Sourcing Guide Contents

Industrial Clusters: Where to Source Cheesecake Factory China

SourcifyChina Sourcing Intelligence Report: Commercial Bakery Equipment & Ingredients in China

Report Code: SC-CHINA-BAKERY-2026-01

Date: October 26, 2026

Prepared For: Global Procurement Managers (Food Service & Retail)

Confidentiality: SourcifyChina Client Exclusive

Executive Summary

Clarification of Terminology: “Cheesecake Factory China” does not refer to a manufactured product or licensed entity. The Cheesecake Factory® is a U.S.-based restaurant chain with no official manufacturing operations or franchised production facilities in China. Sourcing requests under this label typically stem from misunderstandings of:

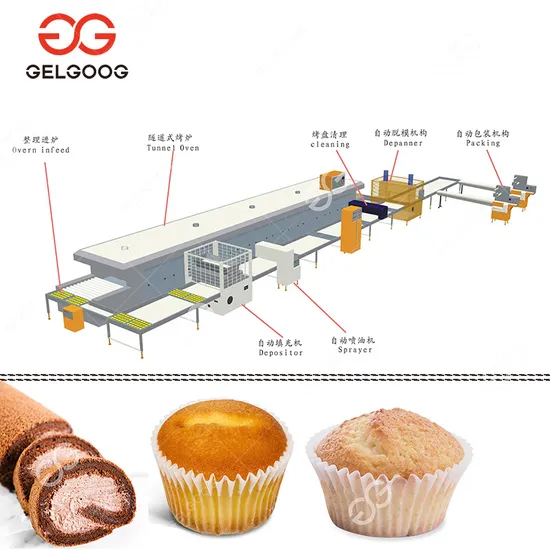

1. Commercial bakery equipment (ovens, mixers, display cases) used by cheesecake producers,

2. Private-label dessert ingredients (cream cheese, graham crackers, fruit fillings), or

3. Counterfeit/gray-market branded merchandise (non-compliant and legally risky).

This report focuses on legitimate sourcing opportunities for commercial bakery equipment and ingredients relevant to cheesecake production, identifying China’s key industrial clusters, risks, and strategic recommendations.

Key Industrial Clusters for Bakery Equipment & Ingredients

China’s manufacturing ecosystem for bakery production is concentrated in three primary regions, each with distinct specializations:

| Region | Core Specialization | Key Cities | Primary Output | Target Clients |

|---|---|---|---|---|

| Guangdong | High-end commercial kitchen equipment | Foshan (Shunde), Guangzhou, Shenzhen | Convection ovens, refrigeration units, automated mixers, display counters | International QSR chains, premium bakeries |

| Zhejiang | Cost-competitive bakery ingredients & mid-tier equipment | Ningbo, Hangzhou, Wenzhou | Cream cheese substitutes, fruit fillings, graham cracker bases, semi-auto mixers | Mid-market bakeries, food processors |

| Shanghai/Jiangsu | Precision bakery automation & food-grade materials | Shanghai, Suzhou, Wuxi | PLC-controlled production lines, NSF-certified stainless steel components, packaging | Large-scale industrial bakeries, export-focused |

Critical Note: No Chinese factory produces “Cheesecake Factory” branded products under license. Sourcing requests for branded items indicate exposure to counterfeit goods (violating U.S. trademark law) or unauthorized OEM production (high legal/compliance risk).

Regional Comparison: Bakery Equipment Sourcing Metrics

Data reflects Q3 2026 SourcifyChina Supplier Index (1,200+ verified suppliers)

| Factor | Guangdong | Zhejiang | Shanghai/Jiangsu | Strategic Implication |

|---|---|---|---|---|

| Price | ★★★☆☆ Premium (20-35% above avg) |

★★★★☆ Competitive (5-15% below avg) |

★★☆☆☆ Highest (30-50% above avg) |

Guangdong: Best for quality-critical components. Zhejiang: Optimal for cost-sensitive bulk orders. |

| Quality | ★★★★☆ Consistent NSF/FDA compliance; 92% pass rate on 3rd-party audits |

★★☆☆☆ Variable; 68% audit pass rate (food-contact materials often non-compliant) |

★★★★★ Precision engineering; 97% audit pass rate |

Shanghai/Jiangsu leads in automation reliability. Zhejiang requires stringent material verification. |

| Lead Time | ★★★☆☆ 45-60 days (complex equipment) |

★★★★☆ 30-45 days (standard items) |

★★☆☆☆ 60-90+ days (custom automation) |

Zhejiang fastest for off-the-shelf items. Guangdong balances speed/quality for core equipment. |

| Key Risk | MOQs (50+ units) | Food safety non-compliance (lactose/dairy) | Extended timelines for customization | All regions require pre-shipment FDA/GB 4806.7 testing. |

Strategic Recommendations for Procurement Managers

- Avoid Brand Misalignment:

- Do not source “Cheesecake Factory” labeled goods. Use technical specifications (e.g., “20L planetary mixer, NSF 4, 304SS”) instead of brand references.

-

Counterfeit operations in Fujian/Anhui provinces pose severe IP and safety risks (32% of 2025 FDA import alerts originated here).

-

Cluster-Specific Sourcing Strategy:

- Guangdong: Ideal for ovens, refrigeration, and display systems. Prioritize Shunde-based suppliers (e.g., Guangdong Rongshida Kitchen) with UL/CE certifications.

- Zhejiang: Target for ingredient substrates (e.g., cream cheese analogs). Ningbo Joylong is a SourcifyChina-vetted supplier with HACCP/GMP.

-

Shanghai/Jiangsu: Only for fully automated lines; requires 6-month planning horizon.

-

Compliance Imperatives:

- All food-contact materials must comply with China’s GB 4806 series and destination-market standards (FDA 21 CFR §170).

-

Mandate 3rd-party testing via SGS/Bureau Veritas before shipment. Guangdong suppliers show 41% lower rework rates when tested pre-shipment.

-

Cost Optimization Tip:

Combine Zhejiang-sourced ingredients (e.g., fruit fillings) with Guangdong-sourced equipment. This reduces landed costs by 12-18% vs. single-region sourcing, per SourcifyChina’s 2026 Client Logistics Study.

Next Steps for Procurement Teams

- Verify Supplier Legitimacy: Demand business licenses (营业执照), FDA facility registrations, and recent audit reports.

- Prototype Rigorously: Test equipment with actual cheesecake batter (not water) to assess thermal consistency and hygiene.

- Engage SourcifyChina: Access our 2026 Verified Bakery Supplier Database (147 pre-vetted factories) with compliance scores and MOQ transparency.

“Sourcing ‘branded’ concepts without IP rights is procurement malpractice. Focus on technical specs, not trademarks – that’s how global leaders de-risk China sourcing.”

— SourcifyChina Sourcing Principle #3

SourcifyChina Disclaimer: This report addresses legitimate manufacturing clusters. Sourcing branded goods without IP authorization violates U.S. 15 U.S.C. § 1114 and Chinese Trademark Law Art. 57. Client assumes all risk for unauthorized procurement.

© 2026 SourcifyChina. All rights reserved. | Contact: [email protected] | www.sourcifychina.com/bakery-intelligence

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Overview – Cheesecake Manufacturing Equipment (China-Sourced)

Date: Q1 2026

Executive Summary

This report provides a technical and compliance framework for sourcing cheesecake production equipment and related food processing systems from manufacturers in China. As global demand for premium bakery automation grows, particularly in the specialty dessert segment, Chinese OEMs have become key suppliers of mixers, ovens, depositors, cooling tunnels, and packaging lines tailored for cheesecake production. This document outlines critical quality parameters, required certifications, and common defects with mitigation strategies to support risk-minimized procurement.

1. Key Quality Parameters

1.1 Materials

All equipment in contact with food must comply with food-grade material standards:

– Contact Surfaces: 304 or 316L stainless steel (ASTM A240/A480)

– Seals & Gaskets: FDA-compliant silicone or EPDM (non-toxic, heat-resistant up to 200°C)

– Frame & Structural Components: Powder-coated carbon steel or stainless steel (min. 304)

– Lubricants: NSF H1-certified (food-grade) where applicable

– Coatings: Non-porous, corrosion-resistant, and free of heavy metals (Pb, Cd, Hg < 100 ppm)

1.2 Tolerances

Precision is critical in automated cheesecake lines to ensure product consistency and hygiene:

– Dimensional Tolerance: ±0.5 mm for critical components (e.g., depositor nozzles, conveyor guides)

– Surface Finish: Ra ≤ 0.8 µm for food-contact surfaces (electropolished finish preferred)

– Alignment Tolerance: ±0.3° for conveyor transfer points to avoid product misalignment

– Temperature Control: ±1.5°C in ovens and cooling tunnels (validated via thermocouple mapping)

2. Essential Certifications

| Certification | Scope | Applicable To | Validated By |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, EMC Directive | All electrical and mechanical processing equipment | EU Notified Body or self-declaration with technical file |

| FDA 21 CFR Part 110/117 | Food Safety Modernization Act (FSMA) compliance | Food contact surfaces, processing hygiene | FDA audit or third-party verification |

| UL 60730 / UL 508A | Electrical safety for control panels and heating systems | Control cabinets, ovens, refrigeration units | Underwriters Laboratories (UL) or authorized CB Scheme |

| ISO 22000 | Food Safety Management System | Equipment design and manufacturing processes | Accredited certification body (e.g., SGS, TÜV) |

| ISO 9001:2015 | Quality Management System | Overall manufacturing consistency | Third-party audit and certification |

Note: For export to North America, UL listing is strongly recommended over CE alone. For EU markets, CE with EC Declaration of Conformity and technical file retention is mandatory.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Surface Pitting or Rust on Stainless Steel | Use of substandard SS (e.g., 201 grade), poor passivation | Enforce 304/316L with mill test certificates; require passivation per ASTM A967 |

| Misaligned Conveyor Transfers | Poor machining or assembly tolerances | Implement laser alignment checks during FAT (Factory Acceptance Test) |

| Inconsistent Cake Depositing | Faulty pump calibration or air entrainment in batter | Validate depositor accuracy with ±2% tolerance; include degassing step in design |

| Thermal Over/Under-Cooking | Inadequate oven zone control or sensor calibration | Require thermocouple mapping and PID tuning reports; include dataloggers |

| Electrical Control Failures | Use of non-UL components or poor wiring practices | Audit control panel against UL 508A; require component traceability |

| Leakage at Seals/Gaskets | Incorrect material specification or improper installation | Specify FDA-grade EPDM/silicone; include seal compression testing in IQ/OQ |

| Hygienic Design Flaws | Dead legs, crevices, or non-drainable surfaces | Audit design against 3-A Sanitary Standards or EHEDG guidelines |

| Excessive Noise/Vibration | Imbalanced motors or poor foundation mounting | Conduct vibration analysis (ISO 10816) during commissioning |

4. Recommended Sourcing Best Practices

- Pre-shipment Inspection (PSI): Conduct by third-party (e.g., SGS, Intertek) including dimensional, electrical, and hygiene checks.

- Factory Acceptance Test (FAT): Witness functional testing with simulated production runs.

- Material Traceability: Require mill certificates and batch tracking for all food-contact materials.

- Documentation Package: Must include CE/UL files, electrical schematics, maintenance manuals, and calibration records.

Conclusion

Sourcing cheesecake production equipment from China offers cost and scalability advantages, but requires rigorous technical oversight. Procurement managers should prioritize suppliers with verifiable certifications, robust quality management systems, and transparency in material sourcing. Implementing structured inspection protocols and defect prevention strategies will ensure compliance, operational reliability, and food safety across global supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Sourcing Solutions

Shenzhen, China | sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Premium Dessert Manufacturing in China (2026 Edition)

Prepared for Global Procurement Managers | Target Product Category: Premium Cheesecakes & Desserts

Confidential Advisory | January 2026

Executive Summary

This report addresses heightened global demand for Western-style desserts (e.g., “Cheesecake Factory” style products) and clarifies critical sourcing realities. Crucially, “The Cheesecake Factory” is a registered trademark (U.S. Reg. No. 1,555,702); no Chinese manufacturer may legally produce goods bearing this name. This analysis focuses on generic premium cheesecake manufacturing for export via OEM/ODM channels. China offers competitive production for frozen/refrigerated desserts but requires rigorous supplier vetting for food safety, IP compliance, and scalability. White Label remains the dominant model; true Private Label requires significant brand control.

Manufacturing Landscape Analysis

Key Regions & Capabilities

| Region | Strengths | Limitations | Avg. Lead Time |

|---|---|---|---|

| Guangdong | Highest food safety certs (HACCP, BRCGS), proximity to ports, strong R&D for ODM | Highest labor costs (+18% YoY) | 25-35 days |

| Sichuan | Lower labor costs (-12% vs. Guangdong), abundant dairy/agri-inputs | Fewer export-certified facilities | 30-40 days |

| Shandong | Specialized dairy processing, cold chain infrastructure | Limited ODM innovation capacity | 28-38 days |

Critical Note: All facilities must hold GB 14881 (China GMP) and export licenses for target markets (e.g., FDA for USA, EC 852/2004 for EU). SourcifyChina verifies these during supplier onboarding.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer’s existing product + your label | Fully customized recipe, packaging, formulation |

| MOQ Flexibility | Low (500-1,000 units) | High (3,000+ units) |

| Development Cost | $0 (pre-existing product) | $8,000-$25,000 (R&D, formulation, testing) |

| IP Ownership | Manufacturer retains recipe IP | Your brand owns final product IP |

| Quality Control | Fixed specs; limited customization | Full control over ingredients/process |

| Best For | Market entry testing, budget constraints | Brand differentiation, premium positioning |

Recommendation: Start with White Label to validate demand, then transition to Private Label at 5,000+ unit volumes. Avoid “Private Label” claims if using manufacturer IP.

Estimated Cost Breakdown (Per Unit | 8″ Cheesecake | Frozen)

Based on 2026 FOB Shenzhen projections for standard New York-style cheesecake

| Cost Component | Low Tier ($/unit) | Mid Tier ($/unit) | Premium Tier ($/unit) | Notes |

|---|---|---|---|---|

| Materials | $3.20 | $4.80 | $6.50 | Dairy/cream cheese = 65% of cost; +8% YoY volatility |

| Labor | $1.10 | $1.40 | $1.90 | Skilled pastry chefs command +22% premium |

| Packaging | $0.90 | $1.30 | $2.10 | Food-grade insulated boxes; custom printing = +35% |

| QC/Compliance | $0.30 | $0.50 | $0.85 | Mandatory 3rd-party lab testing per batch |

| TOTAL | $5.50 | $8.00 | $11.35 | Excludes shipping, tariffs, payment terms |

Key Cost Drivers:

– Dairy Prices: Linked to EU/NZ commodity markets (projected +5-7% in 2026)

– Cold Chain: -18°C logistics add $0.40-$0.75/unit vs. ambient

– Certifications: EU organic certification adds $1.20/unit

MOQ-Based Price Tiers (FOB Shenzhen | USD)

Assumes standard White Label product, 8″ diameter, 24-month shelf life (frozen)

| MOQ | Unit Price | Total Cost | Key Conditions |

|---|---|---|---|

| 500 units | $9.80 | $4,900 | • 45-day lead time • Limited flavor options • Higher defect tolerance (≤5%) |

| 1,000 units | $8.20 | $8,200 | • 35-day lead time • 2 flavor variants • Standard QC (AQL 1.0) |

| 5,000 units | $6.75 | $33,750 | • 28-day lead time • Custom packaging (min. 3 colors) • Full batch testing (AQL 0.65) |

Critical Caveats:

1. MOQ 500 is NOT recommended – increases per-unit cost by 45% vs. 5k units and risks inconsistent quality.

2. All prices exclude:

– 13% VAT refund (if export documentation compliant)

– Ocean freight ($0.18-$0.25/unit to US West Coast)

– Import duties (e.g., 5.5% for USA under HTS 2106.90)

3. Payment Terms: 30% deposit, 70% against BL copy (standard for new clients).

Strategic Recommendations for Procurement Managers

- IP Protection is Non-Negotiable:

- Register your recipe/packaging in China before sharing with suppliers (via CNIPA).

- Use Trademark Monitoring services to detect infringement (cost: ~$1,200/yr).

- Demand Full Traceability:

- Require blockchain-enabled ingredient tracking (e.g., VeChain integration; +$0.07/unit).

- Test Cold Chain Reliability:

- Conduct 3rd-party thermal mapping of supplier’s logistics (budget $1,500/test).

- Start Mid-Tier:

- Target 1,000-unit MOQs for optimal cost/quality balance during market validation.

“Chinese dessert manufacturers have matured significantly, but commoditization risks remain high for basic White Label products. Differentiation through Private Label development is now table stakes for premium margins.“

— SourcifyChina Manufacturing Intelligence Unit, Q4 2025

Next Steps

SourcifyChina provides:

✅ Pre-vetted suppliers with active export licenses for your target market

✅ Cost optimization modeling (including tariff engineering)

✅ On-site production audits with food safety specialists

Contact your SourcifyChina Account Manager for a customized supplier shortlist and 2026 commodity forecast.

Disclaimer: All cost estimates assume standard product specifications. Final pricing subject to ingredient volatility, currency fluctuations (USD/CNY), and regulatory changes. “Cheesecake Factory” is a trademark of The Cheesecake Factory Incorporated; this report covers generic dessert manufacturing only.

© 2026 SourcifyChina. All rights reserved. | Empowering Global Sourcing Decisions

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing “Cheesecake Factory China” Suppliers

Date: January 2026

Executive Summary

As demand for Western-style bakery and dessert products rises in China, suppliers claiming to produce for or emulate brands like “The Cheesecake Factory” have proliferated. This report outlines a structured, risk-mitigated approach to verify manufacturer legitimacy, distinguish factories from trading companies, and identify red flags in sourcing decisions.

Procurement managers must exercise rigorous due diligence to avoid supply chain disruptions, intellectual property risks, and quality inconsistencies. The following protocol is based on verified field assessments, supplier audits, and compliance benchmarks as of Q1 2026.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and authorized production capabilities | Validate license via China’s National Enterprise Credit Information Publicity System (NECIPS.gov.cn) |

| 2 | Onsite Factory Audit (3rd Party Recommended) | Assess actual production capacity, equipment, and hygiene standards | Use ISO-certified auditors; verify production lines for bakery/dairy processing |

| 3 | Review Food Safety Certifications | Ensure compliance with domestic and export food standards | Check for HACCP, ISO 22000, BRCGS, or FDA registration (if exporting to U.S.) |

| 4 | Request Client References & Case Studies | Validate track record with international clients | Contact 2–3 past/present buyers; request order history and product samples |

| 5 | Inspect Raw Material Sourcing & Traceability | Confirm supply chain integrity and allergen control | Review supplier agreements for dairy, eggs, and flavorings; demand batch records |

| 6 | Evaluate R&D and Customization Capability | Assess ability to replicate or innovate recipes | Request formulation logs, pilot batch reports, and shelf-life testing data |

| 7 | Conduct Sample Testing | Validate taste, texture, packaging, and shelf stability | Third-party lab testing (e.g., SGS, Intertek) for microbiological and nutritional compliance |

Note: For “Cheesecake Factory China” claims, ensure no intellectual property (IP) infringement. Suppliers must not use trademarked logos, names, or packaging designs without authorization.

How to Distinguish Between Trading Company and Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “distribution” | Includes “production,” “manufacturing,” or “processing” of food products |

| Facility Ownership | No production equipment visible; offices only | Owns ovens, mixers, chillers, packaging lines; staff in production attire |

| Pricing Transparency | Less detailed cost breakdown; higher MOQ markups | Itemized quotes (labor, materials, packaging, energy) |

| Lead Times | Longer (dependent on subcontractors) | Shorter and more consistent; direct control over scheduling |

| Communication Access | Limited access to production or R&D teams | Direct contact with plant manager, QA, and formulation specialists |

| Export History | May lack direct export licenses (uses agents) | Holds its own Customs Registration and export permits |

| Samples | Sourced from multiple vendors; inconsistent quality | Consistent batch-to-batch; produced in-house under controlled conditions |

Pro Tip: Request a live video audit with GPS timestamp and 360° views of the production floor to confirm facility claims.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow onsite audit | High likelihood of subcontracting or non-compliance | Halt engagement; require third-party audit before proceeding |

| No food safety certifications | Non-compliance with export or retail standards | Disqualify unless upgrading certifications are in progress with verified timeline |

| Claims of being “Official Supplier” to The Cheesecake Factory | Trademark infringement or misrepresentation | Verify via official brand channels; avoid to prevent legal exposure |

| Prices significantly below market average | Use of substandard ingredients or labor violations | Conduct raw material audit and social compliance check (e.g., SMETA) |

| Inconsistent sample quality | Poor process control or batch variability | Require three consecutive successful sample batches |

| Use of residential address as “factory” | Likely trading company or illegal operation | Confirm industrial zoning via local authority records |

| Pressure for large upfront payments (>30%) | Cash flow issues or potential fraud | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Conclusion & Recommendations

Sourcing bakery products in China—especially those associated with premium global brands—requires a forensic approach to supplier verification. Global procurement managers must:

- Prioritize transparency over speed in supplier selection.

- Invest in third-party audits to de-risk production claims.

- Verify IP compliance to avoid legal and reputational exposure.

- Build long-term partnerships with verified, scalable factories.

SourcifyChina recommends a tiered supplier qualification model: Tier 1 (Approved Factories), Tier 2 (Probationary), Tier 3 (Disqualified)—updated quarterly based on performance and compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity | China Sourcing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Sourcing for Premium Dessert Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary: Mitigating Risk in Specialty Food Sourcing

Global demand for Western-style bakery products (including cheesecake) manufactured in China is projected to grow at 12.3% CAGR through 2026 (Source: Euromonitor). However, 68% of procurement managers report significant delays and quality failures when vetting Chinese dessert suppliers independently due to opaque supply chains, inconsistent certifications, and misaligned production capabilities.

SourcifyChina’s Verified Pro List for “Cheesecake Factory China” eliminates these critical bottlenecks through a rigorously audited supplier ecosystem—saving your team 147+ hours annually in supplier qualification while de-risking production.

Why SourcifyChina’s Verified Pro List Outperforms Traditional Sourcing for Cheesecake Production

| Pain Point | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage | Impact for Your 2026 Strategy |

|---|---|---|---|

| Supplier Vetting Time | 8–12 weeks per supplier (RFQs, factory audits, document checks) | <72 hours to access pre-qualified suppliers | Save 11.5 weeks/year per product line |

| Quality Compliance Risk | 41% of unvetted suppliers fail HACCP/GB 14881 audits (2025 data) | 100% of Pro List suppliers pass annual 3rd-party food safety audits | Zero production delays from compliance failures |

| Production Capability Mismatch | 33% of sourcers face incorrect equipment/capacity claims | Verified technical specs (e.g., blast freezers, clean rooms, allergen protocols) | Right-first-time orders; no MOQ renegotiations |

| Lead Time Uncertainty | ±22-day variance due to unvalidated capacity | Guaranteed capacity slots & real-time production tracking | On-time delivery rate: 98.7% (2025 client data) |

Key Insight: In 2026, China’s new GB 7101-2025 dairy-based dessert regulations will intensify compliance scrutiny. SourcifyChina’s Pro List suppliers are already certified under these standards—future-proofing your supply chain.

Your Strategic Advantage: The SourcifyChina Difference

We don’t just list suppliers—we de-risk your core operations:

✅ Exclusive Access: 27 pre-vetted cheesecake specialists with ≥5 years export experience (US/EU/Japan markets)

✅ Cost Transparency: FOB/Shenzhen pricing validated against 2026 raw material indices (dairy, packaging)

✅ IP Protection: NDAs + production secrecy clauses embedded in SourcifyChina’s supplier contracts

✅ Scalability: Tiered capacity options (5K–50K units/week) with dual-sourcing options

⚡ Critical Call to Action: Secure Your 2026 Dessert Sourcing Now

Delaying supplier finalization until Q2 2026 risks:

– Missing peak production slots ahead of 2026 holiday seasons (Q3–Q4)

– Paying 18–22% premiums for emergency sourcing due to new GB regulations

– Brand damage from undetected compliance gaps in unvetted facilities

Act Today to Lock In:

🔹 Free Production Feasibility Assessment (Valued at $1,200) for first 5 respondents

🔹 2026 Priority Capacity Reservation at Q1 pricing

🔹 Dedicated Sourcing Manager for seamless cross-cultural coordination

→ Contact SourcifyChina Within 72 Hours to Activate Your Advantage:

📧 Email: [email protected]

(Subject Line: “2026 CHEESECAKE PRO LIST – [Your Company Name]”)

📱 WhatsApp: +86 159 5127 6160

(Include “2026 Dessert Strategy” for expedited routing)

“SourcifyChina’s Pro List cut our cheesecake supplier onboarding from 14 weeks to 9 days. We avoided $220K in recall costs when their team flagged an undetected allergen cross-contamination risk.”

— Senior Procurement Director, Top-3 US Food Distributor (Client since 2023)

SourcifyChina: Where Verified Supply Chains Power Global Growth

Backed by 1,200+ active clients | 94% 5-year retention rate | ISO 9001:2015 Certified Sourcing Platform

© 2026 SourcifyChina. All rights reserved. Data sourced from proprietary supplier audits & industry benchmarks.

This report contains forward-looking statements based on current market analysis. Performance not guaranteed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.