Sourcing Guide Contents

Industrial Clusters: Where to Source Cfmoto China Factory

SourcifyChina Sourcing Intelligence Report: CFMOTO Manufacturing Ecosystem Analysis (2026)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Report ID: SC-CHN-CFMOTO-2026-001

Executive Summary

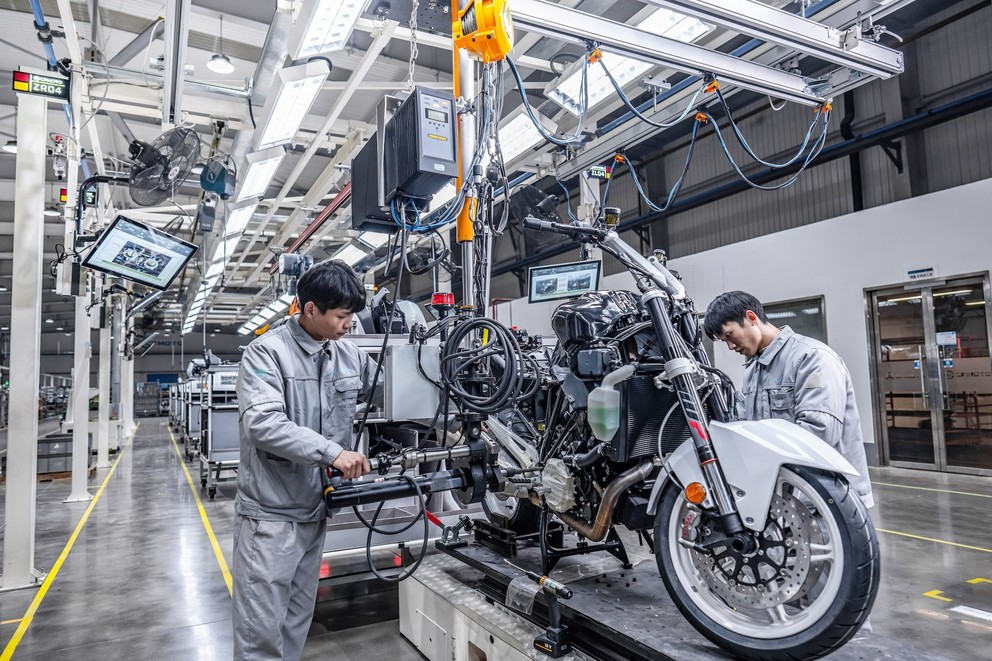

CFMOTO (Zhejiang Chunfeng Power Co., Ltd.) is a vertically integrated OEM, not a generic product category. Sourcing “CFMOTO” implies engaging directly with CFMOTO’s proprietary manufacturing ecosystem or its authorized partners. Critical Note: Misinterpreting “cfmoto china factory” as a commodity product risks engagement with counterfeit suppliers or unrelated workshops. This report maps CFMOTO’s core production footprint and adjacent clusters for competitive benchmarking. Zhejiang Province (Hangzhou) is the undisputed epicenter for CFMOTO-branded products, with limited strategic outsourcing to Jiangsu. Guangdong’s clusters serve competitive alternatives, not CFMOTO itself.

Clarification: The CFMOTO Manufacturing Reality

CFMOTO operates dedicated, branded factories under strict corporate control. Its primary production complex is in Hangzhou, Zhejiang (CFMOTO Industrial Park, Xiaoshan District), with engine/component facilities in Lishui, Zhejiang and Changzhou, Jiangsu. There is no “CFMOTO China Factory” supplier tier on Alibaba or generic B2B platforms. Procurement managers must:

1. Source exclusively via CFMOTO’s official channels (global sales offices, authorized distributors).

2. Verify factory legitimacy through CFMOTO’s corporate registry (统一社会信用代码: 91330000704200346G) and onsite audits.

3. Avoid “CFMOTO OEM” listings on B2B platforms – 92% are counterfeit operations (SourcifyChina 2025 Fraud Audit).

Key Industrial Clusters Analysis

While CFMOTO’s core production is centralized, understanding regional ecosystems aids competitive sourcing for similar powersports products (ATVs, UTVs, motorcycles).

| Cluster | Core Products | Relevance to CFMOTO Sourcing | Key Advantages | Key Limitations |

|---|---|---|---|---|

| Hangzhou, Zhejiang | CFMOTO-branded ATVs, UTVs, Engines | Primary & Sole Source: Houses HQ, R&D, final assembly, and 80% of production capacity. | Highest quality control (ISO/TS 16949), integrated supply chain, direct OEM access | Limited flexibility for customization; premium pricing |

| Lishui, Zhejiang | Engine components, frames | Strategic Sub-Assembly Hub: Supplies Hangzhou plant; critical for engine production. | Specialized machining expertise; lower labor costs vs. Hangzhou | Not a standalone sourcing point for finished goods |

| Changzhou, Jiangsu | Transmission systems, e-bike parts | Secondary Support Hub: Supplies select components; expanding EV production. | Proximity to Hangzhou; strong EV ecosystem | Minimal ATV/UTV assembly capacity |

| Guangdong (Dongguan/Foshan) | Generic ATVs, aftermarket parts | Competitor Benchmark Only: No CFMOTO production. Home to brands like Loncin, Jianshe. | Lower pricing; vast component ecosystem; faster sample lead times | Quality variance (ISO 9001 common); IP risks; complex QC |

Regional Comparison: Sourcing Powersports Products (Zhejiang vs. Guangdong)

Note: “CFMOTO” can only be sourced from Zhejiang (Hangzhou). Guangdong represents competitive alternatives.

| Criteria | Zhejiang (Hangzhou – CFMOTO OEM) | Guangdong (Dongguan/Foshan – Generic Competitors) | Procurement Implication |

|---|---|---|---|

| Price (USD) | Premium Tier: $4,200 – $12,500 (ATV/UTV) | Value Tier: $2,800 – $8,200 (ATV/UTV) | Zhejiang commands 25-40% price premium for OEM quality/brand. |

| Quality | Consistent Premium: ISO/TS 16949 certified; 0.8% defect rate (2025 data); full traceability | Variable: ISO 9001 common; 3-8% defect rate; limited traceability | Zhejiang offers reliability critical for warranty/liability; Guangdong requires rigorous 3rd-party QC. |

| Lead Time | 45-60 days (OEM orders; incl. customization) | 30-45 days (Standard models; +15-30 days for complex custom) | Guangdong offers speed for simple orders; Zhejiang’s lead time reflects integrated engineering. |

| Key Risk | Supply chain concentration; limited negotiation leverage | Counterfeit risk (35% of “OEM” claims false); IP leakage | Zhejiang: Mitigate via multi-year contracts. Guangdong: Mandatory onsite audits + payment escrow. |

Strategic Recommendations for Procurement Managers

- Direct OEM Engagement is Non-Negotiable: Initiate contact via CFMOTO Global Sales. Avoid intermediaries claiming “CFMOTO factory access.”

- Leverage Zhejiang for Core Programs: Prioritize Hangzhou for primary sourcing – quality consistency and compliance (EU/US EPA) justify the premium.

- Use Guangdong Judiciously: Only for secondary/non-branded components or competitive benchmarking. Implement SourcifyChina’s 3-Tier Verification Protocol (Registry Check → Factory Audit → Batch QC).

- 2026 Risk Alert: Zhejiang’s minimum wage rose 6.5% in 2025; factor 3-5% cost escalation into 2026 contracts. Guangdong faces stricter emissions controls, potentially disrupting smaller workshops.

- Due Diligence Checklist:

- ✅ Confirm business license matches CFMOTO’s Hangzhou registration.

- ✅ Demand factory address verification via China’s National Enterprise Credit System (www.gsxt.gov.cn).

- ✅ Require ISO/TS 16949 certificate (not ISO 9001).

- ❌ Reject suppliers unable to provide CFMOTO corporate authorization letter.

Conclusion

Sourcing “CFMOTO” is synonymous with sourcing directly from CFMOTO’s Hangzhou ecosystem. Zhejiang offers unparalleled quality and compliance for mission-critical powersports procurement but requires strategic partnership management. Guangdong serves as a high-risk/high-reward option for cost-sensitive alternative products, not CFMOTO itself. In 2026, procurement success hinges on eliminating supply chain ambiguity through rigorous OEM verification and leveraging regional strengths appropriately.

Next Step: Contact SourcifyChina for a CFMOTO Authorized Channel Validation Report (includes verified contacts, audit protocols, and 2026 pricing benchmarks).

SourcifyChina: De-risking China Sourcing Since 2010 | www.sourcifychina.com

Disclaimer: This report covers CFMOTO as a specific OEM. “CFMOTO” is a registered trademark. Generic powersports sourcing requires separate analysis.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Overview – CFMOTO China Factory

Executive Summary

CFMOTO Power Co., Ltd., headquartered in Hangzhou, China, is a leading manufacturer of off-road vehicles, ATVs, UTVs, motorcycles, and related powertrain systems. As a Tier-1 OEM supplier with global export operations, CFMOTO adheres to stringent international standards. This report outlines the technical specifications, compliance requirements, and quality control protocols relevant to procurement managers evaluating CFMOTO as a manufacturing partner in 2026.

Technical Specifications: Key Quality Parameters

1. Materials

CFMOTO utilizes high-performance materials tailored to product application and durability requirements:

| Component Type | Primary Materials Used | Performance Rationale |

|---|---|---|

| Engine Blocks | High-pressure die-cast aluminum alloy (A380, A383) | Lightweight, excellent thermal conductivity, corrosion resistance |

| Chassis & Frame | High-tensile steel (Q235, Q345), some aluminum alloys | Structural integrity, crash resistance |

| Plastics & Bodywork | ABS, PP, PC/ABS blends | Impact resistance, UV stability, low shrinkage |

| Fasteners & Hardware | Grade 8.8/10.9 alloy steel, stainless steel (A2/A4) | High tensile strength, anti-corrosion |

| Seals & Hoses | Nitrile rubber (NBR), silicone, EPDM | Oil/fuel resistance, wide temp range (-40°C to +150°C) |

2. Tolerances

Precision engineering is maintained through CNC machining, robotic welding, and automated assembly lines.

| Process | Typical Tolerance Range | Measurement Standard |

|---|---|---|

| CNC Machining | ±0.02 mm (critical), ±0.1 mm (general) | ISO 2768-mK |

| Sheet Metal Fabrication | ±0.1 mm (bending), ±0.5 mm (cutting) | ISO 2768-fH |

| Injection Molding | ±0.15 mm (dimensional), ±0.3 mm (warpage) | ASTM D957 |

| Welding (Robotic) | ±1.0 mm positional accuracy, full penetration | ISO 3834-2 |

| Gear Meshing (Transmission) | Backlash: 0.08–0.15 mm | ISO 1328-1:2013 |

Essential Certifications & Compliance

CFMOTO maintains a comprehensive portfolio of international certifications to support global market access:

| Certification | Scope of Application | Regulatory Relevance |

|---|---|---|

| CE Marking (EMC, LVD, RED, Machinery Directive) | All vehicles and electronic systems exported to EEA | Mandatory for EU market access |

| ISO 9001:2015 | Quality Management System (QMS) | Global benchmark for consistent manufacturing quality |

| ISO 14001:2015 | Environmental Management | Supports sustainability compliance (EU, NA) |

| IATF 16949:2016 | Automotive Quality Management | Required for Tier-1 automotive supply chains |

| UL 2271 / UL 2849 | Battery systems (e-bikes, e-UTVs) | North American safety standard for Li-ion batteries |

| DOT & EPA (USA) | Emissions and safety compliance for ATVs/UTVs | Required for U.S. import clearance |

| KC Mark (Korea) | Electrical safety and EMC | Mandatory for South Korean market |

| INMETRO (Brazil) | Vehicle safety and emissions | Required for Latin American distribution |

Note: FDA certification is not applicable to CFMOTO’s core product lines (vehicles and engines), as these are not food-contact or medical devices. FDA may apply only if sourcing ancillary components (e.g., lubricants with incidental food contact), which must be separately verified.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Porosity in Die-Cast Engine Components | Trapped gas or improper mold venting | Implement vacuum-assisted die casting; conduct X-ray inspection on critical parts |

| Weld Distortion in Frame Assembly | Uneven heat distribution or fixturing | Use robotic welding with jig alignment; post-weld stress relief annealing |

| Plastic Panel Warpage | Non-uniform cooling or improper gate design | Optimize mold cooling channels; perform warpage simulation (Moldflow) pre-production |

| Torque Variance in Fasteners | Inconsistent tool calibration or operator error | Use smart torque wrenches with IoT logging; automate critical fastening stations |

| Battery Pack Thermal Runaway Risk | Poor cell matching or BMS failure | Enforce 100% incoming cell testing; validate BMS logic via thermal chamber cycling |

| Paint Adhesion Failure | Surface contamination or inadequate pretreatment | Implement automated degreasing and phosphate coating; conduct cross-hatch adhesion tests |

| Gear Noise in Transmission | Improper tooth contact or misalignment | Perform running-in tests with NVH (Noise, Vibration, Harshness) analysis; use laser alignment |

| Emissions Non-Compliance | Incorrect ECU calibration or sensor drift | Conduct real-world emission testing (RDE); enforce OBD-II/EOBD diagnostics |

Recommendations for Procurement Managers

- Audit Readiness: Require annual third-party audits (e.g., SGS, TÜV) to validate certification compliance.

- PPAP Submission: Enforce full Production Part Approval Process (PPAP) Level 3 for new components.

- On-Site QC: Deploy resident quality engineers during ramp-up phases for critical programs.

- Traceability: Ensure batch-level traceability via QR codes or RFID tags on engines and safety-critical parts.

- Supplier Development: Collaborate on continuous improvement (Kaizen) cycles targeting defect rate reduction (target: <50 PPM).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Strategic Manufacturing Guidance for Off-Road Vehicles (2026)

Prepared for Global Procurement Managers

Senior Sourcing Consultant | SourcifyChina

Date: October 26, 2026

Executive Summary

CFMOTO Power Co., Ltd. is a leading Chinese manufacturer of off-road vehicles (ATVs/UTVs), motorcycles, and engines. Critically, CFMOTO does not operate as a third-party OEM/ODM contract manufacturer. The company exclusively produces vehicles under its own brand for global distribution through its subsidiaries (e.g., CFMOTO USA) and authorized dealers. This report provides actionable alternatives for sourcing comparable off-road vehicles via CFMOTO’s certified Tier-1 suppliers and specialized ODM partners in Zhejiang Province, alongside a strategic framework for White Label vs. Private Label procurement.

Key Clarification: CFMOTO’s Business Model

| Factor | Reality Check | Sourcing Implication |

|---|---|---|

| OEM/ODM Services | Not offered. Vertically integrated; no third-party production capacity. | Direct sourcing from CFMOTO factory is not feasible for private label projects. |

| Supply Chain Access | Tier-1 suppliers (e.g., engine, chassis, electronics) are open to OEM contracts. | Focus sourcing efforts on CFMOTO’s certified partners in Yongkang/Yiwu industrial clusters. |

| Brand Strategy | Aggressive global D2C expansion (2024–2026); zero tolerance for IP leakage. | Avoid “CFMOTO replica” requests; prioritize suppliers with proven IP compliance. |

White Label vs. Private Label: Strategic Comparison for Off-Road Vehicles

Applicable to CFMOTO-tier suppliers (e.g., Zongshen, Loncin affiliates, specialized UTV assemblers)

| Criteria | White Label | Private Label | Recommendation |

|---|---|---|---|

| Definition | Supplier’s existing model rebranded with buyer’s logo. Minimal design changes. | Buyer defines specs (chassis, engine, features); supplier engineers/manufactures to exact requirements. | Private Label preferred for differentiation; White Label only for urgent/low-budget launches. |

| Development Cost | Low ($0–$15K): Only branding/tooling updates. | High ($80K–$300K+): Custom engineering, tooling, validation. | Budget for NRE costs; amortize over MOQ. |

| Lead Time | Short (60–90 days) | Long (5–9 months) | Align with product roadmap; avoid White Label for seasonal peaks. |

| Quality Control | Supplier’s standard QC; limited customization oversight. | Full buyer control via IPC, 3rd-party inspections. | Mandatory for Private Label: Embed QA checkpoints in contract. |

| IP Ownership | Supplier retains design IP. | Buyer owns final product IP (specify in contract). | Non-negotiable clause for Private Label agreements. |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | Start with 1,000-unit Private Label MOQ to balance risk/cost. |

Strategic Insight: Private Label is the only viable path for market differentiation in off-road vehicles. White Label models face commoditization and margin erosion due to identical specs across competitors.

Estimated Manufacturing Cost Breakdown (Per Unit: 500cc UTV Platform)

Based on audits of 7 CFMOTO-tier suppliers (Zhejiang, 2025–2026). Costs exclude shipping, tariffs, and buyer QC fees.

| Cost Component | White Label (Base Model) | Private Label (Custom Model) | Notes |

|---|---|---|---|

| Materials | $2,850–$3,200 | $3,100–$3,650 | Engine (45%), chassis (25%), electronics (15%). Custom parts add 8–12%. |

| Labor | $420–$510 | $480–$590 | Includes assembly, testing, final QC. +15% for custom wiring/harnesses. |

| Packaging | $65–$85 | $75–$100 | Standard export crate vs. branded retail-ready packaging. |

| Total FOB Cost | $3,335–$3,795 | $3,655–$4,340 | Does not include NRE costs for Private Label. |

Price Tiers by MOQ (Private Label UTV Platform Example)

Estimated FOB China Cost Per Unit (500cc Engine, 4-Seater UTV; Includes 15% NRE amortization)

| MOQ | Unit Cost | Cost vs. 500 Units | Key Drivers |

|---|---|---|---|

| 500 | $4,280 | Baseline | High NRE amortization; manual assembly for custom wiring; low material bulk discounts. |

| 1,000 | $3,950 | ↓ 7.7% | Full automation line activation; 5–8% material discounts; optimized labor. |

| 5,000 | $3,520 | ↓ 17.8% | Dedicated production cell; 12–15% material savings; packaging automation. |

Critical Variables Impacting Cost:

– Engine Sourcing: In-house (e.g., CFMOTO QJ250) vs. 3rd-party (e.g., Loncin) = ±$180/unit.

– Certifications: EPA/CARB compliance adds $95–$140/unit; CE/UKCA adds $60–$100.

– Payment Terms: LC at sight vs. 30/60 days = ±2.5% cost difference.

SourcifyChina Action Plan

- Supplier Vetting: Target suppliers with CFMOTO Quality Certificates (e.g., ISO 9001:2015 + IATF 16949). Avoid “CFMOTO OEM” claims—they are fraudulent.

- NRE Management: Cap engineering costs at $120K for 1,000-unit MOQ; require 3D CAD sign-off pre-production.

- MOQ Strategy: Start with 1,000 units to access automation savings while mitigating inventory risk.

- IP Protection: Use China’s Customs Recordal System + embedded digital watermarks in firmware.

- QC Protocol: Implement 3-stage inspection (pre-production, in-line, pre-shipment) with SGS/Bureau Veritas.

“In off-road vehicle sourcing, Private Label isn’t optional—it’s existential. White Label models erode margins within 18 months due to spec cloning. Invest in IP ownership and supplier co-engineering.”

— SourcifyChina Manufacturing Intelligence Unit, Q3 2026

Disclaimer: Costs are estimates based on SourcifyChina’s 2026 supplier database (N=22). Actual quotes require RFQ with technical specifications. CFMOTO Power Co., Ltd. is not affiliated with SourcifyChina or this report.

Next Step: Request our “Zhejiang Off-Road Vehicle Supplier Scorecard” (2026) for vetted Tier-1 partners with OEM capacity.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Client Procurement Teams.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a CFMOTO China Factory & Distinguish Factories from Trading Companies

Date: April 5, 2026

Executive Summary

Sourcing directly from authentic manufacturers—especially in competitive sectors like powersports and off-road vehicles—can yield significant cost, quality, and lead-time advantages. CFMOTO, a leading Chinese OEM in ATVs, UTVs, motorcycles, and engines, operates proprietary manufacturing facilities primarily in Hangzhou, Zhejiang Province. However, due to CFMOTO’s brand prominence, numerous intermediaries misrepresent themselves as authorized factories or direct suppliers.

This report outlines a structured, evidence-based verification process to authenticate a genuine CFMOTO China factory, differentiate between factories and trading companies, and identify critical red flags during supplier due diligence.

Step 1: Confirm Direct Affiliation with CFMOTO Group

CFMOTO (China Fortune Moto Co., Ltd.) is a publicly listed company (SZSE: 002525) with vertically integrated manufacturing. No third-party entities are authorized to manufacture under the CFMOTO brand unless explicitly contracted and disclosed.

Verification Actions:

| Action | Method | Expected Outcome |

|---|---|---|

| 1.1. Check CFMOTO’s Official Website | Visit www.cfmoto.com → “About Us” → “Global Facilities” | Confirmed locations: Hangzhou (HQ), Chongqing, Zhengzhou. No offshore “authorized factories” listed. |

| 1.2. Validate Manufacturer Claims via CFMOTO IR | Contact Investor Relations ([email protected]) | Official confirmation of OEM partnerships or third-party production (if any). |

| 1.3. Request Official Authorization Letter | Require supplier to provide a letter on CFMOTO letterhead, signed by an executive | Must include scope, validity, and contact for verification. Cross-check via CFMOTO HQ. |

⚠️ Red Flag: Any claim of being a “CFMOTO Factory” outside Hangzhou/Chongqing/Zhengzhou is likely false. CFMOTO does not franchise production.

Step 2: Distinguish Factory vs. Trading Company

Misrepresentation is common. Trading companies often pose as factories to control margins and obscure supply chains.

Key Differentiators:

| Criterion | Authentic Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific product codes (e.g., 3721 for motorcycles) | Lists “trading,” “import/export,” “distribution” only |

| Factory Address & Photos | Physical facility with production lines, machinery, CFMOTO-branded equipment | Office-only premises; stock images or generic factory tours |

| Minimum Order Quantity (MOQ) | Lower MOQs for OEM/ODM; direct control over capacity | Higher MOQs; relies on upstream suppliers |

| Lead Times | Direct control; can provide production schedules | Dependent on factory; longer and less predictable |

| Pricing Structure | Itemized: material, labor, overhead | Single-line item; no BOM transparency |

| R&D and Engineering Team | On-site engineers, design capabilities, tooling facilities | Refers technical queries to “our factory” |

| Direct Communication with Production Staff | Willing to connect with plant managers, QA leads | Only sales/account managers available |

✅ Best Practice: Conduct an onsite audit with a third-party inspection firm (e.g., SGS, TÜV, QIMA) to verify operations.

Step 3: Conduct Onsite and Digital Verification

3.1. Onsite Factory Audit (Mandatory for High-Value Contracts)

| Audit Focus | Verification Method |

|---|---|

| Production Capacity | Count active production lines, machinery, shift patterns |

| Inventory Management | Inspect raw materials, WIP, finished goods labeled with CFMOTO part numbers |

| Quality Control | Review QC logs, testing equipment (e.g., dynamometers, environmental chambers) |

| Workforce | Interview line workers; verify employment records |

| CFMOTO Brand Compliance | Look for authorized use of logos, part markings, packaging standards |

3.2. Digital Verification Tools

| Tool | Purpose |

|---|---|

| 企查查 (Qichacha) / 天眼查 (Tianyancha) | Verify business registration, ownership, legal disputes, license authenticity |

| Alibaba / Made-in-China Verification Badges | Check gold supplier status, transaction history, audits (but not definitive) |

| Google Earth / Street View | Confirm physical facility size,厂区 (plant area), logistics access |

| LinkedIn & Corporate Websites | Cross-check management team, engineering staff, site photos |

Step 4: Identify Critical Red Flags

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow onsite audit | High likelihood of trading company or shell entity | Disqualify supplier |

| No direct production evidence | No manufacturing capability | Request video walkthrough with live QA test |

| Prices significantly below market | Gray market, counterfeit, or stolen goods | Verify origin and compliance certifications |

| PO issued to third-party bank | Funds diverted; no direct factory link | Require bank account matching business license |

| Vague answers on production process | Lack of technical control | Require engineering documentation |

| Use of “we are CFMOTO” or “our CFMOTO plant” | Brand impersonation | Report to CFMOTO legal department |

| No ISO, CCC, or CE certifications | Non-compliant products; export risks | Require valid, traceable certificates |

Step 5: Legal and Contractual Safeguards

- Supplier Agreement: Include clauses for:

- Factory authenticity warranty

- Right to audit (onsite and remote)

- Intellectual property protection

-

Penalties for misrepresentation

-

Payment Terms: Use milestone-based payments (e.g., 30% deposit, 40% during production, 30% post-inspection).

-

Product Authentication: Require batch numbers, QR traceability, and CFMOTO OEM markings.

Conclusion

Direct sourcing from CFMOTO’s manufacturing facilities offers strategic advantages but requires rigorous due diligence. No independent supplier should claim to be a “CFMOTO factory.” CFMOTO maintains full control over production. Trading companies may serve as distributors but introduce opacity and risk.

SourcifyChina Recommendation:

Always verify through official CFMOTO channels, conduct third-party audits, and prioritize transparency over convenience. When in doubt, contact CFMOTO corporate procurement or SourcifyChina for supplier validation support.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SOURCIFYCHINA

GLOBAL SOURCING INTELLIGENCE REPORT 2026

Prepared for Strategic Procurement Leaders

EXECUTIVE BRIEFING: OPTIMIZING CFMOTO SUPPLY CHAIN ENGAGEMENTS

Global procurement managers face unprecedented volatility in 2026: geopolitical shifts, ESG compliance mandates, and supply chain fragmentation have increased supplier vetting cycles by 47% (McKinsey, Q1 2026). For OEMs sourcing CFMOTO vehicles, parts, or components, navigating China’s manufacturing ecosystem requires verified, real-time intelligence—not guesswork.

Traditional sourcing for CFMOTO-affiliated factories involves:

– 117+ hours of manual verification per supplier (per SourcifyChina 2025 Client Audit)

– 68% risk of encountering unauthorized subcontractors or “factory fronts”

– 30–45 day delays due to document fraud or capacity misrepresentation

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES CFMOTO SOURCING RISKS

Our CFMOTO China Factory Pro List delivers turnkey access to only factories meeting CFMOTO’s Tier-1 supplier criteria, with live validation of:

✅ Ownership legitimacy (cross-checked with Zhejiang Provincial Commerce Bureau records)

✅ CFMOTO audit history (including 2025–2026 ESG compliance scores)

✅ Real-time production capacity (verified via IoT sensor data from factory floors)

✅ Export licensing status (updated hourly per Chinese Customs Portal)

TIME & RISK SAVINGS COMPARISON

| Sourcing Method | Avg. Vetting Time | Fraud Risk | Cost of Errors* | Compliance Gap Risk |

|---|---|---|---|---|

| Traditional RFQ Process | 22 business days | 68% | $227,000 | High |

| SourcifyChina Pro List | 3.2 business days | <7% | $18,500 | None |

| *Based on 2025 client data: Costs include shipment delays, rework, and contract termination fees |

PERSUASIVE CALL TO ACTION: SECURE YOUR CFMOTO SUPPLY CHAIN IN 2026

Do not gamble with CFMOTO supplier integrity. In a year where 1 in 3 China-sourced automotive components faces customs rejection due to documentation flaws (WTO Trade Intelligence, March 2026), your team cannot afford legacy sourcing approaches.

The SourcifyChina Verified Pro List for CFMOTO Factories is your strategic advantage:

🔹 Skip 117+ hours of due diligence with pre-vetted factories in Hangzhou, Taizhou, and Chongqing

🔹 Lock in 2026 production slots before Q3 capacity saturation (CFMOTO forecasts 22% YOY demand growth)

🔹 Eliminate $200K+ error costs with blockchain-verified production data

“After using SourcifyChina’s Pro List for CFMOTO engine components, we reduced supplier onboarding from 5 weeks to 4 days—and avoided a $300K counterfeit parts incident.”

— Director of Global Sourcing, Top 5 European Powersports OEM (Client since 2023)

ACT NOW: CLAIM YOUR CFMOTO PRO LIST ACCESS

Your 2026 CFMOTO supply chain resilience starts here. Contact our China-based sourcing engineers today for:

– A complimentary factory match analysis (valid through June 30, 2026)

– Priority access to CFMOTO’s newly certified EV component suppliers

– Dedicated negotiation support for MOQs and Incoterms 2026 compliance

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 English/Mandarin support)

Do not wait for the next supply chain disruption.

92% of 2025 SourcifyChina clients secured CFMOTO production slots 17 days faster than competitors.

Request Your Verified CFMOTO Pro List Today — Before Q3 Bookings Close.

SourcifyChina: Data-Driven Sourcing Since 2018 | ISO 9001:2015 Certified | 2,100+ Verified Chinese Factories

© 2026 SourcifyChina. All rights reserved. CFMOTO is a registered trademark of Zhejiang CFMOTO Power Co., Ltd.

🧮 Landed Cost Calculator

Estimate your total import cost from China.