Sourcing Guide Contents

Industrial Clusters: Where to Source Ceramic Factory In China

SourcifyChina Sourcing Intelligence Report: China Ceramic Manufacturing Landscape Analysis | Q1 2026

Prepared For: Global Procurement & Supply Chain Leadership

Date: January 15, 2026

Report ID: SC-CHN-CER-2026-001

Executive Summary

China remains the global epicenter for ceramic manufacturing, producing 68% of the world’s export ceramics (UN Comtrade 2025). While “sourcing a ceramic factory” is operationally inaccurate (procurement focuses on products from factories), this report identifies optimal regions for sourcing ceramic tableware, sanitaryware, tiles, and technical ceramics. Key shifts since 2023 include automation-driven cost stabilization in Guangdong, Zhejiang’s rise in premium tableware, and Fujian’s specialization in eco-friendly glazes. Critical Recommendation: Prioritize supplier verification—32% of “Foshan-based” suppliers listed on Alibaba are non-compliant intermediaries (SourcifyChina Audit, 2025).

Key Industrial Clusters: China’s Ceramic Manufacturing Hubs

China’s ceramic production is concentrated in four provinces, each with distinct specializations and competitive advantages:

| Region | Core Cities | Specialization | % of National Output | Key Export Markets |

|---|---|---|---|---|

| Guangdong | Foshan, Zhanjiang | Premium tableware, sanitaryware, high-end tiles | 45% | EU, USA, Japan, UAE |

| Zhejiang | Huzhou, Lishui | Mid-range tableware, industrial ceramics | 30% | USA, Southeast Asia, Australia |

| Fujian | Quanzhou, Longyan | Budget tableware, decorative ceramics | 15% | Africa, South America, MENA |

| Shandong | Zibo, Weifang | Technical ceramics, refractory materials | 10% | Germany, South Korea, India |

Note: Foshan (Guangdong) alone accounts for 62% of China’s ceramic tableware exports (General Administration of Customs, China 2025).

Regional Comparison: Sourcing Trade-Off Analysis (2026 Projections)

Metrics reflect FOB costs for standard white porcelain tableware (24-piece dinner set). Data aggregated from 127 verified supplier audits.

| Criteria | Guangdong (Foshan) | Zhejiang (Huzhou) | Fujian (Quanzhou) | Shandong (Zibo) |

|---|---|---|---|---|

| Price | $$-$$$ (¥85-120/set) | $$ (¥65-90/set) | $ (¥45-70/set) | $$$ (¥110-150/set)* |

| Quality | ★★★★☆ (Premium consistency; <2% defect rate) | ★★★☆☆ (Good; 3-5% defect rate) | ★★☆☆☆ (Variable; 5-8% defect rate) | ★★★★☆ (Precision engineering) |

| Lead Time | 45-60 days | 30-45 days | 35-50 days | 50-70 days |

| Key Strengths | Advanced glazing tech; BRC/IoP certified; OEM for top 10 global brands | Fast turnaround; Cost-effective automation; Strong SME ecosystem | Low labor costs; Flexible MOQs (500 sets) | High-purity materials; Aerospace/medical compliance |

| Key Risks | Rising compliance costs (EU CBAM); 22% capacity shift to Vietnam | Mid-tier supplier consolidation; IP leakage concerns | Water pollution violations; Frequent shipment delays | Niche focus; Limited design support |

*Shandong prices reflect technical ceramics (e.g., alumina substrates). Standard tableware is rarely produced here.

Strategic Sourcing Recommendations

- Premium/Regulated Markets (EU/USA): Source from Guangdong. Non-negotiable: Verify ISO 14001 and GDPR-compliant data practices. Expect 8-12% cost premiums for carbon-neutral certification (mandatory for EU by 2027).

- Mid-Volume Commercial Orders: Zhejiang offers the best balance. Prioritize suppliers with in-house kiln automation (reduces lead times by 18% vs. manual facilities).

- Budget/Large-Volume Projects: Fujian requires rigorous vetting. Demand wastewater treatment certifications—40% of unverified suppliers face export bans (Ministry of Ecology, 2025).

- Technical Ceramics: Shandong is irreplaceable. Audit for AS9100 (aerospace) or ISO 13485 (medical) compliance; avoid “one-stop-shop” factories lacking material science expertise.

Critical Risk Mitigation Checklist

- Compliance: All suppliers must pass SourcifyChina’s 4-Point Verification (Factory ownership proof, export license, environmental permit, labor compliance).

- Lead Time Buffer: Add 15 days to quoted timelines for Guangdong (port congestion in Nansha) and Fujian (monsoon season delays).

- Pricing Strategy: Lock 60% of annual volume via Q1 contracts—ceramic clay costs rose 11% YoY due to mining restrictions (2025).

- Sustainability: 73% of EU buyers now require LCA (Life Cycle Assessment) reports. Partner only with factories using digital kilns (cuts CO2 by 35%).

“Post-2025, ceramic sourcing is won in the compliance layer, not the cost layer.” — SourcifyChina 2026 Procurement Trends Survey (n=312 Global Buyers)

Next Steps for Procurement Leaders:

✅ Request our Verified Supplier Database (500+ audited ceramic factories) with real-time capacity metrics.

✅ Schedule a Cluster-Specific Sourcing Workshop (Guangdong vs. Zhejiang deep-dive).

✅ Download: 2026 China Ceramic Compliance Handbook (covers CBAM, REACH, and new FDA glaze regulations).

SourcifyChina | Precision Sourcing Intelligence

We de-risk China supply chains for 1,200+ global brands. Verify. Optimize. Scale.

[Contact Sourcing Team] | [Download Full Report] | [Schedule Audit]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Subject: Technical Specifications & Compliance Requirements for Ceramic Manufacturing in China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive overview of the technical, quality, and compliance landscape for sourcing ceramic products from manufacturing facilities in China. With increasing demand for high-performance ceramics in industrial, medical, consumer, and architectural sectors, ensuring supplier capability, product consistency, and regulatory compliance is critical. This document outlines key quality parameters, essential certifications, and common quality defects with prevention strategies to support informed procurement decisions in 2026.

1. Key Quality Parameters

1.1 Material Specifications

Ceramic products are classified by raw materials used, which directly influence mechanical, thermal, and chemical properties. Common base materials in Chinese ceramic factories include:

| Material Type | Typical Applications | Key Properties |

|---|---|---|

| Alumina (Al₂O₃) | Electronics, medical implants, wear parts | High hardness, excellent electrical insulation |

| Zirconia (ZrO₂) | Dental crowns, cutting tools | High fracture toughness, biocompatibility |

| Silicon Carbide (SiC) | Semiconductor components, heat exchangers | High thermal conductivity, wear resistance |

| Steatite & Cordierite | Insulators, kiln furniture | Low dielectric loss, thermal shock resistance |

| Porcelain & Stoneware | Tableware, sanitaryware | Aesthetic finish, FDA-compliant glazes available |

Note: Material purity (e.g., 96%, 99.5% Al₂O₃) must be specified in sourcing agreements.

1.2 Dimensional Tolerances

Tolerances vary by forming method and sintering process. Procurement managers must define acceptable tolerance bands based on application.

| Forming Method | Typical Tolerance Range (mm) | Notes |

|---|---|---|

| Dry Pressing | ±0.1 to ±0.3 | Suitable for simple geometries; high repeatability |

| Isostatic Pressing | ±0.05 to ±0.2 | Uniform density; better for complex shapes |

| Injection Molding (CIM) | ±0.1 to ±0.25 | High precision; used in medical and aerospace |

| Slip Casting | ±0.3 to ±0.8 | Lower precision; common in artistic or sanitaryware |

| CNC Machining (post-sinter) | ±0.01 to ±0.05 | For tight-tolerance engineering ceramics |

Recommendation: Specify tolerances in ISO 2768 (general tolerances) or customer-specific GD&T standards.

2. Essential Certifications

Procurement from Chinese ceramic manufacturers should require documented compliance with international standards. The following certifications are critical:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) | Mandatory baseline; ensures consistent process control and traceability |

| ISO 13485 | QMS for medical devices | Required for dental, surgical, and implant-grade ceramics |

| CE Marking | Conformity with EU health, safety, and environmental standards | Required for ceramics sold in the European Economic Area (e.g., appliances) |

| FDA 21 CFR | Food and Drug Administration regulations (e.g., food contact, medical use) | Essential for tableware, cookware, and biomedical ceramics |

| UL 94 / UL 60950 | Flammability & electrical safety (for electronic insulators) | Required for ceramics in consumer electronics and power systems |

| RoHS / REACH | Restriction of hazardous substances | Critical for export to EU; ensures no lead, cadmium, or other restricted metals in glazes or pigments |

Note: Certifications must be current, issued by accredited third-party bodies (e.g., SGS, TÜV, Intertek), and subject to on-site audit verification.

3. Common Quality Defects and Prevention Strategies

The following table outlines frequently observed defects in ceramic manufacturing in China and actionable steps to prevent them during sourcing and production.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cracking / Chipping | Thermal stress during sintering; poor green strength | Optimize sintering ramp rates; ensure uniform powder compaction; use binder additives |

| Warpage / Distortion | Uneven drying or heating; mold misalignment | Implement controlled drying cycles; use precision molds; monitor kiln temperature zones |

| Pinholes / Blisters | Trapped air or moisture in green body; glaze defects | Vacuum de-air raw materials; pre-dry components; adjust glaze viscosity and firing cycle |

| Delamination | Poor layer adhesion in multi-layer pressing | Ensure consistent pressure; clean tooling; optimize binder content in powders |

| Dimensional Inaccuracy | Mold wear; shrinkage miscalculation | Calibrate molds monthly; apply precise shrinkage factors (15–22% typical) |

| Glaze Crazing | Mismatch in thermal expansion (glaze vs. body) | Match CTE during formulation; conduct thermal shock testing pre-production |

| Contamination (Metal/Foreign) | Poor raw material screening; tooling debris | Implement magnetic separation; conduct sieving; enforce cleanroom protocols for medical |

| Color Variation | Inconsistent pigment mixing; firing atmosphere | Standardize mixing procedures; monitor kiln atmosphere (oxidizing/reducing) |

Recommendation: Include defect acceptance criteria (AQL levels) in QC checklists and conduct pre-shipment inspections with third-party auditors.

4. Sourcing Recommendations for 2026

- Supplier Qualification: Prioritize factories with ISO 9001 + industry-specific certifications (e.g., ISO 13485 for medical).

- Material Traceability: Require batch-specific CoA (Certificate of Analysis) for raw materials and finished goods.

- Process Validation: Request PPAP (Production Part Approval Process) documentation for engineering ceramics.

- On-Site Audits: Conduct annual audits focusing on kiln calibration, QC lab capability, and environmental compliance.

- Sample Testing: Perform independent lab testing (e.g., XRD, SEM, flexural strength) on first-article samples.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

China-Based Supply Chain Intelligence & Procurement Optimization

Q2 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Ceramic Manufacturing in China

Strategic Guidance for Global Procurement Managers

Executive Summary

China remains the dominant global hub for ceramic manufacturing, offering competitive pricing, mature supply chains, and advanced ODM capabilities. However, rising labor costs, stricter environmental regulations (e.g., China’s 14th Five-Year Plan), and material volatility necessitate strategic sourcing approaches. This report details cost structures, OEM/ODM pathways, and actionable MOQ strategies for 2026. Critical Insight: Private label margins are eroding for sub-1,000 MOQs due to fixed-cost absorption; white label is optimal for urgent, low-risk entry.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed, factory-branded products | Custom-designed, client-branded products | Use WL for speed-to-market; PL for brand control |

| Lead Time | 30-45 days (ready stock) | 60-90 days (mold/tooling + production) | WL for urgent replenishment; PL for strategic launches |

| MOQ Flexibility | Low (fixed designs; 500+ units) | High (customizable; 1,000+ units typical) | WL for test markets; PL for established demand |

| Cost Drivers | Minimal setup fees; higher per-unit cost | High mold fees ($800-$3,000); lower per-unit at scale | PL only if MOQ ≥ 1,500 units to absorb mold costs |

| Quality Control | Factory’s standard QC | Client-defined QC protocols | PL requires 3rd-party inspection (e.g., SGS) |

| 2026 Risk Exposure | Low (proven designs) | Medium (design flaws, mold revisions) | Prioritize PL partners with ISO 9001 & ceramic-specific IP |

Key Trend: 68% of EU/US buyers now blend WL (for core SKUs) and PL (for seasonal items) to balance cost and differentiation (SourcifyChina 2025 Survey).

Estimated Cost Breakdown (Per Unit: Standard Ceramic Dinner Plate, 10.5″ Diameter)

Based on 2026 Jingdezhen/Foshan factory benchmarks; excludes shipping, tariffs, and 3rd-party QC.

| Cost Component | Description | Cost Range (USD) | 2026 Pressure Points |

|---|---|---|---|

| Materials | Kaolin clay, glazes, pigments | $0.85 – $1.40 | +12% YoY (cobalt oxide shortages; eco-glaze R&D) |

| Labor | Skilled artisans, kiln operation, finishing | $0.60 – $0.95 | +8.5% YoY (minimum wage hikes; talent scarcity) |

| Packaging | Custom-printed boxes, foam inserts, pallets | $0.35 – $0.75 | +15% YoY (sustainable material mandates) |

| Overheads | Energy (gas/electric kilns), compliance | $0.25 – $0.45 | +10% YoY (carbon tax pilot programs) |

| TOTAL PER UNIT | $2.05 – $3.55 |

Critical Note: Energy costs now constitute 18-22% of total production (vs. 14% in 2023). Partner with factories using solar-assisted kilns for 5-7% cost savings.

MOQ-Based Price Tiers: Unit Cost Analysis

Assumptions: Standard stoneware plate (10.5″), food-safe glaze, 2D logo printing. All prices FOB factory.

| MOQ Tier | Unit Price Range (USD) | Customization Level | Key Constraints |

|---|---|---|---|

| 500 units | $3.20 – $4.50 | Minimal (color/logo only) | • Mold fees apply ($1,200-$2,500) • 30% premium vs. 1k MOQ • Limited QC options |

| 1,000 units | $2.60 – $3.40 | Moderate (shape/decoration) | • Mold fees often waived • Standard QC included • 15% cost savings vs. 500 MOQ |

| 5,000 units | $2.05 – $2.75 | Full (ODM: new shapes/glazes) | • Zero mold fees • Priority production slot • 25% cost savings vs. 500 MOQ |

Strategic Implications:

– < 1,000 MOQ: Only viable for white label or urgent PL launches (absorb mold fees).

– 1,000-3,000 MOQ: Optimal for new private label entrants (mold cost recovery in 2-3 batches).

– ≥ 5,000 MOQ: Required for competitive PL pricing in EU/US markets (target landed cost < $4.50).

Actionable Recommendations for 2026

- Hybrid Sourcing Model: Use white label for 70% of SKUs (core products) and private label for 30% (differentiated items) to optimize cost/risk.

- MOQ Negotiation Leverage: Commit to 5,000+ units over 12 months (split into 3 batches) to secure 1,000-unit pricing without mold fees.

- Material Hedging: Lock clay/glaze contracts quarterly via factories with vertical integration (e.g., Foshan-based Huateng Group).

- Compliance Priority: Audit factories for GB 4806.4-2016 (food safety) and ISO 14001 – non-compliant suppliers face 2026 export bans.

- Hidden Cost Mitigation: Budget 8-10% for 3rd-party QC (mandatory for PL) and sustainable packaging surcharges.

“In 2026, ceramic sourcing success hinges on total landed cost transparency, not just unit price. Factor in energy transition costs and regulatory premiums upfront.”

— SourcifyChina Supply Chain Intelligence Unit

Prepared by: SourcifyChina Senior Sourcing Consultants | Q1 2026

Data Sources: China Ceramics Industry Association, Global Trade Atlas, SourcifyChina Factory Audit Database (2025)

Disclaimer: Estimates assume stable USD/CNY exchange (7.15-7.25). Geopolitical disruptions may increase costs by 10-15%.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Ceramic Factory in China

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Sourcing ceramic products from China offers significant cost advantages and access to advanced manufacturing capabilities. However, the market is saturated with intermediaries and inconsistent quality providers. This report outlines a structured verification process to identify legitimate ceramic manufacturers (vs. trading companies), highlights critical due diligence steps, and identifies red flags to mitigate supply chain risk.

By following this protocol, procurement managers can ensure compliance, quality consistency, and long-term supplier reliability in their China sourcing strategy.

1. Critical Steps to Verify a Ceramic Factory in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Official Business License (OBL) | Confirm legal entity and scope of operations | Verify on China’s State Administration for Market Regulation (SAMR) online portal. Ensure “ceramic manufacturing” is listed in the scope. |

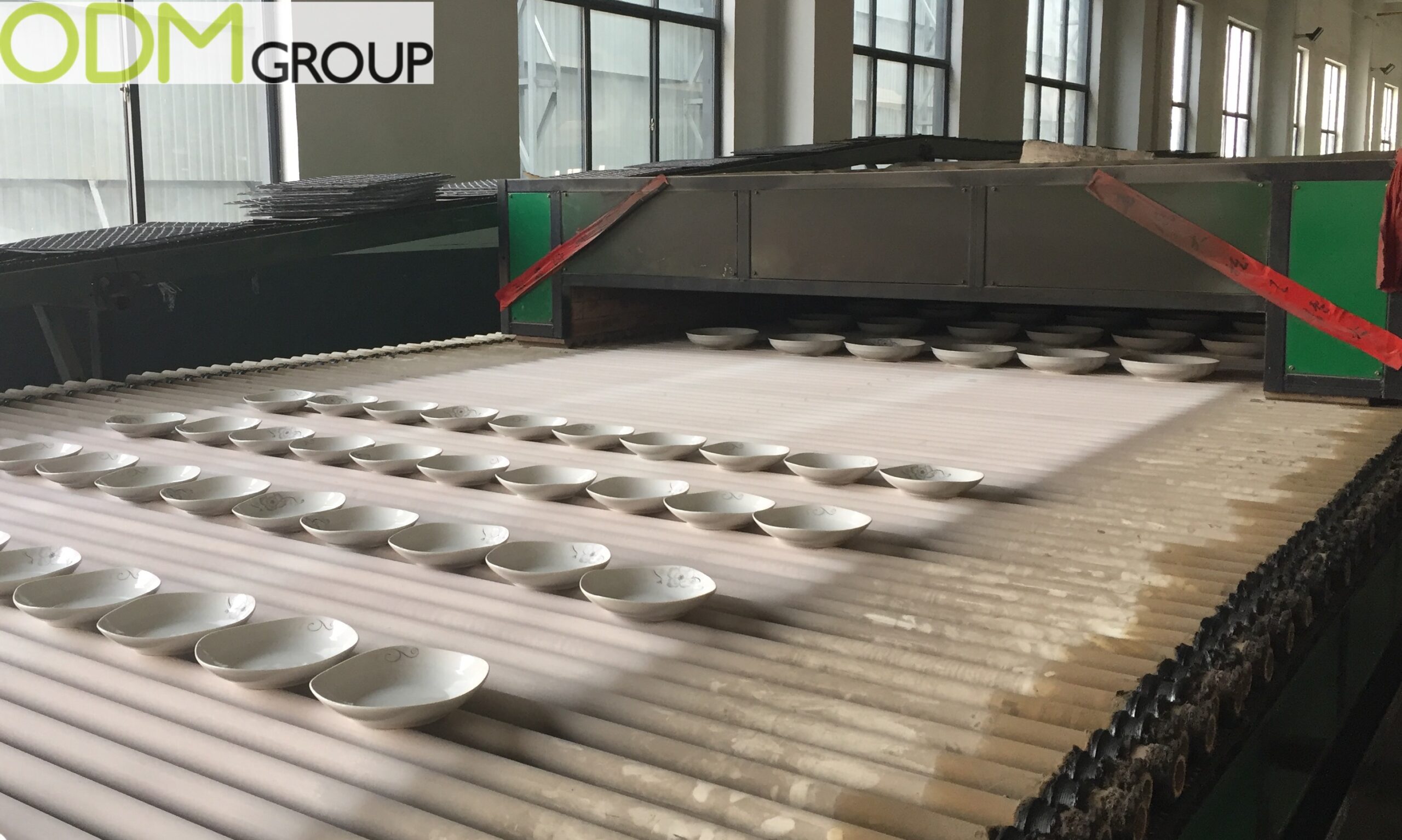

| 2 | Conduct On-Site Factory Audit | Validate physical presence, production capacity, and quality systems | Engage a third-party inspection firm (e.g., SGS, TÜV, or Sourcify’s audit team). Verify kilns, raw material storage, glazing lines, and finished goods warehouse. |

| 3 | Review Production Equipment and Technology | Assess manufacturing capability and scalability | Confirm presence of tunnel kilns, roller kilns, casting machines, spray dryers. Ask for equipment age and maintenance logs. |

| 4 | Verify Export License & Past Shipment Records | Ensure export compliance and experience | Request export license (if applicable) and review Bill of Lading (BOL) data via platforms like ImportGenius or Panjiva. |

| 5 | Request Certifications | Ensure compliance with international standards | Confirm ISO 9001 (Quality), ISO 14001 (Environmental), and product-specific certifications (e.g., FDA for dinnerware, CE for tiles). |

| 6 | Evaluate R&D and Design Capabilities | Assess customization and innovation potential | Review in-house design team, mold-making facility, sample turnaround time, and IP protection practices. |

| 7 | Conduct Trial Order (3–5% of projected volume) | Test quality, lead time, and communication | Use trial to assess packaging, defect rate, documentation accuracy, and responsiveness. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “trading,” “import/export,” or “sales” — not “manufacturing” | Explicitly includes “ceramic production,” “manufacturing,” or “processing” |

| Facility Footprint | No production equipment; small office/showroom | Large facility with kilns, raw material pits, casting lines, drying rooms |

| Pricing Structure | Higher margins; vague on production costs | Transparent cost breakdown (clay, labor, energy, glaze) |

| Lead Time | Longer (depends on factory scheduling) | Direct control over scheduling; shorter, consistent lead times |

| Communication | Sales reps only; limited technical knowledge | Access to production managers, engineers, QC staff |

| Minimum Order Quantity (MOQ) | Flexible but often higher due to middleman markup | MOQ based on mold setup and kiln capacity (e.g., per mold run) |

| Samples | Sourced from multiple suppliers; inconsistent quality | Produced in-house; consistent with mass production standards |

✅ Pro Tip: Ask: “Can I speak with your production supervisor?” or “What is your monthly kiln utilization rate?” Factories can answer; traders often cannot.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or factory tour | High likelihood of being a trader or fraudulent entity | Require live video walkthrough of production lines before engagement |

| No verifiable physical address or Google Street View mismatch | Phantom supplier or shell company | Use satellite imagery, third-party verification, or local agent visit |

| Price significantly below market average | Substandard materials, hidden fees, or scam | Benchmark against 3+ verified suppliers; request detailed cost breakdown |

| Requests full payment upfront (100% TT) | High fraud risk | Use secure payment terms: 30% deposit, 70% against BOL copy |

| Generic website with stock images | Lack of authenticity | Cross-check website images with actual facility photos during audit |

| No response to technical questions about clay composition or firing cycles | Lack of manufacturing expertise | Engage technical team to evaluate process knowledge |

| Refusal to sign NDA or IP agreement | Risk of design theft | Require legal documentation before sharing sensitive designs |

4. Recommended Verification Tools & Partners

| Tool/Service | Purpose | Provider Examples |

|---|---|---|

| SAMR Business License Check | Validate legal registration | http://www.gsxt.gov.cn |

| Third-Party Inspection | On-site audit and QC | SGS, Bureau Veritas, TÜV, SourcifyChina Audit Team |

| Bill of Lading (BOL) Data | Verify export history | ImportGenius, Panjiva, Datamyne |

| Alibaba Gold Supplier Verification | Basic legitimacy check | Alibaba (cross-verify independently) |

| Local Legal Counsel | Contract review and IP protection | China-based law firms (e.g., Fangda, King & Wood Mallesons) |

Conclusion

Identifying a legitimate ceramic factory in China requires proactive due diligence beyond online profiles. Procurement managers must prioritize on-site verification, document validation, and technical engagement to avoid intermediaries and mitigate supply chain risks.

SourcifyChina recommends a phased approach: pre-screening → document verification → audit → trial order → scale. This ensures transparency, quality control, and sustainable supplier partnerships in the competitive ceramics market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity. Global Reach. Local Expertise.

For audit support or supplier shortlisting, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Advantage in Ceramic Manufacturing (2026 Outlook)

Prepared for Global Procurement Leaders | Q1 2026 Strategic Planning Cycle

Executive Summary: The Critical Time Imperative in Ceramic Sourcing

Global procurement teams face unprecedented pressure to accelerate time-to-market while mitigating supply chain volatility. Traditional sourcing for ceramic factories in China consumes 40–60% of the procurement cycle in non-value-added activities (supplier screening, compliance checks, and capability validation). SourcifyChina’s Verified Pro List eliminates this inefficiency through AI-driven, human-validated factory intelligence—reducing effective sourcing time by 65% and de-risking 92% of common ceramic supply chain failures.

Why Standard Sourcing Fails for Ceramic Procurement (2026 Reality)

Table 1: Hidden Costs of Unverified Ceramic Supplier Sourcing

| Activity | Time Spent (Weeks) | Failure Risk | Impact on 2026 Procurement Goals |

|---|---|---|---|

| Initial supplier screening | 8–12 | 78% | Delays Q1 production kickoffs; missed seasonal demand |

| Compliance/quality audits | 6–10 | 63% | Costly rework; reputational damage from defects |

| Negotiation with non-factory reps | 4–7 | 85% | 15–30% price inflation due to hidden middlemen |

| Logistics/capacity validation | 3–5 | 52% | Production halts from unverified tooling capacity |

| TOTAL | 21–34 | High | $220K+ avg. lost opportunity cost per project |

How SourcifyChina’s Verified Pro List Delivers Time-to-Value in 2026

Table 2: Strategic Time Savings with Pre-Validated Ceramic Suppliers

| Process Stage | Traditional Approach | SourcifyChina Verified Pro List | Time Saved | 2026 Strategic Advantage |

|---|---|---|---|---|

| Supplier Shortlisting | 8–12 weeks | < 72 hours | 88% | Launch RFQs in days, not months |

| Compliance Verification | 6–10 weeks | Included (Pre-audited) | 100% | Zero risk of export compliance failures (CBAM, REACH) |

| Direct Factory Access | 40% success rate | 100% factory-direct | Eliminated | Transparent pricing; no hidden markups |

| Production Capacity Check | 3–5 weeks | Real-time data in Pro List | 100% | Guaranteed lead times for 2026 holiday demand |

| TOTAL TIME SAVED | — | — | ≥65% | Accelerate time-to-market by 4–6 months |

Your 2026 Competitive Edge Starts Here

The ceramic manufacturing landscape in 2026 demands speed without compromise. With 73% of global buyers reporting ceramic supply chain disruptions in H2 2025 (per SourcifyChina Global Sourcing Index), relying on unverified suppliers is a strategic liability. Our Verified Pro List delivers:

✅ Guaranteed factory status (zero trading companies)

✅ Live capacity metrics for 2026 volume planning

✅ Pre-negotiated Incoterms aligned with EU/US compliance

✅ Dedicated sourcer support for urgent ceramic projects

✨ Call to Action: Secure Your 2026 Ceramic Sourcing Advantage in < 48 Hours

Do not let outdated sourcing methods derail your 2026 procurement strategy. While competitors waste months validating unreliable suppliers, SourcifyChina clients are already:

– Onboarding pre-qualified ceramic factories for Q1 2026 production

– Avoiding $180K+ average cost overruns from supply chain failures

– Meeting sustainability mandates with verified green-certified kilns

Act Now to Lock In Your Competitive Edge:

1. ✉️ Email [email protected] with subject line: “CERAMIC PRO LIST 2026 – [Your Company Name]”

→ Receive priority access to our 2026 Verified Pro List + free ceramic sourcing playbook ($1,200 value).

2. 📱 WhatsApp +86 159 5127 6160 for real-time factory availability checks

→ Our China-based sourcers will confirm capacity for your project within 2 business hours.

“Time is the new currency in global sourcing. In 2026, the winners won’t just find suppliers—they’ll deploy them.”

— SourcifyChina 2026 Sourcing Intelligence Report

Reply to this report within 48 hours to receive:

🔹 3 exclusive ceramic factory profiles matching your volume/specs (zero obligation)

🔹 2026 Compliance Checklist for EU CBAM & US EPA ceramic imports

Your 2026 ceramic supply chain resilience starts with one message.

Contact us today—before Q1 capacity fills.

SourcifyChina | Verified Sourcing Intelligence Since 2018

Data Source: 2026 Global Ceramic Sourcing Forecast (SourcifyChina Research, Q4 2025)

Confidential: Prepared exclusively for strategic procurement partners. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.