The global cast iron blade market is experiencing steady growth, driven by rising demand in industrial machining, construction, and metal fabrication sectors. According to a 2023 report by Mordor Intelligence, the global industrial blades market—encompassing cast iron, high-speed steel, and carbide variants—is projected to grow at a CAGR of over 4.5% from 2023 to 2028, with cast iron blades maintaining a significant share due to their durability, cost-effectiveness, and suitability for high-impact applications. Similarly, Grand View Research highlights that advancements in manufacturing technologies and increasing infrastructure investments, particularly in Asia-Pacific and Latin America, are accelerating the adoption of high-quality cutting blades, including those made from cast iron. As industries prioritize precision and efficiency, the demand for reliable blade manufacturers has intensified. In this landscape, identifying top-tier cast iron blade producers becomes crucial for sourcing performance-driven, long-lasting solutions. Here, we present the top 10 cast iron blade manufacturers shaping the industry through innovation, scale, and engineering excellence.

Top 10 Cast Iron Blade Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High-Quality Cutting Tools

Domain Est. 1996

Website: widia.com

Key Highlights: WIDIA offers a wide range of cutting tools and solutions for industrial applications. Explore their website for high-quality tools and expert advice….

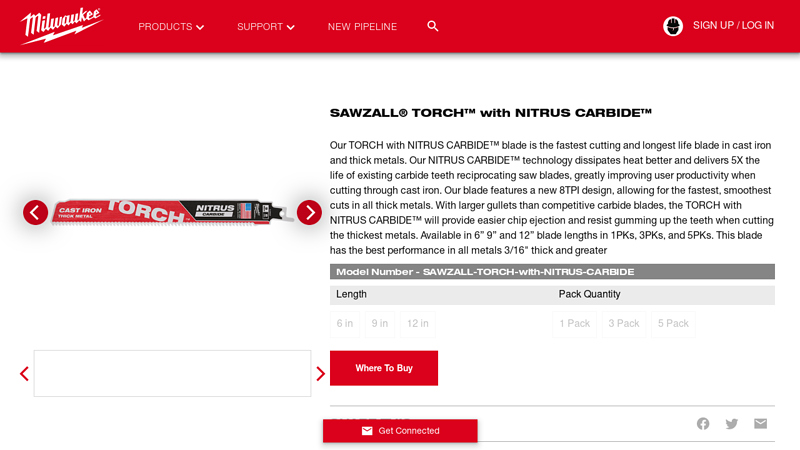

#2 SAWZALL The TORCH with NITRUS CARBIDE

Domain Est. 2000

Website: milwaukeetool.com

Key Highlights: Rating 4.8 (201) Our TORCH with NITRUS CARBIDE™ blade is the fastest cutting and longest life blade in cast iron and thick metals. Our NITRUS CARBIDE™ technology dissipates ……

#3 Cast Iron Blade

Domain Est. 1997

Website: bhel.com

Key Highlights: NIT NO. NIT_35556. UNIT NAME, –. ADDRESS, Purchase Department BHEL ranipet 632406. EMAIL, pkpancholi[at]bhelrpt[dot]co[dot]in. TELEPHONE NO. 04172-284133….

#4 Iron Casting Companies & Suppliers

Domain Est. 1997

Website: calmet.com

Key Highlights: Calmet is a leading global provider of casting and precision-machined components in Iron, Steel, Aluminum and Brass for a wide range of industries….

#5 Band Saw Blades for Cast Iron

Domain Est. 1998

Website: starrett.com

Key Highlights: 15-day returnsThe selection of band saw blades below features the strength and durability to cut this hard and brittle material….

#6 19924TK

Domain Est. 1998

Website: swisherinc.com

Key Highlights: 4-day delivery 30-day returnsHome; 19924 – Housing – Cast Iron Blade Driver, Short. Checkout as a new customer. Creating an account has many benefits: See order and shipping status…

#7 DS0908CFA

Domain Est. 2004

Website: diablotools.com

Key Highlights: Hi-Performance Carbide delivers an unmatched up to 100X longer cutting life in metal cutting applications ranging in thickness from 3/16″ to 9/16″….

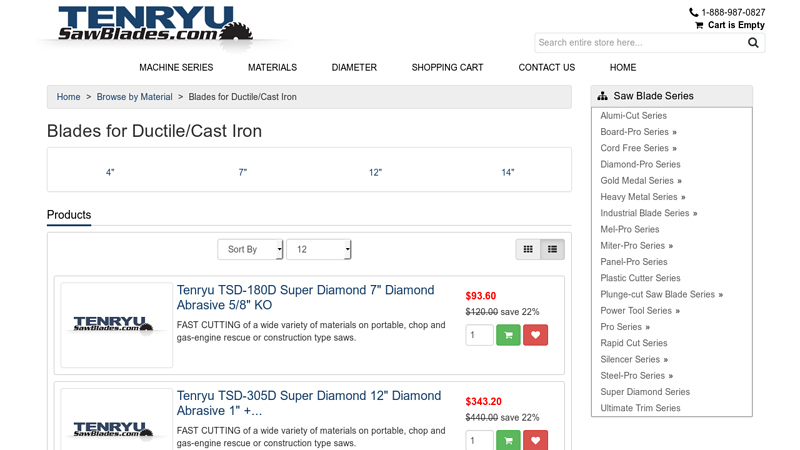

#8 Browse by Material :: Blades for Ductile/Cast Iron

Domain Est. 2006

Website: tenryusawblades.com

Key Highlights: Blades for Ductile/Cast Iron · Products · Tenryu TSD-180D Super Diamond 7″ Diamond Abrasive 5/8″ KO · Tenryu TSD-305D Super Diamond 12″ Diamond Abrasive 1″ +……

#9 LENOX®

Domain Est. 2017

Website: cutwithlenox.com

Key Highlights: LENOX® sawing solutions include bandsaw blades engineered for long life and consistent performance for cutting hard and soft wood, various metals, castings, ……

#10 YG

Domain Est. 2001

Website: yg1usa.com

Key Highlights: STEEL & CAST IRON · STAINLESS STEEL TITANIUM · TITANIUM · MULTI PURPOSE PM60-ONLY … i-Xmill Replaceable Blade Insert System · Indexable Insert Modular ……

Expert Sourcing Insights for Cast Iron Blade

H2: 2026 Market Trends for Cast Iron Blades

The global market for cast iron blades in 2026 is poised for transformation driven by industrial modernization, sustainability demands, and technological advancements. While traditionally associated with heavy-duty cutting applications in construction, foundries, and agriculture, cast iron blades are adapting to evolving market needs. Below are key trends shaping the cast iron blade industry in 2026:

-

Resurgence in Niche Industrial Applications

Despite competition from high-speed steel and carbide-tipped blades, cast iron blades maintain a strong foothold in niche markets such as demolition, masonry cutting, and vintage machinery restoration. In 2026, growing infrastructure redevelopment in emerging economies is increasing demand for durable, cost-effective cutting tools—areas where cast iron blades remain competitive due to their shock resistance and affordability. -

Sustainability and Circular Economy Influence

Environmental regulations are pushing manufacturers toward recyclable materials. Cast iron, being highly recyclable and often produced from scrap metal, aligns with circular economy principles. In 2026, producers are increasingly marketing cast iron blades as eco-friendly alternatives, especially in regions with stringent emissions and waste management policies such as the EU and parts of East Asia. -

Hybrid Material Innovations

To overcome traditional limitations like brittleness and wear, manufacturers are investing in composite cast iron formulations. By combining cast iron with alloys or surface treatments (e.g., induction hardening, ceramic coatings), blade lifespan and performance are improving. These hybrid solutions are gaining traction in high-abrasion environments, bridging the gap between traditional cast iron and advanced cutting materials. -

Regional Market Shifts

Asia-Pacific, particularly India and Southeast Asia, is expected to lead growth in cast iron blade demand due to rapid urbanization and construction activity. Conversely, North America and Western Europe are seeing steady but slower growth, with demand primarily driven by maintenance, repair, and operations (MRO) sectors and heritage equipment servicing. -

Digitalization and Predictive Maintenance Integration

Though cast iron blades are not inherently “smart,” their integration into digitally monitored systems is rising. By 2026, IoT-enabled machinery equipped with sensors can detect blade wear and optimize usage cycles. This trend is prompting blade suppliers to collaborate with equipment manufacturers to ensure compatibility and performance tracking. -

Cost-Driven Adoption in Developing Markets

The relatively low production cost of cast iron blades makes them ideal for price-sensitive markets. As labor and material costs rise globally, cost-efficient tools remain essential. In 2026, emerging economies are favoring cast iron blades for small-scale contractors and artisanal workshops, supporting sustained regional demand. -

Challenges from Advanced Alternatives

Despite these positive trends, cast iron blades face stiff competition from advanced materials such as tungsten carbide, CBN (cubic boron nitride), and ceramic blades, which offer superior hardness and heat resistance. As automation and precision machining expand, especially in aerospace and automotive sectors, the market share for cast iron blades in high-tech applications remains limited.

In conclusion, while cast iron blades are not at the forefront of cutting-edge material innovation, their role in 2026 is being redefined by sustainability, cost efficiency, and targeted industrial use. The market will likely remain stable with modest growth, supported by strategic improvements in material science and alignment with eco-conscious manufacturing trends.

Common Pitfalls When Sourcing Cast Iron Blades (Quality and Intellectual Property)

Sourcing cast iron blades—commonly used in industrial cutters, agricultural equipment, or specialized tools—can present several challenges related to both product quality and intellectual property (IP) risks. Being aware of these pitfalls helps ensure reliable supply chains and legal compliance.

Quality-Related Pitfalls

Inconsistent Material Composition

One of the most frequent quality issues is variability in the cast iron alloy used. Suppliers may use substandard grades (e.g., gray cast iron instead of ductile or high-strength variants), leading to premature wear, chipping, or failure under stress. Without proper material certifications (e.g., ASTM or ISO standards), buyers risk receiving blades with inadequate hardness, tensile strength, or thermal resistance.

Poor Casting and Finishing Processes

Low-cost manufacturers may skip critical steps such as proper heat treatment, stress relieving, or precision grinding. This results in internal stresses, surface porosity, or dimensional inaccuracies. Blades may warp during use or fail to maintain a sharp cutting edge, reducing operational efficiency and lifespan.

Lack of Quality Control Documentation

Many suppliers, especially in emerging markets, do not provide comprehensive quality assurance data. Absence of inspection reports, hardness testing results, or batch traceability increases the risk of receiving non-conforming products. Relying solely on visual inspections at delivery is insufficient for critical applications.

Inadequate Performance Testing

Some sourced blades may meet basic dimensional specs but fail under real-world conditions. Without access to performance data (e.g., endurance, impact resistance), buyers may unknowingly integrate unreliable components into their machinery, leading to downtime and safety hazards.

Intellectual Property (IP) Pitfalls

Unauthorized Replication of Protected Designs

A significant risk arises when suppliers replicate patented blade geometries, cutting-edge profiles, or proprietary engineering without licensing. Even if the buyer is unaware, importing or using such blades can lead to infringement claims, legal disputes, or customs seizures, particularly in regulated markets like the EU or U.S.

Misrepresentation of OEM Compatibility

Suppliers often market blades as “compatible with” or “replacement for” branded equipment (e.g., John Deere, Komatsu). While interoperability is legal, using logos, part numbers, or misleading branding may violate trademark laws. Buyers can be held liable for contributory infringement if they knowingly distribute or use counterfeit-labeled products.

Lack of IP Warranty in Contracts

Many sourcing agreements omit clauses guaranteeing that the product does not infringe third-party IP rights. Without such warranties, the buyer assumes full legal risk. If a patent holder pursues action, the supplier may disappear, leaving the buyer to face costly litigation or product recalls.

Reverse Engineering Risks

If your design is shared with a supplier for manufacturing, there is a risk they will reverse engineer or duplicate it for other clients. In jurisdictions with weak IP enforcement, protecting technical drawings and securing non-disclosure agreements (NDAs) is essential but not always sufficient.

Mitigation Strategies

To avoid these pitfalls, conduct thorough supplier audits, require material and performance certifications, and include strong IP indemnification clauses in contracts. Additionally, work with legal counsel to assess design freedom-to-operate and ensure compliance with international IP regulations.

Logistics & Compliance Guide for Cast Iron Blade

This guide outlines the key logistics and compliance considerations for the safe, efficient, and legal handling, transportation, and sale of Cast Iron Blade products.

Product Classification & Regulatory Compliance

Cast Iron Blade products may be subject to various national and international regulations depending on their design, function, and destination. Ensure compliance with:

– Customs Tariff Classifications: Accurately classify products using HS codes (e.g., 8201.10 for hoes, 8205.51 for chisels) to determine duties and import restrictions.

– Consumer Product Safety Standards: Comply with regulations such as the U.S. Consumer Product Safety Commission (CPSC) guidelines or EU General Product Safety Regulation (GPSR) for product labeling, warnings, and safety testing.

– Blade-Specific Regulations: In some jurisdictions, certain blades may be regulated as tools or restricted items. Verify local laws regarding edge tools, especially for export.

– REACH & RoHS Compliance (EU): Confirm that materials used (including coatings or finishes) comply with chemical restrictions under REACH and RoHS directives.

Packaging & Labeling Requirements

Proper packaging and labeling are essential for safety, compliance, and customer satisfaction.

– Protective Packaging: Use durable materials (e.g., corrugated cardboard, padded inserts) to prevent damage during transit. Include rust inhibitors or desiccants if shipping over long distances or in humid environments.

– Labeling Standards:

– Include product name, model number, country of origin, weight, and handling instructions.

– Add safety warnings (e.g., “Sharp Edge – Handle with Care”) in the local language(s) of the destination market.

– Include compliance marks (e.g., CE marking for EU, FCC if applicable).

– Barcodes & Tracking: Apply scannable barcodes and unique identifiers for inventory and shipment tracking.

Shipping & Transportation Logistics

Efficient logistics planning ensures timely delivery and cost control.

– Carrier Selection: Partner with reliable freight carriers experienced in handling heavy or industrial goods. Consider both air and sea freight based on urgency and volume.

– Incoterms Usage: Clearly define responsibilities using standard Incoterms (e.g., FOB, CIF, DDP) in all sales contracts to avoid disputes over shipping costs and risk transfer.

– Weight & Dimension Management: Optimize packaging to reduce dimensional weight charges. Cast iron is dense—accurate weight reporting is critical for freight pricing.

– Hazardous Materials: While cast iron is not hazardous, verify that any accompanying lubricants, coatings, or packaging materials comply with hazardous goods regulations (e.g., IATA, IMDG).

Import & Export Documentation

Complete and accurate documentation is vital for customs clearance.

– Required Documents:

– Commercial Invoice

– Packing List

– Bill of Lading (BOL) or Air Waybill (AWB)

– Certificate of Origin

– Import/Export Licenses (if required by destination)

– Ensure all documents reflect consistent product descriptions, quantities, and values to prevent delays or penalties.

Storage & Inventory Management

Safe and organized storage preserves product quality.

– Warehousing Conditions: Store in dry, ventilated areas to prevent rust. Use pallets to avoid floor moisture and enable forklift access.

– Inventory Rotation: Implement FIFO (First In, First Out) practices to minimize long-term storage risks.

– Security Measures: Secure storage areas to prevent theft, especially for high-value items.

Quality Assurance & Inspection

Maintain product integrity throughout the supply chain.

– Conduct pre-shipment inspections to verify product quality, quantity, and packaging compliance.

– Address any defects or non-conformities before dispatch.

– Retain inspection records for traceability and compliance audits.

Environmental & Sustainability Considerations

Demonstrate corporate responsibility through sustainable practices.

– Use recyclable or biodegradable packaging materials where possible.

– Partner with logistics providers offering carbon-neutral shipping options.

– Comply with local waste disposal regulations for packaging and damaged goods.

Risk Management & Contingency Planning

Prepare for disruptions to maintain supply chain resilience.

– Maintain insurance coverage for cargo (all-risk marine insurance recommended).

– Identify alternative suppliers, routes, or carriers in case of delays or geopolitical issues.

– Monitor trade policy changes (e.g., tariffs, sanctions) affecting key markets.

By adhering to this guide, Cast Iron Blade can ensure compliant, efficient, and reliable logistics operations across global markets. Regular audits and staff training are recommended to maintain ongoing compliance.

Conclusion for Sourcing Cast Iron Blade:

Sourcing a cast iron blade requires careful consideration of material quality, manufacturing capabilities, supplier reliability, and cost-efficiency. While cast iron offers excellent wear resistance, damping properties, and machinability, it is crucial to ensure that the sourced blades meet the required specifications for hardness, dimensional accuracy, and structural integrity. Engaging with reputable suppliers who adhere to industry standards and provide consistent quality control helps mitigate risks related to performance and longevity. Additionally, evaluating logistics, lead times, and total cost of ownership—beyond just the purchase price—contributes to a sustainable and efficient supply chain. Ultimately, a well-vetted sourcing strategy for cast iron blades supports operational reliability and long-term cost savings in industrial applications.