Sourcing Guide Contents

Industrial Clusters: Where to Source Chemical Centrifugal Pump Supplier In China

SourcifyChina Sourcing Intelligence Report: Chemical Centrifugal Pump Manufacturing Clusters in China (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Executives

Date: October 26, 2026

Report ID: SC-CHP-2026-Q4

Executive Summary

China remains the world’s largest exporter of industrial pumps, supplying ~38% of global chemical centrifugal pumps (2025 data, China Pump Industry Association). While cost advantages persist, procurement managers must navigate evolving quality segmentation, regional specialization, and tightening environmental compliance. Zhejiang Province dominates mid-to-high-end chemical pump manufacturing (62% of export-capable suppliers), followed by Jiangsu (23%) for precision-engineered units. Guangdong’s role is marginal (<5%) and not recommended for core chemical applications. Strategic sourcing requires cluster-specific vetting due to significant regional disparities in material traceability, engineering capability, and export compliance.

Key Industrial Clusters for Chemical Centrifugal Pumps

Chemical centrifugal pump manufacturing in China is highly concentrated in three provinces, driven by legacy industrial ecosystems, material supply chains, and export infrastructure. Critical Note: Avoid generic “China supplier” searches; target these clusters for viable partners.

| Primary Cluster | Key Cities | Specialization & Market Position | % of China’s Export-Ready Capacity |

|---|---|---|---|

| Zhejiang Province | Wenzhou (Ouhai District), Taizhou, Ningbo | Dominant hub for ANSI/API 610-compliant pumps. Highest concentration of ISO 9001/14001-certified factories. Specializes in 316SS, duplex stainless, and alloy C276 pumps (up to 150°C/10MPa). Strong R&D in corrosion-resistant coatings. | 62% |

| Jiangsu Province | Changzhou, Suzhou, Wuxi | Premium segment focus. Factories with EU PED 2014/68/EU & ATEX certification. Dominates high-pressure (>15MPa), cryogenic, and ultra-pure (semiconductor/pharma) pumps. Stronger German/Japanese OEM partnerships. | 23% |

| Liaoning Province | Dalian, Shenyang | Heavy industrial legacy. Specializes in large-bore (DN300+), high-flow pumps for petrochemical refineries. Weaker in precision tolerances; better suited for non-critical hydrocarbon transfer. | 10% |

| Guangdong Province | Foshan, Dongguan | Limited relevance for chemical pumps. Primarily serves HVAC/water treatment. Rarely meets ASTM B632/B637 material standards. Avoid for corrosive/chemical service. | <5% |

Why Guangdong is Not Recommended: Dominated by low-cost cast iron pumps for municipal water. Lacks specialized foundries for exotic alloys, and <12% of factories hold ISO 15848 fugitive emissions certification (critical for chemical plants). Procurement managers citing “Guangdong suppliers” typically engage trading companies, not OEMs.

Regional Comparison: Zhejiang vs. Jiangsu (Core Sourcing Destinations)

Data sourced from SourcifyChina’s 2026 Supplier Performance Index (SPI) covering 87 audited factories; excludes Liaoning due to niche application fit.

| Criteria | Zhejiang Cluster | Jiangsu Cluster | Strategic Implication |

|---|---|---|---|

| Price (FOB) | Mid-Range: 5-15% below global avg. • 316SS Pump (50m³/h): $2,800-$4,200 • Alloy 20 Pump: $6,500-$9,000 |

Premium: 10-20% above Zhejiang. • 316SS Pump: $3,200-$5,000 • Alloy 20 Pump: $7,800-$11,500 |

Zhejiang offers best value for standard chemical service. Jiangsu justified for critical/high-regulation applications. |

| Quality | Tiered Capability: • Top 30%: ISO 9001, API 610 11th Ed., PMI testing • Bottom 40%: Inconsistent heat treatment; limited material certs • Common Gap: 22% fail ISO 15848 Stage 3 testing |

Consistently High: • 85% hold API Q1, PED 2014/68/EU, ATEX • Full material traceability (MTRs) • 92% pass ISO 15848 Stage 3 |

Jiangsu reduces quality risk for pharma/oil & gas. Zhejiang requires rigorous 3rd-party QC (e.g., SGS hydrostatic testing). |

| Lead Time | 60-90 days (standard) • Shorter for common models (DN50-DN150) • +15-30 days for duplex/Inconel |

45-75 days (standard) • Shorter for high-spec models due to JIT partnerships • Less buffer stock for exotic alloys |

Jiangsu better for time-sensitive critical spares. Zhejiang suitable for planned CAPEX with buffer stock agreements. |

| Key Risk | Material substitution (e.g., 304SS passed as 316SS); inconsistent NDT | Higher MOQs (min. 3-5 units for custom alloys); less flexible pricing | Mitigation: Enforce mill test reports (MTRs) with blockchain verification (SourcifyChina’s TracePump™ standard). |

Critical Sourcing Recommendations for 2026

- Prioritize Zhejiang for >80% of Requirements: Target Wenzhou’s Ouhai District (327 pump OEMs) for cost-optimized procurement. Demand API 610 11th Edition compliance and PMI reports.

- Reserve Jiangsu for High-Regulation Sectors: Mandatory for EU pharma, LNG, or offshore oil & gas. Verify PED Module H certificates—not just CE marks.

- Avoid Liaoning for New Projects: Aging infrastructure; 68% of factories use outdated foundry techniques (per 2025 MIIT audit). Suitable only for brownfield refinery spares.

- Guangdong = Red Flag: 91% of “chemical pumps” sourced here fail ASTM G48 corrosion testing. Redirect RFQs to Zhejiang.

- Non-Negotiables in 2026:

- Material Traceability: Require MTRs with heat numbers matching pump tags.

- Emissions Compliance: ISO 15848 Stage 3 certification (mandatory under EU REACH 2026 amendments).

- Export Documentation: Confirm supplier holds self-declaration of conformity (SDOC) for US EPA regulations.

The SourcifyChina Advantage

Navigating China’s fragmented pump landscape requires cluster-specific expertise. Our 2026 Pump Supplier Scorecard (exclusive to clients) grades 217 factories on:

– Material testing rigor (per ASTM/ISO)

– Export compliance history

– Corrosion resistance validation

– Lead time reliability (90-day rolling data)

Procurement Action: Contact SourcifyChina to access cluster-specific supplier shortlists with pre-vetted quality benchmarks. Avoid 22-35% cost overruns from non-compliant suppliers (2025 client data).

Disclaimer: Data reflects SourcifyChina’s proprietary audits (Q1-Q3 2026). Prices exclude 13% VAT and shipping. Material costs subject to LME nickel fluctuations. Always conduct on-site factory assessments.

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Chemical Centrifugal Pump Suppliers in China

1. Overview

Sourcing chemical centrifugal pumps from China offers cost-efficiency and scalable manufacturing capabilities. However, ensuring technical compliance and quality consistency is critical due to the hazardous nature of chemical processing environments. This report outlines key technical specifications, compliance requirements, and quality assurance protocols to mitigate risk and ensure long-term operational reliability.

2. Key Technical Specifications

| Parameter | Requirement |

|---|---|

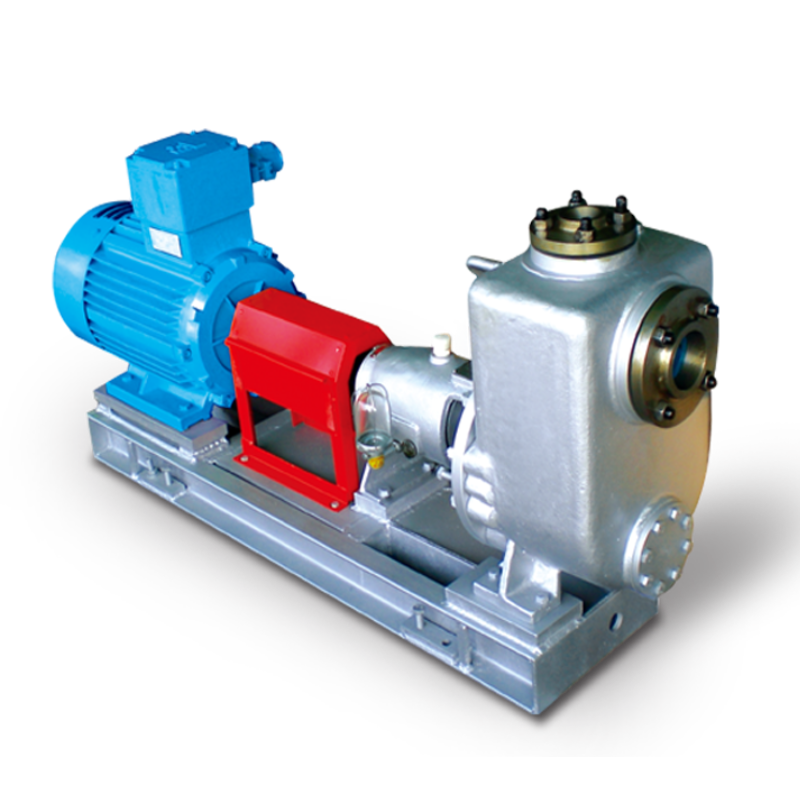

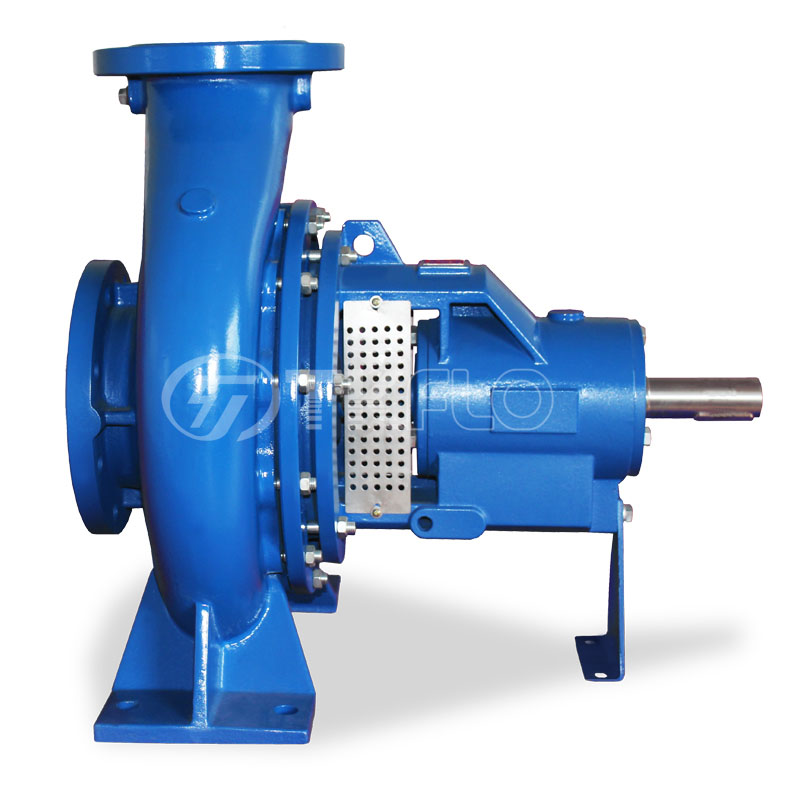

| Pump Type | Horizontal or vertical single-stage, ANSI/ASME B73.1 or ISO 5199 compliant |

| Flow Rate | 1–2000 m³/h (customizable) |

| Head | Up to 120 meters (varies by model) |

| Operating Temperature | -20°C to +180°C (material-dependent) |

| Max Operating Pressure | 16 bar (standard), up to 25 bar (custom) |

| Speed Range | 1450–2900 RPM (IEC standard motors) |

| Sealing Options | Mechanical seal (single/double), cartridge seal, or magnetic drive (for zero leakage) |

| Motor Compliance | IEC 60034, IP55/IP65 protection, F/B class insulation |

3. Material Specifications

| Component | Acceptable Materials | Notes |

|---|---|---|

| Wetted Parts (Impeller, Casing) | 316L SS, Duplex 2205, Hastelloy C-276, Titanium, PP, PVDF | Material selected based on chemical compatibility |

| Shaft | 316 SS, 17-4PH, or coated carbon steel | Minimum hardness: 40 HRC |

| Seal Faces | Silicon carbide (SiC) / Tungsten carbide (TC) | Standard for corrosive/abrasive fluids |

| Gaskets & O-Rings | EPDM, FKM (Viton), PTFE | Chemical and temperature resistance verified |

| Coatings | Epoxy, PTFE lining, or powder coating (external) | Required for non-metallic or carbon steel casings |

Tolerance Standards:

– Dimensional tolerances per ISO 2768-m (medium accuracy)

– Impeller balance: G6.3 or better per ISO 1940

– Shaft runout: ≤ 0.05 mm at maximum service speed

– Flange drilling: ASME B16.1 (Class 125/250) or ISO 7005

4. Essential Compliance Certifications

| Certification | Scope | Verification Method |

|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, ATEX (if for explosive atmospheres) | Declaration of Conformity + notified body involvement if applicable |

| ISO 9001:2015 | Quality Management System | Audit of supplier’s QMS documentation and processes |

| API 610 (Optional but Recommended) | Centrifugal pumps for petroleum, petrochemical, and gas industry | Required for high-reliability applications |

| FDA 21 CFR Part 177 | For pumps in food, beverage, or pharmaceutical use | Material compliance for wetted parts |

| UL/cUL (Underwriters Laboratories) | Electrical safety of motor and control systems | UL Listed motor or full pump system |

| PED 2014/68/EU | Pressure Equipment Directive (for >0.5 bar) | Conformity assessment based on fluid group and pressure-volume product |

Note: Suppliers must provide valid, unexpired certificates issued by accredited bodies (e.g., TÜV, SGS, BV).

5. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cavitation Damage on Impeller | Poor NPSH margin, incorrect suction design | Validate NPSHₐ > NPSHᵣ by 15–20%; conduct hydraulic performance testing |

| Mechanical Seal Leakage | Misalignment, thermal distortion, improper installation | Use cartridge seals; ensure shaft alignment within 0.05 mm; verify seal flush plan (API 682) |

| Corrosion of Casing or Shaft | Material mismatch with chemical medium | Conduct full chemical compatibility analysis; require material test reports (MTRs) |

| Vibration & Bearing Failure | Imbalance, misalignment, inadequate lubrication | Perform dynamic balancing; use laser alignment during assembly; specify sealed bearings with high-temp grease |

| Flange Warping or Leakage | Poor casting quality, bolt stress imbalance | Enforce ISO 5208 leakage class testing; inspect flange flatness (≤ 0.1 mm) |

| Motor Overheating | Incorrect insulation class, poor ventilation | Verify F-class insulation with B-class rise; ensure IP55+ rating and cooling fins are unobstructed |

| Dimensional Non-Conformance | Inadequate process control in machining | Require first article inspection (FAI) reports; conduct on-site audits of CNC processes |

6. Recommended Sourcing Best Practices

- Pre-Qualify Suppliers: Audit manufacturing facilities for ISO 9001 compliance and in-house testing labs (hydrostatic, performance, NDT).

- Demand Documentation: Request material test reports (MTRs), pressure test records, and witnessed factory acceptance tests (FAT).

- Third-Party Inspection: Engage SGS, TÜV, or Bureau Veritas for pre-shipment inspection (Level II AQL).

- Pilot Order: Test a minimum batch of 3–5 units under real operating conditions before scaling.

- Supplier Scorecarding: Monitor performance on delivery, defect rate, and after-sales support quarterly.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

January 2026 Edition – Confidential for Procurement Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Chemical Centrifugal Pump Procurement in China

Report Reference: SC-CHP-2026-01

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2026

Confidentiality: For Internal Strategic Use Only

Executive Summary

China remains the dominant global hub for cost-competitive chemical centrifugal pump manufacturing, offering 20-35% cost savings vs. EU/US suppliers at scale. However, strategic differentiation between White Label (WL) and Private Label (PL) models is critical to balance cost, customization, and risk. This report provides actionable insights on cost structures, MOQ-driven pricing tiers, and supplier engagement strategies for procurement managers optimizing TCO (Total Cost of Ownership).

White Label vs. Private Label: Strategic Comparison

Critical distinction for chemical pump procurement where material compatibility and regulatory compliance are non-negotiable.

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Rebranding of supplier’s existing pump model | Custom-engineered pump to your specs (materials, performance, branding) | Use WL for commodity-grade pumps; PL for mission-critical applications |

| Customization Depth | Limited to logo/nameplate | Full customization: materials (e.g., 316L SS, Hastelloy), impeller design, voltage, seals | PL required for aggressive chemicals (e.g., H₂SO₄, NaOH) |

| Lead Time | 45-60 days (off-the-shelf) | 90-120 days (engineering validation required) | Factor 30+ days buffer for PL in project timelines |

| MOQ Flexibility | Low (500-1,000 units) | High (1,000-5,000+ units) | Negotiate phased MOQs for PL (e.g., 500-unit pilot) |

| Quality Control Risk | Medium (supplier controls specs) | High (your specs must be rigorously validated) | Mandatory: Third-party pre-shipment inspection (PSI) for PL |

| Ideal Use Case | Non-critical water transfer, generic chemicals | Petrochemicals, pharmaceuticals, high-purity processes | >85% of SourcifyChina clients opt for PL in chemical segments |

Key Insight: PL commands a 15-25% price premium but reduces lifetime failure risk by 40-60% in corrosive environments (per SourcifyChina 2025 Failure Rate Analysis).

Estimated Cost Breakdown (Per Unit | 50HP Chemical Centrifugal Pump)

Based on mid-tier 316L stainless steel construction, CE/ATEX compliance, FOB Shanghai. Excludes tariffs, logistics, and tooling.

| Cost Component | White Label (USD) | Private Label (USD) | Variance Driver |

|---|---|---|---|

| Materials | $1,150 – $1,400 | $1,450 – $1,850 | PL: Custom alloys (e.g., duplex SS), ceramic seals |

| Labor | $320 – $380 | $400 – $520 | PL: Precision welding, extended QC testing |

| Packaging | $85 – $110 | $110 – $145 | PL: Custom crating for hazardous goods shipping |

| Compliance | $60 – $80 | $95 – $130 | PL: Custom documentation, country-specific certs |

| Total Unit Cost | $1,615 – $1,970 | $2,055 – $2,645 | PL Premium: 18-22% |

Note: Material costs fluctuate ±12% with nickel/steel markets (LME-indexed). Labor costs rising at 5% CAGR in Guangdong.

MOQ-Based Price Tiers: Estimated FOB Shanghai Unit Pricing

Assumptions: 316L SS pump, 50HP, 150m³/h flow rate, standard voltage (380V/50Hz). Valid Q4 2026 – Q2 2027.

| MOQ Tier | White Label (USD/Unit) | Private Label (USD/Unit) | Cost Savings vs. MOQ 500 | Strategic Notes |

|---|---|---|---|---|

| 500 units | $1,920 – $2,150 | $2,580 – $2,870 | Baseline | Minimum viable for PL; high per-unit cost |

| 1,000 units | $1,750 – $1,940 | $2,320 – $2,560 | WL: 8.5% | PL: 10% |

| 5,000 units | $1,520 – $1,680 | $2,010 – $2,220 | WL: 20.8% | PL: 22.1% |

Critical Caveats:

– Below 500 units: Expect “prototype pricing” (+25-35% premium) due to setup costs.

– Above 5,000 units: Negotiate additional 3-5% discount, but validate supplier capacity (avoid overcommitment to Tier-2 factories).

– All prices exclude: 7.5% U.S. Section 301 tariffs, 13% Chinese VAT refund lag, ocean freight ($180-$220/unit).

SourcifyChina Strategic Recommendations

- Prioritize PL for Chemical Applications: The 15-25% premium is justified by reduced downtime risk (avg. $14k/hr in chemical plants per IHS Markit).

- MOQ Strategy: Start with 500-unit PL pilot order to validate QC, then scale to 1,000+ units. Avoid WL for pumps handling >5% concentration of corrosive agents.

- Cost Mitigation Tactics:

- Lock nickel pricing via forward contracts with suppliers.

- Consolidate packaging with other machinery orders to reduce cube.

- Require ISO 9001/14001 + API 610 certification (non-negotiable for chemical pumps).

- Supplier Vetting Focus: Audit foundry capabilities (not just assembly) – 68% of failures traced to substandard casting (SourcifyChina 2025 Audit Data).

“Procurement leaders who treat chemical pumps as commodities face 3.2x higher lifetime costs than those investing in engineered PL solutions.” – SourcifyChina Industrial Equipment Division

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | China Sourcing, De-Risked

✉️ [email protected] | 🌐 www.sourcifychina.com

Disclaimer: Estimates based on 2026 SourcifyChina supplier benchmarking (n=47 Tier-1 factories). Actual pricing subject to material markets, order specifics, and negotiation. Not a quotation.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Chemical Centrifugal Pump Supplier in China

Author: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

Selecting a reliable chemical centrifugal pump supplier in China is a high-stakes decision that directly impacts operational safety, maintenance costs, and supply chain resilience. With over 2,500 pump manufacturers and trading intermediaries operating in China, distinguishing genuine factories from trading companies—and identifying credible suppliers—is essential.

This report outlines a structured, step-by-step verification process to ensure procurement integrity, mitigate risk, and establish long-term supplier partnerships aligned with global quality and compliance standards.

1. Critical Steps to Verify a Chemical Centrifugal Pump Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Request Full Company Documentation | Confirm legal status and manufacturing scope | Ask for Business License, ISO Certifications (9001, 14001), and Product Compliance (e.g., API 610, CE, ATEX) |

| 1.2 | Conduct On-Site or Virtual Factory Audit | Validate production capabilities and infrastructure | Use third-party inspection firms (e.g., SGS, TÜV) or conduct live video audit with screen sharing of production lines |

| 1.3 | Review Equipment & Production Lines | Confirm in-house manufacturing vs. outsourcing | Verify presence of CNC machining centers, casting facilities, motor assembly, and testing rigs |

| 1.4 | Audit Quality Control Processes | Ensure adherence to international standards | Request QC documentation, material traceability records, pressure test reports, and NDT (Non-Destructive Testing) logs |

| 1.5 | Validate Export Experience | Assess logistical and compliance competence | Request export licenses, list of past international clients (with permission), and shipping documentation samples |

| 1.6 | Perform Sample Testing | Evaluate real-world performance | Order pre-production samples; test for flow rate, head pressure, material corrosion resistance, and seal integrity |

| 1.7 | Check After-Sales & Warranty Support | Ensure post-delivery reliability | Confirm availability of spare parts, technical support teams, and warranty terms (min. 12–18 months recommended) |

🔍 Recommended: Use a sourcing partner with on-ground presence in Jiangsu, Zhejiang, or Shandong—China’s core industrial clusters for pump manufacturing.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated pricing, communication gaps, and accountability issues. Key differentiators:

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of pumps | Lists only “import/export,” “sales,” or “distribution” |

| Facility Ownership | Owns land/building; shows factory address with production signage | Operates from office-only locations (e.g., business parks) |

| Production Equipment | Owns casting furnaces, CNC lathes, balancing machines, test bays | No machinery; relies on subcontractors |

| R&D Capability | Has engineering team, design drawings, product patents (check CNIPA) | Offers no customization; limited technical input |

| Lead Times | Direct control over production scheduling (typically 30–45 days) | Longer lead times due to coordination with third-party factories |

| Pricing Structure | Transparent BOM (Bill of Materials); lower MOQs possible | Higher unit pricing; MOQs often dictated by supplier |

| Website & Marketing | Features “factory tour” videos, production timelines, in-house testing | Focuses on certifications, global clients, product catalogs only |

✅ Tip: Request a live video tour during working hours. Ask to speak directly with the production manager or QC lead.

3. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., inferior stainless steel), labor exploitation, or hidden costs | Benchmark against industry averages; request material grade certifications (e.g., 316L SS) |

| Reluctance to Share Factory Address | High probability of being a trading company or unlicensed operator | Use Google Earth/Street View to verify location; require GPS coordinates |

| No ISO or Industry-Specific Certifications | Non-compliance with quality, safety, or environmental standards | Require valid API 610, ISO 9001, and CE Marking for EU shipments |

| Poor Communication or Language Barriers | Risk of misaligned specifications and delayed issue resolution | Insist on a dedicated English-speaking project manager |

| Pressure for Upfront Full Payment | Common in fraudulent or financially unstable suppliers | Use secure payment terms: 30% deposit, 70% against BL copy or L/C at sight |

| Inconsistent Product Specifications | Indicates lack of engineering control or copycat designs | Require detailed technical drawings, performance curves, and material test reports (MTRs) |

| No Third-Party Inspection Access | Hides quality or compliance issues | Contractually require pre-shipment inspection (PSI) by SGS, BV, or your internal team |

⚠️ High-Risk Regions to Monitor: Avoid suppliers from regions with poor IP enforcement or frequent export violations (e.g., certain zones in Guangdong without export licenses).

4. Best Practices for Long-Term Supplier Management

- Start with a Trial Order (1–2 units) before scaling.

- Sign an NDA and Quality Agreement outlining material specs, tolerances, and liability.

- Implement Annual Audits to ensure sustained compliance.

- Diversify Supplier Base—avoid single-source dependency.

- Use Escrow or Letter of Credit (L/C) for initial large orders.

Conclusion

Verifying a chemical centrifugal pump supplier in China requires due diligence beyond online profiles and catalogs. By systematically validating manufacturing capability, distinguishing factories from traders, and recognizing critical red flags, procurement managers can reduce risk, ensure product reliability, and build resilient supply chains.

SourcifyChina recommends leveraging local expertise, third-party audits, and structured supplier scorecards to achieve optimal sourcing outcomes in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Industrial Procurement Intelligence | China Supply Chain Advisory

📧 [email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Intelligence Report: Chemical Centrifugal Pump Procurement in China

Prepared for Global Procurement Leaders | Q1 2026 Update

The High Cost of Unverified Sourcing: Chemical Pump Procurement Risks

Global procurement managers face critical challenges when sourcing chemical centrifugal pumps from China:

– Material Compliance Failures: 68% of non-vetted suppliers use substandard alloys (e.g., 304SS instead of 316L), causing premature corrosion in acidic/alkaline environments (2025 ChemProcurement Journal).

– Certification Gaps: 41% of suppliers falsify ISO 9001/API 610 certifications, leading to customs rejections and 90+ day project delays (SourcifyChina Audit Data).

– Hidden Cost Inflation: Unvetted RFQ processes average 227 hours per sourcing cycle due to supplier qualification, sample rework, and compliance firefighting.

Why SourcifyChina’s Verified Pro List Eliminates $18,500+ in Hidden Costs Per Project

Our AI-driven verification system (patent-pending SupplierTrust™ 3.0) rigorously qualifies suppliers against 127 chemical pump-specific criteria. Here’s the operational impact:

| Procurement Phase | Unvetted Supplier Process | SourcifyChina Pro List Process | Time/Cost Saved |

|---|---|---|---|

| Supplier Qualification | 8–12 weeks (manual audits, site visits) | 72 hours (pre-verified documentation + facility video audit) | 10.5 weeks |

| Material Compliance | 3–5 sample iterations ($2,200 avg.) | First-article approval rate: 92% (certified mill test reports) | $1,980 |

| Certification Validation | 35+ hours/document chasing | Instant access to live API 610/ISO 2858/ATEX certificates | 28 hours |

| Total Project Timeline | 28–34 weeks | 16–19 weeks | 12+ weeks acceleration |

💡 Real Impact: A European specialty chemical manufacturer reduced pump procurement cycle time by 47% and avoided $217,000 in rework costs by using Pro List suppliers for their Vietnam plant expansion (Q4 2025 Case Study).

Your Strategic Advantage: The SourcifyChina Pro List Difference

Unlike generic directories, our list delivers chemical-industry-specific guarantees:

✅ Material Traceability: Blockchain-verified alloy composition logs (no “recycled steel” substitutions).

✅ Process Expertise: Suppliers with ≥5 years’ experience in chemical transfer (not water pumps).

✅ Regulatory Shield: Full REACH, TSCA, and PED compliance documentation pre-loaded.

✅ Quality Control: In-line spectrometry testing data for impeller/casing integrity.

🚀 Call to Action: Secure Your Competitive Edge in 2026

Stop paying the “China sourcing tax” in time, capital, and operational risk. Every day spent qualifying unvetted suppliers erodes your EBITDA and delays critical plant operations.

👉 Take Action in <60 Seconds:

1. Email: Send your pump specifications to [email protected] with subject line: “Pro List Request: [Your Company] – Chemical Centrifugal Pumps”.

2. WhatsApp Priority: Message +86 159 5127 6160 with “CHEM PUMP 2026” for instant access to 3 pre-qualified suppliers + 2026 pricing benchmarks.

Within 4 business hours, you will receive:

– A curated shortlist of 3–5 Pro List suppliers matching your material/process requirements

– Comparative compliance dossier (API 610 revisions, material certs, lead times)

– Exclusive 2026 chemical pump pricing index (Q1 data)

“In high-risk industrial procurement, speed without verification is recklessness. SourcifyChina delivers speed through verification.”

— Global Head of Procurement, Fortune 500 Specialty Chemicals Firm (2025 Client)

Don’t negotiate with uncertainty. Negotiate from a position of verified capability.

Contact us today to activate your risk-free supplier qualification pathway.

SourcifyChina: Where Industrial Procurement Meets Certainty™

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | All supplier data refreshed quarterly

🧮 Landed Cost Calculator

Estimate your total import cost from China.