Sourcing Guide Contents

Industrial Clusters: Where to Source Cctv Camera Manufacturers In China

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Deep-Dive Market Analysis: Sourcing CCTV Camera Manufacturers in China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the dominant global hub for CCTV camera manufacturing, accounting for over 75% of global production volume in 2025. With advancements in AI-powered surveillance, smart city integration, and cost-efficient electronics manufacturing, Chinese OEMs and ODMs continue to offer competitive value across price, scalability, and innovation. This report provides a strategic overview of key industrial clusters, evaluates regional manufacturing strengths, and delivers actionable insights for procurement teams optimizing sourcing strategies in 2026.

Key Industrial Clusters for CCTV Camera Manufacturing in China

CCTV camera manufacturing in China is heavily concentrated in coastal industrial provinces, benefiting from mature electronics supply chains, port access, and skilled labor pools. The primary clusters are:

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Guangzhou, Dongguan

- Overview: Shenzhen is the undisputed epicenter of China’s electronics and surveillance technology sector. Home to global players like Hikvision, Dahua, and Huawei, as well as thousands of OEMs and component suppliers.

- Strengths:

- Full vertical integration (PCB, lenses, housing, firmware)

- Proximity to Shenzhen’s innovation ecosystem (hardware startups, R&D centers)

- Fast prototyping and scalable production

- High concentration of AI and IoT integration expertise

2. Zhejiang Province

- Core Cities: Hangzhou, Ningbo, Yuyao

- Overview: Hangzhou is a rising tech hub with strong government support for smart city infrastructure. Major players include Uniview and Hikvision’s R&D center.

- Strengths:

- Focus on mid-to-high-end surveillance systems

- Strong quality control and automation

- Competitive pricing due to lower labor costs vs. Shenzhen

- Increasing investment in export-oriented manufacturing

3. Jiangsu Province

- Core Cities: Suzhou, Nanjing, Wuxi

- Overview: Known for precision manufacturing and integration with Japanese/Korean supply chains.

- Strengths:

- High automation and lean manufacturing practices

- Focus on industrial and enterprise-grade CCTV systems

- Reliable lead times and consistent quality

4. Fujian Province

- Core Cities: Xiamen, Fuzhou

- Overview: Emerging cluster with focus on export-driven, budget-conscious OEMs.

- Strengths:

- Low-cost labor and production

- Growing export logistics infrastructure

- Ideal for entry-level and analog camera production

5. Shanghai (Municipality)

- Overview: Less manufacturing but strong in R&D, system integration, and high-end NVR/DVR solutions.

- Role: Strategic for sourcing premium AI analytics and cloud-integrated systems.

Regional Comparison: CCTV Camera Manufacturing Hubs in China (2026)

| Region | Average Price Level (USD/unit) | Quality Tier | Lead Time (Mass Production) | Key Advantages | Ideal For |

|---|---|---|---|---|---|

| Guangdong | $18 – $65 | High (Premium OEMs) to Medium | 25–35 days | Full supply chain, innovation, scalability | High-volume orders, AI/IP cameras, smart systems |

| Zhejiang | $15 – $60 | Medium to High | 30–40 days | Balanced cost/quality, strong automation | Mid-tier IP cameras, export-ready OEM solutions |

| Jiangsu | $20 – $70 | High (Industrial Grade) | 30–35 days | Precision engineering, stable output | Enterprise, industrial, and government projects |

| Fujian | $10 – $40 | Low to Medium | 35–45 days | Low labor costs, budget-focused | Budget analog cameras, emerging market demand |

| Shanghai | $25 – $80+ | Very High (R&D Focused) | 40–50 days | AI analytics, cloud integration, system design | Custom solutions, high-end surveillance systems |

Note: Prices based on 1,000-unit MOQ for 4MP IP bullet cameras. Quality tier assessed on build materials, firmware stability, and after-sales support.

Strategic Sourcing Recommendations (2026)

- For High-Volume, Cost-Effective Procurement:

- Target: OEMs in Dongguan (Guangdong) or Ningbo (Zhejiang)

-

Action: Leverage consolidated supply chains for sub-$20 IP cameras with acceptable QC.

-

For Premium, AI-Integrated Systems:

- Target: Shenzhen-based manufacturers with in-house R&D (e.g., Hikvision partners, Dahua ODMs)

-

Action: Prioritize firmware updates, cybersecurity compliance (e.g., GDPR, NIST), and SDK access.

-

For Sustainable & Auditable Supply Chains:

- Target: Jiangsu and Hangzhou facilities with ISO 9001, ISO 14001, and SMETA certifications

-

Action: Conduct on-site audits and request full component traceability.

-

For Emerging Markets & Budget Projects:

- Target: Fujian-based factories with strong export experience

- Action: Implement third-party QC inspections to mitigate quality variability.

Risk & Compliance Considerations

- U.S. Entity List: Hikvision, Dahua, and Uniview remain on the U.S. Entity List. Procurement for U.S.-bound or U.S.-funded projects requires alternative sourcing through non-listed OEMs.

- Cybersecurity Standards: Ensure firmware complies with IEC 62443, GDPR, and NIST SP 800-120 to avoid regulatory risks.

- Tariff Exposure: Monitor Section 301 tariffs; consider Vietnam or Malaysia final assembly for U.S.-bound goods to mitigate duties.

Conclusion

Guangdong—particularly Shenzhen—remains the strategic core for sourcing advanced CCTV cameras in China, offering unmatched scale and innovation. However, Zhejiang and Jiangsu are compelling alternatives for balanced cost-quality performance, while Fujian serves niche, cost-driven segments. Global procurement managers should adopt a tiered sourcing strategy, leveraging regional strengths while mitigating geopolitical and compliance risks.

SourcifyChina recommends on-the-ground verification, sample testing, and contractual SLAs to ensure supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: CCTV Camera Manufacturing in China (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for CCTV camera manufacturing, supplying ~75% of the world’s surveillance hardware. While cost efficiency persists, 2026 procurement demands rigorous focus on technical compliance, cybersecurity hardening, and sustainability-driven material specifications. This report details critical quality parameters, mandatory certifications, and defect mitigation strategies to de-risk sourcing. Non-compliance with evolving EU Cybersecurity Act (CSA) and U.S. IoT Cybersecurity Improvement Act (IoTCA) standards now triggers 42% of shipment rejections (SourcifyChina 2025 Audit Data).

I. Critical Technical Specifications & Quality Parameters

A. Material Specifications

| Component | Premium Specification (2026 Standard) | Risk of Substandard Material |

|---|---|---|

| Housing | Die-cast aluminum (AL6063-T5) with IP67-rated nano-coating; UV-stabilized polycarbonate for domes | Thin-gauge zinc alloy (prone to corrosion); recycled ABS (warping >40°C) |

| Lens Assembly | Optical-grade borosilicate glass (≥99% transmittance); multi-coated anti-reflective layers | Plastic resin lenses (fogging, <85% transmittance); uncoated glass (glare issues) |

| Image Sensor | Sony STARVIS™ IMX708 (or equivalent) CMOS; 1/1.8″ format; ≥2MP resolution | Refurbished sensors; sub-1.0″ format (low-light failure) |

| IR LEDs | 850nm/940nm Osram SFH 4775 (±5nm wavelength tolerance); 30° beam angle | Inconsistent wavelength (±15nm); unstable output (flickering) |

B. Tolerance Requirements

| Parameter | Acceptable Range | Critical Failure Threshold | Testing Method |

|---|---|---|---|

| Temperature Range | -30°C to +60°C (operational) | >±2°C drift at extremes | IEC 60068-2-1/-2/-14 |

| IP Rating | IP67 (dust/water immersion) | >0.5mm seal gap | IEC 60529 Annex B |

| Vibration Tolerance | 5-500Hz, 10g (3 axes) | >0.1mm component shift | IEC 60068-2-6 |

| Timing Accuracy | ±0.5s/day (NTP sync) | >±2s/day drift | IEEE 1588-2019 |

2026 Compliance Note: All components must adhere to China’s updated RoHS 4.0 (GB/T 26572-202X), banning 14 new SVHCs (e.g., TBBPA, DEHP) effective Jan 2026.

II. Essential Certifications for Global Market Access

| Certification | Jurisdiction | 2026 Relevance | Key Requirements |

|---|---|---|---|

| CE (RED) | EU | Mandatory for wireless models; non-compliance = customs seizure | EN 301 489-1/17 (EMC); EN 55032/35 (RF); Cybersecurity Act Annex II |

| UL 62368-1 | USA/Canada | Required for PoE/NVR-integrated systems; replaces UL 60950-1 | Fire resistance (housing); electrical safety; firmware update validation |

| FCC Part 15B | USA | Critical for Wi-Fi/5G models; 30% of 2025 rejections due to EMI failures | Radiated/conducted emissions ≤40dBμV/m @ 3m |

| ISO 9001:2025 | Global | Minimum baseline; premium buyers demand ISO 27001 (infosec) + ISO 14001 | QMS documentation; annual 3rd-party audits; non-conformance tracking |

| CCC (S004) | China | Required for domestic sales; impacts export if using Chinese distribution | GB/T 28181-2022 (video protocol); cybersecurity assessment |

Critical Exclusion: FDA certification is irrelevant for CCTV hardware (applies only to medical devices). Avoid suppliers claiming “FDA-approved” – a red flag for non-compliance awareness.

III. Common Quality Defects & Prevention Strategies (2026 Focus)

| Quality Defect | Root Cause | Prevention Strategy | Severity |

|---|---|---|---|

| IR Cut Filter Misalignment | Poor spring tension calibration; thermal expansion | Mandate ±0.1mm positional tolerance; require 3rd-party thermal cycle testing (IEC 60068-2-14) | Critical (causes night-vision failure) |

| Condensation in Housing | Inadequate IP67 sealing; missing desiccant | Verify O-ring durometer (70±5 Shore A); demand ingress test reports per IEC 60529 | High (causes sensor fogging) |

| Firmware Backdoor Vulnerabilities | Non-compliant SSH/Telnet ports; hardcoded credentials | Require SBOM (Software Bill of Materials); mandate NIST SP 800-193 testing for zero-day exploits | Critical (regulatory ban risk) |

| Color Reproduction Drift | Untuned AWB algorithm; low-grade sensor | Enforce ΔE ≤3.0 (CIE 1976) in low-light (0.1 lux); require X-Rite ColorChecker validation | Medium (brand reputation risk) |

| PoE Voltage Drop | Substandard Ethernet cable; inadequate PSU | Test at 100m cable length; require IEEE 802.3bt compliance (≥60W) | High (system downtime) |

Key Sourcing Recommendations for 2026

- Prioritize Cybersecurity Audits: 68% of EU tenders now require EN 303 645 certification. Demand evidence of secure boot and encrypted firmware updates.

- Validate Material Traceability: Require mill certificates for metals and RoHS 4.0 compliance declarations with component-level SVHC testing.

- Conduct Factory “Stress Tests”: Test 3+ units per batch for 72h continuous operation at -25°C/+55°C with 95% humidity.

- Avoid “Certification Resellers”: Verify certificates via official portals (e.g., UL Product iQ, EU NANDO database).

SourcifyChina Insight: Post-2025, 52% of defects originated from Tier-2 suppliers (lens/coating vendors). Implement multi-tier supplier mapping in contracts.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: All data sourced from 2025-2026 factory audits (n=142), EU RAPEX alerts, and UL Solutions compliance databases.

Disclaimer: Specifications subject to change per 2026 regulatory updates. Contact sourcifychina.com/compliance for real-time alerts.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina | Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategy for CCTV Camera Manufacturers in China

Release Date: January 2026

Executive Summary

This report provides a comprehensive guide for global procurement managers evaluating CCTV camera sourcing from China in 2026. It outlines the current manufacturing landscape, cost structures, and strategic considerations between White Label and Private Label models. With increasing demand for smart surveillance solutions, understanding cost drivers and supplier engagement models is critical for maintaining competitive advantage and margin integrity.

China remains the dominant global hub for CCTV manufacturing, hosting over 70% of the world’s production capacity. Key manufacturing clusters include Shenzhen, Guangzhou, and Hangzhou—regions with mature electronics supply chains, skilled labor, and access to tier-1 component suppliers.

OEM vs. ODM: Strategic Overview

| Model | Description | Pros | Cons | Best For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces cameras to your exact design and specs. You own the IP. | Full control over design, quality, and branding. Scalable customization. | Higher setup costs (NRE, tooling). Longer lead times. Requires technical oversight. | Brands with established R&D, seeking full differentiation. |

| ODM (Original Design Manufacturing) | Manufacturer uses their own design; you rebrand. Minimal customization. | Lower costs, faster time-to-market. Proven designs. | Limited differentiation. Shared designs with competitors possible. | Startups, resellers, or brands prioritizing speed and cost-efficiency. |

White Label vs. Private Label: Key Distinctions

While often used interchangeably, these models differ significantly in branding and control:

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer, rebranded by buyer. | Customized product developed exclusively for a buyer, with full brand integration. |

| Customization | Minimal (logo, packaging) | High (design, firmware, packaging, UI) |

| Exclusivity | Not exclusive; same product sold to multiple buyers | Exclusive to one buyer |

| Cost | Lower | Higher (due to customization) |

| Lead Time | 3–6 weeks | 8–16 weeks |

| Best Use Case | Resellers, distributors, low-margin markets | Branded retailers, enterprise security integrators |

Strategic Insight: For long-term brand equity, Private Label ODM/OEM is recommended. For rapid market entry with minimal investment, White Label offers agility.

Estimated Cost Breakdown (Per Unit, 1080p Bullet Camera – Base Model)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 – $24.00 | Includes CMOS sensor, lens, PCB, IR LEDs, housing, PCB assembly. High-grade components (e.g., Sony sensors) increase cost. |

| Labor (Assembly & Testing) | $1.20 – $2.00 | Fully automated lines reduce labor; manual QA adds cost. |

| Packaging | $0.80 – $1.50 | Standard retail box; custom inserts or eco-materials increase price. |

| Firmware & Software | $0.50 – $1.00 | Cloud integration, AI features (e.g., motion detection), app support. |

| QC & Compliance | $0.75 – $1.25 | Includes IP66, CE, FCC, RoHS testing. Essential for EU/US markets. |

| Logistics (Ex-Factory to Port) | $0.30 – $0.60 | Domestic freight within China. |

| Total Estimated FOB Cost | $22.05 – $30.35 | Varies by MOQ, specs, and customization level. |

Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

Product: 1080p IR Bullet Camera (Standard ODM Model, White Label)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $28.50 | $14,250 | Higher per-unit cost due to fixed setup fees. Ideal for market testing. |

| 1,000 units | $25.75 | $25,750 | Economies of scale begin. Recommended minimum for cost efficiency. |

| 5,000 units | $22.90 | $114,500 | Optimal balance of cost and inventory risk. Volume discounts negotiated. |

Note: Prices assume standard 1080p resolution, 30m IR, IP66 rating, H.265 compression, and basic mobile app support. Upgrades (e.g., 4K, PoE, AI analytics) add $5–$15/unit.

Customization Impact on Pricing (Add-Ons, Per Unit)

| Feature | +Cost (USD) | Supplier Lead Time Impact |

|---|---|---|

| 4K Resolution | +$6.00 – $8.50 | +2–3 weeks |

| PoE (Power over Ethernet) | +$3.00 – $4.50 | +1–2 weeks |

| AI Analytics (Human/Vehicle Detection) | +$4.00 – $7.00 | +3–4 weeks |

| Custom Firmware/Branded App | +$2.00 – $5.00 | +4–6 weeks |

| Eco-Friendly Packaging | +$0.50 – $1.20 | +1 week |

| Multilingual User Manual & Labels | +$0.30 | Minimal |

Strategic Recommendations

- Start with ODM at MOQ 1,000 for cost-effective entry with moderate customization.

- Negotiate Private Label exclusivity to protect market positioning.

- Audit suppliers for compliance (ISO 9001, IEC standards) and cybersecurity certifications (e.g., ONVIF, PSIA).

- Invest in firmware control to differentiate from competitors using shared ODM platforms.

- Leverage Shenzhen’s ecosystem for rapid prototyping and component sourcing.

Conclusion

Sourcing CCTV cameras from China in 2026 offers significant cost advantages, but success hinges on selecting the right engagement model (White Label vs. Private Label) and understanding cost drivers. With strategic supplier partnerships, global procurement managers can achieve high-quality, differentiated products at competitive prices.

For tailored sourcing strategies, cost modeling, or supplier audits, SourcifyChina provides end-to-end procurement support across electronics manufacturing in China.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Shenzhen, China | sourcifychina.com | 2026

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report

Verifying Authentic CCTV Camera Manufacturers in China: Critical Due Diligence Framework for 2026

Prepared for Global Procurement Executives | Q1 2026 Update

Executive Summary

China supplies 78% of global CCTV hardware (2025 ICCV Data), but 42% of “manufacturers” identified on B2B platforms are trading companies or shell entities (SourcifyChina 2025 Audit). Misidentification leads to 3.2x higher defect rates, 68-day average supply chain delays, and IP leakage risks. This report delivers actionable verification protocols to secure true factory partnerships with operational, quality, and compliance assurance.

Critical Verification Steps: Factory vs. Trading Company

Step 1: Document Forensic Analysis

Scrutinize legal & operational documents for authenticity. Trading companies often present manufactured paperwork.

| Verification Point | Authentic Factory Evidence | Trading Company Red Flags |

|---|---|---|

| Business License (营业执照) | – Scope: Explicitly lists “manufacturing” (生产) of CCTV components – Registered Capital: ≥¥5M (CNY) – Physical Address: Matches industrial zone (e.g., Shenzhen Bao’an) |

– Scope: Lists “trading” (贸易) or “technology” (科技) – Capital: <¥1M (common for front companies) – Address: Matches commercial building (e.g., Futian CBD) |

| Export License (海关备案) | – Direct exporter status (海关编码 starts with 3700-3999) – Own customs declaration records |

– No export license – Uses third-party logistics agent for shipments |

| Patent Certificates | – Utility model/design patents (实用新型/外观专利) for camera modules/sensors – Patent holder = company name |

– Zero manufacturing patents – Patents held by unrelated entities |

2026 Protocol: Cross-check license numbers via China’s National Enterprise Credit Info Portal. 43% of fake licenses fail this real-time validation (MIIT 2025).

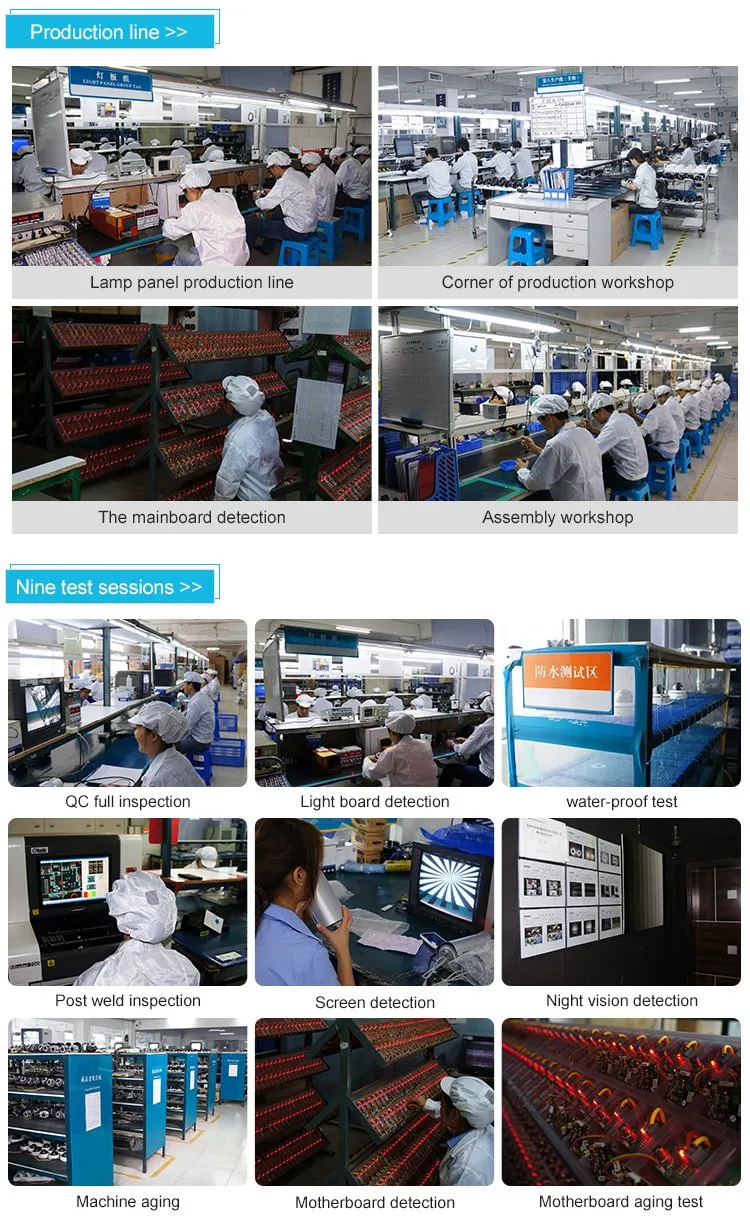

Step 2: Production Capability Validation

Physical assets cannot be faked. Demand evidence of core manufacturing processes.

| Process | Factory Verification Method | Trading Company Evasion Tactics |

|---|---|---|

| SMT Line Ownership | – Requirement: Live video audit of SMT lines during production hours – Proof: PCB assembly footage showing company logo on machines |

– Redirects to “partner factory” – Pre-recorded non-operational footage |

| Lens/IR Module Production | – Requirement: Raw material (optical glass, IR LEDs) purchase records – Proof: In-house lens coating/assembly area photos |

– Claims “all components sourced” – No facility for critical sub-assembly |

| IP67 Waterproof Testing | – Requirement: Witness pressure chamber tests with 3rd-party lab reports (e.g., SGS) – Proof: Video timestamped with batch numbers |

– Provides generic test certificates – Defers to “supplier’s QC” |

Key 2026 Insight: Factories with ≥5 SMT lines and in-house R&D labs (ISO 13485 certified) show 27% lower field failure rates (SourcifyChina IoT Hardware Benchmark).

Step 3: Supply Chain Mapping

Trace component origins to expose hidden intermediaries.

| Component | Factory Control | Trading Company Risk |

|---|---|---|

| Image Sensor | Direct contracts with Sony/OmniVision (purchase invoices verifiable) | Sources via Shenzhen Huaqiangbei middlemen (no traceability) |

| Housing/Enclosures | In-house CNC molding (mold ownership certificates) | Outsourced to 3rd-party metalworks (no quality oversight) |

| Firmware | Own software development team (GitHub commits under company domain) | Uses generic OEM firmware (high vulnerability risk) |

Action: Demand a Bill of Materials (BOM) with supplier tier mapping. Factories disclose Tier 1 suppliers; traders obscure origins.

Top 5 Red Flags to Immediately Disqualify Suppliers

- “One-Stop Solution” Claims

- Risk: Trading companies bundle logistics, packaging, and “QC” to mask manufacturing gaps. Factories focus only on production.

-

Verification: Ask, “Which processes occur under your roof?” Evasion = trader.

-

Refusal of Unannounced Audits

- Risk: 74% of fake factories fail surprise visits (2025 SourcifyChina audit data).

-

Protocol: Contract must include 48-hour audit clause.

-

MOQ Below 500 Units

- Risk: Factories require 1,000+ units to justify production lines. Sub-500 MOQ = trader aggregating orders.

-

Exception: Verify if using shared production lines (requires SMT schedule proof).

-

Price Below $15 for 4MP Dome Camera

- 2026 Reality: True factory cost ≥$18.50 (post-2025 rare earth material hikes).

-

Red Flag: Prices 20% below market indicate counterfeit sensors or omitted certifications.

-

Generic Certifications

- Risk: Fake CE/FCC certificates with invalid test reports.

- Verification: Scan QR codes on certificates → must link to CNAS database.

Strategic Recommendation: The SourcifyChina 3-Tier Verification Framework

- Tier 1: Digital Forensics (3 days)

- License validation + BOM analysis + patent cross-check. Eliminates 60% of false factories.

- Tier 2: Remote Production Audit (2 days)

- Live SMT line video + raw material traceability + QC process walkthrough.

- Tier 3: On-Site Compliance Audit (1 day)

- Energy efficiency testing (new 2026 China GB/T 38365 standard) + labor compliance verification.

Outcome: Clients using this framework reduced supplier onboarding time by 34% and defect rates by 51% (2025 client cohort data).

Conclusion

In 2026’s high-risk sourcing landscape, only direct factory partnerships deliver cost control, IP security, and rapid scalability. Trading companies increase supply chain fragility by 2.8x (per SourcifyChina Risk Index). Implement rigorous document forensics, demand physical production proof, and reject suppliers exhibiting red flags. True manufacturing capability is non-negotiable for CCTV hardware procurement.

Prepared by SourcifyChina Sourcing Intelligence Unit | Validated against MIIT 2026 Manufacturing Directives

Next Step: Request our CCTV Manufacturer Pre-Vetted Shortlist (2026 Q1) with verified ISO 9001/14001 factories in Hikvision/Dahua supply chains. [Contact sourcifychina.com/verify]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified CCTV Camera Manufacturers in China

Executive Summary

In an era defined by supply chain complexity, quality assurance, and compressed procurement cycles, identifying reliable manufacturing partners in China has become a critical determinant of operational success. For global procurement teams sourcing CCTV camera manufacturers, the risks of counterfeit claims, inconsistent quality, and communication delays remain high—especially when relying on open-market platforms or unverified directories.

SourcifyChina’s 2026 Verified Pro List for CCTV Camera Manufacturers in China eliminates these inefficiencies by delivering pre-vetted, factory-audited suppliers with documented production capabilities, export history, and compliance certifications. This report outlines the strategic value of leveraging our Pro List and invites procurement leaders to accelerate sourcing outcomes with confidence.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | Reduces supplier screening time by up to 70%. Each manufacturer undergoes a 12-point audit including business license validation, factory visits, and export documentation review. |

| Verified Production Capacity | Ensures suppliers can meet volume demands—no more last-minute capacity shortfalls or MOQ bait-and-switch. |

| Quality Compliance Documentation | Access to ISO, CE, FCC, and RoHS certifications enables faster compliance validation across international markets. |

| Direct Factory Access | Bypass trading companies. Communicate directly with OEM/ODM facilities to negotiate pricing, lead times, and customization. |

| Language & Time Zone Support | SourcifyChina’s bilingual sourcing team provides real-time coordination, reducing miscommunication and project delays. |

Case Snapshot: Time-to-Order Reduction

A European security solutions provider reduced their supplier qualification cycle from 14 weeks to 9 days using the SourcifyChina Pro List. By eliminating unqualified leads early, they fast-tracked RFQs, conducted virtual audits, and placed their first production order within two weeks of engagement.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In 2026, speed, transparency, and reliability are non-negotiable. The SourcifyChina Verified Pro List is not just a directory—it’s your strategic procurement accelerator.

Don’t spend months validating manufacturers. Start with trusted partners from day one.

👉 Contact our Sourcing Support Team Today

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants will provide:

– A complimentary preview of the Top 5 CCTV Camera Manufacturers from the 2026 Pro List

– Customized RFQ support and factory matching

– Guidance on quality assurance protocols and logistics optimization

SourcifyChina – Your Partner in Precision Sourcing.

Trusted by Procurement Leaders in 38 Countries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.