The global cast iron market is experiencing steady growth, driven by rising demand across automotive, construction, and industrial machinery sectors. According to Grand View Research, the global cast iron market size was valued at USD 58.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by the material’s excellent durability, machinability, and cost-effectiveness, making it a preferred choice for engine blocks, piping systems, and heavy-duty components. In parallel, Mordor Intelligence projects increasing adoption of ductile cast iron in infrastructure and automotive applications, particularly in emerging economies, further bolstering manufacturer activity. As industries prioritize resilient and thermally stable materials, the competitive landscape has intensified, giving rise to a core group of manufacturers leading in innovation, production scale, and global reach. Below are the top 10 cast iron material manufacturers shaping the industry today.

Top 10 Cast Iron Material Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Ductile Iron Castings Manufacturer

Domain Est. 2016

Website: ferroloyinc.com

Key Highlights: We are a turnkey supplier of cast ductile iron parts for the agriculture, construction, industrial equipment, hydraulics and valves industries….

#2 Lemfco, Inc.

Domain Est. 2002

Website: lemfco.com

Key Highlights: We are one of the premier cast iron foundries in the USA, specializing in manufacturing small to medium runs of gray iron castings for all industries….

#3 Grede

Domain Est. 1996 | Founded: 1920

Website: grede.com

Key Highlights: Discover America’s premier iron casting provider, proudly serving automotive, commercial truck and industrial markets since 1920….

#4

Domain Est. 2008 | Founded: 1905

Website: american-usa.com

Key Highlights: Founded in 1905 in Birmingham, Alabama, AMERICAN is a manufacturer of fire hydrants, valves, ductile iron pipe and spiral-welded steel pipe for the waterworks….

#5 ASC Engineered Solutions

Domain Est. 2020

Website: asc-es.com

Key Highlights: Manufacturer and solutions provider of precision-engineered pipe joining products, valves, and related services for the entire construction project ……

#6 McWane

Domain Est. 1997

Website: mcwane.com

Key Highlights: Our story began in 1921, when the McWane Cast Iron Pipe Company was founded in Birmingham, Alabama. What started as a focus on critical components for ……

#7 Iron Casting Companies & Suppliers

Domain Est. 1997

Website: calmet.com

Key Highlights: Calmet is a leading global provider of casting and precision-machined components in Iron, Steel, Aluminum and Brass for a wide range of industries….

#8 Neenah Foundry

Domain Est. 2000

Website: neenahfoundry.com

Key Highlights: Neenah Foundry has been a consistent leader in delivering durable and highly engineered, structural, and sustainable casting solutions for customers….

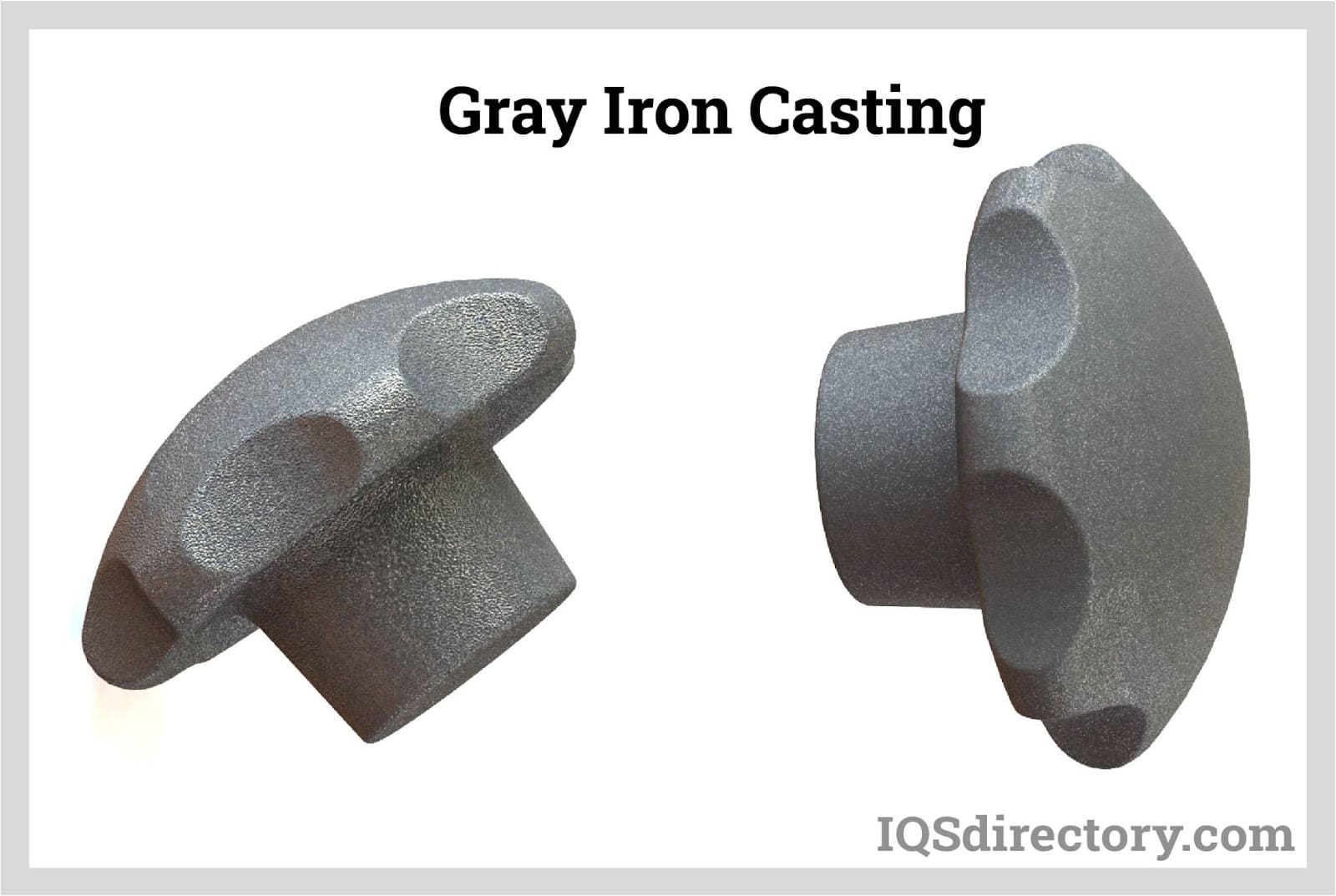

#9 Grey Iron Casting Companies

Domain Est. 2001

Website: grey-iron-castings.com

Key Highlights: Save time and easily find the leading grey iron castings companies and suppliers who produce high quality, durable products available at competitive prices….

#10 Field Company

Domain Est. 2004

Website: fieldcompany.com

Key Highlights: Free delivery over $100 · 45-day returns…

Expert Sourcing Insights for Cast Iron Material

H2: Market Trends for Cast Iron Material in 2026

By 2026, the cast iron material market is projected to undergo notable shifts driven by industrial demand, technological advancements, sustainability initiatives, and regional economic developments. While traditional applications continue to support steady demand, emerging trends are reshaping the landscape for cast iron across key sectors.

-

Resilient Demand in Infrastructure and Construction

The global push for infrastructure modernization—particularly in developing economies—will sustain demand for cast iron, especially ductile and gray cast iron, used in water and sewage pipelines, manhole covers, and drainage systems. Governments investing in resilient public utilities are expected to favor cast iron due to its durability, corrosion resistance (when treated), and long service life, contributing to stable market growth. -

Growth in Automotive and Heavy Machinery

Despite increasing use of lightweight materials like aluminum and composites, cast iron remains critical in engine blocks, cylinder heads, and brake components due to its excellent heat dissipation, wear resistance, and cost-effectiveness. In emerging markets where affordability and durability are prioritized, cast iron usage in commercial vehicles, tractors, and industrial machinery will remain strong, supporting market expansion. -

Technological Advancements in Casting Processes

Foundries are increasingly adopting automation, 3D sand printing, and AI-driven quality control systems to improve precision, reduce waste, and lower production costs. These advancements are enhancing the performance and consistency of cast iron components, making them more competitive against alternative materials. The integration of Industry 4.0 technologies is expected to boost productivity and attract investment in modern foundry infrastructure. -

Sustainability and Recycling Initiatives

Cast iron’s high recyclability is becoming a strategic advantage amid tightening environmental regulations. With up to 95% of scrap cast iron being reusable, the material aligns well with circular economy goals. By 2026, the market is likely to see increased emphasis on energy-efficient melting technologies (e.g., induction furnaces) and reduced carbon footprint manufacturing processes, driven by both regulatory pressure and ESG (Environmental, Social, and Governance) considerations. -

Regional Market Dynamics

Asia-Pacific, led by China, India, and Southeast Asian nations, will remain the largest consumer and producer of cast iron, fueled by rapid urbanization and industrialization. Meanwhile, North America and Europe are expected to focus on high-performance cast iron variants and premium applications in energy and defense sectors. Trade policies, raw material availability (especially pig iron and scrap), and energy costs will continue to influence regional production patterns. -

Competition from Alternative Materials

The cast iron market faces ongoing pressure from lightweight and high-strength alternatives such as engineered plastics, aluminum alloys, and composite materials—particularly in automotive and aerospace applications. However, cast iron’s cost-performance ratio ensures its relevance in applications where mechanical strength and thermal stability are paramount.

In summary, the cast iron market in 2026 will be characterized by steady demand in traditional sectors, innovation in manufacturing, and a growing emphasis on sustainability. While facing material substitution challenges, cast iron’s inherent advantages and adaptability ensure its continued significance in the global industrial ecosystem.

Common Pitfalls When Sourcing Cast Iron Material (Quality, IP)

Sourcing cast iron material involves several potential pitfalls that can impact both the quality of the final product and the protection of intellectual property (IP). Being aware of these risks is crucial for maintaining supply chain integrity and ensuring long-term success.

Poor Material Quality and Inconsistent Composition

One of the most frequent issues is receiving cast iron that does not meet specified chemical or mechanical properties. Variations in carbon, silicon, or trace elements can significantly affect hardness, tensile strength, and machinability. Suppliers, especially in low-cost regions, may cut corners by using recycled scrap with inconsistent quality, leading to casting defects such as porosity, shrinkage, or cracking. Without proper material test reports (MTRs) or third-party certification, buyers risk integrating substandard materials into critical components.

Lack of Traceability and Certification

Many suppliers fail to provide full traceability from raw material to finished casting. This lack of documentation makes it difficult to verify compliance with international standards (e.g., ASTM, ISO, or EN). Without proper mill certifications or heat lot tracking, it becomes nearly impossible to conduct root cause analysis in case of field failures, potentially exposing the buyer to liability and reputational damage.

Inadequate Foundry Process Control

The quality of cast iron heavily depends on foundry practices such as melt control, inoculation, and cooling rates. Poorly managed processes can result in inconsistent microstructure (e.g., excessive free ferrite or inadequate graphite formation), reducing performance. Buyers may overlook the importance of auditing foundries or verifying process controls, assuming specifications alone are sufficient.

Intellectual Property Exposure

When sourcing cast iron components—especially custom-engineered parts—there’s a risk of IP theft or unauthorized replication. Sharing detailed drawings, material specs, or proprietary processing methods with suppliers without proper legal safeguards (e.g., NDAs, IP clauses in contracts) can lead to design cloning or third-party sales. This is particularly concerning when working with suppliers in jurisdictions with weak IP enforcement.

Hidden Costs from Rework and Non-Conformance

Low initial pricing may be misleading if the material requires extensive inspection, rework, or leads to production delays due to non-conformance. Hidden costs arise from scrap, downtime, and expedited shipping when replacements are needed. These issues often stem from unclear specifications or inadequate supplier vetting.

Overreliance on Supplier Claims Without Verification

Some buyers accept supplier certifications at face value without independent testing or on-site audits. This trust can be misplaced, especially when documentation is falsified or standards are misapplied. Implementing a supplier qualification program and conducting periodic material testing are essential to mitigate this risk.

Avoiding these pitfalls requires thorough due diligence, clear technical specifications, robust contracts with IP protections, and ongoing supplier performance monitoring.

Logistics & Compliance Guide for Cast Iron Material

Cast iron, a ferrous alloy known for its excellent casting properties, wear resistance, and high compressive strength, requires specific handling, transportation, and regulatory compliance measures throughout the supply chain. This guide outlines best practices and key compliance considerations for the safe and legal logistics of cast iron materials.

Material Characteristics and Handling

Cast iron is brittle and susceptible to cracking or chipping if subjected to impact or improper handling. It is also heavy, increasing the risk of injury and requiring appropriate equipment for movement. Surfaces may be rough or contain sharp edges from the casting process. Proper personal protective equipment (PPE), including gloves and steel-toed boots, should always be worn during handling.

Packaging and Storage Requirements

Cast iron components should be stored in a dry, covered environment to prevent rust and corrosion. When transporting raw castings or finished parts, use wooden crates, pallets, or steel racks to prevent movement and impact damage. For delicate or precision-machined parts, protective wrapping or cushioning (e.g., foam, plastic sheeting) is recommended. Avoid stacking cast iron items directly on bare ground or in contact with moisture.

Transportation Guidelines

Transport cast iron by road, rail, or sea depending on volume and destination. Secure loads using straps, chains, or dunnage to prevent shifting during transit. Due to high density, ensure that vehicles and containers are within weight limits. Oversized castings may require special permits and route planning. Clearly label shipments with weight, contents, and handling instructions (e.g., “Fragile,” “Heavy Load,” “This Side Up”).

Regulatory Compliance

Ensure compliance with international and local regulations governing the transport of heavy industrial materials. Key standards include:

– IMDG Code for sea freight of cast iron shipments.

– ADR/RID regulations when transporting within or across Europe by road/rail.

– OSHA and DOT guidelines in the United States for workplace safety and hazardous materials (if applicable).

Although cast iron is generally non-hazardous, filings or grinding dust may be regulated under occupational health standards (e.g., OSHA’s permissible exposure limits for iron oxide).

Environmental and Safety Considerations

Dispose of casting waste, such as sprues, gates, and sand molds, in accordance with local environmental regulations. Recycle scrap cast iron whenever possible through approved metallurgical recyclers. Monitor workplace air quality if machining or grinding operations generate particulate matter. Implement spill containment procedures if cutting fluids or lubricants are used during finishing.

Documentation and Traceability

Maintain accurate records for each batch of cast iron material, including:

– Material test reports (MTRs) confirming chemical composition and mechanical properties.

– Certificates of compliance with relevant standards (e.g., ASTM A48, ISO 185).

– Bill of lading, packing lists, and customs documentation for international shipments.

Traceability ensures quality control and supports regulatory audits or customer inquiries.

Import/Export Compliance

For cross-border shipments, classify cast iron products under the correct Harmonized System (HS) code (e.g., 7303.00 for cast iron pipes or 7325.99 for other cast articles). Comply with import/export controls, including anti-dumping duties where applicable (e.g., U.S. or EU tariffs on certain iron castings from specific countries). Ensure all export documentation meets destination country requirements, including phytosanitary or packaging regulations if wooden crates are used.

Conclusion for Sourcing Cast Iron Material

In conclusion, sourcing cast iron material requires a strategic approach that balances quality, cost, reliability, and supply chain efficiency. By carefully evaluating suppliers based on their production standards, material certifications, and track record for consistency, organizations can ensure the acquisition of high-quality cast iron suitable for their specific applications—whether for automotive, machinery, construction, or manufacturing purposes.

Emphasis should be placed on selecting suppliers who adhere to international standards (such as ASTM, ISO, or DIN) and who offer traceability and testing documentation. Additionally, considering factors such as proximity of suppliers, lead times, minimum order quantities, and logistical capabilities helps mitigate risks and supports long-term operational continuity.

Sustainable and ethical sourcing practices, including assessing environmental impact and energy efficiency of production, are increasingly important in today’s supply chain decisions. Building strong relationships with credible suppliers and maintaining flexibility in sourcing options further enhances resilience against market fluctuations and disruptions.

Ultimately, a well-structured sourcing strategy for cast iron not only ensures material performance and durability but also contributes to overall cost-efficiency and competitiveness in the marketplace.