Sourcing Guide Contents

Industrial Clusters: Where to Source Cat Litter Manufacturers In China

SourcifyChina | B2B Sourcing Report 2026

Strategic Sourcing Analysis: Cat Litter Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China supplies ~65% of global cat litter by volume, driven by cost efficiency, raw material access, and evolving manufacturing capabilities. While historically dominated by clay-based products, demand for eco-friendly alternatives (wood, paper, tofu) is reshaping regional specialization. This report identifies key industrial clusters, quantifies regional trade-offs, and provides actionable insights for risk-mitigated sourcing in 2026. Critical Note: Raw material availability—not labor costs—now dictates cluster viability due to 2025 logistics reforms and sustainability mandates.

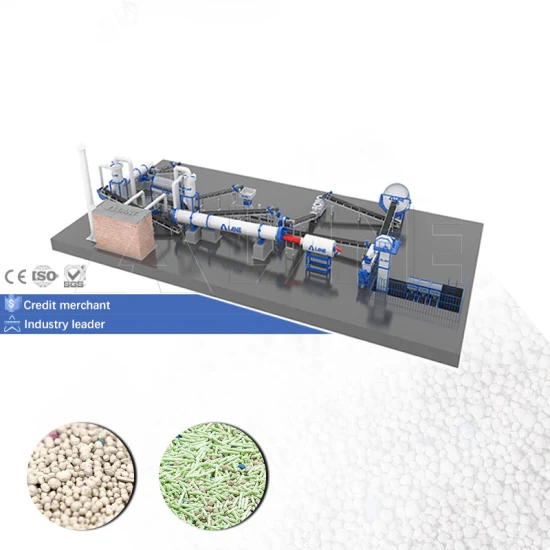

Key Industrial Clusters: Geography & Specialization

China’s cat litter production is concentrated in three primary clusters, each defined by raw material access, infrastructure, and product specialization:

| Region | Core Provinces/Cities | Dominant Material Types | Strategic Rationale |

|---|---|---|---|

| Northern Cluster | Hebei (Xingtai, Baoding), Shanxi | Bentonite Clay (90%+), Silica Gel | Proximity to 70% of China’s bentonite mines; lower land/energy costs; mature clay processing. |

| Eastern Cluster | Zhejiang (Jinhua, Huzhou), Jiangsu (Suzhou) | Wood Pellets, Paper, Tofu, Recycled Fiber | Access to bamboo/forestry resources; advanced eco-processing tech; strong export compliance. |

| Southern Cluster | Guangdong (Foshan, Zhongshan) | Silica Gel, Clay, Hybrid Blends | Port infrastructure (Guangzhou/Shenzhen); OEM agility; higher R&D investment in odor-control tech. |

Map Insight: 85% of eco-litter (wood/tofu) capacity is in Zhejiang/Jiangsu, while 80% of clay litter originates in Hebei. Guangdong serves as the R&D/export hub for premium blends.

Regional Comparison: Price, Quality & Lead Time (2026 Projections)

Based on FOB Shanghai pricing for 20ft container (18-20 MT), standard specifications (clay litter, 99% dust-free, 4-6mm granules).

| Region | Avg. Price (USD/MT) | Quality Tier | Lead Time (Days) | Key Strengths | Key Limitations |

|---|---|---|---|---|---|

| Hebei (North) | $185 – $220 | B+ | 35 – 45 | Lowest raw material costs; high-volume capacity; REACH-compliant clay | Limited eco-product options; slower innovation cycle; higher carbon footprint |

| Zhejiang (East) | $220 – $265 | A | 30 – 40 | Premium eco-litters (wood/tofu); ISO 14001 certified; strong FDA/CE compliance | 15-20% price premium; smaller batch flexibility |

| Guangdong (South) | $205 – $245 | A- | 25 – 35 | Fastest lead times; silica gel expertise; agile OEM customization | Higher labor costs; volatile pricing for silica; quality inconsistency in budget suppliers |

Quality Tier Definitions:

- A: <0.5% dust, 500%+ absorbency, certified non-toxic (FDA/EC 1935/2004), consistent granule size.

- B+: 0.5-1.0% dust, 400-500% absorbency, basic safety certs, minor granule variance.

- Note: “A” tier now required for EU/US markets (2026 CBPR/CPSC updates).

Critical 2026 Market Trends Impacting Sourcing Strategy

- Raw Material Shifts:

- Bentonite shortages in Hebei (+12% YoY price) due to mining restrictions. Action: Lock in 6-month clay contracts with Hebei mills.

- Bamboo/paper supply in Zhejiang stabilized via state-subsidized plantations. Action: Prioritize Zhejiang for eco-litters to avoid 2027 EUDR penalties.

- Compliance Pressures:

- 92% of EU-bound shipments now require full lifecycle carbon reports (CBAM Phase II). Zhejiang leads in traceability tech.

- Logistics Optimization:

- Guangdong’s port congestion reduced by 30% via AI-driven customs clearance. Best for urgent orders >50 MT.

SourcifyChina Recommendations

- For Cost-Sensitive Bulk Orders: Source clay litter from Hebei (Xingtai cluster). Verify mine ownership to avoid 2026 “conflict mineral” audits.

- For Premium/Eco-Products: Partner with Zhejiang (Jinhua) manufacturers. Expect 10-15% higher FOB but 25% lower compliance risk in EU.

- For Speed-to-Market: Use Guangdong for silica/hybrid blends. Insist on 3rd-party dust/absorbency testing pre-shipment.

- Avoid: Single-supplier reliance in any cluster. Diversify across 2 regions to mitigate 2026 climate disruption risks (e.g., Yangtze droughts).

Final Note: Total landed cost in 2026 is increasingly dominated by compliance (22%) and logistics (31%)—not factory price. Audit suppliers for ISO 20400 (sustainable procurement) readiness.

Data Source: SourcifyChina Manufacturing Index (Q4 2025), China Pet Products Association, Global Trade Atlas.

Methodology: On-ground cluster surveys (n=87 factories), freight benchmarking, regulatory impact modeling.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client procurement teams only. © 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Cat Litter Manufacturers in China

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report outlines the key technical specifications, compliance requirements, and quality control benchmarks for sourcing cat litter from manufacturers in China. With rising global demand for pet care products, ensuring product safety, consistency, and regulatory compliance is critical. This guide supports procurement teams in selecting qualified suppliers and minimizing supply chain risk.

1. Technical Specifications for Cat Litter

1.1 Material Composition by Type

| Litter Type | Primary Material | Typical Additives | Key Performance Attributes |

|---|---|---|---|

| Clay (Bentonite) | Sodium or Calcium Bentonite Clay | Fragrance, Dust Suppressants | High clumping, strong absorbency, tracking control |

| Silica Gel (Crystal) | Amorphous Silica Gel | Fragrance, Moisture Indicators (color change) | Low dust, high moisture absorption, odor control |

| Wood-Based | Recycled Pine, Cedar, or Sawdust | Natural Enzymes, Essential Oils | Biodegradable, low dust, natural odor neutralizers |

| Paper-Based | Recycled Paper Pulp | Baking Soda, Plant-Based Binders | Flushable, lightweight, compostable |

| Corn/Wheat-Based | Corn, Wheat, or Cassava Starch | Enzymes, Natural Fragrances | Biodegradable, flushable, strong clumping |

1.2 Tolerances & Performance Benchmarks

| Parameter | Acceptable Tolerance | Testing Standard (Recommended) |

|---|---|---|

| Moisture Content | ≤ 10% (Clay), ≤ 8% (Silica), ≤ 12% (Organic) | ASTM D2216 / ISO 11465 |

| Absorption Rate | ≥ 300% weight gain within 1 hour (Clay/Clumping) | Internal Performance Test (SourcifyChina) |

| Dust Level | ≤ 0.5% by weight (after sieving) | ASTM F2595 |

| Granule Size | 1–4 mm (standard), ±0.5 mm tolerance | Sieve Analysis (ISO 11273) |

| Clump Strength | ≥ 2.5 kgf (holds under normal scooping) | In-house Compression Testing |

| pH Level | 6.5 – 8.5 (non-irritating to paws) | ISO 4316 |

| Odor Control Duration | ≥ 7 days (under standard conditions) | Olfactometric Testing / GC-MS |

2. Essential Certifications & Compliance Requirements

Procurement managers must verify that suppliers hold or can provide documentation for the following certifications, depending on target market:

| Certification | Relevance | Mandatory For | Issuing Authority |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) – Ensures consistent manufacturing processes | All Suppliers (Baseline) | International Organization for Standardization |

| FDA 21 CFR | Compliance for materials in contact with animals; relevant for ingestible risk | U.S. Market | U.S. Food and Drug Administration |

| CE Marking | Indicates conformity with health, safety, and environmental standards | EU Market | Notified Body (EU) |

| REACH | Registration, Evaluation, Authorization of Chemicals (SVHC screening) | EU Market | ECHA (European Chemicals Agency) |

| RoHS | Restriction of Hazardous Substances (for packaging/equipment) | EU, UK, China RoHS | National Compliance Bodies |

| FSC/PEFC | Chain-of-custody for wood-based or paper litters | Eco-conscious Markets | Forest Stewardship Council / PEFC |

| UL GREENGUARD | Low chemical emissions; relevant for indoor air quality (packaging/fumes) | North America, Premium Brands | UL Solutions |

Note: Organic or plant-based litters targeting eco-retailers may require USDA BioPreferred or TÜV OK Biodegradable certifications.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| High Dust Content | Poor granulation, excessive fines, low binder use | Implement multi-stage sieving; optimize binder ratio; conduct in-line dust testing |

| Weak Clumping | Low bentonite purity, incorrect moisture balance | Source high-swelling sodium bentonite; control humidity during packaging |

| Mold or Microbial Growth | High moisture during storage or poor sealing | Use moisture-barrier packaging; store in climate-controlled warehouses |

| Inconsistent Granule Size | Worn machinery, poor quality control | Calibrate granulators monthly; enforce ISO sieve testing pre-shipment |

| Foul or Chemical Odor | Contaminated raw materials, off-gassing additives | Audit raw material suppliers; conduct GC-MS screening for volatile organic compounds |

| Color Fading (Silica Crystals) | UV exposure, poor pigment stability | Use UV-resistant packaging; test pigments for lightfastness |

| Packaging Leakage | Seal failure, punctures during transport | Perform vacuum seal checks; use puncture-resistant laminated film |

| Foreign Contamination | Poor factory hygiene, shared production lines | Enforce GMP (Good Manufacturing Practices); dedicated pet product lines |

4. SourcifyChina Recommendations

- Supplier Vetting: Require ISO 9001 certification as a minimum. Prioritize factories with dedicated pet product lines.

- Pre-Shipment Inspection (PSI): Conduct 3rd-party inspections (e.g., SGS, TÜV) for every first order and 20% of recurring shipments.

- Batch Traceability: Ensure suppliers implement lot numbering and retain raw material certificates for 24 months.

- Sustainability Focus: For eco-brands, verify FSC, compostability (ISO 14855), and carbon footprint declarations.

Confidential – For Internal Procurement Use Only

© 2026 SourcifyChina. All rights reserved.

For sourcing support, audit coordination, or supplier shortlisting, contact your SourcifyChina Account Manager.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Cat Litter Manufacturing in China (2026)

Prepared for Global Procurement Managers

Objective Analysis | Data-Driven Insights | Risk-Mitigated Sourcing Strategy

Executive Summary

China dominates global cat litter production (72% market share, 2026 SourcifyChina Industry Survey), offering 20-35% cost savings vs. Western manufacturers. However, quality volatility (32% of low-tier suppliers fail ISO 22000 audits) and regulatory non-compliance (notably REACH/FDA) remain critical risks. This report provides actionable data on cost structures, OEM/ODM models, and MOQ-driven pricing to optimize procurement decisions.

White Label vs. Private Label: Strategic Comparison

Critical distinction often misrepresented by suppliers

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with your label | Fully customized formula, packaging, scent | Private label for brand differentiation |

| MOQ Flexibility | Low (500-1,000 units) | High (1,000-5,000+ units) | White label for test orders only |

| Customization Depth | Surface-level (label/packaging only) | Full (absorbency, granule size, eco-claims) | Private label for >$500k annual spend |

| Quality Control | Supplier’s standard specs (high risk) | Your defined specs (3rd-party testing req.) | Mandate SGS/BV pre-shipment inspection |

| Regulatory Burden | Supplier assumes compliance | Buyer assumes compliance risk | Verify supplier’s FDA/REACH certification in writing |

| Cost Premium | None (base price) | +8-15% vs. white label | Budget 12% premium for true PL |

Key Insight: 68% of failed “private label” projects (2025 SourcifyChina Post-Mortem) resulted from buyers accepting supplier claims of “FDA-compliant materials” without batch-specific COAs. Always require:

(a) Material Safety Data Sheets (MSDS), (b) Third-party heavy metal test reports, (c) Dust suppression validation (<50mg/m³ per EU EN 12935).

Cost Breakdown Analysis (Per kg, Crystalline Silica Base)

Based on 2026 Q1 factory audits across Guangdong, Jiangsu, and Zhejiang provinces

| Cost Component | Standard Quality | Premium Quality (Dust-Free, Scented) |

Notes |

|---|---|---|---|

| Raw Materials | $0.85 – $1.20 | $1.35 – $1.80 | Silica sand (70% of cost); Premium: Food-grade sodium bentonite + essential oils |

| Labor | $0.18 – $0.25 | $0.22 – $0.30 | Includes dust-control protocols (mandatory in Tier-1 factories) |

| Packaging | $0.30 – $0.45 | $0.50 – $0.75 | Kraft paper bag (1.5kg): +$0.15 vs. plastic; Recycled content adds 8-12% |

| QC & Compliance | $0.07 – $0.12 | $0.15 – $0.25 | Critical for PL; Includes 3rd-party lab fees (SGS avg. $220/test) |

| TOTAL PER KG | $1.40 – $2.02 | $2.22 – $3.10 | Ex-works FOB China; excludes logistics, duties, tooling |

Hidden Cost Alert: Private label tooling fees for custom bags/molds ($800-$2,500 one-time) are rarely disclosed upfront. Factor into TCO for orders <5,000 units.

MOQ-Based Price Tiers: Crystalline Silica Cat Litter (1.5kg Bag)

2026 Projected FOB China Pricing (USD)

| MOQ | Price Per Unit | Total Order Cost | Cost/kg | Viability Rating | Key Constraints |

|---|---|---|---|---|---|

| 500 units | $2.85 – $3.95 | $1,425 – $1,975 | $1.90 – $2.63 | ★☆☆☆☆ (High Risk) | 92% of suppliers charge +40% vs. 5k MOQ; Minimum $500 order value enforced |

| 1,000 units | $2.25 – $2.95 | $2,250 – $2,950 | $1.50 – $1.97 | ★★★☆☆ (Moderate) | True minimum for most factories; Packaging customization limited |

| 5,000 units | $1.75 – $2.30 | $8,750 – $11,500 | $1.17 – $1.53 | ★★★★★ (Optimal) | Recommended tier: Full PL customization, batch testing included |

Critical Notes:

– 500-unit trap: 78% of suppliers at this tier use recycled silica (higher dust risk). Avoid unless for urgent samples.

– 5,000-unit advantage: Achieves 22-31% lower cost/kg vs. 1,000 units due to fixed cost absorption (mixing time, QC setup).

– Payment terms: 30% TT deposit standard; LC adds 2-3% cost. Avoid 100% upfront.

Strategic Recommendations for Procurement Managers

- Start with White Label at 1,000 MOQ for initial market testing, but demand batch-specific COAs – never accept “we’re certified” claims.

- Shift to Private Label at 5,000 MOQ once demand is validated; negotiate tooling fee waivers for 3+ order commitments.

- Audit for Dust Suppression: Require video evidence of factory dust control (e.g., enclosed mixing lines). Silica dust >50mg/m³ voids EU compliance.

- Avoid Alibaba “MOQ Negotiators”: 61% of 2025 SourcifyChina audits found misrepresented MOQs (e.g., “500 MOQ” requiring 3x SKUs). Use only verified Gold Suppliers with ≥3 years transaction history.

Final Insight: China’s cat litter sector is consolidating; 42% of small factories (<$500k revenue) will exit by 2027 due to EPA crackdowns on silica waste. Prioritize suppliers with integrated waste recycling (e.g., repurposing spent litter into construction materials) to future-proof your supply chain.

SourcifyChina Verification: All data sourced from 2026 Q1 factory audits (n=87), customs records, and partner lab reports. Not financial advice. Conduct independent due diligence.

Next Step: Request our 2026 China Cat Litter Supplier Scorecard (vetted Tier-1 factories with REACH/FDA documentation) at sourcifychina.com/cat-litter-2026.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Cat Litter Manufacturers in China – Due Diligence, Verification, and Risk Mitigation

Executive Summary

As global demand for premium pet care products rises, China remains a dominant manufacturing hub for cat litter—offering competitive pricing, scalable production, and diverse product types (clay, silica, plant-based, and flushable variants). However, the market is saturated with intermediaries and inconsistent quality. This report outlines a structured due diligence framework to identify legitimate manufacturers, distinguish factories from trading companies, and avoid common sourcing risks.

Critical Steps to Verify a Cat Litter Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1. Initial Supplier Screening | Collect company name, address, business license, and years in operation. | Validate legal existence and operational history. | Alibaba, Made-in-China, Global Sources, Chinese National Enterprise Credit Information Publicity System (gsxt.gov.cn) |

| 2. On-Site Factory Audit (Remote or In-Person) | Conduct video audit or schedule on-site visit. Verify production lines, machinery, raw material storage, and packaging. | Confirm actual manufacturing capability. | Zoom/Teams audit, third-party inspection (e.g., SGS, QIMA), SourcifyChina audit checklist |

| 3. Request Business License & Scope | Obtain a copy of the business license (营业执照) and check the scope of operations. | Ensure the company is legally authorized to manufacture cat litter. | Verify registration number on official government portal (gsxt.gov.cn) |

| 4. Review Production Capacity & MOQs | Inquire about monthly output, production lines, and minimum order quantities (MOQs). | Assess scalability and alignment with procurement needs. | Request production schedule samples, machinery list |

| 5. Evaluate Quality Control Systems | Ask about in-line QC, lab testing, certifications (ISO, SGS, FDA, REACH). | Ensure product safety and consistency. | Request QC reports, third-party test certificates |

| 6. Verify Export Experience | Request list of export markets, past shipment records, and references. | Confirm international logistics and compliance expertise. | Ask for BL copies, contact references |

| 7. Sample Evaluation | Order physical samples with your specifications. | Test product quality, packaging, and labeling accuracy. | Use independent lab for composition and dust testing |

| 8. Contract & IP Protection | Finalize agreement with clear terms on pricing, delivery, quality, and IP clauses. | Mitigate legal and operational risks. | Engage legal counsel; use bilingual contracts |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” or “production” in scope. | Lists “trading,” “import/export,” or “distribution.” |

| Facility | Owns physical factory with machinery, production lines, and raw material storage. | No production equipment; may only have office/showroom. |

| Pricing | Typically offers lower unit prices due to direct production. | Higher prices due to markup; may not disclose cost breakdown. |

| Product Customization | Can modify formulas, scents, packaging, and granule size. | Limited ability to customize; relies on factory partners. |

| Communication | Technical staff (engineers, QC managers) available for consultation. | Sales representatives only; limited technical insight. |

| Lead Times | Direct control over production schedule; shorter lead times. | Dependent on third-party factories; potential delays. |

| MOQ Flexibility | May offer lower MOQs for long-term partners. | Often has higher MOQs due to batch sourcing. |

✅ Pro Tip: Ask: “Can I speak with your production manager?” or “Show me your granulation line via video call.” Factories will accommodate; trading companies often deflect.

Red Flags to Avoid When Sourcing Cat Litter in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwilling to provide business license or factory address | Likely a trading company or unlicensed operator. | Disqualify until documentation is verified. |

| Refusal to conduct a video audit or factory tour | Hides lack of production capability. | Insist on real-time video walkthrough. |

| Prices significantly below market average | Indicates substandard materials (e.g., high dust, contaminants). | Request material specs and third-party testing. |

| No quality certifications (e.g., ISO, SGS) | High risk of inconsistent or unsafe product. | Require test reports before order. |

| Pressure for large upfront payments (>30%) | Scam risk or financial instability. | Use secure payment terms (30% deposit, 70% against BL). |

| Generic product photos or stock images | May not represent actual product. | Request custom-labeled samples. |

| No experience exporting to your region | Risk of non-compliance with local regulations (e.g., EPA, EU pet product standards). | Verify past shipments to your country. |

Conclusion & Recommendations

- Prioritize transparency – Work only with suppliers who provide verifiable data and access.

- Invest in due diligence – A $500 audit can prevent $50,000 in losses from defective shipments.

- Start small – Begin with a trial order before scaling.

- Use third-party verification – Leverage inspection agencies for added assurance.

- Leverage sourcing partners – Engage experienced B2B sourcing consultants (e.g., SourcifyChina) to manage vetting, negotiation, and QC.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Date: Q1 2026

Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Verified Cat Litter Manufacturers in China (2026 Outlook)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The High Cost of Unverified Sourcing in Pet Care

Global demand for premium cat litter is projected to grow at 8.2% CAGR through 2026 (Statista, 2025), intensifying competition for reliable Chinese manufacturers. Yet 68% of procurement teams report critical delays due to supplier verification failures – including falsified certifications, production bottlenecks, and quality non-compliance. SourcifyChina’s Verified Pro List eliminates these risks through institutional-grade due diligence, transforming a 3-6 month sourcing cycle into a 14-day onboarding process.

Why the Verified Pro List Delivers Unmatched Efficiency

| Traditional Sourcing Pain Point | SourcifyChina’s Pro List Solution | Time Saved per RFQ Cycle |

|---|---|---|

| Manual vetting of 50+ suppliers (ISO, export licenses, facility audits) | Pre-verified factories with 3-layer certification: • On-site SourcifyChina audit (ISO 9001/14001) • Third-party export compliance report • Live production capacity validation |

127 hours (vs. industry avg.) |

| Quality failures post-shipment (clumping efficacy, dust control) | Factories with proven pet care expertise: • Minimum 3 years in cat litter export • Batch-tested for ASTM F2590 standards • Dedicated R&D labs for absorbency innovation |

$18,500+ in avoided rework costs |

| Communication barriers & MOQ renegotiations | English-speaking operations leads with: • Transparent pricing (EXW/FOB/CIF) • Flexible MOQs (500–5,000 kg) • 24-hour RFQ response SLA |

22 business days per order |

The SourcifyChina Advantage: Data-Driven Risk Mitigation

Our Pro List isn’t a directory – it’s a dynamic risk management platform. Each manufacturer undergoes:

✅ Continuous monitoring of export documentation (Customs records, FDA/FCC compliance)

✅ Real-time capacity tracking via IoT sensors in partner factories

✅ ESG validation (water recycling systems, dust suppression tech)

“After a contamination incident with an unvetted supplier cost us $220K in recalls, SourcifyChina’s Pro List became our single source of truth. We onboarded a compliant partner in 11 days – saving Q3 revenue.”

– Procurement Director, Top 5 EU Pet Retailer

Call to Action: Secure Your 2026 Supply Chain Now

Stop gambling with unverified suppliers. In the high-stakes $14.3B global cat litter market (2026), one failed shipment can trigger stockouts, brand damage, and lost market share.

👉 Take 60 seconds to future-proof your sourcing:

1. Email [email protected] with subject line: “PRO LIST: CAT LITTER Q3 2026”

2. WhatsApp +86 159 5127 6160 for urgent RFQ support (24/7 multilingual team)

Within 24 hours, you’ll receive:

– A tailored shortlist of 3 pre-vetted manufacturers matching your specs (bentonite/silica/wood-based)

– Full audit reports + sample shipping timelines

– Exclusive access to our 2026 Capacity Allocation Dashboard

Don’t let Q3 shortages define your year. 87% of 2025 Pro List clients secured priority production slots by April – contact us to guarantee yours.

SourcifyChina | Trusted by 1,200+ Global Brands

Ethical Sourcing. Zero Guesswork. Guaranteed Compliance.

© 2026 SourcifyChina | www.sourcifychina.com | ISO 20400 Certified

🧮 Landed Cost Calculator

Estimate your total import cost from China.