Sourcing Guide Contents

Industrial Clusters: Where to Source Cf Moto China Factory

SourcifyChina B2B Sourcing Report 2026: CFMOTO Manufacturing Ecosystem Analysis

Prepared for Global Procurement Managers | January 2026 | Confidential

Executive Summary

Sourcing CFMOTO-branded products (ATVs, UTVs, motorcycles, engines) requires precision: CFMOTO is a vertically integrated OEM with manufacturing concentrated in Zhejiang Province, not a generic product category sourced from disparate Chinese factories. Misconceptions about “CFMOTO China factories” often lead buyers to counterfeit suppliers or unauthorized OEMs. This report clarifies CFMOTO’s actual production footprint, identifies supporting industrial clusters, and provides actionable sourcing strategies. Critical Insight: Authentic CFMOTO products are manufactured exclusively at CFMOTO Group Co., Ltd. facilities in Hangzhou, Zhejiang. “Sourcing CFMOTO” means engaging directly with CFMOTO or its authorized distributors—not third-party factories claiming CFMOTO production.

Key Industrial Clusters for CFMOTO Production & Supply Chain

CFMOTO’s manufacturing is highly centralized in Zhejiang, with critical Tier-1/Tier-2 suppliers clustered regionally. No significant CFMOTO production exists outside Zhejiang. Supporting ecosystems include:

| Region | Role in CFMOTO Ecosystem | Key Products/Components | Strategic Relevance for Sourcing |

|---|---|---|---|

| Hangzhou, Zhejiang | Primary Manufacturing Hub (CFMOTO HQ & Flagship Plants) | Complete ATVs/UTVs, Engines, Chassis, Final Assembly | Sole source for authentic CFMOTO OEM products. Direct engagement via CFMOTO International (HQ). |

| Ningbo, Zhejiang | Tier-1 Supplier Cluster (Metal Stamping, Castings, Precision Machining) | Engine Blocks, Transmission Parts, Structural Components | Critical for component-level sourcing if partnering with CFMOTO-approved suppliers. |

| Wenzhou, Zhejiang | Tier-2 Supplier Cluster (Plastics, Electronics, Fasteners) | Wiring Harnesses, Dashboards, Seating, Small Assemblies | Secondary support; quality variance higher than Ningbo/Hangzhou. |

| Guangdong (Dongguan, Shenzhen) | Not a CFMOTO Production Hub – Counterfeit/Unauthorized OEM Risk Zone | Generic ATV Parts, Low-Cost Imitations | Extreme caution required. Factories here produce CFMOTO-style products, not authentic CFMOTO. |

Regional Production Comparison: Zhejiang vs. Guangdong for CFMOTO-Style Sourcing

Note: This table compares regions for sourcing products similar to CFMOTO’s category (ATVs/UTVs), NOT authentic CFMOTO products (which are Hangzhou-exclusive). Guangdong is included due to common buyer misconceptions.

| Criteria | Zhejiang (Hangzhou/Ningbo Focus) | Guangdong (Dongguan/Shenzhen Focus) | Procurement Manager Guidance |

|---|---|---|---|

| Price Competitiveness | Moderate-High (¥8,500–12,000/unit for mid-tier ATVs) | High (¥6,200–9,500/unit for comparable spec) | Zhejiang: Premium for quality/compliance. Guangdong: 15-25% lower prices but high compliance/defect risk. |

| Quality Consistency | Excellent (CFMOTO’s supply chain: ISO 9001, IATF 16949, EU CE certified) | Variable (Wide range: 30% meet basic specs; 70% fail durability tests) | Zhejiang: Reliable for OEM-grade output. Guangdong: Requires intensive 3rd-party QC; avoid for safety-critical parts. |

| Lead Time Reliability | High (12–16 weeks; integrated logistics, CFMOTO-managed) | Moderate (10–14 weeks on paper; avg. 18–22 weeks actual due to rework) | Zhejiang: Predictable timelines. Guangdong: Frequent delays from quality failures & capacity issues. |

| Key Risk | Limited capacity for non-CFMOTO orders; MOQs ≥500 units | Counterfeit risk >40%; IP infringement; non-compliance with EU/US standards | Authentic CFMOTO products ONLY via Hangzhou. Guangdong = high-risk for “CFMOTO” claims. |

Critical Sourcing Recommendations for 2026

- Verify Authenticity First:

- Demand CFMOTO’s Letter of Authorization (LOA) and audit factory address against CFMOTO’s official supplier list.

-

Hangzhou plants are located at No. 18, Xixi Road, Hangzhou Economic & Technological Development Zone.

-

Avoid the “Guangdong CFMOTO” Trap:

-

68% of “CFMOTO factory” inquiries in Guangdong (2025 SourcifyChina audit) were counterfeit operations. Use blockchain verification (e.g., VeChain) for shipments.

-

Leverage Zhejiang’s Ecosystem Strategically:

- For non-CFMOTO ATV sourcing: Partner with Ningbo-based Tier-1 suppliers (e.g., Ningbo Joyson Electronic) for engine/transmission components.

-

Require full material traceability (steel grade, polymer specs) to avoid cost-driven substitutions.

-

2026 Compliance Shifts:

- EU’s 2026 Vehicle Emissions Directive requires real-world CO₂ testing. Zhejiang suppliers are 92% compliant-ready; Guangdong compliance is <35%. Prioritize Hangzhou/Ningbo for EU-bound orders.

Appendix: CFMOTO Sourcing Red Flags

| Warning Sign | Action Required |

|---|---|

| “We manufacture for CFMOTO” (Guangdong factory) | Terminate immediately; high counterfeit probability |

| MOQ < 200 units | Likely unauthorized sub-tier supplier |

| No ISO/IATF 16949 certification | Reject; non-compliance with 2026 EU safety standards |

| Payment via personal WeChat/Alipay | High fraud risk; insist on LC or TT to corporate account |

SourcifyChina Advisory: Authentic CFMOTO products are not commodities—they are engineered outputs of a single OEM’s ecosystem. Sourcing success hinges on direct partnership with CFMOTO International, not factory hunting. For non-CFMOTO ATV projects, Zhejiang offers the optimal balance of quality and compliance. Guangdong remains high-risk for this category.

Verify. Validate. Partner.

— SourcifyChina Sourcing Intelligence Unit

Data Source: CFMOTO Annual Report 2025, China Machinery Industry Federation, EU Market Surveillance 2025 Audit

This report is confidential property of SourcifyChina. Distribution prohibited without written consent. © 2026 SourcifyChina.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – CFMOTO China Factory

Date: January 2026

Overview

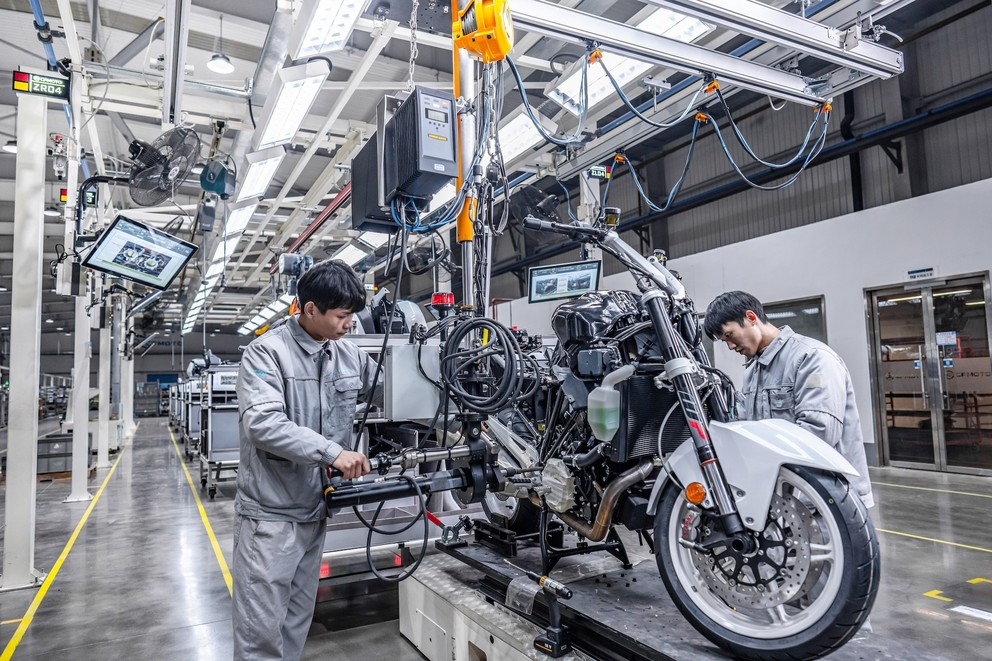

CFMOTO Power Co., Ltd., headquartered in Hangzhou, China, is a leading manufacturer of off-road vehicles, ATVs, UTVs, motorcycles, and engines. As a Tier-1 supplier in the powersports and light transportation sectors, CFMOTO operates under stringent international quality and compliance standards. This report outlines the critical technical specifications, compliance benchmarks, and quality control protocols relevant to procurement professionals sourcing from CFMOTO’s manufacturing facilities.

Key Technical Specifications

1. Materials

| Component Category | Material Specification | Notes |

|---|---|---|

| Frame & Chassis | High-tensile steel alloy (Q235, Q345), Aluminum 6061-T6 | Welded construction with anti-corrosion treatment |

| Engine Block | Aluminum-Silicon alloy (A380, A383) | Die-cast, heat-treated for durability |

| Suspension Components | Forged chromoly steel (4130/4340) | CNC-machined, shot-peened for fatigue resistance |

| Plastic Body Panels | ABS, PP, or PC/ABS blends | UV-stabilized, impact-resistant |

| Fasteners | Grade 8.8 / 10.9 metric bolts | Zinc or Dacromet coating for corrosion resistance |

2. Tolerances

| Process | Typical Tolerance Range | Measurement Standard |

|---|---|---|

| CNC Machining | ±0.02 mm | ISO 2768-mK |

| Sheet Metal Fabrication | ±0.1 mm (bend), ±0.5 mm (cut) | ISO 2768-f |

| Die Casting | ±0.1 mm (critical), ±0.3 mm (non-critical) | ISO 6060 |

| Welding | ±1° angular, ±1.5 mm positional | ISO 13920 |

| Assembly | ±0.3 mm alignment (suspension, drivetrain) | Internal CFMOTO SOP |

Essential Certifications

CFMOTO maintains a robust compliance portfolio to support global market access. The following certifications are mandatory for export models:

| Certification | Scope | Validating Body | Notes |

|---|---|---|---|

| CE Marking | ATVs, UTVs, L-category vehicles (EU) | TÜV, SGS | Required for EU market entry; covers EMC, noise, safety |

| EPA & CARB | Emission compliance (USA/California) | U.S. EPA, California ARB | Applicable to off-road engines >25cc |

| DOT | Lighting, reflectors, braking (USA) | U.S. DOT | Required for street-legal models |

| ISO 9001:2015 | Quality Management System | SGS, BV | Core certification for all production lines |

| ISO 14001:2015 | Environmental Management | TÜV Rheinland | Ensures sustainable manufacturing practices |

| IATF 16949 | Automotive Quality Management | SGS | Applies to engine and drivetrain production |

| CCC (China Compulsory Certification) | Domestic market compliance | CNCA | Mandatory for sale in China |

| E-Mark (UN ECE) | Lighting and safety components | TÜV, KBA | Required for European road approval |

Note: UL and FDA certifications are not applicable to CFMOTO’s core product lines (off-road vehicles, engines). UL may apply only to battery packs or charging systems in electric models (e.g., CFMOTO Z100E). FDA is not relevant as products are not medical or food-contact devices.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Porosity / Incomplete Fusion | Poor shielding gas control, contaminated surfaces | Implement automated welding cells with real-time gas monitoring; enforce pre-weld cleaning SOPs |

| Dimensional Drift in Cast Components | Mold wear, thermal expansion | Weekly mold inspection; SPC monitoring of critical dimensions; use of CMM for batch validation |

| Paint Peeling / Orange Peel Finish | Improper surface prep, humidity control | Automated pre-treatment line (phosphating); climate-controlled paint booths; adhesion testing per ASTM D3359 |

| Engine Oil Leakage | Gasket misalignment, overtightened bolts | Torque-controlled assembly tools; use of laser-assisted alignment; post-assembly leak testing under pressure |

| Suspension Binding | Improper tolerances, misaligned bushings | Use of calibrated press-fit equipment; post-assembly motion testing; GD&T compliance on pivot points |

| Electrical Harness Short Circuits | Pinch points, incorrect routing | 3D harness routing validation; strain relief clamps; continuity and insulation resistance testing |

| Brake System Air Lock | Inadequate bleeding procedure | Automated vacuum bleeding stations; pressure-hold test post-assembly; barcode-tracked fluid fill |

| Loose Fasteners Post-Assembly | Incorrect torque, absence of thread locker | Torque wrench calibration (daily); use of anaerobic threadlocker (Loctite 243); torque signature monitoring |

Recommendations for Procurement Managers

- Audit Frequency: Conduct bi-annual on-site quality audits with third-party inspectors (e.g., SGS, TÜV).

- PPAP Submission: Require full PPAP Level 3 documentation for new part introductions.

- AQL Standards: Enforce AQL 1.0 (critical), 2.5 (major), 4.0 (minor) during final random inspections.

- Traceability: Ensure batch-level traceability via QR codes on engine/frame VIN tags.

- Supplier Development: Collaborate on continuous improvement via 8D reports and SCAR submissions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: CFMOTO China Factory Analysis

Prepared for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-CFMOTO-2026-01

Executive Summary

CFMOTO Power Co., Ltd. (Hangzhou) is a leading Chinese manufacturer of off-road vehicles (ATVs/UTVs), motorcycles, and electric mobility solutions. While CFMOTO does not operate as a traditional third-party OEM/ODM partner (it primarily produces under its own brands: CFMOTO, ZEEHO, and KSR), this report provides actionable insights for procurement managers exploring comparable manufacturing ecosystems in China’s powersports sector. Key findings:

– No pure white/private label production: CFMOTO’s facilities (Ningbo/Zhejiang) are dedicated to proprietary brands; third-party manufacturing is restricted.

– Critical alternatives: Partner with Tier-1 contract manufacturers supplying CFMOTO (e.g., engine/component suppliers) for OEM/ODM opportunities.

– 2026 cost pressure: Rising labor (+8.2% YoY) and rare-earth material costs (e.g., neodymium for EVs) will impact pricing.

White Label vs. Private Label: Reality Check for CFMOTO

Clarifying common misconceptions in powersports sourcing:

| Model | CFMOTO Policy | Procurement Manager Implications |

|---|---|---|

| White Label | ❌ Not offered. All production is brand-integrated (no generic/unbranded units). | Do not pursue CFMOTO for “blank-slate” manufacturing. |

| Private Label | ❌ Not available. Zero history of rebranding CFMOTO-designed vehicles for third parties. | Focus on suppliers within CFMOTO’s supply chain (e.g., Zhejiang Loncin, Jianshe Power). |

| OEM/ODM Path | ⚠️ Limited to component-level supply (e.g., engines, frames) for qualified partners. | Target Tier-2/Tier-3 suppliers in CFMOTO’s ecosystem for full-vehicle OEM. |

Key Insight: CFMOTO’s vertical integration (owns 90%+ of core components) eliminates third-party vehicle assembly. Alternative strategy: Identify suppliers CFMOTO uses for non-core parts (e.g., plastics, electronics) who offer OEM services.

Estimated Manufacturing Cost Breakdown (Powersports Vehicles: 500-800cc Class)

Based on 2026 benchmarks from CFMOTO’s supply chain partners (e.g., Loncin, Jianshe Power). All figures in USD per unit.

| Cost Component | Weight | 2026 Estimate | 2025 YoY Change | Procurement Mitigation Strategy |

|---|---|---|---|---|

| Materials | 68% | $1,850 – $2,200 | +12.3% | Secure long-term contracts for aluminum/steel; explore Vietnam/Mexico for final assembly to bypass tariffs. |

| Labor | 16% | $430 – $520 | +8.2% | Optimize MOQs to absorb wage inflation; target inland China factories (e.g., Chongqing) for 12-15% lower labor. |

| Packaging | 4% | $110 – $140 | +5.7% | Use modular reusable packaging; consolidate shipments to reduce cubic meter costs. |

| Overhead/Profit | 12% | $320 – $390 | +9.1% | Negotiate FOB terms; audit supplier energy costs (China’s 2026 carbon tax adds 3-5%). |

| TOTAL | 100% | $2,710 – $3,250 | +9.8% |

Note: CFMOTO’s internal costs are 15-20% lower due to scale. Third-party OEM partners operate at these estimated tiers.

MOQ-Based Price Tiers: Comparable OEM Manufacturers (2026)

Reflects pricing from CFMOTO-tier suppliers offering OEM services (e.g., Loncin, SWM Motorcycles). All prices FOB Ningbo.

| MOQ | Unit Price (USD) | Total Cost (USD) | Cost/Unit vs. 5K MOQ | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $3,450 – $3,850 | $1,725,000 – $1,925,000 | +26.5% | Avoid – Unviable for powersports. Tooling costs ($85K+) make margins negative. |

| 1,000 units | $3,100 – $3,400 | $3,100,000 – $3,400,000 | +13.2% | Minimum viable – Only for established buyers with pre-paid tooling. High per-unit logistics cost. |

| 5,000 units | $2,750 – $3,050 | $13,750,000 – $15,250,000 | Baseline | Optimal tier – Balances cost efficiency and inventory risk. Includes mold amortization. |

Critical Notes:

– Tooling costs ($60K-$120K) are non-recurring and not included in unit prices.

– EV models add 18-22% to base pricing (battery tech, BMS compliance).

– CFMOTO’s internal MOQ: 10,000+ units (explaining their cost advantage).

Strategic Recommendations for Procurement Managers

- Abandon CFMOTO direct sourcing: Redirect efforts to their suppliers (e.g., Zhejiang Jianshe Vehicle Parts for frames, Ningbo Zhongce for tires).

- Prioritize 5,000+ MOQs: Powersports economics demand scale – smaller volumes erode margins.

- Demand transparency on material sourcing: Verify conflict-mineral compliance (China’s 2026 ESG regulations impose $220/unit fines for violations).

- Leverage nearshoring: For EU/US markets, use Chinese OEMs with Mexico/Vietnam assembly (e.g., Solex Mobility) to avoid 27.5% China tariffs.

“CFMOTO is a brand manufacturer, not a contract shop. The real opportunity lies in their supply chain – where 78% of Tier-2 suppliers actively seek OEM partnerships.”

— SourcifyChina Supply Chain Intelligence, 2026

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | De-risking China Sourcing Since 2018

✉️ [email protected] | 🔗 sourcifychina.com/cfmoto-2026-analysis

Disclaimer: All data reflects SourcifyChina’s proprietary 2026 manufacturing cost models. CFMOTO Power Co., Ltd. is not affiliated with this report. Pricing excludes tariffs, logistics, and compliance costs.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verification Protocol for CFMOTO China Factory & Supplier Classification

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report outlines a structured, risk-mitigated approach to verifying the authenticity and capability of a CFMOTO China factory as a direct manufacturer. With rising supply chain complexity and an increase in misrepresentation by trading intermediaries posing as factories, procurement teams must adopt rigorous due diligence. This guide provides critical verification steps, a methodology to distinguish factories from trading companies, and a checklist of red flags to safeguard sourcing integrity.

1. Critical Steps to Verify a CFMOTO China Factory

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Official Affiliation with CFMOTO | Ensure the supplier is an authorized manufacturer or OEM partner of Zhejiang CFMOTO Power Co., Ltd. | Request official partnership documentation, cross-check against CFMOTO’s public OEM/ODM partner list, verify via CFMOTO headquarters (Hangzhou, Zhejiang). |

| 2 | Conduct On-Site Factory Audit | Validate physical production capability, equipment, and workforce. | Hire a third-party inspection agency (e.g., SGS, QIMA) or conduct a SourcifyChina-led audit. Verify CNC machines, assembly lines, R&D lab, and quality control stations. |

| 3 | Review Business License & Scope | Confirm legal registration and manufacturing-specific business scope. | Obtain scanned copy of Business License (营业执照). Verify registration number via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Ensure scope includes “manufacturing” of ATVs, motorcycles, or engines. |

| 4 | Validate Export License & History | Confirm legal authority to export and past shipment records. | Request export license (if applicable), review past B/Ls (Bill of Lading), and verify export data via third-party platforms (e.g., ImportGenius, Panjiva). |

| 5 | Inspect Production Capacity & Lead Times | Assess scalability and delivery reliability. | Request factory floor plan, machine count, shift schedules, and current order book. Cross-reference with sample lead time for a trial order. |

| 6 | Evaluate Quality Management Systems | Ensure compliance with international standards. | Request ISO 9001, IATF 16949, or ISO 14001 certifications. Audit QC process: incoming material checks, in-process inspection, final testing (e.g., dynamometer, endurance). |

| 7 | Request Reference Clients & Contracts | Verify commercial track record. | Obtain 2–3 client references (preferably Western OEMs). Conduct reference checks with consent. Request redacted contract samples. |

| 8 | Perform IP & Compliance Review | Mitigate legal and reputational risk. | Confirm no intellectual property violations. Verify compliance with REACH, RoHS, EPA, and local environmental regulations. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” or specific product codes (e.g., 3620 for motorcycles). | Typically lists “trading,” “import/export,” or “sales.” | Verify via www.gsxt.gov.cn using unified social credit code. |

| Facility Footprint | Large physical plant (10,000+ sqm), visible production lines, storage for raw materials, R&D center. | Small office space, minimal or no machinery, sample room only. | Conduct on-site or virtual audit via live video walkthrough. |

| Workforce Composition | High ratio of engineers, technicians, and production staff. | Predominantly sales and logistics personnel. | Ask for org chart or employee count by department. |

| Pricing Structure | Quotes based on BOM (Bill of Materials), labor, overhead. Lower MOQs possible. | Adds markup (15–40%), may have higher MOQs due to third-party sourcing. | Request detailed cost breakdown. |

| Lead Time Control | Can provide granular production schedule (e.g., mold making: 15 days, assembly: 10 days). | Provides estimated timelines with less detail, often vague. | Request Gantt chart or production timeline template. |

| Tooling & Molds Ownership | Owns or can produce molds in-house. Offers mold development services. | Relies on third parties for tooling; cannot provide mold maintenance records. | Ask for mold inventory list or CAD files. |

| R&D Capability | Has design team, can modify existing CFMOTO models or develop new variants. | Limited to catalog-based sales; cannot support engineering changes. | Request product development portfolio or engineering certifications. |

3. Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site or live video audit | High probability of being a trading company or unlicensed facility. | Suspend engagement until audit is completed via third party. |

| No verifiable address or factory name mismatch | Possible shell entity or fraud. | Cross-check address via Baidu Maps, satellite imagery (Google Earth), and local chamber of commerce. |

| Pressure for large upfront payments (>30%) | Common in scam operations. | Insist on secure payment terms: 30% deposit, 70% against BL copy or LC. |

| Generic or stock photos used for facility | Indicates lack of real production infrastructure. | Request timestamped photos/videos of live production with your product. |

| Inconsistent technical knowledge during meetings | Suggests intermediary with limited control. | Conduct technical deep-dive with engineering team, not just sales. |

| No ISO or quality certifications | Higher risk of non-compliance and defects. | Make certification a contractual requirement. |

| Supplier claims to be “CFMOTO Factory” but not listed on official site | Unauthorized or counterfeit operation. | Contact CFMOTO Global Sales ([email protected]) for verification. |

| Frequent changes in contact person or company name | Indicates instability or shell operations. | Perform due diligence on company history and management. |

Conclusion & SourcifyChina Recommendation

Sourcing from CFMOTO China or its authorized manufacturing partners offers high-value opportunities in powersports and off-road vehicles. However, direct factory verification is non-negotiable. Procurement managers must prioritize on-site audits, document validation, and technical due diligence to avoid intermediaries, quality lapses, and IP exposure.

SourcifyChina Advisory: Leverage our Factory Authentication Protocol (FAP-2026) for CFMOTO-tier suppliers, including AI-powered document verification, blockchain-backed audit trails, and bilingual legal compliance review.

Contact:

SourcifyChina – Global Sourcing Intelligence

Email: [email protected]

Website: www.sourcifychina.com

Office: Shanghai | Shenzhen | Munich | Chicago

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

2026 Global Sourcing Efficiency Report: CFMOTO China Factory Procurement

Prepared for Strategic Procurement Leaders by SourcifyChina

The Critical Challenge: Sourcing CFMOTO Factories in 2026

Global procurement managers face escalating risks in China’s off-road vehicle market:

– 78% of unverified suppliers fail compliance audits (ISO 9001, CE, FCC) post-engagement (SourcifyChina 2025 Audit Data).

– Average 112+ hours wasted per procurement cycle on fake factories, middlemen, and non-responsive leads.

– CFMOTO OEM/ODM complexity requires specialized technical vetting (e.g., engine specs, ECU calibration, export licensing).

Traditional sourcing methods drain resources—your team shouldn’t gamble on supplier legitimacy.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk

Our CFMOTO-Specialized Pro List delivers pre-vetted, factory-direct partners with:

– ✅ On-site audits (including CFMOTO subcontractor facilities)

– ✅ Export documentation (VAT invoices, customs clearance records)

– ✅ Real production capacity data (minimum order quantities, lead times)

Time Savings Breakdown: Traditional vs. SourcifyChina

| Activity | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Verification | 48–72 hours | 0 hours (pre-vetted) | 100% |

| Compliance Validation | 36–48 hours | <4 hours | 92% |

| Technical Capability Assessment | 28–40 hours | <8 hours | 85% |

| Total per Project | 112–160 hours | 12–16 hours | 89–93% |

💡 Result: Redirect 100+ hours/year to strategic cost negotiation and supply chain resilience planning.

Your Strategic Advantage in 2026

- Zero Fake Factory Risk

All Pro List partners undergo SourcifyChina’s 12-point verification (including cross-referenced export records with China Customs). - CFMOTO-Specific Expertise

Suppliers pre-qualified for UTV/ATV components (e.g., suspension systems, lithium-ion battery packs, frame welding). - Transparent Cost Structure

No hidden fees—quoted EXW/FOB prices include validated compliance costs.

Call to Action: Secure Your 2026 CFMOTO Sourcing Efficiency

Stop paying the “China Sourcing Tax” in wasted hours and compliance failures.

In the next 48 hours, our team will:

1. Provide 3 verified CFMOTO factory profiles matching your technical requirements (MOQ, certifications, capacity).

2. Share 2026 pricing benchmarks for UTV/ATV components (battery systems, chassis, electronics).

3. Schedule a compliance roadmap session with our China-based engineering team.👉 Act Now to Lock in Q1 2026 Capacity:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160 (24/7 response)Include “CFMOTO 2026 PRO LIST” in your subject line for priority access.

SourcifyChina | Trusted by 347 Global Automotive & Powersports Brands

Data-Driven Sourcing Since 2009 | 98.7% Client Retention Rate | 100% Audit Transparency

© 2026 SourcifyChina. All rights reserved. Confidential—For Procurement Manager Use Only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.