The global chiller market is experiencing robust growth, driven by rising demand for efficient cooling solutions across commercial, industrial, and HVAC sectors. According to Mordor Intelligence, the chiller market was valued at USD 37.8 billion in 2023 and is projected to reach USD 55.6 billion by 2029, growing at a CAGR of 6.5% during the forecast period. A critical component within these systems, chiller pumps play a pivotal role in maintaining optimal thermal performance and energy efficiency. With increasing emphasis on sustainable infrastructure and smart building technologies, the demand for high-performance, reliable pumping solutions has surged. This growing need has positioned several manufacturers as key innovators in the space. Based on market presence, technological advancement, energy efficiency ratings, and global distribution, the following list highlights the top 10 chiller pump manufacturers shaping the industry’s future.

Top 10 Chiller Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Thermal Care: Industrial Water Chiller Manufacturer

Domain Est. 1996

Website: thermalcare.com

Key Highlights: Thermal Care is a leading manufacturer of industrial water chillers & process cooling equipment and systems for applications worldwide. ISO 9001 certified….

#2 BROAD U.S.A. INC.

Domain Est. 1999

Website: broadusa.com

Key Highlights: World-Leaders of Modern Absorption Chillers. A cost-effective cooling and heating solution that can better utilize existing thermal energy sources….

#3 GEA ammonia chiller portfolio

Domain Est. 1995

Website: gea.com

Key Highlights: GEA offers an extensive product portfolio of ammonia chillers for virtually any application for industrial refrigeration and air conditioning….

#4 Water-Cooled Chillers

Domain Est. 1995

Website: york.com

Key Highlights: YORK® has the widest variety of water cooled chillers on the market that stand up to the demands of industrial and commercial applications….

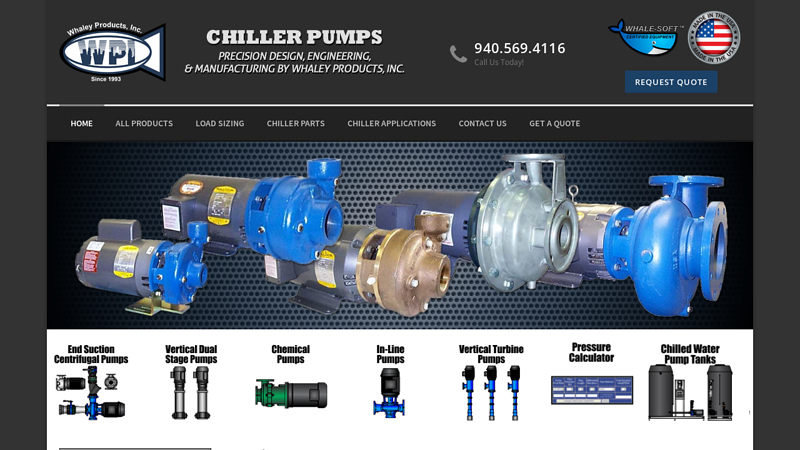

#5 Chiller Pumps

Domain Est. 2009 | Founded: 1993

Website: chillerpumps.com

Key Highlights: WPI has been a water chiller manufacturer and chiller part supplier since 1993. We stock packaged chillers, modular chillers, chiller pumps, cooling tower pumps ……

#6 Air To Water Heat Pump Manufacturer

Domain Est. 2014

Website: chiltrix.com

Key Highlights: Ultra-efficient small air-to-water heat pumps / chillers. Air conditioning & heating & hot water. Indoor: heating, cooling & hot water solutions….

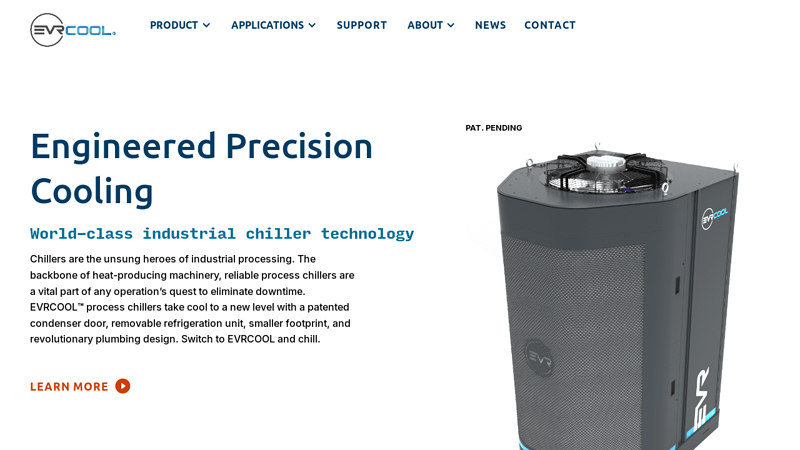

#7

Domain Est. 2023

Website: evrcool.com

Key Highlights: EVRCOOL process chillers take cool to a new level with a patented condenser door, removable refrigeration unit, smaller footprint, and revolutionary plumbing ……

#8 Chillers: Air-Cooled, Water-Cooled

Domain Est. 1995

Website: carrier.com

Key Highlights: Discover Carrier Commercial’s chillers and components for efficient, reliable cooling. Optimize your HVAC system with our innovative solutions today….

#9 Chiller pumps for water chiller systems

Domain Est. 1995

Website: grundfos.com

Key Highlights: Grundfos supplies circulator pumps and water transfer chiller pumps for HVAC chillers and other water chiller systems….

#10 Water Cooled Chillers

Domain Est. 1996

Website: daikin.com

Key Highlights: Forged under harsh conditions around the world, Daikin water cooled chillers provide high quality, operation efficiency, and energy savings….

Expert Sourcing Insights for Chiller Pump

H2: 2026 Market Trends for Chiller Pumps

The chiller pump market is poised for significant transformation by 2026, driven by technological advancements, evolving regulatory standards, and increasing demand for energy-efficient HVAC systems across commercial, industrial, and institutional sectors. Key trends shaping the 2026 landscape include the growing adoption of intelligent pumping systems, rising integration with building automation, an expanding focus on sustainability, and regional shifts in infrastructure development.

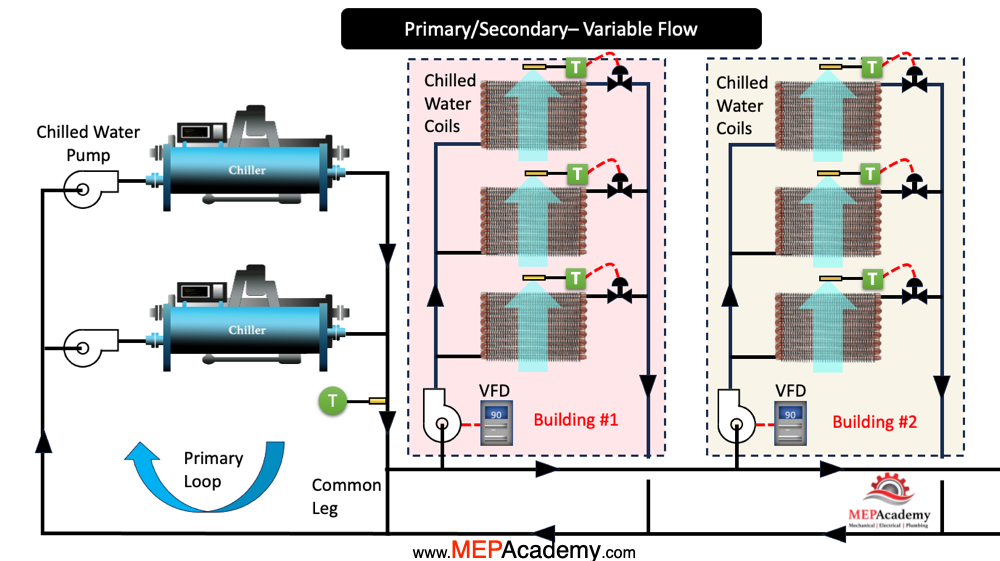

One of the most prominent trends is the shift toward smart and variable-speed chiller pumps. As energy efficiency becomes a top priority, end-users are increasingly investing in pumps equipped with variable frequency drives (VFDs) and IoT-enabled monitoring systems. These technologies allow for real-time performance optimization, predictive maintenance, and reduced energy consumption—contributing to lower operational costs and improved system reliability. By 2026, market analysts anticipate that over 60% of newly installed chiller pumps in commercial buildings will feature smart controls.

Another major driver is the tightening of global energy regulations, such as the EU’s Ecodesign Directive and the U.S. Department of Energy (DOE) efficiency standards. These regulations are compelling manufacturers to innovate and produce high-efficiency chiller pumps that meet or exceed minimum efficiency performance standards (MEPS). As a result, the market is witnessing a surge in premium-efficiency pump models, often incorporating advanced materials and hydraulic designs to minimize friction and energy losses.

Sustainability and decarbonization goals are also influencing procurement decisions. With the building sector accounting for nearly 40% of global energy-related CO₂ emissions, stakeholders are prioritizing low-carbon HVAC solutions. This has led to increased demand for chiller pumps compatible with green refrigerants and renewable energy sources, such as solar-powered cooling systems. Additionally, the trend toward net-zero buildings is accelerating the integration of chiller pumps into holistic energy management platforms.

Regionally, Asia-Pacific is expected to dominate growth in the chiller pump market by 2026, fueled by rapid urbanization, industrial expansion, and government-backed green building initiatives in countries like China, India, and South Korea. Meanwhile, North America and Europe are focusing on retrofitting aging infrastructure with energy-efficient pumping systems, driven by both regulatory mandates and cost-saving incentives.

In summary, the 2026 chiller pump market will be characterized by a strong emphasis on digitalization, energy efficiency, and sustainability. Manufacturers that invest in smart technologies, comply with evolving standards, and align with global decarbonization goals are likely to gain a competitive edge in this dynamic and expanding market.

Common Pitfalls When Sourcing Chiller Pumps (Quality, IP)

Sourcing chiller pumps involves critical decisions that directly impact system efficiency, reliability, and lifecycle costs. Overlooking key factors—especially regarding quality and Ingress Protection (IP) ratings—can lead to costly failures and downtime. Below are common pitfalls to avoid:

Inadequate Quality Assessment

Many buyers focus solely on initial cost, neglecting long-term performance and durability. Low-quality pumps often use substandard materials (e.g., cast iron instead of stainless steel), inferior seals, and poorly balanced impellers, leading to premature wear, leakage, and reduced efficiency. Always verify manufacturer certifications (e.g., ISO 9001), request material test reports, and review third-party performance testing data.

Misunderstanding or Ignoring IP Ratings

The Ingress Protection (IP) rating defines a pump’s resistance to dust and moisture—critical in HVAC applications where pumps may be exposed to humidity, condensation, or outdoor environments. A common mistake is selecting a pump with an insufficient IP rating (e.g., IP54 instead of IP55 or IP65), which can result in motor failure due to water ingress. Always match the IP rating to the installation environment—higher ratings (e.g., IP66) are essential for outdoor or washdown areas.

Overlooking Motor Efficiency and Insulation Class

Energy consumption is a major lifecycle cost. Sourcing pumps with standard-efficiency motors (IE1 or IE2) instead of premium-efficiency models (IE3 or IE4) leads to higher operating costs. Additionally, ignoring insulation class (e.g., Class F or H) can result in motor overheating in high ambient temperatures, reducing lifespan. Ensure the motor meets efficiency standards and is suitable for the operating environment.

Failure to Verify NPSH and System Compatibility

Purchasing a pump without verifying Net Positive Suction Head (NPSH) requirements can lead to cavitation, noise, vibration, and damage. Mismatched flow/pressure ratings or incorrect pump curves also result in poor system performance. Always cross-check pump performance curves with actual system requirements and ensure proper NPSH margin.

Choosing Non-Standard or Proprietary Designs

Some suppliers offer pumps with proprietary components or non-standard dimensions, making future maintenance and spare parts procurement difficult and expensive. Opt for pumps that follow international standards (e.g., ISO, ANSI, or DIN) to ensure interchangeability and long-term serviceability.

Ignoring Vibration and Noise Levels

High vibration and noise often indicate poor build quality or imbalance. These issues not only affect comfort in occupied spaces but can also lead to mechanical failure over time. Request vibration test reports and ensure the pump is designed for low noise, especially in commercial or residential applications.

Overlooking Warranty and After-Sales Support

A long warranty period and responsive technical support are indicators of manufacturer confidence in product quality. Sourcing from suppliers with limited or vague warranty terms increases risk. Confirm warranty coverage, spare parts availability, and local service support before finalizing procurement.

Relying Solely on Supplier Claims Without Due Diligence

Marketing materials may overstate performance or durability. Always conduct independent verification through site visits, reference checks, or third-party audits. Request case studies or installation references in similar applications to validate real-world performance.

Avoiding these pitfalls ensures the selection of a reliable, efficient, and durable chiller pump that supports optimal system operation and reduces total cost of ownership.

Logistics & Compliance Guide for Chiller Pump

Product Overview

A chiller pump is a critical component in HVAC and industrial cooling systems, responsible for circulating chilled water or coolant from the chiller to various heat exchangers or equipment. Proper logistics handling and regulatory compliance are essential to ensure safe transport, installation, and operation.

Packaging and Handling Requirements

- Standard Packaging: Chiller pumps must be shipped in protective wooden crates or heavy-duty cardboard with internal foam or cushioning to prevent vibration and impact damage.

- Lifting Points: Use designated lifting lugs or pads only; never lift by pipes, valves, or motor housing.

- Orientation: Maintain upright position during transport and storage to prevent oil leakage and internal component misalignment.

- Environmental Protection: Store in a dry, indoor location with controlled temperature (ideally 5°C to 40°C) and low humidity to avoid corrosion.

Transportation Guidelines

- Mode of Transport: Suitable for road, rail, sea, and air freight. For air freight, confirm weight and dimensional restrictions with the carrier.

- Securing Load: Pumps must be securely fastened to pallets or in containers using straps or braces to prevent shifting.

- Documentation: Include packing list, bill of lading, commercial invoice, and any required export declarations.

- Hazardous Materials: Most chiller pumps are non-hazardous. However, if lubricants or antifreeze are pre-filled, declare accordingly under IATA/IMDG regulations.

Import/Export Compliance

- HS Code: Typically falls under 8413.70 (Centrifugal pumps for liquids) – verify with local customs authority.

- Export Controls: Check for ITAR or EAR restrictions if components are of U.S. origin or contain controlled technology.

- Certificates Required:

- Certificate of Origin

- CE Marking (for EU market)

- RoHS Compliance (for electronic components)

- Energy Efficiency Certification (e.g., MEPS in Australia, ERP Directive in EU)

- Customs Clearance: Provide technical specifications, test reports, and conformity certificates as needed.

Regional Regulatory Standards

- North America:

- Complies with ASME B31.9 for pressure piping.

- Meets NEMA MG-1 for motor standards.

- Must adhere to DOE energy efficiency regulations.

- European Union:

- CE Marked per Machinery Directive 2006/42/EC and EMC Directive 2014/30/EU.

- Compliant with Ecodesign Regulation (EU) 2019/1781 for circulator pumps.

- Asia-Pacific:

- Meets CCC (China Compulsory Certification) if applicable.

- Complies with JIS B 8308 (Japan) or AS/NZS 2417 (Australia/NZ).

Installation and Site Compliance

- Permits: Confirm local building and mechanical codes; permits may be required for installation.

- Electrical Compliance: Wiring must conform to NFPA 70 (NEC), IEC 60364, or local electrical standards.

- Safety Clearances: Maintain manufacturer-recommended space around the unit for maintenance and ventilation.

- Vibration & Noise: Install anti-vibration mounts and ensure noise levels comply with local ordinances (e.g., OSHA or EU Workplace Directive).

Environmental and Sustainability Considerations

- Refrigerant Handling: If integrated with chiller systems using refrigerants, ensure compliance with F-Gas Regulation (EU) or EPA Section 608 (USA).

- End-of-Life Disposal: Follow WEEE Directive for electronic components and local recycling protocols for metals and oils.

- Energy Efficiency: Select pumps with high IE3 or IE4 motor efficiency ratings to meet global sustainability targets.

Documentation and Record Keeping

- Retain copies of:

- Test and inspection reports (e.g., hydrostatic test, performance curve)

- Compliance certificates (CE, UL, CSA, etc.)

- Warranty and service manuals

- Customs and shipping records for at least 5 years

Adhering to this guide ensures smooth logistics operations and full regulatory compliance for chiller pump distribution and deployment worldwide. Always consult local authorities and the manufacturer for product-specific requirements.

Conclusion for Sourcing Chiller Pumps

In conclusion, sourcing chiller pumps requires a comprehensive evaluation of technical specifications, energy efficiency, reliability, and lifecycle costs to ensure optimal performance within a cooling system. Key factors such as flow rate, head pressure, material compatibility, and pump configuration must align with the specific requirements of the HVAC or industrial process application. Prioritizing energy-efficient models, such as variable speed pumps, not only reduces operational costs but also supports sustainability goals.

Supplier credibility, after-sales support, warranty terms, and availability of spare parts are equally critical to minimizing downtime and maintenance costs. Conducting a thorough market analysis, obtaining competitive quotations, and assessing total cost of ownership (TCO) will lead to a more informed and cost-effective procurement decision.

Ultimately, the successful sourcing of chiller pumps hinges on balancing performance, efficiency, and long-term reliability to ensure seamless integration into the chiller system and uninterrupted operation over its service life.