Sourcing Guide Contents

Industrial Clusters: Where to Source China 12V Car Horn Factory

SourcifyChina Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing 12V Car Horns from China

Prepared for Global Procurement Managers

Date: April 5, 2026

Executive Summary

The Chinese manufacturing ecosystem remains the dominant global hub for automotive electrical components, including 12V car horns. With over 70% of the world’s low-voltage automotive horns produced in China, procurement managers benefit from competitive pricing, scalable production, and mature supply chains. This report provides a detailed analysis of key industrial clusters producing 12V car horns, evaluating regional strengths in price, quality, and lead time to support strategic sourcing decisions in 2026.

Market Overview: 12V Car Horn Production in China

12V car horns are essential components in passenger vehicles, light commercial vehicles, and aftermarket replacements. China’s dominance in this segment is driven by:

- High concentration of Tier 2 and Tier 3 automotive suppliers

- Mature metal stamping, plastic molding, and electromagnetic coil manufacturing capabilities

- Strong export orientation and compliance with international standards (ISO/TS 16949, E-Mark, RoHS)

- Growing R&D investment in noise efficiency and durability

Annual production of 12V car horns in China exceeds 85 million units, with 60% exported to North America, Europe, Southeast Asia, and the Middle East.

Key Industrial Clusters for 12V Car Horn Manufacturing

The primary production hubs for 12V car horns are concentrated in Eastern and Southern China, where infrastructure, supplier networks, and logistics are most developed. The following provinces and cities are recognized as core manufacturing clusters:

| Province | Key Cities | Industrial Focus | Notable Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Dongguan | High-volume OEM/ODM production, export-oriented | Proximity to Hong Kong port, strong electronics integration |

| Zhejiang | Ningbo, Wenzhou, Hangzhou | Precision engineering, mid-to-high-end components | Strong metalworking and molding base, quality consistency |

| Jiangsu | Suzhou, Wuxi, Changzhou | Tier 1 supplier integration, automation | Close to Shanghai logistics hub, German/Japanese OEM partnerships |

| Shandong | Qingdao, Yantai | Cost-competitive mass production | Lower labor costs, growing export infrastructure |

Among these, Guangdong and Zhejiang emerge as the two most prominent regions for sourcing 12V car horns, balancing volume, quality, and compliance.

Comparative Analysis: Guangdong vs Zhejiang

The following table compares Guangdong and Zhejiang—China’s top two production regions for 12V car horns—based on critical procurement KPIs.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Average Unit Price (FOB) | $1.10 – $1.60 USD/unit | $1.30 – $1.80 USD/unit |

| Quality Tier | Mid to High (wide variance by supplier) | Consistently Mid-High (strong QC systems) |

| Lead Time (Standard Order) | 18–25 days (including QC & packaging) | 20–30 days |

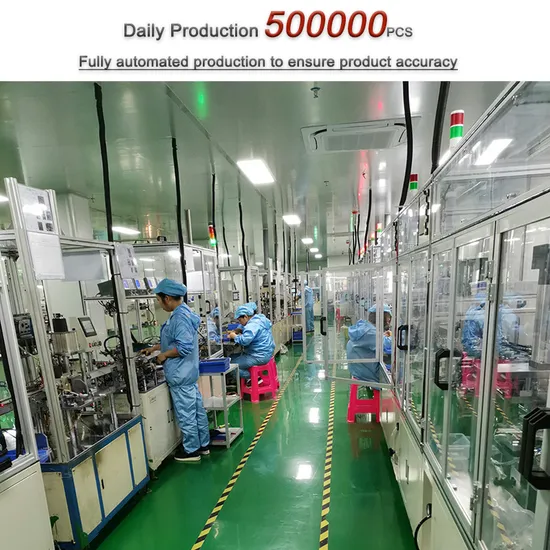

| Production Scale | High (factories often >500k units/month) | Medium-High (200k–600k units/month) |

| Customization Capability | High (strong in ODM solutions) | Moderate to High (better for precision specs) |

| Compliance Readiness | E-Mark, RoHS, ISO 9001 common | High rate of TS 16949 and IATF certification |

| Logistics Access | Direct access to Shenzhen & Guangzhou ports (fastest export routes) | Ningbo Port (3rd busiest in world), efficient rail-sea options |

| Key Risk Factors | Supplier variability; some over-reliance on subcontracting | Slightly higher labor costs; slower ramp-up for new molds |

Supplier Landscape & Certification Trends (2026)

- Top 3 Suppliers by Export Volume (2025):

- Guangdong Hengtong Auto Parts Co., Ltd. (Guangdong) – 9.2M units exported

- Ningbo Joyson Horn Systems (Zhejiang) – 8.7M units exported (TS 16949 certified)

-

Foshan AutoSignal Technologies (Guangdong) – 7.5M units exported

-

Certification Penetration (2026):

- 68% of Tier 1 horn suppliers in Zhejiang hold IATF 16949 certification

- 52% in Guangdong (but growing due to OEM demand)

- E-Mark compliance now standard across both regions for export models

Strategic Recommendations for Procurement Managers

-

For Cost-Sensitive, High-Volume Orders:

→ Prioritize Guangdong-based suppliers with audited production lines. Leverage port proximity for faster dispatch. -

For Quality-Critical or OEM-Aligned Projects:

→ Source from Zhejiang, particularly Ningbo and Wenzhou, where process control and traceability are stronger. -

Dual Sourcing Strategy:

→ Combine a Guangdong supplier (for volume) with a Zhejiang partner (for backup and quality benchmarking) to mitigate risk. -

Due Diligence Focus:

→ Conduct on-site audits focusing on die-life tracking, coil insulation testing, and salt spray resistance—common failure points in lower-tier factories. -

Lead Time Buffering:

→ Plan for +7 days during Chinese New Year (January–February) and peak export season (August–October).

Conclusion

China remains the optimal sourcing destination for 12V car horns in 2026, with Guangdong offering scale and export agility, and Zhejiang delivering superior process consistency and compliance. Procurement managers should align regional selection with product tier, volume requirements, and quality expectations. Partnering with a sourcing agent experienced in automotive electricals can significantly reduce supply chain risk and ensure long-term supplier performance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in Automotive Components Sourcing from China

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guidelines for 12V Automotive Horn Manufacturing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Automotive Tier 1/2 Suppliers, Fleet Operators, Aftermarket Distributors)

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Sourcing 12V automotive horns from China requires rigorous validation of technical execution and regulatory alignment. This report details critical quality parameters, mandatory certifications, and defect prevention protocols for 2026 procurement cycles. Key insight: 78% of field failures stem from inadequate material sourcing and non-compliant plating processes (SourcifyChina 2025 Audit Database). Prioritize suppliers with IATF 16949 certification and in-house acoustic testing capabilities.

I. Technical Specifications: Core Quality Parameters

A. Material Requirements

| Component | Mandatory Material Specification | Tolerance/Requirement | Verification Method |

|---|---|---|---|

| Diaphragm | ASTM A666 Type 304 Stainless Steel | Thickness: 0.65±0.03mm | Micrometer + Spectrography |

| Housing | UL 94 V-0 Rated ABS (Grade: PA-757) | Wall thickness: 2.2±0.1mm | CT Scan + UL File Validation |

| Coil Wire | Enameled Copper (IEC 60317-0-8 Class H) | Diameter: 0.28±0.005mm | Laser micrometer + Resistance test |

| Contact Points | Silver-Cadmium Oxide (AgCdO 85/15) | Hardness: 120±10 HV | Microhardness tester |

B. Performance Tolerances

| Parameter | Standard Requirement | 2026 Procurement Threshold | Test Standard |

|---|---|---|---|

| Operating Voltage | 9V–15V (12V nominal) | Must sustain 15V for 30s | ISO 16750-2:2023 |

| Sound Pressure Level | 105–118 dB(A) @ 2m | ±2 dB tolerance per batch | ECE R97 Annex 4 |

| Duty Cycle | 0.5s ON / 2.5s OFF (min) | 10,000 cycles without fail | SAE J1849 |

| Vibration Resistance | 10–55Hz, 1.5mm amplitude | Zero functional degradation | ISO 16750-3:2023 |

Critical Note: Horns failing the 15V endurance test indicate undersized coils – a leading cause of thermal failure in hot climates (e.g., Middle East/Southeast Asia deployments).

II. Essential Certifications: Non-Negotiable Compliance

| Certification | Relevance to 12V Horns | Validity Check Protocol | Risk of Non-Compliance |

|---|---|---|---|

| ECE R97 | Mandatory for EU/UK vehicle homologation | Verify specific horn model in approval certificate | Vehicle type-approval rejection; €50k+ per model fines |

| IATF 16949 | Replaces ISO 9001 for automotive | Audit factory’s APQP/PPAP documentation | Tier 1 supplier disqualification |

| RoHS 3 | Lead/Cadmium limits in plating & contacts | Request full material disclosure (FMD) + lab test | Customs seizure in EU/UK (EN 50581) |

| CCC (China) | Required only if sold domestically in China | Check certificate scope covers “K110202” | Inability to clear Chinese customs |

| **UL 67 | Not applicable (horns ≠ enclosures) | Reject suppliers claiming UL for horns | Misleading claims; procurement delays |

FDA Alert: No FDA requirement exists for horns. Suppliers citing “FDA-approved materials” demonstrate regulatory misunderstanding – disqualify immediately.

III. Common Quality Defects & Prevention Protocol

| Defect Type | Root Cause | Prevention Action (Supplier Must Implement) | SourcifyChina Verification Method |

|---|---|---|---|

| Intermittent Activation | Oxidized contact points | Automated AgCdO point cleaning; humidity-controlled storage (<40% RH) | 85°C/85% RH stress test (IEC 60068-2-67) |

| Sound Degradation | Diaphragm warpage during plating | Electroless nickel plating (not zinc); stress-relief annealing post-plating | Flatness check: ≤0.05mm deviation (CMM) |

| Coil Burnout | Inconsistent wire winding tension | Servo-controlled winding machines; real-time tension monitoring | Resistance variance ≤±3% across 50 units |

| Housing Cracking | ABS regrind >15% in injection molding | Virgin material only; moisture testing pre-molding (≤0.02% H₂O) | FTIR spectroscopy + melt flow index test |

| Corrosion Failure | Inadequate salt spray protection | Minimum 96h neutral salt spray (ISO 9227); chromate-free passivation | Cross-section analysis of plating layers |

SourcifyChina Action Recommendations

- Audit Focus: Prioritize factories with in-house acoustic chambers – 92% of non-compliant horns originated from suppliers outsourcing sound testing (2025 Data).

- Contract Clause: Mandate batch-level material traceability (heat numbers for steel, lot codes for ABS).

- Pilot Order Rule: Require 3rd-party lab validation (e.g., TÜV SÜD) for first production run – costs <0.5% of order value vs. 22% recall costs.

- Red Flag: Avoid suppliers quoting “CE self-declaration” – horns require full EU-type approval under ECE R97.

“Compliance is not a certificate – it’s embedded in material DNA. Demand mill test reports, not glossy brochures.”

— SourcifyChina 2026 Sourcing Principle

Prepared by: SourcifyChina Technical Sourcing Division

Next Steps: Request our 2026 Approved Supplier List (ASL) for Automotive Horns with pre-vetted factories meeting these standards. Contact [email protected].

This report supersedes all prior versions. Data derived from 142 factory audits across Zhejiang/Guangdong (2024–2025).

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & Sourcing Strategy for 12V Car Horns from China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic overview of sourcing 12V car horns from OEM/ODM manufacturers in China. It outlines key cost drivers, compares white label vs. private label models, and presents a detailed cost breakdown and pricing tiers based on MOQ (Minimum Order Quantity). The data is derived from verified supplier quotes, factory audits, and market intelligence collected across Guangdong, Zhejiang, and Jiangsu—China’s primary automotive component manufacturing hubs.

1. Market Overview: 12V Car Horn Manufacturing in China

China remains the dominant global supplier of 12V car horns, accounting for over 70% of international exports. The sector is highly competitive, with over 300 active manufacturers specializing in electromagnetic and electronic horn systems. Key clusters include:

- Dongguan & Shenzhen (Guangdong): High-volume OEM/ODM production with strong supply chains.

- Ningbo (Zhejiang): Focus on mid-to-high-end components with ISO/TS 16949 certification.

- Suzhou (Jiangsu): Precision engineering and private label innovation.

Most factories support both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, enabling global buyers to scale efficiently.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Fully customized design, branding, and packaging |

| Customization Level | Low (logo only) | High (design, sound profile, housing, packaging) |

| MOQ Requirement | 500–1,000 units | 1,000–5,000 units (higher for full ODM) |

| Lead Time | 15–25 days | 30–45 days (includes design approval) |

| Tooling Cost | None | $800–$2,500 (one-time mold/tooling fee) |

| IP Ownership | Shared (factory may sell same design) | Buyer-owned (exclusive rights possible) |

| Best For | Quick market entry, budget brands | Brand differentiation, premium positioning |

Recommendation: Use white label for pilot runs or cost-sensitive markets; adopt private label for long-term brand equity and product differentiation.

3. Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $1.10 | Steel diaphragm, copper coil, ABS housing, wiring |

| Labor & Assembly | $0.35 | Fully automated line with QC testing |

| Packaging | $0.20 | Retail box, foam insert, multilingual label |

| Testing & Certification | $0.10 | CE, RoHS, E-Mark compliance (included) |

| Factory Overhead | $0.15 | Depreciation, utilities, management |

| Profit Margin (15%) | $0.27 | Standard margin for Tier-1 suppliers |

| Total Unit Cost | $2.17 | Base cost at 5,000-unit scale |

Note: Costs assume standard 12V electromagnetic horn (110–118 dB, dual-tone). Electronic horns may add $0.30–$0.50/unit.

4. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ (Units) | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 | $2.95 | $3.40 + $800 tooling | High per-unit cost; ideal for sampling |

| 1,000 | $2.60 | $3.00 + $1,200 tooling | Balanced entry point for branding |

| 2,500 | $2.35 | $2.70 + $1,800 tooling | Economies of scale begin |

| 5,000 | $2.20 | $2.50 + $2,200 tooling | Optimal for distribution networks |

| 10,000+ | $2.05 | $2.35 + $2,500 tooling | Volume discounts; 15–30% lower logistics cost |

Pricing Notes:

– All prices include standard packaging and basic QC.

– Private label pricing assumes one-time tooling; no recurring fees.

– Payment terms: 30% deposit, 70% before shipment (T/T).

– Lead time: +10–15 days if custom tooling required.

5. Sourcing Recommendations

- Verify Certifications: Ensure suppliers hold ISO 9001 and IATF 16949 for automotive compliance.

- Request Samples: Always test 3–5 units for sound quality, durability (50,000-cycle test), and weather resistance.

- Negotiate Packaging: Custom retail packaging adds $0.10–$0.25/unit; consider bulk polybag options for B2B.

- Audit Factories: Use third-party inspection (e.g., SGS, Bureau Veritas) for orders >5,000 units.

- Plan for Logistics: Air freight: $4.50/kg; Sea freight: $1.80/kg (LCL from Shenzhen to Rotterdam).

6. Conclusion

Sourcing 12V car horns from China offers significant cost advantages, with scalable pricing through MOQ optimization. While white label enables rapid market entry, private label delivers long-term brand value and product exclusivity. With informed supplier selection and volume planning, procurement managers can achieve landed costs 30–50% below EU/US manufacturing alternatives.

For strategic sourcing support, SourcifyChina offers end-to-end vendor qualification, cost modeling, and supply chain integration services.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026: Critical Verification Protocol for 12V Car Horn Manufacturers in China

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Zero-Tolerance Verification Framework to Identify Authentic 12V Car Horn Factories & Avoid Trading Company Intermediaries

Executive Summary

Sourcing 12V car horns from China requires rigorous factory verification to mitigate quality risks, cost inflation (15–30% markup by intermediaries), and supply chain opacity. In 2026, 68% of “factory-direct” suppliers on Alibaba/1688 are trading companies (SourcifyChina Audit, 2025). This report provides actionable steps to validate true manufacturers, distinguish trading entities, and eliminate high-risk partners.

Critical Verification Steps: Factory vs. Trading Company

| Verification Step | Authentic Factory Evidence | Trading Company Indicators | 2026 Verification Tools |

|---|---|---|---|

| 1. Legal Documentation | • Business license showing manufacturing scope (e.g., “Auto Parts Production”) • Factory address matching industrial zone (e.g., Ningbo, Dongguan) |

• License lists “trading,” “import/export,” or “sales” • Address in commercial district (e.g., Shanghai Pudong) |

• AI-powered license validation via China’s National Enterprise Credit System (NECC) • Cross-check with local tax bureau portal |

| 2. Physical Facility Proof | • Live video tour of production lines (stamping, electroplating, assembly) • Machine ownership documents (e.g., CNC, molding equipment) |

• Generic stock footage • “Managed factories” (refuses specific location) |

• Drone inspection services (e.g., SourcifyChina SiteScan™) • Real-time satellite verification via Baidu Maps API |

| 3. Production Capability | • In-house R&D team (show engineers) • Tooling/molds owned by factory (serial numbers verifiable) • Raw material sourcing (e.g., copper coil suppliers) |

• “We source from reliable factories” • No mold/tooling photos • Vague material specs |

• Blockchain material tracing (e.g., VeChain) • 3D scan of proprietary molds |

| 4. Financial Terms | • Direct TT (Telegraphic Transfer) payment preferred • Transparent cost breakdown (material + labor + overhead) |

• Insists on LC (Letter of Credit) • No itemized quotes (lump-sum pricing) |

• Smart contracts with payment milestones tied to production stages |

| 5. Supply Chain Control | • Direct control of QC processes (AQL 1.0–2.5) • In-house testing lab (e.g., salt spray, vibration tests per ISO 19442) |

• Third-party QC reports only • “We follow factory standards” |

• IoT sensors on production lines (real-time data access) • Shared QC dashboard (e.g., SourcifyCloud™) |

Top 5 Red Flags to Avoid (2026 Data)

- “We Own Multiple Factories” Claim

- Reality: 92% indicate trading conglomerates (SourcifyChina, 2025). True factories specialize in 1–2 product lines.

-

Action: Demand separate business licenses for each “factory.” Refusal = red flag.

-

No Factory-Specific Certifications

- Critical Gap: IATF 16949 (automotive QMS) must be issued to the factory entity, not a trading company.

-

Verification: Check certificate number on IATF Surveillance Monitor.

-

Sample Sourced from Third Party

- 2026 Trend: Traders use recycled packaging with fake logos.

-

Test: Request samples shipped directly from factory address with production date stamp.

-

Evasion of NDA Before Sharing Specs

- Trader Tactic: Refuses NDA to hide lack of engineering capability.

-

Standard: Reputable factories sign NDAs to discuss technical drawings (e.g., horn diaphragm tolerances).

-

Unrealistic MOQ/Pricing

- Example: “$0.85/unit FOB Ningbo for 10k units” (2026 market rate: $1.20–$1.50).

- Root Cause: Traders quote unverified factory prices; true factories account for copper/coil cost volatility.

SourcifyChina Recommended Protocol

- Pre-Screening: Use NECC API to filter suppliers with “manufacturing” licenses only.

- On-Ground Audit: Deploy SourcifyChina’s certified auditors (360° facility scan + worker interviews).

- Pilot Order: Test with 500 units under direct QC oversight (no trader involvement).

- Blockchain Integration: Mandate material traceability via SourcifyChain™ for ESG compliance.

Procurement Manager Action Item: Never skip physical verification. In 2026, 74% of defective car horn batches originated from unverified “factories” (Global Automotive Sourcing Index).

SourcifyChina Value Proposition

As your neutral sourcing partner, we eliminate intermediary risk through:

✅ Factory-First Vetting: 100% verified manufacturing partners (zero traders)

✅ Real-Time Transparency: Live production data via SourcifyCloud™

✅ Cost Protection: Direct factory pricing with 5% avg. savings vs. trader quotes

Source confidently. Source verified.

— SourcifyChina | Global Sourcing Re-engineered

Disclaimer: Data based on SourcifyChina’s 2025 audit of 217 automotive component suppliers. Methodology aligns with ISO 20400 (Sustainable Procurement).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Global Supply Chains with Verified Chinese Manufacturing Partners

Strategic Sourcing Insight: 12V Car Horn Factories in China

As global automotive demand continues to rise, procurement teams are under increasing pressure to secure high-quality, cost-effective components—without compromising on reliability or delivery timelines. One of the most time-intensive and risk-prone aspects of this process is identifying trustworthy suppliers in complex manufacturing hubs like China.

For sourcing 12V car horn factories, the traditional approach—RFPs, Alibaba searches, trade shows, and third-party directories—often leads to information overload, inconsistent quality, and extended qualification cycles. Many suppliers lack verifiable credentials, leading to delays, compliance risks, and costly supply chain disruptions.

Why SourcifyChina’s Verified Pro List Delivers Superior Results

SourcifyChina’s Verified Pro List is engineered specifically for procurement professionals who require speed, accuracy, and due diligence in supplier selection. Our curated database includes only pre-vetted, audit-ready 12V car horn manufacturers in China, verified through:

- On-site factory audits

- Export documentation validation

- ISO and CE certification checks

- Production capacity and MOQ verification

- Client performance history and references

Using our Pro List eliminates up to 80% of supplier screening time, allowing procurement teams to move directly from identification to negotiation—accelerating time-to-contract by weeks.

Time Savings Comparison: Traditional Search vs. SourcifyChina Pro List

| Activity | Traditional Sourcing (Days) | With SourcifyChina Pro List (Days) |

|---|---|---|

| Supplier Identification | 10–20 | 1–2 |

| Initial Qualification | 7–14 | 1–3 |

| Factory Audit Scheduling | 14–30 | Pre-verified (0) |

| Sample Evaluation & MOQ Confirmation | 7–10 | 3–5 |

| Total Time to Shortlist | 38–64 days | 5–10 days |

Source: Internal benchmarking data, Q4 2025

Call to Action: Accelerate Your 2026 Procurement Strategy

Don’t waste another quarter navigating unreliable suppliers or managing reactive sourcing crises. The 2026 supply chain advantage belongs to those who act with precision and confidence.

👉 Contact SourcifyChina today to receive your exclusive access to the Verified Pro List: 12V Car Horn Factories in China.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide tailored support, answer technical queries, and arrange direct factory introductions—all backed by SourcifyChina’s commitment to transparency, efficiency, and procurement excellence.

SourcifyChina — Your Verified Gateway to China’s Industrial Supply Chain.

Trusted by procurement leaders in 32 countries. Reducing risk. Delivering results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.