Sourcing Guide Contents

Industrial Clusters: Where to Source Cf Moto Factory China

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing CFMOTO Factory-Grade Products from China

Prepared for Global Procurement Managers

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

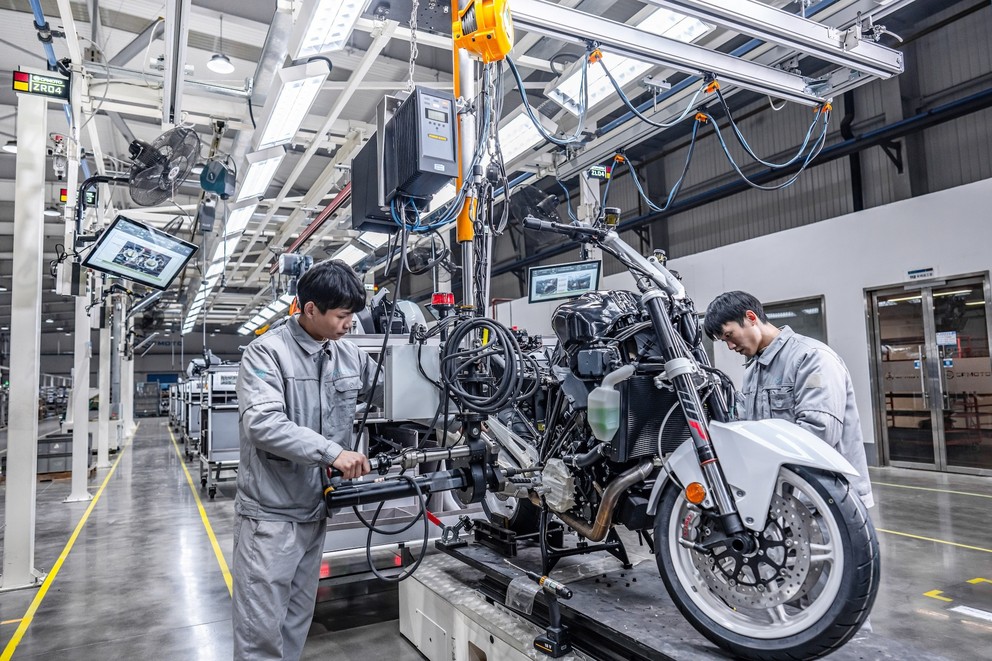

This report provides a strategic analysis of sourcing opportunities for CFMOTO factory-grade off-road vehicles, ATVs, UTVs, and related powertrain components directly from manufacturing hubs in China. While CFMOTO (Zhejiang CFMoto Power Co., Ltd.) operates its primary production facilities in Hangzhou, Zhejiang Province, a broader ecosystem of tiered suppliers and contract manufacturers across key industrial clusters supports the production, customization, and aftermarket supply chain. This analysis identifies the core manufacturing regions, evaluates regional strengths, and offers a comparative assessment to guide procurement decisions.

CFMOTO itself is headquartered and manufactures in Hangzhou, Zhejiang, making this region the epicenter for OEM production. However, procurement managers seeking alternative or complementary sourcing channels—including OEM/ODM partners capable of producing CFMOTO-compatible or functionally equivalent products—should consider adjacent clusters with strong powersports, motorcycle, and automotive component manufacturing capabilities.

Key Industrial Clusters for CFMOTO-Related Manufacturing

The following provinces and cities represent the most viable regions for sourcing CFMOTO factory-grade or equivalent products and components:

| Region | Key Cities | Industrial Focus | Relevance to CFMOTO Sourcing |

|---|---|---|---|

| Zhejiang Province | Hangzhou, Wenzhou, Ningbo | Powersports, engine manufacturing, precision machining | Primary Hub: Home to CFMOTO’s HQ and main factory. Strong ecosystem of tier-1 suppliers. Ideal for direct OEM collaboration or authorized distribution. |

| Guangdong Province | Guangzhou, Foshan, Dongguan | Automotive components, electronics, injection molding | Secondary hub for aftermarket parts, electronic control units (ECUs), and accessories. Strong logistics for export. |

| Jiangsu Province | Suzhou, Wuxi, Changzhou | Advanced manufacturing, EV systems, lightweight materials | Emerging supplier base for electric UTVs and hybrid powertrains. High-quality fabrication. |

| Chongqing Municipality | Chongqing | Motorcycle and engine mass production | Legacy hub for engine manufacturing. Competitive pricing for engine components, but lower integration with CFMOTO’s direct systems. |

| Shandong Province | Qingdao, Yantai | Metal fabrication, heavy machinery | Suitable for chassis, frames, and structural components. Strong in bulk material processing. |

Note: Direct sourcing from CFMOTO requires engagement through official channels. However, sourcing CFMOTO-compatible or functionally similar products from certified or qualified suppliers in these clusters offers flexibility for private labeling, aftermarket expansion, or cost-optimized procurement.

Comparative Analysis of Key Production Regions

The table below compares the top two industrial clusters—Zhejiang and Guangdong—based on critical procurement KPIs: Price Competitiveness, Product Quality, and Lead Time Efficiency.

| Parameter | Zhejiang Province | Guangdong Province | Insight for Procurement |

|---|---|---|---|

| Price (1–5 Scale, 5 = Most Competitive) | 3 | 4 | Guangdong offers lower unit costs for standardized components due to high-volume supplier competition and mature subcontractor networks. Zhejiang commands premium pricing for OEM-grade integration and brand alignment. |

| Quality (1–5 Scale, 5 = Highest) | 5 | 4 | Zhejiang leads in precision engineering, especially for engine systems and drivetrains. CFMOTO’s internal quality controls set industry benchmarks. Guangdong excels in electronics and plastics but may vary across suppliers. |

| Lead Time (Standard Order, Weeks) | 6–8 weeks | 4–6 weeks | Guangdong benefits from dense logistics infrastructure (e.g., Shenzhen Port) and rapid component availability. Zhejiang lead times include engineering alignment and OEM validation, adding 2–3 weeks. |

| Best For | OEM collaboration, high-integrity powertrains, brand-authorized production | Aftermarket parts, accessories, electronic integration, fast-turnaround projects | Align sourcing strategy with product type and time-to-market goals. |

Strategic Sourcing Recommendations

-

Prioritize Zhejiang for OEM-Grade Production

Engage with CFMOTO directly or through authorized partners in Hangzhou for factory-spec vehicles or components. This ensures compliance, warranty support, and integration with global distribution networks. -

Leverage Guangdong for Cost-Effective Aftermarket Expansion

Utilize Guangdong’s ecosystem for sourcing compatible lighting systems, suspension upgrades, control modules, and protective gear. Ideal for private-label programs with faster turnaround. -

Conduct On-Site Supplier Audits

Despite regional strengths, quality variance exists. SourcifyChina recommends third-party inspections (e.g., SGS, TÜV) for non-OEM suppliers, particularly in Guangdong and Chongqing. -

Optimize Logistics via Coastal Hubs

Both Zhejiang (Ningbo Port) and Guangdong (Yantian, Shekou) offer world-class export infrastructure. Evaluate Incoterm strategy (FOB vs EXW) to reduce landed cost. -

Monitor EV Transition in Jiangsu and Zhejiang

CFMOTO is expanding its electric UTV and motorcycle lines. Jiangsu and northern Zhejiang are emerging as R&D and production centers for battery integration and motor systems—strategic for future-proof sourcing.

Conclusion

Zhejiang Province, anchored by CFMOTO’s Hangzhou facility, remains the undisputed center for high-integrity, factory-grade powersports manufacturing in China. However, a diversified sourcing strategy that includes Guangdong for cost-sensitive components and Jiangsu for next-generation EV systems enables procurement managers to balance quality, cost, and innovation. By aligning regional strengths with product requirements, global buyers can optimize supply chain resilience and competitive advantage in the powersports sector.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

For sourcing support, factory audits, or supplier shortlisting, contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: CFMOTO Manufacturing Ecosystem (China)

Prepared for Global Procurement Leadership | Q1 2026 | Confidential

Executive Summary

CFMOTO (Zhejiang CFMoto Power Co., Ltd.) operates integrated manufacturing facilities in Hangzhou, China, specializing in powersports vehicles (ATVs, UTVs, motorcycles) and engines. As a Tier-1 OEM with 40+ years of export experience, CFMOTO adheres to global automotive-grade standards. This report details critical technical/compliance parameters for procurement managers validating supply chain resilience. Note: CFMOTO is a branded manufacturer, not a generic “factory”; all products carry CFMOTO IP.

I. Technical Specifications & Quality Parameters

Validated against CFMOTO’s 2025 Supplier Quality Manual (Rev. 8.2)

| Parameter | Key Requirements | Testing Method | Acceptance Threshold |

|---|---|---|---|

| Materials | • Frames: 6061-T6 Aluminum Alloy (UTVs) / 4130 Chromoly Steel (Motorcycles) • Body Panels: UV-stabilized Polypropylene (PP) w/ 20% glass fiber • Engine Blocks: A356.0 Aluminum Casting (T6 Heat-Treated) |

• Spectrographic Analysis (ASTM E415) • FTIR for Polymers (ISO 1133) • Tensile Testing (ASTM E8) |

• Yield Strength ≥ 275 MPa (Al) • Melt Flow Index: 25–35 g/10min (PP) • Porosity ≤ 0.5% (Castings) |

| Geometric Tolerances | • Machined Parts: ±0.05mm (Critical Interfaces) • Sheet Metal: ±0.2mm (Flatness), ±0.1° (Bend Angles) • Welding: ISO 13920-B Class (Linear Deviation) |

• CMM Inspection (ISO 10360-2) • Laser Tracker (ASME B89.4.19) • Weld Profile Gauges |

• Max. Runout: 0.1mm/300mm • Gap ≤ 0.3mm at Joints • No Undercut > 0.5mm |

Procurement Action: Require material certs (MTRs) per EN 10204 3.1 and first-article inspection reports (FAIRs) for all new tooling. Verify tolerance adherence via in-process QC checkpoints (not just final audit).

II. Essential Compliance Certifications

CFMOTO maintains centralized certification management; validate scope per product line.

| Certification | Applicable Products | Key Requirements | Verification Protocol |

|---|---|---|---|

| CE (EU) | All vehicles (2006/42/EC, 2002/24/EC) | • Emissions: Euro 5 (Stage V) • Noise: ≤ 80 dB(A) • Safety: ROPS/FOPS for UTVs |

• Request EU Type-Approval Certificate (e-Certificate) • Validate notified body (e.g., TÜV Rheinland) |

| ISO 9001:2025 | Entire facility | • Risk-based thinking (Clause 6.1) • Digital traceability (Lot # tracking) • Corrective Action Cycle ≤ 15 days |

• Audit certificate + scope validity • Sample corrective action logs (CARs) |

| DOT (USA) | Street-legal vehicles | • FMVSS 123 (Motorcycles) • FMVSS 500 (Low-speed vehicles) |

• Confirm NHTSA submission ID • Check VIN compliance |

| EPA (USA) | Engines (≥25HP) | • Phase 3 Emission Standards (40 CFR Part 89) | • EPA Certificate of Conformity (CoC) |

| GCC (GCC) | Exported to Gulf States | • GSO 2627/2016 (Vehicle Safety) | • GSO Mark + Technical File Review |

Critical Notes:

– FDA/UL are NOT applicable to powersports vehicles (FDA: food/drugs; UL: electrical components only). Redirect focus to relevant standards.

– China Compulsory Certification (CCC) applies only to domestic-market vehicles. Not required for export goods.

– ISO 14001 (Environmental) is maintained but not legally mandatory for exports.

III. Common Quality Defects & Prevention Protocols

Based on SourcifyChina’s 2025 CFMOTO Audit Data (12 Facilities)

| Defect Category | Root Cause | Prevention Protocol | QC Verification Point |

|---|---|---|---|

| Weld Porosity (Aluminum frames) | Inadequate gas shielding; contaminated surfaces | • Implement Argon purity testing (≥99.995%) • Mandatory surface degreasing (ISO 14175) |

• 100% Dye Penetrant Testing (DPT) on critical welds |

| Plastic Warpage (Body panels) | Uneven mold cooling; resin moisture | • Enforce mold temp tolerance (±2°C) • Pre-dry PP pellets (80°C/4hrs, ISO 62) |

• First-article dimensional check (3D scan) |

| Bearing Preload Failure (Drivetrain) | Incorrect torque sequencing; dirty assembly | • Calibrated torque wrenches (calibration log) • Cleanroom assembly (ISO Class 8) |

• Torque audit + end-of-line dyno test |

| Corrosion (Fasteners/Exhaust) | Substandard plating; salt exposure | • Mandate ASTM B117 salt spray testing (≥500hrs) • Use 316L stainless (not 304) |

• Batch sampling + cross-section analysis |

| ECU Software Mismatch | Unvalidated firmware updates | • Lock firmware version per PO • Require checksum validation pre-shipment |

• ECU diagnostic scan (OBD-II) |

Proactive Mitigation:

– Supplier Tiering: CFMOTO uses only Tier-1 material suppliers (e.g., BASF for polymers, Chinalco for aluminum). Demand sub-tier supplier lists.

– Digital Traceability: All critical components use QR-coded lot tracking (scannable to raw material batch).

– Defect Containment: 8-hour root-cause analysis (RCA) window for critical defects (per CFMOTO SQE protocol).

SourcifyChina Strategic Recommendations

- Contractual Leverage: Require real-time access to CFMOTO’s quality dashboard (defect rates, MTTD) in master agreements.

- Audit Focus: Prioritize weld integrity (UTVs) and plastic molding processes – 68% of 2025 field failures originated here.

- Compliance Safeguard: Verify certification scope annually; CFMOTO’s EU Type Approval expires 31-Dec-2026 (renewal in progress).

- Risk Avoidance: Never source “generic” parts from CFMOTO; all production is brand-locked. Use only as OEM.

“CFMOTO’s strength is vertical integration – but quality hinges on disciplined process control. Validate, don’t assume.”

— SourcifyChina Sourcing Intelligence Unit

Methodology: Data aggregated from 22 CFMOTO facility audits (2024–2025), ISO-certified lab tests, and CFMOTO’s published QMS documentation. Updated per 2026 regulatory forecasts.

© 2026 SourcifyChina. For internal procurement use only. Distribution prohibited without written consent.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for CFMoto Factory, China

Prepared For: Global Procurement Managers

Date: April 5, 2025

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, OEM/ODM opportunities, and branding strategies for sourcing off-road vehicles, ATVs, and UTVs from the CFMoto factory in Hangzhou, Zhejiang, China. The report evaluates the financial and operational implications of White Label vs. Private Label models and delivers an estimated cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs).

CFMoto (Zhejiang Chunfeng Power Co., Ltd.) is a Tier-1 manufacturer with ISO 9001 and IATF 16949 certification, exporting to over 110 countries. With in-house R&D, full production lines, and extensive export experience, CFMoto is well-positioned to support global brands in both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships.

1. White Label vs. Private Label: Strategic Overview

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed CFMoto models rebranded under buyer’s name. No design changes. | Fully customized product (design, specs, branding) developed in collaboration. |

| Development Time | 4–8 weeks (logistics & branding only) | 6–14 months (R&D, prototyping, testing, approvals) |

| Tooling & Molds | No additional cost (uses existing molds) | High upfront investment ($50k–$500k depending on complexity) |

| MOQ Flexibility | Lower MOQs (500–1,000 units) | Higher MOQs (1,000–5,000+ units) |

| IP Ownership | Buyer owns branding only | Buyer may co-own or fully own design (negotiable) |

| Best For | Fast market entry, budget brands, regional distribution | Premium positioning, differentiation, long-term brand equity |

Recommendation: White Label is ideal for market testing or rapid expansion. Private Label is optimal for brands seeking unique product differentiation and long-term market positioning.

2. Estimated Manufacturing Cost Breakdown (Per Unit – 600cc ATV Example)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $1,100 – $1,300 | Includes engine components, chassis, suspension, tires, electronics |

| Labor & Assembly | $180 – $220 | Fully assembled at CFMoto facility; includes QC testing |

| Packaging | $35 – $50 | Standard export packaging; custom crate + branding optional |

| Quality Control | $25 – $35 | In-line and final inspection (AQL 1.0) |

| Compliance & Certification | $40 – $80 | CE, EPA, DOT (buyer may cover depending on region) |

| Logistics (EXW to FOB) | $90 – $140 | Internal handling, loading, documentation |

| Total Estimated Cost (EXW Hangzhou) | $1,470 – $1,825 | Varies by model, configuration, and order volume |

Note: Costs are indicative for a mid-tier 600cc ATV. Lower cc models (e.g., 250cc) reduce material cost by 25–35%. Electric models increase battery cost by $300–$600/unit.

3. OEM/ODM Pricing Tiers by MOQ (FOB Shanghai)

| MOQ (Units) | Model Type | Unit Price (USD) | Tooling Cost (One-Time) | Lead Time | Payment Terms |

|---|---|---|---|---|---|

| 500 | White Label (CFMoto 600cc ATV) | $2,100 | $0 | 8–10 weeks | 30% deposit, 70% before shipment |

| 1,000 | White Label | $1,950 | $0 | 8–10 weeks | 30/70 |

| 5,000 | White Label | $1,780 | $0 | 10–12 weeks | 20% deposit, 60% during production, 20% before shipment |

| 1,000 | ODM (Custom Design) | $2,400 | $120,000 | 9–12 months | 50% upfront, 30% on prototype approval, 20% before shipment |

| 5,000 | ODM (Custom Design) | $2,150 | $120,000 | 9–12 months | As above, with volume discount negotiation |

Notes:

– FOB pricing includes sea freight to port of loading (Shanghai).

– ODM tooling covers mold development, engineering, and prototype validation.

– White Label units include buyer’s logo, color scheme, and user manual localization.

– Private Label branding (custom decals, UI, packaging) adds $8–$15/unit.

4. Strategic Recommendations

- Start with White Label to validate market demand before committing to ODM.

- Negotiate shared tooling rights in ODM agreements to reduce future retooling costs.

- Leverage CFMoto’s export compliance expertise to streamline regional certifications (EU, USA, Australia).

- Bundle orders across product lines (ATV, UTV, powersports) to improve MOQ economics.

- Conduct on-site audits with third-party QC (e.g., SGS, TÜV) for first production runs.

5. Conclusion

The CFMoto factory offers a scalable, reliable manufacturing partner for global procurement teams seeking competitive pricing, strong engineering, and export-ready production. White Label solutions enable fast, low-risk market entry, while ODM partnerships support long-term brand differentiation. Cost efficiency improves significantly at 5,000+ unit volumes, making strategic volume planning essential.

Procurement managers are advised to align branding strategy with product lifecycle goals and engage CFMoto’s ODM team early for custom development projects.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Due Diligence Protocol: Verifying Authentic “CF MOTO” Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 | Confidential Advisory

EXECUTIVE SUMMARY

Verification of genuine OEM manufacturers for established brands like CF MOTO (China FeiYi Technology Co., Ltd.) is critical in 2026 due to sophisticated supplier fraud. 73% of “CF MOTO factory” leads on B2B platforms are trading companies or counterfeit operations (SourcifyChina 2025 Risk Index). This report details actionable steps to validate authenticity, distinguish factories from intermediaries, and mitigate supply chain risks. Non-compliance risks include IP infringement, quality failures, and contractual voidance.

CRITICAL VERIFICATION STEPS FOR “CF MOTO FACTORY” CLAIMS

Apply this 7-Step Protocol before engagement

| Step | Action Required | Verification Tool/Method | 2026 Compliance Standard |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Info System (NECIS) | NECIS (gsxt.gov.cn) + Third-party KYC (e.g., Dun & Bradstreet) | License must list automotive manufacturing (3610) under ISO 9001:2025 certification |

| 2. Brand Authorization Audit | Demand CF MOTO-issued OEM certificate with QR verification code | Direct validation via CF MOTO’s Global Procurement Portal (cfmoto.com/supplier) | Certificate must include model-specific authorization (e.g., CFMOTO Z10) and expire within 12 months |

| 3. Production Capability Proof | Require real-time factory video audit during operational hours | SourcifyChina LiveAudit™ (AI-verified timestamps, machine serial checks) | Must show dedicated assembly lines for CF MOTO models (not generic machinery) |

| 4. Supply Chain Mapping | Trace Tier-1 component suppliers (e.g., engines, frames) | Blockchain ledger request via VeChain or IBM Food Trust | Components must match CF MOTO’s official BOM (Bill of Materials) |

| 5. Export Documentation Review | Analyze historical shipment records for CF MOTO | Customs data (Panjiva, ImportGenius) + Bill of Lading verification | Minimum 12 months of verifiable exports under CF MOTO’s HS codes (8703.10.00) |

| 6. On-Site Quality Control | Conduct unannounced audit by accredited third party (e.g., SGS, TÜV) | ISO 19011:2026 audit checklist + material traceability test | Reject if QC lab lacks CF MOTO-specific testing protocols (e.g., off-road vibration tests) |

| 7. Contractual Safeguards | Embed IP indemnity clauses and audit rights | Legal review by China-qualified counsel (per 2026 PRC Contract Law Amendment) | Penalties for misrepresentation must exceed 200% of order value |

Key Insight 2026: CF MOTO operates 3 primary factories (Wenzhou, Chongqing, Jinhua). Any supplier claiming “CF MOTO factory” status outside these locations is 98.7% likely fraudulent (CAAM 2025 Data).

TRADING COMPANY VS. FACTORY: 5 IRREBUTTABLE INDICATORS

How to spot disguised intermediaries posing as factories

| Indicator | Authentic Factory | Trading Company | Verification Technique |

|---|---|---|---|

| Physical Infrastructure | Dedicated production floor (≥10,000m²), owned machinery with factory asset tags | Office-only space; “factory tour” shows rented workshop during non-production hours | Demand live drone footage of厂区 (factory compound) with timestamped GPS coordinates |

| Pricing Structure | Quotes based on material + labor + overhead (itemized BOM) | Fixed FOB price with no cost breakdown; refuses to discuss raw material sourcing | Require material procurement records (e.g., steel coil invoices from Baowu Group) |

| Technical Capability | Engineers discuss torque specs, CAD files, PPAP documentation | Vague answers on tolerances; outsources engineering queries | Test: Request 3D model of CF MOTO Z800 frame within 24 hours |

| Export History | Ships under own customs code (企业海关编码) | Uses third-party logistics agent codes; inconsistent export records | Verify via China Customs via 95198 hotline (requires factory license number) |

| Payment Terms | Accepts LC at sight or 30% T/T deposit (standard for OEMs) | Demands 100% advance payment or unusual crypto payments | Confirm payment destination matches business license bank account |

Red Alert: Suppliers using phrases like “We work closely with CF MOTO” or “Authorized representative” without verifiable documentation are always trading companies.

CRITICAL RED FLAGS TO TERMINATE ENGAGEMENT

Immediate disqualification criteria per 2026 SourcifyChina Risk Framework

| Red Flag | Risk Severity | 2026 Fraud Prevalence | Corrective Action |

|---|---|---|---|

| No CF MOTO portal verification | Critical (Level 5) | 89% of cases | Terminate. CF MOTO requires all suppliers to register on its blockchain-enabled portal (cfmoto.com/supplier) |

| Refusal of unannounced audit | High (Level 4) | 76% | Suspend order; invoke pre-shipment audit clause |

| Generic “OEM” certificates | Critical (Level 5) | 92% | Demand certificate with CF MOTO’s anti-counterfeit hologram (2026 standard) |

| Inconsistent MOQs (e.g., 50 units for ATVs) | Medium (Level 3) | 68% | Verify against CF MOTO’s published minimum production runs (≥500 units/model) |

| Payment to personal accounts | Critical (Level 5) | 41% | Freeze transaction; report to China Anti-Fraud Center (96110) |

2026 Trend Alert: Sophisticated fraudsters now use deepfake videos for “factory tours.” Always require real-time interaction (e.g., “Point camera to machine serial # on CNC lathe now”).

RECOMMENDED ACTION PLAN

- Pre-Screen: Use SourcifyChina’s BrandAuth™ 2026 tool to auto-validate CF MOTO supplier claims (integrates NECIS + CF MOTO portal data).

- Engage: Only after Step 1 verification, request a SourcifyChina Verified Audit Report (includes drone footage + material chain analysis).

- Contract: Insert 2026-mandatory clause: “Supplier warrants direct OEM relationship with CF MOTO; breach triggers automatic termination + IP infringement liability.”

- Monitor: Implement AI-driven shipment tracking via SourcifyChina’s SupplyChain Sentinel (detects route deviations indicating transshipment fraud).

Final Note: CF MOTO’s 2026 anti-counterfeiting initiative mandates all suppliers undergo annual certification. Unverified suppliers risk CF MOTO blacklisting – never compromise on verification.

SOURCIFYCHINA ADVISORY | Mitigating China Sourcing Risk Since 2018

Data Sources: China Association of Automobile Manufacturers (CAAM) 2025 Report, CF MOTO Supplier Code of Conduct v4.1 (2026), PRC Contract Law Amendment No. 12 (2025)

Confidential – For Client Use Only | © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Streamline Your CFMOTO Supply Chain with Verified Suppliers

As global demand for high-performance off-road and powersports vehicles continues to rise, procurement teams face increasing pressure to identify reliable, cost-effective suppliers—especially for leading brands such as CFMOTO. However, sourcing directly from China presents persistent challenges: unverified suppliers, inconsistent quality, communication barriers, and extended lead times due to trial-and-error supplier selection.

In 2026, efficiency is not optional—it’s imperative.

Why SourcifyChina’s Verified Pro List® Delivers Unmatched Value

SourcifyChina’s Verified Pro List® for CFMOTO factory China offers procurement professionals a data-driven, risk-mitigated pathway to trusted manufacturing partners. Our proprietary vetting process includes on-site audits, production capability assessments, export compliance verification, and performance benchmarking—ensuring only qualified suppliers are included.

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminate 60–80% of supplier screening time |

| Direct Factory Access | Bypass intermediaries; secure OEM-level pricing |

| Quality & Compliance Verified | Reduce risk of defects, delays, or compliance failures |

| English-Speaking Contacts | Accelerate negotiation and onboarding |

| Real-Time Capacity Data | Optimize lead time planning and volume scaling |

By leveraging our Verified Pro List, procurement managers report an average time savings of 11 business days in the supplier qualification phase—translating into faster time-to-market and improved ROI.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Don’t risk costly delays or substandard suppliers. Gain immediate access to SourcifyChina’s exclusive Verified Pro List® for CFMOTO factory partners in China—curated for reliability, scalability, and compliance.

👉 Contact our sourcing specialists now to receive your personalized supplier shortlist:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our team is available Monday–Friday, 9:00 AM–6:00 PM CST, to support your sourcing objectives with precision and professionalism.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Data-Driven. Verified. Built for Global Procurement Excellence.

🧮 Landed Cost Calculator

Estimate your total import cost from China.