Introduction: Navigating the Global Market for Centrifugal Pumps and Submersible Pumps

Selecting the right pump technology directly impacts your operational efficiency, maintenance costs, and long-term ROI. For procurement managers and engineers across the USA and Europe, the choice between centrifugal and submersible pumps represents a critical infrastructure decision—one that affects everything from basement sump systems to large-scale sewage lift stations.

The Challenge

Today’s B2B buyers face a complex landscape:

- Diverse application requirements spanning HVAC condensate removal, stormwater management, sewage ejection, and potable water systems

- Regulatory compliance varying across jurisdictions

- Total cost of ownership calculations that extend beyond initial purchase price

- Installation constraints that may favor one technology over another

Making the wrong choice means excessive energy consumption, premature equipment failure, and costly downtime.

What This Guide Covers

| Section | Focus |

|———|——-|

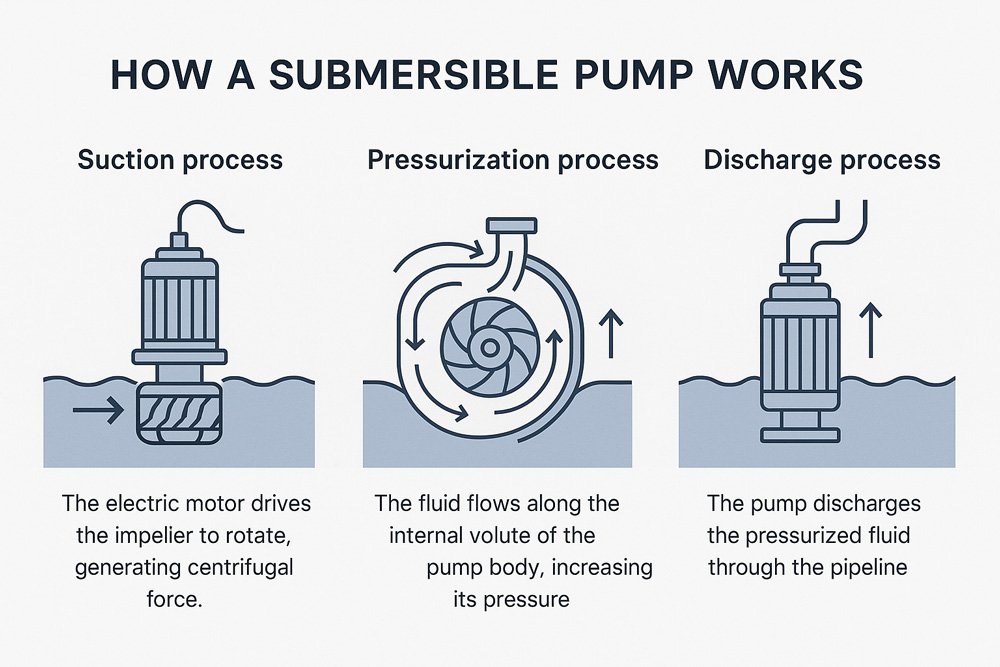

| Technology Overview | How centrifugal and submersible pumps operate |

| Application Matching | Which pump type suits specific use cases |

| Performance Metrics | Flow rates, head pressure, and efficiency comparisons |

| Selection Criteria | Key factors for informed purchasing decisions |

| Maintenance Considerations | Lifecycle costs and serviceability |

Who Should Read This

This guide serves:

– Facility managers specifying equipment for commercial buildings

– Engineers designing municipal and industrial systems

– Procurement specialists evaluating supplier options

– Contractors selecting pumps for residential and commercial installations

Illustrative Image (Source: Google Search)

By the end, you’ll have the technical foundation and practical framework to confidently source pump solutions that align with your operational demands and budget parameters.

Article Navigation

- Top 10 Centrifugal Pump And Submersible Pump Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for centrifugal pump and submersible pump

- Understanding centrifugal pump and submersible pump Types and Variations

- Key Industrial Applications of centrifugal pump and submersible pump

- 3 Common User Pain Points for ‘centrifugal pump and submersible pump’ & Their Solutions

- Strategic Material Selection Guide for centrifugal pump and submersible pump

- In-depth Look: Manufacturing Processes and Quality Assurance for centrifugal pump and submersible pump

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘centrifugal pump and submersible pump’

- Comprehensive Cost and Pricing Analysis for centrifugal pump and submersible pump Sourcing

- Alternatives Analysis: Comparing centrifugal pump and submersible pump With Other Solutions

- Essential Technical Properties and Trade Terminology for centrifugal pump and submersible pump

- Navigating Market Dynamics and Sourcing Trends in the centrifugal pump and submersible pump Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of centrifugal pump and submersible pump

- Strategic Sourcing Conclusion and Outlook for centrifugal pump and submersible pump

- Important Disclaimer & Terms of Use

Top 10 Centrifugal Pump And Submersible Pump Manufacturers & Suppliers List

1. 10 top pump manufacturers of the world

Domain: jeepumps.com

Registered: 2002 (23 years)

Introduction: 1. Grundfos … Grundfos, a European firm, is one of the largest pump manufacturers with a global reach spanning more than 130 countries. The company offers a ……

2. A Complete List of 60+ Pump Manufacturers around the World

3. Pacer Pumps – Centrifugal Pumps Manufacturers In U.S.A

Domain: pacerpumps.com

Registered: 1999 (26 years)

Introduction: Pacer Pumps is the leading centrifugal pumps manufacturers providing industrial centrifugal pumps, marine centrifugal pumps, aquaculture centrifugal pumps….

4. Largest Pump Manufacturers in the U.S. – IndustrySelect®

Domain: industryselect.com

Registered: 2017 (8 years)

Introduction: About the Top 10 Pump and Pumping Equipment Manufacturers · 1. Curtiss-Wright Flow Control Co. (Cheswick, PA) · 2. Baker Hughes (Claremore, OK) · 3 ……

5. Top 10 Pump Manufacturers in USA | Industrial Pump Brands

Domain: daepumps.com

Registered: 2018 (7 years)

Introduction: We explore what makes Eddy Pump, DAE Pump, Xylem, Grundfos, BJM Pumps, ITT Goulds, and others the key industry pump manufacturers….

Illustrative Image (Source: Google Search)

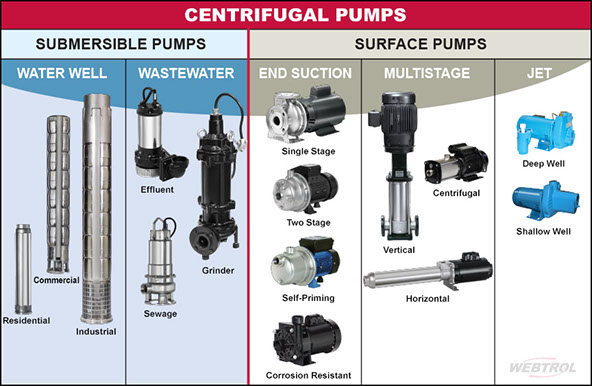

Understanding centrifugal pump and submersible pump Types and Variations

Understanding Centrifugal Pump and Submersible Pump Types and Variations

Selecting the right pump configuration is critical for operational efficiency, maintenance costs, and system longevity. Both centrifugal and submersible pumps serve distinct applications, with several variations designed for specific industrial and commercial requirements.

Pump Type Comparison Overview

| Type | Key Features | Primary Applications | Pros | Cons |

|---|---|---|---|---|

| Standard Centrifugal Pump | Surface-mounted; impeller-driven; requires priming | Water transfer, HVAC systems, industrial processing | Easy maintenance access; lower initial cost; simple installation | Requires priming; limited suction lift; not suitable for solids |

| Submersible Sump Pump | Fully submerged operation; sealed motor; automatic float switch | Basement drainage, groundwater control, stormwater removal | Self-priming; quiet operation; space-efficient | Motor replacement requires full unit removal; limited to clean/low-solids water |

| Submersible Sewage/Grinder Pump | Heavy-duty impeller or grinding mechanism; handles solids up to 2″ | Sewage ejection, wastewater lift stations, septic systems | Handles raw sewage and solids; high head pressure capability | Higher maintenance; greater power consumption |

| Submersible Effluent Pump | Designed for filtered wastewater; handles small solids (≤3/4″) | Septic tank effluent, gray water systems, effluent lift stations | Efficient for pre-treated waste; moderate cost | Cannot handle raw sewage or large solids |

| Turbine Effluent Pump | Multi-stage impeller design; high-efficiency motor | Deep well applications, high-head effluent systems, potable water | Superior lift capacity; energy-efficient at depth | Complex installation; higher upfront investment |

Detailed Type Breakdown

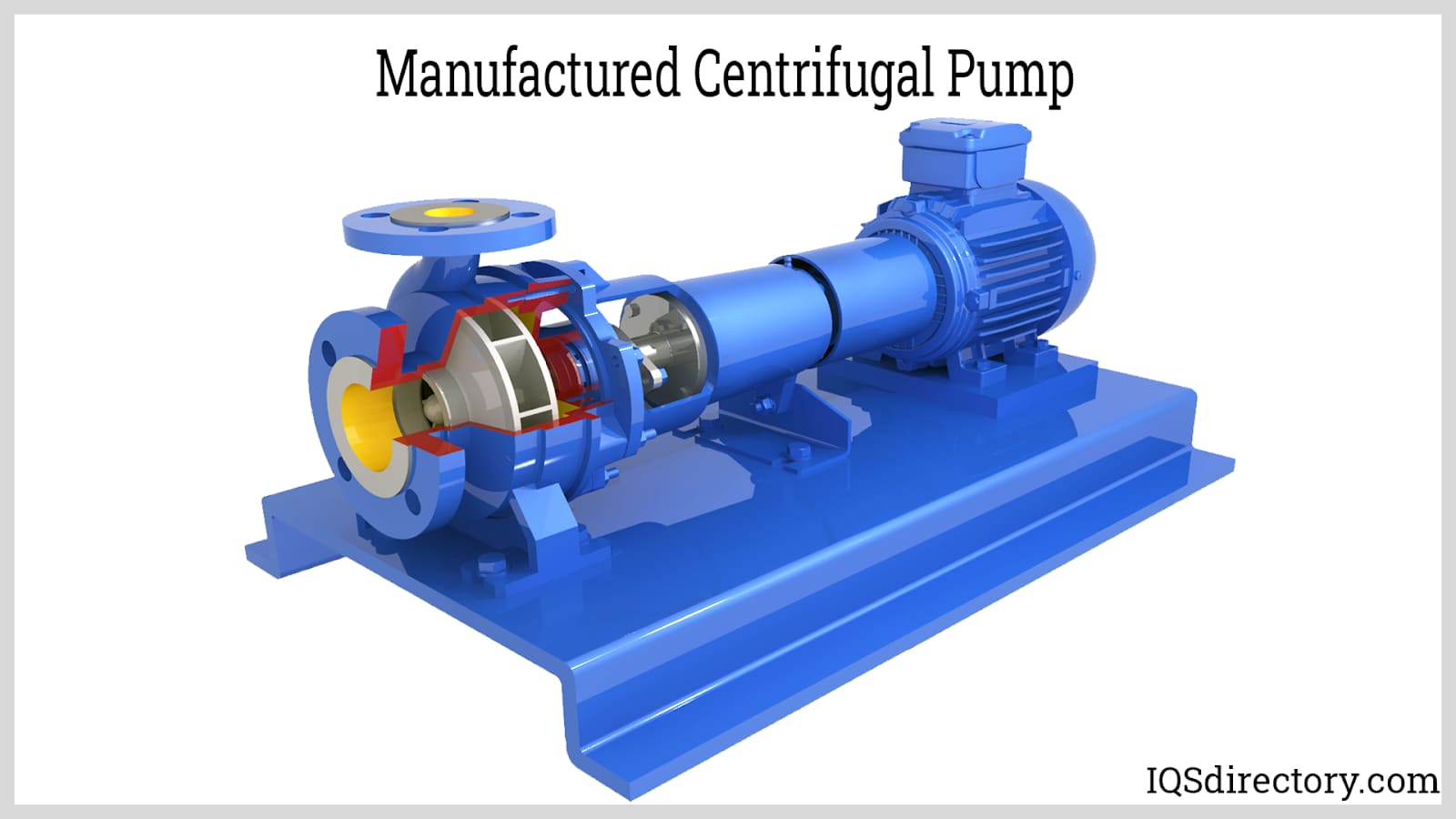

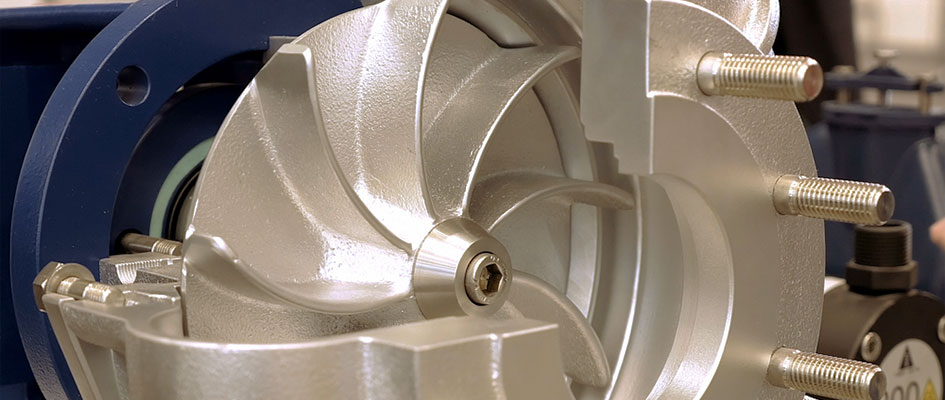

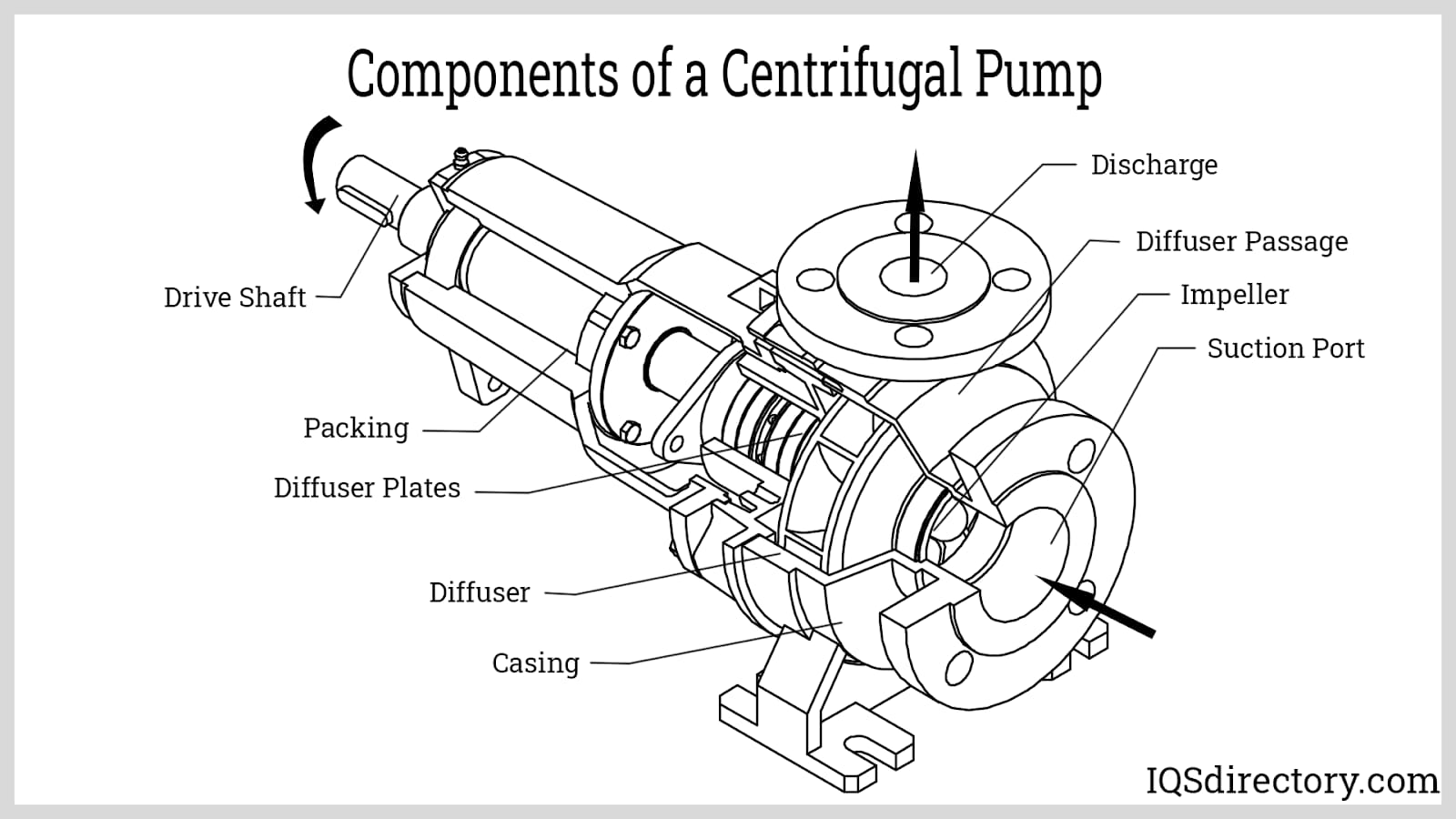

1. Standard Centrifugal Pumps

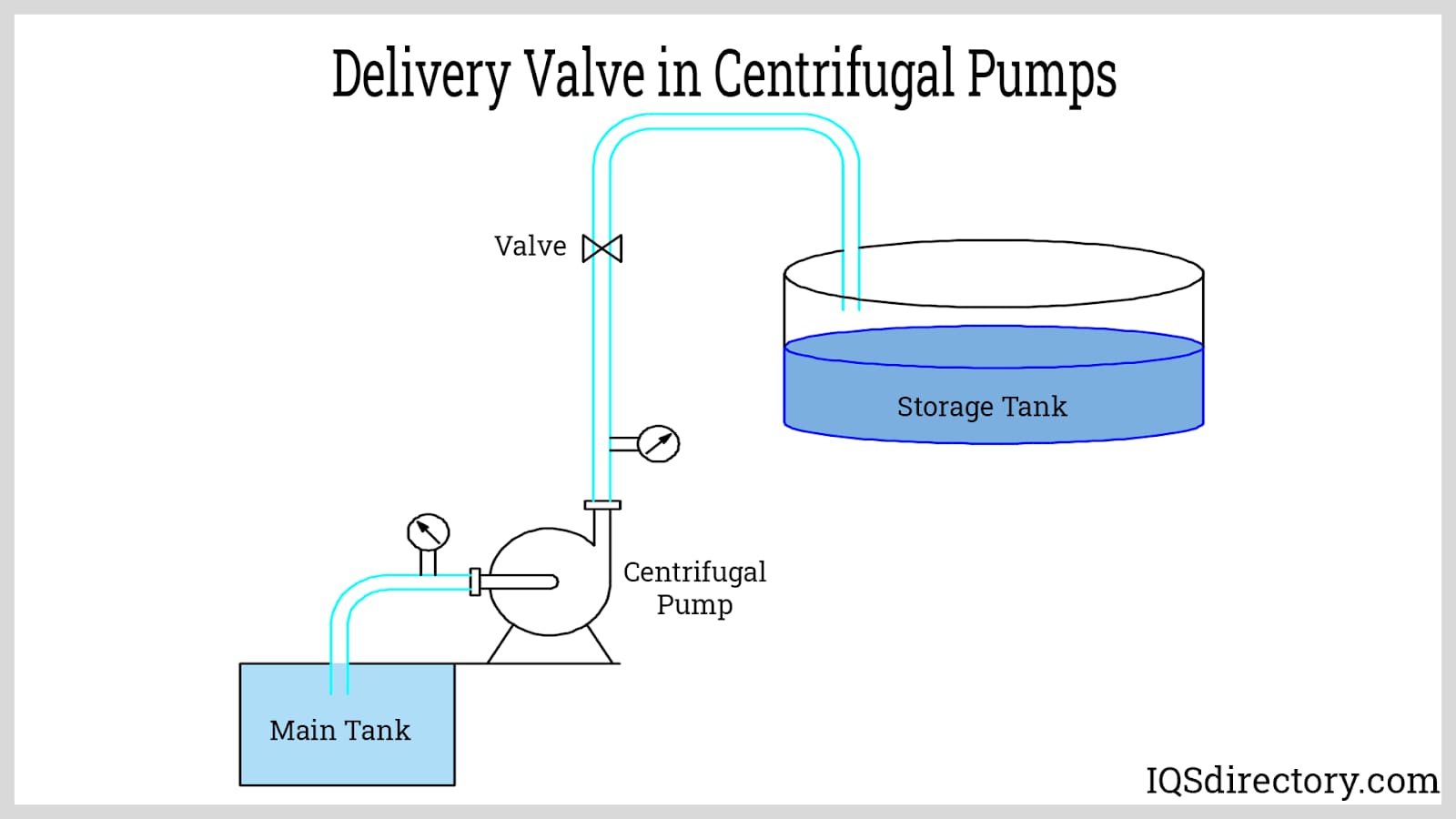

Standard centrifugal pumps operate above the fluid source, using rotational energy from an impeller to move water through the system. These units require priming before operation and are best suited for applications with consistent positive suction head.

Typical specifications:

– Flow rates: 50–5,000+ GPM

– Head pressure: 20–200+ feet

– Operating temperature range: 40°F–200°F

Best for: Clean water transfer, cooling systems, boiler feed, irrigation networks.

2. Submersible Sump Pumps

Submersible sump pumps are designed for installation directly within a sump basin or pit. The hermetically sealed motor prevents electrical shorts while submerged, and integrated float switches enable automatic operation.

Key considerations:

– Corrosion-resistant housings (cast iron, thermoplastic, stainless steel)

– Cord lengths typically range from 9′ to 50′

– LED power indicators available for quick diagnostics

Best for: Basement flood prevention, crawl space drainage, elevator sumps, HVAC condensate removal.

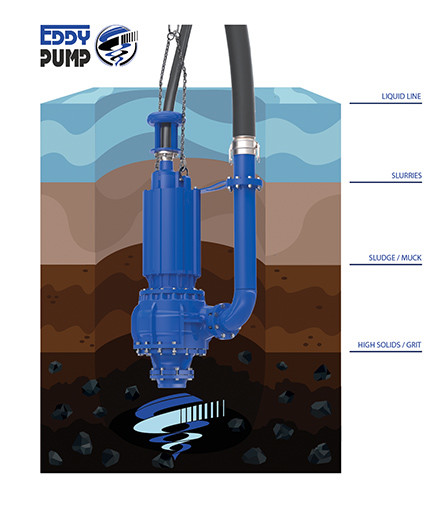

3. Submersible Sewage and Grinder Pumps

These heavy-duty units handle raw sewage containing solids, paper, and organic waste. Grinder pumps incorporate cutting mechanisms to macerate solids before discharge, enabling smaller-diameter force mains.

Illustrative Image (Source: Google Search)

Performance characteristics:

– Solids handling: Up to 2″ spherical solids (sewage); macerated discharge (grinder)

– Typical head range: 20–100+ feet

– Motor ratings: 1/2 HP to 2+ HP

Best for: Commercial restrooms below sewer lines, municipal lift stations, remote septic systems, hazardous-duty environments.

4. Submersible Effluent Pumps

Effluent pumps handle partially treated wastewater from septic tanks or gray water systems. They’re engineered for liquids with suspended particles up to 3/4″ diameter.

Design advantages:

– Higher efficiency than sewage pumps for appropriate applications

– Lower power draw for equivalent flow rates

– Extended service life in filtered-waste environments

Illustrative Image (Source: Google Search)

Best for: Septic tank discharge, drainfield dosing, laundry/gray water systems, light commercial effluent handling.

5. Turbine Effluent Pumps

Turbine effluent pumps utilize multi-stage impeller assemblies to achieve high head pressures required for deep installations or long-distance pumping. These units deliver superior efficiency in applications exceeding 50 feet of total dynamic head.

Specifications to evaluate:

– Stage count (determines maximum head)

– Bowl assembly materials

– Motor enclosure ratings (TEFC, explosion-proof options)

Best for: Deep well water supply, high-head effluent systems, potable water distribution, agricultural irrigation.

Illustrative Image (Source: Google Search)

Selection Criteria for B2B Buyers

When specifying pump types, evaluate:

- Total Dynamic Head (TDH) — vertical lift plus friction losses

- Flow rate requirements — GPM at peak demand

- Fluid characteristics — solids content, temperature, corrosivity

- Installation constraints — available space, power supply, maintenance access

- Duty cycle — continuous vs. intermittent operation

Matching pump type to application requirements minimizes lifecycle costs and reduces unplanned downtime.

Key Industrial Applications of centrifugal pump and submersible pump

Key Industrial Applications of Centrifugal Pumps and Submersible Pumps

Selecting the right pump technology directly impacts operational efficiency, maintenance costs, and system reliability. Below is a comprehensive breakdown of industrial applications where centrifugal and submersible pumps deliver optimal performance.

Application Comparison Matrix

| Industry/Application | Centrifugal Pumps | Submersible Pumps | Primary Selection Factors |

|---|---|---|---|

| Wastewater & Sewage | Lift stations, treatment plants | Sewage ejectors, grinder applications | Solids handling, installation depth |

| Municipal Water Supply | Distribution systems, booster stations | Well extraction, intake structures | Flow rate, head pressure requirements |

| HVAC Systems | Chilled water circulation, heating loops | Condensate removal, drainage | Continuous operation, space constraints |

| Construction & Dewatering | Surface water transfer | Excavation dewatering, portable applications | Portability, submersion requirements |

| Oil & Gas | Process fluid transfer, cooling systems | Produced water extraction, offshore platforms | Hazardous duty ratings, explosion-proof needs |

| Mining Operations | Slurry transport, process water | Underground dewatering, pit drainage | Abrasion resistance, depth capacity |

| Commercial Buildings | Fire suppression, HVAC circulation | Basement sumps, elevator sumps, stormwater | Space limitations, automatic operation |

| Agriculture & Irrigation | Surface water distribution | Deep well extraction, flood control | Energy efficiency, water table depth |

Centrifugal Pump Applications: Detailed Benefits

Process Industries & Manufacturing

– High flow rates for continuous production processes

– Easy maintenance with accessible components above ground

– Cost-effective for high-volume, low-head applications

– Simple integration with existing piping systems

Illustrative Image (Source: Google Search)

Water Treatment & Distribution

– Consistent pressure maintenance across distribution networks

– Scalable configurations for varying demand loads

– Lower initial capital investment for surface installations

HVAC & Building Systems

– Reliable circulation for heating and cooling loops

– Variable speed compatibility for energy optimization

– Straightforward serviceability without system shutdown

Submersible Pump Applications: Detailed Benefits

Sewage & Wastewater Management

– Direct installation in wet wells eliminates priming issues

– Grinder variants handle solids and fibrous materials

– Reduced noise—motor operates below water level

– Compact footprint for space-constrained installations

Groundwater & Well Applications

– Efficient deep well extraction without suction limitations

– Self-priming operation—no air lock concerns

– Protected motor cooling through surrounding fluid

Illustrative Image (Source: Google Search)

Stormwater & Flood Control

– Automatic activation via float switches

– Handles debris-laden water in emergency conditions

– Portable dewatering units for rapid deployment

Hazardous & Specialized Environments

– Explosion-proof configurations for volatile atmospheres

– High-temperature variants for industrial process drainage

– Sealed construction prevents environmental contamination

Selection Criteria by Application Priority

| Priority | Choose Centrifugal | Choose Submersible |

|---|---|---|

| Accessibility | Above-ground maintenance required | Limited access acceptable |

| Installation Depth | Shallow applications (<25 ft suction lift) | Deep installations, below water table |

| Space | Dedicated pump room available | Minimal surface footprint needed |

| Fluid Type | Clean to moderately dirty water | Sewage, effluent, solids-laden fluids |

| Noise Sensitivity | Isolated mechanical rooms | Occupied spaces, residential proximity |

| Initial Cost | Budget-constrained projects | Total lifecycle cost optimization |

Industry-Specific Considerations

Commercial & Institutional Facilities

– Elevator sump pumps require submersible units meeting local codes

– Basement and crawl space protection demands automatic submersible operation

– HVAC condensate removal benefits from compact submersible designs

Industrial & Municipal Operations

– Effluent lift stations utilize submersible turbine effluent pumps for reliable transfer

– Septic system applications require matched pump-to-tank configurations

– Potable water systems demand NSF-certified components regardless of pump type

Illustrative Image (Source: Google Search)

3 Common User Pain Points for ‘centrifugal pump and submersible pump’ & Their Solutions

3 Common User Pain Points for Centrifugal Pumps & Submersible Pumps & Their Solutions

Pain Point 1: Selecting the Wrong Pump Type for the Application

Scenario:

A facilities manager at a manufacturing plant needs to pump wastewater from a below-grade collection pit to the municipal sewer line. They initially specify a standard centrifugal pump based on flow rate requirements alone, without considering the installation environment.

Problem:

Standard centrifugal pumps require dry installation above the fluid level and need priming before operation. In below-grade applications with fluctuating water levels, this creates:

– Frequent priming failures and air-lock issues

– Increased maintenance due to dry-running damage

– Installation complexity requiring separate pump rooms and suction piping

– Potential NPSH (Net Positive Suction Head) problems leading to cavitation

Solution:

| Factor | Centrifugal Pump | Submersible Pump |

|——–|——————|——————|

| Installation Location | Above liquid level | Submerged in liquid |

| Priming Required | Yes | No (self-priming) |

| Space Requirements | Dedicated pump room | Minimal footprint |

| Best For | Surface-level transfer, clean water | Below-grade sumps, sewage, confined spaces |

Action: Match pump type to application requirements. For below-grade sewage ejection, sewage lift stations, and sump applications, submersible pumps eliminate priming issues and simplify installation. Reserve centrifugal pumps for surface-mounted applications with consistent suction conditions.

Illustrative Image (Source: Google Search)

Pain Point 2: Premature Pump Failure from Improper Sizing

Scenario:

A commercial building contractor installs a submersible sewage pump based solely on price point, selecting an undersized unit for an elevator sump application that experiences intermittent high-volume stormwater intrusion.

Problem:

Undersized pumps operating outside their design envelope experience:

– Motor overheating from extended run cycles

– Accelerated impeller and seal wear

– Inability to keep pace with inflow during peak demand

– Reduced service life (often 50% or less of expected lifespan)

– Unplanned downtime and emergency replacement costs

Solution:

Implement proper pump sizing methodology:

- Calculate total dynamic head (TDH): Static lift + friction losses + discharge pressure

- Determine peak flow requirements: Account for worst-case scenarios, not average conditions

- Select pump with performance curve matching application: Operating point should fall within 80-110% of Best Efficiency Point (BEP)

- Factor in solids handling: For sewage/grinder applications, verify passage size matches waste stream characteristics

Action: Utilize manufacturer sizing tools and consult technical specifications. Most reputable manufacturers (including Zoeller) provide sizing calculators and application-specific guidance to ensure proper pump selection for basement sumps, sewage ejectors, and lift station applications.

Illustrative Image (Source: Google Search)

Pain Point 3: Inadequate System Integration and Monitoring

Scenario:

A property management company operates multiple sewage lift stations across a commercial complex. Each station runs independently without centralized monitoring, and maintenance is purely reactive—performed only after failures occur.

Problem:

Disconnected pump systems without proper controls create:

– No early warning of impending failures (seal leaks, motor issues)

– Unbalanced wear on duplex systems when alternators fail

– Overflow events causing property damage and compliance violations

– Higher total cost of ownership from emergency service calls

– Liability exposure from sewage backups

Solution:

Implement comprehensive system integration:

| Component | Function | Benefit |

|---|---|---|

| Control Panels | Automate pump operation, alternation | Balanced wear, reliable sequencing |

| High-Water Alarms | Alert before overflow conditions | Prevent property damage |

| Check Valves | Prevent backflow | Protect pumps and upstream systems |

| Rail Systems | Enable pump removal without dewatering | Reduce maintenance time by 60%+ |

| Remote Monitoring | Real-time status and alerts | Proactive maintenance scheduling |

Action: Specify complete pump packages rather than standalone units. Pre-engineered systems (such as QLS Series packages) include matched components—basins, controls, alarms, and rail systems—designed to work together. This approach reduces integration risk, simplifies procurement, and ensures code compliance for sewage ejector, lift station, and hazardous duty applications.

Illustrative Image (Source: Google Search)

Key Takeaways for B2B Buyers

- Application dictates pump type: Submersible pumps excel in below-grade, space-constrained, and sewage applications; centrifugal pumps suit surface-mounted clean water transfer

- Proper sizing prevents premature failure: Invest time in accurate calculations upfront to avoid costly replacements

- Systems outperform standalone pumps: Integrated packages with controls, alarms, and accessories deliver lower lifecycle costs and higher reliability

Strategic Material Selection Guide for centrifugal pump and submersible pump

Strategic Material Selection Guide for Centrifugal and Submersible Pumps

Selecting the appropriate construction materials for centrifugal and submersible pumps directly impacts operational longevity, maintenance costs, and total cost of ownership. This guide provides procurement and engineering professionals with actionable criteria for material specification across diverse industrial applications.

Critical Material Considerations by Pump Type

Centrifugal Pump Materials

Centrifugal pumps operate above the fluid surface, requiring materials optimized for:

- Impeller construction: Cast iron, stainless steel (304/316), bronze, or engineered polymers

- Casing/volute: Ductile iron, carbon steel, or corrosion-resistant alloys

- Shaft and seals: Hardened steel with ceramic or carbon mechanical seals

- Wear rings: Bronze, stainless steel, or composite materials

Standard centrifugal pumps typically utilize cast iron housings with bronze or stainless impellers for general-purpose applications. Chemical processing demands upgraded metallurgy—316 stainless steel or Hastelloy for aggressive media.

Submersible Pump Materials

Submersible pumps face continuous fluid immersion, demanding:

Illustrative Image (Source: Google Search)

- Motor housing: Cast iron with epoxy coating, stainless steel, or engineered thermoplastics

- Impeller: Engineered thermoplastics (glass-filled nylon), cast iron, or stainless steel

- Seals: Double mechanical seals with oil-filled chambers

- Hardware: Stainless steel fasteners (minimum 304 grade)

- Power cable: Submersible-rated, oil-resistant jacketing

For sewage and grinder applications, hardened steel cutting systems and abrasion-resistant materials extend service intervals in solids-handling environments.

Application-Specific Material Requirements

Potable Water Systems

– NSF/ANSI 61 certified materials mandatory

– Lead-free brass and stainless steel construction

– FDA-compliant elastomers

Wastewater and Sewage

– Corrosion-resistant coatings (epoxy, polyurethane)

– Hardened cutting components for grinder pumps

– Chemical-resistant seals for hydrogen sulfide exposure

Chemical Processing

– Alloy selection based on fluid compatibility (consult corrosion charts)

– PTFE or Viton seals for aggressive chemicals

– Lined or solid alloy construction for concentrated acids

Illustrative Image (Source: Google Search)

High-Temperature Applications

– Elevated temperature ratings for seals and O-rings

– Thermal expansion considerations in material pairings

– Heat-stabilized polymers where applicable

Material Selection Decision Factors

| Factor | Impact on Selection |

|---|---|

| Fluid chemistry | Determines corrosion resistance requirements |

| Solids content | Dictates abrasion resistance and hardness |

| Temperature range | Affects seal compatibility and material stability |

| Regulatory compliance | NSF, ATEX, or hazardous location certifications |

| Lifecycle cost | Premium materials reduce replacement frequency |

Comparative Material Analysis: Centrifugal vs. Submersible Pumps

| Component | Centrifugal Pump Options | Submersible Pump Options | Key Selection Criteria |

|---|---|---|---|

| Housing/Casing | Cast iron, ductile iron, carbon steel, 316SS | Cast iron (epoxy-coated), 316SS, engineered thermoplastics | Corrosion resistance, pressure rating, weight |

| Impeller | Cast iron, bronze, 316SS, CD4MCu, polymers | Glass-filled nylon, cast iron, 316SS, hardened steel | Fluid compatibility, solids handling, efficiency |

| Shaft | Carbon steel, 416SS, 17-4PH SS | 416SS, 304SS, 316SS | Fatigue resistance, corrosion environment |

| Mechanical Seals | Carbon/ceramic, silicon carbide/silicon carbide | Double mechanical (oil-filled), silicon carbide | Abrasion resistance, dry-run capability |

| Fasteners | Carbon steel, 304SS | 304SS minimum, 316SS for corrosive environments | Continuous immersion demands higher grades |

| Wear Components | Bronze, Ni-Resist, composites | Hardened steel, tungsten carbide inserts | Abrasive content, replacement accessibility |

| Coatings | Optional epoxy or ceramic | Standard epoxy or powder coating | Submersibles require full encapsulation |

| Cable/Wiring | Standard electrical rated | Submersible-rated, oil-resistant | Continuous immersion, chemical exposure |

Procurement Recommendations

- Specify material certifications in RFQs—request mill test reports for critical alloys

- Evaluate total cost of ownership rather than initial purchase price

- Confirm spare parts availability in specified materials before purchase

- Request compatibility documentation for chemical service applications

- Consider standardization across facilities to reduce inventory complexity

Material selection errors represent a leading cause of premature pump failure. Investing in appropriate metallurgy and construction materials during specification yields measurable returns through extended service life and reduced unplanned downtime.

In-depth Look: Manufacturing Processes and Quality Assurance for centrifugal pump and submersible pump

In-depth Look: Manufacturing Processes and Quality Assurance for Centrifugal and Submersible Pumps

Understanding the manufacturing processes and quality assurance protocols behind centrifugal and submersible pumps is essential for B2B buyers evaluating suppliers. This section examines the production stages, material considerations, and quality standards that distinguish reliable pump manufacturers in the global market.

Manufacturing Process Overview

Both centrifugal and submersible pumps share fundamental manufacturing stages, though submersible pumps require additional processes to ensure hermetic sealing and motor protection for underwater operation.

Illustrative Image (Source: Google Search)

Stage 1: Material Preparation

| Component | Centrifugal Pumps | Submersible Pumps |

|---|---|---|

| Impeller | Cast iron, bronze, stainless steel | Stainless steel, engineered polymers |

| Casing/Volute | Cast iron, ductile iron | Stainless steel, cast iron with epoxy coating |

| Shaft | Carbon steel, stainless steel | Stainless steel (corrosion-resistant grades) |

| Motor Housing | N/A (external motor) | Cast iron, stainless steel with sealed enclosure |

| Seals | Mechanical seals, packing | Double mechanical seals, oil-filled chambers |

Key preparation steps:

– Raw material inspection and certification verification

– Chemical composition analysis via spectrometry

– Material traceability documentation per batch

Stage 2: Forming and Machining

Casting Operations:

– Sand casting or investment casting for impellers and volutes

– Precision tolerances: ±0.1mm for critical surfaces

– Heat treatment for stress relief and hardness optimization

CNC Machining:

– Multi-axis CNC turning for shafts and bearing housings

– Surface finishing to Ra 0.8-1.6 μm for seal faces

– Dynamic balancing of impellers (ISO 1940 G2.5 or better)

Submersible-Specific Processes:

– Motor winding with Class H or F insulation

– Stator impregnation with vacuum pressure impregnation (VPI)

– Cable entry potting and sealing

Stage 3: Assembly

Centrifugal Pump Assembly Sequence:

1. Bearing installation and preload adjustment

2. Shaft and impeller subassembly

3. Mechanical seal installation

4. Volute/casing attachment

5. Coupling alignment verification

Submersible Pump Assembly Sequence:

1. Motor stator and rotor assembly

2. Oil chamber filling (for oil-cooled designs)

3. Mechanical seal installation (primary and secondary)

4. Pump end attachment to motor

5. Cable termination and sealing

6. Final enclosure sealing and pressure testing

Quality Control Checkpoints

Quality assurance spans the entire production cycle. The table below outlines critical QC checkpoints:

| Stage | Inspection Type | Acceptance Criteria |

|---|---|---|

| Incoming Materials | Chemical/physical testing | Mill certificates, material specs |

| Casting | X-ray/ultrasonic inspection | No porosity, inclusions, or cracks |

| Machining | CMM dimensional verification | Within specified tolerances |

| Assembly | Torque verification, alignment check | Per engineering specifications |

| Sealing (Submersible) | Hydrostatic pressure test | No leakage at 1.5x rated pressure |

| Electrical (Submersible) | Insulation resistance, hi-pot test | >100 MΩ, withstand 2x rated voltage +1000V |

| Performance | Hydraulic curve verification | Within ±5% of published curves |

| Final | Run test, vibration analysis | ISO 10816 limits |

Quality Standards and Certifications

Reputable manufacturers adhere to internationally recognized standards:

Illustrative Image (Source: Google Search)

Management Systems:

– ISO 9001:2015 – Quality management systems

– ISO 14001:2015 – Environmental management systems

– ISO 45001:2018 – Occupational health and safety

Product Standards:

– ISO 9906 – Rotodynamic pumps: Hydraulic performance acceptance tests

– ISO 5199 – Technical specifications for centrifugal pumps (Class II)

– ISO 2858 – End-suction centrifugal pumps: Designation, nominal duty point, and dimensions

– API 610 – Centrifugal pumps for petroleum, petrochemical, and natural gas industries

– IEC 60034 – Rotating electrical machines (motor standards)

Regional Certifications:

– CE Marking – European conformity

– UL/CSA Listing – North American electrical safety

– ATEX/IECEx – Explosive atmosphere certification (hazardous duty pumps)

Supplier Evaluation Criteria

When assessing pump manufacturers, B2B buyers should verify:

Illustrative Image (Source: Google Search)

- Documented QMS – Request ISO 9001 certificates and audit reports

- Testing capabilities – In-house hydraulic test loops and electrical test equipment

- Traceability systems – Serial number tracking from raw material to finished product

- Third-party certifications – Independent verification of performance claims

- Warranty terms – Coverage scope reflects manufacturing confidence

Key Takeaways

- Submersible pumps require more stringent sealing and electrical insulation processes than standard centrifugal designs

- Material selection directly impacts pump longevity in corrosive or abrasive applications

- ISO 9906 compliance ensures hydraulic performance meets published specifications

- Request test certificates and material traceability documentation before procurement

Practical Sourcing Guide: A Step-by-Step Checklist for ‘centrifugal pump and submersible pump’

Practical Sourcing Guide: A Step-by-Step Checklist for Centrifugal and Submersible Pumps

This checklist provides a systematic approach to sourcing centrifugal and submersible pumps for B2B buyers in the USA and Europe. Follow each phase to ensure you select the right equipment from qualified suppliers.

Phase 1: Define Technical Requirements

Before contacting suppliers, document your specifications:

| Parameter | Centrifugal Pumps | Submersible Pumps |

|---|---|---|

| Flow rate (GPM/m³/h) | ☐ Specified | ☐ Specified |

| Total dynamic head (TDH) | ☐ Calculated | ☐ Calculated |

| Fluid type | ☐ Clean water / chemicals / slurry | ☐ Sewage / effluent / groundwater |

| Temperature range | ☐ Defined | ☐ Defined |

| Solids handling capacity | ☐ N/A or specified | ☐ Particle size defined |

| Installation depth | ☐ N/A | ☐ Measured |

| Power supply (voltage/phase) | ☐ Confirmed | ☐ Confirmed |

Action Items:

– [ ] Complete system curve analysis

– [ ] Identify duty cycle (continuous/intermittent)

– [ ] Document ambient conditions (indoor/outdoor, hazardous area classification)

– [ ] Specify material compatibility requirements (cast iron, stainless steel, thermoplastic)

Phase 2: Application Classification

Match your application to pump category:

Centrifugal Pump Applications:

– [ ] HVAC systems

– [ ] Industrial process water

– [ ] Irrigation

– [ ] Booster systems

– [ ] Chemical transfer

Submersible Pump Applications:

– [ ] Basement sumps

– [ ] Sewage ejection

– [ ] Effluent lift stations

– [ ] Stormwater removal

– [ ] Dewatering operations

– [ ] Potable water wells

– [ ] Septic systems

Phase 3: Supplier Qualification Checklist

Evaluate potential suppliers against these criteria:

Compliance & Certifications:

– [ ] ISO 9001 quality management certification

– [ ] UL/CSA listing (USA/Canada)

– [ ] CE marking (Europe)

– [ ] ATEX certification (if hazardous duty required)

– [ ] NSF/ANSI 61 (potable water applications)

Supplier Capabilities:

– [ ] Documented manufacturing history (minimum 10 years recommended)

– [ ] Regional warehouse/distribution presence

– [ ] Technical support availability in your time zone

– [ ] Published product registration process

– [ ] Accessible service parts inventory

– [ ] Sizing tools and selection software provided

Commercial Terms:

– [ ] Standard warranty terms documented

– [ ] Lead time commitments

– [ ] MOQ requirements clarified

– [ ] Payment terms acceptable

– [ ] Return/defect policy reviewed

Phase 4: Request for Quotation (RFQ) Preparation

Include these elements in your RFQ:

RFQ Essential Components:

1. Detailed technical specifications (from Phase 1)

2. Quantity requirements (initial + annual forecast)

3. Delivery location(s) and Incoterms preference

4. Required certifications/compliance standards

5. Requested warranty terms

6. Installation support requirements

7. Spare parts pricing request

8. Training requirements (if applicable)

9. Response deadline

Documentation to Request from Suppliers:

– [ ] Pump performance curves

– [ ] Dimensional drawings

– [ ] Material certifications

– [ ] Electrical schematics

– [ ] Installation manuals

– [ ] Maintenance schedules

Phase 5: Bid Evaluation Matrix

Score supplier responses using weighted criteria:

| Evaluation Criteria | Weight | Supplier A | Supplier B | Supplier C |

|---|---|---|---|---|

| Technical compliance | 25% | /10 | /10 | /10 |

| Price competitiveness | 20% | /10 | /10 | /10 |

| Delivery capability | 15% | /10 | /10 | /10 |

| Warranty terms | 10% | /10 | /10 | /10 |

| After-sales support | 15% | /10 | /10 | /10 |

| References/track record | 10% | /10 | /10 | /10 |

| Spare parts availability | 5% | /10 | /10 | /10 |

| Weighted Total | 100% |

Phase 6: Pre-Order Verification

Before finalizing purchase:

- [ ] Request and verify customer references (similar applications)

- [ ] Confirm stock availability or production schedule

- [ ] Review final technical submittal for accuracy

- [ ] Clarify installation requirements and accessories needed

- [ ] Confirm control panel compatibility (if applicable)

- [ ] Verify basin/mounting requirements (submersible pumps)

- [ ] Document agreed escalation contacts for technical issues

Phase 7: Order Placement & Documentation

Secure these documents at order confirmation:

- [ ] Purchase order acknowledgment

- [ ] Confirmed delivery schedule

- [ ] Final pricing breakdown

- [ ] Warranty registration requirements

- [ ] Commissioning checklist (if applicable)

- [ ] Contact information for technical support

Phase 8: Post-Delivery Actions

- [ ] Inspect shipment against packing list

- [ ] Document any damage immediately

- [ ] Complete product registration

- [ ] File warranty documentation

- [ ] Schedule installation per manufacturer guidelines

- [ ] Establish preventive maintenance schedule

- [ ] Identify local authorized service providers

Regional Considerations

USA Buyers:

– Verify compliance with local electrical codes (NEC)

– Confirm pump meets state-specific efficiency standards

– Check availability of domestic technical support

European Buyers:

– Ensure CE marking and Declaration of Conformity

– Verify compliance with EU Ecodesign Directive (where applicable)

– Confirm documentation available in required languages

– Check REACH compliance for material components

Quick Reference: Key Questions for Suppliers

- What is your standard lead time for this pump model?

- Do you stock replacement parts regionally?

- What technical support is included post-purchase?

- Can you provide references from similar applications?

- What training resources are available?

- How do you handle warranty claims?

- Do you offer sizing tools or selection assistance?

Comprehensive Cost and Pricing Analysis for centrifugal pump and submersible pump Sourcing

Comprehensive Cost and Pricing Analysis for Centrifugal Pump and Submersible Pump Sourcing

Understanding the total cost of ownership for centrifugal and submersible pumps is critical for B2B procurement decisions. This analysis breaks down pricing structures, cost drivers, and strategic approaches to optimize your sourcing budget.

Cost Breakdown by Pump Type

Centrifugal Pumps

| Cost Component | % of Total Cost | Typical Range (USD) |

|---|---|---|

| Materials/Unit | 40-50% | $500 – $15,000+ |

| Motor/Drive | 20-30% | $200 – $8,000 |

| Installation Labor | 10-15% | $300 – $2,500 |

| Logistics/Freight | 5-10% | $150 – $1,500 |

| Accessories/Controls | 5-10% | $100 – $2,000 |

Submersible Pumps

| Cost Component | % of Total Cost | Typical Range (USD) |

|---|---|---|

| Materials/Unit | 45-55% | $800 – $25,000+ |

| Sealed Motor Assembly | 25-35% | $400 – $10,000 |

| Installation Labor | 8-12% | $500 – $3,500 |

| Logistics/Freight | 5-8% | $200 – $2,000 |

| Control Panels/Accessories | 5-10% | $150 – $3,000 |

Materials Cost Analysis

Key Material Cost Drivers:

- Casing/Housing Materials:

- Cast iron: Base cost option

- Stainless steel (304/316): 30-50% premium

- Bronze: 40-60% premium

-

Engineered plastics: 10-20% below cast iron

-

Impeller Construction:

- Standard cast materials: Baseline

- Hardened alloys (for abrasive applications): +25-40%

-

Corrosion-resistant coatings: +15-25%

-

Sealing Systems:

- Mechanical seals (centrifugal): $50 – $800

- Hermetically sealed motors (submersible): Built into unit cost

- Double mechanical seals: +$200 – $1,500

Submersible-Specific Material Considerations:

– Waterproof cable assemblies: $3 – $15 per foot

– Stainless steel hardware for corrosion resistance

– Specialized epoxy-encapsulated motors

Labor Cost Considerations

Installation Labor Comparison

| Factor | Centrifugal Pump | Submersible Pump |

|---|---|---|

| Base Installation | 4-8 hours | 2-6 hours |

| Piping Complexity | Higher (suction/discharge) | Lower (discharge only) |

| Foundation Requirements | Concrete pad required | Minimal/none |

| Alignment Procedures | Critical (motor-pump) | Not applicable |

| Electrical Work | Standard | Specialized (wet-rated) |

Labor Rate Benchmarks:

– USA: $75 – $150/hour (licensed technician)

– Western Europe: €65 – €130/hour

– Eastern Europe: €35 – €70/hour

Maintenance Labor (Annual)

| Maintenance Type | Centrifugal | Submersible |

|---|---|---|

| Routine Inspection | 2-4 hours | 4-8 hours (retrieval required) |

| Seal Replacement | 4-6 hours | 8-12 hours |

| Impeller Service | 3-5 hours | 6-10 hours |

| Motor Service | 2-4 hours | Factory service typical |

Logistics and Freight Costs

Factors Affecting Shipping Costs:

- Weight and Dimensions

- Small sump pumps (25-75 lbs): $50 – $200 domestic

- Mid-size industrial (200-500 lbs): $300 – $800 domestic

-

Large installations (1,000+ lbs): $1,000 – $5,000+ (freight class dependent)

-

Shipping Mode Comparison

| Mode | Transit Time | Cost Index | Best For |

|---|---|---|---|

| Ground (LTL) | 3-7 days | 1.0x | Standard orders |

| Expedited Ground | 1-3 days | 1.5-2.0x | Urgent needs |

| Air Freight | 1-2 days | 3.0-5.0x | Critical downtime |

| Ocean (International) | 4-8 weeks | 0.3-0.5x | Bulk import orders |

- International Sourcing Logistics

- Import duties (USA): 0-6.5% depending on classification

- EU import duties: 1.7-4.2% typical

- Customs brokerage: $150 – $500 per shipment

- Documentation/compliance: $100 – $300

Total Cost of Ownership (TCO) Framework

5-Year TCO Calculation Model:

TCO = Initial Cost + (Annual Operating Cost × 5) + (Maintenance Cost × 5) + Disposal Cost

| TCO Component | Centrifugal | Submersible |

|---|---|---|

| Initial Purchase | Lower | Higher (+15-30%) |

| Energy Consumption | Comparable | Slightly higher (cooling losses) |

| Maintenance Frequency | Higher | Lower |

| Maintenance Cost/Event | Lower | Higher (retrieval) |

| Expected Lifespan | 15-25 years | 10-20 years |

| Replacement Parts | Readily available | Often proprietary |

Strategic Cost-Saving Tips

Procurement Strategies

- Volume Consolidation

- Aggregate purchases across facilities/projects

- Negotiate tiered pricing: 5-15% discount at 10+ units

-

Establish blanket purchase agreements for 20-30% savings

-

Supplier Diversification

- Primary supplier: 60-70% of volume (best pricing)

- Secondary supplier: 30-40% (supply security)

-

Avoid single-source dependency premiums

-

Timing Optimization

- Order during Q1 or Q4 for better pricing (lower demand periods)

- Avoid emergency purchases (25-50% premium typical)

- Plan 8-12 weeks ahead for standard lead times

Specification Optimization

| Strategy | Potential Savings |

|---|---|

| Right-sizing (avoid over-specification) | 10-25% |

| Standardization across facilities | 15-20% |

| Generic vs. proprietary components | 20-35% |

| Material substitution (where appropriate) | 10-30% |

Right-Sizing Checklist:

– [ ] Verify actual flow requirements vs. specified

– [ ] Confirm head pressure calculations

– [ ] Assess duty cycle realistically

– [ ] Consider variable frequency drives (VFDs) for flexibility

Installation Cost Reduction

- Pre-Packaged Systems

- Sump/sewage packages with basins, controls, and pumps

- Reduce field labor by 30-50%

-

Example: QLS Series packages (pre-plumbed, pre-wired)

-

Modular Rail Systems

- Z-Rail® type systems for submersibles

- Enable pump service without confined space entry

-

Reduce maintenance labor costs 40-60%

-

Standardized Accessories

- Stock common check valves, control panels, basins

- Avoid custom fabrication costs

- Maintain spare parts inventory for quick repairs

Long-Term Cost Management

Maintenance Contract Considerations:

– Full-service contracts: 3-5% of equipment value annually

– Parts-only agreements: 1-2% annually

– Self-maintenance with training: Lowest cost, requires expertise

Energy Efficiency Investments:

| Upgrade | Upfront Cost | Payback Period | Annual Savings |

|---|---|---|---|

| Premium efficiency motors | +10-15% | 2-3 years | 3-8% |

| VFD installation | +$500-$3,000 | 1-4 years | 10-30% |

| Impeller trimming | $200-$500 | <1 year | 5-15% |

Price Benchmarking by Application

Residential/Light Commercial

| Application | Centrifugal Option | Submersible Option |

|---|---|---|

| Sump/Basement | N/A | $150 – $600 |

| Sewage Ejector | N/A | $400 – $1,200 |

| Effluent | $300 – $800 | $350 – $900 |

Commercial/Industrial

| Application | Centrifugal Range | Submersible Range |

|---|---|---|

| HVAC/Cooling | $800 – $5,000 | $1,200 – $6,000 |

| Wastewater | $1,500 – $15,000 | $2,000 – $25,000 |

| Process Water | $1,000 – $20,000 | $1,500 – $30,000 |

| Dewatering | $500 – $8,000 | $800 – $12,000 |

Key Takeaways for B2B Buyers

- Submersible pumps carry higher upfront costs but lower installation expenses

- Centrifugal pumps offer easier maintenance access but require more infrastructure

- Total cost of ownership often favors centrifugal for accessible installations

- Standardization across facilities yields 15-25% procurement savings

- Pre-packaged systems significantly reduce installation labor costs

- Plan procurement cycles to avoid emergency purchase premiums

For accurate project pricing, request detailed quotations from multiple qualified suppliers and specify exact operating conditions, materials of construction, and compliance requirements.

Alternatives Analysis: Comparing centrifugal pump and submersible pump With Other Solutions

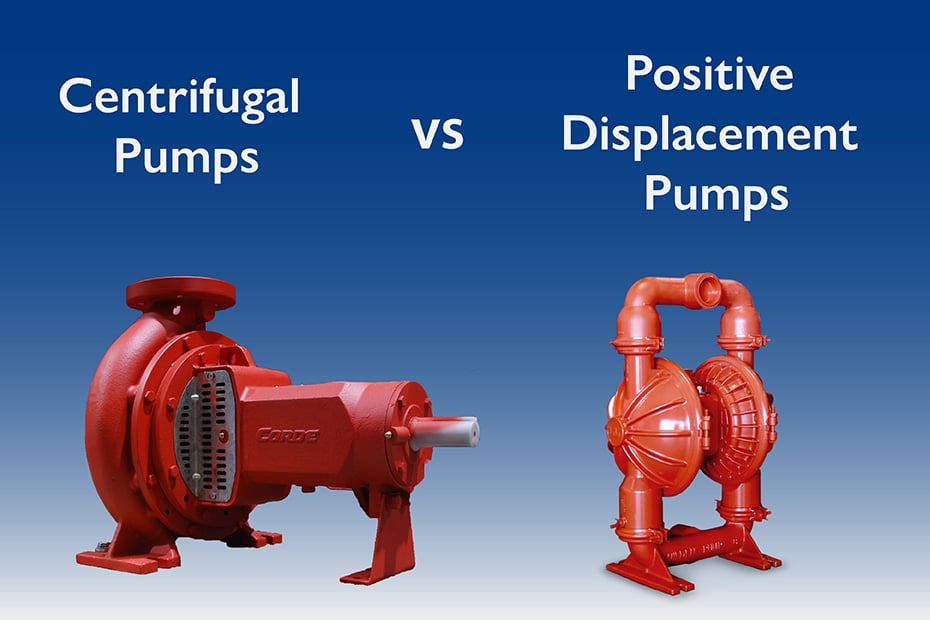

Alternatives Analysis: Comparing Centrifugal Pumps and Submersible Pumps With Other Solutions

When selecting pumping equipment for industrial, commercial, or municipal applications, decision-makers must evaluate multiple technologies against their specific operational requirements. This analysis compares centrifugal and submersible pumps with two commonly considered alternatives: positive displacement pumps and jet pumps.

Comparison Overview

| Criteria | Centrifugal Pumps | Submersible Pumps | Positive Displacement Pumps | Jet Pumps |

|---|---|---|---|---|

| Operating Principle | Kinetic energy via impeller rotation | Kinetic energy (submerged operation) | Mechanical displacement of fixed volumes | Venturi effect with surface motor |

| Typical Flow Rate | High (up to 10,000+ GPM) | Moderate to high (varies by application) | Low to moderate | Low to moderate |

| Head Pressure Capability | Moderate | High (deep well applications) | Very high | Moderate |

| Viscosity Handling | Low viscosity fluids only | Low viscosity fluids only | Excellent for high-viscosity fluids | Low viscosity fluids only |

| Solids Handling | Limited (requires grinder variants) | Good (sewage/grinder models available) | Excellent | Poor |

| Energy Efficiency | 70-85% at BEP | 60-75% | 80-90% | 25-40% |

| Installation Complexity | Low to moderate | Moderate (requires submersion) | Moderate to high | Low |

| Maintenance Access | Easy (surface-mounted) | Difficult (requires extraction) | Moderate | Easy |

| Initial Cost | Low to moderate | Moderate to high | High | Low |

| Noise Level | Moderate | Very low (submerged) | High (pulsation) | Moderate |

| Priming Required | Yes (unless self-priming) | No (inherently primed) | No | No |

Detailed Alternative Analysis

Alternative 1: Positive Displacement Pumps

Best suited for: High-viscosity fluids, precise metering, high-pressure applications, chemical dosing

Advantages over centrifugal/submersible:

– Maintains consistent flow regardless of discharge pressure

– Superior performance with viscous fluids (oils, slurries, polymers)

– Capable of achieving significantly higher pressures

– Ideal for applications requiring precise volumetric delivery

– Self-priming capability standard

Limitations:

– Higher capital and maintenance costs

– Pulsating flow requires dampeners in sensitive systems

– Lower flow rates at comparable power inputs

– More complex mechanical design with increased wear points

– Not suitable for large-volume water transfer

When to choose positive displacement: Select this alternative when handling fluids above 100 centipoise viscosity, when precise chemical dosing is critical, or when system pressure exceeds 150 PSI consistently.

Alternative 2: Jet Pumps (Ejector Pumps)

Best suited for: Shallow to moderate well applications, residential water supply, locations with limited installation space

Advantages over centrifugal/submersible:

– No moving parts below ground (all mechanical components surface-accessible)

– Lower initial equipment cost

– Simplified maintenance—motor and impeller remain above ground

– Single pump can serve multiple wells

– Reliable operation in sandy or silty conditions

Limitations:

– Significantly lower energy efficiency (25-40% vs. 70-85%)

– Limited practical depth (shallow well: 25 feet; deep well: 100-150 feet)

– Lower flow rates compared to submersible alternatives

– Requires two pipes for deep well configurations

– Susceptible to air lock issues

When to choose jet pumps: Consider jet pumps for shallow well applications under 25 feet, when maintenance accessibility is paramount, or when budget constraints preclude submersible installation.

Decision Framework

Choose centrifugal pumps when:

– High-volume, continuous flow is required

– Fluid viscosity remains below 100 centipoise

– Surface installation is feasible and preferred

– Energy efficiency is a priority

– Frequent maintenance access is necessary

Choose submersible pumps when:

– Application involves deep wells, sumps, or sewage ejection

– Noise reduction is critical

– Space constraints prohibit surface equipment

– Self-priming capability is essential

– Flood-prone or submerged installations are required

Choose positive displacement pumps when:

– Handling high-viscosity or shear-sensitive fluids

– Precise metering or dosing is required

– High discharge pressures exceed centrifugal capabilities

– Flow must remain constant despite pressure variations

Choose jet pumps when:

– Budget limitations exist for residential/light commercial wells

– Maintenance accessibility outweighs efficiency concerns

– Well depth remains under 100 feet

– Installation simplicity is prioritized

Total Cost of Ownership Considerations

While initial purchase price varies significantly across these technologies, procurement teams should evaluate:

- Energy consumption: Jet pumps may cost 50-60% more to operate annually than equivalent centrifugal systems

- Maintenance frequency: Submersible pumps require extraction for service; positive displacement pumps need regular seal and valve replacement

- Downtime costs: Surface-mounted centrifugal pumps offer fastest repair turnaround

- Application matching: Oversizing or misapplication increases lifecycle costs regardless of technology selected

Essential Technical Properties and Trade Terminology for centrifugal pump and submersible pump

Essential Technical Properties and Trade Terminology for Centrifugal and Submersible Pumps

Understanding critical technical specifications and industry-standard trade terms is essential for informed procurement decisions. This section covers the key parameters buyers must evaluate and the commercial terminology commonly encountered in B2B pump transactions.

Core Technical Properties

Performance Specifications

| Parameter | Definition | Typical Units | Why It Matters |

|---|---|---|---|

| Flow Rate (Q) | Volume of fluid pumped per unit time | GPM, m³/h, L/min | Determines system throughput capacity |

| Total Dynamic Head (TDH) | Total pressure the pump must overcome | Feet, meters, PSI | Critical for vertical lift and friction loss calculations |

| Pump Efficiency | Ratio of hydraulic power output to power input | Percentage (%) | Directly impacts operating costs |

| Net Positive Suction Head (NPSH) | Minimum pressure required at pump inlet to prevent cavitation | Feet, meters | Essential for centrifugal pump installations |

| Best Efficiency Point (BEP) | Flow rate at which pump operates most efficiently | GPM at specific head | Optimal operating range for longevity |

| Specific Speed (Ns) | Dimensionless value characterizing impeller design | Dimensionless | Indicates impeller type and application suitability |

Electrical Specifications

| Specification | Centrifugal Pumps | Submersible Pumps |

|---|---|---|

| Voltage | 115V, 230V, 460V (single/three-phase) | 115V, 230V, 460V (single/three-phase) |

| Motor Enclosure | TEFC, ODP, Explosion-Proof | Hermetically sealed, oil-filled |

| Insulation Class | Class B, F, or H | Class F or H (higher thermal demands) |

| Service Factor (SF) | 1.0–1.15 typical | 1.0–1.15 typical |

| IP Rating | IP44–IP55 | IP68 (continuous submersion) |

Material Specifications

Wetted Components:

– Impeller Materials: Cast iron, bronze, 316 stainless steel, engineered thermoplastics

– Volute/Casing: Cast iron (ASTM A48), ductile iron, stainless steel

– Shaft: 416 SS, 17-4 PH stainless steel, carbon steel with sleeve

Sealing Systems:

– Mechanical Seals: Silicon carbide/carbon, tungsten carbide, ceramic

– Seal Configuration: Single, double, tandem arrangements

– O-Rings: Buna-N, Viton, EPDM (application-dependent)

Dimensional and Installation Parameters

- Discharge Size: NPT or flanged connections (1.25″–12″ common range)

- Suction Size: Typically one size larger than discharge

- Cord Length: Critical for submersible pumps (10’–50′ standard options)

- Solids Handling Capacity: Maximum sphere size passable (sewage/grinder applications)

- Submersion Depth: Maximum operating depth for submersible units

Critical Performance Curves and Data

Pump Curve Interpretation

Every pump specification should include:

- Head-Capacity Curve (H-Q): Primary performance indicator

- Efficiency Curve: Overlay showing BEP zone

- Power Curve (BHP): Brake horsepower requirements across flow range

- NPSH Required Curve: Minimum inlet conditions to prevent cavitation

System Curve Matching

Buyers must calculate:

– Static head (elevation difference)

– Friction losses (pipe diameter, length, fittings)

– System curve intersection with pump curve determines operating point

Industry Trade Terminology

Commercial Terms

| Term | Definition | Typical Application |

|---|---|---|

| MOQ (Minimum Order Quantity) | Smallest order volume a supplier will accept | Standard: 1–10 units; High-volume: 50–500+ units |

| OEM (Original Equipment Manufacturer) | Manufacturer producing components for rebranding | Private label pump programs, system integrators |

| ODM (Original Design Manufacturer) | Supplier providing design and manufacturing services | Custom pump development |

| FOB (Free On Board) | Shipping term indicating transfer of ownership point | FOB Origin, FOB Destination |

| CIF (Cost, Insurance, Freight) | Seller covers shipping and insurance to destination port | International transactions |

| EXW (Ex Works) | Buyer assumes all costs from seller’s facility | Factory-direct purchasing |

Lead Time and Delivery Terms

| Term | Definition |

|---|---|

| Lead Time | Duration from order confirmation to shipment |

| Stock Items | Standard products available for immediate shipment |

| Made-to-Order (MTO) | Products manufactured upon receipt of order |

| Engineer-to-Order (ETO) | Custom-engineered solutions requiring design phase |

| ARO (After Receipt of Order) | Lead time calculation starting point |

Typical Lead Times:

– Stock pumps: 1–5 business days

– Standard configurations: 2–4 weeks

– Custom/engineered solutions: 8–16 weeks

Quality and Compliance Terms

| Certification/Standard | Description | Region |

|---|---|---|

| UL Listed | Underwriters Laboratories safety certification | USA/Canada |

| CSA Certified | Canadian Standards Association approval | Canada/USA |

| CE Marking | European Conformity declaration | European Union |

| ATEX | Explosive atmosphere equipment directive | EU (hazardous locations) |

| API 610 | American Petroleum Institute centrifugal pump standard | Global (oil & gas) |

| ISO 9001 | Quality management system certification | Global |

| ISO 5199 | Technical specifications for centrifugal pumps | Global |

| Hydraulic Institute (HI) Standards | Industry performance and testing standards | USA/Global |

| NSF/ANSI 61 | Drinking water system components certification | USA (potable water) |

Warranty and Service Terms

| Term | Standard Industry Practice |

|---|---|

| Standard Warranty | 1–3 years from date of purchase or installation |

| Extended Warranty | Optional coverage beyond standard period |

| MTBF (Mean Time Between Failures) | Reliability metric for expected service life |

| Duty Cycle | Operating time ratio (continuous, intermittent, standby) |

| Run-Dry Protection | Capability to operate without liquid without damage |

Specification Checklist for Procurement

When requesting quotations, provide:

Application Data:

– [ ] Fluid type and properties (temperature, pH, specific gravity, solids content)

– [ ] Required flow rate and head

– [ ] Suction conditions (flooded, lift required)

– [ ] Duty cycle (continuous, intermittent, standby)

Site Conditions:

– [ ] Ambient temperature range

– [ ] Available power supply (voltage, phase, frequency)

– [ ] Hazardous area classification (if applicable)

– [ ] Space constraints

Commercial Requirements:

– [ ] Quantity required

– [ ] Delivery location and Incoterms preference

– [ ] Required certifications

– [ ] Spare parts requirements

– [ ] Documentation needs (IOM manuals, test certificates, material certifications)

Key Differentiating Specifications: Centrifugal vs. Submersible

| Property | Centrifugal (Surface-Mounted) | Submersible |

|---|---|---|

| Installation | Above liquid level | Fully submerged in fluid |

| Priming | Required (self-priming models available) | Not required (always flooded) |

| Cooling Method | Air-cooled motor | Fluid-cooled (pumped medium) |

| Suction Lift | Limited to ~25 feet theoretical | Not applicable |

| Noise Level | Higher (motor exposed) | Lower (submerged operation) |

| Maintenance Access | Easy (surface-mounted) | Requires pump retrieval |

| Motor Protection | Standard enclosures | Hermetically sealed, moisture-proof |

| Typical Applications | Process transfer, irrigation, HVAC | Sumps, sewage, wells, dewatering |

Trade Documentation Requirements

Standard Documentation Package:

– Certified pump curves

– General arrangement drawings (GA)

– Installation, Operation, and Maintenance (IOM) manuals

– Material test reports (MTR) for critical components

– Hydrostatic test certificates

– Motor data sheets

– Wiring diagrams

Additional Documentation (Project-Specific):

– Third-party inspection reports

– Certified performance test results (witnessed)

– Spare parts interchangeability lists

– ATEX/hazardous area certificates

Navigating Market Dynamics and Sourcing Trends in the centrifugal pump and submersible pump Sector

Navigating Market Dynamics and Sourcing Trends in the Centrifugal Pump and Submersible Pump Sector

Market Overview and Growth Trajectory

The global centrifugal and submersible pump market continues to demonstrate robust growth, driven by expanding infrastructure development, water management demands, and industrial modernization across North America and Europe. B2B buyers must understand the evolving landscape to optimize procurement strategies and maintain competitive operations.

Key Market Drivers

| Driver | Impact on Centrifugal Pumps | Impact on Submersible Pumps |

|---|---|---|

| Water/Wastewater Infrastructure | High demand for municipal systems | Critical for sewage ejection, lift stations |

| Industrial Expansion | Process applications, HVAC systems | Dewatering, hazardous duty applications |

| Residential Construction | Basement drainage, HVAC condensate | Sump systems, septic applications |

| Agricultural Demand | Irrigation systems | Groundwater extraction, effluent management |

Historical Evolution and Technology Advancement

The pump industry has undergone significant transformation over the past two decades:

- Pre-2010: Predominantly mechanical focus; efficiency secondary to reliability

- 2010-2020: Introduction of variable frequency drives (VFDs); smart monitoring emergence

- 2020-Present: IoT integration, predictive maintenance capabilities, energy-efficient motor designs

Modern submersible pump systems—including sump, sewage, grinder, and effluent variants—now incorporate LED status indicators, explosion-proof configurations for hazardous duty applications, and modular rail systems for simplified maintenance access.

Sustainability and Regulatory Compliance

Environmental Standards Shaping Procurement

European and U.S. markets face increasingly stringent efficiency requirements:

- EU Ecodesign Directive: Mandates minimum efficiency index (MEI) for water pumps

- U.S. DOE Standards: Energy conservation requirements for commercial pumps

- WRAS/NSF Certifications: Essential for potable water applications

Sustainable Sourcing Considerations

| Priority | Specification Focus |

|---|---|

| Energy Efficiency | High-efficiency motors, optimized impeller designs |

| Material Selection | Corrosion-resistant alloys, recyclable components |

| Lifecycle Cost | Total cost of ownership vs. initial purchase price |

| End-of-Life | Manufacturer take-back programs, component recyclability |

Application-Specific Sourcing Trends

Residential and Light Commercial

Demand centers on integrated systems and pre-packaged solutions:

– Backup pump systems with battery or water-powered redundancy

– Complete basin assemblies with check valves and control panels

– Upflush toilet systems for below-grade installations

Industrial and Municipal

Procurement priorities emphasize:

– Hazardous duty and explosion-proof configurations

– High-temperature and corrosive media handling

– Scalable lift station packages with alternator controls

Supply Chain Considerations for B2B Buyers

Vendor Evaluation Criteria

- Manufacturing Footprint: Domestic vs. imported components; lead time implications

- Technical Support Infrastructure: Sizing tools, training programs, service parts availability

- Compliance Documentation: Product registration, certification maintenance

- Distribution Network: Regional availability, emergency stock programs

Risk Mitigation Strategies

- Establish relationships with manufacturers offering comprehensive product lines (sump through grinder pumps)

- Verify accessory compatibility: control panels, basins, rail systems, junction boxes

- Confirm service parts availability and warranty terms before specification

Emerging Trends to Monitor

- Smart Pump Integration: Remote monitoring, automated diagnostics

- Modular System Design: Simplified field installation and maintenance

- Material Innovation: Advanced polymers and coatings for extended service life

- Distributed Manufacturing: Regional production to reduce supply chain vulnerability

Strategic Recommendations

For procurement professionals and specifying engineers:

- Prioritize total cost of ownership over initial price

- Standardize on manufacturers with broad application coverage

- Require energy efficiency documentation at specification stage

- Build redundancy into critical applications through backup systems

- Evaluate manufacturer training and technical support as selection criteria

The centrifugal and submersible pump sector rewards informed sourcing decisions. Understanding market dynamics, sustainability requirements, and application-specific trends positions B2B buyers to secure reliable, efficient, and compliant pump solutions.

Frequently Asked Questions (FAQs) for B2B Buyers of centrifugal pump and submersible pump

Frequently Asked Questions (FAQs) for B2B Buyers of Centrifugal Pumps and Submersible Pumps

1. What is the fundamental difference between centrifugal pumps and submersible pumps?

Centrifugal pumps use rotational energy from an impeller to move fluid, typically installed above the fluid source. Submersible pumps are designed to operate while fully submerged in the fluid being pumped, with the motor hermetically sealed to prevent liquid ingress.

| Feature | Centrifugal Pump | Submersible Pump |

|---|---|---|

| Installation | Above fluid level | Submerged in fluid |

| Priming | Required | Self-priming |

| Motor cooling | Air-cooled | Fluid-cooled |

| Noise level | Higher | Lower |

2. Which pump type is better suited for sewage and wastewater applications?

Submersible pumps are the preferred choice for sewage and wastewater applications. Key advantages include:

- Direct fluid handling without suction lift limitations

- Sealed motor design prevents contamination and corrosion

- Grinder pump variants available for handling solids and raw sewage

- Reduced cavitation risk due to positive inlet pressure

For commercial sewage ejector and lift station applications, submersible grinder pumps offer superior reliability and lower maintenance requirements.

3. What are the critical selection criteria for B2B pump procurement?

When specifying pumps for commercial or industrial projects, evaluate:

- Flow rate (GPM/GPH): Match to system demand calculations

- Total dynamic head (TDH): Account for friction losses and elevation

- Fluid characteristics: Solids content, viscosity, temperature, chemical composition

- Duty cycle: Continuous vs. intermittent operation requirements

- Electrical specifications: Voltage, phase, explosion-proof ratings if required

- Compliance standards: UL listing, OSHA requirements, local codes

4. What is the expected service life and maintenance schedule for each pump type?

| Maintenance Factor | Centrifugal Pump | Submersible Pump |

|---|---|---|

| Typical service life | 10-15 years | 8-12 years |

| Seal inspection | Quarterly | Annually (when accessible) |

| Impeller inspection | Semi-annually | Annually |

| Motor bearing service | 2-3 years | Sealed unit—replacement |

| Accessibility | Easy | Requires extraction |

Note: Submersible pumps in harsh environments (sewage, high-temperature) may require more frequent replacement cycles.

5. Are explosion-proof and hazardous duty pump options available?

Yes. For facilities handling flammable liquids, volatile chemicals, or operating in classified hazardous locations, explosion-proof submersible pumps are available. These units feature:

- Hermetically sealed motors meeting Class I, Division 1 requirements

- Non-sparking construction materials

- Third-party certifications (UL, CSA, ATEX for European markets)

Specify hazardous duty ratings during procurement to ensure compliance with OSHA, NFPA, and regional safety regulations.

6. What system packages and accessories should B2B buyers consider?

Complete pump system packages streamline installation and ensure component compatibility. Standard package components include:

- Pre-engineered basins (polyethylene or fiberglass)

- Control panels with alternator and alarm functions

- Check valves (inline or quiet-check options)

- Rail systems for easy pump removal and servicing

- Level switches and alarms for monitoring and redundancy

For lift stations, consider duplex or triplex configurations with automatic alternation to balance wear and provide backup capacity.

7. How do lead times and inventory availability typically compare?

| Product Category | Standard Lead Time | Notes |

|---|---|---|

| Stock sump pumps | 1-5 business days | Common models readily available |

| Sewage/grinder pumps | 1-2 weeks | Verify motor configurations |

| Explosion-proof models | 3-6 weeks | Built to order |

| Complete system packages | 2-4 weeks | Basin and controls assembly |

| Replacement parts | 1-5 business days | High-availability items |

Recommendation: Establish blanket purchase agreements with distributors for high-volume or recurring projects to secure pricing and reduce lead times.

8. What warranty and technical support should B2B buyers expect?

Professional-grade pumps typically include:

- Standard warranty: 1-3 years on manufacturing defects

- Extended warranty options: Available through authorized distributors

- Technical support: Sizing tools, application engineering, and specification assistance

- Training programs: Product training for contractors and maintenance personnel

- Service parts availability: Long-term parts support for installed base

When evaluating vendors, confirm availability of local sales representatives, responsive technical support channels, and documented service part supply commitments.

Strategic Sourcing Conclusion and Outlook for centrifugal pump and submersible pump

Strategic Sourcing Conclusion: Centrifugal and Submersible Pumps

Selecting the right pump technology directly impacts operational efficiency, maintenance costs, and system reliability. The choice between centrifugal and submersible pumps depends on three core factors:

Key Decision Criteria

| Factor | Centrifugal Pumps | Submersible Pumps |

|---|---|---|

| Installation | Above-ground, accessible | Below liquid surface |

| Best Applications | High-volume transfer, HVAC, industrial processes | Sump, sewage, dewatering, confined spaces |

| Maintenance Access | Easy, no extraction required | Requires pump retrieval |

| Space Requirements | Requires dedicated floor space | Minimal surface footprint |

Sourcing Recommendations

- Evaluate total cost of ownership—not just purchase price

- Prioritize manufacturer support for parts availability and technical assistance

- Verify compliance with regional standards (UL, CE, ATEX for hazardous environments)

- Consider pre-engineered packages to reduce installation complexity

Market Outlook

Growing demand in wastewater management, construction dewatering, and building services continues driving pump innovation. Expect increased adoption of IoT-enabled monitoring, energy-efficient motors, and corrosion-resistant materials through 2025-2027.

Bottom line: Match pump selection to application requirements, prioritize proven manufacturers with strong distribution networks, and factor lifecycle costs into procurement decisions.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.