The global Ethernet cable market is experiencing steady growth, driven by increasing demand for high-speed data transmission across data centers, enterprise networks, and smart infrastructure. According to Grand View Research, the global Ethernet cable market size was valued at USD 7.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. A key driver behind this expansion is the rising adoption of advanced cabling solutions capable of supporting bandwidth-intensive applications such as 10GbE, 4K/8K video streaming, and next-generation Wi-Fi standards. Category 9 (Cat9) cables, offering performance up to 2 GHz and speeds of 10 Gbps with enhanced noise resistance and shielding, are emerging as a future-ready solution in this evolving landscape. As deployment of smart buildings and industrial IoT accelerates, demand for reliable, high-performance cabling is pushing manufacturers to innovate. Based on market presence, technical capabilities, and product reach, the following seven companies stand out as leading Cat9 cable manufacturers shaping the future of connectivity.

Top 7 Cat9 Cable Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 China cat 9 ethernet cable Manufacturers Factory Suppliers

Domain Est. 2022

Website: cat6acabling.com

Key Highlights: GUANYANG is one of the most professional cat6a cable manufacturers and suppliers in China. If you’re going to buy or wholesale high quality cat6a cable with ……

#2 Ethernet Cables Explained

Domain Est. 1996

Website: tripplite.eaton.com

Key Highlights: Network cables are divided into categories based mainly on bandwidth (measured in MHz), maximum data rate (measured in megabits per second) and shielding….

#3 Ethernet Cable Types

Domain Est. 1998

Website: netally.com

Key Highlights: Confused by Cat5e vs Cat6 vs Cat8? Our complete guide breaks down ethernet cable types, categories, speeds, and applications….

#4 CAT5E, CAT6, CAT7, CAT8: Which To Choose?

Domain Est. 2001

Website: telco-data.com

Key Highlights: Take a look at the differences between CAT5E, CAT6, CAT7, AND CAT8 cables. Telco Data is here to help you with any of your structured cabling needs….

#5 When Will Cat9 or CAT10 Ethernet Cables be Available?

Domain Est. 2006

Website: satmaximum.com

Key Highlights: The short answer is both ethernet cables (CAT9 and CAT10) are unavailable at the moment. However, the latest CAT8 cable operates with power frequencies on 2000 ……

#6 Does cat 9 cable exist?

Domain Est. 2021

Website: uk.genuinemodules.com

Key Highlights: As of my knowledge cutoff in October 2023, there is no officially recognized “Cat 9” Ethernet cable standard….

#7 When will Cat 9 Ethernet cable be available?

Domain Est. 2023

Website: romtronic.com

Key Highlights: As of mid-2025, Cat 9 cables remain just a concept, not a product that can be purchased. In fact, industry standards only define Ethernet ……

Expert Sourcing Insights for Cat9 Cable

H2: Projected 2026 Market Trends for Cat9 Cable

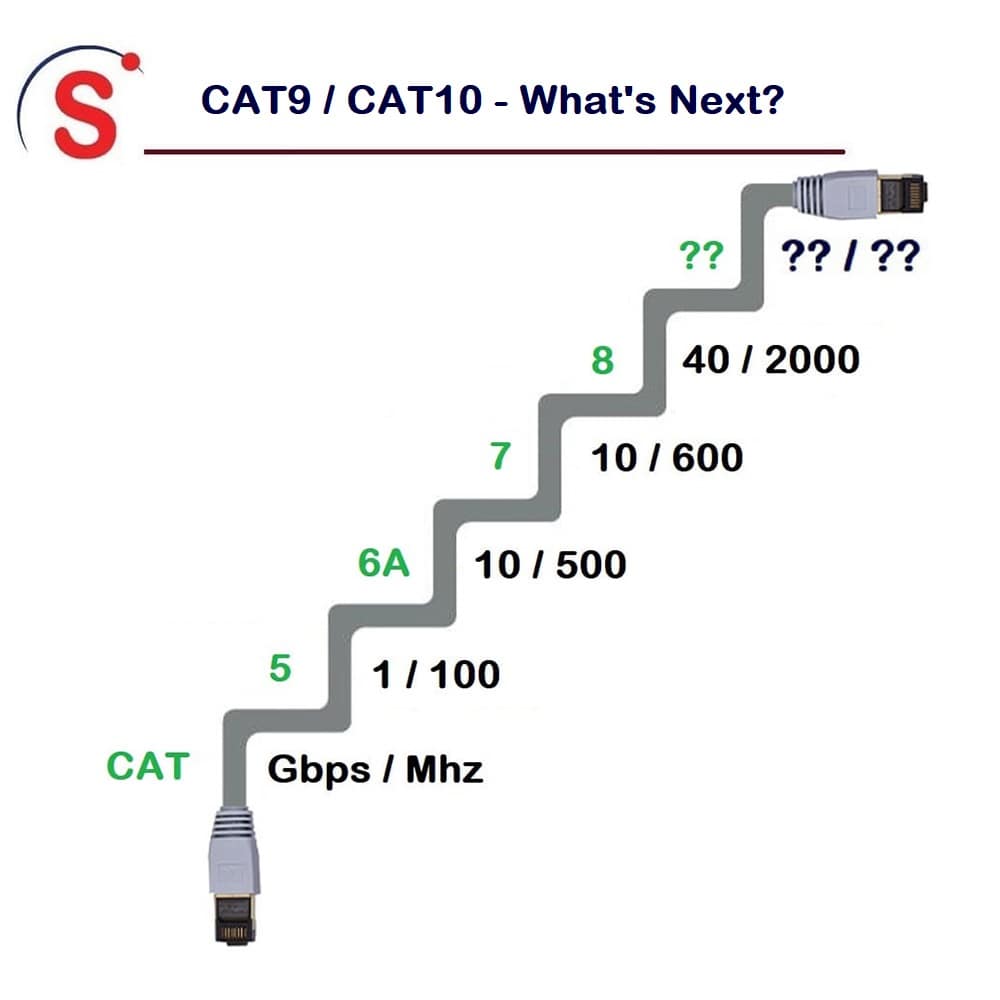

While Cat9 cable is often discussed in networking circles, it’s crucial to clarify a significant market reality: as of 2024, Cat9 cable is not an officially recognized or standardized category by the Telecommunications Industry Association (TIA) or the International Organization for Standardization (ISO). The current highest standardized category is Cat8, defined for 25/40 Gigabit Ethernet up to 30 meters over balanced twisted-pair copper cabling.

Therefore, analyzing “Cat9” market trends for 2026 requires interpreting the term in the context of emerging high-performance cabling solutions that vendors might market under names like “Cat9” to signify capabilities beyond Cat6a and approaching or exceeding Cat8 performance, even without formal standardization. Based on this understanding, here are the projected market trends for such next-generation cabling solutions in 2026:

-

Focus on Enhanced Performance & Bandwidth (Beyond 2 GHz):

- Trend: The primary driver will be the demand for cabling supporting bandwidths significantly exceeding the 500 MHz (Cat6a) and 2000 MHz (Cat8) limits. Solutions marketed as “Cat9” are expected to target frequencies of 2.5 GHz, 3 GHz, or higher.

- Drivers: Anticipation of future 50G, 100G, and even 200G Ethernet over shorter copper links (e.g., data center top-of-rack, high-performance workstations), immersive technologies (8K+ video, VR/AR workspaces), and increasingly dense IoT deployments requiring high aggregate bandwidth.

- 2026 Outlook: Early adopters in specialized high-performance computing (HPC), financial trading, and cutting-edge AV/IT convergence environments will begin evaluating and deploying these ultra-high-frequency solutions. Widespread adoption in mainstream enterprise will likely remain limited due to cost and the dominance of fiber for longer/higher-speed runs.

-

Blurring Lines Between Copper and Fiber; Copper’s Niche Refinement:

- Trend: “Cat9” solutions will not replace fiber for long-haul or highest-speed backbones. Instead, they will aim to extend the practical reach and cost-effectiveness of high-speed copper for specific, short-reach applications where fiber installation is complex or cost-prohibitive (e.g., within racks, between adjacent racks, high-speed workstation connections).

- 2026 Outlook: The market will see a clearer segmentation: Fiber dominates core/backbone and >30m high-speed links; Cat8 remains the standard for 25/40G up to 30m; “Cat9”-like cabling targets applications needing >40G potential or extreme resilience/redundancy over very short distances (e.g., <15m) where its potential advantages in power delivery (PoE) or EMI resilience might be leveraged.

-

Increased Emphasis on Shielding and Signal Integrity:

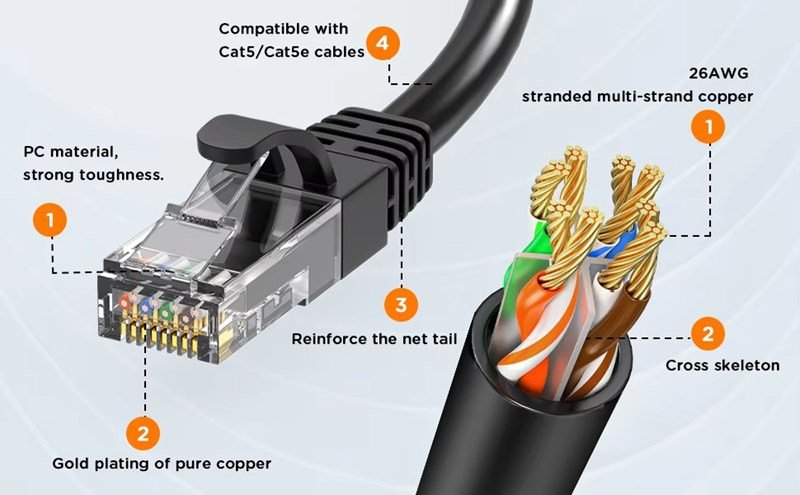

- Trend: Achieving multi-GHz performance over twisted pair requires exceptional shielding (likely S/FTP or F/FTP – shielded individual pairs and overall shield) and advanced manufacturing techniques to minimize crosstalk (alien crosstalk – ANEXT) and signal attenuation.

- 2026 Outlook: Cables marketed as “Cat9” will be inherently shielded, demanding meticulous installation practices (proper grounding, avoiding tight bends, separation from power cables). Products focusing on superior ANEXT performance and stability under real-world conditions will gain traction.

-

Vendor-Driven Marketing and Lack of Standardization:

- Trend: The term “Cat9” will remain a marketing label used by various manufacturers to differentiate their highest-performing, non-standardized copper products. Performance claims (bandwidth, distance support) will vary significantly between vendors.

- 2026 Outlook: This lack of standardization will create market confusion. Buyers will need to scrutinize detailed specifications (frequency, attenuation, ACR-N, ACR-F, shielding type, PoE support) rather than relying solely on the “Cat9” label. Interoperability testing between different vendors’ “Cat9” products will be essential but potentially challenging.

-

Niche Adoption and High Costs:

- Trend: These ultra-high-performance cabling solutions will command a significant price premium over Cat6a and Cat8.

- 2026 Outlook: Adoption will be highly niche, concentrated in specific verticals:

- Data Centers: For specific high-speed server-to-TOR switch connections where fiber SFP+ modules are undesirable.

- Broadcast & Media Production: For uncompressed 8K/16K video over copper.

- High-Performance Workstations: Connecting workstations to storage or rendering farms.

- Financial Trading: Ultra-low latency requirements in co-location facilities.

- Mainstream office and residential deployments will overwhelmingly stick with Cat6a or Cat8 where needed.

-

Potential Catalyst: Formal Standardization Efforts (Emerging):

- Trend: Industry bodies like TIA TR-42 may initiate exploratory work or draft standards for cabling supporting 50G or higher over copper beyond 30m by 2026.

- 2026 Outlook: While a formal “Cat9” standard is unlikely to be ratified by 2026, 2026 could see the publication of initial draft specifications or technical reports from TIA/ISO, providing some direction and potentially accelerating vendor alignment. This would mark a shift from pure marketing towards potential future standardization.

In Conclusion for 2026:

The “Cat9 cable” market in 2026 will be characterized by vendor-driven innovation in ultra-high-frequency, shielded copper cabling, operating in a pre-standardization phase. It will target very specific, high-value, short-reach applications demanding bandwidth beyond current Cat8 capabilities. While offering potential performance benefits, widespread adoption will be hindered by high costs, lack of standardization, significant installation complexity, and the established dominance of fiber for high-speed backbones. The term “Cat9” will remain a marketing descriptor rather than a reliable performance indicator, requiring careful due diligence from buyers. The most significant trend might be the beginning of formal industry discussions paving the way for potential future standardization post-2026.

Common Pitfalls When Sourcing Cat9 Cable: Quality and IP Concerns

Poor Quality Control and Non-Compliance with Standards

One of the most significant pitfalls when sourcing Cat9 cable is encountering substandard manufacturing. Despite claims of “Cat9” performance, no official TIA/EIA standard currently recognizes Cat9 as a ratified category. This lack of standardization opens the door for manufacturers to exaggerate performance metrics such as bandwidth (e.g., claiming 2000 MHz) or transmission speeds without third-party verification. Buyers may receive cables that fail to deliver on promised performance, leading to network instability, crosstalk, or reduced transmission distances.

Additionally, poor-quality materials—such as impure copper conductors (e.g., copper-clad aluminum instead of pure copper), inadequate shielding, or subpar jacketing—can degrade signal integrity and increase vulnerability to electromagnetic interference (EMI). These issues often only become apparent after installation, resulting in costly troubleshooting and replacements.

Misleading Marketing and IP (Intellectual Property) Risks

Another major concern is misleading branding and potential intellectual property (IP) infringement. Since “Cat9” is not an official industry designation, some suppliers use the term purely as a marketing tactic to upsell uncertified or rebranded cables. In some cases, these cables may simply be repackaged Cat6A or Cat7 cables with no real performance improvements.

Moreover, sourcing from unverified suppliers—especially through third-party marketplaces—increases the risk of purchasing counterfeit products that infringe on the trademarks or patented designs of reputable cable manufacturers. This exposes businesses to legal liability, warranty voids, and reliability issues. Without proper due diligence, companies may also inadvertently support manufacturers engaged in IP theft or unethical production practices.

To mitigate these risks, buyers should demand documentation such as test reports, compliance certifications (e.g., UL, ETL), and manufacturer traceability. Sticking with reputable vendors and avoiding “too good to be true” pricing can help ensure both quality and IP integrity.

Logistics & Compliance Guide for Cat9 Cable

Overview

Cat9 cable is a high-performance networking solution designed to support data transmission speeds of up to 40 Gbps over distances of up to 30 meters, with backward compatibility across earlier Ethernet standards. Due to its advanced specifications and specialized use cases (e.g., data centers, high-bandwidth industrial applications), its logistics and compliance requirements are more stringent than lower-category cables. This guide outlines key considerations for the safe, legal, and efficient handling, transport, and deployment of Cat9 cable.

International Shipping & Customs Compliance

- Harmonized System (HS) Code: Typically classified under HS 8544.49 (Insulated and electrically conductive wire and cable, other). Confirm country-specific classifications prior to export.

- Documentation: Include commercial invoice, packing list, and certificate of origin. For regulated markets, a conformity declaration may be required.

- Import Restrictions: Some countries impose restrictions on electronic components or require pre-clearance for high-frequency communication equipment. Verify import regulations with local customs authorities.

- RoHS & REACH Compliance: Cat9 cables must comply with EU directives on hazardous substances (RoHS 3) and chemical registration (REACH). Ensure suppliers provide compliance certificates.

Environmental & Safety Regulations

- Fire Safety Standards: Cat9 cables must meet flame-retardant standards such as:

- UL 1666 (Riser-rated cables)

- UL 910 (Plenum-rated cables – for air-handling spaces)

- IEC 60332 (Flame propagation test)

- Halogen-Free Options: For installations in confined spaces, low-smoke zero-halogen (LSZH) variants may be required to reduce toxic emissions during combustion.

- Temperature & Humidity: Store and transport cables within -20°C to +60°C; avoid prolonged exposure to moisture to prevent jacket degradation.

Packaging & Handling Requirements

- Reel & Spool Specifications: Cat9 cables are typically shipped on non-conductive, protective reels to prevent kinking and signal interference. Reels must be sealed against dust and moisture.

- Minimum Bend Radius: Maintain a minimum bend radius of 8x the cable diameter during handling to avoid damaging internal conductors or shielding.

- Labeling: Each cable and reel must be labeled with:

- Category (Cat9)

- Length

- Manufacturer & model number

- Compliance marks (e.g., UL, CE, RoHS)

- Installation rating (e.g., CMR, CMP)

Regulatory Certifications

- North America:

- UL (Underwriters Laboratories) Listed

- ETL Verified

- FCC Part 15 (EMI compliance)

- European Union:

- CE Marking (indicating conformity with health, safety, and environmental standards)

- CPR (Construction Products Regulation) for cables used in fixed installations

- Other Regions:

- CCC (China Compulsory Certification)

- KC (Korea Certification)

- RCM (Australia/New Zealand)

Installation & Field Compliance

- Shielding & Grounding: Cat9 cables are typically fully shielded (S/FTP or F/FTP). Proper grounding is essential to prevent electromagnetic interference (EMI) and ensure signal integrity.

- Pulling Tension: Limit pulling force to 25 pounds (111 N) to avoid conductor damage. Use cable lubricants rated for shielded cables.

- Separation from Power Lines: Maintain a minimum 12-inch (30 cm) separation from AC power lines to minimize crosstalk.

Storage & Shelf Life

- Indoor Storage: Store in a dry, temperature-controlled environment away from direct sunlight and chemicals.

- Shelf Life: Most Cat9 cables have a recommended shelf life of 5–10 years when stored properly. Inspect packaging and cable integrity before deployment after long-term storage.

Disposal & Recycling

- E-Waste Regulations: Cat9 cables contain copper, plastics, and shielding materials. Dispose of in accordance with local e-waste laws (e.g., WEEE Directive in the EU).

- Recycling Partners: Work with certified e-waste recyclers who can recover metals and safely process halogenated materials.

Summary

Successfully managing the logistics and compliance of Cat9 cable requires attention to international regulations, proper handling, certification standards, and environmental safety. Ensuring compliance not only avoids legal penalties but also guarantees performance and reliability in mission-critical network infrastructures. Always source Cat9 cables from reputable manufacturers with full documentation and testing certifications.

Conclusion for Sourcing Cat9 Cable:

After thorough evaluation of technical specifications, market availability, performance requirements, and cost considerations, it is important to note that Cat9 cable is not currently a standardized or commercially recognized Ethernet cabling solution as defined by IEEE or TIA/EIA standards. While the designation “Cat9” may appear in marketing materials or online listings, it often refers to non-standardized or potentially misleading labeling—possibly representing enhanced versions of Cat6a, Cat7, or shielded cables with higher shielding and performance beyond Cat6 but not officially certified as Cat9.

For high-speed network deployments requiring performance beyond 10 Gbps over copper (such as 25G or 40G), Cat6a or Cat7 cables remain the reliable and standardized choice, especially for distances up to 100 meters. In cases where higher speeds or future-proofing are critical, fiber optic solutions (such as OM4/OM5 multimode or single-mode fiber) are more appropriate and widely supported.

Therefore, sourcing “Cat9” cable is not recommended for mission-critical or standard-compliant installations. Instead, organizations should focus on purchasing certified Cat6a or Cat7 cables from reputable vendors or consider fiber optic infrastructure for next-generation speed requirements. Verifying cable certification (e.g., ANSI/TIA-568-C.2, ISO/IEC 11801) and avoiding unverified product claims will ensure network reliability, performance, and compliance with industry standards.