The global cheese market is experiencing robust growth, driven by rising demand for dairy-based products across foodservice, retail, and convenience sectors. According to Mordor Intelligence, the market was valued at approximately USD 135 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2029. Increasing consumer preference for high-protein diets, innovation in cheese varieties, and expanding distribution networks—particularly in emerging economies—are key drivers fueling this expansion. As competition intensifies, a handful of manufacturers have risen to the top through scale, innovation, and global reach. Based on market presence, production capacity, and brand influence, the following list highlights the ten most influential cheese manufacturers shaping the industry today.

Top 10 Cheese Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Grande Cheese

Domain Est. 1996

Website: grandecheese.com

Key Highlights: We are an authentic Italian cheese manufacturer based in Wisconsin that exclusively crafts fine cheeses for Independent pizzerias and Italian restaurant owners….

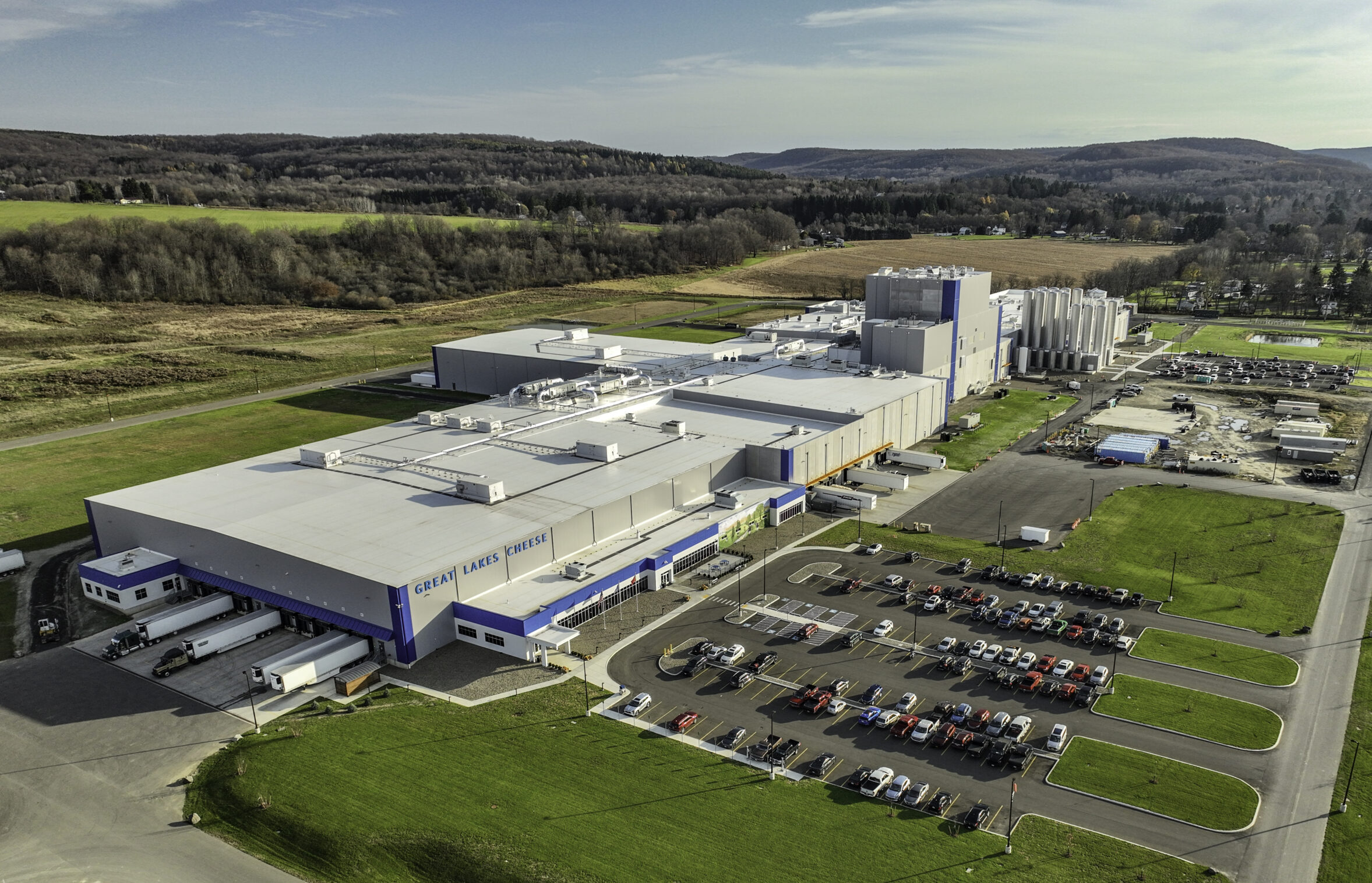

#2 Great Lakes Cheese

Domain Est. 1998

Website: greatlakescheese.com

Key Highlights: Great Lakes Cheese is an award-winning, premier manufacturer and packager of natural and processed bulk, shredded, and sliced cheeses….

#3 New England Cheesemaking Supply Company

Domain Est. 1996

#4 Wisconsin Cheese from The Cheese State ! We Dream in Cheese …

Domain Est. 1998

Website: wisconsincheese.com

Key Highlights: We’ve been making cheese since before Wisconsin was even a state. Our cheesemaking heritage goes back more than 180 years combining art and science….

#5 Schreiber Foods

Domain Est. 1999

Website: schreiberfoods.com

Key Highlights: Schreiber Foods is a customer-brand leader in cream cheese, natural cheese, process cheese, beverages and yogurt….

#6 Forever Cheese

Domain Est. 2000

Website: forevercheese.com

Key Highlights: At Forever Cheese, we import exceptional cheeses and specialty foods from Italy, Spain, Portugal, Croatia, and Switzerland. We offer a wide selection of ……

#7 Yancey’s Fancy New York’s Artisan Cheese

Domain Est. 2002

Website: yanceysfancy.com

Key Highlights: Creating distinctly delicious cheeses is our passion and we’ve reached back to our traditional artisan roots, utilizing unique cultures and time-honored ……

#8 Borden® Cheese

Domain Est. 2005

Website: bordencheese.com

Key Highlights: Borden® Cheese brings wholesome products and tasty recipes to your family table, lunch or snack time, because life is just Better With Borden….

#9 Schuman Cheese

Domain Est. 2015

Website: schumancheese.com

Key Highlights: Supplier to the industry’s most trusted food businesses. Importing. Our team of experts hand selects the best cheeses from around the globe. Cheese Making. We ……

#10 Lactalis American Group

Domain Est. 2009

Website: lactalisamericangroup.com

Key Highlights: We are proud to be part of a third-generation, family-owned company that is passionate about bringing you the world’s best dairy products….

Expert Sourcing Insights for Cheese

H2 2026 Market Trends for the Global Cheese Industry

The global cheese market is poised for dynamic transformation in H2 2026, shaped by evolving consumer preferences, technological advancements, supply chain adaptations, and sustainability imperatives. Key trends are expected to drive innovation, market segmentation, and competitive strategies across regions.

1. Accelerated Demand for Plant-Based and Alternative Cheeses

By H2 2026, plant-based cheese is forecast to capture over 8% of the global cheese market, driven by heightened health consciousness, environmental concerns, and improved taste/texture technologies. Major dairy companies (e.g., Danone, Lactalis) are expected to expand hybrid portfolios, launching fermented almond, oat, and cashew-based products with cleaner labels and enhanced meltability. Fermentation-derived dairy proteins (precision fermentation) will gain traction, offering lactose-free, animal-free cheeses with authentic flavor profiles.

2. Premiumization and Functional Cheese Offerings

Consumers are increasingly seeking value-added cheese products. In H2 2026, expect growth in functional cheeses enriched with probiotics, omega-3s, plant sterols, and high-quality protein. Artisanal and region-specific cheeses (e.g., AOC-protected European varieties, U.S. craft aged cheddars) will continue to command premium pricing, supported by storytelling and traceability. The “clean label” movement will push manufacturers to eliminate artificial additives and embrace natural cultures and traditional aging methods.

3. Sustainability and Carbon-Neutral Dairy Initiatives

Environmental accountability will become a competitive differentiator. Leading dairy cooperatives and cheese producers (e.g., Arla, Fonterra) are projected to announce carbon-neutral cheese lines by Q3 2026, leveraging regenerative agriculture, methane-reducing feed additives, and renewable energy in processing. Packaging innovations—such as compostable films and reusable containers—will be adopted more widely in response to EU and North American regulatory pressures.

4. Supply Chain Resilience and Regionalization

Ongoing geopolitical tensions and climate volatility will drive regionalization of cheese production and distribution. North America and Europe will focus on local sourcing to mitigate import dependency, while emerging markets in Asia-Pacific (particularly China and India) will expand domestic dairy infrastructure. Blockchain traceability will become standard for premium export cheeses, enhancing food safety and consumer trust.

5. E-Commerce and Direct-to-Consumer (DTC) Expansion

Online sales of specialty and subscription-based cheese boxes will grow at a CAGR of 15% through 2026. In H2, expect increased investment in digital marketing, personalized curation, and AI-driven recommendation engines by both artisanal brands and mass-market players. Partnerships with gourmet food platforms (e.g., Goldbelly, Murray’s) will expand reach beyond traditional retail.

6. Flavor Innovation and Global Fusion

Culinary globalization will fuel demand for bold, ethnic-inspired cheese varieties. H2 2026 will see rising popularity of spicy queso fresco, harissa-infused feta, wasabi-mozzarella, and umami-rich fermented cheeses. Collaborations between dairy producers and celebrity chefs will amplify innovation and drive social media engagement.

Conclusion

The second half of 2026 will mark a pivotal phase in the cheese industry’s evolution—balancing tradition with innovation, indulgence with responsibility. Companies that prioritize sustainability, transparency, and consumer-centric product development will lead the market, while those slow to adapt risk losing share in an increasingly competitive and conscious landscape.

Common Pitfalls Sourcing Cheese (Quality, IP)

Sourcing cheese, especially for commercial use or premium offerings, involves navigating various challenges related to both quality consistency and intellectual property (IP) protection. Failing to address these pitfalls can result in compromised product standards, legal risks, and reputational damage.

Quality-Related Pitfalls

Inconsistent Maturation and Aging

Cheese quality heavily depends on precise aging conditions—temperature, humidity, and time. Sourcing from producers without strict environmental controls can lead to batch inconsistencies in flavor, texture, and aroma, undermining customer expectations.

Variable Milk Source and Seasonality

The quality of cheese is directly influenced by the milk used, which can vary by season, animal diet, and region. Sourcing without clear specifications on milk origin or seasonal adjustments may result in unpredictable taste and texture profiles.

Poor Cold Chain Management

Cheese is highly perishable and sensitive to temperature fluctuations. Breaks in the cold chain during transport or storage can accelerate spoilage, encourage microbial growth, and degrade sensory qualities, especially in soft or fresh cheeses.

Lack of Traceability and Transparency

Without clear traceability from farm to table, it becomes difficult to verify quality claims (e.g., grass-fed, organic, artisanal). This opacity increases the risk of receiving adulterated or substandard products.

Overlooking Sensory Evaluation

Relying solely on lab tests or supplier claims without regular sensory analysis (taste, smell, texture) can result in the acceptance of cheeses that meet technical standards but fail on organoleptic quality.

Intellectual Property-Related Pitfalls

Misuse of Protected Designations of Origin (PDOs)

Cheeses like Parmigiano Reggiano, Roquefort, or Gorgonzola are protected under EU and international law. Sourcing imitations labeled deceptively (e.g., “Parmesan-style”) risks legal action, customs seizures, and consumer mistrust.

Unauthorized Use of Brand Names and Logos

Using names, packaging, or branding that resemble famous cheeses—even unintentionally—can lead to trademark infringement claims. This is especially risky when private-labeling or repackaging.

Failure to Verify Authenticity Documentation

Importers and buyers may assume certifications are valid without verifying them with official registries (e.g., EU’s DOOR database). Counterfeit certificates are common, leading to unintentional IP violations.

Sourcing from Unauthorized Producers

Some PDO/PGI cheeses can only be produced by licensed dairies in specific regions. Sourcing from non-licensed suppliers—even if the product tastes similar—constitutes IP infringement and misrepresentation.

Inadequate Contracts Addressing IP Rights

When developing proprietary blends or private-label cheeses, failing to clearly define IP ownership in supplier agreements can result in disputes over recipes, branding, or distribution rights.

Avoiding these pitfalls requires due diligence, clear specifications, legal awareness, and strong supplier relationships—all essential to ensuring both superior quality and compliance with intellectual property standards.

Logistics & Compliance Guide for Cheese

Cheese, as a perishable and highly regulated food product, requires careful handling throughout the supply chain to ensure safety, quality, and regulatory compliance. This guide outlines key considerations for the logistics and compliance of cheese from production to distribution.

Temperature Control & Cold Chain Management

Cheese is sensitive to temperature fluctuations, which can affect texture, flavor, and microbial safety. Maintaining a consistent cold chain is essential.

- Chilled Storage: Most cheeses must be stored between 2°C and 8°C (35°F–46°F). Hard and semi-hard cheeses are more stable, while soft and fresh cheeses require stricter temperature control.

- Refrigerated Transport: Use refrigerated trucks or containers with calibrated temperature monitoring. Pre-cool vehicles before loading.

- Temperature Monitoring: Employ data loggers or real-time GPS temperature tracking to ensure compliance during transit.

- Avoid Freezing: Freezing can damage cheese structure, especially for soft varieties like Brie or Mozzarella.

Packaging Requirements

Proper packaging preserves quality, prevents contamination, and extends shelf life.

- Vacuum Sealing: Used for hard and semi-hard cheeses to limit mold growth and oxidation.

- Modified Atmosphere Packaging (MAP): Extends shelf life by adjusting internal gas composition (e.g., high CO₂ for mold inhibition).

- Primary vs. Secondary Packaging: Primary packaging should be food-grade and moisture-resistant. Secondary packaging (e.g., cardboard boxes) must protect against physical damage.

- Labeling: Include product name, weight, ingredients, allergens (especially milk), country of origin, storage conditions, use-by date, and batch/lot number.

Regulatory Compliance

Cheese is subject to strict food safety and import/export regulations depending on the region.

United States (FDA & USDA)

- Pasteurization: Most cheeses sold in the U.S. must be made from pasteurized milk unless aged over 60 days (per FDA 21 CFR 1240.61).

- Grade Standards: Voluntary USDA grading (e.g., Grade A) verifies quality, flavor, and appearance.

- FSMA (Food Safety Modernization Act): Requires hazard analysis and risk-based preventive controls (HARPC), traceability, and sanitary transportation practices (Sanitary Transport Rule).

European Union (EU)

- Hygiene Regulations (EC No 852/2004 & 853/2004): Mandate HACCP-based controls, traceability, and hygiene standards in production and handling.

- Protected Designation of Origin (PDO): Regulates traditional cheeses like Parmigiano Reggiano or Roquefort; strict geographical and production rules apply.

- CE Marking: Required for pre-packed cheeses indicating compliance with EU food law.

International Trade Considerations

- Import Permits: Required by many countries; often include certification of origin, production method, and veterinary inspection.

- Veterinary Certificates: Issued by the exporting country’s authority confirming compliance with health standards.

- Customs Documentation: Include commercial invoice, packing list, bill of lading, and phytosanitary or health certificate if required.

Shelf Life & Rotation

- Shelf Life Variability: Fresh cheeses (e.g., ricotta) last 1–2 weeks; hard cheeses (e.g., aged cheddar) can last several months when properly stored.

- FIFO (First In, First Out): Critical for inventory management to prevent spoilage and ensure freshness.

- Use-by vs. Best-before Dates: Clearly distinguish on labels. Use-by dates are mandatory for perishable cheeses.

Handling & Hygiene

- Clean Handling Practices: Staff must follow hygiene protocols—gloves, sanitized tools, and no bare-hand contact.

- Cross-Contamination Prevention: Separate raw and ready-to-eat cheeses; avoid shared cutting boards or knives without cleaning.

- Pest Control & Facility Sanitation: Regular audits and cleaning schedules are mandatory under food safety regulations.

Transportation & Distribution

- Load Segregation: Separate cheese from non-food items and strong-smelling goods (e.g., fish, cleaning agents) to prevent odor absorption.

- Load Stability: Secure packaging to prevent shifting and damage during transit.

- Delivery Timeframes: Minimize transit time, especially for fresh cheeses; prioritize direct routes and reduce handling.

Traceability & Recall Preparedness

- Batch Tracking: Maintain records of batch numbers, production dates, and distribution points.

- One-Up, One-Down Traceability: Know your immediate supplier and customer for rapid recall response.

- Recall Plan: Develop and test a recall protocol in line with FSMA or EU General Food Law (Regulation EC No 178/2002).

Special Considerations for Artisanal & Raw Milk Cheeses

- Aging Requirements: In the U.S., raw milk cheeses must be aged at least 60 days at ≥35°F (1.7°C).

- Labeling: Clearly state “Made from Raw Milk” where required.

- Microbial Testing: Frequent testing for pathogens (e.g., Listeria monocytogenes, E. coli) is recommended.

Conclusion

Successful cheese logistics hinge on strict temperature control, compliant packaging, adherence to regional and international regulations, and robust traceability systems. Whether distributing domestically or internationally, proactive compliance ensures product safety, extends shelf life, and maintains consumer trust. Regular staff training and audits are essential to uphold standards across the supply chain.

In conclusion, selecting the right cheese supplier is a critical decision that impacts product quality, cost-efficiency, consistency, and customer satisfaction. After thorough evaluation of potential suppliers based on criteria such as product quality, food safety certifications, reliability, pricing, sustainability practices, and ability to meet volume and delivery requirements, [insert preferred supplier name] emerges as the most suitable partner. Their strong reputation for high-quality artisanal and/or specialty cheeses, compliance with food safety standards (e.g., HACCP, ISO), consistent supply chain, and commitment to ethical sourcing align well with our brand values and operational needs. By establishing a long-term partnership with this supplier, we can ensure a stable, scalable, and premium cheese supply that supports our business goals and enhances customer trust. Ongoing performance reviews and open communication will further strengthen the relationship and allow for continuous improvement.