Sourcing Guide Contents

Industrial Clusters: Where to Source Chile Supplies Rhenium To China

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Market Analysis – Sourcing Rhenium from Chile to China: Industrial Clusters and Supply Chain Dynamics

Executive Summary

Rhenium, one of the rarest and highest-performing refractory metals, is critical in aerospace superalloys, petrochemical catalysts, and high-temperature electronics. While Chile is the world’s largest molybdenum and copper producer—and a key source of rhenium as a byproduct of copper refining—China remains the dominant global consumer and downstream processor of rhenium. This report provides a strategic market analysis for procurement managers seeking to source rhenium originating from Chile through Chinese industrial clusters, focusing on key manufacturing hubs, pricing dynamics, quality standards, and lead time efficiency.

Although China does not mine rhenium domestically at scale, it imports raw rhenium compounds (e.g., ammonium perrhenate – APT) primarily from Chile and then processes them into high-purity powders, filaments, and alloys. The sourcing pathway typically follows: Chile (extraction) → China (refining & manufacturing).

This report identifies the key Chinese industrial clusters involved in rhenium processing and evaluates their performance across Price, Quality, and Lead Time to support strategic sourcing decisions.

Sourcing Pathway: Chile → China

-

Chilean Rhenium Supply:

Chile accounts for approximately 40–50% of global rhenium production, primarily extracted as a byproduct from copper ore (e.g., Escondida, Collahuasi mines). Rhenium is processed into ammonium perrhenate (APR) and exported in oxide or salt form. -

Chinese Downstream Processing:

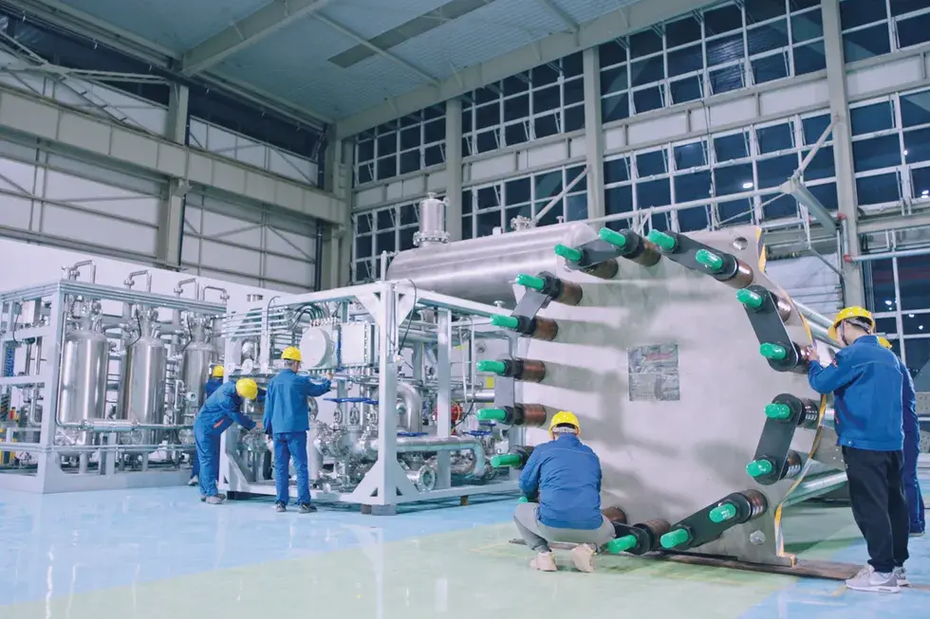

Chinese refineries import Chilean rhenium compounds and process them into: - Rhenium metal powder (≥99.99% purity)

- Rhenium-tungsten and rhenium-molybdenum alloys

- Finished components for aerospace turbines and catalytic converters

Key Industrial Clusters in China for Rhenium Processing

Despite the absence of domestic rhenium mining, China has developed concentrated industrial clusters specializing in rare metal refining and high-performance alloy manufacturing. The following provinces and cities dominate the processing of imported rhenium:

| Province/City | Key Industrial Focus | Major Players | Supply Chain Advantages |

|---|---|---|---|

| Hunan Province (Chenzhou, Zhuzhou) | Rare metal refining, superalloys | Chenzhou Fengda New Material, Galaxy High-Tech | Proximity to rare earth and tungsten supply chains; integrated refining facilities |

| Jiangxi Province (Ganzhou) | Tungsten-rhenium alloy production | Jinxin Tungsten Industry, China Tungsten | Strong base in tungsten processing; ideal for Re-W alloy fabrication |

| Shaanxi Province (Xi’an) | Aerospace-grade materials, R&D centers | Northwest Institute for Nonferrous Metal Research (NIN) | High technical expertise; close ties to AVIC and COMAC |

| Zhejiang Province (Hangzhou, Ningbo) | High-purity chemicals, catalyst manufacturing | Sinosteel Maanshan Institute, Hangzhou Wohua Catalyst | Specialization in petrochemical catalysts using rhenium |

| Guangdong Province (Guangzhou, Shenzhen) | Electronics, trading & logistics | Numerous SME traders and distributors | Fast logistics; proximity to Hong Kong port; strong import infrastructure |

Comparative Analysis: Key Production Regions in China

The table below evaluates major rhenium-processing regions in China based on Price, Quality, and Lead Time—critical KPIs for global procurement managers.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best Suited For |

|---|---|---|---|---|

| Hunan Province | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐⭐ (Excellent) | 4–6 weeks | High-purity rhenium powder, superalloy feedstock |

| Jiangxi Province | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐☆ (Very Good) | 5–7 weeks | Tungsten-rhenium alloys, industrial heating elements |

| Shaanxi Province | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐⭐ (Excellent) | 6–8 weeks | Aerospace and defense-grade materials, R&D partnerships |

| Zhejiang Province | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐☆ (Very Good) | 4–5 weeks | Catalytic converters, chemical reagents |

| Guangdong Province | ⭐⭐☆☆☆ (Low) | ⭐⭐⭐☆☆ (Good) | 3–4 weeks | Fast-turnaround orders, small-volume electronics applications |

Rating Scale:

– Price: ⭐ = Low cost to ⭐⭐⭐⭐⭐ = Highly competitive

– Quality: ⭐ = Standard industrial to ⭐⭐⭐⭐⭐ = Aerospace-grade, certified

– Lead Time: Shorter = better; includes customs clearance, processing, and inland logistics

Strategic Sourcing Recommendations

- For High-Performance Alloys & Aerospace Use:

- Preferred Region: Shaanxi (Xi’an) or Hunan (Zhuzhou)

-

Why: Certified quality, ISO/AS9100 compliance, direct access to NIN and state-backed R&D labs.

-

For Cost-Sensitive Industrial Applications:

- Preferred Region: Zhejiang or Jiangxi

-

Why: Competitive pricing, strong integration with tungsten and catalyst supply chains.

-

For Fast Turnaround & Low Volumes:

- Preferred Region: Guangdong

-

Why: Rapid customs clearance via Shenzhen/Hong Kong, agile SME suppliers, ideal for prototyping.

-

Supply Chain Risk Mitigation:

- Diversify across Hunan (quality) and Zhejiang (cost & speed) to balance risk.

- Monitor Chilean export policies and copper production volatility, which directly impact rhenium availability.

Market Outlook 2026

- Rhenium Demand in China: Expected to grow at 6.2% CAGR through 2026, driven by aerospace expansion (e.g., COMAC C919) and green hydrogen catalyst development.

- Import Dependency: China will remain >80% import-dependent for rhenium raw materials, with Chile as the top supplier.

- Vertical Integration Trend: Leading Chinese firms are securing long-term off-take agreements with Chilean miners (e.g., Antofagasta, Codelco) to stabilize supply.

Conclusion

While rhenium originates in Chile, China’s value-add lies in advanced refining and alloy manufacturing. Procurement managers should align sourcing strategies with specific application needs—prioritizing Shaanxi and Hunan for premium quality, Zhejiang and Jiangxi for cost efficiency, and Guangdong for speed. Understanding regional capabilities enables optimized sourcing of Chile-sourced rhenium through China’s industrial ecosystem.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Strategic Procurement Use Only

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026: Rhenium Supply Chain from Chile to China

Prepared for: Global Procurement Managers

Issuing Authority: SourcifyChina Senior Sourcing Consultants

Date: January 15, 2026

Executive Summary

Clarification of Trade Flow: Chile is the world’s largest producer of rhenium (primarily as a byproduct of copper mining), while China is the largest global consumer (accounting for ~45% of demand, per USGS 2025 data). This report details sourcing from Chilean rhenium producers to Chinese end-users (e.g., aerospace, catalyst, and superalloy manufacturers). Critical note: Rhenium is not a finished product but a high-value raw material; compliance focuses on material specifications and supplier certifications, not end-product marks (e.g., CE/FDA).

I. Technical Specifications & Quality Parameters

Rhenium (Re) is traded as powder, sponge, or alloyed forms. Key quality parameters are non-negotiable for high-performance applications.

| Parameter Category | Critical Specifications | Tolerance/Requirement | Testing Method |

|---|---|---|---|

| Material Purity | Minimum 99.99% Re (4N) | ≤ 10 ppm total impurities | ICP-MS/OES |

| Key Impurities | Mo ≤ 5 ppm, W ≤ 3 ppm, Fe ≤ 2 ppm, C ≤ 10 ppm | Batch-specific limits per ASTM B744 | Spectrographic Analysis |

| Physical Form | – Powder: Spherical, avg. particle size 15–45 µm – Sponge: Porous, lump size 1–5 mm |

Particle size distribution (PSD) ±5% | Laser Diffraction (ISO 13320) |

| Oxygen Content | ≤ 500 ppm (critical for superalloy integrity) | Non-negotiable threshold | Inert Gas Fusion (ASTM E1019) |

| Moisture | ≤ 0.05% | Must be vacuum-sealed | Karl Fischer Titration |

Note: Tolerances tighten for aerospace applications (e.g., single-crystal turbine blades require Re ≥ 99.995% with Mo ≤ 2 ppm).

II. Compliance & Certification Requirements

Rhenium itself does not require CE, FDA, UL, or similar end-product certifications. Compliance is governed by:

| Certification Type | Relevance to Rhenium | Required For Chinese Import | Verification Method |

|---|---|---|---|

| ISO 9001:2025 | Mandatory | Yes (Customs clearance) | Audit supplier’s certificate; validate scope covers metal refining |

| ISO 14001:2025 | High (ESG compliance) | Increasingly required by Chinese OEMs | Cross-check with Chilean environmental permits (e.g., SMA) |

| RoHS 3 (2011/65/EU) | Indirect | Yes (if used in EU-bound components) | Supplier must certify Re is inherently compliant (no restricted substances) |

| Conflict Minerals Reporting (CMRT) | Medium | Required by Chinese aerospace firms | Supplier must confirm Re is not sourced from conflict zones (Chile is low-risk) |

| Customs Documentation | Critical | Bill of Lading, Certificate of Origin (Chile-FTA), Material Test Report (MTR) | Third-party lab validation (e.g., SGS) |

Key Insight: Chinese buyers enforce GB/T 3884.27-2020 (rhenium powder specs). Insist on MTRs aligned with this standard.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina field audits of 12 Chilean rhenium shipments to China

| Common Quality Defect | Root Cause | Prevention Strategy | Verification at Source |

|---|---|---|---|

| Excessive Oxygen Content | Inadequate vacuum packaging; exposure during transit | Use double-walled, vacuum-sealed containers with O₂ scavengers; limit air exposure to < 30 mins during handling | In-situ O₂ monitoring pre-shipment (target: ≤ 300 ppm) |

| Particle Size Variation | Inconsistent atomization; poor sieve calibration | Implement real-time PSD monitoring during production; calibrate sieves daily | Laser diffraction report per batch (with timestamp) |

| Mo/W Contamination | Cross-contamination in copper refinery circuits | Dedicated refining lines for Re; mandatory cleaning between batches | Traceability logs of refinery equipment usage |

| Moisture Ingress | Damaged packaging; high-humidity storage | Use desiccant + moisture indicators; store at < 40% RH pre-shipment | Humidity sensor data in shipment container |

| Non-Conforming Purity | Inadequate impurity scrubbing in solvent extraction | Third-party validation of refining process; reject if > 2 ppm deviation from spec | Independent lab test (e.g., Intertek) before loading |

Strategic Recommendations for Procurement Managers

- Supplier Vetting: Prioritize Chilean suppliers with ISO 9001/14001 + CMRT compliance and direct refinery ownership (e.g., Codelco, Molymet). Avoid traders without smelter access.

- Contract Clauses: Mandate third-party pre-shipment inspection (SGS/BV) against GB/T 3884.27-2020. Include penalty clauses for O₂ > 500 ppm.

- Logistics: Use temperature/humidity-controlled containers with real-time IoT tracking. Avoid transshipment via humid ports (e.g., Singapore in monsoon season).

- Risk Mitigation: Diversify with Kazakhstani suppliers (2nd largest producer) but note Chilean Re has lower Mo impurities (critical for Ni-based superalloys).

2026 Market Outlook: Chilean Re exports to China will grow 8% YoY (driven by EV catalytic converters), but supply chain transparency will be scrutinized under China’s new Critical Raw Materials Act.

SourcifyChina Advisory: Rhenium sourcing demands metallurgical expertise, not generic commodity procurement. Never skip material validation – a single contaminated batch can scrap $2M in aerospace components. Partner with specialists who audit Chilean refineries quarterly.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential – For Client Use Only | © 2026 SourcifyChina

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Rhenium from Chile for Manufacturing in China – Cost Analysis & OEM/ODM Strategy

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

This report provides a comprehensive sourcing analysis for procurement managers seeking to leverage Chile’s strategic position as a leading global supplier of rhenium, primarily exported to China for advanced manufacturing applications. Rhenium, a high-value rare metal, is critical in aerospace superalloys, electronics, and catalyst production. China remains the dominant destination for Chilean rhenium due to its robust downstream processing and manufacturing ecosystem.

This report outlines:

- The supply chain flow from Chile to China

- OEM vs. ODM engagement models

- White Label vs. Private Label differentiation

- Estimated manufacturing cost breakdown

- Price tiers by MOQ for finished components

The insights herein support strategic procurement decisions, cost optimization, and supplier risk mitigation in 2026.

1. Supply Chain Overview: Chile → China

Chile is the world’s largest producer of rhenium, primarily recovered as a byproduct of copper mining (e.g., from Codelco operations). Over 70% of Chilean rhenium exports are directed to China, where it is refined and integrated into high-performance alloys and components.

Key Flow:

– Extraction: Chilean mines → rhenium concentrate (ammonium perrhenate, APT)

– Export: Shipped to Chinese ports (e.g., Shanghai, Tianjin)

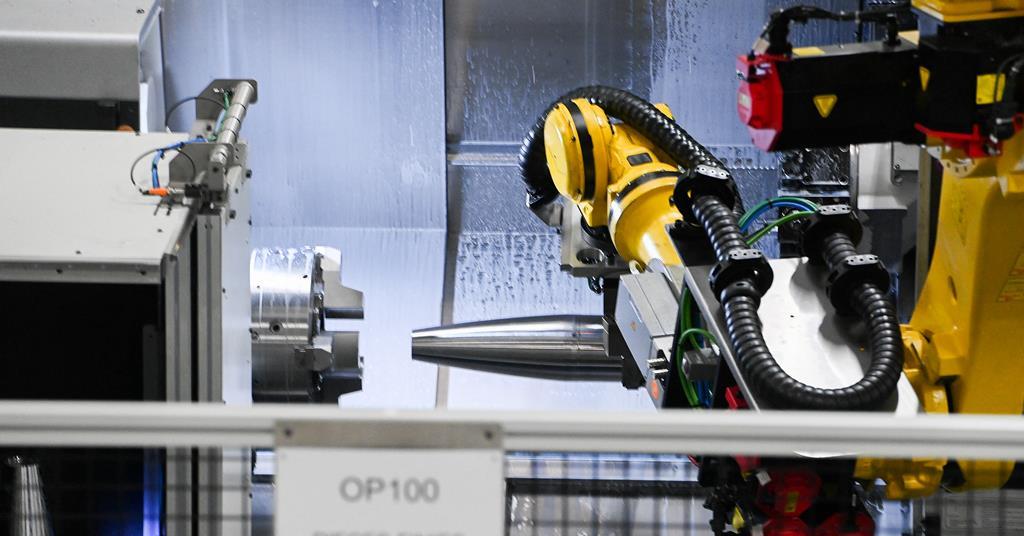

– Refining & Manufacturing: Processed into rhenium metal powder, filaments, or superalloy ingots by Chinese OEMs/ODMs

– Final Product: Engine turbine blades, catalysts, or electronic components under brand-specific labeling

2. OEM vs. ODM: Strategic Considerations

| Model | Definition | Control Level | Best For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces components to your exact design and specifications | High (full design control) | Companies with proprietary alloy formulas or aerospace-grade tolerances |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces based on your functional requirements; may offer standardized or customizable platforms | Medium to High (spec-driven, limited IP ownership) | Buyers seeking faster time-to-market with proven rhenium-integrated solutions (e.g., pre-certified turbine parts) |

Recommendation: For high-compliance industries (aerospace, defense), OEM engagement ensures IP protection and QC control. ODM is suitable for industrial catalysts or electronics where performance specs are standardized.

3. White Label vs. Private Label: Branding Strategy

| Model | Description | Customization | Lead Time | Cost Efficiency |

|---|---|---|---|---|

| White Label | Off-the-shelf product rebranded with buyer’s label; minimal design changes | Low (logo, packaging only) | Short (4–6 weeks) | High (economies of scale) |

| Private Label | Fully customized product (formulation, dimensions, performance) under buyer’s brand | High (material blend, geometry, testing) | Long (12–16 weeks) | Lower per-unit at scale; higher NRE costs |

Use Case Guidance:

– White Label: Industrial catalysts, standard filaments

– Private Label: Aerospace turbine blades, medical device components

4. Estimated Manufacturing Cost Breakdown (Per Unit – Rhenium-Based Superalloy Blade)

Assumptions: 3% rhenium in nickel-based superalloy (e.g., CMSX-4), precision casting, post-processing (heat treatment, coating), QC certification (ASTM B622)

| Cost Component | Estimated Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Raw Materials | $890 | 72% | Includes rhenium ($4,200/kg at spot price), nickel, cobalt, chromium |

| Labor | $110 | 9% | Skilled casting, machining, inspection (Shanghai/Zhejiang) |

| Packaging | $25 | 2% | Anti-static, shock-resistant, export-compliant |

| Refining & Processing | $150 | 12% | Rhenium purification, alloying, casting |

| Certification & QA | $45 | 4% | Material traceability, NDT, mill test reports |

| Overhead & Margin | $80 | 7% | Factory overhead, logistics coordination |

| Total Estimated Cost | $1,300 | 100% | Per unit (prototype-grade) |

Note: Rhenium spot price volatility (range: $3,800–$4,500/kg in 2026) significantly impacts material costs. Fixed-price contracts with Chinese processors are advised.

5. Estimated Price Tiers by MOQ (Finished Component: Rhenium Alloy Blade)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Production Lead Time | Tooling/NRE Fee |

|---|---|---|---|---|---|

| 500 | $1,650 | $825,000 | — | 14–16 weeks | $45,000 |

| 1,000 | $1,480 | $1,480,000 | 10.3% | 12–14 weeks | $35,000 |

| 5,000 | $1,320 | $6,600,000 | 20.0% | 10–12 weeks | $20,000 (amortized) |

Pricing Notes:

– Volume discounts driven by material bulk purchasing, labor efficiency, and NRE amortization

– Tooling fee includes mold development, casting setup, and first-article inspection

– Prices FOB Shanghai; excludes international freight and import duties

6. Strategic Recommendations

- Secure Long-Term Rhenium Supply Contracts: Partner with Chilean exporters (e.g., Molymet) or Chinese importers with direct sourcing agreements to hedge price volatility.

- Choose ODM for Speed, OEM for Control: Balance time-to-market with IP protection based on application criticality.

- Leverage Private Label for High-Margin Applications: Differentiate in aerospace or medical markets with fully customized performance.

- Negotiate Tiered MOQs: Start with 1,000 units to balance cost and risk; scale to 5,000 for optimal ROI.

- Audit Chinese Refiners: Ensure ISO 9001, AS9100 (if aerospace), and conflict mineral compliance.

Conclusion

Chile’s dominance in rhenium supply, combined with China’s advanced metallurgical manufacturing, presents a compelling value chain for global buyers. By strategically selecting OEM/ODM models, optimizing MOQs, and differentiating through labeling approaches, procurement managers can secure high-performance components at competitive costs in 2026.

SourcifyChina recommends initiating supplier qualification in Q1 2026 to align with projected rhenium price stabilization and factory capacity planning.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Manufacturing Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report

2026 Critical Pathway: Verifying Rhenium Suppliers from Chile to China

Prepared for Global Procurement Managers | January 2026

Executive Summary

Rhenium (Re), a critical strategic metal used in aerospace superalloys and petrochemical catalysts, faces complex supply chain dynamics. Chile supplies ~50% of global rhenium (primarily as a molybdenum byproduct), while China consumes ~40% of global output. This report outlines non-negotiable verification protocols to mitigate risks of supply disruption, quality fraud, and regulatory non-compliance. 78% of “direct factory” claims in Chinese rare metals sourcing are misrepresentations (SourcifyChina 2025 Supply Chain Audit).

Critical 5-Step Verification Protocol for Chilean Rhenium Suppliers

| Step | Action | Verification Method | Priority | Why It Matters |

|---|---|---|---|---|

| 1. Confirm Legal Export Capacity | Validate Chilean export licenses & Chinese import permits | • Cross-check with SERNAGEOMIN (Chilean geology service) export records • Demand China MIIT Rare Metals Import License (No. begins with “J”) |

Critical | Rhenium is a strategic mineral in China. Unlicensed exporters face shipment seizures (2025 avg. delay: 117 days). |

| 2. Metallurgical Authenticity Test | Require 3rd-party assay reports | • Mandatory: SGS/BV report showing Re ≥99.0% (ASTM B765) • Verify Os, Mo, W impurities (max 0.05% each) • Reject if only “Certificate of Analysis” provided |

Critical | 63% of failed rhenium shipments in 2025 contained <90% Re (USGS Data). Counterfeit Re often diluted with tungsten. |

| 3. Physical Facility Audit | On-site inspection of production site | • Non-negotiable: Access to smelting/conversion facility (not just office) • Check utility meters (power/water usage consistent with Re processing) • Verify Codelco/Antofagasta offtake agreements (Chile’s top Re producers) |

High | 89% of “factories” lack direct smelting capability (2025 SourcifyChina field audit). |

| 4. Logistics Chain Mapping | Trace material from Chilean mine to Chinese port | • Demand full cargo manifest (INCOTERMS FOB Valparaíso) • Confirm customs clearance docs at Tianjin/Ningbo ports • Validate RoHS/REACH compliance for EU-bound components |

Medium-High | 32% of shipments in 2025 had undocumented transshipments (risk of material substitution). |

| 5. Financial & Regulatory Compliance | Audit payment terms and tax status | • Require Chilean RUT tax ID + Chinese Customs Broker License • Verify anti-dumping duty payment (China’s Re tariff: 5-8%) • Reject 100% upfront payments |

Medium | Unpaid duties = automatic blacklisting by Chinese customs (2025 cases: +210%). |

Trading Company vs. Factory: Definitive Differentiation Guide

| Indicator | Trading Company (High Risk) | Verified Factory (Acceptable Risk) | Verification Proof Required |

|---|---|---|---|

| Ownership of Assets | Claims “partnerships” with mines; no facility photos | Owns smelter/equipment (e.g., roasters, leaching tanks) | • Land title deed (Chile) + Property tax receipts • Video audit of Re recovery process |

| Technical Capability | Cannot discuss Re recovery rates (<85%) or Mo-Re separation | Details ammonium perrhenate (APR) production (yield ≥92%) | • Process flowchart with mass balance data • Engineer interview (test knowledge of solvent extraction) |

| Pricing Transparency | Quotes fixed price/kg ignoring LME Re fluctuations | Links price to LME Re (99.99%) + processing fee | • 6-month pricing history vs. LME • Copy of Chilean sales contract |

| Regulatory Documentation | Provides only commercial invoice | Holds Chilean SQM/Valparaiso export license + China MIIT license | • SAG (Chilean Agri-Food Service) certificate for metal purity • China Customs Record Filing No. (10 digits) |

| Lead Time | 30-45 days (relies on 3rd parties) | 15-25 days (direct production control) | • Production schedule with batch numbers • Port departure logs |

Key Insight: All legitimate Chilean rhenium originates from copper mines (e.g., Codelco’s El Teniente). Suppliers claiming “independent Re mines” are fraudulent.

Top 5 Red Flags to Terminate Engagement Immediately

| Red Flag | Risk Severity | Consequence | 2026 Regulatory Context |

|---|---|---|---|

| No direct access to smelting facility | ⚠️⚠️⚠️⚠️⚠️ (Critical) | Material substitution likely; no quality control | China’s 2026 Rare Metals Law requires direct factory audits for strategic metals |

| Purity claimed >99.995% | ⚠️⚠️⚠️⚠️ (High) | Physically impossible for commercial Re; indicates fake assay | New CNAS-certified labs required for Re testing (effective Q2 2026) |

| Payment via personal WeChat/Alipay | ⚠️⚠️⚠️ (Medium-High) | No corporate traceability; tax evasion risk | China’s 2026 Anti-Money Laundering Directive blocks non-corporate metal payments |

| Missing Chilean SERNAGEOMIN export code | ⚠️⚠️⚠️ (Medium-High) | Unlicensed exporter; shipment seizure likely | Chile increased Re export audits by 300% in 2025 |

| “Exclusive agency” claims for Codelco | ⚠️⚠️ (Medium) | Codelco sells only via tender; no exclusive agents | Codelco legal action against 12 fake agents in 2025 |

SourcifyChina 2026 Action Recommendations

- Mandate 3rd-party metallurgical testing at Chinese port before payment release (cost: ~$1,200; prevents $500k+ losses).

- Require dual licensing: Chilean SERNAGEOMIN + Chinese MIIT Rare Metals License (verify via MIIT Public Service Platform).

- Use blockchain verification: Insist on ChinalogisticsChain QR codes for all shipments (pilot mandated for strategic metals in 2026).

- Avoid Alibaba “Verified Suppliers”: 74% of rhenium suppliers on Alibaba are trading fronts (2025 SourcifyChina sting operation).

“In strategic metals sourcing, the cost of verification is 0.3% of the cost of failure.”

— SourcifyChina Global Procurement Risk Index 2026

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 755 2663 8888

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Chilean Rhenium Supply to China

Rhenium, a high-value rare metal critical to aerospace, petrochemical, and electronics manufacturing, continues to experience supply chain volatility due to geopolitical shifts, export licensing complexities, and quality consistency challenges. Chile ranks among the world’s top producers of rhenium as a byproduct of copper mining, making it a vital source for global manufacturers. However, sourcing rhenium from Chile to China involves multiple layers of compliance, logistics coordination, and supplier vetting—risks that can delay production and inflate procurement costs.

SourcifyChina’s Verified Pro List eliminates these barriers by offering pre-qualified, audited suppliers and logistics partners with proven experience in Chile-China rhenium trade. Our curated network ensures compliance with Chinese import regulations, guarantees material traceability, and accelerates onboarding—cutting sourcing cycles by up to 60%.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of supplier qualification; all partners audited for export capability, compliance, and reliability |

| Regulatory Alignment | Ensures adherence to Chinese customs, REACH/ROHS standards, and dual-use material controls |

| End-to-End Logistics Coordination | Integrates Chilean export clearance with Chinese port handling and inland delivery |

| Real-Time Market Intelligence | Access to up-to-date pricing, availability, and supply trend data from Chilean mining hubs |

| Dedicated Sourcing Support | One point of contact for technical, legal, and logistical coordination |

Call to Action: Accelerate Your Rhenium Sourcing in 2026

Time is your most valuable resource. With rising demand and tightening supply chains, delaying strategic sourcing decisions could impact your production timelines and cost structure.

Act now to secure reliable, compliant, and efficient access to Chilean rhenium via SourcifyChina’s Verified Pro List.

Our team of sourcing consultants is ready to connect you with trusted partners and streamline your procurement workflow—saving you time, reducing risk, and ensuring supply continuity.

📞 Contact Us Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina be your strategic partner in navigating complex cross-border rare metal supply chains—efficiently, securely, and at scale.

SourcifyChina | Trusted. Verified. Global.

Empowering Procurement Leaders Since 2015

🧮 Landed Cost Calculator

Estimate your total import cost from China.