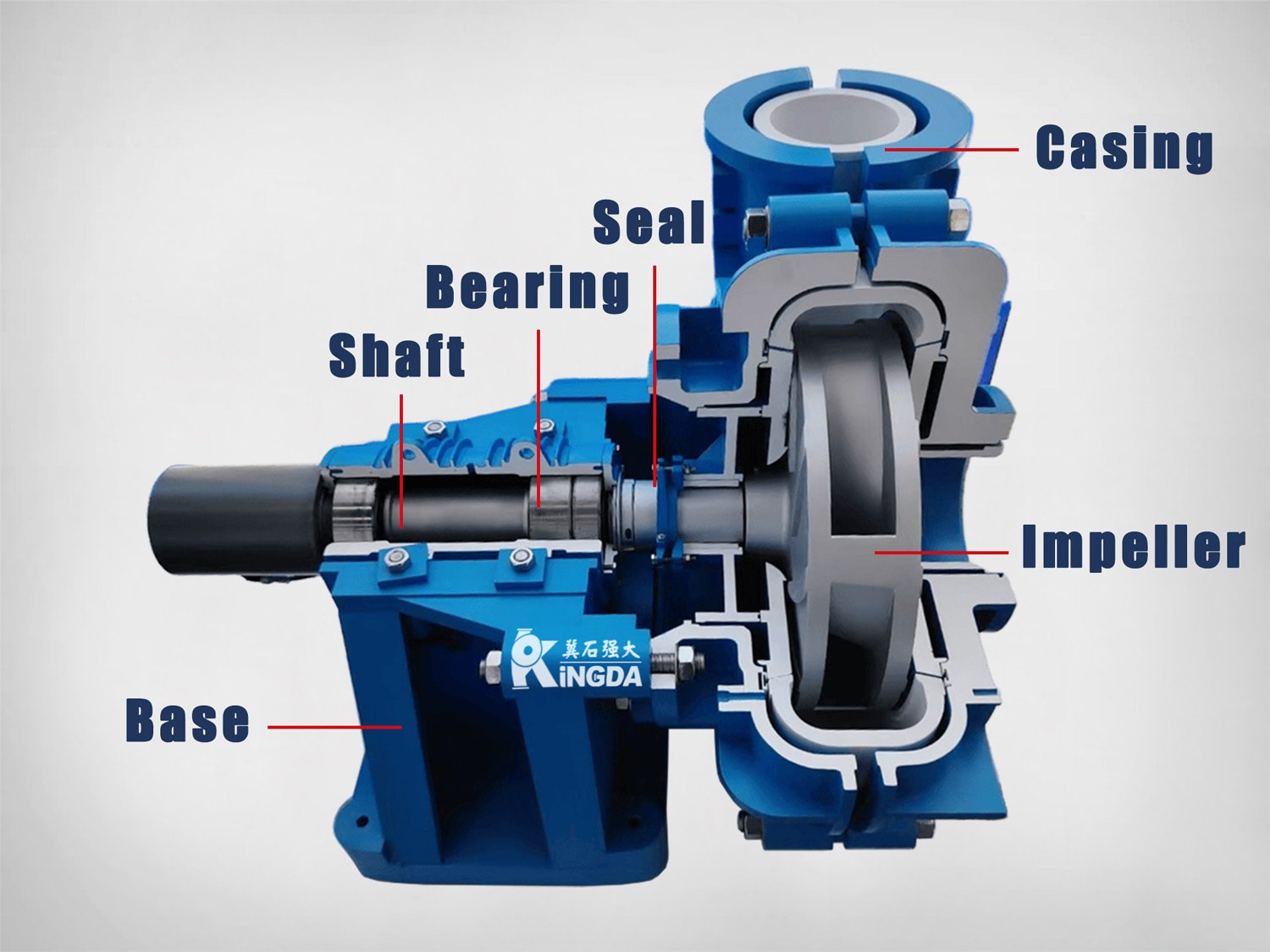

The global centrifugal pump market is experiencing robust growth, driven by increasing demand across industries such as oil and gas, water and wastewater treatment, power generation, and chemical processing. According to Grand View Research, the market was valued at USD 53.02 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of over 4.5% during the forecast period of 2024–2029, citing infrastructure development and industrial automation as key growth catalysts. As demand for reliable and energy-efficient pumping systems rises, the need for high-quality centrifugal pump components—such as impellers, casings, shafts, seals, and bearings—has intensified. This growing demand has positioned leading component manufacturers at the forefront of innovation and supply chain resilience. The following list highlights the top 10 centrifugal pump parts manufacturers that are shaping the industry through technological advancement, global reach, and consistent performance.

Top 10 Centrifugal Pump Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Marine Centrifugal Pump Manufacture

Domain Est. 1996

Website: carverpump.com

Key Highlights: Carver Pump is an ISO 9001:2015 Certified Manufacturer of Centrifugal Pumps, Multistage, Axial Split Case, Self-priming, API & Solids-handling Pumps….

#2 Industrial Centrifugal Pumps & Solutions

Domain Est. 2011

Website: psgdover.com

Key Highlights: Discover Griswold’s centrifugal pumps, trusted by pump manufacturers across industries for exceptional performance, proven reliability, and long service ……

#3 Cornell Pump Company

Domain Est. 1997

Website: cornellpump.com

Key Highlights: Cornell Pump Company in Clackamas, Oregon, is a trusted manufacturer of high-quality pumps that have been designed in the USA, manufactured in the US with ……

#4 Centrifugal Pumps

Domain Est. 1997

Website: buffalopumps.com

Key Highlights: Buffalo Pumps is the Premier Pump Manufacturer and Supplier, Located in Western New York! Quality centrifugal pumps have been manufactured by Buffalo Pumps….

#5 MP Pumps

Domain Est. 1998 | Founded: 1942

Website: mppumps.com

Key Highlights: Discover MP Pumps’ durable centrifugal and self-priming pumps for agriculture, marine, petroleum, and industrial applications. Trusted since 1942….

#6 SPP Pumps

Domain Est. 2000

Website: spppumps.com

Key Highlights: SPP Pumps are world-renowned for industry-leading centrifugal pumps across a range of industries. Browse our collection of products and services on our ……

#7 AMT Pump Company

Domain Est. 2002

Website: amtpumps.com

Key Highlights: AMT Pump Company manufactures and sells Industrial/Commercial pumps & accessories through authorized distributors. Web Development: KDS FX Design. Go to Top….

#8 Ampco Pumps

Domain Est. 1999

Website: ampcopumps.com

Key Highlights: Ampco Pumps Company has been providing quality centrifugal pumps and positive displacement pumps worldwide for more than 70 years….

#9 Priming Assisted & Standard Centrifugal Pump Parts Kits

Domain Est. 1999

Website: pioneerpump.com

Key Highlights: Pioneer Pump Parts Kits offer a single-part number solution for various maintenance and repair tasks. They ensure shorter maintenance times….

#10 Gorman

Domain Est. 2000 | Founded: 1933

Website: grpumps.com

Key Highlights: Since 1933, Gorman-Rupp has manufactured the high-performance, high-quality pumps and pumping systems required for lasting service….

Expert Sourcing Insights for Centrifugal Pump Parts

H2: 2026 Market Trends for Centrifugal Pump Parts

The global market for centrifugal pump parts is poised for steady growth through 2026, driven by increasing demand across key industrial sectors, technological advancements, and a growing emphasis on energy efficiency and predictive maintenance. As industries modernize infrastructure and prioritize sustainable operations, several critical trends are shaping the centrifugal pump parts landscape.

-

Rising Demand from Industrial and Infrastructure Sectors

The expansion of water and wastewater treatment facilities, oil and gas operations, power generation, and chemical processing plants continues to fuel demand for reliable centrifugal pump components. Emerging economies in Asia-Pacific and Africa are investing heavily in infrastructure development, including desalination plants and urban water supply systems, which directly increases the need for efficient pump parts such as impellers, casings, mechanical seals, and bearings. -

Emphasis on Energy Efficiency and Sustainability

Energy efficiency regulations and sustainability goals are pushing end-users to upgrade aging pump systems. Modern centrifugal pump parts are being designed to reduce friction, improve hydraulic efficiency, and minimize energy loss. Components made from advanced materials—such as high-grade stainless steel, duplex alloys, and engineered plastics—are gaining traction due to their durability and lower lifecycle costs. -

Adoption of Smart Pumping Systems and IoT Integration

By 2026, the integration of Internet of Things (IoT) sensors and condition monitoring systems into pump assemblies is expected to become more widespread. Smart parts equipped with vibration sensors, temperature gauges, and seal health monitors enable predictive maintenance, reducing unplanned downtime and extending component life. This digital shift is particularly prominent in smart manufacturing and process industries. -

Growth in Aftermarket and Replacement Parts

As the installed base of centrifugal pumps ages, the aftermarket for replacement parts is expanding rapidly. Maintenance, repair, and operations (MRO) spending is rising, especially in mature markets like North America and Western Europe. OEMs and third-party suppliers are focusing on providing compatible, high-quality spare parts, including remanufactured components, to meet cost-conscious customer demands. -

Supply Chain Localization and Resilience

Geopolitical uncertainties and past supply chain disruptions have prompted manufacturers to localize production and inventory of critical pump components. Companies are increasingly sourcing parts regionally to reduce lead times and mitigate risks. This trend supports the growth of regional suppliers and encourages investment in local manufacturing hubs. -

Innovation in Materials and Coatings

To combat wear, corrosion, and cavitation, pump part manufacturers are investing in advanced surface treatments and composite materials. Ceramic coatings, tungsten carbide overlays, and corrosion-resistant alloys are being widely adopted, especially in harsh operating environments such as mining, chemical processing, and offshore applications. -

Consolidation and Strategic Partnerships

The centrifugal pump parts market is witnessing increased consolidation, with major players acquiring niche component manufacturers to broaden their product portfolios. Strategic partnerships between pump OEMs and parts suppliers are also on the rise, aimed at delivering integrated solutions and improving service offerings.

In summary, the 2026 centrifugal pump parts market will be characterized by technological innovation, a focus on efficiency and reliability, and a growing reliance on digital monitoring and sustainable practices. Companies that adapt to these trends by offering smarter, more durable, and environmentally friendly components will be well-positioned for long-term success.

Common Pitfalls Sourcing Centrifugal Pump Parts: Quality and Intellectual Property Concerns

Sourcing centrifugal pump parts, especially for critical industrial applications, involves significant risks if not managed carefully. Two of the most critical pitfalls revolve around part quality and intellectual property (IP) rights. Failing to address these can lead to operational failures, safety hazards, legal disputes, and financial losses.

Quality-Related Pitfalls

-

Substandard Materials and Manufacturing

A major risk is receiving parts made from inferior materials or produced using poor manufacturing practices. Counterfeit or non-OEM parts may use lower-grade alloys, incorrect heat treatments, or inadequate tolerances. These deficiencies can lead to premature wear, corrosion, vibration, or catastrophic failure under operational stress, jeopardizing system reliability and safety. -

Lack of Traceability and Certification

Reputable suppliers provide material test reports (MTRs), certifications (e.g., ISO, API), and full traceability. Sourcing from unreliable vendors often means missing or falsified documentation, making it impossible to verify compliance with industry standards or original equipment manufacturer (OEM) specifications. -

Inconsistent Dimensional Accuracy

Even minor deviations in dimensions—such as impeller diameter, shaft fit, or seal chamber tolerances—can drastically reduce pump efficiency, increase energy consumption, or cause mechanical failure. Off-spec parts may fit initially but fail under load or thermal expansion. -

Poor Surface Finishes and Coatings

Components like shafts and seals require precise surface finishes to prevent leakage and wear. Poorly finished or improperly coated parts (e.g., missing chrome plating or incorrect epoxy coating) accelerate degradation, especially in corrosive or abrasive environments.

Intellectual Property (IP) Pitfalls

-

Infringement of OEM Design Patents and Trademarks

Many pump components are protected by patents, design rights, or trademarks. Sourcing aftermarket or “compatible” parts from unauthorized manufacturers may involve IP infringement, exposing the buyer to legal liability, seizure of goods, or forced replacement at significant cost. -

Voiding Warranties and Service Agreements

Using non-OEM or unapproved parts often voids the original pump warranty and prevents access to OEM service support. This not only increases long-term maintenance costs but also complicates troubleshooting and compliance with regulatory standards. -

Lack of Technical Support and Documentation

OEMs provide detailed installation, maintenance, and performance data tied to their parts. Third-party suppliers may not offer equivalent technical documentation, increasing the risk of improper installation and reduced reliability. Without proper support, diagnosing issues becomes more difficult. -

Counterfeit Parts Masquerading as Genuine

The market is rife with counterfeit components falsely labeled as OEM. These parts not only compromise performance and safety but also pose serious IP issues. Purchasing such parts—knowingly or unknowingly—can implicate the buyer in IP violations and damage the organization’s reputation.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Source from authorized distributors or certified suppliers with verifiable quality management systems.

– Require full documentation, including MTRs, conformance certificates, and traceability records.

– Conduct regular audits or inspections of critical parts upon delivery.

– Consult legal and technical experts when sourcing non-OEM components to assess IP risks.

– Maintain clear procurement policies that prioritize authenticity, compliance, and lifecycle performance over short-term cost savings.

By proactively addressing quality and IP concerns, organizations can ensure reliable pump operation, avoid legal exposure, and reduce total cost of ownership.

Logistics & Compliance Guide for Centrifugal Pump Parts

This guide outlines key considerations for the logistics and regulatory compliance associated with importing, exporting, storing, and transporting centrifugal pump components.

Classification and Tariff Codes

Properly classifying centrifugal pump parts under the Harmonized System (HS) is essential for accurate customs clearance and duty calculation. Common HS codes include:

– 8413.30: Parts of centrifugal pumps

– 8413.91: Valve parts (if applicable)

– 8483.40: Shafts, impellers, or bearings specific to pumps

Always verify classification with local customs authorities or a licensed customs broker, as codes may vary by country and part specificity.

Import/Export Regulations

Ensure compliance with export control laws such as:

– ITAR (International Traffic in Arms Regulations): Not typically applicable unless pump parts are for military applications.

– EAR (Export Administration Regulations): May apply if parts contain dual-use technologies or advanced materials.

Check destination country restrictions and licensing requirements, especially for shipments to sanctioned regions.

Packaging and Handling Requirements

Use protective packaging to prevent damage during transit:

– Shock-absorbent materials for fragile components (e.g., seals, impellers)

– Moisture-resistant wrapping to prevent corrosion

– Secure crate or palletized shipment for heavy parts (e.g., casings, housings)

Label packages with handling instructions: “Fragile,” “This Side Up,” and part identification.

Transportation Modes and Lead Times

Choose transport based on urgency, cost, and part size:

– Air Freight: Best for urgent, high-value, or small components; typical lead time 3–7 days.

– Ocean Freight: Cost-effective for bulk or heavy parts; lead time 20–45 days depending on origin/destination.

– Ground Freight: Suitable for domestic or regional transport; lead time 2–10 days.

Monitor transit for delays due to port congestion or customs inspections.

Customs Documentation

Prepare complete documentation for smooth customs processing:

– Commercial Invoice (with detailed part descriptions and values)

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin (may be required for preferential tariffs)

– Import/Export Licenses (if applicable)

Regulatory Compliance and Standards

Ensure parts meet relevant international and local standards:

– ISO 5199: Specification for centrifugal pump technical requirements

– API 610: Standard for petroleum, petrochemical, and natural gas industries

– CE Marking: Required for entry into the European Economic Area

– ATEX/IECEx: If parts are used in explosive atmospheres

Maintain documentation proving conformity with applicable standards.

Storage and Inventory Management

Store pump parts in a controlled environment to prevent degradation:

– Temperature and humidity control to avoid rust or material warping

– Use first-in, first-out (FIFO) inventory practices

– Clearly label shelves with part numbers, model compatibility, and inspection dates

Conduct regular audits to ensure stock accuracy and part traceability.

Environmental and Safety Compliance

Adhere to environmental regulations for hazardous materials:

– Proper disposal of lubricants, coatings, or packaging containing contaminants

– Compliance with REACH (EU) and RoHS directives for restricted substances

– Use of SDS (Safety Data Sheets) for any chemical-treated components

Train staff in handling procedures and emergency response.

Traceability and Documentation Retention

Maintain records for compliance audits and warranty claims:

– Part batch numbers and serial tracking

– Supplier certifications and inspection reports

– Customs filings and shipping logs

Retain documents for a minimum of 5–7 years, depending on jurisdiction.

Conclusion on Sourcing Centrifugal Pump Parts

Sourcing centrifugal pump parts requires a strategic approach that balances quality, cost, availability, and compatibility. Selecting reliable suppliers—whether original equipment manufacturers (OEMs), authorized distributors, or reputable aftermarket providers—is critical to ensuring long-term pump performance, efficiency, and reduced downtime. Key considerations include material compatibility, adherence to industry standards (e.g., ANSI, ISO, API), and the availability of technical support.

While OEM parts guarantee precise fit and performance, they often come at a higher cost. Aftermarket parts can offer significant cost savings but must be carefully vetted for quality and reliability. Additionally, maintaining an inventory of critical spares and leveraging digital procurement tools can enhance supply chain resilience and operational continuity.

In summary, an effective sourcing strategy for centrifugal pump parts integrates technical requirements with supply chain best practices, ensuring optimal pump reliability, lifecycle cost efficiency, and minimal operational disruption. Regular evaluations of supplier performance and ongoing monitoring of market trends will further support informed decision-making and sustained maintenance excellence.