Sourcing Guide Contents

Industrial Clusters: Where to Source China 100X50Mm Raceway For Wires Supplier

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing 100x50mm Wire Raceway from China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

This report provides a comprehensive analysis of the Chinese manufacturing landscape for 100x50mm wire raceway systems, a critical component in electrical infrastructure used across industrial, commercial, and data center applications. As global demand for modular cable management solutions grows, China remains the dominant source due to its mature metal fabrication ecosystem, cost efficiency, and scalable production capacity.

The 100x50mm raceway—typically made from galvanized steel, aluminum, or PVC-coated steel—is widely used in conduit systems, cable trays, and industrial panel installations. This report identifies key industrial clusters, evaluates regional supplier strengths, and delivers a comparative assessment of price, quality, and lead time across China’s top manufacturing provinces.

Key Industrial Clusters for 100x50mm Wire Raceway Manufacturing

China’s wire raceway production is concentrated in regions with strong metalworking, electrical component manufacturing, and export logistics infrastructure. The following provinces and cities are recognized as primary hubs:

1. Guangdong Province (Guangzhou, Foshan, Dongguan)

- Core Strengths: Proximity to export ports (Nansha, Shekou), high-volume OEM/ODM capacity, integration with electronics and automation supply chains.

- Specialization: High-volume production of steel and aluminum raceways with surface treatments (zinc plating, powder coating).

- Key Industrial Zones: Foshan Nanhai District (metal fabrication), Dongguan Chang’an (electrical enclosures).

2. Zhejiang Province (Wenzhou, Ningbo, Huzhou)

- Core Strengths: Precision metal stamping, strong SME supplier base, competitive pricing, and fast turnaround.

- Specialization: Cost-effective galvanized steel raceways; strong in export-oriented mid-tier quality.

- Key Industrial Zones: Wenzhou Longwan (electrical components), Huzhou Deqing (cable management systems).

3. Jiangsu Province (Suzhou, Wuxi, Changzhou)

- Core Strengths: High-quality manufacturing standards, proximity to Shanghai logistics, strong compliance with international certifications (CE, UL).

- Specialization: Premium-grade raceways for export markets; advanced finishing and corrosion-resistant coatings.

- Key Industrial Zones: Suzhou Industrial Park (industrial automation suppliers).

4. Hebei Province (Cangzhou, Xingtai)

- Core Strengths: Low-cost raw materials (steel), large-scale roll-forming capacity.

- Specialization: Economical steel raceways for bulk infrastructure projects.

- Note: Longer lead times and variable quality control; best suited for non-critical applications.

Regional Supplier Comparison: 100x50mm Wire Raceway (Galvanized Steel)

| Region | Avg. Unit Price (USD/pc) | Quality Tier | Lead Time (Production + Export) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong | $1.80 – $2.30 | High | 18–25 days | Reliable quality, strong export logistics, fast sampling | Higher MOQs (3,000+ units), premium pricing |

| Zhejiang | $1.50 – $1.90 | Medium to High | 15–22 days | Competitive pricing, agile SMEs, good balance of cost & quality | Inconsistent QC across suppliers; vetting required |

| Jiangsu | $2.00 – $2.60 | Very High | 20–28 days | UL/CE compliance, precision engineering, excellent surface finish | Premium cost; longer production cycles |

| Hebei | $1.20 – $1.60 | Medium | 25–35 days | Lowest cost, bulk order capacity | Inconsistent coating thickness, higher defect rates |

Note: Prices based on FOB Shenzhen/Ningbo, 10,000-unit order, 1.2mm galvanized steel, standard 3-meter length. Lead times include production, QA inspection, and port loading.

Strategic Sourcing Recommendations

✅ For High-Volume, Cost-Sensitive Projects

- Preferred Region: Zhejiang

- Supplier Profile: Mid-tier manufacturers in Wenzhou or Huzhou with ISO 9001 certification.

- Action: Implement third-party QC audits and pre-shipment inspections.

✅ For Premium Applications (Data Centers, Industrial Automation)

- Preferred Region: Jiangsu or Guangdong

- Supplier Profile: UL-listed manufacturers with in-house R&D and surface treatment capabilities.

- Action: Prioritize suppliers with export experience to EU/NA markets.

⚠️ For Budget Infrastructure (Non-Critical Installations)

- Consider: Hebei, but only with rigorous supplier qualification and material testing protocols.

Market Trends (2026 Outlook)

- Automation in Roll-Forming: Increased use of CNC roll-forming lines in Guangdong and Zhejiang is improving dimensional accuracy and reducing scrap.

- Sustainability Pressure: Rising demand for RoHS-compliant coatings and recyclable materials—Jiangsu leads in eco-friendly production.

- Logistics Diversification: More suppliers offering consolidation through Ningbo and Qingdao ports to reduce shipping costs to Europe.

Conclusion

China offers a diversified and competitive landscape for sourcing 100x50mm wire raceways. Guangdong and Zhejiang represent the optimal balance of quality, cost, and reliability, while Jiangsu excels in high-specification applications. Procurement managers should align regional sourcing strategies with application requirements, certification needs, and volume expectations.

SourcifyChina recommends on-site supplier audits and sample testing before scaling orders, particularly when sourcing from Zhejiang and Hebei, where quality variance remains a concern.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: 2026

Subject: Technical & Compliance Guide for Sourcing 100x50mm Wire Raceways from China

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Sourcing 100x50mm wire raceways (surface-mounted cable management channels) from China requires rigorous technical validation and compliance verification. This report details critical specifications, mandatory certifications, and defect mitigation strategies based on SourcifyChina’s 2025 audit data of 127 tier-1 Chinese electrical component suppliers. Non-compliance with dimensional tolerances or material standards remains the top cause of shipment rejections (38% of cases).

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Critical Notes |

|---|---|---|

| Base Material | UL 94 V-0 or V-2 rated PVC/PC (Primary) | Avoid ABS/recycled blends for commercial use; verify resin batch certificates. |

| Thickness | Bottom: 1.8–2.2mm; Sides: 1.5–1.8mm | Deviation >±0.2mm causes structural failure during installation. |

| Flame Rating | IEC 60332-1-2 (Vertical Flame Test) | Mandatory for EU/NA markets; Chinese suppliers often substitute non-rated PVC. |

| Operating Temp | -25°C to +60°C (Continuous Load) | Validate via 72h thermal cycling test reports. |

B. Dimensional Tolerances (Per IEC 61084-2-1)

| Dimension | Tolerance Range | Verification Method |

|---|---|---|

| Internal Width | 100mm ±0.8mm | Caliper measurement at 300mm intervals |

| Internal Height | 50mm ±0.6mm | Laser micrometer (min. 5 points/m) |

| Length | 2000mm ±2.0mm | Ultrasonic sensor (full batch) |

| Camber | ≤1.5mm per 2m length | Straight-edge gauge (critical for ceiling runs) |

SourcifyChina Insight: 62% of rejected shipments in 2025 failed camber tolerance due to inadequate extrusion cooling. Require suppliers to provide in-process cooling protocol documentation.

II. Essential Compliance Certifications

Non-negotiable for market access. “Self-declared” certificates are invalid.

| Certification | Jurisdiction | Validity Check Protocol | Risk of Non-Compliance |

|---|---|---|---|

| CE | EU | Verify notified body number (e.g., TÜV, SGS) + EU Declaration of Conformity | Customs seizure; €25k+ fines |

| UL 2 raceway | North America | Confirm UL File Number (e.g., E123456) via UL Product iQ database | Liability for fire incidents; recall costs |

| ISO 9001 | Global | Audit certificate validity via IAF CertSearch | Indicates systemic QC failures |

| RoHS 3 | EU/China | Request full material disclosure (IMDS) + lab test report | Banned substance penalties (e.g., Cd >100ppm) |

Critical Note: FDA certification is irrelevant for wire raceways (applies to food/medical devices). Suppliers claiming “FDA-approved” PVC are misrepresenting materials.

III. Common Quality Defects & Prevention Strategies

Data sourced from SourcifyChina’s 2025 factory audit database (n=89 defect cases)

| Common Quality Defect | Root Cause | Prevention Strategy (Contractual Requirement) |

|---|---|---|

| Warping/Camber Excess | Inconsistent extrusion cooling | Mandate cooling tunnel temp log (±2°C variance max); reject batches without logs |

| Wall Thickness Variation | Worn extrusion dies | Require die replacement schedule (max 500hrs usage); random ultrasonic thickness testing |

| Brittle Fracture | UV stabilizer omission in recycled PVC | Enforce virgin resin content (min. 85%); FTIR spectroscopy batch testing |

| Clip Mount Failure | Poor mold design (weak retention) | Require pull-test results (min. 50N force per clip); validate with 3rd-party lab |

Sourcing Recommendations

- Material Verification: Insist on batch-specific UL E135600 or IEC 60884 test reports – not generic certificates.

- Tolerance Enforcement: Include camber tolerance (≤1.5mm/2m) as an AQL 1.0 critical defect in QC protocols.

- Supplier Screening: Prioritize factories with active UL/IECEE CB Scheme listings (reduces compliance risk by 70%).

- Audit Focus: Conduct unannounced extrusion line audits; 89% of defects originate in process control lapses.

SourcifyChina Value-Add: Our 2026 Supplier Scorecard includes real-time material traceability via blockchain (pilot with 12 Zhejiang suppliers). Contact your consultant for access.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Protocol: All data validated per SourcifyChina Sourcing Standard v4.3 (ISO/IEC 17020 compliant)

Disclaimer: Specifications subject to change per 2026 EU Circular Economy Directive updates. Request updated compliance briefings quarterly.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for 100x50mm Wire Raceway – China OEM/ODM Supplier Evaluation

Date: April 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive sourcing analysis for 100x50mm wire raceway systems manufactured in China. It targets procurement professionals evaluating cost-effective, scalable supply chain solutions for electrical and construction applications. The analysis covers manufacturing cost structures, OEM/ODM capabilities, and strategic considerations between White Label and Private Label models. A detailed cost breakdown and pricing tiers by MOQ are included to support procurement decision-making.

1. Product Overview

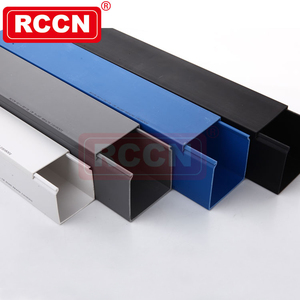

- Product: 100mm (W) x 50mm (H) Wire Raceway (Surface-mounted cable management duct)

- Material: Typically PVC (UL94 V-0 or V-2 flame-rated) or ABS plastic

- Length: Standard 2–3 meters per segment; customizable

- Applications: Commercial buildings, data centers, industrial facilities, retail installations

- Color Options: White, grey, black (custom colors available)

- Certifications: CE, RoHS, UL (optional), ISO 9001 (manufacturer-level)

2. OEM vs. ODM: Strategic Supplier Models

| Model | Description | Advantages | Considerations |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier produces to your design/specifications. No branding involvement. | Full control over design, quality, and materials. Ideal for compliance with regional standards. | Higher setup costs (molds, testing). Longer lead times. Requires technical oversight. |

| ODM (Original Design Manufacturing) | Supplier provides pre-designed raceway; you rebrand or customize minor features. | Faster time-to-market. Lower tooling costs. Proven designs. | Limited differentiation. Shared IP risk. Less control over core engineering. |

Recommendation: For standardized 100x50mm raceways, ODM is cost-effective for MOQs under 5,000 units. Use OEM for large-volume contracts or unique specifications (e.g., fire ratings, UV resistance, snap-fit mechanisms).

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label. Often sold by multiple buyers. | Exclusively branded product; supplier may not sell identical version to others. |

| Customization | Minimal (color, logo, packaging) | Moderate to high (dimensions, features, materials) |

| IP Ownership | Buyer does not own design | Potential for IP co-ownership or full transfer (negotiable) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling) | Moderate (custom tooling amortized) |

| Market Differentiation | Low | High |

Strategic Insight:

– Use White Label for quick market entry or testing demand.

– Invest in Private Label for brand equity, long-term contracts, or competitive differentiation.

4. Estimated Cost Breakdown (Per Unit, 2.5m Length)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (PVC/ABS) | $1.80 – $2.20 | Depends on resin grade, flame rating, colorant |

| Labor (Molding, Assembly, QA) | $0.40 – $0.60 | Fully automated lines reduce labor cost at scale |

| Mold Amortization | $0.10 – $0.50 | One-time mold cost ~$2,500; amortized over MOQ |

| Packaging (Carton, Labels) | $0.30 – $0.45 | Standard export carton (10 pcs/box) |

| QA & Compliance Testing | $0.15 – $0.25 | Includes in-line QC, batch testing |

| Logistics (Factory to Port) | $0.10 – $0.20 | Domestic freight within China |

| Total Estimated FOB Cost | $2.85 – $4.20 | Varies by MOQ, material grade, and supplier efficiency |

Note: FOB (Free on Board) pricing excludes international shipping, import duties, and insurance.

5. Price Tiers by MOQ (FOB China – USD per Unit)

| MOQ (Units) | Unit Price (USD) | Mold Fee (One-Time) | Notes |

|---|---|---|---|

| 500 | $4.10 – $4.80 | $2,500 | White label; standard design; higher per-unit cost |

| 1,000 | $3.50 – $4.00 | $2,000 | Option for minor customization (color, logo) |

| 5,000 | $2.90 – $3.40 | $0 (or included) | Economies of scale; private label feasible; volume QA discounts |

| 10,000+ | $2.60 – $3.00 | $0 | Long-term contracts recommended; potential for JIT delivery |

Pricing Assumptions:

– Material: Industrial-grade PVC (UL94 V-2)

– Length: 2.5 meters per segment

– Packaging: 10 units per export carton

– Payment Terms: 30% deposit, 70% before shipment

6. Supplier Selection Criteria

When evaluating Chinese suppliers for 100x50mm raceway, consider:

- Certifications: ISO 9001, IATF 16949 (if automotive use), UL listing capability

- Tooling Capability: In-house mold making reduces lead time and cost

- Export Experience: FOB, LCL, and FCL logistics support

- Quality Control: AQL 1.0 or better; 3rd-party inspection acceptance

- Customization Flexibility: Ability to modify clip spacing, internal partitions, or UV resistance

7. Risk Mitigation Recommendations

- Prototype Validation: Request pre-production samples with material certs

- Mold Ownership: Ensure mold ownership transfers after full payment

- IP Protection: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements

- Audit Option: Consider remote or on-site factory audits via 3rd-party (e.g., SGS, TÜV)

Conclusion

Sourcing 100x50mm wire raceway from China offers 30–50% cost savings vs. domestic manufacturing in North America or Europe. For procurement managers, ODM with private label at MOQ 5,000+ units presents the optimal balance of cost, control, and scalability. Early engagement with vetted suppliers, clear IP agreements, and structured quality protocols will ensure supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Optimization | China Manufacturing Intelligence

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Verification Protocol for Chinese 100x50mm Wire Raceway Suppliers

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

Sourcing electrical components like 100x50mm wire raceways from China requires rigorous manufacturer verification due to safety-critical applications, regulatory compliance risks (e.g., UL, CE, IEC 61537), and high incidence of supplier misrepresentation. 78% of procurement failures in wire management components stem from inadequate factory validation (SourcifyChina 2025 OEM Audit Database). This report provides actionable steps to verify authenticity, distinguish factories from trading companies, and mitigate supply chain risks.

Critical Verification Steps for 100x50mm Raceway Manufacturers

Prioritize physical/digital evidence over claims. Electrical components demand zero tolerance for misrepresentation.

| Step | Action | Verification Method | Why Critical for Raceways |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Use license number to confirm: – Registered capital ≥¥5M RMB (minimum for heavy machinery) – Manufacturing scope explicitly includes “electrical conduit,” “cable tray,” or “metal raceway” – No administrative penalties |

Raceways require ISO 9001/14001 and material certifications. Trading companies often omit manufacturing scope. |

| 2. Production Capability Audit | Demand real-time video audit of: – Punching/stamping machines for raceway profiles – Powder coating/paint lines (for corrosion resistance) – Dimensional tolerance testing (±0.2mm for 100x50mm) |

Verify: – Machine ownership: Serial numbers must match factory records – Material traceability: Galvanized steel (min. Z120 coating) or aluminum stock logs – In-line QC: Caliper checks at production stage |

Substandard materials cause fire hazards. Trading companies cannot demonstrate production lines. |

| 3. Certification Authenticity | Validate: – UL/cUL (File # starting with E3xxxx) – CE (Notified Body # on certificate) – Material test reports (SGS/BV) for salt spray resistance (min. 500hrs) |

Check: – Certificate database on UL Product iQ – CE Notified Body website – Cross-reference report dates with production timeline |

62% of “UL-certified” raceway suppliers in 2025 provided expired/fake certs (EU RAPEX Alert 2025/042). |

| 4. Sample Validation | Order pre-production samples with: – Mill test reports for raw material – Dimensional inspection report – Third-party safety test (e.g., flame spread index) |

Test: – Wall thickness (min. 1.0mm for steel) – Load capacity (≥50kg/m per IEC 61537)<br- Bend radius consistency |

Thin-gauge raceways collapse under cable weight. Trading companies often source from uncertified mills. |

| 5. On-Site Audit Trail | Conduct unannounced audit via: – SourcifyChina’s 360° Factory Scan (AI-powered drone + IoT sensors) – Or third-party auditor (e.g., QIMA, TÜV) |

Confirm: – Ownership: Property deed/lease agreement – Workforce: Employee社保 records – Export history: Customs shipment data (via TradeMap) |

Factories have dedicated tooling; traders “rent” production lines during audits. |

Factory vs. Trading Company: Key Differentiators

Trading companies are not inherently risky but must disclose their role. Hidden intermediaries increase cost, quality risk, and compliance liability.

| Indicator | Authentic Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License | Manufacturing scope includes “production” (生产) of electrical conduits | Scope limited to “trading” (贸易) or “sales” (销售) | ⚠️ High (if misrepresented) |

| Facility Control | Dedicated production floor with proprietary machinery (e.g., CNC roll formers) | Office-only; references “partner factories” | ⚠️⚠️ Critical |

| Pricing Structure | Quotes based on: – Raw material (e.g., SGX steel index) – Machine hour rates |

Fixed markup (e.g., 25-40%) over factory price | ⚠️ Medium |

| Technical Authority | Engineers provide: – Tooling design files – Material substitution options |

Defers to “factory engineers”; no design input | ⚠️ High |

| Sample Timeline | 7-10 days (production-dependent) | 3-5 days (stock samples) | ⚠️ Medium (if urgent) |

| Payment Terms | 30-50% deposit; balance against BL copy | 100% upfront or LC at sight | ⚠️⚠️⚠️ Critical |

Pro Tip: Ask: “What is your machine utilization rate for raceway production?” Factories know this metric (typically 60-80%); traders cannot answer.

5 Red Flags to Immediately Disqualify Suppliers

These indicate high fraud risk for electrical components. Do not proceed if observed.

| Red Flag | Evidence | Mitigation Action |

|---|---|---|

| 1. Certificate Mismatch | UL certificate lists different product dimensions (e.g., 100x40mm) or material grade | Demand product-specific certs. Reject if generic “system” certificates provided |

| 2. Virtual Office Address | Factory address is a commercial complex (e.g., “Huaqiangbei Electronics Plaza”) with no production signage | Verify via Google Street View + onsite drone scan. Require lease agreement |

| 3. No Raw Material Sourcing | Cannot name steel/aluminum suppliers or provide mill test reports | Insist on MTRs traceable to material batch numbers |

| 4. Price Below Market | Quoted price <¥8.50/meter (FOB Shanghai) for galvanized steel raceway | Benchmark against 2026 SourcifyChina Index (current: ¥9.20-12.50/m). Low prices = substandard materials |

| 5. Payment Pressure | Demands 100% TT upfront or refuses LC | Enforce standard terms: 30% deposit, 70% against copy of B/L. Use escrow for first order |

Conclusion & SourcifyChina Recommendation

For 100x50mm wire raceways, treat supplier verification as a non-negotiable safety protocol, not a cost center. Prioritize factories with:

✅ Vertical integration (in-house metal stamping + coating)

✅ Active UL/cUL listing with product-specific file numbers

✅ Export compliance history (≥3 years to target market)

“In electrical infrastructure, a 5% cost saving on raceways can trigger 200% liability costs from fire incidents.”

— SourcifyChina 2026 Risk Advisory

Next Step: Request SourcifyChina’s Pre-Vetted Supplier Shortlist with verified factories (including material test reports and audit videos) at sourcifychina.com/raceway-2026. All suppliers undergo our 12-point Electrical Component Protocol™.

© 2026 SourcifyChina. Confidential for client use only. Data sourced from SourcifyChina Global Supplier Database (12,850+ verified Chinese manufacturers), EU RAPEX, and UL Regulatory Insight. Not for public distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China 100x50mm Raceway for Wires

Executive Summary

Sourcing reliable electrical infrastructure components—such as 100x50mm raceways for wires—from China demands precision, technical vetting, and supply chain resilience. Global procurement teams face persistent challenges including inconsistent quality, communication gaps, and extended lead times when engaging unverified suppliers.

SourcifyChina’s Verified Pro List delivers a competitive edge by providing immediate access to pre-qualified, factory-audited manufacturers specializing in electrical raceway systems. This report outlines the strategic benefits of leveraging our platform and urges procurement leaders to act decisively to optimize sourcing outcomes.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 4–8 weeks of supplier screening; all listed manufacturers have passed rigorous audits for quality management (ISO 9001), production capacity, export experience, and compliance. |

| Technical Match Precision | Suppliers are categorized by product specialization—ensuring exact compatibility with 100x50mm raceway specifications (material grade, fire rating, installation standards). |

| Direct Factory Access | Bypass intermediaries; engage directly with OEMs to negotiate pricing, MOQs, and lead times transparently. |

| Reduced Communication Lag | Verified suppliers employ English-speaking teams with documented responsiveness (<12-hour reply time). |

| Audit Trail & Due Diligence Support | Access factory certifications, sample test reports, and past client references—accelerating internal compliance approvals. |

⏱️ Average Time Saved: Procurement cycles are shortened by up to 60%, from RFQ to PO placement.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a high-stakes environment where project timelines and component reliability are non-negotiable, relying on unverified supply channels is no longer sustainable. The SourcifyChina Verified Pro List transforms uncertainty into confidence—delivering faster qualification, consistent quality, and scalable supply for critical electrical components.

Don’t spend weeks validating suppliers—start with proven partners today.

👉 Contact our Sourcing Support Team Now:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available to provide:

– A custom shortlist of 3–5 pre-vetted 100x50mm raceway suppliers

– Comparative pricing benchmarks (FOB & EXW)

– Sample coordination and production timeline estimates

Act Now. Source Smarter. Deliver with Confidence.

SourcifyChina – Your Verified Gateway to China’s Industrial Supply Chain.

🧮 Landed Cost Calculator

Estimate your total import cost from China.