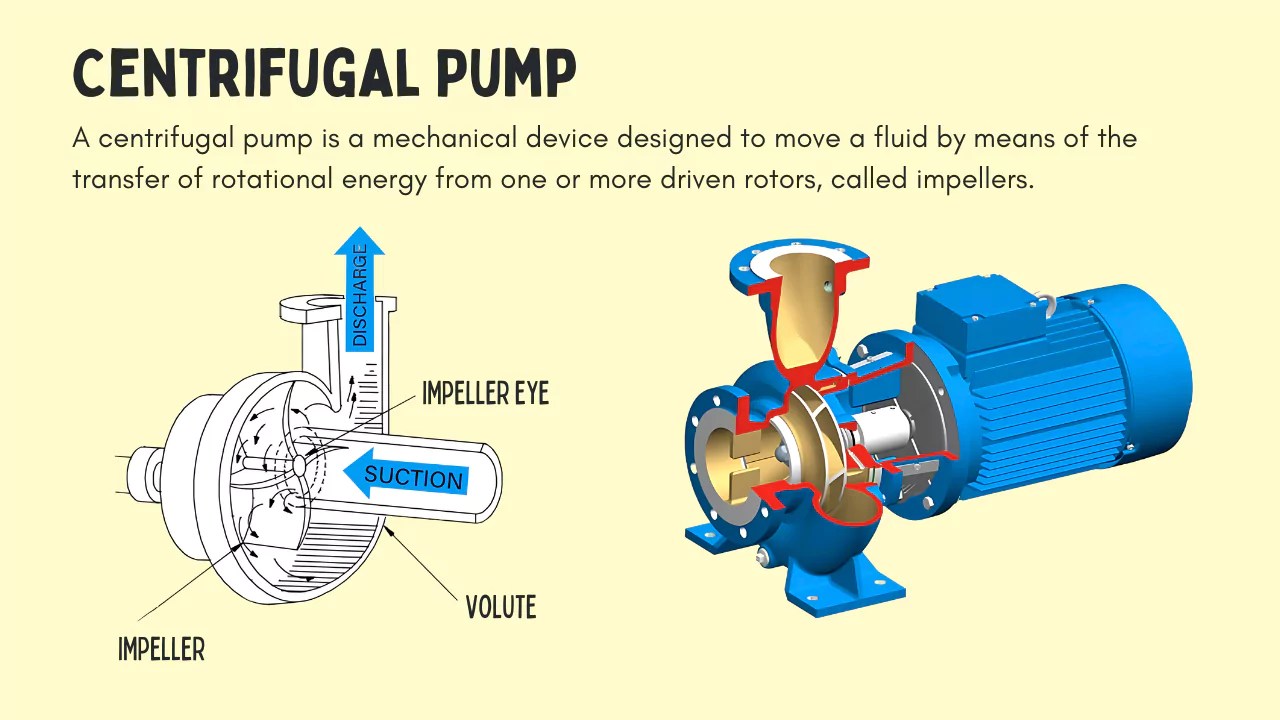

Introduction: Navigating the Global Market for Centrifugal Pumps

Centrifugal pumps move more fluid across more industries than any other pump technology. From municipal water systems in Chicago to petrochemical facilities in Rotterdam, these workhorses convert rotational energy into fluid flow with remarkable efficiency—handling everything from clean water to abrasive slurries.

The Challenge for Today’s Buyers

Selecting the right centrifugal pump has never been more complex. Global buyers face:

- Expanding supplier networks spanning North America, Europe, and Asia

- Evolving efficiency regulations (EU Ecodesign, DOE standards)

- Application-specific requirements across water, wastewater, oil & gas, and chemical processing

- Total cost of ownership pressures demanding lifecycle analysis, not just purchase price

A mismatched pump specification doesn’t just underperform—it drives up energy costs, increases maintenance burden, and shortens equipment life.

What This Guide Covers

This comprehensive B2B guide equips procurement professionals, engineers, and plant managers with actionable intelligence for centrifugal pump sourcing:

| Section | Focus |

|———|——-|

| Technology Overview | Working principles, pump types, and configurations |

| Application Matching | Selecting pumps for specific fluid handling needs |

| Supplier Landscape | Key manufacturers across USA and European markets |

| Specification Best Practices | Critical parameters and common pitfalls |

| Compliance & Standards | Regional regulations affecting procurement |

| TCO Analysis | Energy, maintenance, and lifecycle cost factors |

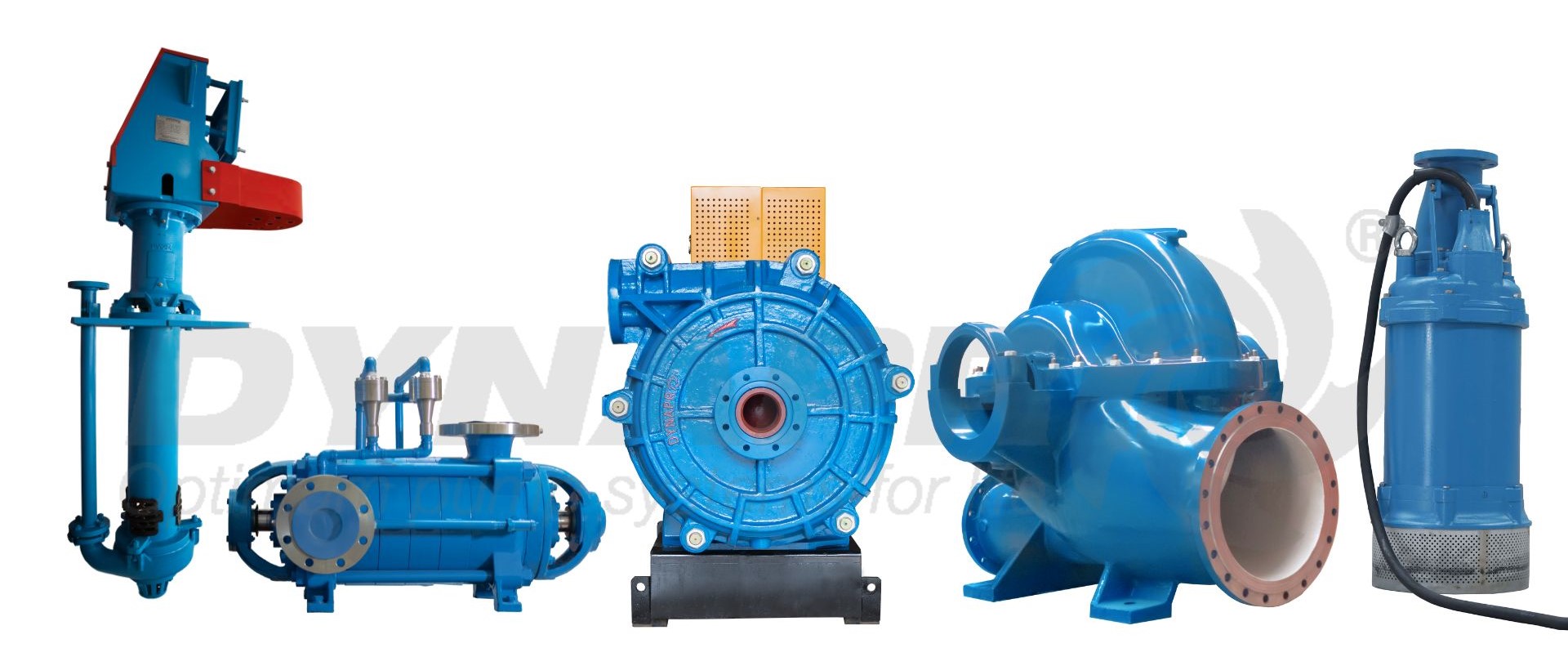

Illustrative Image (Source: Google Search)

Whether you’re replacing aging infrastructure or specifying pumps for a greenfield project, this guide delivers the technical and commercial insights needed to make confident purchasing decisions.

Article Navigation

- Top 10 Centrifugal Pump Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for centrifugal pump

- Understanding centrifugal pump Types and Variations

- Key Industrial Applications of centrifugal pump

- 3 Common User Pain Points for ‘centrifugal pump’ & Their Solutions

- Strategic Material Selection Guide for centrifugal pump

- In-depth Look: Manufacturing Processes and Quality Assurance for centrifugal pump

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘centrifugal pump’

- Comprehensive Cost and Pricing Analysis for centrifugal pump Sourcing

- Alternatives Analysis: Comparing centrifugal pump With Other Solutions

- Essential Technical Properties and Trade Terminology for centrifugal pump

- Navigating Market Dynamics and Sourcing Trends in the centrifugal pump Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of centrifugal pump

- Strategic Sourcing Conclusion and Outlook for centrifugal pump

- Important Disclaimer & Terms of Use

Top 10 Centrifugal Pump Manufacturers & Suppliers List

1. Top 12 Centrifugal Pump Companies in the World – IMARC Group

Domain: imarcgroup.com

Registered: 2009 (16 years)

Introduction: List of top Centrifugal Pump Companies including Baker Hughes (A GE Company), Circor International Inc., Ebara Corporation, Flowserve, Grundfos Holding, ……

2. Pacer Pumps – Centrifugal Pumps Manufacturers In U.S.A

Domain: pacerpumps.com

Registered: 1999 (26 years)

Introduction: Pacer Pumps is the leading centrifugal pumps manufacturers providing industrial centrifugal pumps, marine centrifugal pumps, aquaculture centrifugal pumps….

3. Pump Suppliers and Manufacturers in the USA – A Thomas Industry …

Domain: thomasnet.com

Registered: 1996 (29 years)

Introduction: Roth Pump Co. · Xylem, Inc. · Dickow Pump Co. · Blend Plants LLC · The Lee Company · Centec LLC · HYDAC Technology Corporation · Hydro-Pac….

4. Industrial Centrifugal Pumps & Solutions – PSG Dover.

Domain: psgdover.com

Registered: 2011 (14 years)

Introduction: Backed by 70 years of experience and commitment to manufacturing quality centrifugal pumps, Griswold provides solutions for many of the world’s largest ……

5. Centrifugal Pumps – Burt Process Equipment

Domain: burtprocess.com

Registered: 1997 (28 years)

Introduction: Free deliveryChoose from a wide selection of centrifugal pumps from leading manufacturers like AMT, Hayward, Oberdorfer, Finish Thompson and March….

Illustrative Image (Source: Google Search)

6. Global Top 10 Industrial Pump Manufacturers [2025]

Domain: blackridgeresearch.com

Registered: 2019 (6 years)

Introduction: 1.1. Flowserve Corporation · 1.2. Grundfos · 1.3. Xylem Inc. · 1.4. KSB SE · 1.5. WILO SE · 1.6. Sulzer Ltd. · 1.7. Ebara Corporation · 1.8. Pentair….

7. Centrifugal Pumps Companies, Suppliers and Distributors

Domain: centrifugalpumpcompanies.com

Registered: 2025 (0 years)

Introduction: ACCA Pumps (TX) · Ace Pump Corporation (TN) · Albritton Machine, Inc. (TX) · American-Marsh Pumps LLC (TN) · Ameriflo (TN) · Baker Hughes (TX) · BakerCorp (TX)….

8. Top 10 Pump Manufacturers in USA | Industrial Pump Brands

Domain: daepumps.com

Registered: 2018 (7 years)

Introduction: We explore what makes Eddy Pump, DAE Pump, Xylem, Grundfos, BJM Pumps, ITT Goulds, and others the key industry pump manufacturers….

Understanding centrifugal pump Types and Variations

Understanding Centrifugal Pump Types and Variations

Selecting the right centrifugal pump configuration directly impacts operational efficiency, maintenance costs, and system longevity. Below, we examine the primary types available to industrial buyers, their distinguishing characteristics, and optimal application scenarios.

Quick Comparison Table

| Type | Key Features | Primary Applications | Pros | Cons |

|---|---|---|---|---|

| Single-Stage Horizontal | One impeller; horizontal shaft orientation; simple design | General water transfer, HVAC, light industrial processes | Low cost; easy maintenance; widely available | Limited head pressure; not suitable for high-viscosity fluids |

| Multistage | Multiple impellers in series; progressive pressure buildup | High-pressure applications, boiler feed, reverse osmosis, pipeline transport | High head capability; compact footprint vs. multiple pumps | Higher initial cost; more complex maintenance |

| Vertical (In-line) | Vertical shaft; compact footprint; motor mounted above pump | Space-constrained installations, sump drainage, deep well applications | Small floor space; self-priming variants available; handles submerged operation | Alignment-sensitive; bearing wear concerns; complex installation |

| Froth Pumps | Specialized impeller design; oversized casing; air-handling capability | Mining slurries, flotation circuits, froth-laden fluids | Handles entrained air up to 50%; abrasion-resistant materials available | Limited to specific applications; higher wear rates |

| Magnetically Coupled | Sealless design; magnetic drive coupling; hermetic containment | Hazardous chemicals, corrosive fluids, leak-sensitive environments | Zero mechanical seal leakage; reduced contamination risk | Lower efficiency; temperature limitations; higher upfront cost |

Single-Stage Horizontal Centrifugal Pumps

The industry workhorse, single-stage horizontal pumps utilize one impeller to generate flow and pressure. Their straightforward design—featuring a horizontal shaft connected directly or via coupling to an electric motor—makes them the default choice for standard fluid transfer operations.

Best suited for:

– Municipal water distribution

– Cooling water circulation

– Agricultural irrigation

– General process water handling

Illustrative Image (Source: Google Search)

Technical considerations: These pumps typically deliver flow rates from 10 to 5,000+ GPM with head pressures up to approximately 200 feet per stage. When system requirements exceed single-stage capabilities, operators must either select larger equipment or transition to multistage configurations.

Multistage Centrifugal Pumps

Multistage pumps stack multiple impellers along a common shaft, with each stage adding incremental pressure to the fluid. This design achieves high discharge pressures without the mechanical stress associated with oversized single-stage units.

Best suited for:

– Boiler feedwater systems

– High-pressure cleaning operations

– Reverse osmosis and desalination plants

– Long-distance pipeline transport

– Pressure boosting applications

Technical considerations: Stage count directly correlates with achievable head pressure—common configurations range from 2 to 10+ stages. Buyers should evaluate NPSH requirements carefully, as multistage pumps can be sensitive to inlet conditions.

Illustrative Image (Source: Google Search)

Vertical Centrifugal Pumps

Vertical configurations orient the shaft perpendicular to the mounting surface, with the motor typically positioned above the pump assembly. This arrangement proves advantageous where floor space is limited or when pumping from below-grade sumps, pits, or tanks.

Best suited for:

– Sump and drainage applications

– Condensate return systems

– Deep well and borehole extraction

– Cooling tower circulation

– Marine and offshore installations

Technical considerations: Vertical turbine and submersible variants extend capabilities to depths exceeding 1,000 feet. However, bearing lubrication, shaft alignment, and thrust load management require careful engineering attention during specification.

Froth Pumps

Engineered specifically for mining and mineral processing, froth pumps handle slurries containing significant entrained air—conditions that would cause conventional centrifugal pumps to lose prime or cavitate.

Illustrative Image (Source: Google Search)

Best suited for:

– Flotation cell discharge

– Froth transfer in mineral processing

– Slurry handling with air entrainment up to 50%

Technical considerations: Oversized casings and specialized impeller geometries accommodate air-laden fluids while maintaining hydraulic performance. Material selection (rubber-lined, high-chrome alloys) addresses abrasive wear from suspended solids.

Magnetically Coupled Centrifugal Pumps

Magnetic drive pumps eliminate traditional mechanical seals by transmitting torque through a magnetic coupling across a containment shell. This sealless design prevents process fluid leakage entirely—a critical requirement for hazardous, toxic, or expensive fluids.

Best suited for:

– Chemical processing (acids, solvents, caustics)

– Pharmaceutical manufacturing

– Semiconductor fabrication

– Any application requiring zero-leak containment

Illustrative Image (Source: Google Search)

Technical considerations: Magnetic coupling introduces efficiency losses (typically 3-5%) due to eddy currents. Temperature limits depend on magnet materials—standard configurations handle fluids up to 250°F, with high-temperature variants available. Dry running protection is essential, as magnetic pumps cannot tolerate loss of lubrication from the pumped fluid.

Selection Guidance

When evaluating centrifugal pump types, prioritize these factors:

- Flow rate and head requirements — Match hydraulic performance to system curves

- Fluid characteristics — Viscosity, solids content, corrosivity, temperature

- Installation constraints — Available space, suction conditions, accessibility

- Reliability requirements — Criticality of service, maintenance capabilities

- Total cost of ownership — Initial investment balanced against energy consumption and maintenance burden

Engaging with pump manufacturers or authorized distributors during the specification phase ensures proper sizing and configuration for your specific operating conditions.

Key Industrial Applications of centrifugal pump

Key Industrial Applications of Centrifugal Pumps

Centrifugal pumps serve as critical infrastructure across multiple industries, converting rotational kinetic energy into fluid movement through impeller-driven hydrodynamic force. Below is a comprehensive breakdown of primary industrial applications and their specific operational benefits.

Illustrative Image (Source: Google Search)

Industry Application Matrix

| Industry | Primary Applications | Fluid Types Handled |

|---|---|---|

| Water & Wastewater | Municipal water supply, sewage treatment, stormwater management | Clean water, raw sewage, sludge |

| Oil & Gas | Crude transfer, refinery processes, pipeline boosting | Petroleum, refined products, process fluids |

| Chemical Processing | Reactor feed, product transfer, cooling systems | Acids, alkalis, solvents, slurries |

| Power Generation | Boiler feed, condenser cooling, ash handling | High-temperature water, cooling water |

| Mining & Minerals | Slurry transport, dewatering, tailings management | Abrasive slurries, process water |

| Food & Beverage | Product transfer, CIP systems, ingredient dosing | Liquids, viscous products, sanitary fluids |

| Pharmaceutical | Process fluid transfer, purified water systems | Sterile fluids, WFI, process chemicals |

| HVAC & Building Services | Chilled water circulation, heating loops | Treated water, glycol solutions |

| Agriculture | Irrigation, fertigation, drainage | Groundwater, surface water, liquid fertilizers |

Detailed Benefits by Application Sector

Water & Wastewater Treatment

- High flow rate capacity handles municipal-scale volumes efficiently

- Abrasive solution compatibility manages raw sewage containing solids

- Low maintenance requirements reduce operational downtime

- Scalable configurations from small lift stations to large treatment plants

Oil & Gas / Petrochemical

- Continuous duty operation supports 24/7 refinery processes

- API 610 compliant designs meet stringent industry standards

- Handles varying viscosities across crude grades and refined products

- Explosion-proof motor options ensure hazardous area compliance

Chemical Processing

- Material versatility (stainless steel, alloys, lined construction) resists corrosion

- Seal-less magnetic drive options eliminate leak points for hazardous chemicals

- Precise flow control supports batch and continuous processes

- Temperature range flexibility from cryogenic to high-heat applications

Mining & Minerals Processing

- Froth pump configurations handle aerated slurries in flotation circuits

- Hardened wear components extend service life with abrasive media

- High solids concentration capability reduces water consumption

- Robust construction withstands harsh operating environments

Power Generation

- Multistage configurations deliver high-pressure boiler feed requirements

- Thermal shock resistance manages rapid temperature fluctuations

- Critical service reliability supports baseload and peaking operations

- Efficiency ratings reduce parasitic load on generation output

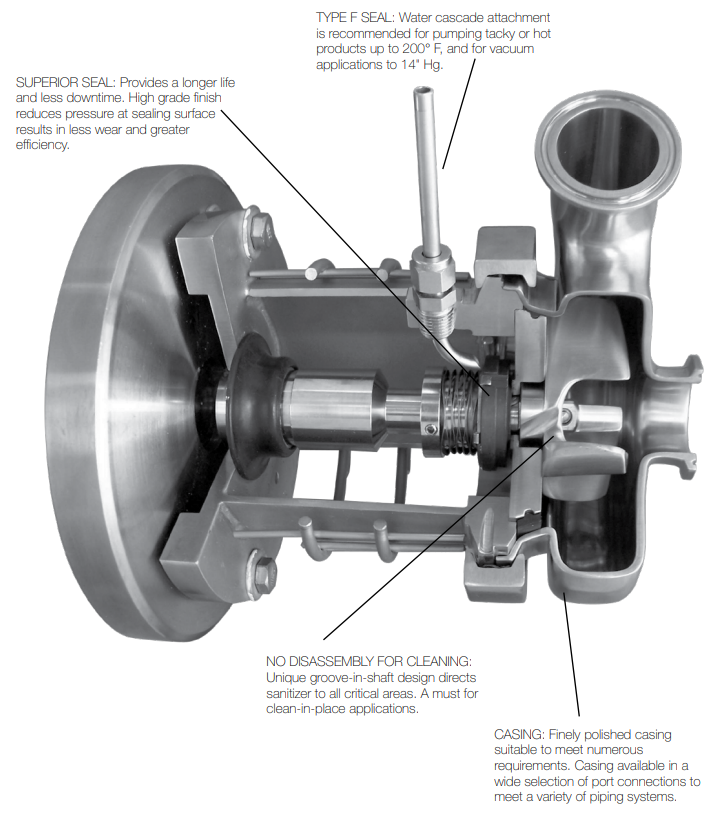

Food, Beverage & Pharmaceutical

- Sanitary designs meet FDA, 3-A, and EHEDG standards

- CIP/SIP compatibility enables in-place cleaning and sterilization

- Gentle product handling preserves ingredient integrity

- Electropolished surfaces prevent bacterial harborage

Operational Advantages Across All Applications

| Benefit | Technical Basis |

|---|---|

| High Flow Rates | Radial impeller design enables continuous, high-volume discharge |

| Simple Engineering | Fewer moving parts than positive displacement alternatives |

| Variable Speed Control | VFD compatibility allows precise flow adjustment |

| Compact Footprint | Vertical configurations minimize floor space requirements |

| Lower Capital Cost | Simpler construction reduces initial procurement expense |

| Energy Efficiency | Modern hydraulic designs achieve 80%+ efficiency ratings |

| Mixing Capability | Inherent turbulence supports in-line blending applications |

Selection Considerations by Application

When specifying centrifugal pumps for industrial use, evaluate:

- Fluid characteristics — viscosity, solids content, chemical compatibility

- System curve requirements — head, flow rate, NPSH available

- Operating conditions — temperature range, duty cycle, ambient environment

- Regulatory compliance — API, ANSI, ISO, or sanitary standards

- Total cost of ownership — energy consumption, maintenance intervals, spare parts availability

3 Common User Pain Points for ‘centrifugal pump’ & Their Solutions

3 Common User Pain Points for Centrifugal Pumps & Their Solutions

Pain Point 1: Cavitation Damage and Performance Degradation

Scenario: A chemical processing facility notices their centrifugal pump is producing unusual noise, experiencing vibration, and showing declining flow rates. Maintenance inspections reveal pitting damage on the impeller surfaces.

Problem: Cavitation occurs when the pressure at the pump suction drops below the fluid’s vapor pressure, causing vapor bubbles to form and collapse violently against internal components. This leads to:

– Premature impeller erosion

– Reduced pump efficiency

– Increased maintenance costs

– Unplanned downtime

Solution:

| Action | Implementation |

|——–|—————-|

| Ensure adequate NPSH margin | Maintain Net Positive Suction Head Available (NPSHa) at least 10-15% above NPSHr |

| Optimize suction piping | Minimize friction losses, avoid unnecessary fittings, ensure proper pipe diameter |

| Control fluid temperature | Implement cooling where applicable to reduce vapor pressure |

| Select appropriate impeller design | Consider low-NPSH impeller designs for challenging applications |

Illustrative Image (Source: Google Search)

Pain Point 2: Seal Failures and Leakage

Scenario: A petrochemical plant experiences repeated mechanical seal failures on their process pumps, resulting in product loss, environmental compliance issues, and frequent unscheduled maintenance.

Problem: Mechanical seal failures represent one of the most common centrifugal pump issues, caused by:

– Dry running conditions

– Misalignment between pump and driver

– Incompatible seal materials for the pumped fluid

– Excessive vibration or temperature fluctuations

Solution:

| Action | Implementation |

|——–|—————-|

| Implement proper seal flush plans | Select appropriate API seal flush arrangement for your application |

| Conduct precision alignment | Use laser alignment tools; verify alignment under operating temperature |

| Match seal materials to application | Consult with seal manufacturers for chemical compatibility |

| Install condition monitoring | Deploy vibration and temperature sensors for early fault detection |

Pain Point 3: Priming Difficulties and Air Entrainment

Scenario: A water treatment facility struggles with inconsistent pump startup, particularly in lift applications where the pump is positioned above the fluid source. Operators report the pump failing to establish flow or losing prime during operation.

Illustrative Image (Source: Google Search)

Problem: Standard centrifugal pumps are not self-priming and cannot evacuate air from the suction line. Air entrainment causes:

– Inability to establish initial flow

– Reduced hydraulic efficiency

– Erratic discharge pressure

– Potential dry running damage

Solution:

| Action | Implementation |

|——–|—————-|

| Install foot valves or check valves | Maintain fluid in suction line during shutdown |

| Consider self-priming pump designs | Evaluate recirculating or liquid-ring priming systems for lift applications |

| Eliminate air leaks | Inspect and seal all suction-side connections and gaskets |

| Install priming assistance | Add vacuum pumps or ejectors for critical applications requiring rapid startup |

Key Takeaway: Proactive maintenance programs combining condition monitoring, proper installation practices, and application-specific component selection significantly reduce centrifugal pump failures and total cost of ownership.

Strategic Material Selection Guide for centrifugal pump

Strategic Material Selection Guide for Centrifugal Pumps

Selecting the appropriate materials for centrifugal pump components directly impacts operational lifespan, maintenance costs, and system reliability. This guide provides a systematic framework for material selection based on application requirements, fluid characteristics, and operating conditions.

Illustrative Image (Source: Google Search)

Critical Factors in Material Selection

Material selection for centrifugal pumps must account for multiple interacting variables:

Chemical Compatibility

– Fluid pH levels and chemical composition

– Presence of dissolved gases (oxygen, hydrogen sulfide, CO2)

– Concentration of corrosive agents

– Temperature-dependent chemical reactivity

Mechanical Requirements

– Operating pressures and pressure fluctuations

– Rotational speeds and associated stresses

– Abrasive particle content and hardness

– Cavitation potential

Environmental Conditions

– Ambient and fluid temperatures

– Humidity and external corrosion exposure

– Regulatory compliance requirements (FDA, ATEX, NSF)

Illustrative Image (Source: Google Search)

Material Options by Component

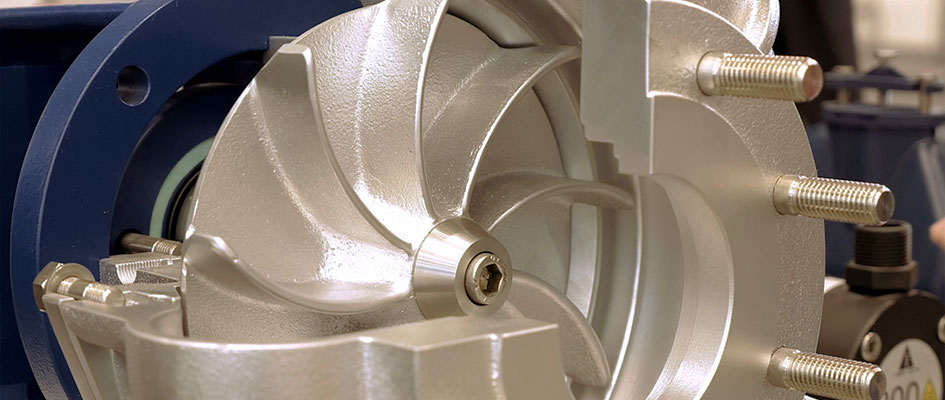

Impeller Materials

The impeller experiences the most demanding conditions—combining high velocity, pressure differentials, and direct fluid contact.

Cast Iron (Gray Iron)

Suitable for clean water applications at ambient temperatures. Cost-effective for general-purpose installations where corrosion resistance is not critical. Limited to pH ranges of 6.5-8.5.

Bronze (Leaded and Unleaded)

Excellent corrosion resistance in seawater and brackish water applications. Unleaded variants comply with NSF/ANSI 61 for potable water systems. Maximum operating temperature typically 200°F (93°C).

316 Stainless Steel

Standard selection for chemical processing, pharmaceutical, and food-grade applications. Provides superior corrosion resistance compared to 304 SS due to molybdenum content. Handles mild acids, caustics, and chloride-containing fluids up to moderate concentrations.

Illustrative Image (Source: Google Search)

Duplex Stainless Steel (2205, 2507)

Combines high strength with excellent chloride stress corrosion cracking resistance. Preferred for offshore, desalination, and aggressive chemical environments. Cost premium of 30-50% over 316 SS typically justified by extended service life.

Alloy 20 (Carpenter 20)

Specifically engineered for sulfuric acid service across concentration ranges. Also performs well with phosphoric acid and mixed acid environments.

Hastelloy C-276

Premium corrosion resistance for highly aggressive chemicals including hydrochloric acid, wet chlorine, and mixed oxidizing/reducing environments. Essential for specialty chemical and pharmaceutical applications.

Titanium

Exceptional resistance to seawater, chlorides, and oxidizing acids. Low density reduces rotating mass. High cost limits use to critical applications where alternatives fail.

Illustrative Image (Source: Google Search)

Casing Materials

Casing selection balances structural integrity with corrosion resistance. Thickness provides additional corrosion allowance compared to impellers.

Ductile Iron

Superior mechanical properties versus gray iron. Handles higher pressures and provides better impact resistance. Standard for water and wastewater applications.

Carbon Steel

Economical choice for hydrocarbon services and high-pressure applications. Requires internal coatings or linings for corrosive fluids.

Fiberglass Reinforced Plastic (FRP)

Lightweight, corrosion-resistant option for chemical services. Temperature limitations (typically below 200°F) restrict applications. Excellent for sodium hypochlorite and dilute acids.

Illustrative Image (Source: Google Search)

Shaft Materials

Shafts must withstand torsional loads, bending moments, and localized corrosion at seal interfaces.

416/420 Stainless Steel

Martensitic grades providing hardness for wear resistance at packing and seal areas. Moderate corrosion resistance.

17-4 PH Stainless Steel

Precipitation-hardened grade offering high strength and good corrosion resistance. Standard upgrade for demanding applications.

Alloy Overlays

Ceramic or carbide coatings (tungsten carbide, chromium oxide) applied to sleeve areas extend life in abrasive services.

Material Selection for Specific Applications

Water and Wastewater

Standard municipal applications typically specify ductile iron casings with bronze impellers. Aggressive wastewater with hydrogen sulfide requires upgrading to 316 SS or duplex grades. Grit-laden influent demands hard-faced components or high-chrome iron impellers.

Chemical Processing

Match materials to the most aggressive chemical in the process stream, accounting for upset conditions. Temperature excursions significantly impact corrosion rates—design for worst-case scenarios.

Oil and Gas

Upstream applications require materials meeting NACE MR0175/ISO 15156 for sour service environments. Duplex and super duplex stainless steels dominate offshore installations.

Food and Pharmaceutical

316L stainless steel (low carbon) with electropolished surfaces meets FDA and 3-A sanitary standards. Material certificates and full traceability documentation required.

Illustrative Image (Source: Google Search)

Mining and Slurry

High-chrome white iron (27% Cr) impellers and liners provide abrasion resistance for slurry service. Rubber-lined casings absorb impact from large particles while resisting wear.

Abrasion Resistance Considerations

Abrasive fluids require material hardness exceeding particle hardness by at least 20%. Key material options include:

- High-chrome white iron: 600-700 HB hardness, excellent for sand and mineral slurries

- Ni-Hard: 550-650 HB, good impact resistance with wear resistance

- Tungsten carbide coatings: 1200+ HV, applied to critical wear surfaces

- Polyurethane linings: Effective for fine abrasives at lower velocities

Temperature Considerations

Material strength and corrosion resistance vary significantly with temperature:

- Below 32°F (0°C): Austenitic stainless steels maintain toughness; avoid ferritic grades

- 32-200°F (0-93°C): Full material range available

- 200-500°F (93-260°C): Eliminate elastomers; verify material ratings

- Above 500°F (260°C): Specialty alloys and high-temperature gaskets required

Cost-Benefit Analysis Framework

Material selection should optimize total cost of ownership rather than initial purchase price:

Illustrative Image (Source: Google Search)

- Calculate expected component life for each material option

- Factor in replacement costs including downtime

- Consider inventory standardization benefits

- Evaluate warranty and performance guarantee terms

- Assess failure consequences (safety, environmental, production)

Material Compatibility Quick Reference

| Fluid Type | Impeller | Casing | Shaft | Notes |

|---|---|---|---|---|

| Clean water (ambient) | Bronze | Cast iron | 416 SS | Cost-effective baseline |

| Potable water | Unleaded bronze/316 SS | Ductile iron (lined) | 316 SS | NSF 61 compliance required |

| Seawater | Duplex SS/Bronze | Duplex SS/Bronze | Duplex SS | Avoid 316 SS in stagnant conditions |

| Dilute acids (<10%) | 316 SS | 316 SS/FRP | 316 SS | Verify specific acid compatibility |

| Concentrated acids | Hastelloy/Alloy 20 | Hastelloy/Alloy 20 | Hastelloy | Application-specific selection |

| Caustics | 316 SS | Carbon steel (lined) | 316 SS | Avoid aluminum, zinc |

| Hydrocarbons | Carbon steel | Carbon steel | 4140 steel | Sour service requires NACE compliance |

| Slurries (mineral) | High-chrome iron | Rubber-lined steel | 17-4 PH with sleeve | Particle size determines liner type |

| Food/Pharma | 316L SS | 316L SS | 316L SS | Electropolished, certified materials |

| High temperature (>300°F) | 316H SS/Alloy 800 | Carbon steel | 17-4 PH | Verify thermal expansion compatibility |

Comprehensive Material Properties Comparison Table

| Material | Corrosion Resistance | Abrasion Resistance | Max Temp °F (°C) | Relative Cost | Typical Applications |

|---|---|---|---|---|---|

| Gray cast iron | Low | Moderate | 400 (204) | 1.0x | Clean water, HVAC |

| Ductile iron | Low-Moderate | Moderate | 400 (204) | 1.2x | Water/wastewater |

| Bronze (C83600) | Good (seawater) | Low | 400 (204) | 2.5x | Marine, potable water |

| Carbon steel | Low | Moderate | 800 (427) | 1.3x | Hydrocarbons |

| 304 Stainless Steel | Good | Low | 1500 (816) | 3.0x | General chemical |

| 316 Stainless Steel | Very Good | Low | 1500 (816) | 3.5x | Chemical, food, pharma |

| 316L Stainless Steel | Very Good | Low | 1500 (816) | 3.7x | Welded constructions, pharma |

| Duplex 2205 | Excellent | Moderate | 600 (316) | 5.0x | Offshore, desalination |

| Super Duplex 2507 | Excellent | Moderate | 500 (260) | 6.5x | Aggressive chlorides |

| Alloy 20 | Excellent (H2SO4) | Low | 1000 (538) | 8.0x | Sulfuric acid service |

| Hastelloy C-276 | Superior | Low | 1900 (1038) | 15.0x | Aggressive chemicals |

| Titanium Grade 2 | Superior | Low | 600 (316) | 12.0x | Seawater, oxidizing acids |

| High-chrome white iron | Low | Excellent | 800 (427) | 4.0x | Slurry, mining |

| Ni-Hard | Low | Very Good | 800 (427) | 3.5x | Abrasive slurries |

| FRP (Vinyl Ester) | Excellent | Low | 200 (93) | 2.0x | Corrosive chemicals |

Implementation Recommendations

- Request material test reports (MTRs) for critical applications

- Specify hardness requirements for abrasive services

- Define corrosion allowance in procurement specifications

- Establish inspection intervals based on material-fluid combinations

- Document field performance to refine future selections

Proper material selection during the specification phase prevents costly failures and optimizes lifecycle economics. Consult with pump manufacturers and metallurgical specialists when handling unusual or aggressive fluids.

In-depth Look: Manufacturing Processes and Quality Assurance for centrifugal pump

In-depth Look: Manufacturing Processes and Quality Assurance for Centrifugal Pumps

Understanding how centrifugal pumps are manufactured is essential for B2B buyers evaluating supplier capabilities, product reliability, and long-term operational performance. This section details the core manufacturing stages and quality assurance frameworks that distinguish high-quality pump production.

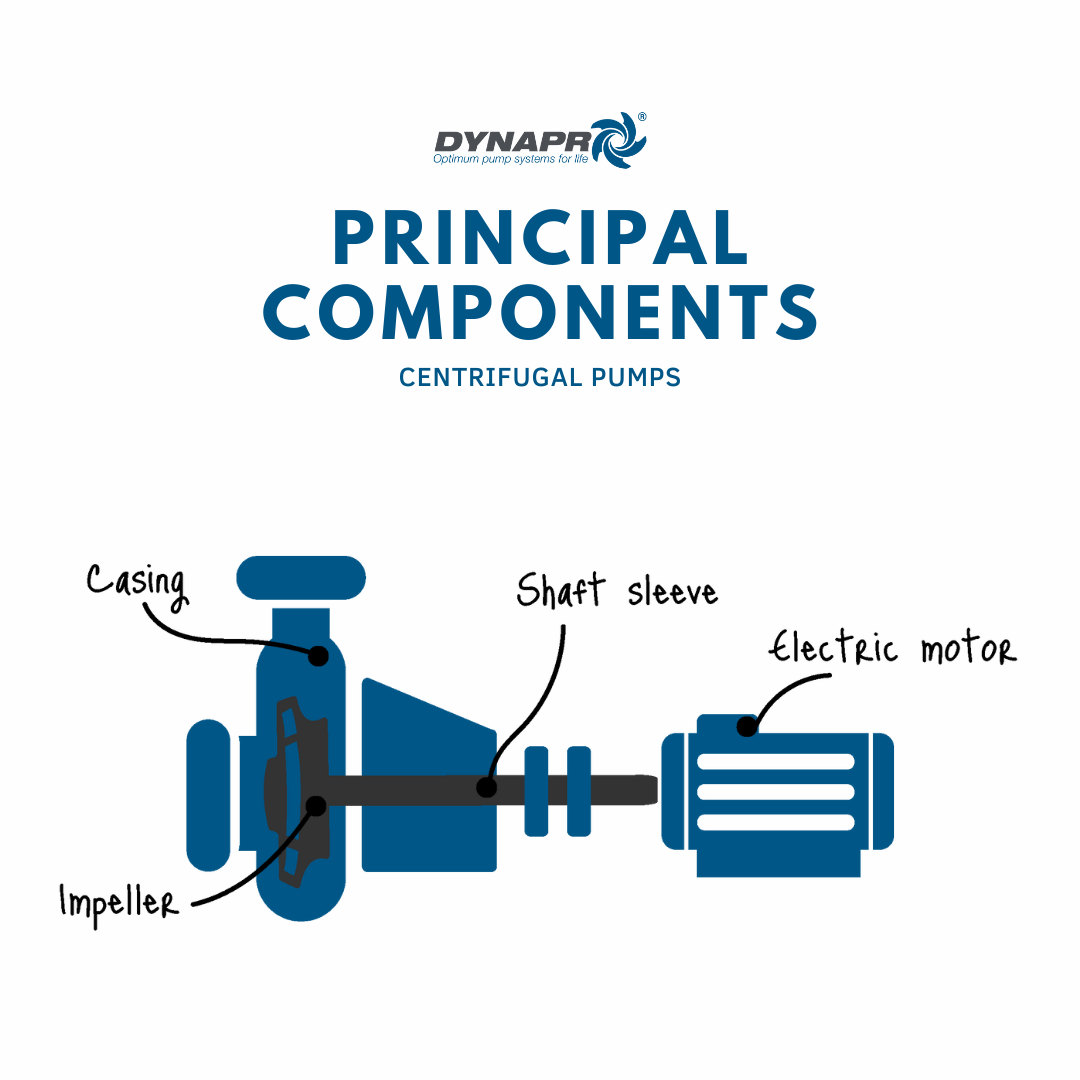

Manufacturing Process Overview

Centrifugal pump production follows a structured sequence designed to ensure dimensional accuracy, material integrity, and hydraulic efficiency.

1. Material Preparation

| Step | Description |

|---|---|

| Material Selection | Specification of alloys (cast iron, stainless steel, duplex, bronze) based on application requirements—corrosion resistance, temperature, and abrasion factors |

| Raw Material Inspection | Chemical composition analysis and mechanical property verification via spectrometry and tensile testing |

| Pattern/Mold Preparation | Creation of casting patterns for impellers, volutes, and casings using CNC-machined tooling |

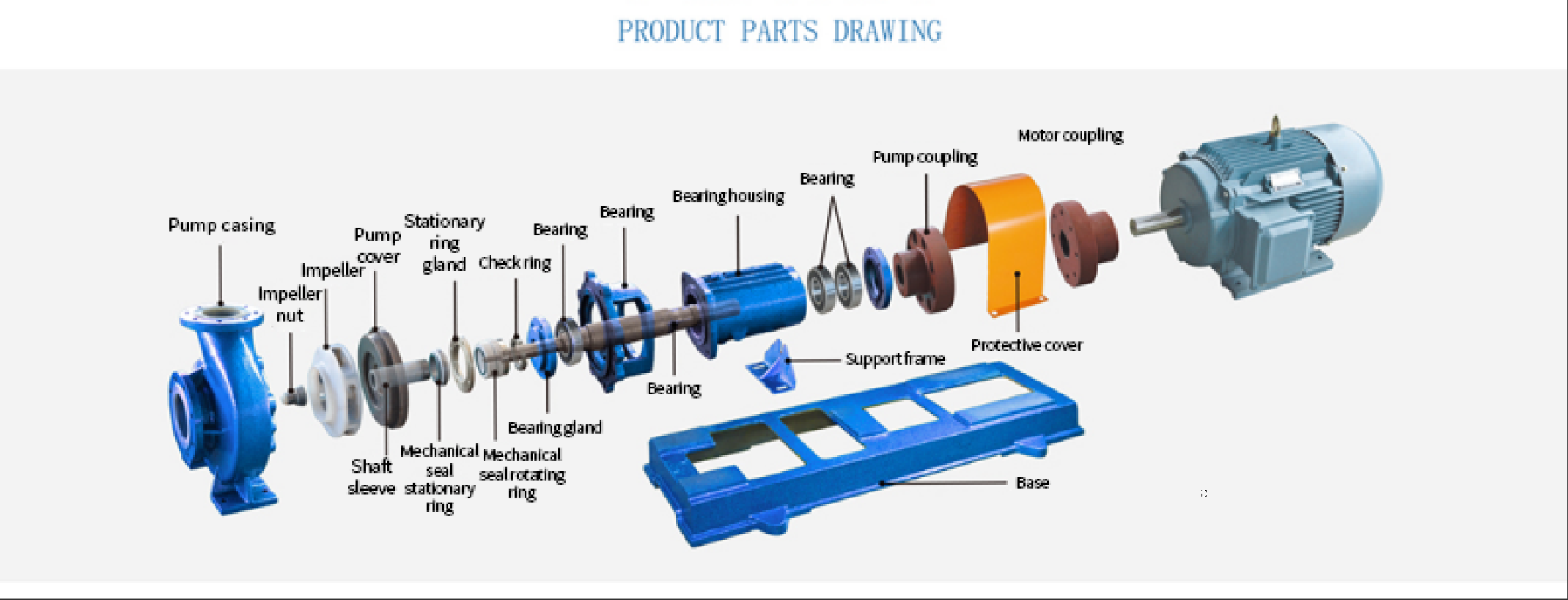

2. Forming Operations

- Casting: Sand casting or investment casting for impellers and volute casings; critical for complex geometries

- Forging: Applied to shafts and high-stress components requiring superior grain structure

- Machining: CNC turning, milling, and grinding to achieve tight tolerances on bearing housings, shaft fits, and sealing surfaces

- Balancing: Dynamic balancing of impellers to minimize vibration and extend bearing life

3. Assembly

- Sub-assembly: Shaft installation, bearing fitting, mechanical seal or packing integration

- Impeller Mounting: Precision alignment to volute; torque-controlled fastening

- Casing Closure: Gasket installation, bolting sequence per engineering specifications

- Motor Coupling: Alignment verification using laser or dial indicator methods

4. Quality Control (QC) Testing

| Test Type | Purpose |

|---|---|

| Hydrostatic Testing | Verifies pressure containment integrity |

| Performance Testing | Validates flow rate, head, and efficiency against design curves |

| NPSH Testing | Confirms cavitation resistance under specified suction conditions |

| Vibration Analysis | Detects imbalance, misalignment, or bearing defects |

| Dimensional Inspection | CMM verification of critical tolerances |

Quality Standards and Certifications

Reputable manufacturers adhere to internationally recognized standards to ensure consistency, safety, and traceability.

Illustrative Image (Source: Google Search)

| Standard | Scope |

|---|---|

| ISO 9001 | Quality management systems—process control and continuous improvement |

| ISO 5199 | Technical specifications for centrifugal pumps (Class II) |

| API 610 | Heavy-duty centrifugal pumps for petroleum, petrochemical, and gas industries |

| ATEX / IECEx | Compliance for pumps in explosive atmospheres (EU/international) |

| CE Marking | Conformity with EU health, safety, and environmental requirements |

Key Takeaways for Buyers

- Request material test reports (MTRs) and performance test certificates

- Verify ISO 9001 certification and application-specific compliance (API 610 for hydrocarbons, NSF/ANSI 61 for potable water)

- Evaluate manufacturer QC protocols—particularly balancing, hydrostatic, and performance testing capabilities

- Confirm traceability systems for critical components

Thorough manufacturing and QA processes directly correlate with pump reliability, efficiency, and total cost of ownership.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘centrifugal pump’

Practical Sourcing Guide: A Step-by-Step Checklist for Centrifugal Pumps

Use this comprehensive checklist to streamline your centrifugal pump procurement process and ensure you select the right equipment for your application.

Phase 1: Define Application Requirements

- [ ] Identify the fluid characteristics

- Type (water, sewage, petroleum, chemicals, slurry)

- Viscosity and specific gravity

- Temperature range

- Solids content and particle size (if applicable)

-

Corrosive or abrasive properties

- [ ] Determine flow requirements

- Required flow rate (GPM/m³/h)

- Total dynamic head (TDH)

- Suction conditions (NPSH available)

-

System pressure requirements

- [ ] Document operating conditions

- Continuous vs. intermittent duty

- Operating hours per day/year

- Ambient temperature and environment

- Indoor/outdoor installation

Phase 2: Select Pump Configuration

| Configuration | Best For |

|---|---|

| Single-stage | Low-to-medium head applications |

| Multistage | High-pressure requirements |

| Vertical | Limited floor space, submerged applications |

| Self-priming | Applications with air entrainment |

| Magnetically coupled | Zero-leakage requirements, hazardous fluids |

| Froth pumps | Mining, flotation processes |

- [ ] Choose impeller type based on fluid properties

- [ ] Select materials of construction (casing, impeller, seals)

- [ ] Determine seal type (mechanical seal, packing, magnetic coupling)

- [ ] Specify motor requirements (voltage, frequency, enclosure rating)

Phase 3: Supplier Qualification

- [ ] Verify manufacturer credentials

- ISO 9001 certification

- Industry-specific certifications (API, ANSI, ISO 5199)

-

Regional compliance (CE marking for Europe, UL listing for USA)

- [ ] Assess supplier capabilities

- Production capacity and lead times

- Engineering support availability

- Custom design capabilities

-

Geographic coverage and local representation

- [ ] Review track record

- Industry references in your sector

- Installed base in similar applications

- Case studies and performance data

Phase 4: Request for Quotation (RFQ)

Include the following in your RFQ package:

- [ ] Detailed data sheet with all operating parameters

- [ ] P&ID and general arrangement drawings

- [ ] Material specifications and preferences

- [ ] Required documentation (test certificates, manuals, drawings)

- [ ] Delivery timeline and shipping requirements

- [ ] Warranty expectations

- [ ] Spare parts requirements (commissioning and 2-year operation)

Phase 5: Evaluate Proposals

| Evaluation Criteria | Weight |

|---|---|

| Technical compliance | 30% |

| Total cost of ownership | 25% |

| Energy efficiency | 15% |

| Delivery schedule | 10% |

| Warranty and support | 10% |

| Supplier reliability | 10% |

- [ ] Compare efficiency curves at your operating point

- [ ] Calculate total cost of ownership (acquisition + energy + maintenance)

- [ ] Verify NPSH requirements meet available conditions

- [ ] Review spare parts pricing and availability

- [ ] Confirm service network in your region

Phase 6: Pre-Order Verification

- [ ] Request and review pump performance curves

- [ ] Confirm dimensional drawings fit installation space

- [ ] Verify electrical specifications match site power supply

- [ ] Agree on factory acceptance test (FAT) requirements

- [ ] Finalize documentation package

- [ ] Negotiate payment terms and milestones

Phase 7: Order and Delivery Management

- [ ] Issue purchase order with complete specifications

- [ ] Schedule pre-shipment inspection (if required)

- [ ] Coordinate delivery logistics and site readiness

- [ ] Verify packing and preservation requirements

- [ ] Confirm commissioning support availability

- [ ] Establish warranty start date and terms

Key Documentation Checklist

Ensure you receive:

- [ ] Certified performance test report

- [ ] Material test certificates (MTCs)

- [ ] Installation, operation, and maintenance manual

- [ ] Spare parts list with part numbers

- [ ] Cross-sectional and assembly drawings

- [ ] Warranty certificate

Common Pitfalls to Avoid

- Undersizing NPSH margin — Allow minimum 1m (3 ft) safety margin

- Ignoring energy costs — A more efficient pump often pays for itself within 2 years

- Overlooking spare parts strategy — Stock critical spares before commissioning

- Selecting on price alone — Total cost of ownership matters more than purchase price

- Neglecting local support — Verify service availability in your operating region

Comprehensive Cost and Pricing Analysis for centrifugal pump Sourcing

Comprehensive Cost and Pricing Analysis for Centrifugal Pump Sourcing

Understanding the total cost of ownership for centrifugal pumps requires analyzing multiple cost components beyond the initial purchase price. This section breaks down the primary cost drivers and provides actionable strategies for optimizing procurement spend.

Cost Breakdown by Category

Materials Cost (40-60% of Total Pump Cost)

| Component | Material Options | Relative Cost Impact |

|---|---|---|

| Impeller | Cast iron, Bronze, Stainless steel, Duplex steel | 15-25% of pump cost |

| Casing/Volute | Cast iron, Carbon steel, Stainless steel | 20-30% of pump cost |

| Shaft | Carbon steel, Stainless steel, Alloy steel | 5-10% of pump cost |

| Seals | Mechanical seals, Packing, Magnetic coupling | 5-15% of pump cost |

| Motor | Standard efficiency, Premium efficiency (IE3/IE4) | Often quoted separately |

Key Material Cost Drivers:

– Corrosion resistance requirements (316SS vs. cast iron can triple material costs)

– Abrasive service applications requiring hardened materials

– Food-grade or pharmaceutical certifications

– Temperature and pressure ratings

Labor Costs (15-25% of Total Cost)

- Manufacturing labor: Varies significantly by region (China: $8-15/hour; USA/Europe: $35-75/hour)

- Quality control and testing: Typically 5-8% of unit cost

- Engineering/customization: Custom specifications add 10-30% to standard models

- Installation labor: $500-5,000+ depending on pump size and complexity

Logistics Costs (5-15% of Total Cost)

| Shipping Method | Cost Range (per pump) | Lead Time |

|---|---|---|

| Sea freight (Asia to USA/EU) | $200-2,000 | 4-8 weeks |

| Air freight (Asia to USA/EU) | $1,500-10,000+ | 5-10 days |

| Domestic ground (USA/EU) | $150-800 | 3-7 days |

Additional Logistics Considerations:

– Import duties: 0-6% (varies by country of origin and trade agreements)

– Customs clearance fees: $150-500 per shipment

– Insurance: 0.5-2% of declared value

– Crating and packaging: $100-500 per unit

Pricing Benchmarks by Pump Type

| Pump Category | Flow Range | Typical Price Range (USD) |

|---|---|---|

| Standard end-suction | 50-500 GPM | $1,500-8,000 |

| ANSI process pumps | 100-2,000 GPM | $3,000-25,000 |

| API 610 refinery pumps | 200-5,000 GPM | $15,000-150,000+ |

| Multistage pumps | 50-1,000 GPM | $5,000-50,000 |

| Submersible pumps | 100-3,000 GPM | $2,000-30,000 |

| Mag-drive (sealless) | 50-500 GPM | $4,000-35,000 |

Cost-Saving Strategies

Specification Optimization

- Right-size the pump: Oversizing by 20% adds 15-25% to capital and operating costs

- Review material specifications: Specify only necessary corrosion/abrasion resistance

- Standardize across facilities: Volume discounts of 8-15% on repeat orders

- Consider standard vs. custom: Custom configurations add 20-40% premium

Procurement Tactics

- Bundle orders: Combine pump, motor, and baseplate purchases for 5-12% savings

- Negotiate spare parts packages: 15-25% discount when purchased with pump

- Establish blanket purchase agreements: Lock pricing for 12-24 months

- Evaluate total cost of ownership: Premium efficiency motors offset higher upfront cost within 2-3 years

Supplier Selection

- Qualify multiple sources: Maintain 2-3 approved suppliers per pump category

- Consider regional manufacturing: Reduce logistics costs and lead times

- Evaluate warranty terms: Extended warranties (3-5 years) reduce lifecycle risk

- Assess aftermarket support: Local service capability reduces downtime costs

Energy Cost Considerations

Centrifugal pumps account for approximately 20% of industrial electricity consumption. Factor in:

– Motor efficiency class (IE3/IE4 motors reduce operating costs 3-8%)

– Variable frequency drives (VFDs): 20-50% energy savings on variable-load applications

– Hydraulic efficiency: Higher-efficiency impeller designs reduce long-term operating costs

Hidden Cost Factors

- Documentation packages: API/ASME documentation adds $500-5,000

- Witness testing: Factory acceptance testing adds $1,000-10,000

- Expediting fees: Rush orders incur 15-50% premium

- Spare parts inventory: Budget 10-15% of pump cost for critical spares

Alternatives Analysis: Comparing centrifugal pump With Other Solutions

Alternatives Analysis: Comparing Centrifugal Pumps With Other Solutions

Selecting the right pump technology directly impacts operational efficiency, maintenance costs, and long-term ROI. This analysis examines centrifugal pumps against two primary alternatives: positive displacement pumps and axial flow pumps.

Comparison Overview

| Factor | Centrifugal Pumps | Positive Displacement Pumps | Axial Flow Pumps |

|---|---|---|---|

| Flow Rate | High (up to 100,000+ GPM) | Low to moderate | Very high |

| Pressure Generation | Moderate (up to 300 PSI typical) | High (up to 5,000+ PSI) | Low (under 40 PSI) |

| Viscosity Handling | Low viscosity fluids only | Excellent for high-viscosity | Low viscosity only |

| Flow Consistency | Variable with pressure changes | Constant regardless of pressure | Variable |

| Efficiency at BEP | 70-85% | 80-95% | 75-90% |

| Maintenance Complexity | Low | Moderate to high | Low |

| Initial Cost | Low to moderate | Moderate to high | Moderate |

| Solids Handling | Good (with proper impeller design) | Limited | Poor |

| Self-Priming | Requires priming (unless self-priming variant) | Yes | No |

When Centrifugal Pumps Are the Optimal Choice

Select centrifugal pumps when:

– High flow rates at moderate pressures are required

– Fluid viscosity remains below 500 cP

– Continuous, non-pulsating flow is essential

– Space constraints demand compact equipment

– Budget prioritizes lower capital expenditure

– Applications involve water, sewage, petrochemicals, or abrasive slurries

Key advantages:

– Simple engineering with fewer moving parts reduces failure points

– Lower maintenance requirements translate to reduced downtime

– Scalable across multistage configurations for increased head pressure

– Compatible with variable frequency drives for energy optimization

When Positive Displacement Pumps Outperform

Select positive displacement pumps when:

– Handling high-viscosity fluids (oils, polymers, sludge)

– Precise metering or dosing is required

– High pressures exceed centrifugal pump capabilities

– Suction lift conditions are challenging

– Flow rate must remain constant regardless of system pressure

Trade-offs to consider:

– Higher acquisition and maintenance costs

– Pulsating flow may require dampeners

– More complex sealing requirements

When Axial Flow Pumps Are Preferable

Select axial flow pumps when:

– Very high flow rates at low head are needed

– Applications include flood control, irrigation, or circulation

– Large volumes of low-viscosity liquids require movement

– Installation space accommodates vertical orientation

Trade-offs to consider:

– Limited pressure generation capability

– Poor performance with variable system conditions

– Not suitable for high-head applications

Decision Framework

For most industrial water handling, sewage treatment, HVAC circulation, and petrochemical transfer applications, centrifugal pumps deliver the optimal balance of performance, reliability, and total cost of ownership. Their high flow rate capabilities, compatibility with abrasive solutions, and straightforward maintenance make them the default choice for approximately 80% of pumping applications in process industries.

Evaluate alternatives when application requirements fall outside centrifugal pump performance envelopes—specifically high-viscosity fluids, extreme pressure requirements, or precise volumetric control.

Essential Technical Properties and Trade Terminology for centrifugal pump

Essential Technical Properties and Trade Terminology for Centrifugal Pumps

Understanding the technical specifications and industry-standard terminology is critical for procurement professionals and engineers evaluating centrifugal pump solutions. This section covers the key performance parameters and B2B trade terms essential for specification and purchasing decisions.

Key Technical Properties

| Property | Unit | Description |

|---|---|---|

| Flow Rate (Q) | m³/h, GPM, L/s | Volume of fluid moved per unit time; primary sizing parameter |

| Head (H) | m, ft | Energy imparted to fluid, expressed as vertical lift height |

| Efficiency (η) | % | Ratio of hydraulic power output to shaft power input |

| NPSH (Net Positive Suction Head) | m, ft | Minimum suction pressure required to prevent cavitation |

| Specific Speed (Ns) | dimensionless | Impeller design classification for optimal efficiency range |

| BEP (Best Efficiency Point) | — | Operating point where pump achieves maximum efficiency |

| Power Consumption | kW, HP | Energy required at shaft; critical for lifecycle cost analysis |

| Impeller Diameter | mm, inches | Determines head and flow characteristics |

| RPM (Rotational Speed) | rev/min | Operating speed; affects head, flow, and wear rates |

Material Specifications

- Casing/Volute: Cast iron, stainless steel (304/316), duplex steel, bronze

- Impeller: Bronze, stainless steel, high-chrome alloys, polymers

- Shaft Sealing: Mechanical seals, gland packing, magnetic coupling (sealless)

- Elastomers: EPDM, Viton, NBR (application-dependent)

Standard B2B Trade Terminology

| Term | Definition |

|---|---|

| MOQ | Minimum Order Quantity—smallest batch size accepted per order |

| OEM | Original Equipment Manufacturer—pumps supplied for integration into third-party systems |

| ODM | Original Design Manufacturer—custom-designed pumps per buyer specifications |

| FOB | Free On Board—price includes delivery to shipping port; buyer assumes freight |

| CIF | Cost, Insurance, Freight—seller covers shipping and insurance to destination port |

| EXW | Ex Works—buyer responsible for all transport from seller’s facility |

| Lead Time | Production and delivery timeline from order confirmation |

| RFQ | Request for Quotation—formal inquiry for pricing and terms |

| API 610 | American Petroleum Institute standard for centrifugal pumps in oil/gas/petrochemical |

| ISO 5199 | International standard for technical specifications of centrifugal pumps |

| ATEX | European directive for equipment in explosive atmospheres |

Critical Procurement Specifications

When issuing RFQs, include:

- Duty point: Required flow rate and head at operating conditions

- Fluid properties: Viscosity, specific gravity, solids content, temperature, corrosivity

- NPSH available: System suction conditions

- Driver requirements: Electric motor specs, voltage, frequency, hazardous area classification

- Material compatibility: Wetted parts suitable for process fluid

- Certification requirements: CE marking, API 610, ISO 9001, ATEX (where applicable)

- Spare parts package: Recommended spares for 2-year operation

- Documentation: Test certificates, GA drawings, IOM manuals, material traceability

Performance Curve Essentials

Centrifugal pump performance is defined by manufacturer-supplied curves showing:

- H-Q Curve: Head vs. flow relationship

- Efficiency Curve: Efficiency vs. flow

- Power Curve: Shaft power vs. flow

- NPSH Required Curve: Cavitation threshold vs. flow

Specify curve tolerance per ISO 9906 (Grades 1, 2, or 3) or Hydraulic Institute standards for acceptance testing.

Navigating Market Dynamics and Sourcing Trends in the centrifugal pump Sector

Navigating Market Dynamics and Sourcing Trends in the Centrifugal Pump Sector

Historical Foundation and Modern Evolution

The centrifugal pump traces its origins to 1475, when Italian Renaissance engineer Francesco di Giorgio Martini documented the first mud-lifting machine using centrifugal principles. The technology remained rudimentary until Denis Papin developed true centrifugal pumps with straight vanes in the late 17th century. British inventor John Appold’s introduction of curved vanes in 1851 marked the pivotal advancement that established the foundation for modern pump efficiency.

Today’s centrifugal pumps convert rotational kinetic energy—typically from electric motors—into hydrodynamic fluid energy, serving critical applications across water treatment, sewage management, agriculture, petroleum, and petrochemical industries.

Current Market Dynamics

| Market Driver | Impact on Sourcing |

|---|---|

| Energy efficiency regulations | Increased demand for high-efficiency motor-pump combinations |

| Water infrastructure investment | Growing municipal and industrial procurement volumes |

| Industrial digitalization | Preference for IoT-enabled, condition-monitoring units |

| Supply chain regionalization | Shift toward dual-sourcing strategies in USA/EU markets |

Key sourcing considerations for B2B buyers:

- Flow rate requirements: Centrifugal pumps excel in high-volume applications

- Fluid compatibility: Evaluate abrasive solution handling capabilities

- Total cost of ownership: Energy consumption represents 85%+ of lifecycle costs

Sustainability Trends Shaping Procurement

- Energy optimization: Variable frequency drives (VFDs) paired with centrifugal pumps reduce energy consumption by 20-50%

- Material innovation: Corrosion-resistant alloys extending service life and reducing replacement cycles

- Circular economy alignment: Remanufactured pump programs gaining traction among EU buyers

- Carbon footprint disclosure: Suppliers increasingly providing lifecycle assessment data

Strategic Sourcing Recommendations

- Prioritize suppliers offering comprehensive efficiency documentation

- Evaluate magnetically coupled pump options for leak-free, environmentally sensitive applications

- Consider multistage centrifugal configurations for high-pressure requirements

- Request energy performance guarantees in procurement contracts

Frequently Asked Questions (FAQs) for B2B Buyers of centrifugal pump

Frequently Asked Questions (FAQs) for B2B Buyers of Centrifugal Pumps

1. What applications are centrifugal pumps best suited for?

Centrifugal pumps excel in applications requiring high flow rates and continuous fluid transfer. Common B2B applications include:

- Water and wastewater treatment

- Agricultural irrigation systems

- Petroleum and petrochemical processing

- HVAC hydronic heating systems

- Chemical processing and transfer

- Mining and coal preparation (slurry handling)

They’re particularly effective for low-viscosity fluids and situations where abrasive solution compatibility is required.

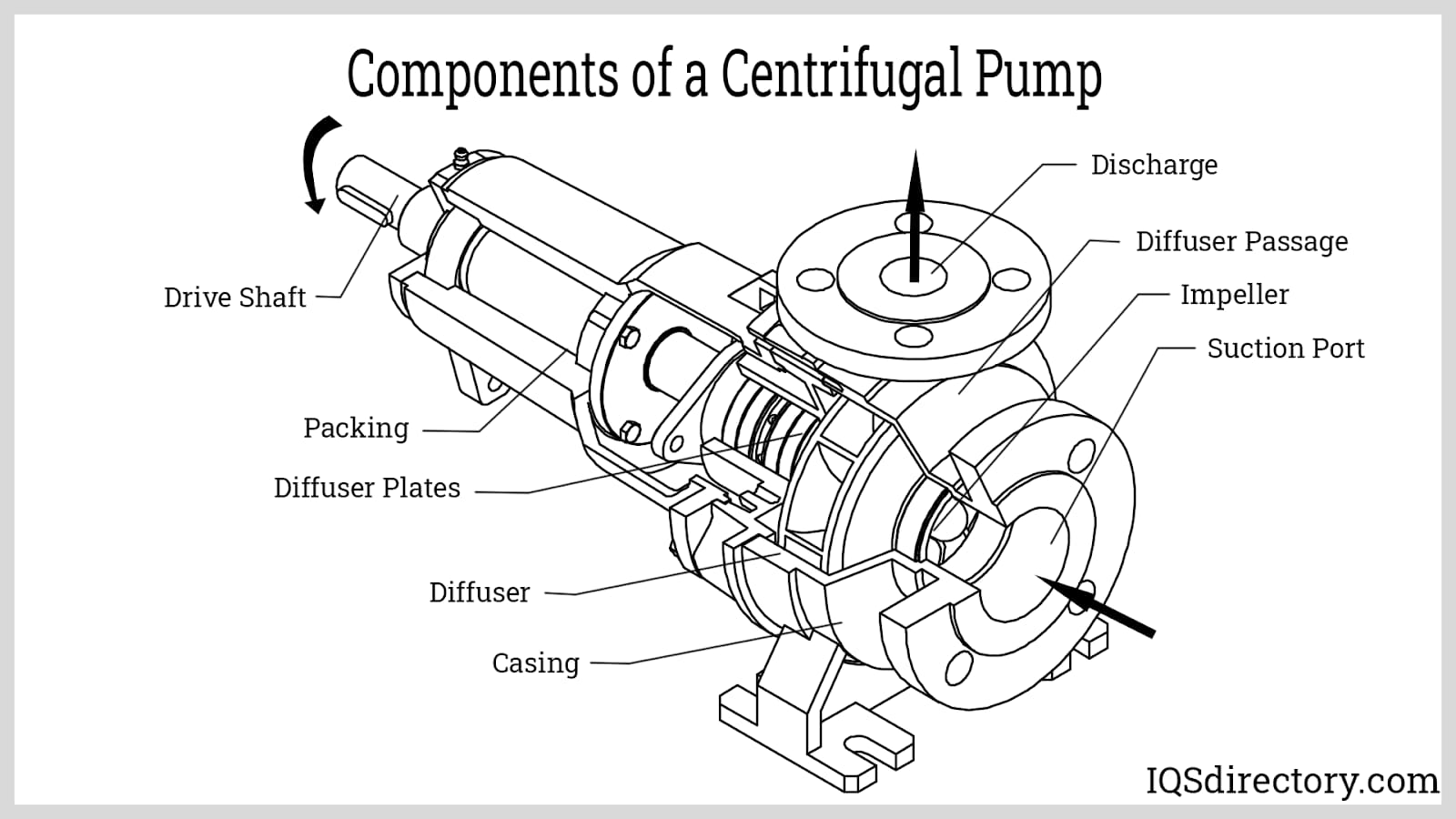

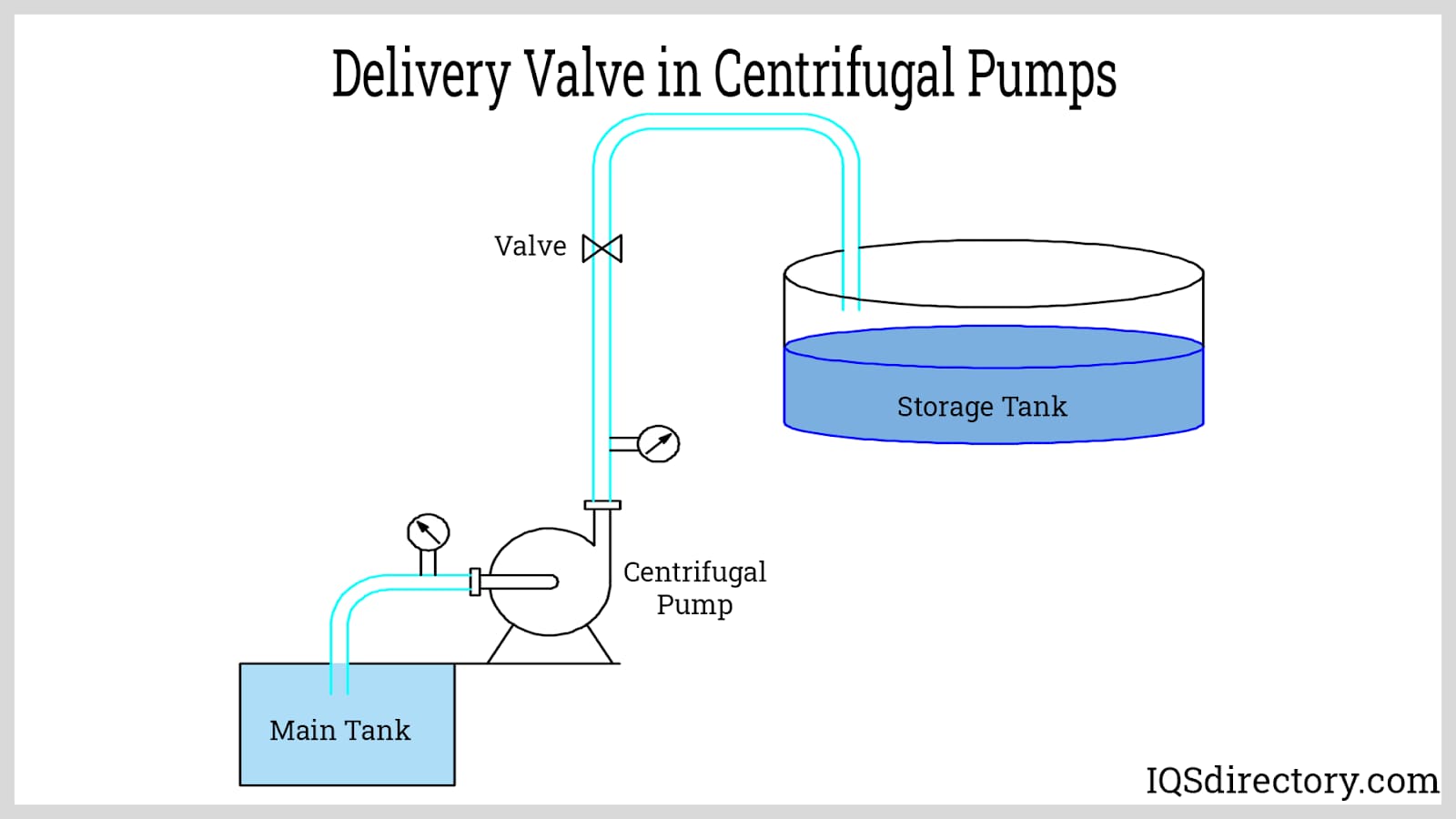

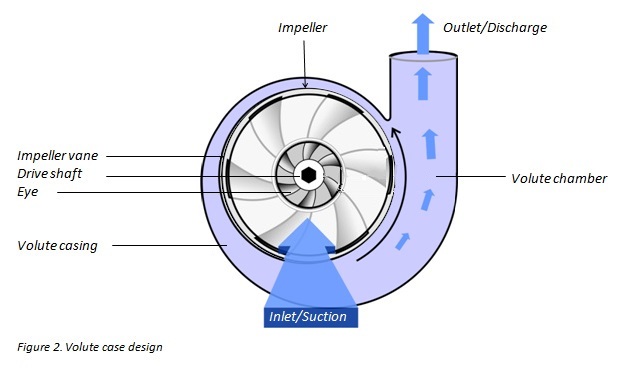

2. How do centrifugal pumps work?

Centrifugal pumps convert rotational kinetic energy (typically from an electric motor or engine) into hydrodynamic energy. The process involves:

- Fluid enters axially through the pump’s eye

- The rotating impeller accelerates the fluid radially outward

- Fluid passes through a diffuser or volute chamber

- Both velocity and pressure increase as fluid exits

This design enables efficient, continuous flow rather than pulsating delivery.

3. What are the main types of centrifugal pumps available?

| Type | Best Application | Key Feature |

|---|---|---|

| Standard/End-suction | General water transfer | Cost-effective, easy maintenance |

| Vertical centrifugal | Space-constrained installations | Compact footprint |

| Multistage centrifugal | High-pressure requirements | Multiple impellers in series |

| Froth pumps | Mining/mineral processing | Handles frothy slurries |

| Magnetically coupled | Hazardous/sealed applications | Leak-free operation |

4. What factors should we consider when specifying a centrifugal pump?

Critical specification parameters include:

- Flow rate requirements (GPM or m³/h)

- Total dynamic head (TDH)

- Fluid properties (viscosity, temperature, corrosiveness, solids content)

- Net Positive Suction Head Available (NPSHa)

- Operating environment (indoor/outdoor, hazardous area classification)

- Material compatibility (impeller, casing, seals)

- Energy efficiency ratings

5. Do centrifugal pumps require priming?

Yes, most centrifugal pumps require priming—removing air from the suction line and pump casing before operation. Operating a non-primed pump causes:

- Impeller damage

- Seal failure

- Cavitation

Solution options:

– Install foot valves or check valves

– Use self-priming centrifugal pumps (designed with internal reservoirs)

– Implement automatic priming systems for critical applications

6. What are common operational problems with centrifugal pumps?

| Problem | Cause | Prevention |

|---|---|---|

| Cavitation | Insufficient NPSHa | Proper system design, reduce suction lift |

| Seal failure | Dry running, misalignment | Proper priming, alignment checks |

| Reduced efficiency | Wear, incorrect sizing | Regular maintenance, proper specification |

| Vibration | Imbalance, bearing wear | Scheduled inspections, quality bearings |

7. When should we choose magnetically coupled centrifugal pumps?

Magnetically coupled (mag-drive) pumps eliminate shaft seals by using magnetic coupling between motor and impeller. Specify mag-drive pumps when:

- Handling hazardous, toxic, or flammable fluids

- Zero-leakage is mandatory

- Regulatory compliance requires sealed systems

- Maintenance access is limited

- Pumping expensive fluids where losses are costly

Trade-off: Higher initial cost, but reduced maintenance and leak-related risks.

8. How can we optimize energy consumption with centrifugal pumps?

Centrifugal pumps represent significant energy costs in industrial operations. Optimization strategies include:

- Right-sizing: Avoid oversized pumps operating at throttled conditions

- Variable Frequency Drives (VFDs): Match pump speed to actual demand

- High-efficiency impellers: Specify pumps meeting IE3/IE4 motor standards

- System optimization: Reduce unnecessary pipe friction and fittings

- Regular maintenance: Worn impellers reduce efficiency by 10-25%

ROI consideration: VFDs typically deliver 20-50% energy savings in variable-demand applications.

Strategic Sourcing Conclusion and Outlook for centrifugal pump

Strategic Sourcing Conclusion: Centrifugal Pumps

Centrifugal pumps remain the backbone of industrial fluid handling across water treatment, petrochemical, agriculture, and manufacturing sectors. Their fundamental advantages—high flow rate capabilities, compatibility with abrasive solutions, and relatively straightforward engineering—make them the default choice for most B2B applications.

Key Sourcing Takeaways

| Factor | Strategic Consideration |

|---|---|

| Application Match | Verify flow rates, head requirements, and fluid compatibility before procurement |

| Total Cost of Ownership | Energy consumption often exceeds purchase price over pump lifecycle |

| Supplier Reliability | Prioritize vendors with proven aftermarket support in your region |

| Efficiency Standards | Specify IE3/IE4 motors to meet EU and US energy regulations |

Market Outlook

The centrifugal pump market continues evolving toward:

– Smart monitoring integration for predictive maintenance

– Higher efficiency impeller designs driven by energy cost pressures

– Corrosion-resistant materials for demanding chemical applications

Final Recommendation

Successful sourcing requires balancing upfront costs against operational efficiency, maintenance requirements, and supplier support capabilities. Engage suppliers early in project planning, request detailed performance curves, and validate specifications against actual operating conditions to maximize return on investment.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.

![Global Top 10 Industrial Pump Manufacturers [2025]](https://www.sohoinchina.com/wp-content/uploads/2025/12/blackridgeresearchcom-9353.jpg)