The global construction equipment manufacturing market is experiencing robust growth, driven by rising infrastructure investments, urbanization, and public-private development projects—particularly across Asia-Pacific, the Middle East, and North America. According to Grand View Research, the global construction equipment market size was valued at USD 184.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. Within this landscape, excavators remain a cornerstone segment, with models like the Caterpillar 326 representing a benchmark for performance, durability, and technological integration.

As demand for high-efficiency, fuel-optimized excavators grows, a number of manufacturers have risen to meet—and in some cases exceed—Caterpillar’s engineering standards. These companies not only produce machines compatible with or competitive to the Cat 326 but also leverage advancements in telematics, emissions control, and hydraulics to capture market share. Driven by data from industry leaders like Grand View Research and Mordor Intelligence, which project sustained expansion in equipment demand through 2030, this report identifies the top 7 manufacturers producing machines that stand toe-to-toe with the Caterpillar 326 in both operational capability and reliability.

Top 7 Caterpillar 326 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

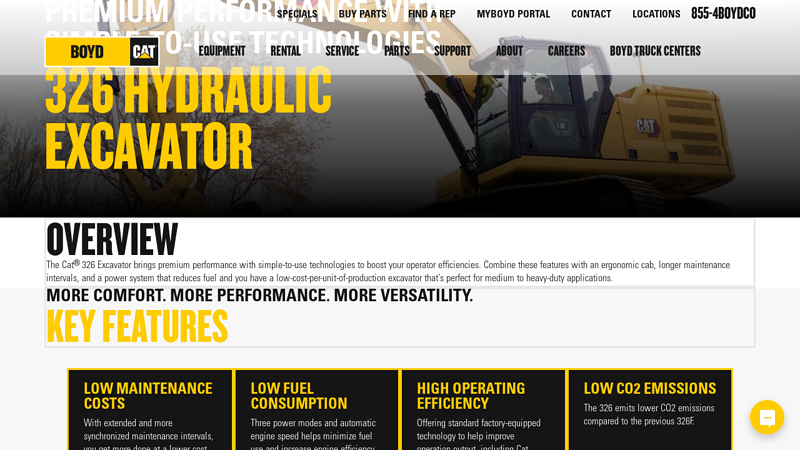

#1 326 Hydraulic Excavator

Domain Est. 2012

Website: boydcat.com

Key Highlights: Offering standard factory-equipped technology to help improve operation output, including Cat Grade with 2D, Grade with Assist and Payload. Low CO2 Emissions….

#2 326 Hydraulic Excavator

Domain Est. 1993

Website: cat.com

Key Highlights: Cat® 326 hydraulic trackhoe excavators offer the ideal balance of control, digging, trenching, and lifting capacity all at lower hourly operating costs….

#3 [PDF] Cat® 326

Domain Est. 2000

Website: s7d2.scene7.com

Key Highlights: The Cat® 326 Excavator brings premium performance with simple-to-use technologies like Cat GRADE with 2D, Grade Assist, and Payload – all standard equipment ……

#4 326 Hydraulic Excavator

Domain Est. 2003

Website: miltoncat.com

Key Highlights: Product Description. The Cat® 326 Excavator brings premium performance with simple-to-use technologies to boost your operator efficiencies….

#5 Caterpillar unveil Next Generation 326 excavator

Domain Est. 2006

Website: agg-net.com

Key Highlights: The new high-performance Caterpillar 326 excavator, with its integrated, simple-to-use technologies, is said to boost operating efficiencies by up to 45% ……

#6 CAT Next Generation CAT®326 GC Hydraulic excavator

Domain Est. 2018

Website: product.global-ce.com

Key Highlights: This excavator has a maximum of 52°C(125°F)Ambient capability to work under temperature conditions as well as at the lowest –18°C(0°F)Cold start capability….

#7 Cat 326

Domain Est. 2024

Website: zeppelin-cat.no

Key Highlights: About the Cat 326. The Cat® 326 Excavator brings premium performance with simple-to-use technologies to boost your operator efficiencies….

Expert Sourcing Insights for Caterpillar 326

H2: Caterpillar 326 Market Trends Outlook for 2026

As the construction and mining sectors continue to evolve, the market for heavy equipment like the Caterpillar 326 excavator is expected to experience notable shifts by 2026. The Caterpillar 326, a 26-ton class hydraulic excavator known for its fuel efficiency, durability, and advanced hydraulics, remains a staple in medium-scale construction, demolition, and infrastructure projects globally. Several key trends are shaping its market trajectory in the second half (H2) of 2026:

-

Increased Demand in Emerging Markets

Infrastructure development across Asia-Pacific (especially India, Indonesia, and Vietnam), the Middle East, and parts of Africa is driving strong demand for reliable mid-sized excavators like the Cat 326. Governments investing in urbanization, transportation networks, and energy projects are prioritizing machinery that balances performance and operating cost—key attributes of the 326 model. -

Shift Toward Fuel Efficiency and Emissions Compliance

With tightening environmental regulations—particularly in North America and Europe—operators are favoring Tier 4 Final/Stage V-compliant machines. The Cat 326, equipped with Cat C7.1 engines meeting these standards, is well-positioned in markets emphasizing sustainability. Additionally, rising fuel costs are amplifying demand for fuel-efficient models, further boosting the 326’s appeal. -

Growth in Rental and Fleet Utilization

The equipment rental market is expanding, especially in North America and Western Europe. Contractors are increasingly opting to rent rather than buy, favoring versatile machines like the Cat 326 for short- to medium-term projects. Rental fleets are expected to upgrade to newer, tech-enabled models, increasing deployment of the 326 in 2026. -

Technology Integration and Connectivity

By H2 2026, demand for telematics and machine health monitoring is rising. The Cat 326’s integration with Cat Connect technologies—such as VisionLink, Grade with Assist, and payload estimation—adds significant value for operators seeking improved productivity, reduced downtime, and remote diagnostics. This technological edge supports premium pricing and brand loyalty. -

Competition and Market Pressure

The Cat 326 faces growing competition from models like Komatsu PC210, Hitachi ZX250, and Volvo EC250. However, Caterpillar’s global service network, parts availability, and strong resale value continue to give it a competitive advantage, particularly in regions where uptime and support are critical. -

Used Equipment Market Dynamics

With new machine prices rising due to supply chain and material costs, the pre-owned market for Cat 326s is expected to remain robust in 2026. Well-maintained used units are in high demand, especially in cost-sensitive markets, contributing to the model’s long-term market presence.

Conclusion:

In H2 2026, the Caterpillar 326 is projected to maintain strong market relevance, supported by global infrastructure growth, environmental regulations, digital integration, and Caterpillar’s service ecosystem. While competitive pressures persist, the 326’s balance of power, efficiency, and technology ensures it remains a preferred choice across diverse applications and geographies.

Common Pitfalls When Sourcing Caterpillar 326 Excavators: Quality and Intellectual Property Concerns

Sourcing a Caterpillar 326 hydraulic excavator—whether new, used, or through third-party channels—can be fraught with risks related to quality and intellectual property (IP). Being aware of these pitfalls is crucial for ensuring you receive a reliable machine and avoid legal or financial repercussions.

Inadequate Verification of Machine Authenticity

One of the most significant risks is unintentionally purchasing a counterfeit or rebranded unit. While full replicas of large machinery like the 326 are rare, fraudulent practices include cloning serial numbers, using fake Cat badges, or misrepresenting rebuilt or grey-market machines as genuine Caterpillar products. Buyers who fail to verify the machine’s VIN, service history, and factory specifications may end up with equipment that lacks performance consistency or manufacturer support.

Poor Maintenance History and Hidden Damage

Used Cat 326 excavators are popular in secondary markets, but incomplete or falsified maintenance records are common. Critical issues such as engine wear, hydraulic leaks, undercarriage degradation, or structural fatigue may be concealed during inspections. Without a thorough third-party inspection or access to Cat’s Product Link™ data, buyers risk acquiring a machine with a shortened service life and high repair costs.

Use of Non-OEM or Counterfeit Replacement Parts

Aftermarket or counterfeit parts—especially in the hydraulic system, engine, and electronics—are frequently used during repairs or rebuilds. These components may appear identical but fail to meet Caterpillar’s engineering standards, leading to reduced reliability, increased downtime, and potential safety hazards. Using non-OEM parts can also void warranties and service agreements with authorized dealers.

Grey Market Imports and Warranty Limitations

Purchasing a Cat 326 from unauthorized international dealers or grey market sources may offer lower prices, but often comes with significant drawbacks. These machines may not meet local emissions or safety regulations (e.g., Tier 4 Final compliance), and Caterpillar typically refuses warranty coverage or technical support for units not distributed through official channels. This exposes buyers to compliance risks and long-term service challenges.

Intellectual Property Infringement in Rebuilds and Replicas

Some third-party rebuilders or suppliers may infringe on Caterpillar’s intellectual property by copying proprietary designs, software, or control systems. For example, unauthorized duplication of Cat’s advanced hydraulics or electronic control modules (ECMs) can lead to performance issues and expose the buyer to legal liability. Caterpillar actively enforces its IP rights, and buyers of infringing equipment may face cease-and-desist orders or fines.

Lack of Access to Genuine Software and Diagnostics

Caterpillar machines rely on proprietary software for diagnostics, calibration, and performance optimization. Unauthorized sellers or rebuilders may use pirated or modified software to bypass system locks, which compromises machine integrity and security. Without genuine Cat ET (Electronic Technician) tools and software access, owners face difficulties in performing routine diagnostics or updates, reducing machine uptime and resale value.

Conclusion

To avoid these pitfalls, always source Cat 326 excavators through authorized dealers, conduct independent inspections, verify machine history via Cat’s online platforms, and insist on genuine OEM parts and documentation. Due diligence protects both the quality of your investment and your compliance with intellectual property regulations.

Logistics & Compliance Guide for Caterpillar 326

Equipment Overview

The Caterpillar 326 is a hydraulic excavator designed for heavy-duty construction, mining, and excavation tasks. Proper logistics planning and regulatory compliance are essential for its safe and legal transport and operation.

Transportation Planning

Ensure route assessment includes bridge weight limits, road classifications, and overhead clearance. The Caterpillar 326 typically weighs between 26–28 metric tons depending on configuration. Use a lowboy or step-deck trailer with proper securing points. Confirm transport permits are obtained for oversize/overweight loads as required by local jurisdictions.

Load Securing Requirements

Secure the excavator using certified chains or straps rated for its weight. Minimum four tie-down points (two per track) with load binders or ratchet tensioners. Ensure boom and arm are fully retracted and bucket stowed. Install travel locks if available. Conduct a pre-transport inspection to verify all restraints are properly tensioned.

Regulatory Compliance

Comply with local, national, and international transport regulations such as FMCSA (U.S.), ADR (Europe), or equivalent standards. Verify required documentation including equipment registration, transport permits, and insurance. Adhere to working hour regulations for operators during delivery and setup.

Environmental & Safety Standards

Transport and operate the Caterpillar 326 in accordance with environmental regulations, including emissions standards (e.g., Tier 4 Final compliance). Ensure machine has valid noise certification and fluid containment measures are in place. Operators must hold valid certifications (e.g., OSHA or equivalent) and follow site-specific safety protocols.

Import/Export Documentation (International Shipments)

For cross-border movement, provide a commercial invoice, bill of lading, packing list, and certificate of origin. Confirm adherence to customs requirements and verify if the machine meets destination country emissions and safety standards. Arrange for customs brokerage if necessary.

On-Site Compliance

Upon delivery, perform a safety inspection before operation. Ensure all warning decals and compliance labels (CE, ANSI, etc.) are present and legible. Maintain records of maintenance, inspections, and operator training as required by local occupational safety authorities.

Contact & Support

For compliance queries or logistical support, contact Caterpillar Customer Service or your local Cat dealer. Refer to machine manual (SEBU8430 or latest revision) for technical specifications and compliance details.

Conclusion for Sourcing Caterpillar 326 Excavator

Sourcing a Caterpillar 326 excavator presents a strategic opportunity for operations requiring high performance, durability, and reliability in medium to heavy-duty excavation tasks. Known for its fuel efficiency, advanced hydraulic system, and operator comfort, the Cat 326 offers a strong return on investment, especially in construction, mining, and infrastructure development.

When sourcing this machine, it is essential to consider key factors such as model year, hours of operation, maintenance history, and emission standards (e.g., Tier 4 compliance). Purchasing from authorized Caterpillar dealers or certified pre-owned programs ensures authenticity, access to warranty options, and comprehensive technical support. Alternatively, the used equipment market can offer cost-effective solutions, provided due diligence is conducted through inspections, verification of ownership, and performance testing.

Financing options, availability of spare parts, and after-sales service should also influence the sourcing decision. Given the global presence of Caterpillar, support networks are typically robust, minimizing downtime and maintenance costs.

In conclusion, sourcing a Caterpillar 326—whether new or used—should align with operational needs, budget constraints, and long-term equipment strategy. With proper evaluation and supplier selection, the Cat 326 stands out as a reliable, efficient, and valuable asset that enhances productivity and project success.

![[PDF] Cat® 326](https://www.sohoinchina.com/wp-content/uploads/2026/01/pdf-cat-326-579.jpg)