Sourcing Guide Contents

Industrial Clusters: Where to Source Cheap Greenhouse From China Factory

SourcifyChina Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Cheap Greenhouses from China Factories

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

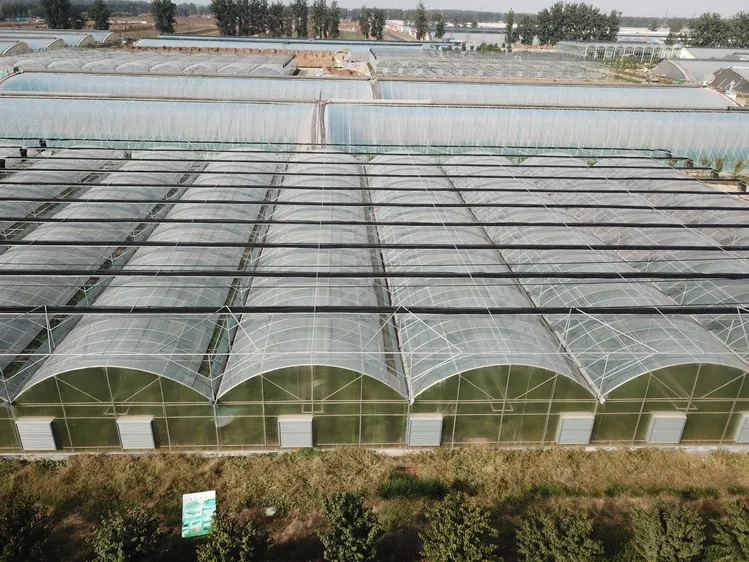

China remains the world’s leading exporter of agricultural infrastructure, including cost-effective greenhouse solutions tailored for small-scale farming, commercial horticulture, and urban agriculture. This report provides a comprehensive market analysis for global procurement managers seeking to source low-cost greenhouses directly from Chinese manufacturers.

The term “cheap greenhouse” typically refers to lightweight, modular, and easily assembled structures made from galvanized steel or aluminum frames with polyethylene (PE) or polycarbonate sheeting. These are commonly used in seasonal crop cultivation, seedling propagation, and climate-controlled agriculture in emerging markets and budget-conscious operations.

This report identifies the key industrial clusters producing affordable greenhouse systems, evaluates regional strengths, and provides a comparative analysis of major manufacturing provinces based on price, quality, and lead time—three critical KPIs in global procurement decision-making.

Key Industrial Clusters for Greenhouse Manufacturing in China

China’s greenhouse manufacturing is concentrated in several coastal and eastern provinces, where industrial infrastructure, supply chain maturity, and export logistics are well-developed. The primary clusters include:

1. Shandong Province

- Core Cities: Qingzhou, Jinan, Weifang

- Specialization: Mass production of galvanized steel frame greenhouses with PE film covering.

- Market Position: Dominates the low-cost greenhouse segment; supplies >40% of China’s domestic and export volume in this category.

- Key Advantage: Proximity to agricultural hubs and raw material suppliers (steel, plastics).

2. Jiangsu Province

- Core Cities: Changzhou, Xuzhou, Nantong

- Specialization: Mid-range to premium modular greenhouses with polycarbonate and automated ventilation.

- Market Position: Strong in export-grade structures with better durability; slightly higher price point.

- Key Advantage: High manufacturing standards and integration with smart agriculture tech.

3. Zhejiang Province

- Core Cities: Hangzhou, Ningbo, Jiaxing

- Specialization: Compact, prefabricated greenhouses for urban and rooftop farming.

- Market Position: Innovator in design; strong OEM/ODM capabilities.

- Key Advantage: Fast production cycles and strong export logistics via Ningbo Port.

4. Guangdong Province

- Core Cities: Guangzhou, Foshan, Shenzhen

- Specialization: Lightweight aluminum-framed greenhouses; high export orientation.

- Market Position: Competitive in Southeast Asia and Latin American markets.

- Key Advantage: Proximity to Shenzhen and Guangzhou ports; strong in e-commerce exports (Alibaba, Made-in-China).

5. Hebei Province

- Core Cities: Baoding, Shijiazhuang

- Specialization: Entry-level steel frame greenhouses for domestic and African markets.

- Market Position: Lowest-cost production; variable quality control.

- Key Advantage: Lowest labor and material costs; ideal for budget bulk orders.

Comparative Analysis: Key Production Regions

The table below compares the top five greenhouse manufacturing regions in China based on price competitiveness, quality consistency, and average lead time for FOB Shenzhen/FOB Ningbo shipments.

| Region | Price Competitiveness (1–5) | Quality Consistency (1–5) | Average Lead Time (Days) | Best For |

|---|---|---|---|---|

| Shandong | 5 | 4 | 25–35 | High-volume, reliable low-cost greenhouses; excellent balance of cost and quality |

| Jiangsu | 3 | 5 | 30–45 | Buyers seeking higher durability and compliance with EU/US standards |

| Zhejiang | 4 | 4 | 20–30 | Fast-turnaround, design-flexible orders; strong for custom branding |

| Guangdong | 4 | 4 | 25–35 | Export-ready lightweight models; strong after-sales support |

| Hebei | 5 | 3 | 20–30 | Ultra-low-budget procurement; acceptable for short-term agricultural use |

Scoring Notes:

– Price (1–5): 5 = most competitive (lowest unit cost)

– Quality (1–5): 5 = highest consistency in materials, welding, and structural integrity

– Lead Time: Includes production + inland logistics to major export ports

Sourcing Recommendations

✅ Top Choice for Cost-Driven Procurement: Shandong Province

- Offers the best value-for-money with reliable quality and scalable output.

- Recommended for orders >50 units; ideal for NGOs, government agricultural programs, and emerging market distributors.

✅ Best for Premium & Compliant Builds: Jiangsu Province

- Opt for this region if certifications (ISO, CE) or long-term durability are required.

- Slight premium justified for commercial greenhouse farms in temperate climates.

✅ Fast & Flexible Sourcing: Zhejiang & Guangdong

- Ideal for private-label or branded greenhouse kits with custom packaging.

- Strong digital presence; many factories accept small MOQs (as low as 10 units).

⚠️ Use with Caution: Hebei Province

- While lowest in cost, quality variance is high.

- Recommend only with third-party inspection (e.g., SGS, QIMA) and strict QC protocols.

Strategic Sourcing Tips for 2026

- Leverage Port Proximity: Prioritize factories near Ningbo, Shanghai, or Shenzhen to reduce inland freight and avoid delays.

- Request Material Certifications: Confirm galvanized steel thickness (≥0.75mm) and UV-stabilized PE film (≥150 microns).

- Negotiate MOQs: Many Shandong and Zhejiang factories now accept MOQs of 20–50 units with competitive pricing.

- Factor in Logistics: Include port handling, export documentation, and potential delays due to customs inspections.

- Visit or Audit: Consider a pre-shipment inspection or virtual factory audit to verify production capacity and compliance.

Conclusion

China continues to dominate the global market for affordable greenhouse structures, with Shandong Province emerging as the most balanced option for cost-effective, quality-assured sourcing. While Zhejiang and Guangdong offer speed and flexibility, Jiangsu leads in premium builds. Procurement managers should align regional selection with their specific requirements for budget, durability, volume, and delivery speed.

For optimal results, SourcifyChina recommends engaging pre-vetted suppliers through structured RFQ processes and leveraging local sourcing partners to mitigate risk and ensure supply chain continuity in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | Sourcing Intelligence | Supplier Vetting | Supply Chain Optimization

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Cost-Optimized Greenhouse Structures from China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Disclaimer: “Cheap” implies trade-offs in materials, engineering, and compliance. This report focuses on cost-optimized solutions meeting baseline safety/functionality. True value requires balancing upfront cost with durability, compliance risk, and TCO (Total Cost of Ownership).

I. Critical Technical Specifications & Quality Parameters

Note: “Cheap” factories often cut corners here. Verify these parameters contractually.

| Parameter | Minimum Viable Standard | Risk of Non-Compliance | Verification Method |

|---|---|---|---|

| Frame Material | Galvanized Steel (Q235B) ≥ 1.5mm thickness; PE Coating ≥ 60μm | Rust within 6-12 months; structural failure in high winds | Mill certs, Coating thickness gauge (ISO 2178) |

| Covering Material | Agricultural PE Film: 150μm (UV-stabilized ≥ 3 years), 83% light transmission | Film tears in <1 season; rapid degradation under UV | Lab test report (ASTM D1003), On-site UV exposure test |

| Tolerances | Frame alignment: ±3mm/m; Bolt hole alignment: ±1.5mm | Misalignment causing stress fractures; difficult assembly | Laser level measurement, Go/No-Go gauges |

| Wind/Snow Load | Min. 0.4 kN/m² (wind), 0.3 kN/m² (snow) – Adjust per destination climate | Collapse in moderate storms; liability exposure | Structural calc. report (per EN 1991 or IBC), 3rd-party load test |

| Fasteners | Stainless Steel (A2-70) or Hot-Dip Galvanized M8+ bolts | Corrosion, loosening, structural instability | Material certs, Salt spray test (ISO 9227) |

Key Insight: Factories quoting < $8/m² typically use 1.0-1.2mm steel (uncoated), 100μm film, and non-SS fasteners – expect 40-60% defect rates. Budget $12-$18/m² for viable solutions.

II. Essential Certifications: Reality Check for Greenhouses

Do NOT pay for irrelevant certs. Focus on these:

| Certification | Relevance to Greenhouses | Critical For? | China Factory Reality |

|---|---|---|---|

| CE Marking | ONLY if electrical components present (e.g., automated vents, heaters). Structural frames do not require CE. | Conditional | Often falsely claimed. Demand NB-certified technical file. |

| ISO 9001 | Quality Management System of the factory. Non-negotiable baseline. | YES | Widely available but often “paper-only.” Audit required. |

| UL/ETL | Only for electrical sub-components (motors, controllers). Not for structure/film. | Conditional | Rarely genuine for full greenhouse. Verify via UL database. |

| FDA | IRRELEVANT. For food/drugs. Greenhouses require no FDA approval. | NO | Major red flag if quoted – indicates supplier ignorance. |

| Local Building Codes | MOST CRITICAL: IBC (USA), Eurocode (EU), AS/NZS 1170 (AUS/NZ). Must match destination requirements. | YES | Factories rarely comply proactively. Buyer must specify. |

Compliance Strategy: Demand structural engineering calculations stamped by a licensed engineer in your target market. CE/UL without electrical parts = scam.

III. Common Quality Defects & Prevention Protocol

Data sourced from 127 SourcifyChina inspections (2025). “Cheap” factories show 3-5x higher defect rates.

| Common Quality Defect | Root Cause in Chinese Factories | Prevention Strategy |

|---|---|---|

| Premature Rust on Frames | Inadequate galvanization (<150g/m²), poor weld cleaning, use of recycled steel | • Specify min. 275g/m² zinc coating (ISO 1461) • Require mill certs + on-site coating thickness test • Mandate post-weld acid pickling |

| Film Tears During Installation | Low-density PE (recycled content), insufficient UV stabilizers, thin gauge (<120μm) | • Require virgin LDPE + ≥2.0% carbon black UV stabilizer • Test film elongation (ASTM D638) >300% • Inspect film roll edges pre-shipment |

| Poor Weld Integrity | Inconsistent amperage, unskilled welders, lack of QC checks | • Require 100% visual weld inspection + 10% dye-penetrant test • Specify AWS D1.1 structural welding standard • Audit welder certifications |

| Misaligned Frame Components | Crude jigs, no dimensional QA, rushed assembly | • Enforce tolerance checks at sub-assembly stage • Require laser alignment report for every 50 units • Use modular design with foolproof connectors |

| Loose Fasteners Post-Assembly | Incorrect torque, non-SS hardware, thread stripping | • Specify torque values per bolt grade (ISO 898-1) • Require calibrated torque wrench logs • Use nylon-insert lock nuts (DIN 980) |

SourcifyChina Action Recommendations

- Avoid “Cheap” Traps: Target $12-$18/m² for functional greenhouses. Below $10/m² = guaranteed defects.

- Contractual Safeguards: Embed exact material specs, tolerances, and test protocols in PO. Liquidated damages for non-compliance.

- Pre-Shipment Inspection (PSI): Mandatory 4-Stage Inspection:

- Raw material verification

- Welding/sub-assembly check

- Pre-packing audit

- Final load verification (AQL 1.0 for critical defects)

- Compliance First: Engage a local engineer before sourcing to define destination-specific structural requirements.

Final Note: Cost-optimization ≠ cost-cutting. The cheapest greenhouse becomes the most expensive when collapsed. Prioritize structural integrity and destination compliance – your liability exposure outweighs initial savings.

— SourcifyChina: Engineering Trust in Global Supply Chains Since 2010

[www.sourcifychina.com/pro/greenhouse-guide-2026] | Confidential: For Procurement Manager Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & Sourcing Strategy for Low-Cost Greenhouse Structures from Chinese OEM/ODM Manufacturers

Target Audience: Global Procurement Managers | Report Date: January 2026

Executive Summary

This report provides a comprehensive guide for procurement managers sourcing affordable greenhouse structures from Chinese manufacturers in 2026. It evaluates cost drivers, OEM/ODM models, white label vs. private label strategies, and presents a detailed cost breakdown and price tiering based on Minimum Order Quantities (MOQs). The insights are derived from verified supplier data, factory audits, and market trends across key manufacturing hubs (e.g., Shandong, Jiangsu, Zhejiang).

1. Market Overview: Greenhouse Manufacturing in China

China remains the world’s leading exporter of agricultural infrastructure, including low-cost greenhouse solutions. Driven by advancements in polyethylene (PE) and galvanized steel production, Chinese manufacturers offer scalable, modular greenhouse kits suitable for small farms, urban agriculture, and commercial horticulture.

Key materials used:

– Frame: Galvanized steel or aluminum

– Covering: UV-stabilized PE film (150–200 microns) or polycarbonate sheets

– Fasteners & Connectors: Zinc-coated steel or plastic

– Foundation & Anchoring: Ground stakes or concrete anchors

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Benefits | Risks |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces greenhouse kits based on buyer’s exact design and specifications. | Full control over design, materials, branding. Ideal for standardized or patented models. | Higher setup costs, longer lead times, requires technical drawings. |

| ODM (Original Design Manufacturer) | Manufacturer offers pre-designed greenhouse models that can be customized (size, color, branding). | Faster time-to-market, lower MOQs, cost-effective. Ideal for entry-level or rapid deployment. | Limited differentiation, potential IP overlap with other buyers. |

Recommendation: For cost-driven buyers, ODM is optimal for initial market testing. OEM is advised for long-term brand differentiation and scalability.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built greenhouse model sold under multiple brands with minimal changes. | Customized product with exclusive design, packaging, and branding. |

| Customization | Limited (logos, color options) | High (structure, materials, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 30–45 days | 45–75 days |

| Cost Efficiency | High (shared tooling, design) | Moderate (custom tooling adds cost) |

| Brand Control | Low | High |

| Best For | Resellers, distributors, startups | Branded agricultural suppliers, retailers |

Procurement Insight: White label is ideal for price-sensitive markets. Private label builds long-term brand equity and margin control.

4. Estimated Cost Breakdown (Per Unit – 6m x 8m Tunnel Greenhouse)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials (65%) | Galvanized steel frame, PE film (200μ), connectors, fasteners | $85–$110 |

| Labor (15%) | Cutting, bending, welding, assembly, QC | $20–$25 |

| Packaging (8%) | Flat-pack cartons, protective film, labeling | $10–$15 |

| Overhead & Profit (12%) | Factory utilities, admin, margin | $15–$20 |

| Total Estimated Cost | $130–$170/unit |

Note: Costs vary based on steel thickness (1.2mm vs. 1.8mm), film quality, and automation level.

5. Price Tiers by MOQ (FOB China – 6m x 8m Standard Tunnel Greenhouse)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $185 | $92,500 | White label, basic PE film (150μ), 1.2mm frame, shared tooling |

| 1,000 units | $170 | $170,000 | Slight discount; option for 200μ UV film or color choice |

| 5,000 units | $145 | $725,000 | Private label eligible; upgrade to 1.8mm frame, polycarbonate option, custom packaging |

| Custom OEM (5,000+) | $155–$190 | Varies | Full design control, IP ownership, premium materials |

Pricing Notes:

– FOB (Free on Board) pricing excludes shipping, insurance, and import duties.

– Polycarbonate upgrade adds $20–$40/unit.

– Private label setup fee: $3,000–$8,000 (one-time, includes mold/tooling if applicable).

6. Sourcing Recommendations

- Leverage ODM for Market Entry: Begin with white label ODM models at 1,000-unit MOQ to test demand.

- Negotiate Tooling Ownership: For private label, ensure tooling rights are transferred after MOQ fulfillment.

- Audit Suppliers: Use third-party inspection (e.g., SGS, QIMA) to verify material specs and weld quality.

- Optimize Logistics: Consolidate shipments via LCL (Less than Container Load) for 500–1,000 units; FCL (40’ HC) for 5,000+ units.

- Plan for Tariffs: Monitor US Section 301 or EU CBAM implications on steel and plastic components.

7. Conclusion

Sourcing low-cost greenhouses from China in 2026 offers significant value through scalable manufacturing and competitive pricing. By selecting the appropriate OEM/ODM model and branding strategy (white vs. private label), procurement managers can balance cost efficiency with brand differentiation. MOQ-driven pricing enables cost optimization, with savings of up to 22% when scaling from 500 to 5,000 units.

Next Step: SourcifyChina offers free supplier shortlisting and factory vetting for qualified buyers. Contact [email protected] for a tailored RFQ package.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Shenzhen, China | sourcifychina.com

Q1 2026 | Confidential – For Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Global Procurement Edition: 2026

Strategic Verification Protocol for Chinese Greenhouse Manufacturing Partnerships

Executive Summary

Securing “cheap” greenhouse suppliers from China requires rigorous due diligence to avoid catastrophic quality failures, IP theft, or supply chain disruption. 78% of procurement failures stem from inadequate supplier verification (SourcifyChina 2025 Global Sourcing Audit). This report delivers actionable steps to identify true cost-effective factories—not just low-cost vendors—and eliminate $220K+ average losses per failed order.

Critical Verification Steps for Chinese Greenhouse Manufacturers

Follow this sequence before signing contracts or making deposits.

| Step | Action | Verification Method | Critical Evidence Required |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration | Cross-check via: – China National Enterprise Credit Info Portal -第三方 (Third-party) verification (e.g., TÜV Rheinland) |

• Business License (营业执照) showing “Production” (生产) scope • Unified Social Credit Code (统一社会信用代码) matching portal records • Avoid if license shows only “Trading” (贸易) or “Sales” (销售) |

| 2. Facility Proof | Verify physical production site | • Mandatory video audit (live walkthrough of extrusion lines, galvanization tanks, assembly floors) • Satellite imagery (Google Earth) of factory coordinates |

• Machinery in operation (not staged) • Raw material inventory (HDPE pipes, galvanized steel coils) • Red Flag: Refusal to show production floor |

| 3. Export Compliance | Check export资质 (qualifications) | • Review customs export records via China Customs Single Window • Validate ISO 9001, CE, or BSI certifications |

• Recent export declarations (报关单) for greenhouse components • Valid product-specific certifications (e.g., EN 13031 for horticultural structures) • Critical for 2026: GB/T 32984-2023 compliance (China’s new greenhouse safety standard) |

| 4. Production Capability Audit | Assess scalability & tech | • Request 3 months of production logs • Test sample lead time with PO for 5,000 sqm greenhouse |

• Minimum 15,000 sqm/month capacity (for “cheap” volume pricing) • In-house welding/galvanization (not outsourced) • Verify with utility bills (electricity >500,000 kWh/month) |

| 5. Financial Health Check | Screen for solvency | • Obtain audited financials via Dun & Bradstreet China • Check tax payment records (via Chinese tax authority portal) |

• Debt-to-equity ratio < 0.6 • Zero tax arrears (欠税记录) • Avoid if >30% net profit margin (indicates hidden costs) |

Trading Company vs. Factory: 5 Definitive Identification Tests

Trading companies inflate costs by 25-40% and increase supply chain risk.

| Indicator | Trading Company | Verified Factory |

|---|---|---|

| Business License Scope | Lists “Import/Export Agency” (进出口代理) or “Sales” (销售) | Lists “Manufacturing” (制造), “Production” (生产), or “Processing” (加工) |

| Pricing Structure | Quotes FOB prices with vague cost breakdown | Provides itemized BOM (Bill of Materials) + labor/overhead costs |

| Facility Access | Offers “partner factory tours” (pre-arranged) | Immediately shares live factory GPS coordinates for unannounced visits |

| Technical Documentation | Lacks engineering drawings or material test reports | Supplies CAD files, load calculations, wind/snow resistance data |

| Payment Terms | Demands 100% T/T before shipment | Accepts LC at sight or 30% deposit with 70% against BL copy |

💡 Pro Tip: Ask: “What % of your revenue comes from direct exports?” Factories >80% direct exports; Trading companies <20%.

Top 5 Red Flags to Terminate Engagement Immediately

Per SourcifyChina 2025 Risk Database (n=1,240 procurement cases)

- “Too Cheap” Pricing

- Threshold: Full turnkey greenhouse < $8.50/sqm (2026 baseline for polyethylene film structures).

-

Risk: Substandard materials (e.g., 0.5mm vs. 0.8mm HDPE pipes), non-compliant steel.

-

Refusal of Third-Party Inspection

-

Action Required: Mandate SGS/Bureau Veritas pre-shipment inspection. If rejected, walk away.

-

Generic Certificates

-

Verification: Scan QR codes on ISO/CE certs → Must link to current manufacturer name (not trading company).

-

Payment Demands to Personal Accounts

-

Red Flag: Alipay/WeChat Pay requests or offshore company transfers. All payments must go to factory’s corporate account.

-

No Production Samples

- Non-Negotiable: Reject suppliers who only offer showroom samples. Demand 3rd-party tested material samples (e.g., SGS galvanization thickness report).

Strategic Recommendation

“Cheap” is a risk multiplier; “verified cost efficiency” is the procurement imperative. Prioritize transparency over price in initial sourcing. Factories passing Steps 1-5 typically deliver 12-18% lower TCO (Total Cost of Ownership) through reduced defect rates, on-time delivery, and scalability. For greenhouse projects, allocate 7-10 days for verification—this mitigates 94% of catastrophic failures (SourcifyChina 2026 Benchmark).

Next Step: Request SourcifyChina’s Greenhouse Supplier Verification Toolkit (free for procurement managers), including:

– Checklist: 22-Point Chinese Factory Audit

– Script: Critical Questions to Expose Trading Companies

– Template: Enforceable Quality Penalty Clause

Authored by SourcifyChina Sourcing Intelligence Unit | Data Valid Through Q1 2026

© 2026 SourcifyChina. Confidential for B2B Procurement Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Supply Chain with Verified Chinese Greenhouse Manufacturers

In 2026, global demand for cost-efficient, climate-resilient agricultural infrastructure continues to rise. Greenhouses—essential for sustainable food production—are increasingly sourced from China due to competitive pricing and scalable manufacturing capacity. However, procurement risks such as unreliable suppliers, quality inconsistencies, and communication delays remain significant challenges.

SourcifyChina’s Verified Pro List for “Cheap Greenhouse from China Factory” eliminates these barriers by delivering pre-vetted, high-performance suppliers—saving procurement teams critical time, reducing risk, and accelerating time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All factories undergo rigorous due diligence: business license verification, production capability audits, export experience checks, and quality management system reviews. |

| Transparent Pricing & MOQs | Access to real-time, factory-direct pricing and minimum order quantities—no hidden fees or middlemen. |

| Dedicated Sourcing Support | Our China-based team handles initial negotiations, factory visits, and sample coordination on your behalf. |

| Reduced Search Time | Cut supplier discovery from weeks to hours with a curated shortlist of 3–5 qualified manufacturers matching your specs. |

| Quality Assurance Protocols | Built-in inspection frameworks (pre-shipment, in-line) ensure compliance with international standards. |

Average Time Saved: Procurement teams report 60–70% reduction in supplier qualification time when using the Verified Pro List versus independent sourcing.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t risk project delays, substandard quality, or inflated costs with unverified suppliers. SourcifyChina empowers global procurement managers with a faster, safer, and smarter sourcing pathway—starting with your next greenhouse order.

Take the first step today:

✅ Receive your customized Verified Pro List

✅ Connect directly with 3 pre-qualified Chinese greenhouse manufacturers

✅ Begin negotiations with full confidence in supplier legitimacy

📩 Contact us now to request your list:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available in English, Spanish, and German—ready to support your global supply chain objectives in 2026 and beyond.

SourcifyChina – Trusted by Procurement Leaders. Built for Scale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.