The global ceiling grid systems market is experiencing steady growth, driven by rising construction activities, increasing demand for acoustic and sustainable building solutions, and the expansion of commercial infrastructure. According to Grand View Research, the global suspended ceiling market was valued at USD 10.3 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. Similarly, Mordor Intelligence forecasts a CAGR of approximately 5.6% over the same period, citing increased urbanization and modernization of building standards as key growth catalysts. With North America and Europe maintaining strong demand due to retrofitting projects and stringent acoustic regulations, and the Asia-Pacific region emerging as a high-growth market fueled by rapid industrialization, the competitive landscape is intensifying among leading manufacturers. As performance, durability, and design flexibility become critical differentiators, the following nine companies have emerged as top innovators and suppliers in the ceiling grid systems space.

Top 9 Ceiling Grid Systems Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rulon International

Domain Est. 1997

Website: rulonco.com

Key Highlights: Transform spaces with Rulon’s finest custom wood ceilings. Leading manufacturer of suspended wood ceiling systems for commercial architects….

#2 CEILINGS

Domain Est. 2010

Website: gordon-inc.com

Key Highlights: Gordon ceilings are designed for commercial, acoustical, educational, cleanroom, data center, healthcare, industrial, & institutional applications….

#3 Armstrong World Industries

Domain Est. 1995

Website: armstrong.com

Key Highlights: Armstrong World Industries is a leader in the design, innovation and manufacture of ceiling and wall system solutions, transforming how people design, ……

#4 Ceiling & Wall Systems

Domain Est. 1995

Website: certainteed.com

Key Highlights: Above All, Innovation. QuickSpan™ Locking Drywall Grid System. Fewer hanger wires. Faster installation. Lower labor costs….

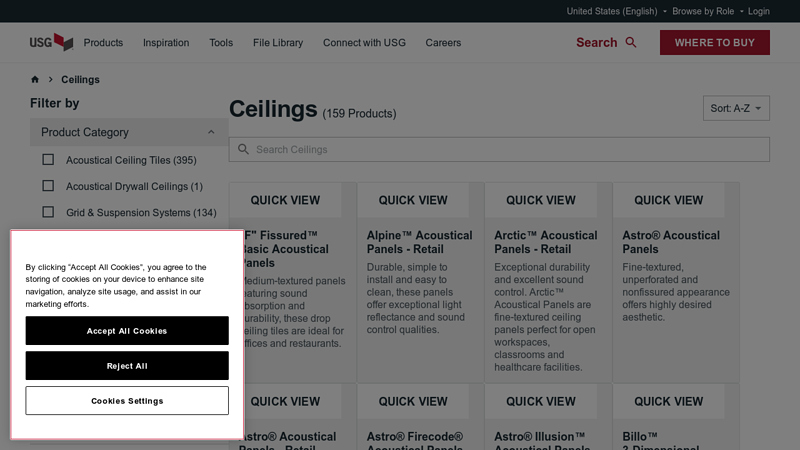

#5 Ceilings

Domain Est. 1996

Website: usg.com

Key Highlights: Alpine™ Acoustical Panels – RetailDurable, simple to install and easy to clean, these panels offer exceptional light reflectance and sound control qualities….

#6 Stone Wool, Metal & Grid Ceiling Solutions

Domain Est. 1996

Website: rockfon.com

Key Highlights: Rockfon provides stone wool, metal, and grid ceiling solutions designed for acoustic comfort, sustainability, and modern architectural design….

#7 Ceiling, Grid & Wall …

Domain Est. 1999

Website: armstrongceilings.com

Key Highlights: Armstrong World Industries is a global leader in the design and manufacture of innovative commercial ceiling, suspension system and wall solutions….

#8 Ceiling Systems, Drywall Assemblies & Finishes

Domain Est. 2003

Website: usgme.com

Key Highlights: USG Middle East’s ever-growing portfolio of groundbreaking ceilings systems, drywall assemblies, and end-to-end solutions is backed by unparalleled quality ……

#9 Acoustic Solutions for the Open Office

Domain Est. 2016

Website: turf.design

Key Highlights: An iconic ceiling baffle, elevated and reimagined. Wedge A minimal acoustic baffle, with amazing sound absorption. Beam A modern take on the classic beam ……

Expert Sourcing Insights for Ceiling Grid Systems

2026 Market Trends for Ceiling Grid Systems

The ceiling grid systems market is poised for significant evolution by 2026, driven by shifting construction dynamics, technological advancements, and heightened focus on sustainability and indoor environmental quality. Several key trends are expected to define the landscape:

Increasing Demand for Sustainable and Recyclable Materials

Environmental concerns are reshaping material selection in construction. By 2026, demand for ceiling grid systems made from recycled aluminum and steel will intensify, supported by green building certifications like LEED and BREEAM. Manufacturers will prioritize closed-loop recycling processes and transparent supply chains to meet stringent sustainability standards and appeal to eco-conscious developers and end-users.

Growth in Smart Building Integration

As commercial buildings adopt IoT and smart infrastructure, ceiling grids are becoming platforms for integrating sensors, lighting controls, and HVAC components. By 2026, expect greater innovation in grid designs that support seamless integration of smart devices—such as occupancy sensors and air quality monitors—without compromising aesthetics or acoustic performance.

Expansion in Healthcare and Education Sectors

Healthcare and educational facilities require high-performance ceilings for hygiene, acoustics, and durability. The ongoing investment in modernizing hospitals and schools, especially post-pandemic, will drive demand for antimicrobial-coated, cleanable grid systems with superior sound attenuation. These sectors will favor grids compatible with modular ceiling panels that facilitate easy access to mechanical systems.

Rise of Hybrid and Open-Plan Office Spaces

The shift toward flexible work environments continues to influence ceiling design. Hybrid workspaces demand adaptable acoustic solutions, prompting increased use of grid systems that support high NRC (Noise Reduction Coefficient) ceiling panels and zoning strategies. Exposed grid systems and demountable designs will gain traction for their flexibility and cost-effective reconfiguration.

Advancements in Acoustic Performance and Design Aesthetics

Architectural trends are pushing for visually striking interiors, leading to demand for concealed grid systems, linear metal ceilings, and custom grid patterns. Simultaneously, building codes and occupant comfort are emphasizing superior sound control. By 2026, manufacturers will focus on developing lightweight, high-strength grids that deliver both aesthetic versatility and enhanced acoustic performance.

Regional Growth in Asia-Pacific and Emerging Markets

While North America and Europe remain stable markets, the Asia-Pacific region—including India, China, and Southeast Asia—will witness the fastest growth due to rapid urbanization, infrastructure development, and rising commercial construction. Localized production and cost-optimized grid solutions will be critical for market penetration.

Supply Chain Resilience and Localized Manufacturing

Global disruptions have highlighted vulnerabilities in supply chains. By 2026, companies will increasingly adopt nearshoring and regional manufacturing strategies to ensure reliable delivery of ceiling grid components. Digital inventory management and predictive logistics will become standard to mitigate material shortages and shipping delays.

In summary, the 2026 ceiling grid systems market will be defined by sustainability, technological integration, and adaptability—meeting the evolving needs of smart, healthy, and flexible built environments.

Common Pitfalls Sourcing Ceiling Grid Systems (Quality, IP)

Sourcing ceiling grid systems involves more than just selecting a product based on price or availability. Overlooking key quality and intellectual property (IP) considerations can lead to performance issues, legal risks, and long-term cost overruns. Below are common pitfalls to avoid:

Poor Material Quality and Finish

Low-cost ceiling grid systems may use substandard steel with inadequate zinc coating, leading to rust, warping, or reduced load-bearing capacity. Inferior paint or powder coatings can chip or discolor over time, affecting aesthetics and durability—especially in high-humidity environments.

Lack of Compliance with Industry Standards

Some suppliers offer grids that do not meet ASTM C635 or other regional performance standards for deflection, strength, and dimensional accuracy. Using non-compliant systems can compromise fire ratings, acoustic performance, and overall ceiling integrity.

Inconsistent Dimensional Tolerances

Poor manufacturing control can result in inconsistent cross-tee lengths or main runner configurations. This leads to misalignment, gaps, and difficulty during installation, increasing labor costs and project delays.

Inadequate Load Capacity for Intended Use

Standard grids may not support heavy ceiling loads such as lighting fixtures, HVAC components, or acoustic clouds. Failing to verify load ratings for specific applications can result in sagging or system failure.

Counterfeit or IP-Infringing Products

Unauthorized manufacturers may replicate patented grid designs (e.g., specific cam-lock mechanisms or suspension systems) without licensing. Purchasing such products exposes specifiers and contractors to legal liability and may void warranties or building code compliance.

Missing or Falsified Certifications

Some suppliers provide forged fire, seismic, or sustainability certifications (e.g., EPDs, HPDs). Always verify documentation directly with the manufacturer or certification body to ensure legitimacy.

Poor Compatibility with Ceiling Panels

The grid system must be compatible with the intended ceiling panels (e.g., mineral fiber, metal, or wood). Mismatched systems can cause panel droop, visible gaps, or difficulty in panel insertion and removal.

Insufficient Technical Support and Documentation

Lack of detailed installation guides, load charts, or engineering support can lead to improper installation. Reliable suppliers provide comprehensive technical resources and access to support teams.

Overlooking Long-Term Availability and Spare Parts

Choosing obscure or generic brands may result in discontinued components, making future repairs or expansions difficult. Ensure the manufacturer has a stable supply chain and long-term product availability.

Failure to Verify Manufacturer Identity and Origin

Some distributors rebrand third-party products without disclosing the actual manufacturer. This can obscure accountability for quality issues and complicate warranty claims. Always confirm the OEM and country of origin.

Avoiding these pitfalls requires due diligence: vet suppliers thoroughly, request material samples and test reports, verify IP status, and prioritize reputable manufacturers with proven track records in quality and compliance.

Logistics & Compliance Guide for Ceiling Grid Systems

This guide outlines essential logistics considerations and compliance requirements for the transportation, handling, storage, installation, and regulatory adherence of ceiling grid systems. Proper planning ensures product integrity, worker safety, and project compliance.

Product Handling and Packaging Standards

Ceiling grid components—main runners, cross tees, wall angles, and suspension hardware—are typically manufactured from galvanized steel or aluminum and must be handled with care. Products are shipped in bundled, labeled packages secured with steel or plastic banding and protected with corner boards or edge protectors. Always lift bundles using forklifts or cranes with spreader bars to prevent deformation; never drag or drop materials. Inspect packaging upon delivery for damage, which may indicate bent or compromised grid components.

Transportation and Delivery Requirements

Coordinate deliveries to align with project schedules to avoid on-site congestion. Ceiling grid systems are generally transported via flatbed or dry van trucks on pallets or in crates. Secure loads to prevent shifting during transit. Deliveries should occur during accessible hours, with designated unloading zones near the installation area. Confirm site access for large vehicles and ensure ground support (e.g., temporary mats) if necessary. Require delivery documentation including packing slips, bill of lading, and material safety data sheets (MSDS) when applicable.

On-Site Storage and Environmental Controls

Store ceiling grid materials indoors in a clean, dry, and well-ventilated area. Elevate bundles on pallets to prevent moisture absorption from concrete floors. Protect materials from exposure to rain, high humidity, or extreme temperatures, which can lead to corrosion or warping. Avoid stacking excessive weight on top of grid bundles. Keep storage areas free of construction debris and separate from high-traffic zones to reduce impact damage.

Installation Compliance and Safety Protocols

Installation must adhere to manufacturer specifications and local building codes. Workers should be trained in fall protection when working at heights and use appropriate personal protective equipment (PPE), including gloves, hard hats, and safety glasses. Follow OSHA regulations for scaffolding and aerial lift use. Ensure proper spacing and alignment per design plans, and verify compatibility with ceiling tiles and mechanical systems (e.g., HVAC, lighting). Suspended grid systems must be supported at specified intervals using approved hangers and fasteners.

Regulatory and Building Code Compliance

Ceiling grid systems must comply with applicable standards such as ASTM C635 (Standard Specification for Dimensional Accuracy of Metal Suspension Systems for Acoustical Tile and Lay-in Panels) and ASTM C636 (Standard Practice for Installation of Metal Suspension Systems for Acoustical Tile and Lay-in Panels). Fire-rated assemblies must meet requirements outlined in the International Building Code (IBC) and be installed exactly as tested in certified assemblies (e.g., UL Design Numbers). Verify local jurisdiction requirements for seismic bracing in high-risk zones per IBC and ASCE 7.

Sustainability and Material Compliance

Many ceiling grid systems are manufactured with recycled content and are fully recyclable at end-of-life. Confirm compliance with environmental standards such as LEED v4.1 for Material and Resource credits. Avoid materials containing restricted substances per RoHS or REACH regulations, especially in healthcare or sensitive environments. Request Environmental Product Declarations (EPDs) and Health Product Declarations (HPDs) when required by project specifications.

Documentation and Quality Assurance

Maintain comprehensive records including product submittals, delivery receipts, inspection reports, and as-built installation documentation. Conduct quality checks during installation to verify grid levelness, plumb, and alignment. Address non-conformances promptly per project quality control plans. Final inspections should confirm compliance with contract documents and applicable codes prior to acceptance.

Conclusion for Sourcing Ceiling Grid Systems

Sourcing the right ceiling grid system is a critical decision that impacts not only the aesthetic appeal of a space but also its functionality, acoustics, durability, and ease of maintenance. After evaluating key factors such as material quality, load capacity, acoustic performance, fire resistance, compatibility with ceiling tiles, and compliance with building codes, it becomes evident that a well-informed procurement strategy is essential.

Opting for reputable suppliers who offer industry-standard products—such as those made from galvanized or pre-galvanized steel with high corrosion resistance—ensures long-term reliability. Additionally, considering sustainable and recyclable materials supports environmental goals and contributes to green building certifications.

Cost-effectiveness should not be pursued at the expense of quality; instead, a balance must be achieved by selecting systems that offer durability, easy installation, and minimal lifecycle costs. Engaging suppliers early in the design phase can also lead to better integration with HVAC, lighting, and fire safety systems.

In conclusion, successful sourcing of ceiling grid systems requires a comprehensive approach that evaluates technical specifications, sustainability, supplier reputation, and total cost of ownership. By doing so, stakeholders can ensure a high-performing, compliant, and visually pleasing ceiling solution that meets both immediate project needs and long-term operational demands.