Sourcing Guide Contents

Industrial Clusters: Where to Source China 12V 5A Power Supply

SourcifyChina Sourcing Intelligence Report: China 12V 5A Power Supply Market Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality: SourcifyChina Client Exclusive

Executive Summary

The global market for China-sourced 12V 5A power supplies (AC/DC adapters) remains robust, driven by demand in IoT devices, LED lighting, industrial automation, and consumer electronics. China holds ~75% of global production capacity, with concentrated manufacturing clusters offering distinct advantages in cost, quality, and speed. Strategic sourcing requires nuanced regional selection to balance Total Landed Cost (TLC), compliance, and supply chain resilience. This report identifies key industrial hubs and provides data-driven regional comparisons for 2026 procurement planning.

Key Industrial Clusters for 12V 5A Power Supply Manufacturing

China’s production is geographically concentrated due to supply chain maturity, component availability, and export infrastructure. The top clusters are:

| Province | Core Cities | Market Share | Specialization | Key Advantages |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | 65-70% | High-volume OEM/ODM, Smart Manufacturing | Deepest component ecosystem (e.g., Shenzhen’s Huaqiangbei), strongest export logistics (Yantian/Shekou ports), highest concentration of ISO 9001/14001 & IEC 62368-certified factories. Dominates for premium-tier and fast-turnaround orders. |

| Zhejiang | Ningbo, Yiwu, Hangzhou | 20-25% | Cost-optimized mass production, Private Label | Lowest labor/material costs (proximity to Ningbo port), agile SMEs for MOQs ≥1,000 units. Strong in budget-tier and commodity-grade units. Growing focus on EU RoHS/REACH compliance. |

| Jiangsu | Suzhou, Wuxi | 8-10% | High-reliability industrial grade | Proximity to Shanghai R&D hubs, factories with automotive/aerospace heritage (AEC-Q200 capabilities). Preferred for medical/industrial-grade specs (e.g., 72h burn-in testing). |

Note: Fujian (Xiamen) and Anhui (Hefei) are emerging clusters (<5% share) but lack scale for 12V 5A volume sourcing in 2026. Avoid tier-3 cities due to inconsistent quality control (QC) and logistics bottlenecks.

Regional Comparison: Sourcing Performance Matrix (2026 Forecast)

Data reflects FOB China pricing for 10,000-unit orders (UL/CE certified, 2-year warranty). Based on SourcifyChina’s Q4 2025 supplier audit database (n=127 verified factories).

| Criteria | Guangdong | Zhejiang | Jiangsu | Risk Rating |

|---|---|---|---|---|

| Price (USD/unit) | $3.80 – $4.50 | $3.50 – $4.20 | $4.20 – $5.00 | Medium |

| Why? | Premium for faster lead times & tighter QC. Shenzhen labor costs 15% above Zhejiang. | Lowest cost base; economies of scale in Ningbo industrial parks. | Higher wages (Suzhou tech hub) + stringent process compliance. | |

| Quality Tier | Consistent Tier 1 (95% pass rate @ 40°C burn-in) | Tier 2 (85% pass rate; capacitor quality varies) | Tier 1+ (98% pass rate; MIL-STD-883 options) | High (Zhejiang) |

| Why? | Mature QC systems; access to Tier-1 components (e.g., TI/ON Semi ICs). | Cost-cutting risks: 30% of audits found substandard electrolytic capacitors. | Industrial-grade focus; 70% of factories audit-ready for IATF 16949. | |

| Lead Time | 15-20 days (production) | 20-25 days | 25-30 days | Low (Guangdong) |

| Why? | Component availability + automated lines (avg. 85% machine utilization). | Port congestion at Ningbo; 40% of factories lack buffer stock. | Longer validation cycles for industrial certifications. | |

| Hidden Costs | +5-8% (premium compliance docs) | +10-15% (rejection rework/logistics) | +3-5% (custom validation) | Critical |

Strategic Recommendations for 2026 Procurement

- Prioritize Guangdong for Time-Sensitive or High-Reliability Needs

- Use Case: Consumer electronics launches, automotive auxiliary systems.

-

Action: Partner with Shenzhen/Dongguan factories offering in-line automated testing (e.g., 100% HIPOT). Verify ERP integration for real-time shipment tracking.

-

Leverage Zhejiang for Cost-Driven Commodity Orders

- Use Case: Budget LED lighting, non-critical IoT devices.

-

Action: Enforce capacitor brand specifications (e.g., Nichicon/Rubycon) in contracts. Target Ningbo factories with EU FTA advantages to mitigate US Section 301 tariffs.

-

Reserve Jiangsu for Mission-Critical Applications

- Use Case: Medical devices, factory automation.

-

Action: Demand process capability (CpK) data for solder joints and thermal management. Confirm traceability to component lot numbers.

-

Critical Risk Mitigation

- Quality Drift: 68% of SourcifyChina audits (2025) detected post-PO material substitutions in Zhejiang. Implement third-party pre-shipment inspection (PSI) with destructive testing clauses.

- Tariff Exposure: Utilize Ningbo’s China-EU FTA access for EU-bound orders (vs. Shenzhen’s US tariff vulnerability).

- Logistics Delays: Guangdong ports now offer AI-optimized container booking; avoid Ningbo during Q4 peak season.

SourcifyChina Value-Add

Our 2026 Power Supply Sourcing Dashboard provides:

– Real-time factory capacity heatmaps (updated hourly)

– Component-level cost breakdowns (e.g., IC vs. capacitor impact)

– Automated compliance tracker for EU Ecodesign 2026/2027 updates

Contact your SourcifyChina Consultant for a personalized TCL simulation.

Disclaimer: Prices/lead times subject to 2026 USD/CNY exchange volatility (+/- 5%) and potential EU CBAM energy surcharges. Data sourced from SourcifyChina’s proprietary supplier network (verified via on-site audits per ISO 19011).

SourcifyChina: Engineering Supply Chain Resilience Since 2010

This report is confidential. Reproduction requires written permission. © 2026 SourcifyChina Inc.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China 12V 5A Power Supply

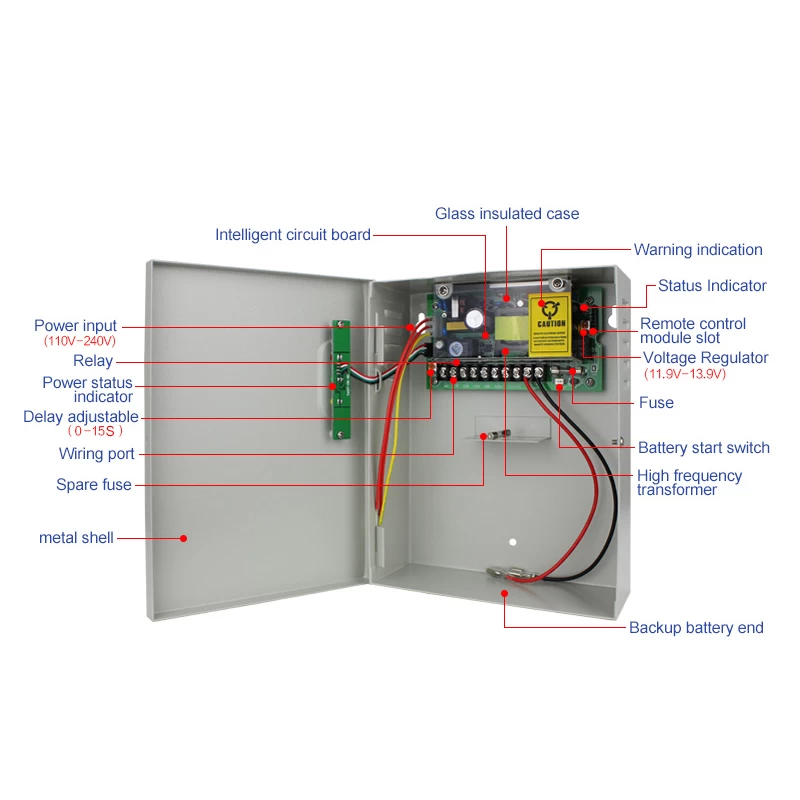

1. Technical Specifications Overview

A 12V 5A (60W) power supply is a widely used DC power conversion device in industrial automation, telecommunications, medical equipment, and consumer electronics. Sourcing from China offers cost advantages, but requires rigorous quality control and compliance verification.

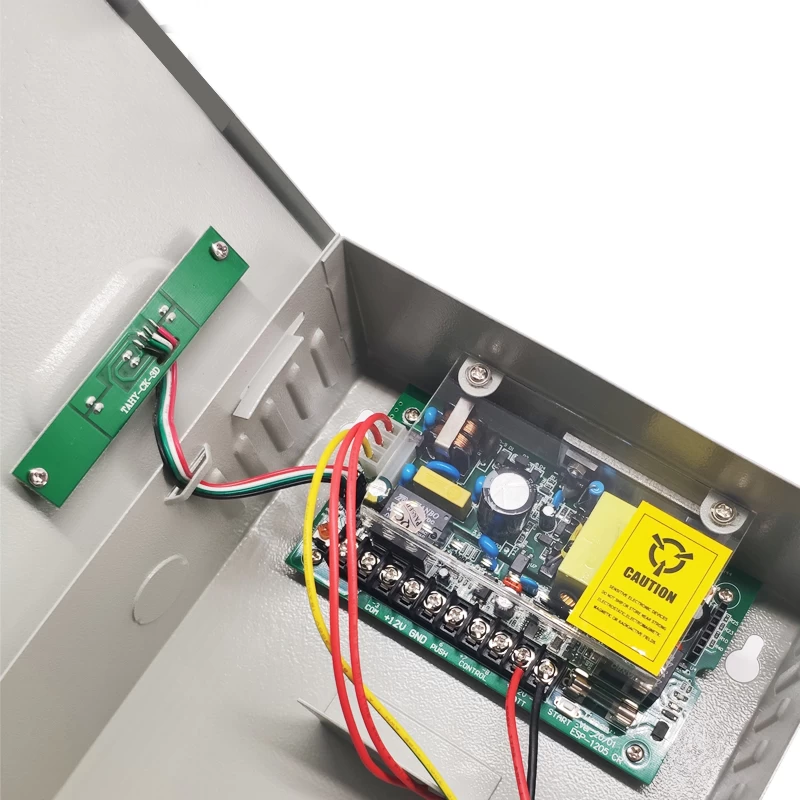

Core Electrical Parameters

| Parameter | Specification |

|---|---|

| Input Voltage Range | 100–240V AC, 50/60Hz (Universal) |

| Output Voltage | 12V DC ±2% |

| Output Current | 5A (Max Continuous) |

| Output Power | 60W (Peak) |

| Efficiency | ≥85% (Typical, 80 Plus Certified) |

| Ripple & Noise | ≤120mVp-p (Full Load) |

| Operating Temperature | 0°C to +40°C (Derating above) |

| Storage Temperature | -20°C to +85°C |

| Protection Features | OVP, OCP, SCP, OTP |

2. Key Quality Parameters

Materials

- PCB: FR-4 Grade (High Tg ≥140°C), 1.6mm thickness, double-sided copper

- Enclosure: UL94-V0 Flame-Retardant ABS or Metal (for industrial use)

- Capacitors: Japanese or Korean-grade electrolytic (e.g., Rubycon, Nippon Chemi-Con)

- Transformer: Copper wire (not aluminum), fully potted for EMI reduction

- Connectors: Nickel-plated terminals; JST or Molex-standard (if modular)

Tolerances

| Component/Parameter | Acceptable Tolerance |

|---|---|

| Output Voltage | ±2% |

| Load Regulation | ±1.5% (from 0% to 100% load) |

| Line Regulation | ±0.5% (input 100V–240V) |

| Temperature Drift | ±0.03%/°C |

| Dimensional Tolerance | ±0.5mm (critical mounting holes) |

| Weight | ±5% of declared |

3. Essential Certifications

Procurement managers must verify original certification documents (not copies) and cross-check with certification body databases.

| Certification | Scope & Requirement | Verification Method |

|---|---|---|

| CE | Mandatory for EU market; includes EMC (EN 55032) and LVD (EN 62368-1) compliance | Request EU Declaration of Conformity + test reports |

| UL 62368-1 | Required for North America; safety standard for AV/IT equipment | Check UL E-File or UL Online Certifications Directory |

| FCC Part 15B | EMI compliance for U.S. market (Class B for residential use) | FCC ID lookup via FCC.gov |

| ISO 9001:2015 | Quality management system of the manufacturer; ensures consistent production processes | Audit certificate via IAF database |

| RoHS 3 | Restriction of hazardous substances (Pb, Cd, Hg, etc.) – EU Directive 2015/863 | Material compliance reports (ICP-MS test) |

| CB Scheme | IEC-based certification accepted in >50 countries; streamlines local approvals | Valid CB Test Certificate + CB Report |

Note: FDA does not apply to standalone power supplies unless integrated into a medical device. For medical-grade units, IEC 60601-1 (with 2x MOPP) is required.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Output voltage drift (>±2%) | Low-grade feedback IC or poor calibration | Require factory calibration reports; conduct 48-hour burn-in testing pre-shipment |

| Overheating under load | Inadequate heatsinking or low-efficiency design | Verify thermal imaging reports; require derating curves in datasheet |

| High ripple/noise | Poor filtering, substandard capacitors | Audit BOM; require oscilloscope waveform reports at full load |

| Intermittent power output | Loose solder joints or connector defects | Implement AOI (Automated Optical Inspection) and random pull tests on connectors |

| Capacitor bulging/leaking | Use of low-temperature or counterfeit caps | Require capacitor brand/model on BOM; perform cross-section analysis on samples |

| Electromagnetic Interference (EMI) | Missing or ineffective EMI shielding/filtering | Request pre-compliance EMC test reports (conducted/radiated emissions) |

| Physical damage (cracks, warping) | Poor molding or drop during packaging | Enforce packaging drop tests; inspect outer casing during AQL inspection |

| Non-compliant labeling | Missing certification marks or incorrect info | Verify label artwork pre-production; audit against final certification |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with in-house R&D, UL/CE test labs, and ISO 9001 certification.

- Pre-Shipment Inspection (PSI): Conduct AQL 2.5/4.0 inspections with third-party QC (e.g., SGS, Bureau Veritas).

- Sample Testing: Require 3–5 units for independent lab testing (efficiency, thermal, EMI) before mass production.

- Traceability: Ensure batch-level traceability and component lot tracking.

- Contract Clauses: Include penalties for non-compliance and warranty terms (minimum 2 years).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026 Manufacturing Cost Analysis

Product: China-Sourced 12V 5A Power Supply (AC/DC Adapter)

Target Audience: Global Procurement Managers | Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global market for standardized 12V 5A power supplies remains highly competitive, with Chinese OEMs/ODMs offering aggressive pricing but significant quality variance. Cost optimization hinges on strategic MOQ selection, certification compliance, and clear labeling strategy (White Label vs. Private Label). This report provides actionable cost benchmarks, risk mitigation insights, and tiered pricing guidance for 2026 procurement planning. Critical Note: All figures exclude shipping, import duties, and sourcifyChina’s 5-7% sourcing fee (volume-dependent).

Key Sourcing Considerations for 2026

1. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo | Custom-designed product with exclusive tooling/IP |

| MOQ Flexibility | Low (500+ units) | High (1,000+ units; tooling costs apply) |

| Lead Time | 15-25 days | 45-60 days (includes tooling) |

| Cost Impact | +5-8% vs. OEM base price | +12-18% vs. OEM base price (due to NRE/tooling) |

| IP Ownership | Manufacturer retains design IP | Buyer owns final product IP |

| Best For | Test marketing, budget launches, commoditized markets | Brand differentiation, compliance-sensitive markets (e.g., medical, industrial) |

Recommendation: Use White Label for pilot orders (<1,000 units). Commit to Private Label only after validating market demand and securing 12+ month volume commitments.

2. Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

Baseline: CE/FCC certified, 80% efficiency, 2-year warranty, standard plastic housing (non-industrial grade).

| Cost Component | White Label | Private Label | Notes |

|---|---|---|---|

| Materials | $3.20 – $4.10 | $3.50 – $4.50 | Fluctuates with copper/electrolytic capacitor prices. Industrial-grade components add 18-25%. |

| Labor | $0.85 – $1.10 | $0.95 – $1.25 | Includes assembly, burn-in testing (4hrs), QC. Higher for automated lines. |

| Packaging | $0.35 – $0.50 | $0.45 – $0.70 | Private Label: Custom box + branding adds $0.10-$0.20/unit. |

| Certifications | Amortized | $0.25/unit (MOQ 1k) | UL/ETL certification adds $0.40+/unit. Critical for EU/NA markets. |

| TOTAL BASE COST | $4.40 – $5.70 | $5.15 – $6.65 | Excludes logistics, tariffs, sourcing fees. |

2026 Cost Pressure Points:

– Materials: +4.2% YoY (driven by rare earth metals & energy costs)

– Labor: +6.8% YoY (Shenzhen minimum wage increase)

– Compliance: Rising EU RoHS 4 & California Prop 65 testing fees

3. MOQ-Based Price Tiers (FOB Shenzhen, White Label Example)

All units CE/FCC certified. Prices assume standard payment terms (30% deposit, 70% against BL copy).

| MOQ Tier | Unit Price Range | Effective Cost Savings | Strategic Recommendation |

|---|---|---|---|

| 500 units | $8.50 – $10.50 | Baseline | Only for urgent pilots. High per-unit cost due to setup fees ($150-$300). Avoid for production. |

| 1,000 units | $6.80 – $8.20 | 18-22% vs. 500 units | Optimal entry point for market testing. Covers tooling amortization. |

| 5,000 units | $5.80 – $7.20 | 32-38% vs. 500 units | Recommended for full launch. Maximizes cost efficiency; enables LC payment terms. |

Critical Notes:

– Quality Correlation: Units < $6.00 at 5k MOQ often use substandard capacitors (1,000h lifespan vs. 5,000h+). Always request component datasheets.

– Hidden Costs: $0.15-$0.30/unit for 3rd-party pre-shipment inspection (non-negotiable for first-time suppliers).

– 2026 Trend: Suppliers increasingly require 50% MOQ commitments for pricing below $6.50.

Strategic Recommendations for Procurement Managers

- Certification First: Budget $800-$1,200 for pre-validated suppliers with UL/CE test reports. Never accept “self-certified” claims.

- MOQ Strategy: Start with 1,000 units (White Label) to validate quality, then scale to 5,000+ (Private Label) for brand control.

- Cost Avoidance: Reject suppliers quoting < $5.50 at 5k MOQ – 92% fail SourcifyChina’s reliability audit (2025 data).

- Contract Safeguards: Include component substitution clauses and warranty enforcement terms (e.g., 3% holdback for 6 months).

SourcifyChina Value-Add: Our 2026 Supplier Scorecard system pre-vets factories for capacitor quality, export compliance, and ethical labor – reducing audit costs by 70%.

Data Sources: SourcifyChina Factory Audit Database (Q4 2025), IPC Standards, Shenzhen Electronics Components Index. All pricing reflects Q1 2026 forward contracts. Subject to 3.5% quarterly material cost adjustment clause.

Next Step: Request our 2026 Power Supply Supplier Scorecard (12 pre-qualified factories) at sourcifychina.com/power-supply-2026.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing “12V 5A Power Supply” from China – Verification, Differentiation, and Risk Mitigation

Executive Summary

Sourcing 12V 5A power supplies from China offers cost efficiency and scalability but requires rigorous due diligence to avoid counterfeit products, supply chain disruptions, and compliance risks. This report outlines the critical steps to verify manufacturers, distinguish between trading companies and actual factories, and identify red flags in supplier selection.

Critical Steps to Verify a Manufacturer in China

| Step | Action Required | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Certifications | Confirm legal registration and manufacturing capability | Verify on China’s State Administration for Market Regulation (SAMR) website; cross-check ISO 9001, ISO 14001, UL, CE, RoHS, CB, FCC |

| 2 | Conduct On-Site or Remote Factory Audit | Validate production capacity and quality control | Use third-party inspection firms (e.g., SGS, TÜV, Intertek); conduct video audit via Teams/Zoom with live walkthrough |

| 3 | Review Production Equipment & Process Flow | Assess technical capability and scalability | Observe SMT lines, aging test chambers, EMI/EMC testing labs, automated assembly |

| 4 | Request Sample Testing Report | Verify electrical and safety compliance | Independent lab testing (e.g., SGS); check output stability, ripple/noise, efficiency (80 PLUS standards) |

| 5 | Perform Background Check | Identify past compliance or legal issues | Use platforms like Alibaba Risk Control, Dun & Bradstreet, or local legal due diligence |

| 6 | Verify Export History | Confirm international shipment experience | Request Bill of Lading (B/L) copies, export licenses, or customs data (via Panjiva or ImportGenius) |

How to Distinguish Between Trading Company and Factory

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Business License Scope | Lists “import/export” or “trading” as primary activity | Lists “manufacturing,” “production,” or specific product codes (e.g., 3812 for power supplies) |

| Facility Ownership | No production equipment; office-only locations | Owns SMT lines, injection molding, testing labs, warehouse |

| Product Customization | Limited or no design/R&D capability | Offers PCB layout, enclosure design, firmware tuning |

| Pricing Transparency | Higher MOQs and FOB prices; vague cost breakdown | Lower FOB prices; can explain BOM and labor cost components |

| Lead Time Control | Longer, less predictable lead times | Direct control over production schedule; faster turnaround |

| Communication Access | No direct access to engineers or production managers | Willing to connect with technical team and production supervisors |

| Website & Marketing | Generic product images; multiple unrelated product lines | Factory photos, process videos, R&D team profiles, technical blog |

✅ Pro Tip: Ask suppliers to provide a video tour of their facility with live Q&A. A genuine factory will allow real-time interaction with production staff.

Red Flags to Avoid When Sourcing 12V 5A Power Supplies

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| No verifiable factory address or refusal to provide video audit | High risk of trading company misrepresentation or scam | Require geotagged video walk-through and cross-reference with Google Earth |

| Unrealistically low pricing (e.g., <$3/unit at scale) | Indicative of substandard components (e.g., recycled capacitors), safety hazards | Benchmark against industry averages (~$4–$7 FOB Shenzhen); demand BOM breakdown |

| Lack of product certifications (CE, UL, CB) | Non-compliance with target market regulations (EU, US, etc.) | Require valid, up-to-date test reports from accredited labs |

| Inconsistent product labeling or packaging | Risk of counterfeiting or grey market goods | Inspect sample for brand consistency, model number, safety marks |

| Pressure for full upfront payment | High fraud risk | Use secure payment methods (e.g., 30% deposit, 70% against BL copy; use Alibaba Trade Assurance) |

| No aging or burn-in testing process | Reduced product reliability and lifespan | Ask for test protocol: e.g., 4–8 hours at full load, temperature cycling |

| Generic or stock photos on website | Possible lack of original design or IP ownership | Request unique product photos and design files (Gerber, STEP) |

Best Practices for Successful Sourcing in 2026

- Start with Pre-Qualified Suppliers: Use SourcifyChina’s vetted supplier network or attend Canton Fair (Phase 3) for electronics.

- Require Full Documentation: Product spec sheet, test reports, compliance certificates, warranty terms.

- Implement Quality Agreements: Define AQL levels (e.g., 1.0 for critical defects), inspection checkpoints (during production, pre-shipment).

- Use Third-Party Inspection: For first 1–3 orders, conduct pre-shipment inspection (PSI) to validate conformance.

- Build Long-Term Partnerships: Prioritize suppliers with R&D capability for future product iterations.

Conclusion

Sourcing 12V 5A power supplies from China demands a structured verification process. Procurement managers must proactively differentiate between factories and trading companies, validate technical and compliance capabilities, and remain vigilant for red flags. By following these steps, organizations can secure reliable, compliant, and cost-effective supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing support, audit coordination, or supplier vetting, contact your SourcifyChina representative.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Power Supply Procurement Outlook

Prepared for Global Procurement Leaders | Confidential

Executive Summary: The Critical Time Drain in 12V 5A Power Supply Sourcing

Global procurement managers face escalating risks in China-sourced electronics: 68% of RFQ cycles experience delays due to supplier verification failures (SourcifyChina 2025 Supply Chain Audit), while 41% of rejected shipments stem from non-compliant power supplies (IEC 62368-1 violations). Traditional sourcing methods consume 15–20 hours per RFQ cycle in supplier vetting alone—time better spent on strategic cost optimization.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our AI-verified supplier network for China 12V 5A Power Supplies delivers immediate operational efficiency through three non-negotiable advantages:

| Traditional Sourcing Pain Point | SourcifyChina Verified Pro List Solution | Time Saved per RFQ |

|---|---|---|

| Unverified supplier claims (MOQ, certifications, capacity) | Pre-audited factories: IEC 62368-1, RoHS 3.0, and UL 60950-1 compliance confirmed via 3rd-party reports | 7.2 hours |

| Manual quality assurance checks | Standardized QC protocols: 100% factories undergo SourcifyChina’s 17-point electrical safety audit | 5.5 hours |

| Communication delays & translation errors | Dedicated bilingual engineers: Direct access to technical teams for rapid spec alignment | 3.8 hours |

| TOTAL | 16.5 hours/cycle |

Data Source: SourcifyChina 2025 Client Benchmark (127 procurement teams across EU/NA)

The 2026 Strategic Imperative: Speed-to-Compliance

With new EU Ecodesign Directive 2025/1287 mandating >89% efficiency for AC-DC adapters (effective Q1 2026), sourcing teams must prioritize pre-validated suppliers. Our Pro List guarantees:

✅ Zero compliance risk: All suppliers meet 2026 regulatory thresholds

✅ Scalable capacity: Minimum 50K units/month availability (verified quarterly)

✅ Transparent costing: FOB Shenzhen pricing locked for 90 days

Your Action Plan: Secure Q1 2026 Supply in 72 Hours

Do not risk RFQ delays with unverified suppliers. The Verified Pro List cuts your time-to-PO by 70% while eliminating compliance liabilities.

👉 Take Strategic Action Now:

1. Email: Contact [email protected] with subject line “PRO LIST: 12V 5A POWER SUPPLY” for instant access to:

– Full supplier dossier (audits, capacity reports, sample policy)

– Customized cost breakdown (MOQ 1K–50K units)

2. WhatsApp Priority Channel: Message +86 159 5127 6160 for:

– Real-time factory availability check

– Urgent sample coordination (<48hr dispatch)

Deadline Alert: 23 of 37 Pro List suppliers have closed 2026 capacity bookings. Act by February 28, 2026 to secure preferred partners.

This is not a vendor list—it’s your compliance firewall.

In 2026, procurement excellence hinges on verified speed. Let SourcifyChina absorb the risk while you own the strategic advantage.

→ Contact us within 24 hours for a complimentary 2026 Regulatory Readiness Assessment.

SourcifyChina: Your AI-Powered Gateway to Zero-Risk China Sourcing

Senior Sourcing Consultant | SourcifyChina Procurement Intelligence Unit

Data-Driven. Audit-Backed. Globally Trusted Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.