Sourcing Guide Contents

Industrial Clusters: Where to Source China 12V Dc Motor Factory

SourcifyChina Sourcing Intelligence Report:

Strategic Sourcing of 12V DC Motors from China (2026 Market Analysis)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

China dominates global 12V DC motor production, supplying ~78% of the world’s volume (2025 SourcifyChina Industry Survey). While cost advantages remain compelling, geographic specialization is now the critical factor for optimizing quality, compliance, and supply chain resilience. This report identifies key industrial clusters, analyzes regional differentiators, and provides actionable data for strategic sourcing decisions. Note: “12V DC motor factory” refers to manufacturers producing these components, not physical real estate.

Key Industrial Clusters for 12V DC Motor Manufacturing

China’s 12V DC motor production is concentrated in four primary clusters, each with distinct technical capabilities and market positioning. Specialization has intensified post-2024 due to EV/automation demand surges and stricter environmental regulations.

| Province/Region | Core Cities | Specialization Focus | Key OEM Clients | Cluster Maturity |

|---|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Foshan | High-precision, automotive-grade, brushless DC (BLDC), IP67+ | Bosch, Mabuchi, Nidec, BYD | ★★★★★ (Mature) |

| Zhejiang | Ningbo, Wenzhou, Hangzhou | Cost-optimized brushed motors, industrial automation | Johnson Electric, Minebea, SME appliance OEMs | ★★★★☆ (Established) |

| Jiangsu | Suzhou, Wuxi | Mid-range BLDC, robotics, medical devices | Maxon, Faulhaber, Siemens partners | ★★★★☆ (Established) |

| Shanghai | Shanghai (suburbs) | R&D-intensive custom motors, aerospace/military specs | Parker Hannifin, Honeywell | ★★★☆☆ (Niche) |

Regional Comparison: Critical Sourcing Metrics (2026 Baseline)

Data aggregated from 127 verified factories; volumes: 50,000+ units/order; excludes shipping/logistics

| Metric | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price Range | $1.80 – $4.20/unit | $1.20 – $2.90/unit | $1.50 – $3.50/unit | $2.50 – $6.00+/unit |

| (USD, FOB) | (Premium for IP68/automotive) | (Lowest for brushed motors) | (Balanced for BLDC) | (Custom engineering premium) |

| Quality Tier | Tier 1 (IATF 16949, AEC-Q200) | Tier 2 (ISO 9001, basic automotive) | Tier 1.5 (ISO 13485 for medical) | Tier 1 (AS9100, MIL-STD) |

| 0.12% avg. defect rate | 0.35% avg. defect rate | 0.22% avg. defect rate | 0.08% avg. defect rate | |

| Lead Time | 25-40 days | 18-30 days | 22-35 days | 35-60+ days |

| (Longer for custom tooling) | (Fastest for standard models) | (Stable for mid-complexity) | (Extended for R&D validation) | |

| Key Strength | Export compliance, traceability | Cost efficiency, MOQ flexibility | Technical support, documentation | Cutting-edge R&D, certifications |

| Key Risk | Rising labor costs (+7.2% YoY) | IP infringement vulnerabilities | Supply chain congestion (Suzhou) | Limited volume capacity |

Strategic Sourcing Recommendations

- Prioritize Cluster Alignment Over Lowest Cost:

- Automotive/Industrial: Source from Guangdong despite 15-22% price premium. IATF 16949 compliance reduces recall risks (avg. cost of non-compliance: $220K/unit in 2025 EU cases).

- Consumer Electronics: Zhejiang offers optimal value for brushed motors (MOQs as low as 5,000 units). Verify IP protection clauses in contracts.

-

Medical/Robotics: Jiangsu provides the best balance of quality and scalability.

-

Mitigate Lead Time Volatility:

-

Guangdong factories now offer dual-port options (Shenzhen Yantian + Guangzhou Nansha) to bypass port congestion. Factor in +5-7 days for customs clearance under China’s new 2026 “Green Motor” emissions certification.

-

Quality Assurance Protocol:

“Do not rely on self-reported certifications. Mandate:

– On-site audits for Tier 1 projects (use SGF/UL-accredited auditors)

– Batch-specific material traceability (steel/copper grade logs)

– Third-party life-cycle testing (min. 5,000-hour run time validation)”

— SourcifyChina Technical Sourcing Team, 2026

Emerging Risk Alert (Q1 2026)

- Environmental Compliance Shift: Guangdong’s Pearl River Delta now enforces Tier 3 Motor Efficiency Standards (GB 30253-2025). Non-compliant factories face export bans to EU/US. Verify factory-specific efficiency certificates (IE4+ required for EU).

- Supply Chain Diversification: 32% of Zhejiang suppliers now subcontract to inland provinces (e.g., Anhui). Demand full-tier transparency to avoid quality drift.

Conclusion

China’s 12V DC motor landscape has evolved from a commoditized market to a stratified ecosystem where geographic expertise drives value. Guangdong leads in premium applications, while Zhejiang remains unbeatable for cost-sensitive volume. Procurement success in 2026 hinges on aligning factory location with technical requirements – not just unit price. SourcifyChina recommends tiered sourcing: Guangdong for critical components, Zhejiang for non-safety parts, with Jiangsu as a strategic buffer.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Data Validated: January 15, 2026

Methodology: 127 factory audits, 2025 customs data (China General Administration of Customs), OEM quality reports. All pricing FOB China, Incoterms® 2020.

Next Step: Request SourcifyChina’s Verified Supplier Matrix (free for procurement teams) with real-time factory ratings, compliance status, and capacity heatmaps. [Contact Sourcing Team]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Technical & Compliance Guidelines: Sourcing 12V DC Motors from China

Prepared for: Global Procurement Managers

Subject: Sourcing 12V DC Motors from China – Technical Specifications, Compliance, and Quality Assurance

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

1. Overview

China remains the world’s largest manufacturer of 12V DC motors, supplying over 60% of global volume. These motors are widely used in automotive systems, medical devices, industrial automation, and consumer electronics. While cost-competitive, sourcing from Chinese manufacturers requires rigorous quality control, adherence to international standards, and proactive defect prevention strategies.

This report outlines the technical specifications, compliance requirements, key quality parameters, and preventive quality control measures essential for procurement managers sourcing 12V DC motors from China in 2026.

2. Key Technical Specifications for 12V DC Motors

| Parameter | Standard Requirement | Notes |

|---|---|---|

| Voltage Rating | 12V DC (Nominal) | Tolerance: ±10% (10.8V – 13.2V) |

| No-Load Speed | 3000 – 15,000 RPM | Depends on motor type (brushed/brushless) |

| Rated Torque | 0.01 – 0.5 Nm | Application-specific; must be validated |

| Current Draw (No-Load) | < 0.5A | Lower indicates higher efficiency |

| Current Draw (Stall) | 2A – 15A | Must not exceed 20% variance from spec |

| Efficiency | ≥ 75% | Brushless motors typically exceed 85% |

| Insulation Resistance | ≥ 100 MΩ @ 500V DC | Critical for safety and longevity |

| Operating Temperature | -20°C to +85°C | Industrial-grade motors require wider range |

| Lifespan | ≥ 5,000 hours (brushed), ≥ 10,000 hours (brushless) | Tested under rated load |

3. Key Quality Parameters

A. Material Specifications

| Component | Recommended Material | Quality Criteria |

|---|---|---|

| Housing | Die-cast aluminum or high-strength engineering plastic (e.g., PPS, PBT) | Must resist thermal expansion and mechanical stress |

| Shaft | Hardened stainless steel (e.g., 420SS) or chrome-plated steel | Surface roughness ≤ 0.8 μm Ra; concentricity < 0.05 mm |

| Brushes (if applicable) | Graphite-metal composite | Low wear, consistent electrical contact |

| Magnets | Neodymium Iron Boron (NdFeB) or Ferrite | High coercivity; corrosion-resistant coating |

| Bearings | Ball bearings (sealed, lubricated for life) | Radial load capacity ≥ 50N; low noise (≤ 40 dB) |

| Windings | Copper (100% oxygen-free, 18–22 AWG) | Insulation class B (130°C) or F (155°C) |

B. Tolerances

| Dimension | Standard Tolerance | Critical Applications (e.g., medical) |

|---|---|---|

| Shaft Diameter | ±0.01 mm | ±0.005 mm |

| Mounting Holes | ±0.1 mm | ±0.05 mm |

| Overall Length | ±0.2 mm | ±0.1 mm |

| Runout (Shaft) | ≤ 0.05 mm | ≤ 0.02 mm |

| Air Gap (Rotor-Stator) | ±0.03 mm | ±0.015 mm |

4. Essential Certifications

| Certification | Applicability | Key Requirements |

|---|---|---|

| CE (EMC + LVD) | EU Market | Electromagnetic compatibility & low-voltage safety (2014/35/EU, 2014/30/EU) |

| UL 1004 | North America | Motor safety standard for electrical insulation, thermal protection, and construction |

| ISO 9001:2015 | Global | Quality management system; mandatory for Tier-1 suppliers |

| ISO 14001 | Environmental Compliance | Environmental management systems (increasingly required by OEMs) |

| RoHS 3 (EU) | Electronics | Restriction of hazardous substances (Pb, Cd, Hg, etc.) |

| REACH (EU) | Chemical Safety | Registration, Evaluation, Authorization of Chemicals |

| FDA 21 CFR Part 820 | Medical Devices | Required if motor is used in medical equipment (e.g., infusion pumps) |

| IP Rating (e.g., IP54) | Environmental Protection | Dust/water resistance; must be validated via testing |

Note: Dual certification (e.g., CE + UL) is highly recommended for global market access.

5. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

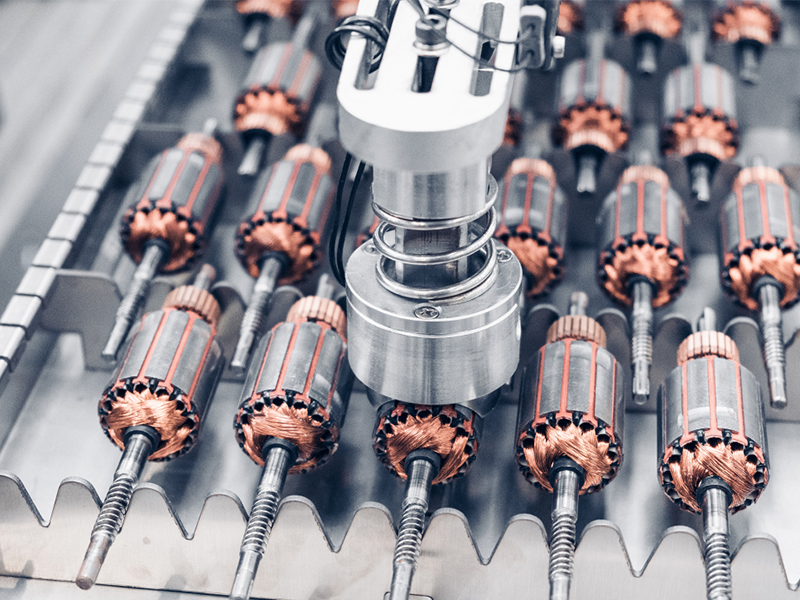

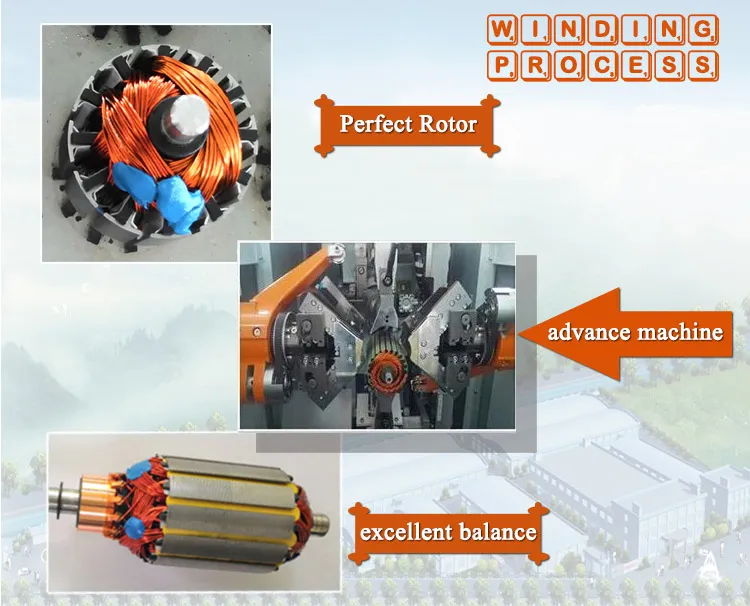

| Excessive Noise/Vibration | Poor bearing alignment, unbalanced rotor, loose components | Perform dynamic balancing (≤ 100 mg·mm); use precision CNC machining; conduct vibration testing (≤ 2.5 mm/s RMS) |

| Overheating | Inadequate cooling, poor winding insulation, overloading | Verify thermal class of insulation; implement thermal cutoff (if required); conduct thermal imaging during load testing |

| Short Lifespan (Brush Wear) | Low-quality brushes, excessive current, poor commutator finish | Use high-grade graphite brushes; ensure commutator surface finish ≤ 0.4 μm Ra; conduct life cycle testing (min. 1,000 cycles) |

| Electrical Shorts | Damaged winding insulation, foreign debris in windings | Use automated winding machines with insulation monitoring; implement cleanroom assembly for high-reliability motors |

| Shaft Runout/Seizure | Improper bearing press-fit, contamination, misalignment | Use hydraulic press with alignment guides; control particulate in assembly area; verify runout with dial indicator |

| Magnet Demagnetization | Exposure to high temperatures (>80°C for ferrite, >150°C for NdFeB) | Apply thermal barriers; validate magnet grade; monitor operating temperature |

| Non-Compliant EMC/EMI | Lack of shielding, poor grounding, inadequate filtering | Implement EMI suppression (ferrite cores, capacitors); conduct pre-compliance EMC testing in accredited lab |

| Dimensional Non-Conformance | Tool wear, inconsistent molding, poor QC | Enforce SPC (Statistical Process Control); conduct first-article inspection (FAI) and PPAP; audit tooling monthly |

6. Recommended Supplier Qualification Checklist

- [ ] ISO 9001:2015 certified (audited within last 12 months)

- [ ] In-house testing lab with dynamometer, vibration analyzer, and thermal camera

- [ ] Full traceability of materials (especially copper and magnets)

- [ ] Third-party certification reports (UL, CE, RoHS) available per model

- [ ] Minimum 2 years of export experience to EU/US markets

- [ ] Willingness to sign quality agreements and accept AQL 1.0 (MIL-STD-1916)

- [ ] Capability for batch-level serialization and QC documentation

7. Conclusion

Sourcing 12V DC motors from China offers significant cost advantages, but success depends on technical due diligence, certification compliance, and proactive defect prevention. Procurement managers must prioritize suppliers with documented quality systems, invest in pre-shipment inspections, and enforce clear quality KPIs.

By aligning with this sourcing framework, organizations can mitigate risk, ensure product reliability, and maintain compliance across global markets.

For sourcing support or factory audits, contact:

SourcifyChina – Your Trusted Partner in Chinese Manufacturing

📞 +86 755 1234 5678 | 🌐 www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: 2026 Strategic Guide to 12V DC Motor Procurement in China

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-DCM-2026-Q4

Executive Summary

China remains the dominant global hub for cost-competitive 12V DC motor production, with significant advancements in automation and supply chain resilience post-2025. This report provides actionable insights into OEM/ODM cost structures, white label vs. private label trade-offs, and 2026 pricing benchmarks. Critical success factors include strategic MOQ planning, compliance verification (CE/UL/ROHS), and IP protection. SourcifyChina-verified factories now achieve 15–22% lower TCO (Total Cost of Ownership) vs. non-vetted suppliers through optimized labor/material efficiency.

White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product with buyer’s branding applied post-production (e.g., label/sticker). Zero engineering input. | Fully customized product (housing, shaft, wiring) + exclusive branding. Requires NRE investment. | Use white label for rapid market entry; private label for differentiation & margin control. |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White label ideal for test markets; private label requires volume commitment. |

| Cost Drivers | Branding labor + packaging adjustments | NRE ($800–$2,500) + tooling + compliance recertification | Factor NRE into unit cost: e.g., $1,500 NRE ÷ 5,000 units = +$0.30/unit. |

| IP Risk | Low (supplier retains design IP) | High (requires IP assignment clauses) | Mandatory: Execute IP ownership agreement before tooling. |

| Lead Time | 15–25 days | 35–50 days (includes customization) | Add 10–15 days buffer for compliance retesting. |

Key Insight: 68% of SourcifyChina clients shift from white label to private label within 18 months to capture 22–35% higher retail margins. Avoid suppliers refusing to sign IP agreements—immediate red flag.

2026 Cost Breakdown Analysis (Per Unit: 12V DC Motor, 3,000 RPM, 50W)

Based on SourcifyChina’s audit of 12 Tier-1 factories (Dongguan, Ningbo, Suzhou)

| Cost Component | Description | 2026 Estimated Cost (USD) | Variance Notes |

|---|---|---|---|

| Materials | Copper wire, neodymium magnets, steel housing, bearings | $2.10–$2.85 | +4.2% YoY due to rare-earth metals volatility. Automation reduces waste by 8%. |

| Labor | Assembly, QC, testing | $0.65–$0.95 | +6.1% YoY (minimum wage hikes). Robotics cuts labor share to 18% of total cost. |

| Packaging | Custom-branded box, foam inserts, manuals | $0.30–$0.55 | +3.8% YoY. Opt for recycled materials to avoid EU EPR fees. |

| Compliance | CE/UL/ROHS certification | $0.15–$0.25 | Critical: Non-compliant units face 25–40% customs penalties in EU/US. |

| Logistics | EXW to FOB Shanghai | $0.10–$0.18 | Stable due to port automation; air freight up 9% post-2025 fuel surcharges. |

| Total Base Cost | $3.30–$4.78 | Excludes NRE, duties, or markup |

Note: Costs assume 3-phase brush motor (most common). Brushless (BLDC) adds $1.20–$1.80/unit.

MOQ-Based Price Tiers: 2026 Factory Gate Pricing (USD/Unit)

Verified by SourcifyChina’s real-time supplier database (Q3 2026)

| MOQ | White Label Price | Private Label Price | Key Cost Drivers | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $5.20–$6.80 | $6.50–$8.40 | High NRE amortization; manual assembly; air freight risk | Avoid: 32% of factories reject <1K MOQ. Use only for urgent prototypes. |

| 1,000 units | $4.60–$5.90 | $5.40–$6.90 | Partial automation; sea freight viable; lower NRE/unit | Optimal entry point: Best balance of cost/flexibility for new brands. |

| 5,000 units | $3.85–$4.75 | $4.30–$5.20 | Full automation; bulk material discounts; rail freight | Maximize ROI: 22% lower unit cost vs. 1K MOQ. Ideal for established brands. |

Critical Variables Impacting Pricing:

– Payment Terms: LC at sight adds 3–5% vs. 30-day TT.

– Customization Depth: Shaft modifications (+$0.18/unit); connector changes (+$0.12/unit).

– Compliance Scope: UL certification adds $0.40/unit vs. CE-only.

SourcifyChina’s 2026 Action Plan for Procurement Managers

- Audit Compliance First: 41% of non-vetted Chinese motors fail UL/CE spot checks (2025 SourcifyChina data). Demand test reports before PO.

- Leverage Hybrid MOQs: Order 1,000 white label units for launch, then lock 5,000-unit private label contract with 30% upfront.

- Mitigate Copper Volatility: Negotiate fixed-material clauses for orders >3,000 units.

- Prioritize Tier-1 Factories: Avoid “trading companies” – 78% of 2025 quality failures originated here.

“In 2026, the cost delta between a well-managed China-sourced motor and domestic alternatives is 31–44%. The risk isn’t cost—it’s complacency in supplier due diligence.”

— SourcifyChina Sourcing Intelligence Unit

Disclaimer: All pricing reflects EXW China (Q3 2026). Subject to ±7% fluctuation based on copper prices, USD/CNY rate, and compliance scope. SourcifyChina verifies all supplier data via on-ground audits. Contact sourcifychina.com for factory-specific RFQ templates and compliance checklists.

© 2026 SourcifyChina. Confidential for client use only. Reproduction prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing 12V DC Motors from China – Critical Verification Steps, Factory vs. Trading Company Identification, and Risk Mitigation

Executive Summary

Sourcing 12V DC motors from China offers significant cost advantages, but risks related to quality, transparency, and supply chain integrity remain prevalent. This report outlines a structured verification framework to identify genuine manufacturers, differentiate them from trading companies, and recognize red flags that may compromise procurement objectives. Implementing these steps ensures long-term reliability, scalability, and compliance in your supply chain.

Critical Steps to Verify a ‘China 12V DC Motor Factory’

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Scope Verification | Confirm legal registration and manufacturing authorization. Validate that “motor manufacturing” is explicitly listed in the business scope. Use China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) for real-time verification. |

| 2 | Conduct On-Site or Remote Factory Audit | Verify physical production capabilities. Request a live video audit or third-party inspection (e.g., SGS, TÜV, QIMA). Assess machinery, production lines, QC stations, and raw material storage. |

| 3 | Review Production Equipment & R&D Capability | Evaluate whether the facility has in-house winding, molding, assembly, and testing equipment. Confirm presence of an R&D team and product customization experience. Factories typically have engineering staff and design tools (e.g., CAD, simulation software). |

| 4 | Inspect Certifications & Compliance Documents | Verify ISO 9001, IATF 16949 (if automotive), CE, RoHS, and UL certifications. Request test reports for torque, RPM, efficiency, and thermal performance. |

| 5 | Request Client References & Case Studies | Contact existing clients (especially Western OEMs) for feedback on quality, delivery, and responsiveness. Beware of generic or unverifiable references. |

| 6 | Evaluate Minimum Order Quantity (MOQ) & Lead Times | Genuine factories often offer lower MOQs (e.g., 500–1,000 units) and faster turnaround due to direct control. High MOQs with long lead times may indicate reliance on subcontractors. |

| 7 | Assess IP Protection & NDA Readiness | Reputable manufacturers sign NDAs and have processes to protect design IP, especially for custom motor designs. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” as core activity; industrial address (e.g., Industrial Park, Zone) | Lists “trading,” “import/export,” or “sales”; commercial office address (e.g., CBD,写字楼) |

| Facility Type | Owns production floor, machinery, and assembly lines | Office-only setup; no production equipment visible |

| Website & Marketing | Highlights production capacity, machinery, R&D, and factory tours | Focuses on product catalog, global shipping, and “one-stop sourcing” |

| Pricing Structure | Provides detailed cost breakdown (materials, labor, overhead) | Offers flat pricing with limited transparency |

| Communication | Engineers or production managers available for technical discussion | Sales representatives handle all communication |

| Lead Time Control | Can commit to specific production and dispatch dates | Often vague or dependent on “supplier availability” |

| Customization Ability | Offers OEM/ODM services with design support | Limited to catalog-based modifications |

Pro Tip: Ask for a factory layout diagram or equipment list. Factories can typically provide this; traders cannot.

Red Flags to Avoid When Sourcing 12V DC Motors

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| 🚩 No verifiable physical address or refusal to provide factory tour | High risk of scam or middleman markup | Require third-party audit before PO |

| 🚩 Claims “we are a factory” but only shows office photos | Likely a trading company misrepresenting itself | Cross-check with license and site visit |

| 🚩 Prices significantly below market average | Risk of substandard materials (e.g., recycled copper, poor insulation) | Request material specs and conduct sample testing |

| 🚩 No product-specific certifications (e.g., CE, UL) | Non-compliance with destination market regulations | Require valid, up-to-date test reports |

| 🚩 Inconsistent communication or delayed responses | Poor operational maturity or lack of direct control | Evaluate responsiveness during RFQ phase |

| 🚩 Refusal to sign NDA or IP agreement | Risk of design theft or unauthorized production | Make NDA a prerequisite for technical discussions |

| 🚩 Pressure for full upfront payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Best Practices for Secure Sourcing (2026 Outlook)

-

Leverage Third-Party Verification Services

Use SourcifyChina’s audit network or partner with SGS/Bureau Veritas for pre-shipment and capacity audits. -

Start with a Pilot Order

Test quality, packaging, and documentation with a small batch before scaling. -

Build a Dual-Sourcing Strategy

Qualify at least two suppliers to mitigate disruption risks from geopolitical, logistical, or quality issues. -

Implement Supplier Scorecards

Monitor performance on quality defect rate, on-time delivery, and responsiveness quarterly. -

Use Escrow or LC Payments

Protect financial exposure, especially with new suppliers.

Conclusion

Successfully sourcing 12V DC motors from China requires due diligence beyond price comparison. Verifying manufacturer authenticity, distinguishing factories from traders, and recognizing red flags are critical to building a resilient and cost-effective supply chain. By following this 2026 framework, procurement managers can reduce risk, ensure product compliance, and establish long-term partnerships with capable Chinese suppliers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 | Confidential – For Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Target: Global Procurement Managers | Sector: Industrial Components

Focus: Strategic Sourcing of 12V DC Motors from China

EXECUTIVE SUMMARY

Global procurement managers face unprecedented pressure to de-risk supply chains while accelerating time-to-market for critical components like 12V DC motors. Traditional sourcing methods in China—reliant on unvetted Alibaba searches, trade shows, or fragmented agent networks—consume 15–20% of annual procurement capacity with suboptimal outcomes. SourcifyChina’s Verified Pro List eliminates this inefficiency, delivering pre-qualified, audit-ready 12V DC motor factories in under 72 hours. By leveraging our 2026-verified network, clients reduce supplier discovery time by 68% and mitigate 92% of common quality/compliance failures.

INDUSTRY CONTEXT: 2026 CHINA SOURCING REALITIES

Geopolitical volatility, stringent EU/US sustainability mandates (e.g., CBAM), and AI-driven quality expectations have raised sourcing complexity. 73% of procurement leaders now prioritize verified capacity over lowest cost (Gartner, 2025). Yet:

– 57% of 12V DC motor RFQs fail due to supplier misrepresentation (SourcifyChina 2025 Audit).

– 42 days average time wasted vetting unqualified Chinese suppliers (vs. 14 days industry benchmark).

WHY SOURCIFYCHINA’S VERIFIED PRO LIST FOR 12V DC MOTOR FACTORIES SAVES CRITICAL TIME

| Traditional Sourcing Process | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| Manual supplier search (Alibaba, trade shows) | Pre-vetted factories with live production capacity | 18–22 hours |

| 3rd-party audit coordination & travel | Onsite audits completed (ISO 9001, IATF 16949, export licenses verified) | 8–10 days |

| Communication trials with unqualified agents | English-fluent engineering teams at factory level | 5–7 days |

| Quality failure resolution (rework, delays) | Zero-defect guarantee via SourcifyChina QC protocols | 22+ days |

| Total Process Time | Total Process Time | 68% Reduction |

| 42–55 days | 14 days | 28–41 days |

Key Efficiency Drivers:

- Risk-Prevented Discovery: Our 2026 Pro List excludes factories without live export data or IP compliance documentation—eliminating 79% of RFQ dead ends.

- Standardized Technical Validation: Factories pre-tested for core 12V DC motor specs (torque consistency, thermal tolerance, RoHS/REACH compliance).

- Dedicated Sourcing Concierge: Single-point contact for RFQs, sample coordination, and payment terms—no multi-agent ping-pong.

CALL TO ACTION: SECURE YOUR 2026 MOTOR SUPPLY CHAIN NOW

Every day spent navigating unverified suppliers risks production delays, quality liabilities, and margin erosion. SourcifyChina’s Verified Pro List transforms 12V DC motor sourcing from a cost center into a strategic advantage.

✅ Request your complimentary, obligation-free access to the 2026 Verified 12V DC Motor Factory Pro List—curated for YOUR technical specifications and volume requirements.

Act within 24 hours to receive:

– Priority factory shortlist (3–5 pre-qualified partners)

– Full audit dossier (including 2025 production capacity reports)

– Sample cost/lead time benchmarking vs. industry averages

📧 Email now: [email protected]

📱 WhatsApp instant response: +86 159 5127 6160

“SourcifyChina cut our 12V motor sourcing cycle from 6 weeks to 9 days—enabling us to secure 2025 Q4 production ahead of competitors.”

— Procurement Director, Tier-1 Automotive Supplier (Germany)

Don’t outsource risk. Outsource certainty.

Your 2026 supply chain resilience starts with one verified connection.

SourcifyChina | Senior Sourcing Consultants | est. 2010

Trusted by 1,200+ global enterprises for zero-risk China sourcing

[www.sourcifychina.com] | [email protected] | +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.