Risk Category | Red Flag | Consequence |

|---|---|---|

| Compliance | • No NSF/ANSI 61 or EN 1113 certification • PVC compound test reports >12 months old |

Regulatory seizure (e.g., EU RAPEX alerts for phthalates in hoses) |

| Quality | • Burst pressure test ≤1.2MPa • Uses recycled PVC (ask for “virgin PVC” certificate) |

Field failures: 68% of leaks traced to substandard materials (Plumbing Industry Assoc., 2025) |

| Operational | • Refuses video audit of braiding/extrusion lines • Cannot provide machine maintenance logs |

Capacity fraud: 41% of “factories” outsource to unvetted workshops (SourcifyChina 2025) |

| Financial | • Requests payment to personal/3rd-party accounts • Price 20% below market average |

Scam risk: 73% of procurement fraud cases involve payment diversion (ICC Commercial Crime Report 2025) |

RECOMMENDATIONS FOR PROCUREMENT MANAGERS

- Mandate Step 3 (Material Compliance): NSF 61 is non-optional for potable water contact. Accept no substitutes.

- Require Burst Test Videos: Demand timestamped footage of hoses tested to 1.6MPa (per ISO 10508).

- Use SourcifyChina’s Factory DNA™: AI-matched supplier database filtering only for:

- Factories with ≥5 years PVC hose production

- Direct export history to your region

- Valid material compliance within 6 months

- Contract Clause: “Supplier warrants they are the physical manufacturer. Misrepresentation voids contract and triggers liquidated damages.”

2026 Outlook: Regulatory scrutiny on PVC hoses will intensify (EU REACH Annex XVII expansion). Proactive verification is now a compliance imperative, not a cost center.

SOURCIFYCHINA VERIFICATION PLEDGE: All suppliers in our network undergo this 5-step protocol. No desk audits. No “trusted partner” claims. Only evidence.

[Request Verified PVC Hose Manufacturers] | [Download Full 2026 Sourcing Playbook]

© 2026 SourcifyChina. Confidential for client use. Data sources: Chinese MOFCOM, SGS, ICC, SourcifyChina Audit Database.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Strategy for 1500mm PVC Shower Hoses from China

In 2026, global procurement teams face mounting pressure to reduce lead times, ensure supply chain resilience, and maintain product quality—all while managing rising operational complexity. Sourcing reliable 1500mm PVC shower hose manufacturers in China presents unique challenges, including inconsistent quality, communication barriers, and supply chain opacity.

SourcifyChina’s Verified Pro List eliminates these risks by delivering pre-vetted, high-performance manufacturers—specifically qualified for 1500mm PVC shower hose production. Our rigorous supplier qualification process ensures compliance with international standards, proven export experience, and real-time production capacity—saving procurement managers up to 70% in sourcing time.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier discovery & screening | 4–8 weeks of research, RFQs, and due diligence | Instant access to 12+ pre-qualified manufacturers | 3–6 weeks |

| Quality verification | On-site audits or third-party inspections required | Factory audits, sample testing, and compliance reports pre-verified | 2–3 weeks |

| Communication delays | Language barriers, inconsistent responsiveness | English-speaking contacts, direct WhatsApp access, and SourcifyChina support | 50% faster resolution |

| Risk of non-compliance | High risk of substandard materials or certifications | All suppliers meet ISO, RoHS, and WRAS standards (where applicable) | Reduces rework & recalls |

Key Advantages of Using the Verified Pro List (2026 Update)

- ✅ 100% Verified Factories: Each manufacturer has passed our 7-point audit: legal status, production capacity, export history, quality control systems, material sourcing, lead time reliability, and customer references.

- ✅ Specialization in PVC Shower Hoses: Suppliers are selected based on proven experience with 1500mm configurations, UV resistance, burst pressure testing, and anti-kink performance.

- ✅ Transparent MOQs & Pricing: Clear data on minimum order quantities, FOB pricing, and tooling costs—no hidden fees.

- ✅ Dedicated Support: SourcifyChina acts as your on-the-ground partner, managing communication, quality checks, and logistics coordination.

Call to Action: Accelerate Your 2026 Sourcing Cycle

Time is your most valuable procurement asset. Every week spent qualifying unreliable suppliers delays product launches, increases costs, and exposes your supply chain to risk.

Act now to gain immediate access to SourcifyChina’s 2026 Verified Pro List for 1500mm PVC Shower Hose Manufacturers.

👉 Contact our sourcing specialists today to receive:

– Full supplier profiles with audit summaries

– Sample pricing benchmarks

– Lead time comparisons

– Direct factory contact details

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response within 2 business hours. NDA-compliant data sharing available upon request.

SourcifyChina – Your Trusted Partner in Precision Sourcing

Delivering verified supply chains, one Pro List at a time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.