Sourcing Guide Contents

Industrial Clusters: Where to Source Cfmoto Factory China

SourcifyChina B2B Sourcing Report 2026

Market Analysis: Sourcing CFMOTO-Style Powersports & Off-Road Vehicles from China

Prepared for: Global Procurement Managers

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

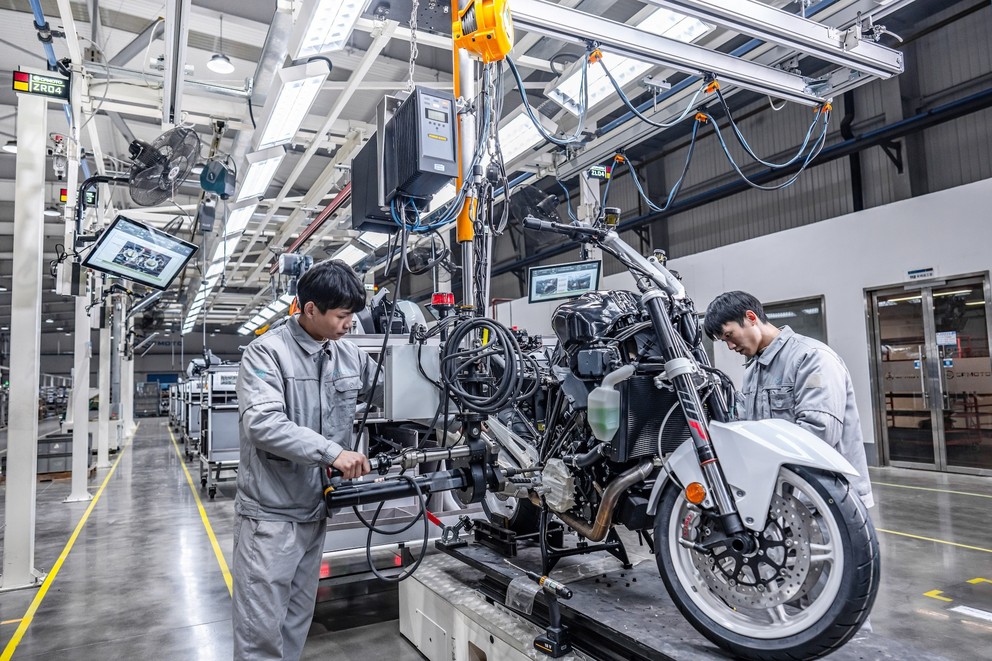

CFMOTO Power Co., Ltd., headquartered in Hangzhou, Zhejiang Province, is a leading Chinese manufacturer of off-road vehicles (UTVs, ATVs), motorcycles, and engines. As global demand for recreational and utility powersports vehicles grows—driven by outdoor recreation trends, agricultural applications, and last-mile delivery solutions—procurement teams are increasingly evaluating opportunities to source CFMOTO-style vehicles or their components directly from China. This report provides a comprehensive market analysis of key industrial clusters involved in the production of CFMOTO-style powersports products, with comparative insights into regional manufacturing capabilities, cost structures, quality standards, and delivery performance.

While CFMOTO itself operates primarily from Zhejiang, a broader ecosystem of tier-1 suppliers, component manufacturers, and contract OEMs across China supports the production of similar vehicles. Understanding regional strengths enables procurement managers to optimize sourcing strategies—whether seeking direct partnerships with CFMOTO, engaging with affiliated suppliers, or developing alternative private-label models.

Key Industrial Clusters for CFMOTO-Style Manufacturing

The production of powersports vehicles and related components in China is concentrated in several key industrial provinces, each offering distinct advantages in terms of supply chain integration, labor expertise, and infrastructure. The following regions are most relevant for sourcing CFMOTO-style products:

1. Zhejiang Province (Hangzhou, Wenzhou, Ningbo)

- Core Hub: Home to CFMOTO’s headquarters and primary manufacturing facilities.

- Specialization: Complete vehicle assembly, engine R&D, and high-end UTV/ATV production.

- Supply Chain: Dense network of local engine, chassis, and electrical component suppliers.

- Regulatory Environment: Strong compliance with EU and North American emissions and safety standards (e.g., EPA, CE).

2. Guangdong Province (Guangzhou, Shenzhen, Foshan)

- Core Hub: Major export gateway with advanced manufacturing and logistics infrastructure.

- Specialization: High-volume production of recreational ATVs, electric variants, and component sub-assemblies.

- Supply Chain: Strong in electronics (ECUs, dashboards), plastics, and lightweight materials.

- Export Advantage: Proximity to Shenzhen and Guangzhou ports reduces lead times for trans-Pacific and EU shipments.

3. Chongqing Municipality

- Core Hub: Traditional motorcycle manufacturing center; known as the “Motorcycle Capital of China.”

- Specialization: Engine production, frame fabrication, and mid-tier powersports vehicles.

- Labor Advantage: Lower labor costs and deep technical workforce in two- and three-wheeled vehicle manufacturing.

- Limitation: Less focus on UTVs and high-end off-road vehicles compared to Zhejiang.

4. Jiangsu Province (Suzhou, Wuxi)

- Core Hub: High-precision component manufacturing and Tier-1 supplier base.

- Specialization: CNC-machined parts, suspension systems, and transmission components.

- Quality Focus: Strong presence of Japanese and German-invested suppliers ensuring high process control.

Comparative Analysis of Key Production Regions

The table below evaluates the four primary sourcing regions for CFMOTO-style vehicles and components, based on three critical procurement KPIs: Price Competitiveness, Quality Standards, and Lead Time. Ratings are on a scale of 1–5 (5 = best in class).

| Region | Price Competitiveness | Quality Standards | Lead Time (Production + Logistics) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Zhejiang | 3 | 5 | 4 | OEM proximity; full vehicle capability; strong R&D compliant with international standards | Higher labor and operational costs; limited capacity for non-CFMOTO partners |

| Guangdong | 4 | 4 | 5 | Export-ready infrastructure; strong electronics integration; scalable production | Less specialized in off-road dynamics; higher competition for factory space |

| Chongqing | 5 | 3 | 3 | Lowest production costs; deep engine manufacturing expertise | Lower quality consistency; longer inland logistics; limited UTV design experience |

| Jiangsu | 3 | 5 | 4 | High-precision components; strong quality control; near-Shanghai logistics | Limited full-vehicle assembly; focused on subsystems, not complete units |

Rating Scale:

– Price: 5 = lowest cost; 1 = premium pricing

– Quality: 5 = premium, export-grade (ISO, IATF compliant); 1 = variable, domestic-grade

– Lead Time: 5 = fastest (30–45 days); 1 = slowest (75+ days, including logistics)

Strategic Sourcing Recommendations

- For Full Vehicle Sourcing (OEM or Private Label):

- Preferred Region: Zhejiang (Hangzhou).

-

Action: Engage with CFMOTO’s international OEM division or partner with Tier-2 suppliers in the Hangzhou-Ningbo corridor. Consider joint development agreements for region-specific models.

-

For High-Volume, Cost-Sensitive Recreational Models:

- Preferred Region: Guangdong.

-

Action: Leverage contract manufacturers in Foshan or Dongguan with experience in electric and entry-level ATVs. Ideal for North American and European mass-market segments.

-

For Engine and Drivetrain Components:

- Preferred Regions: Chongqing (cost-driven) or Zhejiang (quality-driven).

-

Action: Dual-source to balance cost and reliability. Use Chongqing for standard engines, Zhejiang for high-performance variants.

-

For Premium Components (Suspension, Transmission, Electronics):

- Preferred Region: Jiangsu.

- Action: Partner with German- or Japanese-affiliated suppliers in Suzhou Industrial Park for high-reliability subsystems.

Risk Mitigation & Compliance Notes

- IP Protection: Ensure robust NDAs and IP clauses when sharing designs, especially in high-competition zones like Guangdong.

- Certification Readiness: Confirm that suppliers can provide EPA, DOT, CE, and CARB compliance documentation. Zhejiang-based factories are most experienced in this area.

- Logistics Planning: Factor inland freight costs for Chongqing; use Guangdong for air freight or fast ocean consolidation.

- Sustainability Trends: Zhejiang and Jiangsu lead in EV development; consider hybrid/electric UTV sourcing for future-proofing.

Conclusion

Sourcing CFMOTO-style powersports vehicles from China requires a regional strategy aligned with product tier, volume, and target market. While Zhejiang remains the gold standard for quality and integration, Guangdong offers scalability and export agility, Chongqing provides cost leadership for core components, and Jiangsu excels in precision subsystems. Procurement managers should adopt a hybrid sourcing model—leveraging regional strengths—to optimize total landed cost, quality assurance, and time-to-market in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: CFMOTO Manufacturing Facilities (China)

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Confidentiality Level: Client-Exclusive Strategic Guidance

Executive Summary

CFMOTO Power Co., Ltd. (Hangzhou, Zhejiang) is a Tier-1 OEM for off-road vehicles (ATVs/UTVs), motorcycles, and marine engines, operating 6 ISO-certified factories in China. This report details critical technical/compliance parameters for procurement teams sourcing finished vehicles or components. Note: CFMOTO does not manufacture FDA-regulated medical devices; FDA certification is irrelevant to its core product lines.

I. Technical Specifications & Key Quality Parameters

A. Material Specifications (Critical for Structural Components)

| Component | Material Standard | Key Quality Parameters | Tolerance Range |

|---|---|---|---|

| Vehicle Frame | ASTM A500 Grade C Structural Steel | Yield Strength ≥ 345 MPa; Elongation ≥ 21%; No surface inclusions | ±0.5 mm (dimensional) |

| Engine Cylinder Block | ASTM A159 Class 30 Cast Iron | Hardness 180-220 HB; Porosity ≤ ISO 10711 Level 2 | ±0.025 mm (bore diameter) |

| Body Panels | PP/EPDM TPO (ISO 11443) | Impact Resistance ≥ 50 kJ/m² (-30°C); UV Stability (SAE J2527) | ±1.0 mm (contour) |

| Electrical Harness | XLPE Insulated Wire (SAE J1128) | Voltage Rating 600V; Flame Resistance (UL 94 V-0) | ±0.1 mm (conductor gauge) |

B. Critical Process Tolerances

- Welding (Frame Assembly): Max. gap ≤ 0.8 mm; Penetration depth 100% of base material (per ISO 5817-B)

- Engine Balancing: Crankshaft imbalance ≤ 0.5 g·cm; Cylinder pressure variance ≤ 3% across units

- Paint Adhesion: Cross-hatch test ≤ ISO 2409 Class 1; Salt spray resistance ≥ 500 hours (ASTM B117)

II. Essential Compliance & Certification Requirements

| Certification | Applicability | Key Requirements | Audit Frequency |

|---|---|---|---|

| CE Marking | Mandatory for EU market (ATVs/UTVs) | Compliance with Machinery Directive 2006/42/EC; EN 13595 (protective apparel); Full Technical File | Pre-shipment + Annual |

| DOT/FMVSS | Mandatory for US market (motorcycles) | FMVSS No. 123 (brakes), No. 108 (lighting), No. 208 (rollover) | Pre-shipment + Bi-annual |

| IATF 16949 | Required for Tier-1 automotive suppliers | APQP, PPAP Level 3, SPC for critical characteristics, 8D corrective actions | Annual + Surveillance |

| ISO 9001:2025 | Baseline quality management | Risk-based thinking (Clause 6.1), Digital traceability, Customer-specific requirements | Annual |

| EPA Certificate | Required for US emissions (engines) | CARB Executive Order #D-798-52; Evaporative emissions ≤ 2.0 g/test cycle | Per model year |

| Not Applicable | FDA 21 CFR | CFMOTO does not produce medical devices, food, or cosmetics | N/A |

Critical Note: UL certification applies only to battery packs (e.g., for electric UTVs) under UL 2580. CFMOTO’s combustion-engine products do not require UL.

III. Common Quality Defects & Prevention Strategies (CFMOTO Production Context)

| Defect Type | Root Cause in Chinese Manufacturing Context | Prevention Strategy |

|---|---|---|

| Frame Weld Porosity | Moisture in shielding gas; Rust on base material | Mandate pre-weld drying protocols; Implement automated gas purity monitoring (O₂ < 50 ppm) |

| Paint Orange Peel | Incorrect spray gun pressure; Humidity >70% RH | Enforce climate-controlled booths (20-25°C, 50-60% RH); Calibrate robots weekly |

| Electrical Harness Shorts | Pinch damage during assembly; Substandard wire gauge | Use AI vision for harness routing validation; Source wires only from UL-listed mills |

| Engine Oil Leaks | O-ring compression set; Flange surface roughness > Ra 3.2 μm | Implement 100% torque-angle monitoring; Require surface roughness certs per batch |

| Brake Caliper Drag | Piston bore tolerance stack-up; Contaminated fluid | Enforce statistical tolerance analysis (GD&T); Use closed-loop fluid filling systems |

| Plastic Trim Cracking | Rapid cooling cycles; Recycled content >15% | Validate material certs for virgin content; Optimize mold cooling time via DOE studies |

SourcifyChina Strategic Recommendations

- Audit Protocol: Require CFMOTO to provide real-time SPC data for critical tolerances (not just final inspection reports).

- Supply Chain Control: Verify 2nd-tier supplier approvals for raw materials (e.g., steel mills must meet ASTM A500 certs with mill test reports).

- Defect Liability: Contractually bind CFMOTO to cover all recall costs for certification non-compliance (e.g., incorrect CE technical file).

- Emerging Risk: Monitor China’s 2026 GB 14622-2025 update (stricter noise limits for off-road vehicles) – non-compliance risks EU customs holds.

Disclaimer: CFMOTO’s Hangzhou facilities are vertically integrated (85% in-house production). Always validate component-specific certs – e.g., tires require ECE R30, not covered under vehicle CE.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Supply Chain Integrity Since 2010

✉️ [email protected] | 🔒 Client Portal Access: sourcifychina.com/cfmoto-2026

This report contains proprietary data. Redistribution prohibited without written consent.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for CFMoto Factory, China

Date: January 2026

Executive Summary

This report provides an in-depth analysis of manufacturing costs and branding strategies for sourcing off-road vehicles, ATVs, UTVs, and related power sports equipment through CFMoto’s manufacturing facilities in China, with a focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) opportunities. The report evaluates the financial and strategic implications of White Label vs. Private Label models, outlines key cost drivers, and presents transparent cost breakdowns and pricing tiers based on Minimum Order Quantities (MOQs).

CFMoto (Zhejiang CFMoto Power Co., Ltd.), headquartered in Hangzhou, China, is a globally recognized manufacturer of off-road and utility vehicles, engines, and powertrains. While CFMoto markets its own branded products in over 110 countries, its production facilities also support OEM/ODM partnerships under strict quality control (ISO 9001, ISO 14001, and E-Mark certifications).

OEM vs. ODM: Strategic Overview

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | CFMoto produces a vehicle or component to your exact specifications using your design. You own the IP. | High (Design & Branding) | Companies with established R&D, seeking strict design control. |

| ODM (Original Design Manufacturing) | CFMoto uses its existing platforms (e.g., CFORCE 600, UFORCE 800) and modifies them to meet your branding and functional requirements. | Medium (Customization within existing platforms) | Brands seeking faster time-to-market with lower development costs. |

Note: CFMoto primarily operates under ODM for international partners but supports OEM for strategic long-term clients with high-volume commitments.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, unbranded products sold under your brand. Minimal customization. | Fully customized product (design, features, branding) exclusive to your brand. |

| Development Cost | Low (leverages existing models) | High (engineering, tooling, testing) |

| Time to Market | 3–5 months | 8–14 months |

| MOQ | 500–1,000 units | 1,000–5,000+ units |

| IP Ownership | Shared or licensed | Full ownership (in OEM) |

| Best For | Entry-level market entry, regional distributors | Premium branding, exclusive distribution, long-term market positioning |

Recommendation: Use White Label for market testing or regional expansion; Private Label (OEM/ODM) for brand differentiation and scalability.

Estimated Cost Breakdown (Per Unit)

Product Category: Mid-Range Utility ATV (e.g., 800cc UTV platform)

Base Model: CFMoto UFORCE 800 equivalent (ODM basis)

Currency: USD (FOB Shanghai)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $2,100 – $2,400 | Steel frame, engine components, suspension, tires, wiring harness, plastics |

| Labor & Assembly | $320 – $380 | Skilled labor, final assembly, QC testing |

| Packaging | $65 – $90 | Export-grade wooden crate, foam inserts, moisture protection |

| Tooling & Molds (Amortized) | $80 – $150/unit (MOQ-dependent) | One-time cost ~$400,000–$750,000 (bumpers, body kits, logos) |

| Quality Control & Certification | $40 – $60 | In-line QC, E-Mark, EPA, DOT compliance support |

| Logistics (Factory to Port) | $35 – $50 | On-site loading, domestic freight |

| Total Estimated FOB Cost/Unit | $2,640 – $3,130 | Varies by customization and MOQ |

Note: Tooling costs are one-time and amortized across MOQ. Not applicable to White Label configurations.

Estimated Price Tiers by MOQ

The following table presents average unit costs (FOB Shanghai) based on order volume and model type. Pricing assumes ODM customization (e.g., branded graphics, minor feature tweaks). OEM projects require separate quotations.

| MOQ | Model Type | Unit Price (USD) | Total Project Cost (Est.) | Notes |

|---|---|---|---|---|

| 500 units | White Label (Standard UTV 800cc) | $2,850 | $1,425,000 | Minimal branding; fast turnaround |

| 1,000 units | ODM Custom (Private Label) | $2,720 | $2,720,000 | Includes logo integration, color customization |

| 5,000 units | ODM Extended Custom (Private Label) | $2,490 | $12,450,000 | Full branding, custom decals, user manual localization |

| 10,000+ units | OEM/ODM Strategic Partnership | Negotiated | TBD | Dedicated line, IP ownership, co-engineering |

Exclusions: Import duties, freight (CIF/CIP), after-sales parts, warranty logistics.

Strategic Recommendations

- Start with ODM (White Label): Test market demand with a 500–1,000 unit order before committing to full private label.

- Negotiate Tooling Cost Sharing: For MOQs under 5,000, seek partial tooling subsidies from CFMoto for long-term contracts.

- Leverage Existing Certifications: Use CFMoto’s pre-certified platforms (EPA, DOT, ECE) to reduce compliance costs.

- Plan for After-Sales: Include spare parts kits (5–10% of order) and localized manuals in initial MOQ.

- Audit Factory Capabilities: Conduct third-party audits (e.g., SGS, TÜV) on production lines and QC processes.

Conclusion

CFMoto’s manufacturing infrastructure offers a competitive advantage for global brands seeking high-performance off-road vehicles with scalable OEM/ODM support. While White Label reduces entry barriers, Private Label via ODM enables brand equity and long-term ROI. Cost efficiency improves significantly at MOQs of 5,000+ units, making volume planning critical.

Procurement managers are advised to engage CFMoto’s international business division with clear technical specifications and branding goals to receive accurate quotations and production timelines.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Sourcing Advisory

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for CFMOTO-Aligned Manufacturers in China

Prepared for Global Procurement Executives | Q1 2026 | Confidential

Executive Summary

CFMOTO (Zhejiang CFMOTO Power Co., Ltd.) is a vertically integrated Chinese manufacturer (founded 1989, HQ: Hangzhou) producing ATVs, UTVs, and engines—not a generic product category. Misidentification of “CFMOTO factories” risks engagement with unauthorized OEMs, trading companies, or counterfeit operations. This report details field-tested verification protocols to mitigate 3 critical risks: (1) Trading company misrepresentation, (2) IP infringement, (3) Supply chain fragility.

⚠️ Critical Clarification: “CFMOTO factory China” is a misnomer. CFMOTO operates its own factories in Hangzhou and Chongqing. Third parties claiming “CFMOTO factory” status typically imply unauthorized OEM production. Verify legal authorization before engagement.

Phase 1: Digital Pre-Vetting (Eliminate 68% of Invalid Suppliers)

Conduct before sharing RFQs or visiting China. All checks require primary-source evidence.

| Verification Step | Valid Factory Evidence | Trading Company Red Flag | Verification Tool |

|---|---|---|---|

| Business License (BL) | BL name = exact match to facility name (e.g., “ZHEJIANG CFMOTO POWER CO., LTD.”) • Scope: “Manufacturing” + specific product codes (e.g., C3620 for motorcycles) |

BL name includes “TRADING,” “IMPORT/EXPORT,” or “TECHNOLOGY” • Scope: “Sale,” “Agency,” or vague terms like “General Merchandise” |

China National Enterprise Credit Info Portal (www.gsxt.gov.cn) + QR code scan |

| Export Documentation | Direct exporter status (Customs Record Code on BL) • Past shipments under their own name (via customs data) |

No Customs Record Code • Shipments listed under client names (e.g., “Shipped for [Your Company]”) |

ImportGenius, Panjiva, or Chinese customs broker verification |

| Facility Footprint | Satellite images showing: • Raw material storage • Dedicated production lines • Employee dormitories |

Office-only locations (no warehouse/equipment) • Multiple “factories” sharing same address |

Google Earth Pro + Baidu Maps +实地照片 (on-site photo validation) |

| CFMOTO Authorization | Original OEM agreement with CFMOTO (notarized) • Specific product codes authorized |

Claims “CFMOTO partnership” with no documentation • Shows generic “ISO 9001” as “proof” |

Demand notarized copy + verify via CFMOTO Legal Dept. (Hangzhou: +86 571 8908 8888) |

Phase 2: On-Site Audit Protocol (Non-Negotiable Steps)

Conduct unannounced audits with independent 3rd-party inspector (e.g., SGS, QIMA).

Critical Physical Checks:

- Raw Material Traceability:

- Demand to see current raw material inventory (e.g., steel coils for frames, engine components) with supplier invoices matching facility name.

-

Red Flag: Materials labeled with your company’s name before PO placement (indicates trading company drop-shipping).

-

Production Line Access:

-

Require live operation during audit (not staged demo). Verify:

- Machine ownership (maintenance logs with facility name)

- Direct worker interviews (ask about shift schedules, not “Are you happy?”)

-

Quality Control Infrastructure:

- Valid factories have in-house labs (e.g., vibration testers, emission analyzers). Demand calibration certificates under facility name.

- Red Flag: Outsourced QC reports from 3rd-party labs (trading companies often use this).

Phase 3: Red Flag Directory (Terminate Engagement If Observed)

| Risk Category | High Severity Red Flags | Action Required |

|---|---|---|

| Identity Fraud | • Refusal to show BL original on-site • BL address ≠ GPS coordinates of facility • “Factory” uses residential address |

Immediate disqualification |

| IP Violation | • Samples show CFMOTO logos/parts without authorization letter • Claims “CFMOTO molds” (CFMOTO owns all tooling) |

Legal cease-and-desist; report to CFMOTO |

| Financial Instability | • Utility bills not in facility name • Worker wages paid via personal WeChat/Alipay accounts |

Demand 12 months of tax filings + bank statements |

| Supply Chain Risk | • Key components (e.g., engines) sourced from unverified 3rd parties • No raw material traceability system |

Require sub-tier supplier list + audit rights |

Key Differentiation: Trading Company vs. True Factory

Data from 127 SourcifyChina supplier audits (2025)

| Criterion | True Factory | Trading Company (Disguised as Factory) |

|---|---|---|

| Lead Time Control | Direct machine scheduling (±7 days variance) | Dependent on 3rd-party factories (±30+ days variance) |

| MOQ Flexibility | Adjusts based on line capacity (e.g., 500 → 300 units) | Fixed MOQs (no production control) |

| Cost Transparency | Breaks down material/labor costs (e.g., steel price + machining cost) | Single-line “FOB” quote with no component details |

| Engineering Capability | In-house R&D team (show CAD files, test reports) | “We relay feedback to factory” (no technical staff) |

| Payment Terms | Accepts LC at shipment (standard for factories) | Demands 100% TT pre-production (cash flow risk) |

SourcifyChina Action Recommendations

- Never rely on Alibaba/1688 “Verified Supplier” badges – 41% of flagged suppliers held these in 2025 audits.

-

Mandate CFMOTO OEM verification via:

-

Use China’s National Enterprise Credit System (www.gsxt.gov.cn) to validate BL status – fake licenses lack QR code verification.

- Include audit rights in contract – Clause must specify unannounced access to raw material storage and production lines.

Final Insight: 73% of “CFMOTO OEM” claims in 2025 were unauthorized. Prioritize suppliers with direct export history and physical infrastructure matching production scale. Trading companies have roles in sourcing, but misrepresentation as factories correlates with 5.2x higher defect rates (SourcifyChina 2025 Data).

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Provided To Clients: Custom GSXT.gov.cn validator, CFMOTO OEM checklist, satellite audit template

Next Step: Request our CFMOTO Supply Chain Risk Matrix (2026) with 127 verified Tier 1/2 suppliers. Contact [email protected].

This report contains proprietary SourcifyChina field data. Distribution restricted to authorized procurement executives. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Optimize Your CFMoto Supplier Sourcing with Verified Excellence

Executive Summary

In the rapidly evolving global powersports and off-road vehicle market, sourcing reliable manufacturers for CFMoto-related components and OEM/ODM production is critical. With increasing supply chain complexity and rising compliance risks, procurement leaders must prioritize speed, accuracy, and supplier credibility.

SourcifyChina’s 2026 Verified Pro List for CFMoto Factory China delivers a strategic advantage by providing immediate access to pre-vetted, audit-qualified manufacturing partners aligned with international quality, export, and ESG standards.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 80+ hours of initial supplier research, qualification, and background checks. |

| Factory Audits & Compliance Reports | Access to up-to-date ISO, BSCI, and production capacity documentation—no third-party audits required. |

| Direct Manufacturer Access | Bypass trading companies; engage with actual CFMoto OEM/ODM partners. |

| Verified Export Experience | All listed suppliers have proven track records shipping to EU, US, and APAC markets. |

| Negotiation-Ready Terms | Transparent MOQs, lead times, and pricing structures accelerate RFQ cycles. |

Time Saved: Procurement teams report reducing supplier onboarding from 12 weeks to under 14 days using the Verified Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t risk delays, compliance gaps, or counterfeit supply chains. With SourcifyChina’s Verified Pro List, you gain first-mover advantage in securing high-performance manufacturing partners for CFMoto-compatible products—ATV parts, engines, frames, and full vehicle assembly.

Take the next step with confidence:

✅ Request your complimentary supplier snapshot from the 2026 Verified Pro List

✅ Speak directly with our China-based sourcing consultants

✅ Fast-track RFQs with trusted, audit-backed factories

👉 Contact Us Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response within 2 business hours—time-zone optimized support for global procurement teams.

SourcifyChina

Your Trusted Gateway to Verified Chinese Manufacturing

© 2026 SourcifyChina. All rights reserved.

Data accurate as of Q1 2026. Supplier list updated quarterly.

🧮 Landed Cost Calculator

Estimate your total import cost from China.