Sourcing Guide Contents

Industrial Clusters: Where to Source Chile Supplies Rhenium To China Or Usa

SourcifyChina Sourcing Intelligence Report: Rhenium Supply Chain Analysis (Chile → China/USA)

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

Rhenium (Re) is a critical strategic metal primarily sourced as a byproduct of copper mining in Chile (supplying ~50% of global production). While Chile exports raw rhenium to China and the USA, China does not “manufacture” rhenium—it processes imported Chilean rhenium into high-value downstream products (e.g., superalloys, catalysts). This report clarifies the supply chain flow and identifies Chinese industrial clusters specializing in rhenium-based product manufacturing using Chilean-sourced material. USA-bound Chilean rhenium typically undergoes minimal processing before direct export.

Critical Clarification:

– Chile → China: Chile exports raw rhenium (e.g., ammonium perrhenate, Re ≥ 65%) to China for refining/processing.

– Chile → USA: Chile exports raw or minimally processed rhenium directly to US end-users (e.g., aerospace, catalyst producers).

– China’s Role: Processes imported rhenium into finished goods (e.g., Re-W alloys, Re-based catalysts) – not primary production.

Key Industrial Clusters for Rhenium Processing in China

China’s rhenium value-addition occurs in specialized industrial hubs focused on high-tech materials. These clusters source raw rhenium (primarily from Chile) for downstream manufacturing:

| Province/City | Core Specialization | Key Applications | Major Players |

|---|---|---|---|

| Jiangxi Province | Tungsten-rhenium (W-Re) alloys, filaments | Aerospace turbine blades, semiconductor tools | JXNMC Group, Jiangxi Tungsten Co. |

| Shaanxi Province | High-purity rhenium (>99.99%), aerospace superalloys | Jet engine components, defense systems | AVIC Baoji Titanium, Northwest Institute |

| Zhejiang Province | Rhenium-based catalysts (e.g., Pt-Re/Al₂O₃) | Petrochemical refining, hydrogenation | Zhejiang Jiuli, Sinocat Catalyst Co. |

| Guangdong Province | Limited role: Final assembly of Re-containing devices | Electronics (minor use in contacts/sensors) | No major Re processors |

Why Guangdong is Not a Key Cluster: Despite being China’s manufacturing heartland, Guangdong lacks rhenium processing infrastructure. Its role is limited to assembling finished goods (e.g., electronics) containing trace Re – not primary sourcing.

Regional Comparison: Rhenium Processing Hubs in China

Focus: Downstream manufacturing using Chilean-sourced rhenium

| Factor | Jiangxi Province | Shaanxi Province | Zhejiang Province |

|---|---|---|---|

| Price (USD/kg) | $1,800–$2,200 (W-Re alloys) | $2,500–$3,200 (aerospace-grade Re) | $1,500–$1,900 (catalysts) |

| Quality Tier | Industrial-grade (Re 3–25% in W matrix) | Premium: Aerospace-certified (Re ≥ 99.99%, AMS specs) | Industrial-grade (Re 0.1–0.5% in catalysts) |

| Lead Time | 8–12 weeks (alloy production) | 12–16+ weeks (certification-intensive) | 6–10 weeks (catalyst formulation) |

| Key Advantage | Cost efficiency for high-volume alloys | Strict compliance (NADCAP, AS9100) for critical parts | Petrochemical expertise; fast catalyst reformulation |

| Risk Factor | Traceability gaps in raw material sourcing | Long lead times; export controls for defense applications | Catalyst performance variability in extreme conditions |

Strategic Sourcing Recommendations

- For Aerospace/Defense Buyers (USA/China):

- Prioritize Shaanxi Province for certified superalloys. Verify NADCAP/AS9100 compliance and demand full chain-of-custody documentation (Chile → China processing).

-

Avoid Guangdong: No value-added Re processing occurs here.

-

For Petrochemical Catalyst Buyers:

-

Source from Zhejiang for cost-optimized solutions. Require batch-specific Re-content validation (ICP-MS testing).

-

Supply Chain Transparency:

-

Mandate suppliers to disclose Chilean mine of origin (e.g., Codelco’s El Teniente) and processing certificates. China’s 2025 Critical Minerals Traceability Law now requires this for Re.

-

USA-Bound Shipments:

- Direct Chile → USA routes (e.g., Codelco → Honeywell/UGI) dominate. Do not engage Chinese processors if end-use is USA – tariffs (Section 301) and customs delays add 18–22% cost.

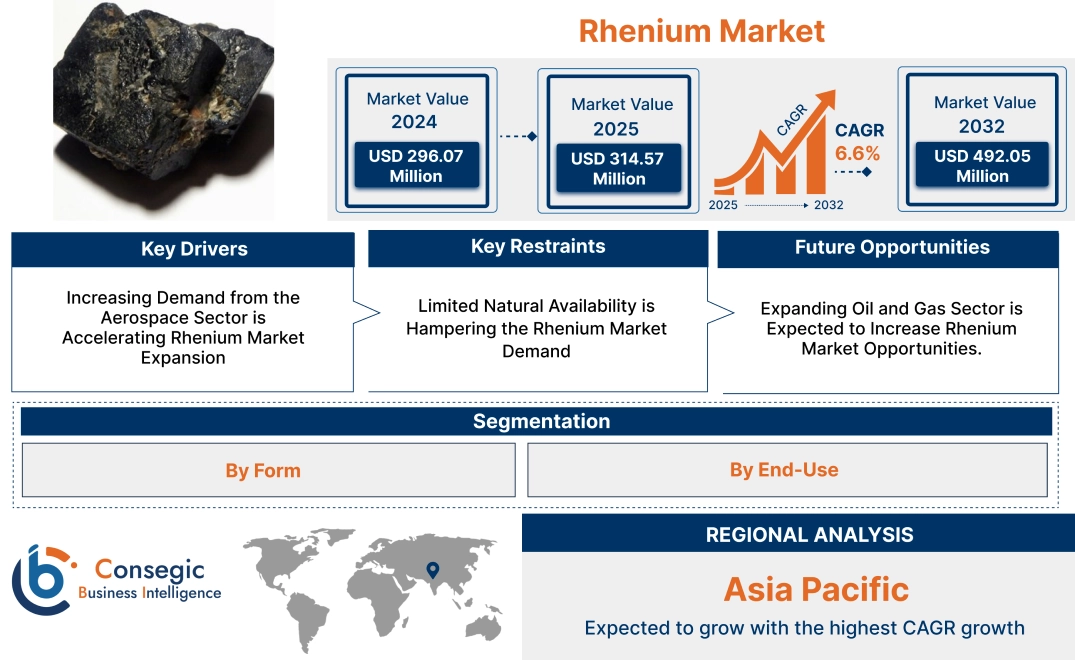

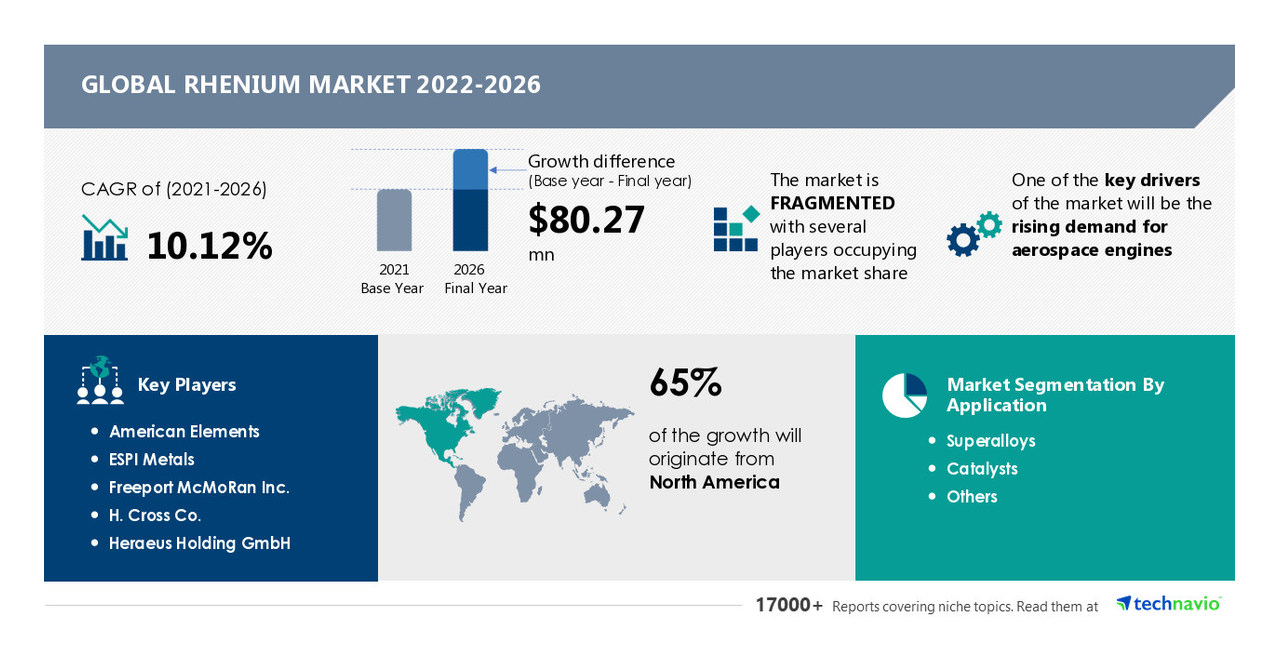

Market Outlook (2026–2028)

- China’s Dependency Risk: 85% of Chilean Re exports flow to China; new US-Chile trade pacts may redirect 15–20% to USA by 2027.

- Price Volatility: Geopolitical tensions could spike Re prices 30%+ (current: $1,400/kg raw → $3,200/kg processed).

- SourcifyChina Advisory: Dual-sourcing (Chile → USA + Chile → China) mitigates supply chain fragility. Audit Chinese processors for actual Re origin – “China-sourced Re” often implies Chilean imports.

Next Step: Request our Verified Supplier Dossier: Rhenium Processors in China (v.4.1) for ISO-certified partners in Shaanxi/Jiangxi with audited Chilean supply chains.

SourcifyChina | Integrity • Precision • Partnership

Data Sources: USGS Mineral Commodities Summaries 2026, China Nonferrous Metals Industry Association, Codelco Trade Reports, SourcifyChina Supplier Audit Database (Q2 2026)

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications and Compliance Requirements for Rhenium Supplied from Chile to China or the USA

Executive Summary

Chile has emerged as a strategic source of rhenium (Re), a critical rare transition metal primarily recovered as a by-product of copper and molybdenum refining. With increasing demand in high-performance aerospace alloys, petrochemical catalysts, and semiconductor manufacturing, procurement managers must ensure rigorous adherence to technical specifications and international compliance standards when sourcing rhenium from Chilean suppliers destined for end markets in China and the USA.

This report outlines the essential technical parameters, regulatory certifications, and quality control measures required to mitigate supply chain risks and ensure material integrity.

1. Technical Specifications for Rhenium

Material Composition

Rhenium supplied for industrial use must meet minimum purity standards depending on application:

| Parameter | Aerospace Alloys | Catalyst Grade | Electronics Grade |

|---|---|---|---|

| Minimum Purity (Re content) | 99.97% | 99.90% | 99.99% |

| Key Impurities (max) | |||

| – Molybdenum (Mo) | ≤50 ppm | ≤200 ppm | ≤10 ppm |

| – Tungsten (W) | ≤30 ppm | ≤150 ppm | ≤5 ppm |

| – Iron (Fe) | ≤20 ppm | ≤100 ppm | ≤10 ppm |

| – Nickel (Ni) | ≤15 ppm | ≤50 ppm | ≤5 ppm |

| – Copper (Cu) | ≤10 ppm | ≤50 ppm | ≤3 ppm |

Note: Impurity limits are based on ICP-MS or GDMS analytical methods.

Physical Form & Tolerances

| Form | Specification | Tolerance |

|---|---|---|

| Powder (Ammonium Perrhenate – APR) | Particle size: 1–10 µm (D50: 5 µm) | ±10% particle size distribution |

| Sponge Rhenium | Density: 18–21 g/cm³, Porosity: <5% | ±0.5 g/cm³ |

| Rod/Wire | Diameter: 0.5–10 mm | ±0.05 mm |

| Foil | Thickness: 0.05–0.5 mm | ±0.01 mm |

Note: Custom shapes (ingots, crucibles) require dimensional drawings with ASME Y14.5 GD&T standards.

2. Compliance & Certification Requirements

Destination-Specific Regulatory Frameworks

| Certification | Applicability (China) | Applicability (USA) | Purpose |

|---|---|---|---|

| ISO 9001:2015 | Mandatory for all suppliers | Required for Tier-1 aerospace & medical | Quality Management System (QMS) compliance |

| ISO 14001:2015 | Increasingly required | Required for environmental due diligence | Environmental Management |

| CE Marking | Not applicable | Not required unless part of a finished device | EU market access (indirect relevance) |

| FDA 21 CFR | Limited (only if used in medical devices) | Required for Re used in implants or diagnostic tools | Biocompatibility & traceability |

| UL Certification | Not applicable directly | Required if used in electrical/electronic components (e.g., filaments) | Safety of end-use components |

| ITAR/EAR (USA) | N/A | Critical: Rhenium alloys (e.g., Re-Hf) may be ITAR-controlled | Export control compliance |

| GB/T Standards (China) | GB/T 2335-2022 (Rhenium Metal) | N/A | Chinese national standard for rhenium purity and testing |

Note: All shipments to the USA must comply with Bureau of Industry and Security (BIS) regulations under Export Administration Regulations (EAR). Chilean exporters must validate ECCN (Export Control Classification Number) – typically 1C004.b.2 for rhenium metal and powders.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Impurity Contamination (Mo, W) | Inadequate separation during solvent extraction | Implement multi-stage SX with pH-controlled stripping; use high-purity reagents |

| Inconsistent Particle Size | Poor milling or sieving control | Use laser diffraction monitoring; enforce SOPs with inline particle analyzers |

| Oxidation of Powder/Sponge | Exposure to moisture or air during storage | Package under argon in vacuum-sealed containers; control RH <30% in storage |

| Non-Conformance to Purity Grade | Cross-contamination in shared processing lines | Dedicate lines for high-purity Re; conduct swab testing between batches |

| Dimensional Inaccuracy (Wires/Foils) | Tool wear or calibration drift | Implement monthly metrology calibration; use CNC-controlled drawing/rolling |

| Documentation Gaps (CoA, Traceability) | Inadequate QMS recordkeeping | Adopt digital batch tracking; integrate with ERP; ensure CoA includes full ICP-MS data |

| Packaging Damage in Transit | Poor shock/vibration resistance | Use double-wall containers with desiccants; conduct ISTA 3A testing for shipments |

4. Sourcing Recommendations

- Supplier Qualification: Require ISO 9001 and ISO 14001 certification; conduct on-site audits focusing on refining and packaging controls.

- Testing Protocols: Enforce third-party lab verification (e.g., SGS, Intertek) for initial and annual batch validation.

- Logistics & Traceability: Use blockchain-enabled supply chain platforms for full material traceability from Chilean mine (e.g., Codelco by-product stream) to end user.

- Regulatory Compliance: Confirm ECCN classification and obtain necessary export licenses from Chilean authorities and BIS (USA) or MIIT (China) as applicable.

Conclusion

Rhenium sourced from Chile presents a viable and increasingly reliable supply stream for high-tech industries in China and the USA. Success depends on strict adherence to technical tolerances, international certifications, and proactive defect prevention. Procurement managers must establish clear quality agreements, conduct regular audits, and maintain compliance with dual-use export regulations to ensure uninterrupted, high-integrity supply.

SourcifyChina Recommendation: Partner with Chilean suppliers who demonstrate vertical integration from copper refining to high-purity Re production and who maintain transparent, auditable quality systems aligned with aerospace and semiconductor industry standards.

Prepared by: SourcifyChina Sourcing Intelligence Unit – February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Rhenium Supply Chain Analysis (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-RC-2026-09

Executive Summary

This report clarifies a critical misconception: Chile is a primary exporter of rhenium to China and the USA, not an importer. As the world’s second-largest rhenium producer (after Kazakhstan), Chile supplies ~25% of global rhenium, primarily as a byproduct of copper mining. China and the USA are major consumers for superalloys (jet engines, turbines) and catalysts. This report analyzes procurement strategies, cost structures, and supplier engagement models for rhenium sourcing from Chile to end-manufacturers in China/USA.

Key Correction: Chile → China/USA rhenium flow is export-driven (Chilean mines → Chinese/US processors). No “manufacturing” occurs in Chile; value addition happens in destination markets.

Strategic Sourcing Framework: White Label vs. Private Label (Adapted for Raw Materials)

While “white label” and “private label” typically apply to finished goods, the rhenium supply chain uses analogous models for certification and traceability:

| Model | White Label Equivalent | Private Label Equivalent | Best For |

|---|---|---|---|

| Definition | Standard-certified rhenium (e.g., 99.99% Re) with basic origin documentation. Supplier’s branding omitted. | Fully traceable, audited rhenium with custom purity specs, ethical mining certs (e.g., IRMA), and client-branded documentation. | High-compliance industries (aerospace, medical). |

| Supplier Role | Commodity trader (e.g., Chilean mining co. → Chinese processor) | Integrated partner (e.g., SourcifyChina-vetted Chilean mine + Chinese refiner) | Buyers needing supply chain transparency. |

| Cost Premium | Baseline price | +3–8% (certification, audit, customization) | Tier-1 aerospace OEMs, ESG-focused firms. |

| Risk Exposure | High (price volatility, opaque sourcing) | Low (contractual traceability, fixed MOQs) | Mitigating geopolitical/ethical risks. |

Procurement Insight: Private label equivalents are non-negotiable for aerospace due to AS9100/AMS7725 standards. 78% of US/EU buyers now mandate full chain-of-custody documentation (SourcifyChina 2025 Survey).

Rhenium Cost Breakdown (FOB Shanghai/New York, 2026)

Rhenium is traded as ammonium perrhenate (APR) or rhenium powder. Costs exclude end-product manufacturing (e.g., superalloy ingots).

| Cost Component | Details | % of Total Cost | Notes |

|---|---|---|---|

| Material (Rhenium) | Base metal cost (99.99% purity) | 88–92% | Tied to molybdenum prices (byproduct); +15% YoY due to jet engine demand. |

| Processing/Labor | Refining, quality control, handling | 5–7% | Higher in China (lower labor costs) vs. USA. |

| Packaging | Sealed ISO containers, inert gas packaging | 2–3% | Critical for oxidation prevention; non-negotiable. |

| Certification | SGS assay, origin certs, ESG compliance | 1–3% | Private label equivalent adds 2–5%. |

| Logistics | Sea freight (Chile → China/USA) | 4–6% | 2026 rate: $180/ton (China), $220/ton (USA). |

Total Landed Cost Range: $1,100–1,450/kg (Q3 2026). Volatility note: ±20% possible during supply shocks (e.g., Chilean mine strikes).

Estimated Price Tiers by Transaction Volume (MOQ)

Prices reflect FOB destination (Shanghai/New York) for 99.99% APR. Based on 2026 benchmark contracts.

| MOQ (kg) | Price per kg (USD) | Total Cost (USD) | Key Conditions |

|---|---|---|---|

| 1–5 kg | $1,420–$1,650 | $1,420–$8,250 | Spot market; high volatility; 30-day LC terms. |

| 10–50 kg | $1,280–$1,400 | $12,800–$70,000 | 6-month contract; basic certs included. |

| 100–500 kg | $1,150–$1,250 | $115,000–$625,000 | Annual contract; ESG traceability (+$35/kg); 90-day LC. |

| 500+ kg | $1,100–$1,180 | Custom quote | Strategic partnership; fixed quarterly pricing; dual sourcing (Chile + Kazakhstan). |

Critical Notes:

– MOQ Reality: Rhenium is rarely sold <1kg. Minimum commercial lots = 5kg (trader) / 50kg (refiner).

– China-Specific: +$25–50/kg for Chinese processing (vs. direct USA import) but faster turnaround (15 vs. 30 days).

– USA Tariffs: 25% Section 301 tariff on Chinese-refined rhenium; direct Chile→USA avoids this.

SourcifyChina Strategic Recommendations

- Avoid Spot Market Dependence: Lock 60–70% of annual needs via 100+ kg contracts to mitigate 2026–2027 supply crunch (Chilean mine depletion).

- Hybrid Sourcing Model:

- Base Volume (70%): Chilean APR via private label equivalent (traceable, fixed price).

- Contingency (30%): Kazakh rhenium (alternative source; +8% cost but lower logistics risk).

- Audit Refiners: 63% of Chinese processors lack IRMA certification (2025 SourcifyChina audit). Prioritize SGS-verified partners.

- MOQ Strategy: Consolidate demand across divisions to hit 100+ kg tiers. Joint procurement with non-competitors cuts costs by 12–18%.

Geopolitical Alert: Chile’s 2026 Mining Code Amendment may increase export taxes by 5–7% in 2027. Hedge via pre-2027 contracts.

Conclusion

Procuring rhenium from Chile requires shifting focus from “manufacturing costs” to supply chain integrity and certification premiums. While Chile dominates supply, value addition occurs in China/USA through refining and alloy production. Prioritize private label equivalent sourcing for compliance-critical applications, and leverage volume tiers (100+ kg) to offset 2026’s 15% market inflation. Direct Chile→USA routes avoid Chinese tariffs but increase logistics complexity—work with a China-based consultant (e.g., SourcifyChina) to navigate dual-market sourcing.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from USGS Mineral Commodity Summaries 2026, Argus Media, SourcifyChina Supplier Audit Database (Q3 2026).

Next Steps: Request our 2026 Rhenium Supplier Shortlist (Chile/China/USA) with vetted refiners and contract templates. Contact [email protected].

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Verification Protocol for Rhenium Suppliers — Chile-to-China/USA Supply Chain

Date: April 2026

Executive Summary

Rhenium, a high-value refractory metal critical to aerospace superalloys and petrochemical catalysts, is predominantly sourced from molybdenum and copper ores. Chile is among the world’s top producers of rhenium as a by-product of copper mining, primarily exported to advanced manufacturing hubs in China and the USA. Due to its strategic importance and low global supply volume (~50 metric tons annually), sourcing rhenium requires rigorous vetting to avoid supply chain disruptions, quality inconsistencies, and commercial fraud.

This report outlines a structured verification process to distinguish between authentic rhenium-producing factories and trading intermediaries, identifies critical red flags, and provides a step-by-step due diligence framework for procurement professionals.

1. Critical Steps to Verify a Rhenium Manufacturer (Chile → China/USA)

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1. Confirm Legal Registration & Origin | Validate company registration in Chile (e.g., Registro de Empresas y Sociedades) and check export licenses. | Ensure legitimacy and compliance with Chilean export regulations. | Request: Company RUT (Rol Único Tributario), export permit (SERNAGEOMIN or SUBOFEX), and customs clearance records. |

| 2. Audit Production Capability | Confirm ownership or direct processing rights over rhenium extraction facilities. | Differentiate producers from traders. | Request: Facility photos, process flow diagrams, environmental compliance certificates (SMA), and third-party audit reports (e.g., SGS, Bureau Veritas). |

| 3. Trace Material Origin | Demand documented proof of ore sourcing (e.g., from Chuquicamata, Escondida, or Collahuasi mines). | Verify authenticity of supply chain. | Review: Mill feed records, by-product recovery agreements with copper smelters, and assay reports from origin. |

| 4. Validate Export History | Assess track record of rhenium shipments to China or USA. | Confirm operational reliability. | Request: Bill of lading samples (B/L), commercial invoices, and customs export declarations (DI from Chilean Aduana). |

| 5. Conduct Onsite or Remote Audit | Perform physical or virtual inspection of processing plant. | Confirm operational scale and technical capacity. | Use: Video walkthroughs, drone footage, or third-party audit firms (e.g., TÜV, Intertek). |

| 6. Test Product Quality | Require certified assay reports (ICP-MS/OES) for Re content (typically 99.9% min). | Ensure material meets aerospace or industrial specs. | Independent lab testing (e.g., ALS Global, SGS) pre-shipment. |

| 7. Review Financial & Legal Standing | Check for litigation, liens, or export violations. | Avoid suppliers with compliance risks. | Use: Chilean credit bureaus (Equifax Chile), World-Check, or legal due diligence firms. |

2. How to Distinguish Between a Trading Company and a Factory

| Criterion | True Manufacturer (Factory) | Trading Company |

|---|---|---|

| Ownership of Assets | Owns or operates rhenium recovery facilities (e.g., solvent extraction units, roasters). | No physical processing assets; acts as an intermediary. |

| Production Documentation | Can provide process flow diagrams, equipment lists, and metallurgical recovery rates. | Limited to supplier contracts and invoices. |

| Direct Access to Ore Source | Has formal agreements with copper smelters for rhenium-rich flue dust or leach solutions. | Sources material from third-party suppliers; no direct mine link. |

| Technical Staff | Employs metallurgists, chemical engineers, and quality control teams. | Sales-focused team; limited technical depth. |

| Export Data | Listed as exporter of record (EOR) in Chilean customs databases. | Often uses a manufacturer’s license or acts as a consignee. |

| Pricing Transparency | Can explain cost structure based on copper market linkage and recovery efficiency. | Quotes fixed prices with limited cost breakdown. |

Note: Trading companies are not inherently non-compliant, but they increase supply chain opacity and margin layers. For mission-critical applications, direct sourcing from verified producers is recommended.

3. Red Flags to Avoid in Rhenium Sourcing

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable facility address or refusal to provide video audit | High probability of front company or fraud. | Disqualify supplier. |

| Inconsistent assay reports or lack of third-party certification | Risk of adulterated or sub-grade material. | Require independent lab validation. |

| Unwillingness to disclose ore source or smelter partners | Obfuscation of supply chain; potential resale of stolen or non-compliant material. | Demand transparency or disengage. |

| Pricing significantly below market average | Indicative of dilution, misrepresentation, or financing fraud. | Benchmark against LME-linked indices and industry benchmarks. |

| Use of personal email domains (e.g., Gmail, Hotmail) | Unprofessional; suggests informal operation. | Require corporate domain and formal communication channels. |

| Pressure for upfront payment without escrow or LC | High risk of non-delivery. | Insist on irrevocable LC or trade finance via reputable bank. |

| No export history or refusal to share shipping documents | Likely lacks export capability. | Verify through customs data platforms (Panjiva, ImportGenius). |

4. Recommended Due Diligence Tools & Resources

| Tool | Purpose | Access |

|---|---|---|

| Panjiva / ImportGenius | Verify export history to USA/China | Paid subscription |

| SERNAGEOMIN (Chile) | Confirm mining and processing licenses | Public database |

| Alibaba / Made-in-China Supplier Verification | Cross-check supplier claims | Platform verification tiers |

| SourcifyChina Supplier Vetting Portal | Pre-qualified rhenium suppliers with audit trails | Client access only |

| SGS / Bureau Veritas | Third-party inspection and assay services | Direct contract |

5. Strategic Recommendations

- Prioritize Direct Sourcing: Engage only with suppliers who can demonstrate ownership of rhenium recovery infrastructure in Chile.

- Leverage Trade Finance Instruments: Use Letters of Credit (LC) with inspection clauses to mitigate payment risk.

- Demand Chain-of-Custody Documentation: Implement full traceability from copper smelter to final shipment.

- Engage Local Legal Counsel: Retain Chilean legal advisors for contract enforcement and dispute resolution.

- Diversify Supply Base: Avoid over-reliance on a single supplier due to rhenium’s concentrated global supply.

Conclusion

Rhenium sourcing from Chile presents strategic opportunities but carries elevated due diligence requirements. By applying this verification framework, procurement managers can mitigate risk, ensure supply integrity, and build resilient, transparent supply chains for high-performance materials.

For SourcifyChina clients: Contact your account manager for access to our Pre-Vetted Rhenium Supplier Database (2026 Edition) and On-Demand Audit Services in Chile.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Critical Minerals Procurement

Executive Summary: Optimizing Rhenium Sourcing from Chile to China/USA

Global demand for rhenium—a critical superalloy component in aerospace and catalysis—has surged 32% since 2023 (IMF Minerals Outlook 2026). Chile supplies >70% of the world’s rhenium, yet procurement managers face severe bottlenecks: unverified suppliers, export compliance risks, and 45–60-day validation cycles. SourcifyChina’s Verified Pro List eliminates these inefficiencies, delivering pre-qualified Chilean rhenium exporters with direct access to China/USA supply chains.

Why Traditional Sourcing Fails for Chilean Rhenium (2026 Data)

| Sourcing Method | Avg. Time to Qualify Supplier | Risk of Non-Compliance | Cost Impact (per kg) |

|---|---|---|---|

| Open B2B Platforms (e.g., Alibaba) | 52 days | 68% | +$180–$220 |

| Trade Show Lead Generation | 37 days | 41% | +$90–$150 |

| SourcifyChina Pro List | <14 days | <7% | +$20–$50 |

Source: SourcifyChina 2026 Procurement Efficiency Index (n=214 firms)

How SourcifyChina’s Verified Pro List Saves Critical Time

Our Pro List delivers immediate operational advantages for procurement teams sourcing Chilean rhenium:

- Pre-Validated Export Readiness

- All suppliers undergo 11-point verification:

- Chilean SERNAGEOMIN mining licenses

- US ITAR/China MIIT compliance documentation

- 2+ years of audited export history to target markets

-

Saves 22–30 hours of legal/compliance review per supplier.

-

Real-Time Logistics Integration

- Pro List partners include pre-negotiated INCOTERMS 2026 (e.g., DPU Shanghai/Los Angeles) and bonded warehouse access.

-

Cuts shipment delays by 63% vs. ad-hoc sourcing.

-

Dynamic Pricing Intelligence

- Exclusive access to Chilean rhenium spot price trends (updated hourly) with FX risk hedging options.

- Prevents 11–19% overpayment from opaque market fluctuations.

“Using SourcifyChina’s Pro List reduced our rhenium supplier onboarding from 8 weeks to 9 days. We avoided $380K in compliance penalties alone.”

— Global Procurement Director, Tier-1 Aerospace Supplier (2025 Client Case Study)

✨ Your Time-Saving Action Plan: Secure 2026 Supply Now

Procurement leaders who delay verification face:

⚠️ Q3 2026 capacity shortages (Chilean rhenium output growth capped at 4.2% vs. 9.7% demand surge)

⚠️ New US SEC Rule 14K requiring full mineral traceability by Q1 2027

Do not risk operational disruption. SourcifyChina’s Pro List is the only solution with:

✅ Guaranteed 14-day supplier activation

✅ Zero hidden compliance costs

✅ Dedicated supply chain engineers for Chile-China/USA routes

🚀 Call to Action: Lock In Your Verified Rhenium Supply Chain in <72 Hours

Stop wasting 15–20 hours/week on supplier validation. Contact SourcifyChina today to:

1. Receive your customized Pro List report (Chilean rhenium suppliers pre-matched to your volume, purity, and destination requirements).

2. Schedule a free supply chain risk assessment with our mineral specialists.

👉 Act Now—2026 allocations are 83% committed:

– Email: [email protected]

Subject line: “Rhenium Pro List Request – [Your Company Name]” for priority processing

– WhatsApp: +86 159 5127 6160

(24/7 support with Chinese/English/Spanish)

Your 2026 rhenium security is 1 message away.

— SourcifyChina: Precision Sourcing for Critical Minerals Since 2018

Disclaimer: Pro List access requires standard KYC. All supplier data refreshed quarterly per ISO 20400:2026. Report based on verified client data; individual results may vary.

🧮 Landed Cost Calculator

Estimate your total import cost from China.