The global ceramic armor market is experiencing robust growth, driven by rising defense expenditures, increasing demand for lightweight protective systems, and advancements in material science. According to Mordor Intelligence, the body armor market—of which ceramic solutions are a critical component—is projected to grow at a CAGR of over 5.2% from 2024 to 2029. Complementing this, Grand View Research estimates that the global ballistic armor market size was valued at USD 3.8 billion in 2022 and is expected to expand at a CAGR of 4.6% through 2030, with ceramic materials playing a pivotal role due to their superior strength-to-weight ratio and multi-hit resistance. As military modernization programs accelerate worldwide and law enforcement agencies upgrade personal protection gear, ceramic armor manufacturers are scaling innovation in materials like silicon carbide, boron carbide, and alumina composites. In this evolving landscape, the following ten companies have emerged as key players, combining technological expertise, certification compliance, and global supply capacity to lead the sector.

Top 10 Ceramic Armour Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Paxis Ceramics

Domain Est. 2014

Website: paxisceramics.com

Key Highlights: Paxis employs patented and state of the art technology in ceramic materials to create bespoke ballistic armor and industrial solutions….

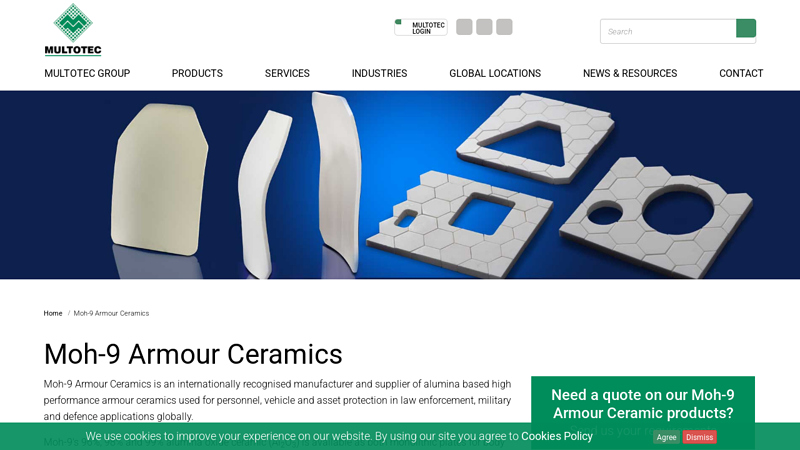

#2 Moh

Domain Est. 1998

Website: multotec.com

Key Highlights: Moh-9 Armour Ceramics is an internationally recognised manufacturer and supplier of alumina based high performance armour ceramics used for personnel, vehicle ……

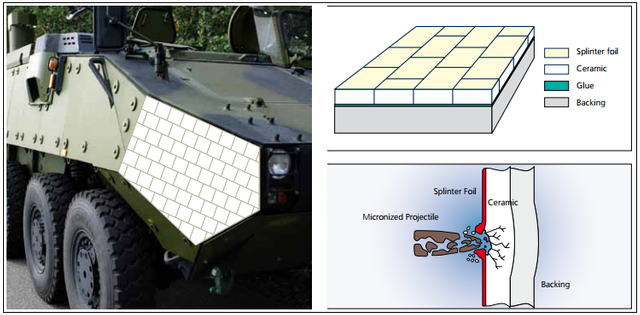

#3 Ground Vehicle Ceramic Armor Components

Domain Est. 1999

Website: coorstek.com

Key Highlights: Lightweight, custom ceramic armor components for use in vehicle protection systems that meet or exceed the performance of traditional steel-based systems….

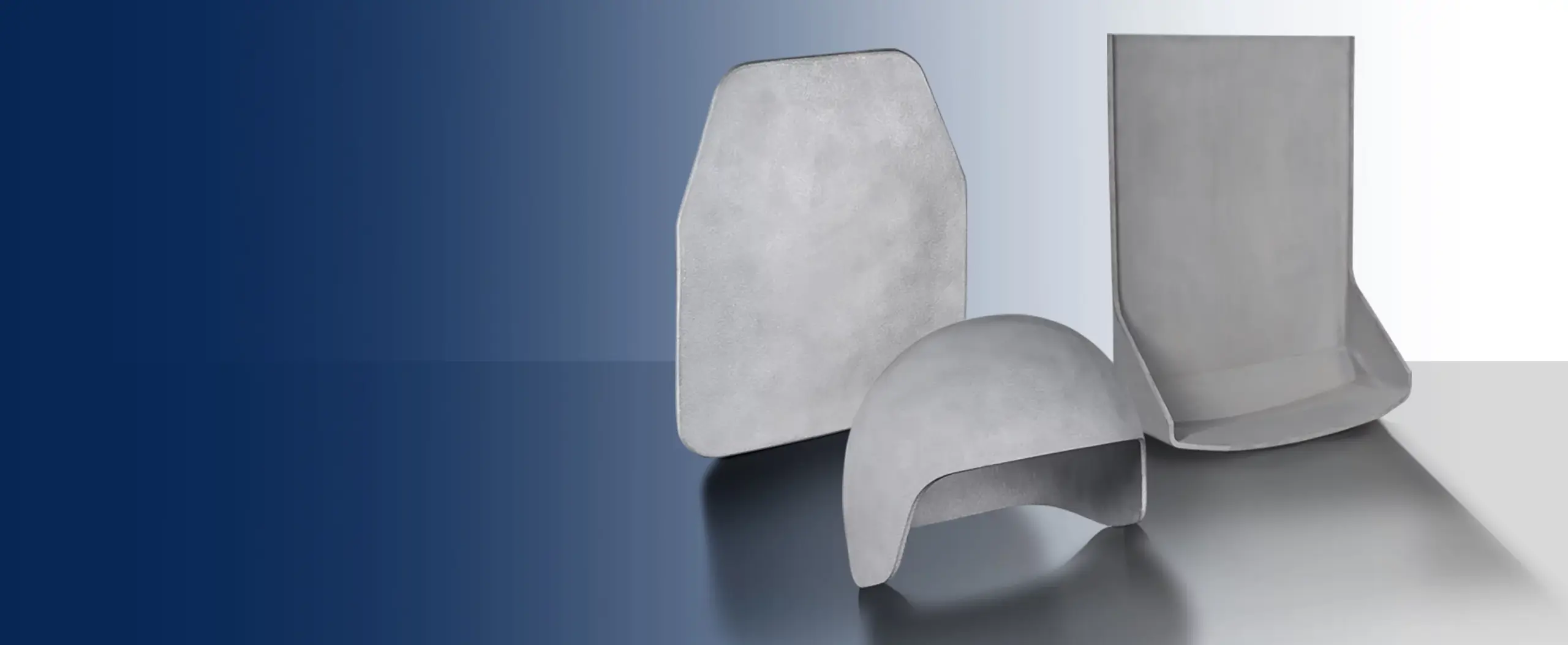

#4 Protective Ceramics for Onshore Applications

Domain Est. 2020

Website: ceramtec-industrial.com

Key Highlights: CeramTecs expertise is in the manufacture of advanced ceramics as components for armour systems, cut, drilled and machined to customer specifications….

#5 Ceramic Armor

Domain Est. 1995

Website: ceramicsrefractories.saint-gobain.com

Key Highlights: Saint-Gobain Performance Ceramics & Refractories produces a range of ceramic materials designed for integration into high-performance composite armor systems….

#6 Ballistic Plates & Vehicle Armor

Domain Est. 1997

Website: schunk-group.com

Key Highlights: Hard ballistic panels from Schunk Ceramics provide the perfect protection for body and vehicle armor – while keeping weight to a minimum….

#7 Advanced Ceramics for the Security and Defence Market

Domain Est. 2004

Website: morgantechnicalceramics.com

Key Highlights: Our advanced ceramic materials offer superior dimensional stability, strength, stiffness and chemical resistance across a wide range of temperatures….

#8 Rostec Starts Mass Production of High

Domain Est. 2005

Website: rostec.ru

Key Highlights: Corundum ceramic armor plates have demonstrated high protective properties, comparable to armored steel at smaller dimensions and mass….

#9 High

Website: ade.pt

Key Highlights: We research and produce cutting-edge compounds and incorporate them into innovative, ultra-high-performance body armor plates, riot gear, and ballistic helmets….

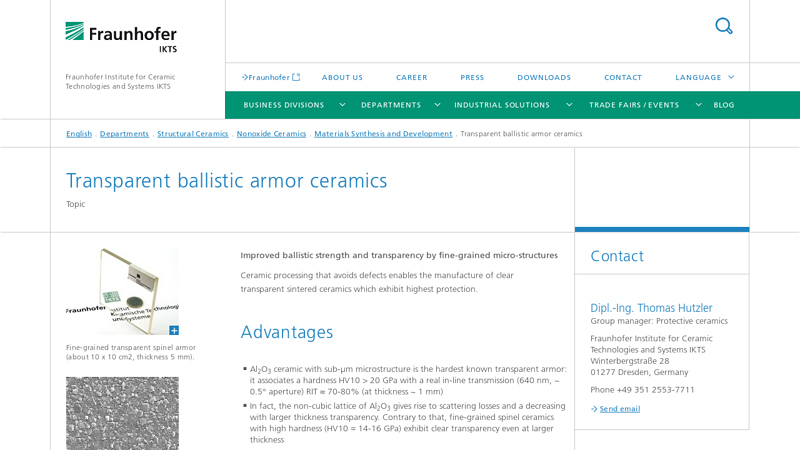

#10 Transparent ballistic armor ceramics

Website: ikts.fraunhofer.de

Key Highlights: Development of technologies to manufacture transparent ceramic armor, upscaling investigations; Development of optimized materials for specific applications…

Expert Sourcing Insights for Ceramic Armour

H2: Market Trends in Ceramic Armor for 2026

The global ceramic armor market is poised for significant transformation by 2026, driven by advancements in material science, rising defense expenditures, and increasing demand across military, law enforcement, and commercial sectors. As nations prioritize soldier protection and vehicle survivability amid evolving security threats, ceramic armor—known for its high strength-to-weight ratio and superior ballistic performance—will play a pivotal role in modern defense systems.

1. Growth in Defense and Homeland Security Spending

Global geopolitical tensions, regional conflicts, and counterterrorism efforts are prompting governments to increase investments in personal and vehicular protection systems. According to defense budget analyses, countries in North America, Europe, and Asia-Pacific are allocating larger portions of their defense budgets to next-generation body armor and armored vehicles. This shift is expected to drive demand for advanced ceramic materials such as aluminum oxide (Al₂O₃), silicon carbide (SiC), and boron carbide (B₄C), which offer enhanced threat protection with reduced weight.

2. Advancements in Composite and Hybrid Armor Solutions

By 2026, the market will see a growing adoption of hybrid armor systems that integrate ceramic tiles with lightweight backing materials such as ultra-high-molecular-weight polyethylene (UHMWPE) and aramid composites. These multi-material systems improve energy absorption and reduce overall system weight, making them ideal for body armor, armored vehicles, and aircraft applications. Innovations in nano-ceramics and functionally graded materials (FGMs) are also expected to enhance performance and durability, offering better resistance to multi-hit scenarios.

3. Rise of Commercial and Civil Applications

Beyond military use, ceramic armor is increasingly being adopted in civilian markets, including VIP protection, armored cars, and critical infrastructure security. The growing private security industry and rising concerns over personal safety are stimulating demand for lightweight, discreet ballistic solutions. Automotive manufacturers are exploring ceramic-reinforced panels for luxury and executive vehicles, particularly in high-risk regions.

4. Regional Market Dynamics

- North America remains the largest market, led by the U.S. Department of Defense’s modernization programs such as the Next Generation Combat Vehicle (NGCV) and Soldier Lethality initiatives.

- Asia-Pacific is expected to register the highest growth rate, fueled by military modernization in India, China, South Korea, and Japan, as well as regional territorial disputes.

- Europe continues to invest in collaborative defense projects and NATO-compliant armor standards, supporting demand for high-performance ceramics.

- Middle East and Africa show strong demand due to ongoing conflicts and national security upgrades.

5. Sustainability and Manufacturing Innovations

By 2026, environmental and cost considerations will drive the development of more sustainable ceramic manufacturing processes. Additive manufacturing (3D printing) of ceramic components is emerging as a promising technique to reduce waste, lower production costs, and allow for complex geometries tailored to specific threat profiles. Additionally, recycling and reuse of ceramic armor materials are likely to gain attention as part of broader defense sustainability goals.

6. Challenges and Constraints

Despite growth, the ceramic armor market faces challenges, including high production costs, brittleness under repeated impacts, and supply chain vulnerabilities for raw materials like boron carbide. Ongoing R&D is focused on overcoming these limitations through improved sintering techniques, coating technologies, and alternative materials.

Conclusion

By 2026, the ceramic armor market will be shaped by technological innovation, strategic defense investments, and expanding application areas. As lightweight, high-performance protection becomes a priority across sectors, ceramic armor will remain at the forefront of ballistic defense solutions. Companies that invest in R&D, scalable manufacturing, and strategic partnerships will be best positioned to capitalize on this growing market.

Common Pitfalls When Sourcing Ceramic Armour: Quality and Intellectual Property Risks

Sourcing ceramic armour presents unique challenges due to the high-performance nature of the material and the sensitive technologies involved. Buyers, particularly in defense and security sectors, must navigate significant pitfalls related to both quality assurance and intellectual property (IP) protection.

Quality-Related Pitfalls

- Inconsistent Material Properties: Ceramic armour performance is highly dependent on precise composition, sintering processes, and microstructure. Sourcing from suppliers without rigorous process controls can lead to batch-to-batch variations, resulting in unpredictable ballistic performance and potential failures under real-world conditions.

- Inadequate or Misleading Ballistic Testing: Relying solely on supplier-provided test data without independent verification is risky. Pitfalls include testing under non-standard conditions, using outdated threat levels, or failing to test representative samples. This can lead to overestimation of protection levels.

- Poor Quality Control and Inspection: Ceramic tiles are brittle and susceptible to micro-cracks, voids, and density variations introduced during manufacturing or handling. Suppliers without advanced non-destructive testing (NDT) capabilities (e.g., ultrasonic testing, X-ray) may deliver substandard or damaged tiles that compromise the entire armour system.

- Substandard Backing Materials and Integration: Ceramic armour is typically part of a composite system (ceramic strike face + ductile backing, e.g., UHMWPE or aramid). Sourcing the ceramic alone ignores the critical interface and performance of the backing. Poor bonding or incompatible materials can lead to delamination and catastrophic failure.

- Lack of Traceability and Documentation: Failure to demand full traceability (material lot numbers, processing parameters, test results) makes it difficult to investigate field failures, ensure consistency in future orders, or meet audit requirements, especially in regulated defense procurement.

Intellectual Property (IP)-Related Pitfalls

- Unintentional IP Infringement: Ceramic armour formulations, manufacturing processes (e.g., specific sintering techniques), and composite designs are often protected by patents. Sourcing from suppliers without clear IP clearance can expose the buyer to lawsuits for infringement, especially when integrating the armour into larger systems.

- Ambiguous IP Ownership in Custom Designs: When collaborating with a supplier on a bespoke ceramic solution, failing to establish clear contractual terms on IP ownership (e.g., who owns the design, process improvements, test data) can lead to disputes, loss of control over the technology, and inability to source from alternative suppliers in the future.

- Insufficient Protection of Buyer’s Specifications: Providing detailed performance requirements or integration designs to potential suppliers without robust Non-Disclosure Agreements (NDAs) and clear IP clauses risks the exposure of sensitive design information or proprietary system architectures to competitors.

- Sourcing from Suppliers with Questionable IP Practices: Engaging with suppliers known for reverse engineering or operating in jurisdictions with weak IP enforcement increases the risk of receiving products that themselves infringe third-party rights, potentially implicating the buyer downstream.

- Failure to Secure Rights for Future Use and Modification: Contracts that only grant a limited license to use the ceramic armour, without rights to modify, repair, or have it produced by other qualified manufacturers (e.g., for sustainment), can create long-term supply chain vulnerabilities and dependency on a single source.

Mitigating these pitfalls requires thorough due diligence on suppliers, rigorous independent testing, clear and comprehensive contracts addressing both quality standards and IP rights, and ongoing supply chain management.

Logistics & Compliance Guide for Ceramic Armour

Ceramic armour, used in body, vehicle, and structural protection systems, is subject to strict international and national regulations due to its strategic military and defense applications. Proper logistics and compliance procedures are essential to ensure legal transport, avoid sanctions violations, and maintain supply chain integrity.

Export Controls and Regulatory Frameworks

Ceramic armour components are often classified under military or dual-use export control lists. Key regulatory regimes include:

-

International Traffic in Arms Regulations (ITAR) – In the United States, ceramic armour designed for military use may be listed on the U.S. Munitions List (USML) under categories such as XIII (Armor Plate) or XV (Military Training Equipment). ITAR requires prior approval from the U.S. Department of State’s Directorate of Defense Trade Controls (DDTC) for export, re-export, or transfer.

-

Export Administration Regulations (EAR) – Items not controlled under ITAR may fall under EAR, administered by the U.S. Department of Commerce’s Bureau of Industry and Security (BIS). Check Commerce Control List (CCL) entries such as 1A005 (ballistic protection materials) for potential licensing requirements.

-

Wassenaar Arrangement – An international export control regime that includes guidelines for advanced materials like ceramic composites used in armour. Participating countries coordinate to prevent destabilizing accumulations of such technologies.

-

National Export Laws – Countries such as the UK (Export Control Act), Germany (AWG), France (General Directorate for Armaments), and others maintain their own control lists. Always verify classification under the relevant jurisdiction.

Action Required: Obtain an official export classification (e.g., ECCN or USML category) before any shipment.

Classification and Documentation

Accurate classification and documentation are critical for compliance:

-

Harmonized System (HS) Codes: Use appropriate HS codes (e.g., 6815.10 for non-metallic mineral-based armour plates in some jurisdictions), but note that these may not reflect military controls. Always cross-reference with export control lists.

-

Technical Specifications: Include detailed product data (material composition, hardness, intended use, ballistic rating) in documentation to assist customs and licensing authorities.

-

End-Use Documentation: Provide end-user undertakings (EUUs), end-user certificates (EUCs), or other proof of legitimate end use when required.

-

Export Licenses: Secure valid export authorization from the relevant government body before shipment. Retain copies for audit and compliance purposes.

Transportation and Handling

Ceramic armour is fragile and classified as high-value, sensitive cargo. Follow these logistics best practices:

-

Packaging: Use shock-resistant, moisture-proof packaging with internal cushioning to prevent cracking or chipping. Clearly label packages as “Fragile” and “Do Not Drop.”

-

Marking and Labeling: Avoid labeling packages with military terms (e.g., “ballistic plate,” “armor”) unless necessary. Use commercial or neutral descriptors where possible to minimize customs scrutiny, while ensuring compliance with disclosure requirements.

-

Carrier Selection: Use freight forwarders experienced in handling defense or dual-use goods. Confirm they comply with relevant regulations (e.g., IATA, IMDG for air and sea freight).

-

Chain of Custody: Maintain a secure, auditable chain of custody throughout transit. Use tamper-evident seals and GPS tracking for high-risk shipments.

Customs Clearance and Border Compliance

-

Pre-Clearance Filings: Submit accurate export declarations (e.g., AES in the U.S., SAD in EU) with proper ECCN or license information.

-

Transit Countries: Be aware that transit through certain countries may require additional licenses or re-export approvals, especially under ITAR.

-

Inspection Readiness: Be prepared for customs inspections. Provide supporting documentation promptly and ensure staff are trained in compliance procedures.

Recordkeeping and Audits

-

Maintain records of all transactions (licenses, invoices, shipping documents, correspondence) for a minimum of five years (or longer per national requirements).

-

Conduct regular internal audits to ensure ongoing compliance with export control laws.

Restricted Destinations and Parties

-

Screen all parties (end users, intermediaries, carriers) against government restricted party lists (e.g., U.S. SDN, BIS Denied Persons List, EU Consolidated List).

-

Do not export to embargoed countries (e.g., Russia, Iran, North Korea) without specific authorization, if permitted at all.

Training and Compliance Programs

-

Implement a robust export compliance program including employee training on ITAR, EAR, and local regulations.

-

Appoint a designated compliance officer to oversee ceramic armour logistics and regulatory adherence.

Adhering to this guide ensures that the logistics of ceramic armour remain compliant, secure, and efficient across international borders.

Conclusion for Sourcing Ceramic Armor

Sourcing ceramic armor requires a strategic and thorough approach that balances performance, cost, reliability, and compliance with technical and regulatory standards. Ceramic armor offers superior protection against high-velocity threats due to its high hardness and lightweight properties, making it ideal for military, law enforcement, and specialized security applications. However, the effectiveness of the armor is highly dependent on the quality of materials, manufacturing processes, and design integration with backing composites.

When sourcing ceramic armor, it is critical to evaluate suppliers based on their technical expertise, quality certifications (such as ISO standards and NIJ or MIL-SPEC compliance), production capacity, and track record in delivering reliable armor systems. Material selection—such as silicon carbide, boron carbide, or alumina—must align with the intended application, balancing performance requirements with budgetary constraints.

Additionally, supply chain resilience, lead times, and long-term support (including warranty and replacement) are essential considerations to ensure operational readiness and lifecycle sustainability. As threats continue to evolve, investing in innovative, next-generation ceramic solutions through trusted suppliers will be key to maintaining a tactical advantage.

In conclusion, successful sourcing of ceramic armor hinges on a comprehensive supplier evaluation, rigorous performance testing, and close collaboration with experienced manufacturers to deliver protection systems that are not only effective but also consistent, sustainable, and future-ready.