The global excavator market is experiencing robust growth, driven by rising infrastructure development, urbanization, and increased investments in mining and construction activities. According to Mordor Intelligence, the excavator market was valued at USD 59.3 billion in 2023 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029. A significant portion of this demand is attributed to mid-sized hydraulic excavators, particularly the 20-ton class, such as the Caterpillar 320, which strikes an optimal balance between performance, fuel efficiency, and versatility across applications. As demand for reliable, high-performance machinery continues to surge, particularly in Asia-Pacific and North America, a competitive landscape of manufacturers has emerged. These companies, either original OEMs or licensed producers, leverage Caterpillar’s engineering specifications while tailoring production to regional needs. This report identifies the top four manufacturers producing Caterpillar 320-class excavators, evaluated based on production volume, global distribution reach, technological integration, and market share trends supported by industry data from Mordor Intelligence and Grand View Research.

Top 4 Caterpillar Excavator 320 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 320 Hydraulic Excavator

Domain Est. 1993

Website: cat.com

Key Highlights: Cat® 320 hydraulic trackhoe excavators offer the ideal balance of control, digging, trenching, and lifting capacity all at lower hourly operating costs….

#2 Caterpillar in China

Domain Est. 1995

Website: caterpillar.com

Key Highlights: Caterpillar core products manufactured in China include hydraulic excavators, track-type tractors, wheel loaders, soil compactors, motor graders, paving ……

#3 [PDF] Technical Specifications for 320 Hydraulic Excavator AEXQ2219

Domain Est. 2000

Website: s7d2.scene7.com

Key Highlights: Engine speed at 1,800 rpm. (1) Cat engines are compatible with diesel fuel blended with the following lower-carbon intensity fuels** up to ……

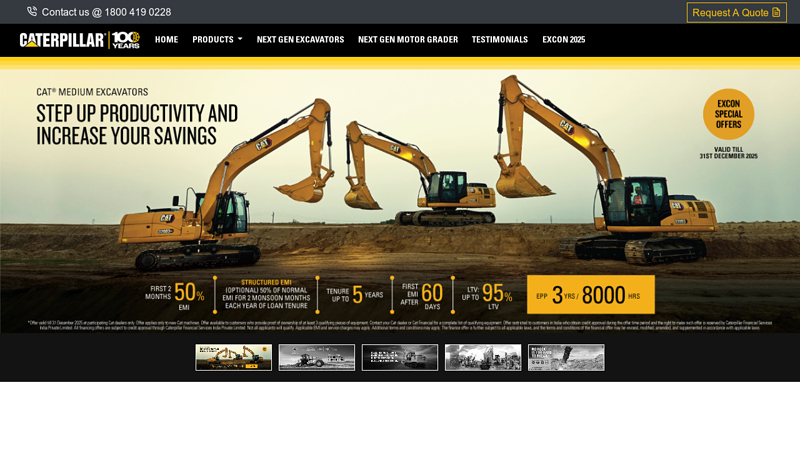

#4 Cat Machines India

Domain Est. 2015

Website: catmachine.co.in

Key Highlights: The Cat® 320D3 GC Hydraulic Excavator delivers reduced fuel consumption & lower maintenance costs, low owning costs, simpler routine maintenance, increased ……

Expert Sourcing Insights for Caterpillar Excavator 320

H2: Projected 2026 Market Trends for the Caterpillar Excavator 320

The Caterpillar 320 excavator, a staple in the mid-size hydraulic excavator segment, is expected to experience notable shifts in market dynamics by 2026 due to evolving construction demands, technological advancements, and global economic conditions. This analysis explores key trends shaping the 320 model’s market position and performance in the coming years.

-

Increased Demand for Fuel Efficiency and Emissions Compliance

By 2026, global emissions regulations—particularly in North America, Europe, and parts of Asia—are expected to tighten further. The Cat 320, already compliant with Tier 4 Final/Stage V emissions standards, will benefit from its fuel-efficient engine and hydraulic system. Buyers will increasingly favor models like the 320 that balance performance with sustainability, driving demand in environmentally conscious markets. -

Growth in Infrastructure Investment

Governments worldwide, particularly in the U.S. (via the Infrastructure Investment and Jobs Act), India, and Southeast Asia, are expected to continue or expand infrastructure spending through 2026. This sustained investment will boost demand for reliable mid-size excavators like the 320, which is well-suited for urban construction, road development, and utility projects. -

Rise of Technology Integration and Telematics

The Cat 320 already features Cat Connect technology, offering advanced telematics, remote monitoring, and predictive maintenance. By 2026, integration with AI-driven analytics and machine learning for operational optimization is expected to become standard. Contractors will prioritize equipment with connectivity features that improve uptime and reduce operating costs—areas where the 320 holds a competitive edge. -

Expansion of Rental and Used Equipment Markets

With construction firms managing capital expenditure cautiously, the rental and pre-owned equipment markets are projected to grow. The Cat 320’s reputation for durability and strong resale value will make it a top choice in both segments. OEM-certified reconditioned units and extended service packages are expected to gain traction, supported by Caterpillar’s global service network. -

Shift Toward Electrification and Hybrid Models

While the standard Cat 320 remains diesel-powered, Caterpillar is investing heavily in electrification. Although a fully electric 320 may not launch by 2026, hybrid variants or battery-assist technologies could emerge in pilot markets. Early adopters in urban or indoor applications may begin transitioning, influencing future product development. -

Supply Chain and Manufacturing Resilience

Post-pandemic supply chain adjustments and regionalization of manufacturing will impact availability. Caterpillar’s strategy to localize production (e.g., in China, Mexico, and India) will help stabilize supply of the 320 model, reducing lead times and import dependencies—key factors in maintaining market share. -

Competition from Asian OEMs

Brands like Komatsu, Volvo, and Hyundai continue to innovate in the 20-ton excavator class. However, the Cat 320’s global support infrastructure, brand loyalty, and proven reliability are expected to maintain its leadership, especially in regions with high operational demands.

Conclusion:

By 2026, the Caterpillar 320 excavator is poised to remain a leading choice in the mid-size excavator market. Its success will hinge on Caterpillar’s ability to enhance digital capabilities, support sustainability goals, and adapt to shifting ownership models. With strong fundamentals and ongoing innovation, the Cat 320 is expected to sustain robust demand across key global markets.

Common Pitfalls When Sourcing a Caterpillar Excavator 320 (Quality and Intellectual Property)

Sourcing a Caterpillar 320 Excavator—whether new, used, or via third-party suppliers—comes with significant risks, especially concerning equipment quality and intellectual property (IP) protection. Being aware of these common pitfalls can help avoid costly mistakes, operational downtime, and legal issues.

1. Purchasing Counterfeit or Replica Parts

One of the most prevalent risks in sourcing Cat 320 components is encountering counterfeit parts. These imitations often mimic genuine Caterpillar parts in appearance but fail to meet the original equipment manufacturer (OEM) standards for durability, performance, and safety.

- Quality Risks: Counterfeit hydraulic hoses, filters, engines, or electronic control modules may degrade quickly, leading to system failures, increased maintenance costs, and safety hazards.

- IP Violations: Selling or using counterfeit parts infringes on Caterpillar’s trademarks and patents, potentially exposing buyers and resellers to legal action.

Always verify part authenticity through Caterpillar’s official distribution channels or authorized dealers.

2. Buying Unauthorized or Rebadged Equipment

Some suppliers offer “Cat 320”-style excavators manufactured by third parties under different brand names or unlicensed rebadged versions. These machines may look similar but lack Caterpillar engineering, support, and warranties.

- Performance & Reliability Issues: Non-genuine machines often use inferior materials and design, resulting in higher fuel consumption, reduced uptime, and shorter lifespan.

- IP and Legal Exposure: Distributing or claiming ownership of equipment using Caterpillar’s branding without authorization violates intellectual property rights and can lead to cease-and-desist orders or lawsuits.

Ensure any equipment is sourced directly from Caterpillar or an authorized dealer with verifiable documentation.

3. Lack of Proper Documentation and Service History

When sourcing used Cat 320 excavators, incomplete or falsified service records are a major red flag.

- Hidden Mechanical Issues: Without accurate maintenance logs, buyers risk acquiring machines with worn undercarriages, rebuilt engines, or undiagnosed hydraulic problems.

- Verification Challenges: Genuine Caterpillar machines have serial numbers tied to Caterpillar’s global database (Cat Product Link™). Falsifying these records may involve tampering, which is both a fraud and IP integrity issue.

Always request and verify machine history reports through Cat dealers or third-party verification services.

4. Sourcing from Unverified or Grey Market Suppliers

Purchasing from brokers, online marketplaces, or international sellers not affiliated with Caterpillar increases exposure to fraud and substandard equipment.

- No Warranty or Support: Grey market machines often lack valid warranties and access to Cat’s global service network.

- Potential IP Infringement: Some grey market operators may modify or clone electronic control units (ECUs), violating Caterpillar’s software copyrights and anti-tampering protections.

Stick to authorized dealers or Caterpillar-certified resellers to ensure compliance and supportability.

5. Ignoring Software and Digital IP Rights

Modern Cat 320 models include proprietary software for machine monitoring, diagnostics (via Cat ET or VisionLink), and performance optimization.

- Unauthorized Software Use: Installing pirated or hacked versions of Cat software to bypass maintenance alerts or unlock features violates licensing agreements and IP laws.

- Security and Compliance Risks: Tampering with embedded software can compromise machine safety, void warranties, and expose operators to cybersecurity threats.

Always use genuine Cat diagnostic tools and software obtained through official channels.

6. Overlooking Aftermarket Modifications That Compromise IP

Third-party upgrades—such as non-Cat GPS systems, performance tuners, or hydraulic add-ons—may seem cost-effective but can conflict with OEM systems.

- Voided Warranties: Unauthorized modifications often void existing warranties.

- Infringement Concerns: Reverse engineering or cloning Cat’s integrated systems (e.g., Grade Control) may infringe on patents and copyrighted technology.

Consult with Caterpillar or authorized partners before installing any aftermarket systems.

Conclusion

Sourcing a Caterpillar 320 Excavator requires diligence to avoid quality compromises and IP violations. Prioritize authorized channels, verify documentation, and respect OEM intellectual property to ensure long-term reliability, legal compliance, and optimal performance.

Logistics & Compliance Guide for Caterpillar Excavator 320

Overview

The Caterpillar 320 Excavator is a widely used mid-sized hydraulic excavator in construction and excavation projects. Proper logistics planning and regulatory compliance are essential for its safe, legal, and efficient transport and operation. This guide outlines key considerations for moving and using the Cat 320 in compliance with international, national, and regional standards.

Equipment Specifications

- Model: Caterpillar 320 (e.g., 320, 320 GC, 320 GC XHP)

- Operating Weight: 21,000–23,000 kg (varies by configuration)

- Length: ~9.8 m (with blade and arm retracted)

- Width: ~3.0 m (transport width)

- Height: ~3.2 m (canopy) to ~3.4 m (ROPS)

- Transport Dimensions: Confirm exact specs per configuration before shipment

Transportation Logistics

Pre-Shipment Planning

- Verify route restrictions (bridge weight limits, low clearances, road width)

- Obtain necessary permits for oversized/overweight loads

- Confirm transport method: flatbed trailer, lowboy, or RORO (for international)

- Secure certified heavy haul transporters with experience in construction equipment

Loading & Securing

- Use ramps with adequate load rating and angle ≤ 15°

- Excavator must be clean, with bucket curled and boom lowered

- Secure with minimum four (4) rated tie-down straps or chains (front and rear)

- Chock tracks and ensure parking brake is engaged

- Disconnect battery if required for long transit

Domestic & International Shipping

- Domestic (U.S./Canada): Comply with FMCSA and provincial regulations; permit lead times vary

- International: Prepare ISPM-15 compliant wooden crating (if applicable), bill of lading, commercial invoice, and certificate of origin

- For sea freight, use approved containers or RORO services with proper lashing

Regulatory Compliance

Environmental Regulations

- Ensure machine meets local emission standards (e.g., Tier 4 Final in U.S./EU)

- Confirm validity of EPA or EU Stage V certification

- Maintain records of emissions compliance and DPF/SCR system servicing

Safety Standards

- Equipment must comply with OSHA (U.S.), WHMIS (Canada), or equivalent local safety codes

- Operator must have valid certification (e.g., OSHA 1926.602, CPCS, or equivalent)

- Use only approved lifting points if hoisting

Import/Export Compliance

- Check HTS codes (e.g., 8429.52.00 for hydraulic excavators in U.S.)

- Comply with customs documentation: commercial invoice, packing list, CoO, import permits

- Be aware of anti-dumping or countervailing duties in certain jurisdictions

Operator & Site Compliance

Operator Requirements

- Valid heavy equipment operator license or certification

- Familiarity with Cat 320 operator manual and safety protocols

- Site-specific training if working in confined or hazardous areas

On-Site Operation

- Conduct pre-shift inspections (fluids, tracks, lights, alarms)

- Use machine only on stable ground with proper slope assessment

- Follow lockout/tagout (LOTO) procedures during maintenance

Maintenance & Documentation

Required Records

- Service logs and maintenance history

- Proof of ownership (title or bill of sale)

- Transport permits and customs documents (for cross-border moves)

Routine Compliance Checks

- Verify hydraulic fluid and fuel meet environmental standards

- Inspect for leaks, structural cracks, or worn components

- Update GPS/tracking data if equipped (for fleet compliance)

Emergency & Incident Response

Reporting Obligations

- Report accidents or environmental spills per local regulations (e.g., EPA, OSHA, Environment Canada)

- Maintain incident logs and cooperate with investigations

Contingency Planning

- Have emergency shutdown procedures posted

- Ensure operators know emergency contact numbers and spill response kits are available

Conclusion

Transporting and operating the Caterpillar 320 Excavator requires strict adherence to logistics best practices and regulatory standards. Proactive planning, accurate documentation, and trained personnel ensure safety, avoid fines, and maintain operational continuity. Always consult local authorities and Caterpillar documentation for model-specific and region-specific requirements.

Conclusion for Sourcing Caterpillar Excavator 320

Sourcing a Caterpillar 320 excavator requires a strategic approach that balances cost, condition, availability, and long-term operational needs. Whether purchasing new or used, the Cat 320 model offers proven reliability, strong performance, and excellent support through Caterpillar’s global dealer network. Key considerations in the sourcing process include evaluating machine specifications (such as the 320 GC, 320, or 320 XE variants), verifying service history, assessing warranty and after-sales support, and comparing total cost of ownership.

Opting for authorized dealers ensures authenticity, access to genuine parts, and comprehensive service packages, while the used market may offer cost savings but requires thorough inspection and ideally a Cat Certified pre-owned unit. Additionally, considering regional availability, emissions compliance, and financing options can further optimize the sourcing decision.

Ultimately, sourcing a Caterpillar 320 excavator should align with project requirements, operational efficiency goals, and budget constraints. With due diligence and proper planning, the Cat 320 remains a sound investment for construction, mining, and infrastructure applications, delivering durability, productivity, and strong resale value.

![[PDF] Technical Specifications for 320 Hydraulic Excavator AEXQ2219](https://www.sohoinchina.com/wp-content/uploads/2026/01/pdf-technical-specifications-for-320-hydraulic-excavator-aexq2219-526.jpg)